Global Protein Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

58.53 Billion

USD

82.33 Billion

2024

2032

USD

58.53 Billion

USD

82.33 Billion

2024

2032

| 2025 –2032 | |

| USD 58.53 Billion | |

| USD 82.33 Billion | |

|

|

|

|

Protein Ingredients Market Size

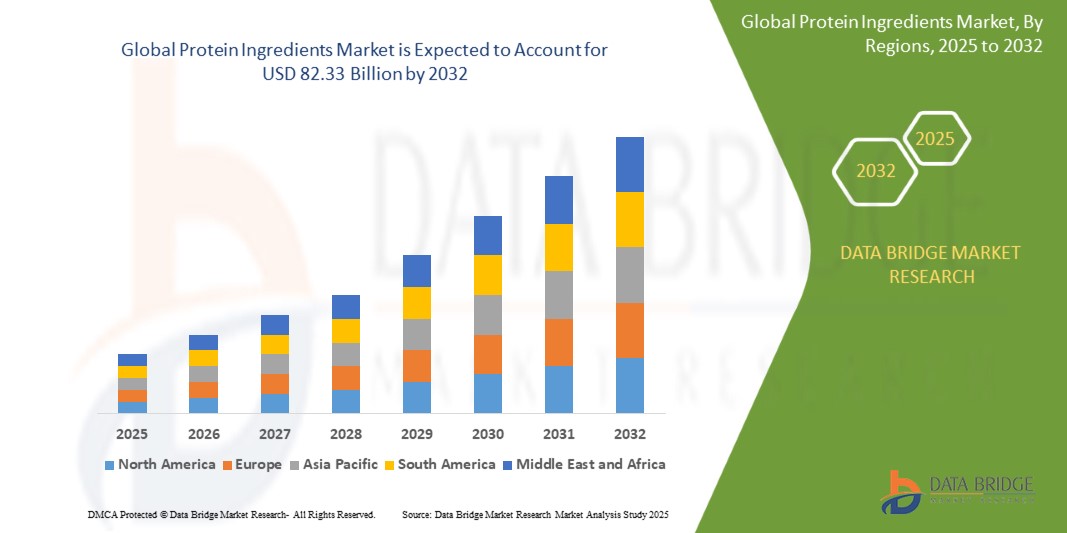

- The global protein ingredients market was valued at USD 58.53 billion in 2024 and is expected to reach USD 82.33 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.40%, primarily driven by the growing shift toward sustainable, alternative protein sources including upcycled and low-impact raw materials driven by consumer demand for clean-label and environmentally friendly products .

- This growth is driven by factors such as the growing popularity of plant-based diets and rising health awareness and demand for high-quality protein

Protein Ingredients Market Analysis

- The protein ingredients market is driven by rising health awareness and growing demand for high-protein diets that support fitness, weight management, and healthy aging. Consumers are increasingly incorporating protein-enriched foods, supplements, and beverages into daily routines.

- While plant-based proteins are gaining momentum due to sustainability and allergen-free appeal, animal-based proteins such as whey, casein, and egg protein remain dominant due to their superior amino acid profiles and high digestibility, particularly in sports and clinical nutrition sectors.

- North America and Europe are mature markets characterized by functional product innovation and strong retail presence, whereas Asia-Pacific is witnessing the fastest growth, fueled by increasing disposable incomes, urbanization, and protein malnutrition awareness.

- The animal segment is expected to dominate the market by source, accounting for approximately 65% of global revenue share in 2025, driven by its long-standing application across dietary supplements, medical nutrition, and food fortification industries.

Report Scope and Protein Ingredients Market Segmentation

|

Attributes |

Protein Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Ingredients Market Trends

Rise of Sustainable and Upcycled Protein Sources to Meet Clean Label and Eco-Conscious Demands

- A major trend in the global protein ingredients market is the growing shift toward sustainable, alternative protein sources including upcycled and low-impact raw materials driven by consumer demand for clean-label and environmentally friendly products

- Manufacturers are increasingly incorporating protein extracted from food industry byproducts such as brewers’ spent grain, sunflower press cake, and rice bran to reduce waste and carbon footprint

- Single-cell proteins derived from algae, fungi, and precision fermentation are also gaining traction, offering high protein yield with lower resource input compared to traditional animal-based sources

- For instance, Danish biotech company Kaffe Bueno has developed Kafflour, an upcycled, gluten-free flour made from spent coffee grounds. Kafflour is rich in protein, dietary fibers, and minerals, and is designed for use in healthy baking. The company plans to scale up production to meet demand from food makers in the Nordics and Western Europe.

Protein Ingredients Market Dynamics

Driver

Rising Health Awareness and Demand for High-Quality Protein

- The growing global awareness of the health benefits associated with protein consumption is driving the demand for high-quality protein ingredients. Consumers are increasingly seeking protein-rich products to support their active lifestyles, fitness goals, and general well-being.

- The rise in sports nutrition, weight management, and immunity-boosting trends is fueling the adoption of protein ingredients in functional foods, beverages, and supplements.

- With the aging population, especially in regions like North America and Europe, there is a growing demand for protein ingredients that support muscle maintenance, bone health, and overall longevity.

For instance,

- An August 2024 article from The Guardian highlights that plant-based meat alternatives are more environmentally friendly and generally healthier compared to traditional animal-based products. The study evaluated 68 plant-based and 36 meat products, finding that meat substitutes generate fewer greenhouse gas emissions and use less water. Nutritionally, these alternatives have fewer calories, lower saturated fats, and more fiber.

- As health and wellness trends continue to evolve, the demand for protein ingredients in everyday products, from snacks to beverages, is expected to expand significantly, further driving market growth.

Opportunity

Increasing Collaborations Between Protein Manufacturers and Foodservice Companies

- Strategic partnerships between protein ingredient manufacturers and foodservice companies are accelerating the development and adoption of innovative protein-based products.

- These collaborations enable the co-creation of tailored protein solutions that meet specific culinary and nutritional needs, enhancing product offerings in the foodservice sector.

- By leveraging each other's expertise, these partnerships facilitate faster product development, scalability, and market penetration, catering to the growing consumer demand for diverse protein-rich foods.

For instance,

- In April 2025, Spanish plant-based meat leader Heura Foods partnered with French vegan whole-cut specialist Swap (formerly Umiami) to launch a whole-cut chicken fillet in three European markets. This collaboration aims to revolutionize the plant-based fillet experience.

- As the demand for high-quality, sustainable protein sources continues to rise, such collaborations present significant opportunities for growth and innovation in the protein ingredients market.

Restraint/Challenge

Regulatory Frameworks for Novel Protein Products

- The introduction of novel protein ingredients products often involves innovative plant-based ingredients that must meet strict regulatory approvals, especially in markets like the EU, U.S., and Asia.

- These regulatory processes can be time-consuming and require extensive documentation, clinical trials, or safety testing, which delays product launches and hampers market responsiveness.

- Companies must invest heavily in compliance, labeling, and reformulation to meet evolving food safety and labeling standards, increasing operational and legal costs.

- Smaller manufacturers face disproportionate challenges in navigating complex regulatory environments, limiting their ability to scale and innovate effectively.

For instance,

- A 2024 article from Nature Food highlights that the lack of clear and transparent standards and guidelines at both national and international levels regarding alternative proteins is considered one of the key issues slowing down progress in the industry. The article emphasizes the need for regulatory frameworks that ensure consumer safety while facilitating innovation and fair trade among food companies across countries.

Protein Ingredients Market Scope

The market is segmented on the basis of source, form and application.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Form |

|

|

By Application |

|

In 2025, the Food & Beverages segment is projected to dominate the market with the largest share in the application segment.

The Food & Beverages segment is expected to dominate the Global Protein Ingredients Market with the largest share of approximately 58% in 2025. This growth is driven by the increasing incorporation of protein ingredients in a variety of products, such as snacks, dairy alternatives, ready-to-eat meals, and beverages, to meet rising consumer demand for high-protein, functional foods.

In 2025, the animal segment is expected to account for the largest share during the forecast period in the source segment.

In 2025 the animal segment is expected to dominate the market by source, accounting for approximately 65% of global revenue share in 2025, driven by its long-standing application across dietary supplements, medical nutrition, and food fortification industries.

Protein Ingredients Market Regional Analysis

Asia-Pacific is the Dominant Region in the Protein Ingredients Market

-

Asia-Pacific dominates the global protein ingredients market, fueled by rising health awareness, increasing demand for high-protein diets, and strong government support for nutrition-related programs.

- Countries like China and India lead due to growing middle-class populations, rapid urbanization, and an expanding focus on fitness, wellness, and preventative health.

- The growing popularity of functional foods, sports nutrition, and plant-based diets is accelerating demand for protein sources such as soy, pea, and rice proteins.

- In China, major food manufacturers are actively incorporating protein fortification into packaged foods, while India’s booming nutraceutical and dietary supplement industries are increasing demand for whey and plant-based proteins.

Asia-Pacific is Projected to Register the Highest Growth Rate

-

The region is expected to record the fastest growth, owing to increasing investments in food innovation, consumer education about nutrition, and growing interest in sustainable protein sources.

- South-East Asian countries, including Thailand, Indonesia, and Vietnam, are seeing rapid adoption of protein-enriched beverages, snacks, and meal replacements.

- Japan and South Korea are leveraging advanced food technology to develop protein-rich functional foods, targeting aging populations and health-conscious consumers.

- With rising veganism, environmental concerns, and protein malnutrition awareness, Asia-Pacific is emerging as both a consumption and production hub for protein ingredients.

Protein Ingredients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ADM (U.S)

- Cargill, Incorporated (U.S)

- Kerry Group plc (Ireland)

- Arla Foods amba (Denmark)

- BRF Global (Brazil)

- The Scoular Company (U.S)

- Roquette Freres (France)

- AMCO Proteins (U.S)

- A&B Ingredients (U.S)

- Puris (U.S)

- Cosucra (Belgium)

- Burcon (Canada)

- Sotexpro (France)

- AGT Food & Ingredients (Canada)

- Now Foods (U.S)

- Shandong Sinoglory Health Food Co., Ltd (China)

- Process Agrochem Industries Pvt Ltd (India)

- CJ Selecta (Brazil)

- Aminola BV (Netherlands)

- The Green Labs LLC (U.S)

- ETchem (China)

- Bremil Group (Brazil)

- Chaitanya Group of Industries (India)

- Nordic Soya Oy (Finland)

- JR Unique Foods (Thailand)

- Protenga (Singapore)

- Hipromine SA (Poland)

- Bioflytech (Spain)

- Tebrio (Spain)

Latest Developments in Global Protein Ingredients Market

- In April 2024, Denmark-based Arla Foods amba announced its plans to acquire the UK’s Volac Whey Nutrition business, including Volac Whey Nutrition Holdings Limited and its subsidiaries. Subject to regulatory approval, the transaction is expected to be finalized later this year. The acquisition is intended to transform the Felinfach facility into a global production hub, strengthening Arla Foods Ingredients' position in the sports nutrition, health, and food industries.

- In September 2023, Cargill, Incorporated (US) announced the opening of its first European Protein Innovation Hub at its Saint-Cyr en Val facility in France, part of a USD 54.1 million investment. The new hub, which included a test kitchen and pilot plant, aimed to support customers in co-creating and testing protein-rich products. This expansion increased the site's output capacity by 10% and enhanced its sustainability efforts.

- In May 2023, Arla Foods amba (Denmark) launched Lacprodan Alpha-50, a new alpha-lactalbumin-rich ingredient for low-protein infant formulas. This product meets the rising demand for reduced protein content due to obesity concerns and regulatory changes. With 90% of its protein as alpha-lactalbumin, Lacprodan Alpha-50 allows manufacturers to match human milk protein levels with smaller doses.

- In April 2024, Glanbia announced the acquisition of Aroma Holding Company, a US flavoring business, for USD 300 million, with potential additional payments based on performance. This acquisition aims to strengthen Glanbia's Glanbia Nutritionals segment by integrating flavor solutions into its nutritional products, catering to the evolving tastes and preferences in the health and wellness market.

- On May 12, 2025, Danone announced the acquisition of a majority stake in Kate Farms, a U.S.-based producer of plant-based organic nutritional drinks. Founded in 2012 to address medical feeding needs, Kate Farms provides nutritional shakes and formulas for individuals with health conditions. The integration aims to expand Danone’s presence in the U.S. medical nutrition market. Kate Farms' CEO, Brett Matthews, will lead Danone's North American Medical Nutrition business, while the current management retains a minority stake.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Protein Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protein Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protein Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.