Global Protein Engineering Market

Market Size in USD Billion

CAGR :

%

USD

3.02 Billion

USD

10.12 Billion

2024

2032

USD

3.02 Billion

USD

10.12 Billion

2024

2032

| 2025 –2032 | |

| USD 3.02 Billion | |

| USD 10.12 Billion | |

|

|

|

|

Protein Engineering Market Size

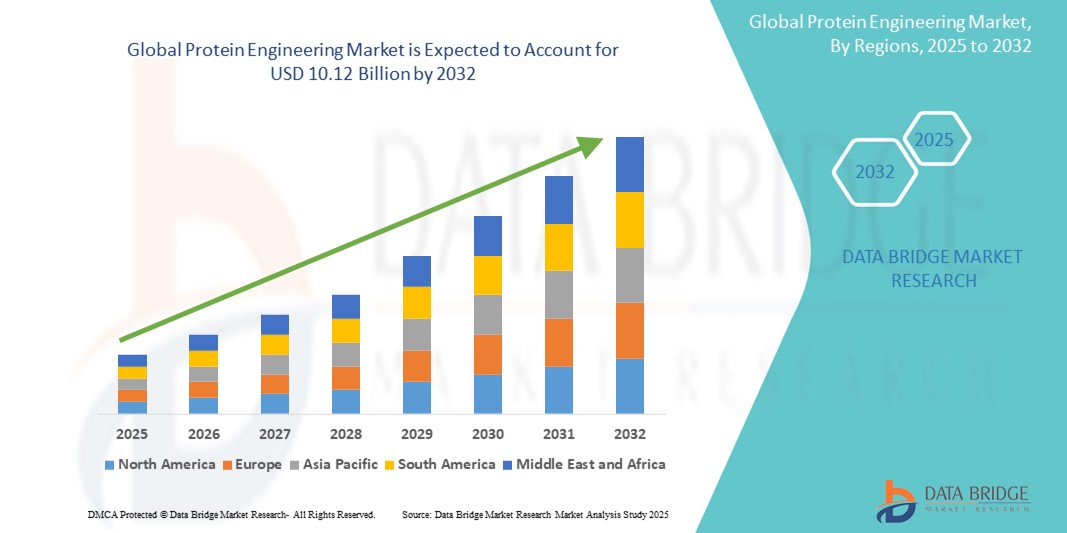

- The global protein engineering market was valued at USD 3.02 billion in 2024 and is expected to reach USD 10.12 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 16.30%, primarily driven by the increasing demand for personalized medicine

- This growth is driven by factors such as the increasing demand of targeted therapy especially in treating chronic disease, and biopharmaceutical advances

Protein Engineering Market Analysis

- Protein engineering is a critical technology used to design and modify proteins for specific applications, offering enhanced functionality, stability, and efficiency. It is essential in the development of therapeutic proteins, industrial enzymes, and novel biologics, playing a central role in fields such as drug discovery, synthetic biology, and diagnostics

- The demand for protein engineering is significantly driven by the increasing prevalence of chronic and genetic diseases, as well as advancements in biotechnology and drug development. Over half of the global demand is driven by the biopharmaceutical sector, with the highest need seen in regions investing heavily in precision medicine and biologics development

- North America stands out as one of the dominant regions for protein engineering, driven by its strong biotechnology ecosystem, advanced research infrastructure, and high R&D expenditure

- For instance, the number of clinical trials involving engineered proteins in the U.S. has steadily increased. From leading pharmaceutical companies to cutting-edge research institutions, the North America region not only utilizes but also drives innovations in protein-based therapeutics

- Globally, protein engineering ranks as one of the most crucial technologies in the biotechnology and pharmaceutical industries, following gene editing tools such as CRISPR, and plays a pivotal role in ensuring the efficacy, safety, and specificity of next-generation therapies

Report Scope and Protein Engineering Market Segmentation

|

Attributes |

Protein Engineering Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Engineering Market Trends

“Integration of AI and Machine Learning in Protein Design”

- One prominent trend in the global protein engineering market is the increasing integration of artificial intelligence (AI) and machine learning (ML) in protein design and development

- These advanced technologies significantly enhance the speed, accuracy, and efficiency of identifying protein structures and predicting their functionality, accelerating the discovery of novel therapeutics and enzymes

- For instance, AI-driven platforms can rapidly analyze massive datasets to model protein folding patterns and simulate interactions with target molecules, which is crucial for designing highly specific and stable therapeutic proteins

- Machine learning algorithms also enable real-time optimization of protein variants, reducing the time and cost associated with traditional trial-and-error methods in laboratory settings

- This trend is transforming the protein engineering landscape by enabling data-driven, automated design workflows, leading to faster innovation, improved drug efficacy, and increased interest from pharmaceutical and biotech companies in adopting these intelligent technologies

Protein Engineering Market Dynamics

Driver

“Growing Demand for Targeted Therapies and Biologics”

- The increasing prevalence of chronic diseases such as cancer, autoimmune disorders, and rare genetic conditions is significantly contributing to the growing demand for protein engineering technologies

- As the global population ages and chronic disease rates continue to rise, there is a heightened need for therapies that offer high specificity, reduced side effects, and improved efficacy—benefits that engineered proteins can provide

- Monoclonal antibodies, recombinant proteins, and enzyme replacement therapies are among the most promising protein-based treatments, requiring sophisticated engineering techniques to optimize their stability, potency, and targeting ability

- Ongoing advancements in genomics, synthetic biology, and drug delivery systems further underscore the necessity of protein engineering in developing next-generation therapeutics

- As personalized medicine gains momentum, more pharmaceutical companies are investing in protein design platforms to create tailored drugs that align with individual patient profiles

For instance:

- In June 2024, according to an article published by Nature Reviews Drug Discovery, over 60% of new biologics entering clinical trials are derived from engineered proteins, highlighting the critical role of protein engineering in modern drug development

- In January 2023, the World Health Organization reported that cancer accounted for nearly 10 million deaths worldwide, further emphasizing the need for advanced protein-based therapies that can target tumors more effectively with fewer side effects

- Therefore, the rising burden of chronic diseases and the shift toward personalized medicine are key drivers accelerating the global adoption of protein engineering technologies

Opportunity

“Emergence of AI-Driven Protein Design and Computational Modeling”

- The integration of artificial intelligence and machine learning into protein engineering has opened new frontiers in speed, precision, and cost-effectiveness.

- AI algorithms can predict protein folding, binding affinities, and structural stability with high accuracy, greatly accelerating the design and optimization of novel therapeutic proteins and enzymes

- These capabilities not only reduce R&D timelines but also enable companies to explore a broader landscape of protein variants and therapeutic targets.

- AI-powered platforms are also being used to repurpose existing proteins and predict their behavior in different disease models, facilitating a more dynamic and scalable drug discovery process

For instance:

- In February 2024, according to an article published by the journal Science, Google's DeepMind successfully demonstrated AlphaFold’s ability to predict the 3D structure of nearly every known protein, significantly boosting global research efforts in drug discovery and protein-based innovation

- In October 2023, an article from MIT Technology Review highlighted how biotech startups using AI-based protein modeling raised over USD 2.5 billion in funding, signaling robust investor confidence in this transformative approach

- Thus, the integration of AI and machine learning is revolutionizing protein engineering by enhancing innovation, accelerating drug discovery, and attracting significant investment in the biotech sector

Restraint/Challenge

“High Research Costs and Technical Complexity”

- Despite its vast potential, protein engineering remains a capital-intensive and technically complex field, often requiring specialized facilities, advanced instrumentation, and highly skilled personnel

- The costs associated with research, development, clinical trials, and regulatory compliance can be prohibitively high, especially for startups and research institutions in emerging markets

- In addition, the complexity of protein behavior—such as misfolding, aggregation, or unexpected immune responses—adds further challenges in achieving consistent and safe outcomes

- These hurdles can delay product development and limit the broader adoption of protein engineering technologies in mainstream healthcare and industrial settings

For instance:

- In December 2024, according to a report by the International Federation of Pharmaceutical Manufacturers, the average cost to develop a protein-based biologic drug was estimated at over USD 2.6 billion, highlighting the financial barriers to entry in this market

- In March 2023, the journal Biotechnology Advances emphasized the difficulty of scaling protein production due to complex purification processes, stability issues, and regulatory constraints, which can deter innovation in smaller biotech firms

- Consequently, high development costs and technical complexities pose significant barriers to entry and scalability in the protein engineering market, particularly for smaller players and emerging regions

Protein Engineering Market Scope

The market is segmented on the basis of product, technology, protein type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Protein Type |

|

|

By End User

|

|

Protein Engineering Market Regional Analysis

“North America is the Dominant Region in the Protein Engineering Market”

- North America dominates the protein engineering market, driven by its robust biotechnology sector, advanced research infrastructure, and the strong presence of key pharmaceutical and biotech companies

- The United States holds a significant share due to increasing investments in biologics development, high demand for targeted therapies, and widespread adoption of advanced technologies such as AI in drug discovery

- Supportive regulatory frameworks, well-established reimbursement policies, and substantial government and private funding for life sciences research further strengthen the market across the region

- In addition, the growing number of clinical trials involving engineered proteins and the presence of leading academic and research institutions contribute to the continued innovation and expansion of the protein engineering landscape in North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the protein engineering market, fueled by rapid developments in the healthcare and biotechnology sectors, rising R&D capabilities, and increased demand for affordable biologics

- Countries such as China, India, South Korea, and Japan are emerging as major players due to their growing biotech industries, expanding pharmaceutical manufacturing capabilities, and large patient populations suffering from chronic and genetic diseases

- Japan remains a key market, backed by its strong focus on innovation, regulatory support for biologics, and collaborations between academia and industry to drive protein research

- In China and India, government-led initiatives to boost biotech research, increasing foreign direct investments, and the rise of domestic biopharma startups are accelerating the adoption of protein engineering technologies

- The improving accessibility to advanced research tools, skilled workforce, and international partnerships make Asia-Pacific a critical growth frontier for global players in the protein engineering space

Protein Engineering Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer (U.S.)

- GenScript (U.S.)

- Merck KGaA (Germany)

- Waters Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Lonza (Switzerland)

- Sartorius AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abcam Limited (U.K.)

- Amgen Inc. (U.S.)

- Regeneron Pharmaceuticals Inc. (U.S.)

- Cell Signaling Technology, Inc. (U.S.)

- WuXi AppTec (China)

- Corteva (U.S.)

- BASF (Germany)

- Eppendorf SE (Germany)

- GSK plc. (U.K.)

Latest Developments in Global Protein Engineering Market

- In February 2025, Capgemini unveiled a cutting-edge generative AI methodology for protein engineering, powered by a proprietary protein large language model (pLLM). Designed to predict the most effective protein variants, this innovative approach—currently patent-pending—aims to accelerate progress in the global bioeconomy and drive transformative breakthroughs across sectors such as healthcare, agriculture, and environmental science.

- In November 2024, Cradle Bio announced a USD 73 million Series B funding round led by IVP, bringing its total funding to over USD 100 million. This significant investment highlights the company’s rapid growth as it continues to revolutionize protein engineering with its AI-driven platform, poised to impact a wide range of industries—from therapeutics to agriculture.

- In June 2024, Evolutionary Scale, an AI-focused biology startup, secured USD 142 million in seed funding to develop large language models aimed at creating novel proteins and biological systems. Their innovations are expected to accelerate drug discovery and environmental applications, such as engineering microbes to break down plastics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.