Global Protective Packaging Market

Market Size in USD Billion

CAGR :

%

USD

40.43 Billion

USD

66.50 Billion

2025

2033

USD

40.43 Billion

USD

66.50 Billion

2025

2033

| 2026 –2033 | |

| USD 40.43 Billion | |

| USD 66.50 Billion | |

|

|

|

|

Protective Packaging Market Size

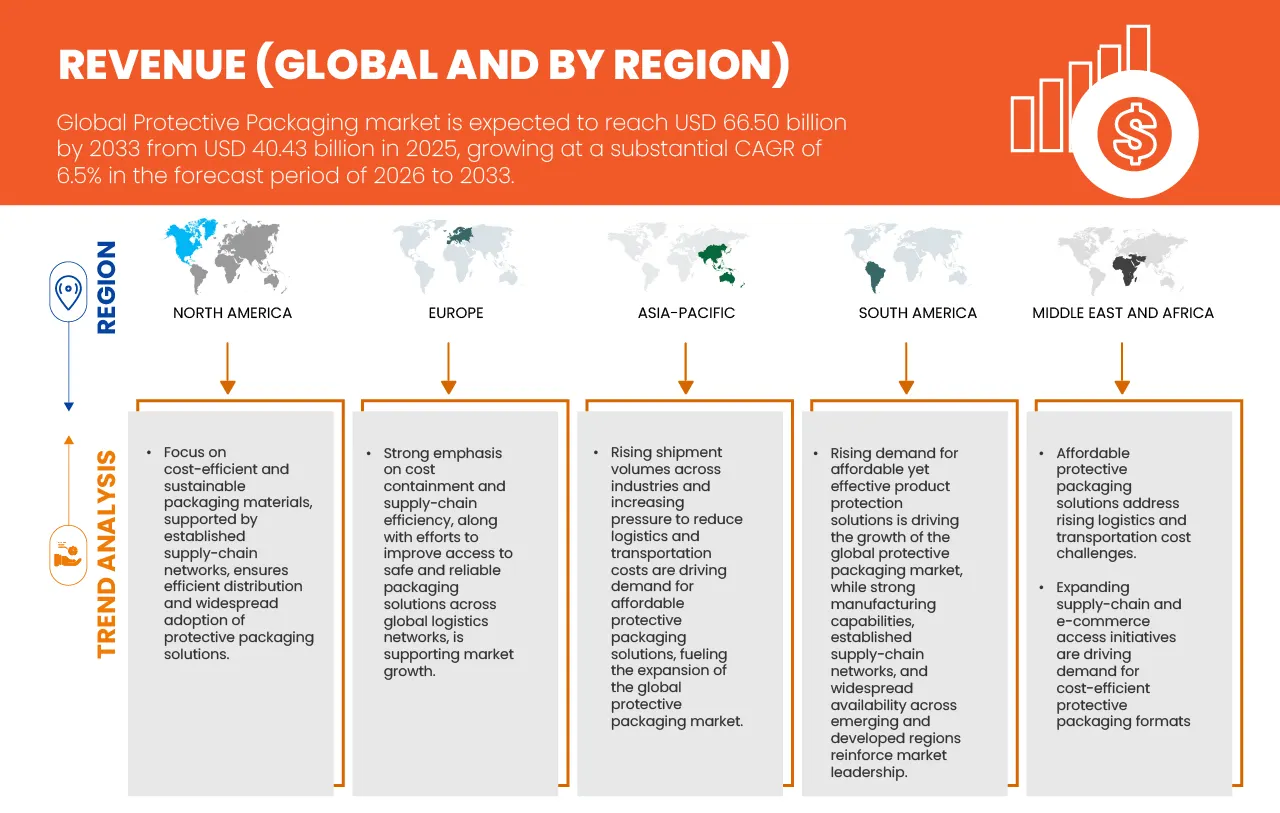

- The Global protective packaging market size was valued at USD 66.50 billion by 2033 from USD 40.43 billion in 2025, growing with a CAGR of 6.5% during the forecast period

- The Global protective packaging market is witnessing steady growth, supported by strong demand from end-use industries such as chemicals, food & beverages, construction materials, and agriculture, driven by increased need for safe handling, storage, and transportation of goods.

- Rising global trade and export activities, along with growth in bulk transportation and cross-regions logistics, are significantly contributing to the expansion of protective packaging solutions across the region.

- Advancements in warehouse automation, digital inventory systems, and specialized logistics infrastructure including temperature-controlled storage, bonded warehouses, and integrated distribution centers are improving operational efficiency and supporting market scalability.

Protective Packaging Market Analysis

- The protective packaging market is experiencing steady growth, driven by rising demand from industries such as food & beverages, chemicals, pharmaceuticals, electronics, and industrial goods, where product safety during storage and transportation is critical.

- North America dominates the market, accounting for 39.84% share, supported by its strong manufacturing base, advanced logistics infrastructure, and high export activity across Global.

- Asia-Pacific is the fastest-growing regional market, with a robust CAGR of 7.8%. Rapid industrialization, expanding e-commerce, and rising export activity in countries such as China, India, and Southeast Asian nations are key growth drivers. The region benefits from increasing demand for protective packaging in electronics, consumer goods, and automotive components.

- The Flexible protective packaging segment leads the market, holding a 66.71% share, due to its cost-effectiveness, lightweight nature, ease of handling, and suitability for diverse applications.

- Increasing adoption of advanced logistics solutions, warehouse automation, and e-commerce distribution networks is accelerating demand for high-performance protective packaging solutions.

- Growing emphasis on sustainability, recyclable materials, and compliance with regulatory standards, along with value-added packaging services, is further strengthening long-term market growth.

Report Scope and Protective Packaging Market Segmentation

|

Attributes |

Protective Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protective Packaging Market Trends

“Integration of Smart & Advanced Technologies”

- Smart tracking technologies such as RFID, QR codes, and IoT-enabled sensors are increasingly integrated into protective packaging to enable real-time tracking of shipments, improve inventory visibility, and reduce loss or theft during transit.

- Condition-monitoring solutions embedded in packaging help track temperature, humidity, shock, and vibration, ensuring product integrity—especially for sensitive goods like electronics, pharmaceuticals, and food products.

- Automation and robotics in packaging lines are enhancing efficiency by improving packing speed, consistency, and accuracy, while reducing labor dependency and operational costs.

- Advanced materials and intelligent cushioning systems are being developed to provide enhanced impact resistance, adaptive protection, and optimized material usage, supporting lightweight and sustainable packaging goals.

- Digital integration with logistics and warehouse management systems (WMS) allows data-driven decision-making, predictive maintenance, and seamless coordination across supply chains, improving overall operational performance.

For Instance,

- In April 2025, Sonoco completed the acquisition of TC Transcontinental’s flexible packaging business, enhancing its flexible and automated packaging capabilities a move that expands Sonoco’s tech‑enabled offerings and protective solutions portfolio.

- In March 2024, Sealed Air signed a strategic partnership with DHL Supply Chain to co‑develop more sustainable protective packaging solutions across DHL’s global logistics network, focusing on efficiency and reduced environmental impact.

- In February 2025, Flexible Packaging Partners completed the acquisition of New Tech Plastics, a blown film manufacturer, allowing the company to scale manufacturing capacity and introduce more advanced, custom protective solutions for industry clients.

- In November 2025, Alexander Watson Associates (AWA) announced the acquisition of the Active & Intelligent Packaging Industry Association (AIPIA) to expand its smart packaging expertise, analytics, and service offerings — strengthening its position in the smart/connected packaging space.

Protective Packaging Market Dynamics

Driver

“Growing international trade”

- Growing international trade boosts demand for protective packaging as companies move higher volumes of goods across longer and more complex supply chains. Exporters ship products through multiple handling points such as ports, warehouses, customs facilities, and distribution hubs, which increases the risk of impact, vibration, compression, and environmental exposure.

- protective packaging helps businesses prevent product damage, reduce returns, and maintain quality standards while goods travel by sea, air, rail, and road across borders. Cross-border trade also pushes manufacturers to comply with diverse regulatory, labeling, and safety requirements in different countries.

- protective packaging solutions support these needs by providing tamper resistance, moisture control, thermal insulation, and contamination prevention, especially for pharmaceuticals, electronics, automotive components, and food products.

For Instances

- In October 2024, the World Trade Organization (WTO) revised its forecast for world merchandise trade growth in 2024 to 2.7%, up slightly from the previous estimate of 2.6%, and to 3.0% in 2025.

- In November 2025, according to Press Information Bureau, India’s total exports (Merchandise and Services combined) for November 2025 are estimated at USD 73.99 billion, registering a positive growth of 15.52% vis-à-vis November 2024.

- In November 2025, the National Statistics Office of Vietnam reported that total trade turnover neared USD 840 billion by late November, up 17.2 percent from a year earlier. Exports reached more than USD 430 billion, a 16.1 percent gain that already topped the full-year 2024 figure.

- In November 2025, according to the Office for National Statistics (ONS), the Value of UK total trade in the 12 months to the end of September 2025 reached USD 2,518.47 billion, up 5.1% on the previous 12 months.

Restraint/Challenge

“Volatility in raw material”

- Volatility in raw material prices hampers demand for protective packaging as frequent cost fluctuations disrupt manufacturing budgets and pricing strategies. Sudden increases in pulp, paper, and resin prices raise production costs for protective packaging manufacturers, which forces them to increase product prices for end users.

- Many customers, especially small and medium enterprises, respond by reducing packaging usage, shifting to lower-grade materials, or delaying procurement decisions, which directly suppresses demand. Unstable raw material pricing also creates uncertainty across supply chains and discourages long-term investment in advanced protective packaging solutions. Manufacturers struggle to lock in contracts, maintain profit margins, and plan capacity expansion when input costs change unpredictably.

- As a result, companies prioritize cost control over packaging performance and sustainability upgrades, which slows the adoption of high-value protective packaging products and restrains overall market growth.

For Instances,

- In October 2024, The Times of India reported that kraft paper, a key raw material for corrugated boxes, “skyrocketed by more than 20% in the last three months,” putting severe cost pressure on corrugated-box manufacturers.

- In February 2025, the pulp and paper times newsletter observed that depreciation of the Indian Rupee and rising global pulp prices (softwood pulp quoted around USD 890/ton) significantly increased the cost of imported raw materials for local paper manufacturers.

- In March 2021, The Economic Times reported that Indian corrugated box manufacturers were facing a raw material crisis as kraft paper prices had risen sharply over the preceding months, driven by increased pulp and paper exports to China, putting severe cost pressure on packaging suppliers.

- In July 2022, Tissue World Magazine reported that in Global, the price of eucalyptus will increase to USD 1,380 per tonne, while in North America, it will increase its prices by USD 40 per tonne, meaning that the cost of one tonne of eucalyptus pulp will now be USD 1,610.

Protective Packaging Market Scope

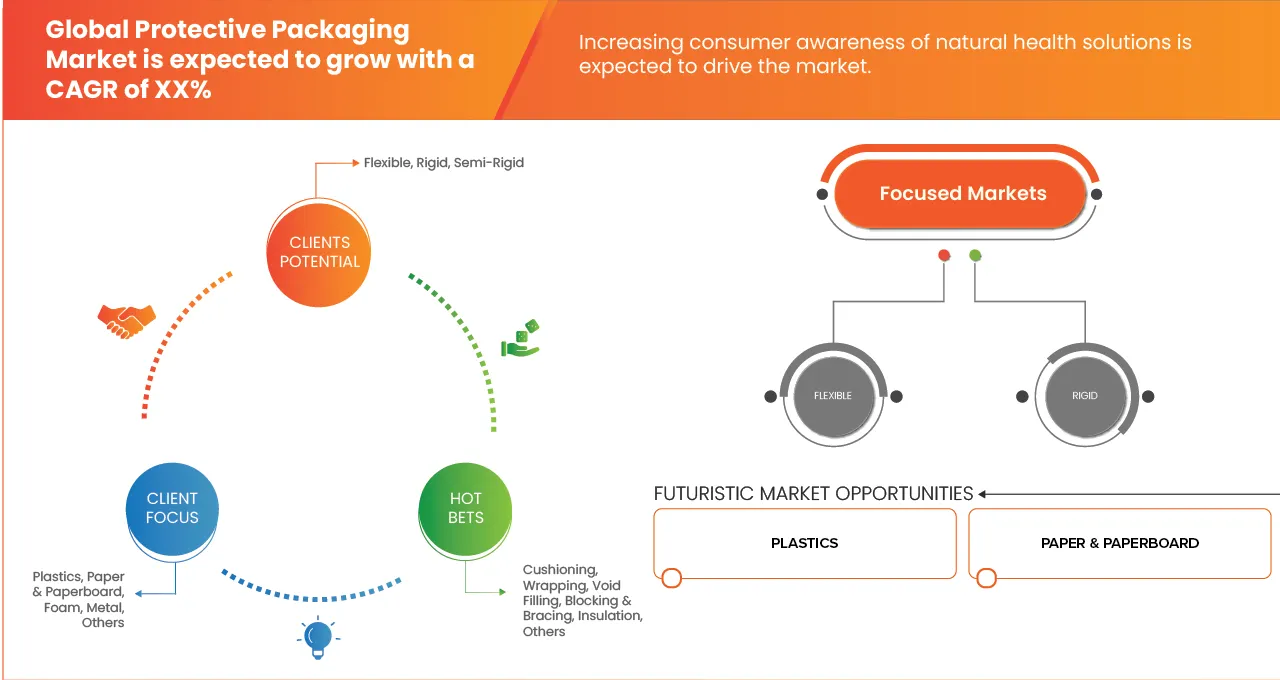

The Global protective packaging market is categorized into five notable segments which are based on Product type, Material, Application, End User, Distribution Channel.

By Product Type

On the basis of Product type, Global protective packaging market is segmented into Flexible, Rigid, Semi-Rigid.

The Flexible segment is expected to dominate the market with 66.83% market share and growing with the highest CAGR of 6.7%due to its widespread adoption across e-commerce, logistics, and consumer goods industries, driven by its lightweight nature, cost efficiency, and versatility. Flexible protective packaging solutions such as air pillows, bubble wrap, foam wraps, paper fillers, and cushioning envelopes offer effective shock absorption and void-filling capabilities while reducing overall package weight and transportation costs. The rapid growth of online retail and direct-to-consumer shipping has significantly increased demand for flexible packaging, as these materials are easy to use, scalable, and adaptable to products of varying shapes and size.

By Materials

On the basis Material, the Global protective packaging market is segmented into Plastics, Paper & Paperboard, Foam, Metal, Others.

The Plastics segment is expected to dominate the market with 41.32% market share and CAGR of 6.9% due to its superior durability, versatility, and cost-effectiveness across a wide range of applications. Plastic materials such as polyethylene (PE), polypropylene (PP), polyurethane (PU), and polyvinyl chloride (PVC) offer excellent cushioning, impact resistance, moisture protection, and flexibility, making them highly suitable for safeguarding products during transportation and storage. These materials are widely used in flexible packaging formats such as air pillows, bubble wrap, and protective films, as well as in rigid and semi-rigid solutions, supporting demand across e-commerce, electronics, automotive, pharmaceutical, and industrial sectors. Plastics also enable lightweight packaging, which helps reduce shipping costs and improves logistics efficiency.

By Application

On the basis of Application, the Global protective packaging market is segmented into Cushioning, Wrapping, Void Filling, Blocking & Bracing, Insulation, Others.

The Cushioning segment is expected to dominate the market with 39.01% market share CAGR of 7.0% due to growing need to protect products from shock, vibration, and impact damage throughout increasingly complex supply chains. Cushioning solutions are widely used across industries such as e-commerce, electronics, consumer goods, pharmaceuticals, and automotive, where preventing breakage and product returns is a critical priority. The rapid expansion of online retail and home delivery services has significantly increased demand for effective cushioning materials that can protect items during multiple handling stages and last-mile delivery. Cushioning materials such as bubble wrap, foam inserts, air pillows, and molded pulp provide adaptable protection for products of various shapes, sizes, and weights, making them highly versatile and cost-effective.

By End Use

On the basis of End User, the Global protective packaging market is segmented into Automotive (2900), Industry, Trade (Retail) (4700), Logistics (4900), Others.

The Automotive (2900) segment is expected to dominate the market with 36.00% market share and CAGR of 7.2% due to the high value, complexity, and sensitivity of automotive components and systems that require robust protection during transportation and storage. Automotive manufacturers and suppliers handle a wide range of parts, including engines, transmissions, electronic modules, body panels, and precision components, all of which are vulnerable to shock, vibration, moisture, and corrosion. protective packaging solutions such as molded trays, foam blocks, corrugated boxes, and custom cushioning are essential to prevent damage, ensure component integrity, and maintain just-in-time manufacturing operations. The growth of electric vehicles and advanced automotive electronics has further increased demand for specialized protective packaging with enhanced cushioning and insulation properties.

By Distribution Channel

On the basis of Distribution Channel, the Global protective packaging market is segmented into Direct and Indirect.

The Direct segment is expected to dominate the market with 66.11% market share and CAGR of 6.4% due to the increasing preference of manufacturers and large end users for direct procurement from packaging suppliers. Direct channels enable better customization, consistent quality control, and closer collaboration between packaging manufacturers and end-use industries such as automotive, electronics, pharmaceuticals, and e-commerce. Through direct sales, customers can obtain tailored protective packaging solutions designed to meet specific product dimensions, protection requirements, and sustainability goals, which is particularly important for high-volume and high-value shipments.

Protective Packaging Market Regional Analysis

- North America remains the largest regional market for protective packaging, accounting for 39.84% share in 2025 and projected to reach USD 25.51 billion by 2033. The region’s steady CAGR of 6.0% from 2026–2033 reflects mature but resilient demand, driven by strong e-commerce penetration, advanced logistics infrastructure, and high consumption of electronics, pharmaceuticals, and food products. Sustainability initiatives are shaping product innovation, with increased adoption of recyclable and lightweight protective materials. The U.S. dominates regional demand due to large-scale manufacturing and distribution networks, while Canada contributes through growing industrial exports. Despite market maturity, ongoing automation in warehousing and rising cross-border trade continue to support consistent growth.

- Europe represents the second-largest market, holding 25.97% share in 2025 and expected to reach USD 16.36 billion by 2033, growing at a CAGR of 5.8%. Growth is supported by strong regulatory emphasis on sustainable and recyclable packaging solutions, particularly under EU environmental directives. Demand is driven by food & beverage, pharmaceuticals, and automotive sectors, where protective packaging ensures product safety and compliance. Western Europe leads due to advanced manufacturing bases, while Eastern Europe is emerging as a cost-efficient production and logistics hub. Although growth is comparatively moderate, innovation in biodegradable materials and circular packaging systems continues to sustain market expansion across the region.

South America Protective Packaging Market Insight

South America is expected to reach USD 5.63 billion by 2033, growing at a healthy CAGR of 7.4% and accounting for 7.93% market share in 2025. Growth is fueled by expanding agricultural exports, food processing industries, and improving logistics infrastructure. Countries such as Brazil and Argentina lead regional demand due to strong export-oriented economies requiring effective protective packaging for transit safety. E-commerce growth is also contributing to increased usage of cushioning and void-fill materials. However, market development is somewhat constrained by economic volatility and infrastructure gaps. Even so, rising industrial activity and trade integration are expected to support sustained growth through 2033.

Middle East and Africa Protective Packaging Market Insight

The Middle East and Africa market is projected to reach USD 3.46 billion by 2033, growing at a CAGR of 7.1%, with a 4.98% share in 2025. Growth is driven by expanding trade, increasing industrialization, and rising demand for packaged food, pharmaceuticals, and consumer goods. Gulf countries benefit from strong logistics hubs and import-export activity, while African markets are supported by improving supply chains and urbanization. protective packaging demand is increasing as manufacturers focus on reducing product damage during long-distance transportation. Although the market remains relatively small, ongoing infrastructure investments and diversification of regional economies present strong long-term growth opportunities.

Asia-Pacific Protective Packaging Market Insight

Asia-Pacific is the fastest-growing regional market, with a robust CAGR of 7.8% and a projected value of USD 15.55 billion by 2033, holding 21.28% share in 2025. Rapid industrialization, expanding e-commerce, and rising export activity in countries such as China, India, and Southeast Asian nations are key growth drivers. The region benefits from increasing demand for protective packaging in electronics, consumer goods, and automotive components. Cost-effective manufacturing and a growing middle-class population further support volume growth. While sustainability adoption varies by country, increasing government focus on waste reduction is accelerating the shift toward eco-friendly protective packaging solutions.

China Protective Packaging Market Insight

China leads the Asia-Pacific protective packaging market, driven by its expanding industrial, manufacturing, and e-commerce sectors. Strong demand from chemicals, food & beverages, electronics, and construction industries, coupled with investments in warehouse automation, smart logistics, and flexible packaging solutions, is fueling rapid growth and making China the fastest-growing market in the region.

India Protective Packaging Market Insight

India protective packaging market is growing steadily, driven by expanding industrial, food & beverage, pharmaceutical, and e-commerce sectors. Increasing demand for bulk handling, safe storage, and flexible packaging solutions, along with investments in modern logistics, warehouse automation, and value-added services, is supporting market growth and improving supply chain efficiency.

Australia Protective Packaging Market Insight

Australia’s protective packaging market is witnessing steady growth, driven by demand from chemicals, food & beverages, pharmaceuticals, and industrial sectors. The market is supported by increasing e-commerce activities, bulk transportation needs, and adoption of flexible and automated packaging solutions, along with investments in modern warehousing, logistics infrastructure, and value-added protective services

South Africa Protective Packaging Market Insight

The South Africa protective packaging market is expanding steadily due to rising e‑commerce, industrial growth, and the need for secure product transport across sectors like food & beverage, electronics, and pharmaceuticals. Demand for solutions such as bubble wrap, corrugated board, and cushioning materials is fueled by increased online retail and logistics activities. Sustainability trends are pushing manufacturers toward recyclable and biodegradable materials, though cost and regulatory pressures remain challenges. Key players include global and local firms innovating in protective materials. The market’s growth is supported by expanding online shopping and logistics infrastructure, with regional hubs like Gauteng leading adoption.

Egypt Protective Packaging Market Insight

Egypt protective packaging market is growing as e‑commerce, industrial output, and logistics demand secure transit solutions like cushioning, mailers, and void fills, with protective packaging emerging as a key product segment within Egypt’s expanding e‑commerce packaging industry. Rising online retail, food & beverage shipments, and electronics distribution are driving demand for effective protection materials. However, limited access to advanced protective materials, fluctuating raw material costs, and infrastructure challenges constrain market efficiency. Continued innovation, strategic partnerships, and investment in modern protective technologies are critical for meeting the evolving needs of Egypt’s supply chains.

Germany Protective Packaging Market Insight

Germany dominates the European protective packaging market, holding a 23.30% share, driven by its strong industrial base in chemicals, pharmaceuticals, food & beverages, construction, and agro-products. The demand is fueled by bulk handling requirements for powders, dry goods, and sensitive materials, with FIBCs, flexible packaging, and advanced cushioning solutions widely adopted. The country benefits from well-developed logistics networks, modern warehousing, and stringent regulatory standards, ensuring safe storage and transport. Additionally, the growing trend of automated packaging, smart protective solutions, and value-added services supports operational efficiency and reinforces Germany’s position as the leading contributor to Europe’s protective packaging market.

Protective Packaging Market Share

The protective Packaging industry is primarily led by well-established companies, including:

- AbrisoJiffy (Netherlands)

- ASH Automated Packaging Systems Inc. (U.S.)

- Atlas Roofing Corporation (U.S.)

- BASF (Germany)

- Blue Box Packaging (U.S.)

- Crown Holdings, Inc. (U.S.)

- Dow Inc. (U.S.)

- FlexiPack (India)

- Huhtamaki (Finland)

- International Paper (U.S.)

- IPG – Intertape Polymer Group (U.S.)

- Mondi Group (United Kingdom)

- NEFAB Group (Sweden)

- Novolex (U.S.

- Oasis Industries (U.S.)

- Packaging Corporation of America (U.S.)

- Packman Packaging Private Limited (India)

- Packtek (Canada)

- Pregis LLC (U.S.)

- ProAmpac (U.S.)

- Pro-Pac Packaging Limited (Australia)

- Ranpak (U.S.)

- Sealed Air (U.S.)

- Smurfit Westrock (Ireland)

- Sonoco Products Company (U.S.)

- Storopack Hans Reichenecker GmbH (Germany)

- UFP Technologies, Inc. (U.S.)

- Universal protective Packaging, Inc. (U.S.)

- Veritiv Operating Company (U.S.)

Latest Developments in Global Protective Packaging Market

- In September 2025, Sealed Air Corporation is advancing its strategy as a one-stop shop for fulfillment operations with the launch of the AUTOBAG 850HB Hybrid Bagging Machine, a new automated bagging system engineered to run both poly and paper mailers.

- In November 2025, Smurfit Westrock inaugurated the first-of-its-kind adherence and clinical packaging facility, reinforcing Ireland’s role at the forefront of global healthcare. Over €40 million was invested in the brand-new site, which will provide packaging solutions for clinical trials and regulated pharma packaging.

- In September 2025, Smurfit Westrock completed its 150th Design2Market project. Design2Market is Smurfit Westrock’s pioneering accelerated development process, dedicated to speeding up the journey from product design to availability in-market.

- In September 2024, Marigold Health Foods has collaborated with Sonoco, a global leader in sustainable packaging solutions, to introduce a new, fully recyclable packaging solution for a range of plant-based food products, including stock cubes, sauces, and meat and fish alternatives. This innovative packaging marks a significant advancement in sustainable food packaging for consumers and industries alike.

- In October 2024, Sonoco introduces the latest paper packaging innovation with fully recyclable 95% paper-based cans. This more sustainable solution replaces the conventional metal bottom with a fibre-based bottom, making the entire can-body fully recyclable across households in the UK and mainland Global.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Protective Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protective Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protective Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.