Global Protein Crystallization Crystallography Market

Market Size in USD Billion

CAGR :

%

USD

2.37 Billion

USD

5.52 Billion

2024

2032

USD

2.37 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 2.37 Billion | |

| USD 5.52 Billion | |

|

|

|

|

Protein Crystallization and Crystallography Market Size

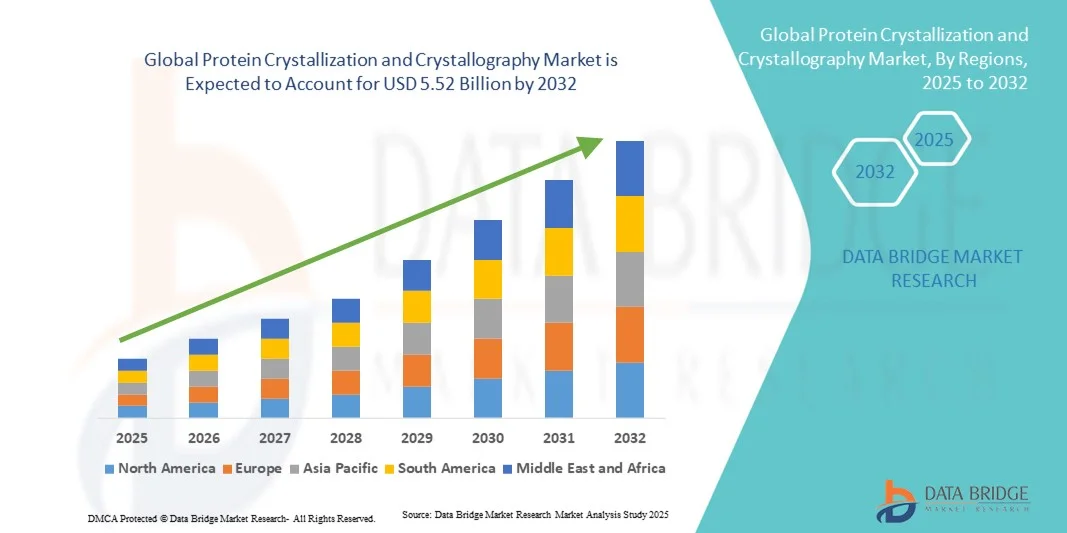

- The global protein crystallization and crystallography market size was valued at USD 2.37 billion in 2024 and is expected to reach USD 5.52 billion by 2032, at a CAGR of 11.15% during the forecast period

- The protein crystallization and crystallography market is witnessing significant growth, driven by the increasing adoption of advanced analytical technologies and high-throughput crystallization platforms across pharmaceutical and biotechnology research

- Rising investments in drug discovery, structural biology, and protein engineering are further fueling demand for crystallography solutions. Researchers and scientists are increasingly leveraging these technologies to determine protein structures, study biomolecular interactions, and accelerate the development of novel therapeutics

Protein Crystallization and Crystallography Market Analysis

- Protein Crystallization and Crystallography techniques are increasingly vital for structural biology, drug discovery, and biochemical research, as they allow precise determination of protein structures, interaction sites, and functional mechanisms

- The escalating demand for protein crystallization and crystallography is primarily fueled by the growing biopharmaceutical industry, rising R&D investments, and increasing focus on targeted therapeutics and structural biology studies

- North America dominated the protein crystallization and crystallography market with the largest revenue share of 42.3% in 2024, driven by the strong presence of key biotechnology and pharmaceutical companies, high R&D expenditure, and early adoption of advanced crystallography technologies. The U.S. particularly witnessed substantial growth, supported by government-funded research initiatives, well-established laboratory infrastructure, and innovations from both established firms and startups focusing on high-throughput crystallization and automated crystallography platforms

- Asia-Pacific is expected to be the fastest-growing region in the protein crystallization and crystallography market during the forecast period, with a CAGR of 10.1% from 2025 to 2030, due to increasing investments in pharmaceutical R&D, rapid expansion of biotech hubs, and rising adoption of modern crystallography equipment in research institutions and universities

- The protein crystallography segment dominated the largest market revenue share of 46.5% in 2024, driven by its central role in determining high-resolution protein structures, supporting rational drug design, and providing critical insights for biochemical and pharmaceutical research

Report Scope and Protein Crystallization and Crystallography Market Segmentation

|

Attributes |

Protein Crystallization and Crystallography Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Crystallization and Crystallography Market Trends

Enhanced Adoption of Automated and AI-Driven Crystallography Techniques

- A significant and accelerating trend in the global protein crystallization and crystallography market is the increasing integration of automation, robotics, and artificial intelligence (ai) in crystallization and structural analysis workflows. these technologies are enhancing throughput, accuracy, and reproducibility in laboratories, enabling faster drug discovery and structural biology research

- for instance, in march 2024, rigaku corporation launched an automated high-throughput crystallization platform that uses ai algorithms to optimize crystallization conditions and predict optimal protein crystal growth. this integration reduces manual trial-and-error and accelerates experimental timelines

- ai-driven software in crystallography can analyze diffraction patterns, predict suitable crystallization conditions, and guide experimental design, minimizing failed experiments and improving research efficiency

- robotics integration allows for automated handling of microplates, pipetting, and sample preparation, significantly reducing human error and enabling continuous operation of crystallization experiments

- the adoption of advanced imaging techniques, including micro-focus x-ray sources and electron diffraction, allows researchers to visualize crystal formation at high resolution, facilitating early detection of optimal conditions

- the trend towards automated and ai-enhanced protein crystallography is particularly evident in academic research institutes and pharmaceutical companies seeking to accelerate structural determination for drug design

- companies such as hampton research and molecular dimensions are also investing in ai-enabled crystallization kits and robotic systems, enhancing precision and workflow efficiency

- overall, this trend is reshaping expectations for laboratory throughput and experimental accuracy, providing faster insights into protein structures and interactions

- the seamless combination of robotics, ai, and high-throughput crystallography platforms is driving adoption in both industrial and academic research environments

- investments in cloud-based data analysis and ai algorithms allow laboratories to centralize data interpretation, enabling collaborative research and remote experiment monitoring

- this integrated approach significantly reduces time-to-result for drug discovery projects and accelerates structural biology research

- the trend is expected to continue as ai and automation become more accessible and cost-effective, particularly for emerging biotech companies and contract research organizations

- consequently, the market is witnessing a shift towards more efficient, intelligent, and reproducible protein crystallization and structural analysis workflows

Protein Crystallization and Crystallography Market Dynamics

Driver

Rising R&D Investments and Demand for Accelerated Drug Discovery

- The global protein crystallization and crystallography market is primarily driven by increasing investments in pharmaceutical and biotechnology R&D, particularly for novel drug discovery, vaccine development, and biologics research

- For instance, in February 2024, Pfizer expanded its structural biology research facilities in the U.S., integrating advanced crystallography and automation platforms to accelerate pipeline development

- High demand for structural insights into proteins, enzymes, and therapeutic targets is driving the adoption of high-throughput crystallization and crystallography platforms across academic and industrial laboratories

- The increasing prevalence of diseases requiring targeted therapies is compelling pharmaceutical companies to invest in rapid structural analysis to design effective drugs

- Integration of AI and machine learning accelerates experimental design and data interpretation, reducing trial-and-error and operational costs

- Contract research organizations (CROs) are increasingly adopting automated crystallography systems to offer high-quality structural data services to multiple clients simultaneously

- Rising government funding and grants for protein structure research, particularly in North America and Europe, are further boosting market demand

- The growing biopharmaceutical sector in Asia-Pacific, coupled with expansion of R&D infrastructure, is creating additional market opportunities

- Automated crystallization platforms reduce human error and operational time, enabling faster turnaround for drug candidates

- The integration of robotics and advanced imaging technologies enhances reproducibility and success rates of crystallization experiments

- High-throughput crystallization and crystallography techniques allow multiple protein targets to be analyzed simultaneously, meeting the increasing demand for efficient drug development pipelines.

- Overall, the convergence of rising R&D spending, technological advancements, and the need for accelerated drug discovery is propelling global market growth

Restraint/Challenge

High Cost of Advanced Crystallography Systems and Technical Complexity

- The high initial investment and operational costs associated with advanced protein crystallization and crystallography platforms pose a significant restraint to market growth

- For instance, a state-of-the-art automated X-ray crystallography system from Rigaku can cost several hundred thousand dollars, limiting adoption among smaller research labs or institutions in developing regions

- Technical complexity and the need for skilled personnel to operate sophisticated instruments reduce accessibility for some academic and research institutions

- Maintenance and calibration requirements add ongoing operational expenses, further impacting cost-sensitive buyers

- The integration of AI and robotics, while improving efficiency, also necessitates specialized training and expertise, which can slow adoption

- In emerging economies, limited infrastructure for high-throughput crystallography and protein crystallization constrains market penetration

- Smaller biotech companies may be hesitant to invest in expensive equipment without immediate returns from accelerated drug discovery

- The software and data analysis tools required for AI-enabled crystallography also involve licensing fees and updates, adding to the total cost of ownership

- Complex sample preparation, handling requirements, and variability in protein crystallization success rates introduce additional operational challenges

- Addressing these challenges requires cost-effective automation solutions, user-friendly software, and training programs to build technical expertise

- Manufacturers such as Hampton Research and Molecular Dimensions are developing modular, scalable systems to reduce upfront costs and improve accessibility

- Overcoming cost and complexity barriers is critical for broader adoption of advanced crystallography techniques in both industrial and academic research setting

- Ensuring affordability while maintaining high throughput and precision will be key to sustaining long-term market growth

Protein Crystallization and Crystallography Market Scope

The market is segmented on the basis of technology, product, and end users.

- By Technology

On the basis of technology, the protein crystallization and crystallography market is segmented into protein purification systems, protein crystallization, protein crystal mounting, and protein crystallography. The protein crystallography segment dominated the largest market revenue share of 46.5% in 2024, driven by its central role in determining high-resolution protein structures, supporting rational drug design, and providing critical insights for biochemical and pharmaceutical research. Protein crystallography is widely adopted in academic research institutes, pharmaceutical companies, and biotechnology firms due to its established reliability, regulatory acceptance, and proven applications in structural biology. The segment also benefits from integration with advanced imaging techniques such as synchrotron radiation and automated diffraction analysis, which enhance throughput and accuracy. Increasing R&D investments and the need for precise protein characterization further reinforce the dominance of this segment. High adoption is observed in North America and Europe, where structural biology and drug discovery infrastructure are highly developed. Technological improvements, including AI-assisted diffraction analysis, further solidify the segment’s market position.

The protein crystallization segment is expected to witness the fastest CAGR of 10.8% from 2025 to 2032, fueled by growing demand for high-throughput crystallization techniques and automated screening solutions. Protein crystallization enables initial determination of crystal quality, morphology, and suitability for X-ray diffraction studies, making it essential in early-stage structural analysis. Advances in automated crystallization platforms, microfluidic systems, and robotics allow rapid screening of hundreds of conditions simultaneously, significantly reducing time and increasing success rates. Growing adoption in pharmaceutical and biotechnology companies for accelerating drug discovery, coupled with increasing academic research in structural biology, is driving market growth. Emerging economies in Asia-Pacific are investing heavily in crystallization infrastructure, creating new growth opportunities. AI-enabled predictive crystallization methods further improve experimental efficiency and reduce trial-and-error failures. As pharmaceutical pipelines expand and structural characterization becomes increasingly critical for biologics development, the protein crystallization segment is expected to maintain strong momentum throughout the forecast period.

- By Product

On the basis of product, the market is segmented into instruments, reagents or consumables, and services & software. The instruments segment dominated the largest market revenue share of 44.3% in 2024, driven by the essential role of precision equipment such as X-ray diffractometers, crystallization robots, and imaging systems in structural biology workflows. High adoption is fueled by their ability to provide accurate, reproducible, and high-throughput data for protein structure determination. Pharmaceutical and biotechnology companies prefer investing in state-of-the-art instrumentation for in-house research capabilities, while academic institutions utilize these instruments for fundamental structural studies. Technological enhancements, including automation, AI-assisted analysis, and improved resolution capabilities, contribute to instrument dominance. Strong market presence in North America and Europe is supported by established supply chains, after-sales services, and availability of skilled personnel. The segment also benefits from continuous upgrades and replacement cycles, sustaining recurring demand.

The reagents or consumables segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by the growing requirement for high-quality protein samples, crystallization kits, buffers, and screening solutions. Consumables are critical for optimizing experimental conditions, ensuring reproducibility, and achieving high success rates in crystallization and diffraction experiments. The rapid expansion of contract research organizations (CROs) and academic research labs increases demand for ready-to-use consumables. Adoption of high-throughput screening and automated platforms further fuels consumable usage. Additionally, increasing research on biologics, vaccines, and novel therapeutics drives continuous demand for specialized reagents. Growth in emerging regions such as Asia-Pacific is supported by the establishment of modern laboratories and increasing R&D funding. Companies focusing on cost-effective, high-quality consumables are expected to capture a significant share of the expanding market.

- By End Users

On the basis of end users, the market is segmented into pharmaceutical companies, biotechnology companies, government institutes, and academic institutions. The pharmaceutical companies segment dominated the largest market revenue share of 48.6% in 2024, driven by the need for protein structure analysis to support drug discovery, biologics development, and regulatory submissions. Pharmaceutical firms invest heavily in crystallography infrastructure and automated platforms to accelerate pipeline development and ensure high-quality structural data. This segment also benefits from collaborations with CROs and academic institutions for access to specialized crystallization and diffraction equipment. The presence of established R&D centers in North America and Europe, along with high-capacity laboratories and skilled personnel, further reinforces dominance.

The biotechnology companies segment is expected to witness the fastest CAGR of 12.0% from 2025 to 2032, fueled by rapid growth in biologics, vaccines, and novel therapeutic proteins. Biotech firms increasingly rely on high-throughput crystallization and structural characterization platforms to optimize protein design, stability, and interactions. Emerging startups and regional biotechnology hubs in Asia-Pacific are driving adoption, supported by government incentives and R&D funding. Demand is particularly strong for integrated solutions that combine protein crystallization, crystal mounting, and diffraction analysis, enabling efficient drug discovery workflows. The growth is also aided by increasing collaborations with academic institutes and CROs to leverage advanced crystallography techniques.

Protein Crystallization and Crystallography Market Regional Analysis

- North America dominated the protein crystallization and crystallography market with the largest revenue share of 42.3% in 2024, driven by the strong presence of key biotechnology and pharmaceutical companies, high R&D expenditure, and early adoption of advanced crystallography technologies

- The market particularly witnessed substantial growth, supported by government-funded research initiatives, well-established laboratory infrastructure, and innovations from both established firms and startups focusing on high-throughput crystallization and automated crystallography platforms. The region’s extensive collaboration between academia and industry fosters the development of cutting-edge protein crystallization techniques, including automated crystallization, high-resolution diffraction systems, and AI-assisted structural analysis

- North America’s regulatory environment encourages high-quality research output, and significant investment in structural biology further reinforces the market’s dominance. Increasing demand for novel therapeutics, biologics, and vaccine development continues to drive the adoption of advanced crystallography platforms, while well-established distribution networks ensure availability of instruments, reagents, and software solutions

U.S. Protein Crystallization and Crystallography Market Insight

The U.S. protein crystallization and crystallography market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of high-throughput and automated crystallography solutions. Extensive investments in pharmaceutical and biotechnology R&D, coupled with a robust network of research institutions and government-funded projects, are accelerating the deployment of modern crystallography technologies. Universities and research labs in the U.S. are increasingly implementing protein crystallization platforms integrated with advanced imaging, data analytics, and automation, improving experimental efficiency and reproducibility. Additionally, collaborations between CROs, pharmaceutical companies, and technology providers are expanding access to high-end instruments and consumables. The focus on structural biology for drug discovery, biologics development, and vaccine research further drives market growth in the country.

Europe Protein Crystallization and Crystallography Market Insight

The Europe protein crystallization and crystallography market is projected to expand at a substantial CAGR throughout the forecast period, supported by rising investments in life sciences research and stringent regulatory standards for drug development. Countries such as Germany, France, and Switzerland host leading pharmaceutical and biotechnology companies that rely on protein crystallization and crystallography for structural characterization of therapeutic targets. Increasing urbanization, expansion of research infrastructure, and government funding for life sciences projects further contribute to market growth. The adoption of automated crystallization platforms, integration of high-resolution diffraction systems, and use of advanced data analysis software are key factors enabling the region’s expansion. Demand is observed across pharmaceutical R&D, academic research, and contract research organizations, reinforcing Europe’s position as a major hub for structural biology research.

U.K. Protein Crystallization and Crystallography Market Insight

The U.K. protein crystallization and crystallography market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased investments in structural biology research, academic collaborations, and pharmaceutical R&D initiatives. Research institutions and universities are adopting modern protein crystallization platforms and crystallography systems to accelerate drug discovery and biologics development. Growing interest in automation, high-throughput screening, and integration of advanced software tools for structural analysis is supporting market expansion. Government funding, coupled with a well-established laboratory infrastructure and skilled scientific workforce, further stimulates growth in the U.K., ensuring widespread adoption across both public research institutions and private pharmaceutical enterprises.

Germany Protein Crystallization and Crystallography Market Insight

The Germany protein crystallization and crystallography market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investment in research infrastructure and technological innovation. German pharmaceutical and biotechnology firms, along with academic institutes, are implementing state-of-the-art protein crystallization and crystallography equipment to enhance drug discovery processes. The market is supported by well-developed supply chains, high-quality manufacturing standards, and a strong focus on sustainability and precision research. Growing collaborations between research institutes and private companies are driving adoption of automated and high-throughput platforms, further strengthening Germany’s market position.

Asia-Pacific Protein Crystallization and Crystallography Market Insight

The Asia-Pacific Protein Crystallization and Crystallography market is expected to be the fastest-growing region during the forecast period, with a CAGR of 10.1% from 2025 to 2030, driven by increasing investments in pharmaceutical R&D, rapid expansion of biotechnology hubs, and rising adoption of modern crystallography equipment in research institutions and universities. Countries such as China, Japan, India, and South Korea are witnessing rapid urbanization, technological advancements, and establishment of state-of-the-art laboratory infrastructure. The growing pharmaceutical and biotech industries in APAC, combined with government incentives for scientific research, are accelerating adoption of high-throughput protein crystallization platforms and advanced crystallography systems. Additionally, collaborations between academic institutions and pharmaceutical companies are promoting technology transfer and knowledge sharing, increasing efficiency and throughput in structural biology research.

Japan Protein Crystallization and Crystallography Market Insight

The Japan protein crystallization and crystallography market is gaining momentum due to high investments in life sciences research, advanced technological adoption, and demand for precise structural analysis. Japanese pharmaceutical and biotech companies, along with academic research institutes, are increasingly implementing automated crystallization platforms and integrated diffraction systems. The focus on biologics development, structural characterization of proteins, and optimization of crystallography workflows is driving market growth. Government funding for research and collaborations with international research entities further enhance Japan’s market position in protein crystallization and crystallography.

China Protein Crystallization and Crystallography Market Insight

The China protein crystallization and crystallography market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid expansion of pharmaceutical and biotechnology research, increasing urbanization, and high adoption of modern laboratory infrastructure. The country is witnessing growing investment in high-throughput protein crystallization systems, automated crystallography platforms, and advanced structural analysis software. Government initiatives supporting scientific research, combined with a large base of domestic instrument manufacturers, are making crystallography solutions more accessible and affordable. Rising demand for biologics, vaccines, and therapeutic proteins further supports China’s market growth, positioning it as a key hub for protein crystallization and crystallography in the Asia-Pacific region

Protein Crystallization and Crystallography Market Share

The protein crystallization and crystallography industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc.(U.S.)

- Merck KGaA (Germany)

- Rigaku Holdings Corporation (Japan)

- Bruker (U.S.)

- HAMPTON RESEARCH CORP. (U.S.)

- Molecular Dimensions Ltd. (U.K.)

- Jena Bioscience GmbH (Germany)

- Bio-Techne (U.S.)

- Oxford Instruments plc (U.K.)

- Greiner Bio-One International GmbH (Germany)

Latest Developments in Global Protein Crystallization and Crystallography Market

- In August 2025, Thermo Fisher Scientific launched the Gibco Expi293 PRO Expression System, a next-generation HEK293 transient expression system designed to deliver exceptional protein yields for a wider variety of proteins, including low-yield and challenging proteins, with higher throughput and speed. This launch underscores Thermo Fisher's commitment to advancing protein research and therapeutic drug development

- In May 2025, Bruker Corporation introduced the timsOmni mass spectrometer at the 73rd Conference on Mass Spectrometry and Allied Topics (ASMS). This new system is designed for scientific, drug discovery, and clinical researchers, offering high-speed, high-sensitivity capabilities for identifying low-abundant proteoforms, which are critical in understanding complex diseases

- In June 2025, Bruker launched the timsUltra AIP system, delivering enhanced sensitivity and sequence coverage for sample-limited applications such as single-cell studies. The system offers up to 20% gains in protein identifications and up to 35% gains in peptide identifications, enabling more comprehensive ion coverage for de novo peptide sequencing and immunopeptidomics neoantigen discovery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.