Global Pruritus Drug Market

Market Size in USD Billion

CAGR :

%

USD

7.99 Billion

USD

11.90 Billion

2024

2032

USD

7.99 Billion

USD

11.90 Billion

2024

2032

| 2025 –2032 | |

| USD 7.99 Billion | |

| USD 11.90 Billion | |

|

|

|

|

Pruritus Drug Market Size

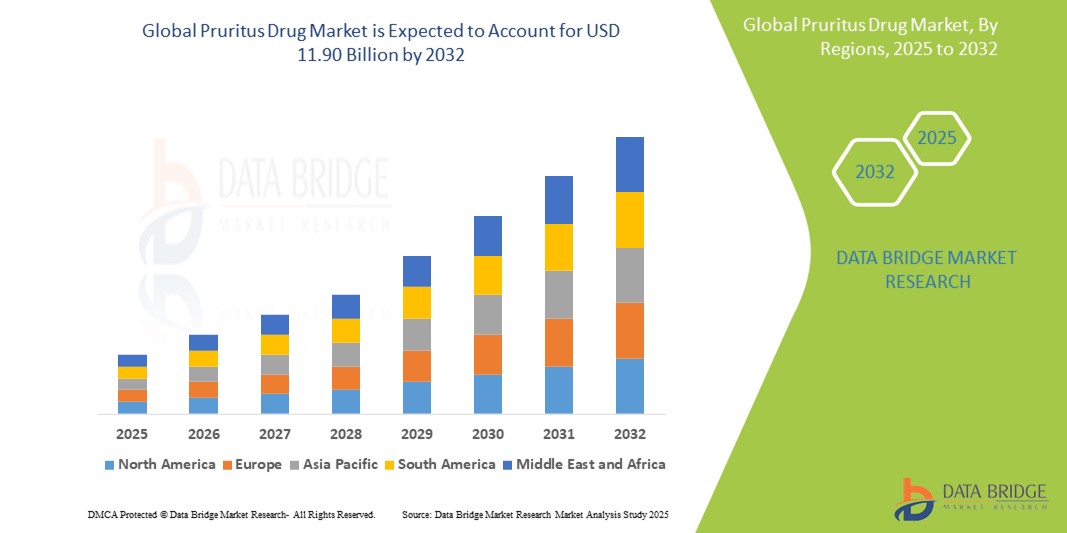

- The global pruritus drug market size was valued at USD 7.99 billion in 2024 and is expected to reach USD 11.90 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic skin conditions such as atopic dermatitis, psoriasis, and allergic reactions, which are major underlying causes of pruritus. This rising disease burden is driving the demand for effective antipruritic therapies, thereby boosting market expansion

- Furthermore, advancements in dermatological research and the development of novel drug formulations, including biologics and targeted therapies, are enhancing treatment efficacy and patient outcomes. These innovations are accelerating the uptake of pruritus drug solutions, significantly contributing to the growth of the global market

Pruritus Drug Market Analysis

- Pruritus drugs, aimed at relieving chronic and acute itching sensations caused by dermatological, systemic, or allergic conditions, are increasingly vital components of modern therapeutic regimens across dermatology, nephrology, and oncology due to their targeted action, improved tolerability, and rising patient demand for symptom relief

- The escalating demand for pruritus drugs is primarily fueled by the increasing prevalence of conditions such as atopic dermatitis, chronic kidney disease-associated pruritus (CKD-aP), and cholestatic liver diseases, combined with growing awareness of quality-of-life treatments and greater access to dermatologic care in both developed and emerging regions

- North America dominates the pruritus drug market with the largest revenue share of 38.5% in 2024, driven by advanced healthcare infrastructure, high diagnosis rates, and widespread adoption of prescription therapies, including newly approved biologics and JAK inhibitors in the U.S. for treating inflammatory skin conditions associated with chronic pruritus

- Asia-Pacific is expected to be the fastest growing region in the pruritus drug market during the forecast period, with an CAGR of 7.2%, fueled by rising disposable incomes, urbanization, expanding healthcare access, and increasing focus on skin health and chronic disease management in countries such as China, India, and South Korea

- Antihistamines segment dominates the pruritus drug market with a market share of 42.7% in 2024, due to its long-standing use as a first-line treatment, cost-effectiveness, and broad accessibility in both over-the-counter and prescription formats across multiple indications

Report Scope and Pruritus Drug Market Segmentation

|

Attributes |

Pruritus Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pruritus Drug Market Trends

“Enhanced Convenience Through Advanced Connectivity and Intuitive Control”

- A significant and accelerating trend in the global pruritus drug market is the rising incidence of chronic itching disorders, driven by conditions such as atopic dermatitis, psoriasis, chronic kidney disease, and various systemic illnesses. This escalating disease burden is compelling pharmaceutical companies to innovate and expand their treatment portfolios, as pruritus remains a common yet often challenging symptom to treat

- For instance, the development of novel drug classes, including biologics and JAK inhibitors, is seamlessly integrating into treatment paradigms, offering more precise and effective solutions. These advanced therapies, such as Dupilumab for atopic dermatitis-associated pruritus or specific kappa opioid receptor agonists for chronic kidney disease-associated pruritus, are reshaping the market by addressing underlying inflammatory and neural pathways rather than just alleviating symptoms

- Growing awareness among patients and healthcare professionals regarding the impact of chronic pruritus on quality of life is enabling earlier diagnosis and driving demand for advanced treatments. This increased understanding facilitates more intelligent treatment pathways, leading to better patient outcomes and reduced long-term discomfort. Furthermore, the expansion of clinical trials for pruritus-related conditions is creating new opportunities for industry players to bring more effective and safer options to market

- The increasing geriatric population is a key demographic factor amplifying market demand, as older adults are more susceptible to chronic pruritus due to age-related skin changes and underlying health conditions. This demographic shift necessitates the development of well-tolerated and effective treatments suitable for an aging patient base

- The seamless integration of new pharmaceutical innovations with established dermatological and systemic treatment protocols facilitates a more centralized and comprehensive approach to patient care. Through a multidisciplinary approach, healthcare providers can manage pruritus alongside primary conditions, creating a unified and effective treatment experience

- This trend towards more intelligent, intuitive, and interconnected treatment approaches is fundamentally reshaping patient and clinician expectations for pruritus management. Consequently, companies are actively developing new drugs and formulations with improved efficacy and safety profiles, focusing on long-term relief and enhanced patient adherence. The demand for pruritus drugs that offer targeted action and improved patient outcomes is growing rapidly across various healthcare sectors, as consumers increasingly prioritize effective symptom control and overall well-being

Pruritus Drug Market Dynamics

Driver

“Growing Need Due to Rising Disease Prevalence and Advancements in Therapies”

- The increasing prevalence of chronic pruritic conditions among patients worldwide, coupled with the accelerating adoption of advanced diagnostic methods, is a significant driver for the heightened demand for pruritus drug solutions

- For instance, in April 2024, new clinical trial data for targeted biologics in severe atopic dermatitis-associated pruritus highlighted advancements in understanding itch pathways. Such advancements in Pruritus Drug development by key pharmaceutical companies are expected to drive the pruritus drug industry growth in the forecast period

- As patients become more aware of available treatments for chronic itch and seek enhanced relief for their discomfort, pruritus drug options offer advanced features such as targeted anti-inflammatory action, neuro-modulation, and long-term symptom control, providing a compelling upgrade over traditional symptomatic therapies

- Furthermore, the growing understanding of the pathogenesis of chronic pruritus and the desire for improved patient quality of life are making novel Pruritus Drug classes an integral component of comprehensive treatment regimens, offering seamless integration with existing dermatological and systemic disease management platforms

- The convenience of reduced itch burden, improved sleep quality for patients, and the ability to manage symptoms through more effective pharmaceutical applications are key factors propelling the adoption of pruritus drug solutions in both clinical and home care settings. The trend towards personalized medicine and the increasing availability of user-friendly pruritus drug options further contribute to market growth

Restraint/Challenge

“Concerns Regarding High Treatment Costs and Limited Awareness of Specific Etiologies”

- Concerns surrounding the high initial costs of advanced pruritus drug systems, particularly novel biologics and targeted therapies, pose a significant challenge to broader market penetration. As these pruritus drug solutions rely on complex manufacturing processes and often require specialized administration, they can be susceptible to high price tags, raising anxieties among potential consumers about the accessibility and affordability of their treatment

- For instance, high-profile reports of the cost of some specialty dermatological drugs have made some healthcare providers and payers hesitant to adopt widespread use of these advanced pruritus drug solutions, including in developing regions

- Addressing these cost concerns through robust reimbursement policies, patient assistance programs, and the development of more affordable generic or biosimilar pruritus drug options is crucial for building consumer trust and broader access. Companies such as those developing next-generation itch therapies emphasize their commitment to patient access and affordability strategies in their marketing to reassure potential buyers. In addition, the relatively limited awareness of specific pruritus etiologies (causes) among general practitioners compared to dermatologists or specialists can be a barrier to adoption for accurate diagnosis and targeted treatment

- While prices for some pruritus drug categories are gradually decreasing, the perceived premium for innovative therapies can still hinder widespread adoption, especially for those who do not see an immediate need for the advanced features offered

Pruritus Drug Market Scope

The market is segmented on the basis of types, drugs, route of administration, end-users, and distribution channel.

- By Types

On the basis of types, the pruritus drug market is segmented into chronic kidney disease-associated pruritus, chronic liver disease-associated pruritus, atopic dermatitis-associated pruritus, and others. The atopic dermatitis-associated pruritus segment held the largest market revenue share of approximately 38.6% in 2024, driven by the high prevalence of eczema globally and rising awareness regarding its dermatological management. The expanding range of biologics and targeted therapies further supports growth in this segment.

The chronic kidney disease-associated pruritus segment is anticipated to witness the fastest CAGR of 18.2% from 2025 to 2032, due to the increasing incidence of end-stage renal disease and growing emphasis on symptom relief in dialysis patients.

- By Drugs

Based on drugs, the market is segmented into corticosteroids, antihistamines, counterirritants, and others. Antihistamines segment dominates the market with a market share of 42.7% in 2024, due to its long-standing use as a first-line treatment, cost-effectiveness, and broad accessibility in both over-the-counter and prescription formats across multiple indications

The antihistamines segment is also projected to register the fastest CAGR of 16.5% from 2025 to 2032, fueled by rising demand for non-sedating formulations and increased over-the-counter availability for allergic and dermatological itch relief.

- By Route of Administration

On the basis of route of administration, the pruritus drug market is segmented into injectable, topical, oral, and others. The oral segment held the largest market share in 2024, driven by widespread patient preference for convenience and ease of use in managing chronic conditions. Oral antihistamines and novel oral agents for specific pruritic conditions are widely prescribed.

The Injectable segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing adoption of biologics and other targeted therapies that are often administered via injection, particularly for severe and refractory cases. Precise 2024 percentages for each route are not widely available in summary.

- By End-Users

On the basis of end-users, the pruritus drug market is segmented into hospitals, homecare, specialty clinics, and others. Hospital pharmacies held the largest market revenue share in 2024, reflecting their central role in dispensing prescription-only and advanced biologic therapies, particularly for newly diagnosed or complex cases.

The specialty clinics is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing patient referrals to specialists who provide expert management for chronic and complex pruritus. Homecare is vital for ongoing management of topical and oral therapies.

Pruritus Drug Market Regional Analysis

- North America dominates the pruritus drug market with a substantial revenue share of 38.5% to 41% in 2024. This dominance is driven by a high prevalence of chronic pruritic conditions, a well-established healthcare infrastructure, and significant healthcare expenditure within the region

- Consumers and healthcare providers in the region highly value access to advanced therapeutic options, robust diagnostic capabilities, and specialized treatment centers

- This widespread adoption is further supported by high disposable incomes, increasing awareness about chronic skin conditions, and the presence of key market players actively developing and launching innovative pruritus drug therapies. The strong regulatory support for novel drug approvals also contributes to the region's leading position, establishing North America as a favored hub for both therapeutic development and widespread adoption of pruritus drug solutions

U.S. Pruritus Drug Market Insight

The U.S. pruritus drug market captured largest revenue share of 75.5% in 2024. This is fueled by the high prevalence of chronic pruritic conditions, a robust healthcare infrastructure, and significant advancements in dermatological and systemic therapies. Consumers and healthcare professionals prioritize effective, long-lasting treatments, driving demand for novel biologics and targeted oral therapies. The well-established reimbursement landscape and strong investment in R&D further propel the pruritus drug industry. Moreover, increasing awareness campaigns and patient advocacy groups are significantly contributing to the market's expansion.

Europe Pruritus Drug Market Insight

The Europe pruritus drug market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising burden of chronic skin diseases such as atopic dermatitis and psoriasis, coupled with an aging population. The increasing focus on patient quality of life and improved diagnostic capabilities are fostering the adoption of advanced treatments. European healthcare systems are also emphasizing access to specialized care, leading to greater prescription of innovative pruritus drug solutions. The region is experiencing significant growth across various therapeutic areas, with new drug formulations being integrated into standard treatment protocols.

U.K. Pruritus Drug Market Insight

The U.K. pruritus drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating prevalence of chronic itch conditions and a strong emphasis on improved patient outcomes within the National Health Service (NHS). Additionally, rising awareness of the debilitating impact of pruritus is encouraging both patients and healthcare providers to explore advanced therapeutic options. The U.K.'s robust pharmaceutical research landscape, alongside its accessible healthcare infrastructure, is expected to continue to stimulate pruritus drug market growth.

Germany Pruritus Drug Market Insight

The Germany pruritus drug market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of complex dermatological conditions and the demand for effective, well-tolerated treatment solutions. Germany’s well-developed healthcare system, combined with its emphasis on innovation and high-quality patient care, promotes the adoption of advanced pruritus drug therapies, particularly in specialist clinics. The integration of novel biological agents and targeted small molecules is becoming increasingly prevalent, with a strong preference for secure, patient-focused solutions aligning with local consumer expectations.

Asia-Pacific Pruritus Drug Market Insight

The Asia-Pacific pruritus drug market is poised to grow at the fastest CAGR of 7.2% from 2025 to 2032 driven by increasing disease prevalence, rising disposable incomes, and improving healthcare access in countries such as China, Japan, and India. The region's growing understanding of dermatological conditions, supported by government initiatives promoting public health, is driving the adoption of pruritus drug therapies. Furthermore, as APAC's pharmaceutical manufacturing capabilities expand, the affordability and accessibility of pruritus drug options are reaching a wider consumer base.

Japan Pruritus Drug Market Insight

The Japan pruritus drug market is gaining momentum due to the country’s aging population, high healthcare spending, and a strong demand for advanced medical solutions. The Japanese market places a significant emphasis on addressing chronic conditions, and the adoption of pruritus drug treatments is driven by the increasing incidence of atopic dermatitis and other chronic skin ailments. The integration of novel therapeutics, such as IL-31 receptor antagonists, is fueling growth. Moreover, Japan's robust research and development activities are likely to spur demand for more effective and specialized access solutions in both hospital and specialty care sectors.

China Pruritus Drug Market Insight

The China pruritus drug market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and increasing burden of dermatological diseases. China stands as a large market for pharmaceutical products, and pruritus drug therapies are becoming increasingly popular in addressing widespread chronic itch. The push towards improved healthcare access and the availability of advanced pruritus drug options, alongside strong domestic manufacturers and a growing biopharmaceutical sector, are key factors propelling the market in China.

Pruritus Drug Market Share

The pruritus drug industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- MOD3 Pharma (U.S.)

- NeRRe Therapeutics (U.K.)

- Vyne Therapeutics Inc. (U.S.)

- XBiotech USA, INC. (U.S.)

- Ipsen Pharma (France)

- Eledon Pharmaceuticals, Inc. (U.S.)

- Amorepacific (South Korea)

- RDD Pharma, Ltd. (Israel)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Sanofi (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Takeda Pharmaceutical Company Limited (Japan)

Latest Developments in Global Pruritus Drug Market

- In June 2023, Ipsen announced that the U.S. FDA approved Bylvay (odevixibat) for the treatment of cholestatic pruritus in patients from 12 months of age with Alagille syndrome. This marked a significant advancement, providing an additional treatment option for the debilitating itch associated with this rare genetic disorder

- In September 2022, Dupilumab (Dupixent) received approval for the treatment of Prurigo Nodularis in the U.S. (September 2022) and Canada (July 2023). This marked the first approved targeted therapy for Prurigo Nodularis, a chronic inflammatory skin condition characterized by intensely itchy nodules, signifying a paradigm shift in its treatment

- In March 2023, The European Commission approved Dupixent (dupilumab) for the treatment of severe atopic dermatitis in children aged 6 months to 5 years old who are candidates for systemic therapy. This expanded indication makes Dupixent the first and only targeted medicine approved for this young age group in Europe and the U.S., addressing a significant unmet need

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.