Global Proximity Cards Market

Market Size in USD Billion

CAGR :

%

USD

13.44 Billion

USD

23.27 Billion

2024

2032

USD

13.44 Billion

USD

23.27 Billion

2024

2032

| 2025 –2032 | |

| USD 13.44 Billion | |

| USD 23.27 Billion | |

|

|

|

|

Proximity Cards Market Size

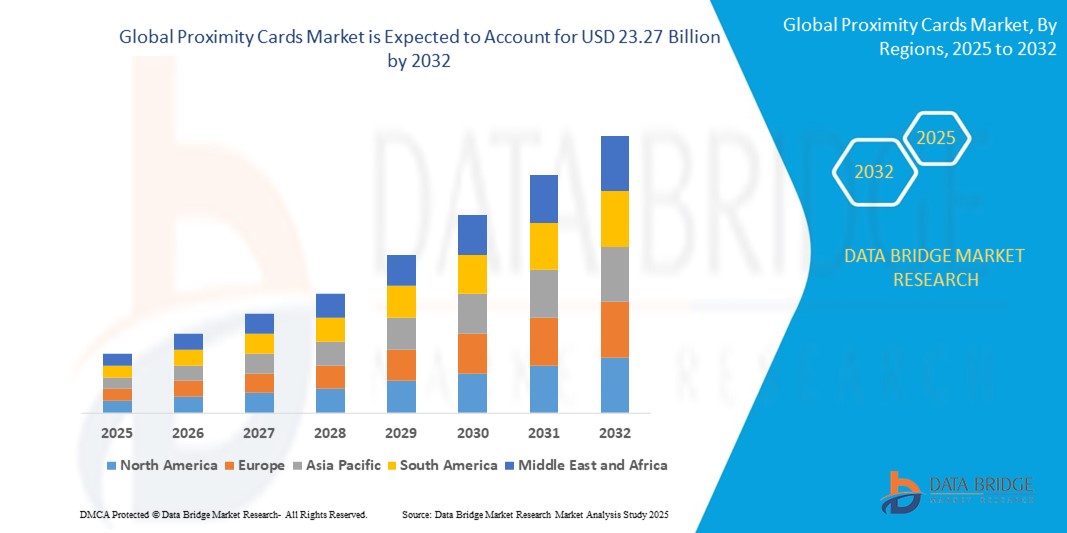

- The global proximity cards market size was valued at USD 13.44 billion in 2024 and is expected to reach USD 23.27 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is primarily driven by the increasing adoption of contactless payment systems, enhanced security requirements across various sectors, and advancements in RFID technology

- Rising consumer preference for secure, efficient, and seamless access control and payment solutions is positioning proximity cards as a preferred choice in both commercial and institutional settings, significantly boosting market expansion

Proximity Cards Market Analysis

- Proximity cards, utilizing RFID and NFC technologies for contactless access and transactions, are integral to modern security, payment, and identification systems across industries due to their convenience, speed, and enhanced security features

- The growing demand for proximity cards is fueled by the widespread adoption of contactless technologies, increasing security concerns, and the need for efficient access control and payment systems in various sectors

- North America dominated the proximity cards market with the largest revenue share of 38.5% in 2024, driven by early adoption of contactless technologies, high penetration of smart payment systems, and the presence of major industry players. The U.S. leads in proximity card adoption, particularly in banking and retail, supported by innovations from established companies and startups focusing on secure, scalable solutions

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing digital payment adoption, and rising investments in infrastructure development

- The low frequency cards segment dominated the market with the largest market revenue share in 2024, driven by their reliability, cost-effectiveness, and widespread compatibility with existing access control systems

Report Scope and Proximity Cards Market Segmentation

|

Attributes |

Proximity Cards Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Proximity Cards Market Trends

“Enhanced Convenience through AI and Voice Integration”

- A prominent and rapidly growing trend in the global proximity cards market is the integration with artificial intelligence (AI) and voice-controlled ecosystems such as amazon alexa, google assistant, and apple homekit. This integration enhances user convenience and streamlines access control systems

- For instance, certain smartcard integrated circuits, such as those used in multi-application proximity cards, can now interface with voice assistants, enabling users to manage access permissions or authenticate transactions using voice commands

- AI integration in proximity cards enables advanced features such as learning user access patterns to optimize security protocols and providing intelligent alerts for suspicious activities. For instance, some microprocessor smart cards utilize AI to improve authentication accuracy over time and can notify administrators of unusual access attempts in real time

- Voice control capabilities allow hands-free operation, enabling users to grant or revoke access remotely through simple verbal commands, which is particularly valuable in applications such as office buildings and government facilities

- The integration of proximity cards with digital assistants and broader smart ecosystems facilitates centralized control over access management, payment systems, and other connected services. Through a single interface, users can manage cards for applications in transportation, banking, and retail alongside other IoT devices

- Companies such as HID Global and NXP Semiconductors are developing AI-enabled proximity cards with features such as automatic authentication based on authorized access patterns and compatibility with voice assistants, enhancing user experience and operational efficiency

- The demand for proximity cards with seamless AI and voice control integration is growing across sectors such as transportation, banking, retail and loyalty, entertainment, government, energy and utility, and healthcare, as organizations prioritize convenience and integrated smart solutions

Proximity Cards Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart System Adoption”

- The increasing prevalence of security concerns across industries, coupled with the rapid adoption of smart ecosystems, is a significant driver for the demand for proximity cards

- For instance, in March 2025, HID Global announced advancements in IoT-based access control solutions, integrating cutting-edge RFID and NFC technologies into their proximity card systems to enhance security and convenience. Such innovations by key players are expected to propel market growth through 2032

- As organizations and individuals become more aware of security threats, proximity cards offer advanced features such as encrypted authentication, activity logs, and tamper-proof designs, making them a superior alternative to traditional access methods such as keys or magnetic stripe cards

- The growing popularity of smart systems, particularly in smart buildings and smart cities, has made proximity cards an integral component of these ecosystems, offering seamless integration with IoT devices and platforms

- The convenience of contactless access, remote management of credentials, and the ability to use multi-application cards for purposes such as secure payments, transit ticketing, and building access are key factors driving adoption in sectors such as transportation, banking, retail, and government. The trend toward user-friendly, scalable smart solutions further accelerates market growth

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Cybersecurity vulnerabilities in connected proximity card systems pose a significant challenge to market expansion. As proximity cards rely on RFID, NFC, or network connectivity, they are susceptible to hacking, data interception, or unauthorized cloning, raising concerns among users about security and privacy

- For instance, reports of vulnerabilities in RFID-based systems have made some organizations hesitant to fully adopt proximity cards, particularly in high-security sectors such as government and healthcare

- Addressing these concerns requires robust encryption, secure authentication protocols, and regular firmware updates. Companies such as Giesecke Devrient and Infineon Technologies emphasize advanced encryption and secure chip designs to build trust among users

- In addition, the high initial cost of advanced proximity card systems, particularly those with microprocessor smart cards or biometric integration, can be a barrier for price-sensitive markets, such as small businesses or developing regions

- Overcoming these challenges through enhanced cybersecurity measures, consumer education on secure usage, and the development of cost-effective proximity card options will be critical for sustained market growth

Proximity Cards market Scope

The market is segmented on the basis of frequency, technology, application, and end user.

- By Frequency

On the basis of frequency, the proximity cards market is segmented into low frequency cards, high frequency cards, and ultra-high frequency cards. The low frequency cards segment dominated the market with the largest market revenue share in 2024, driven by their reliability, cost-effectiveness, and widespread compatibility with existing access control systems. Low Frequency Cards, typically operating at 125 kHz, are favored for their simplicity and suitability for short-range applications such as office and hotel access control.

The Ultra-High frequency cards segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by their extended reading ranges and faster data transfer speeds, making them ideal for logistics, asset tracking, and large-scale industrial applications. Operating at 860–960 MHz, Ultra-High Frequency Cards are increasingly adopted in IoT and automation-driven environments, enhancing operational efficiency in warehouses and supply chain management.

- By Technology

On the basis of technology, the proximity cards market is segmented into smartcard integrated circuits, memory smart cards, microprocessor smart card, and others. The smartcard integrated circuits segment held the largest market revenue share in 2024, driven by their ability to support advanced security features and seamless integration with contactless technologies such as NFC and RFID. These cards are widely used for secure access control and cashless payments in corporate and financial sectors.

The microprocessor Smart Card segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its enhanced processing capabilities and ability to handle complex applications such as secure identification, electronic passports, and transit ticketing. Microprocessor Smart Cards offer robust encryption and dynamic data processing, making them suitable for high-security applications.

- By Application

On the basis of application, the proximity cards market is segmented into hotel buildings, office building, government building, and others. The office building segment accounted for the largest market revenue share in 2024, driven by the widespread adoption of proximity cards for employee access control, time and attendance management, and secure entry systems in corporate environments. The integration of proximity cards with modern office infrastructure enhances security and operational efficiency.

The government building segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing government initiatives for secure identification, e-passports, and digital record-keeping. Proximity cards are increasingly used for citizen ID programs and access control in sensitive government facilities, supported by global digitization trends

- By End User

On the basis of end user, the proximity cards market is segmented into transportation, banking, retail and loyalty, entertainment, government, energy and utility, healthcare, and others. The transportation segment held the largest market revenue share in 2024, driven by the extensive use of proximity cards in transit fare systems, such as London’s Oyster card, and their role in facilitating contactless payments and ticketing. The rise in urbanization and smart city initiatives further boosts demand in this sector.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of proximity cards for patient identification, secure access to medical records, and staff access control in healthcare facilities. The emphasis on data security and efficiency in healthcare operations fuels this segment’s growth.

Proximity Cards Market Regional Analysis

- North America dominated the proximity cards market with the largest revenue share of 38.5% in 2024, driven by early adoption of contactless technologies, high penetration of smart payment systems, and the presence of major industry players. The U.S. leads in proximity card adoption, particularly in banking and retail, supported by innovations from established companies and startups focusing on secure, scalable solutions

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by rapid urbanization, increasing digital payment adoption, and rising investments in infrastructure development

U.S. Proximity Cards Market Insight

The U.S. proximity cards market held the largest revenue share of 78% in 2024 within North America, driven by widespread adoption of contactless access control systems and the growing trend of secure identification in various sectors. Businesses and consumers are increasingly prioritizing enhanced security through proximity card-based solutions for access control in offices, educational institutions, and healthcare facilities. The surge in demand for integrated systems with mobile credentials and IoT-enabled devices further accelerates market growth. In addition, the compatibility of proximity cards with smart building technologies, such as automated entry systems and time-tracking solutions, significantly contributes to market expansion.

Europe Proximity Cards Market Insight

The Europe proximity cards market is projected to grow at a substantial CAGR throughout the forecast period, fueled by stringent data protection regulations and the rising need for secure access control in commercial and public sectors. Urbanization, coupled with the demand for contactless and efficient identification systems, is driving the adoption of proximity cards. European organizations are increasingly drawn to the scalability and cost-effectiveness of these solutions. The region is witnessing significant growth in applications across corporate offices, government facilities, and multi-tenant buildings, with proximity cards being integrated into both new installations and retrofitted systems.

U.K. Proximity Cards Market Insight

The U.K. proximity cards market is expected to expand at a notable CAGR during the forecast period, propelled by the growing trend of smart building solutions and the demand for enhanced security and operational efficiency. Concerns over unauthorized access and data breaches are encouraging businesses and institutions to adopt proximity card systems. The U.K.’s robust digital infrastructure and widespread adoption of contactless technologies, supported by a strong e-commerce and retail ecosystem, are anticipated to further stimulate market growth.

Germany Proximity Cards Market Insight

The Germany proximity cards market is forecasted to grow at a significant CAGR during the forecast period, driven by increasing awareness of cybersecurity and the demand for advanced, eco-friendly access control solutions. Germany’s advanced technological infrastructure, combined with its focus on innovation and data privacy, fosters the adoption of proximity cards, particularly in corporate and industrial sectors. The integration of proximity cards with smart building management systems is gaining traction, with a strong emphasis on secure, GDPR-compliant solutions that align with local consumer expectations.

Asia-Pacific Proximity Cards Market Insight

The Asia-Pacific proximity cards market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising investments in smart infrastructure, and technological advancements in countries such as China, Japan, and India. The region’s increasing focus on smart cities, supported by government initiatives promoting digitalization, is accelerating the adoption of proximity cards. As APAC emerges as a key manufacturing hub for proximity card components, affordability and accessibility are expanding, catering to a broader consumer and business base.

Japan Proximity Cards Market Insight

The Japan proximity cards market is gaining momentum due to the country’s advanced technological landscape, rapid urbanization, and demand for secure access solutions. The Japanese market places a strong emphasis on security, with proximity cards being widely adopted in smart offices, educational institutions, and public transportation systems. The integration of proximity cards with IoT ecosystems, such as smart locks and surveillance systems, is driving growth. In addition, Japan’s aging population is likely to increase demand for user-friendly, secure access control solutions across residential and commercial sectors.

China Proximity Cards Market Insight

The China proximity cards market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s expanding urban population, growing middle class, and rapid adoption of contactless technologies. China is one of the largest markets for smart access control systems, with proximity cards gaining popularity in corporate offices, residential complexes, and public infrastructure. The push toward smart city development, coupled with the availability of cost-effective proximity card solutions and strong domestic manufacturing, are key factors propelling market growth in China.

Proximity Cards Market Share

The proximity cards industry is primarily led by well-established companies, including:

- Thales (France)

- CardLogix Corporation (U.S.)

- Giesecke+Devrient GmbH (Germany)

- Watchdata Technologies Co., Ltd. (China)

- HID Global Corporation (U.S.)

- ID card SMB (France)

- IDenticard Systems, Inc. (U.S.)

- Paragon Group Limited (U.K.)

- ADT Inc. (U.S.)

- Zions Security (U.S.)

- Advanced Card Systems Ltd. (Hong Kong)

- ASSA ABLOY (Sweden)

- Zebra Technologies Corporation (U.S.)

- Magicard Ltd. (U.K.)

- AlphaCard, LLC (U.S.)

What are the Recent Developments in Global Proximity Cards Market?

- In February 2024, dormakaba introduced the Saflok QuantumRFID proximity card system at the ISC West 2024 expo. This advanced electronic lock series integrates low-frequency RFID technology with mobile credential support, ensuring seamless access control for hotels and commercial spaces. The system enhances security, user convenience, and operational efficiency, supporting contactless entry solutions

- In January 2024, Integrated Biometrics (IB) announced that its Danno FAP 30 biometric capture device was integrated into DataWorks Plus' Evolution 3 handheld device. This collaboration enhances field-based identification for law enforcement, criminal justice, and government agencies, leveraging Livescan identity management software and multimodal biometric technology. The Summit County Medical Examiner’s Office in Ohio adopted the Evolution 3, improving fingerprint identification speed and accuracy

- In November 2023, IDSecurityOnline.com expanded its proximity card offerings, introducing a new premium collection with an extra smooth card surface and personalization options for black text printing. These high-quality access cards can be customized with up to 35 characters, allowing organizations to add their own branding. The QuickShip line ensures fast delivery, including printable cards, fobs, and clamshell cards

- In April 2023, Kanpur Metro launched the GoSmart National Common Mobility Card (NCMC), enabling seamless travel across metro, bus, retail, and parking services nationwide. This interoperable transport card eliminates the need for separate tickets, offering 10% discounts on metro rides and supporting digital payments. The card is available at Kanpur Metro ticket counters and 23 designated banks, ensuring easy access and top-up options

- In January 2023, dzcard launched its Next-Gen Card Development Lab in Bangkok, Thailand, focusing on next-generation smart card technologies with a strong emphasis on sustainability. This innovation hub enables co-creation with clients and partners, developing eco-friendly solutions that advance digital security and environmentally responsible practices. The lab explores cutting-edge card technologies, including dynamic CVV, LED, and biometrics, ensuring innovative and secure smart card solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Proximity Cards Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Proximity Cards Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Proximity Cards Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.