Global Pulmonary Alveolar Proteinosis Drug Market

Market Size in USD Billion

CAGR :

%

USD

0.75 Billion

USD

1.31 Billion

2024

2032

USD

0.75 Billion

USD

1.31 Billion

2024

2032

| 2025 –2032 | |

| USD 0.75 Billion | |

| USD 1.31 Billion | |

|

|

|

|

Pulmonary Alveolar Proteinosis Drug Market Size

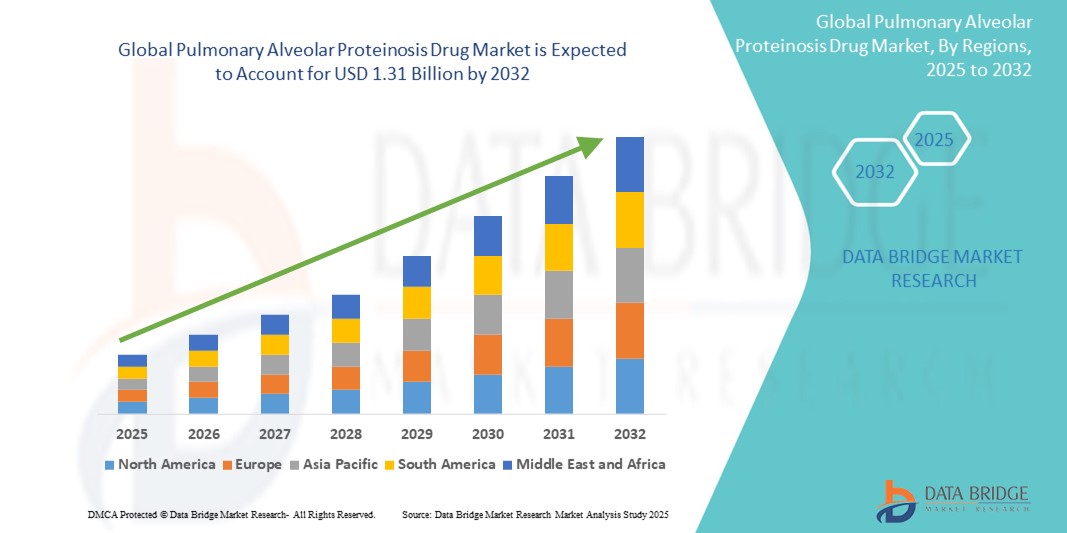

- The Global Pulmonary Alveolar Proteinosis Drug Market size was valued at USD 750.00 Million in 2024 and is expected to reach USD 1.31 billion by 2032, at a CAGR of 7.23% during the forecast period

- The market growth is largely driven by increasing awareness and early diagnosis of rare respiratory disorders, along with the rising prevalence of autoimmune pulmonary alveolar proteinosis (aPAP)

- Furthermore, ongoing advancements in therapeutic options such as GM-CSF replacement therapy and targeted biologics like rituximab are improving patient outcomes and expanding treatment adoption. These combined factors are fostering innovation and accelerating demand for effective PAP drug therapies, thereby supporting sustained growth of the global market

Pulmonary Alveolar Proteinosis Drug Market Analysis

- Pulmonary alveolar proteinosis (PAP) is a rare lung disorder characterized by the accumulation of surfactant within the alveoli, leading to impaired gas exchange and progressive respiratory dysfunction. The rising clinical recognition of PAP, along with improved diagnostic modalities, is driving demand for specialized drug therapies.

- The market is witnessing increasing demand due to growing awareness of PAP among healthcare professionals, the emergence of advanced therapies such as GM-CSF replacement and rituximab-based treatment for autoimmune PAP (aPAP), and ongoing research in targeted and supportive therapies, including whole lung lavage (WLL) and immunomodulatory approaches.

- North America dominates the PAP drug market with the largest revenue share of approximately 38.5% in 2025, driven by greater disease awareness, access to advanced diagnostics, and strong clinical research infrastructure, especially in the U.S. Key pharmaceutical and biotech companies are actively developing targeted biologics and enrolling patients in rare disease registries to improve disease management.

- Asia-Pacific is expected to be the fastest-growing region in the PAP drug market during the forecast period, owing to increasing healthcare investment, improved access to specialty care, and rising recognition of rare pulmonary conditions in countries like Japan, China, and South Korea.

- The autoimmune PAP segment is anticipated to dominate the market by disease type, accounting for approximately 62.3% of the global market share in 2025. This dominance is driven by its higher prevalence compared to congenital and secondary forms, as well as the availability of targeted therapies such as GM-CSF therapy and rituximab, which are demonstrating promising clinical outcomes

Report Scope and Pulmonary Alveolar Proteinosis Drug Market Segmentation

|

Attributes |

Pulmonary Alveolar Proteinosis Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pulmonary Alveolar Proteinosis Drug Market Trends

“Growing Focus on Targeted and Personalized Therapies for Rare Lung Diseases”

- A significant and emerging trend in the global PAP drug market is the increased focus on targeted biologic therapies and personalized treatment approaches, particularly for autoimmune PAP (aPAP)—the most prevalent form of the disease. Innovations in immunomodulatory and GM-CSF-based therapies are transforming the treatment landscape, offering more effective and safer alternatives to traditional methods such as whole lung lavage.

- For instance, Savara Inc.'s inhaled GM-CSF therapy, molgramostim, currently under clinical trials, is designed specifically for aPAP patients and has shown promising results in improving oxygenation and lung function. Similarly, rituximab, a monoclonal antibody targeting B-cells, is being investigated for refractory cases of aPAP with encouraging efficacy and tolerability outcomes.

- The increasing use of precision diagnostics, such as genetic testing, high-resolution CT imaging, and bronchoalveolar lavage analysis, is enabling early detection and more accurate differentiation of PAP subtypes, thereby supporting targeted treatment selection.

- Pharmaceutical companies are also leveraging orphan drug designations and rare disease pathways to expedite the development and approval of novel therapies, with favorable regulatory support in regions such as the U.S. and Europe.

- Moreover, increased collaborations between biotech firms, academic institutions, and rare lung disease foundations are facilitating data sharing, patient registry creation, and multi-center clinical trials, helping expand the global PAP treatment pipeline.

- This growing emphasis on biologic, personalized, and inhalable therapies is reshaping the clinical approach to PAP, enabling more effective management of the disease and improving quality of life for affected patients.

Pulmonary Alveolar Proteinosis Drug Market Dynamics

Driver

“Increasing Awareness and Advancements in Rare Disease Diagnostics and Therapies”

- One of the key drivers for the global PAP drug market is the rising awareness of rare lung disorders and the increasing ability of healthcare systems to accurately diagnose and classify different forms of PAP.

- As awareness grows among pulmonologists and general physicians, patients are being identified earlier, leading to timely intervention and improved outcomes. Campaigns by organizations such as the Rare Lung Disease Consortium and increased educational efforts by hospitals are boosting diagnosis rates.

- Additionally, advancements in diagnostic tools such as bronchoscopy, HRCT imaging, and autoantibody testing have significantly improved clinicians' ability to detect autoimmune PAP, which represents over 90% of adult cases.

- Biopharmaceutical innovations, including the development of inhaled GM-CSF formulations, off-label rituximab, and novel investigational agents, are expanding therapeutic options beyond invasive whole lung lavage procedures.

- The increasing focus of regulatory agencies on orphan diseases, coupled with expedited drug approval pathways and incentives such as market exclusivity and R&D tax credits, is encouraging companies to invest in PAP-related drug development.

- These combined factors are significantly propelling the demand for safe, effective, and targeted PAP therapies, especially in developed healthcare markets such as North America and Europe.

Restraint/Challenge

“Limited Patient Pool and High Treatment Costs in Rare Disease Management”

- Despite growing interest, the PAP drug market faces a critical challenge: the limited global prevalence of the disease, which constrains the addressable patient population for therapy providers.

- PAP is classified as an ultra-rare disease, with an estimated prevalence of around 7 cases per million population, which limits the commercial viability of developing drugs unless supported by orphan drug frameworks.

- Furthermore, the high cost of biologic therapies and advanced diagnostics can strain both healthcare systems and patients, particularly in low- and middle-income countries. Treatments such as inhaled GM-CSF or rituximab infusions can be expensive and require specialist administration, which may not be widely available outside of tertiary care centers.

- Access to advanced care is limited in many regions, and lack of reimbursement policies for rare disease drugs continues to pose a barrier to treatment adoption.

- Additionally, diagnostic delay remains an issue, as symptoms of PAP often overlap with more common respiratory conditions such as asthma or COPD, leading to underdiagnosis or misdiagnosis.

- Overcoming these challenges will require greater investment in global awareness, expansion of reimbursement frameworks, and cost optimization strategies to ensure that innovative therapies reach underserved patient populations worldwide.

Pulmonary Alveolar Proteinosis Drug Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

By Drug Type

On the basis of disease type, the PAP drug market is segmented into autoimmune PAP (aPAP), congenital PAP, and secondary PAP. The autoimmune PAP segment dominates the largest market revenue share of 62.3% in 2025, driven by its higher prevalence compared to the other subtypes. Autoimmune PAP is characterized by the presence of anti-GM-CSF antibodies and has become more identifiable with improved diagnostic assays. The availability of targeted therapies such as inhaled GM-CSF and off-label use of rituximab makes this segment clinically significant.

The congenital PAP segment is expected to witness the fastest CAGR of 6.2% from 2025 to 2032, owing to advancements in neonatal care, genetic testing, and increased awareness of surfactant-processing gene mutations. Although rare, early detection is enabling timely intervention and supporting demand for experimental and supportive treatments in pediatric care settings.

By Drug Type

On the basis of drug type, the market is segmented into rituximab and others (including GM-CSF therapies, corticosteroids, and supportive agents).

The rituximab segment is projected to account for the largest revenue share in 2025, particularly in patients with autoimmune PAP who are unresponsive to standard therapies. Its targeted mechanism, involving B-cell depletion, is demonstrating positive outcomes in clinical trials.

The GM-CSF therapy (categorized under others) is expected to register the fastest growth, with agents like molgramostim and sargramostim under clinical development or compassionate use protocols. These biologics offer localized delivery and minimal systemic effects, gaining favor among physicians for long-term PAP management.

• By Treatment

On the basis of treatment, the market is segmented into whole lung lavage (WLL), lung transplant, plasmapheresis, GM-CSF replacement therapy, and others.

Whole lung lavage remains the most widely used treatment, contributing to the highest revenue share in 2025 due to its established role as the standard first-line procedure, especially in severe cases. Despite being invasive, WLL provides symptomatic relief and lung function improvement.

GM-CSF replacement therapy is anticipated to witness the fastest CAGR during the forecast period, as it offers a non-invasive, targeted approach with fewer complications and is suitable for long-term disease control in autoimmune PAP.

• By Diagnosis

On the basis of diagnosis, the market is segmented into blood tests, bronchoscopy, imaging tests, pulmonary function tests, biopsy, and others.

Imaging tests, particularly high-resolution CT scans, held the largest market share in 2025, owing to their non-invasive nature and ability to identify the characteristic “crazy paving” pattern in the lungs.

Bronchoscopy with lavage is expected to grow at the fastest CAGR, as it plays a dual role in both diagnosis and initial therapeutic intervention, especially in tertiary and specialized care centers.

• By Route of Administration

The market is segmented into oral, inhalation, and others (e.g., intravenous).

The inhalation segment accounted for the largest market revenue share in 2025, driven by the clinical adoption of inhaled GM-CSF therapies, which allow for targeted lung delivery and improved safety profiles.

The oral segment is expected to witness the fastest growth, supported by the development of immunosuppressive and adjunctive oral agents, and by the ease of administration for long-term outpatient management.

• By End Users

On the basis of end users, the market is segmented into hospitals, specialty clinics, homecare, and others.

Hospitals dominated the market in 2025 due to the need for specialized care, access to diagnostic equipment, and administration of whole lung lavage and biologics.

Homecare is projected to grow at the fastest CAGR, driven by the increasing availability of self-administered inhaled therapies, rising healthcare decentralization, and patient preference for at-home chronic disease management.

• By Distribution Channel

The market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

Hospital pharmacies hold the largest share in 2025 due to the distribution of specialized therapies and biologics that require clinical oversight.

Online pharmacies are expected to see the fastest growth from 2025 to 2032, fueled by expanding e-commerce adoption, telemedicine integration, and improved cold-chain delivery infrastructure for biologics and orphan drugs.

Pulmonary Alveolar Proteinosis Drug Market Regional Analysis

- North America dominates the Pulmonary Alveolar Proteinosis Drug Market with the largest revenue share of 40.01% in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology

- Consumers in the region highly value the convenience, advanced security features, and seamless integration offered by Pulmonary Alveolar Proteinosis Drugs with other smart devices such as thermostats and lighting systems.

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for remote monitoring and control, establishing Pulmonary Alveolar Proteinosis Drugs as a favored solution for both residential and commercial properties.

U.S. Pulmonary Alveolar Proteinosis Drug Market Insight

The U.S. Pulmonary Alveolar Proteinosis Drug Market captured the largest revenue share of 81% within North America in 2025, fueled by the swift uptake of connected devices and the expanding trend of home automation. Consumers are increasingly prioritizing the enhancement of home security through intelligent, keyless entry systems. The growing preference for DIY smart home setups, combined with robust demand for voice-controlled systems and mobile application integration, further propels the Pulmonary Alveolar Proteinosis Drug industry. Moreover, the increasing integration of smart home technologies, such as Alexa, Google Assistant, and Apple HomeKit, is significantly contributing to the market's expansion.

Europe Pulmonary Alveolar Proteinosis Drug Market Insight

The European Pulmonary Alveolar Proteinosis Drug Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent security regulations and the escalating need for enhanced security in homes and offices. The increase in urbanization, coupled with the demand for connected devices, is fostering the adoption of Pulmonary Alveolar Proteinosis Drugs. European consumers are also drawn to the convenience and energy efficiency these devices offer. The region is experiencing significant growth across residential, commercial, and multi-family housing applications, with Pulmonary Alveolar Proteinosis Drugs being incorporated into both new constructions and renovation projects.

U.K. Pulmonary Alveolar Proteinosis Drug Market Insight

The U.K. Pulmonary Alveolar Proteinosis Drug Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of home automation and a desire for heightened security and convenience. Additionally, concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions. The UK’s embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth.

Germany Pulmonary Alveolar Proteinosis Drug Market Insight

The German Pulmonary Alveolar Proteinosis Drug Market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious solutions. Germany’s well-developed infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of Pulmonary Alveolar Proteinosis Drugs, particularly in residential and commercial buildings. The integration of Pulmonary Alveolar Proteinosis Drugs with home automation systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations.

Asia-Pacific Pulmonary Alveolar Proteinosis Drug Market Insight

The Asia-Pacific Pulmonary Alveolar Proteinosis Drug Market is poised to grow at the fastest CAGR of over 24% in 2025, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of Pulmonary Alveolar Proteinosis Drugs. Furthermore, as APAC emerges as a manufacturing hub for Pulmonary Alveolar Proteinosis Drug components and systems, the affordability and accessibility of Pulmonary Alveolar Proteinosis Drugs are expanding to a wider consumer base.

Japan Pulmonary Alveolar Proteinosis Drug Market Insight

The Japan Pulmonary Alveolar Proteinosis Drug Market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of Pulmonary Alveolar Proteinosis Drugs is driven by the increasing number of smart homes and connected buildings. The integration of Pulmonary Alveolar Proteinosis Drugs with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is such asly to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

China Pulmonary Alveolar Proteinosis Drug Market Insight

The China Pulmonary Alveolar Proteinosis Drug Market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and Pulmonary Alveolar Proteinosis Drugs are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable Pulmonary Alveolar Proteinosis Drug options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Pulmonary Alveolar Proteinosis Drug Market Share

The Pulmonary Alveolar Proteinosis Drug industry is primarily led by well-established companies, including:

- Savara Inc. (U.S.)

- Partner Therapeutics, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Sanofi (France)

- Novartis AG (Switzerland)

- GlaxoSmithKline plc. (U.K.)

- Cipla Inc. (India)

- The Ritedose Corporation (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Shermco (U.S.)

- Aurobindo Pharma (India)

- Circassia (U.K.)

- Nostrum Laboratories Inc. (U.S.)

- Endo Pharmaceuticals Inc. (U.S.)

- Rhodes Pharmaceuticals L.P. (U.S.)

- Mylan N.V. (U.S.)

- Avet Pharmaceuticals Inc. (U.S.)

- Glenmark Pharmaceuticals Limited (India)

- Alembic Pharmaceuticals Limited (India)

- Tris Pharma, Inc. (U.S.)

- Celerion (U.S.)

- Pharmaceutical Associates Inc. (U.S.)

- Allergan (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES

5.3 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET ANALYSIS

6 EPIDEMOLOGY

7 PIPELINE ANALYSIS

7.1 PHASE III CANDIDATES

7.2 PHASE II CANDIDATES

7.3 PHASE I CANDIDATES

7.4 OTHERS (PRE-CLINICAL AND RESEARCH)

8 INDUSTRY INSIGHTS

8.1 DEMOGRAPHIC TRENDS

8.2 KEY PRICING STRATEGIES

8.3 KEY PATIENT ENROLLMENT STRATEGIES

8.4 INTERVIEWS WITH MANUFACTURING COMPANIES

8.5 OTHER KOL SNAPSHOTS

9 REGULATORY FRAMWORK

10 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY TYPE

10.1 OVERVIEW

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB SEGMENTS)

10.2 GRANULOCYTE-MACROPHAGE COLONY-STIMULATING FACTOR (GM-CSF)

10.2.1 SARGRAMOSTIM

10.2.2 MOLGRADEX

10.2.3 OTHERS

10.3 RITUXIMAB

10.4 BRONCHODILATOR

10.4.1 BY TYPE

10.4.1.1. BETA-2 AGONISTS

10.4.1.1.1. SALBUTAMOL

10.4.1.1.2. SALMETEROL

10.4.1.1.3. FORMOTEROL

10.4.1.1.4. VILANTEROL

10.4.1.2. ANTICHOLINERGICS

10.4.1.2.1. IPRATROPIUM

10.4.1.2.2. TIOTROPIUM

10.4.1.3. THEOPHYLLINE

10.4.2 BY MECHANISM

10.4.2.1. LONG ACTING

10.4.2.2. SHORT ACTING

10.5 OTHERS

11 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY DISEASE TYPE

11.1 OVERVIEW

11.2 PRIMARY PULMONARY ALVEOLAR PROTEINOSIS

11.2.1 AUTOIMMUNE PULMONARY ALVEOLAR PROTEINOSIS

11.2.2 HEREDITY PULMONARY ALVEOLAR PROTEINOSIS

11.3 SECONDARY PULMONARY ALVEOLAR PROTEINOSIS

11.4 CONGENITAL PULMONARY ALVEOLAR PROTEINOSIS

12 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY DRUG TYPE

12.1 OVERVIEW

12.2 BRANDED

12.2.1 LEUKINE

12.2.2 RIABNI

12.2.3 RITUXAN

12.2.4 RUXIENCE

12.2.5 TRUXIMA

12.2.6 VENTOLIN

12.2.7 AIROMIR

12.3 GENERIC

13 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY MODE OF PURCHASE

13.1 OVERVIEW

13.2 PRESCRIPTION

13.3 OVER THE COUNTER

14 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY GENDER

14.1 OVERVIEW

14.2 MALE

14.2.1 CHILDREN

14.2.2 ADULT

14.2.3 GERIATRIC

14.3 FEMALE

14.3.1 CHILDREN

14.3.2 ADULT

14.3.3 GERIATRIC

15 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY ROUTE OF ADMINISTRATION

15.1 OVERVIEW

15.2 ORAL

15.2.1 TABLETS

15.2.2 CAPSULES

15.3 PARAENTRAL

15.3.1 SUBCUTANEOUS

15.3.2 INTRAVENOUS

15.4 INHALATION

16 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 CLINICS

16.4 SPECIALITY CLINICS

16.5 ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES

16.6 OTHERS

17 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDER

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACY

17.3.2 RETAIL PHARMACY

17.3.3 ONLINE PHARMACY

18 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, BY REGION

GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 RUSSIA

18.2.7 SWITZERLAND

18.2.8 TURKEY

18.2.9 BELGIUM

18.2.10 NETHERLANDS

18.2.11 DENMARK

18.2.12 SWEDEN

18.2.13 POLAND

18.2.14 NORWAY

18.2.15 FINLAND

18.2.16 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 SINGAPORE

18.3.6 THAILAND

18.3.7 INDONESIA

18.3.8 MALAYSIA

18.3.9 PHILIPPINES

18.3.10 AUSTRALIA

18.3.11 NEW ZEALAND

18.3.12 VIETNAM

18.3.13 TAIWAN

18.3.14 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 EGYPT

18.5.3 BAHRAIN

18.5.4 UNITED ARAB EMIRATES

18.5.5 KUWAIT

18.5.6 OMAN

18.5.7 QATAR

18.5.8 SAUDI ARABIA

18.5.9 REST OF MIDDLE EAST AND AFRICA

18.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT & APPROVALS

19.7 EXPANSIONS

19.8 REGULATORY CHANGES

19.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL PULMONARY ALVEOLAR PROTEINOSIS DRUG MARKET, COMPANY PROFILE

20.1 SANOFI

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 SAVARA INC.

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPEMENTS

20.3 F. HOFFMANN-LA ROCHE AG

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPEMENTS

20.4 BAYER AG

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPEMENTS

20.5 ASTRAZENECA

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPEMENTS

20.6 TEVA PHARMACEUTICAL INDUSTRIES LTD.

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPEMENTS

20.7 NOVARTIS AG

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPEMENTS

20.8 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPEMENTS

20.9 GLAXOSMITHKLINE PLC

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPEMENTS

20.1 ZYDUS CADILA

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPEMENTS

20.11 CIPLA INC.

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPEMENTS

20.12 MYLAN N.V.

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPEMENTS

20.13 MERCK & CO., INC.

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPEMENTS

20.14 GLENMARK PHARMACEUTICALS LIMITED

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPEMENTS

20.15 PFIZER INC

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPEMENTS

20.16 VECTURA GROUP PLC

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPEMENTS

20.17 SUN PHARMACEUTICAL INDUSTRIES LTD.

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPEMENTS

20.18 AMNEAL PHARMACEUTICALS LLC.

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPEMENTS

20.19 BEXIMCO PHARMACEUTICALS LTD.

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPEMENTS

20.2 MUNDIPHARMA

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPEMENTS

20.21 INOGEN, INC.

20.21.1 COMPANY OVERVIEW

20.21.2 REVENUE ANALYSIS

20.21.3 GEOGRAPHIC PRESENCE

20.21.4 PRODUCT PORTFOLIO

20.21.5 RECENT DEVELOPMENTS

20.22 HOME OXYGEN COMPANY

20.22.1 COMPANY OVERVIEW

20.22.2 REVENUE ANALYSIS

20.22.3 GEOGRAPHIC PRESENCE

20.22.4 PRODUCT PORTFOLIO

20.22.5 RECENT DEVELOPMENTS

20.23 MEDLINE INDUSTRIES, INC

20.23.1 COMPANY OVERVIEW

20.23.2 REVENUE ANALYSIS

20.23.3 GEOGRAPHIC PRESENCE

20.23.4 PRODUCT PORTFOLIO

20.23.5 RECENT DEVELOPMENTS

20.24 NOVARTIS AG

20.24.1 COMPANY OVERVIEW

20.24.2 REVENUE ANALYSIS

20.24.3 GEOGRAPHIC PRESENCE

20.24.4 PRODUCT PORTFOLIO

20.24.5 RECENT DEVELOPMENTS

20.25 ACHÉ LABORATÓRIOS FARMACÊUTICOS S.A

20.25.1 COMPANY OVERVIEW

20.25.2 REVENUE ANALYSIS

20.25.3 GEOGRAPHIC PRESENCE

20.25.4 PRODUCT PORTFOLIO

20.25.5 RECENT DEVELOPMENTS

20.26 HORIZON THERAPEUTICS PLC

20.26.1 COMPANY OVERVIEW

20.26.2 REVENUE ANALYSIS

20.26.3 GEOGRAPHIC PRESENCE

20.26.4 PRODUCT PORTFOLIO

20.26.5 RECENT DEVELOPMENTS

20.27 DR. REDDY’S LABORATORIES LTD.

20.27.1 COMPANY OVERVIEW

20.27.2 REVENUE ANALYSIS

20.27.3 GEOGRAPHIC PRESENCE

20.27.4 PRODUCT PORTFOLIO

20.27.5 RECENT DEVELOPMENTS

20.28 ABBOTT

20.28.1 COMPANY OVERVIEW

20.28.2 REVENUE ANALYSIS

20.28.3 GEOGRAPHIC PRESENCE

20.28.4 PRODUCT PORTFOLIO

20.28.5 RECENT DEVELOPMENTS

20.29 ASTELLAS PHARMA INC.

20.29.1 COMPANY OVERVIEW

20.29.2 REVENUE ANALYSIS

20.29.3 GEOGRAPHIC PRESENCE

20.29.4 PRODUCT PORTFOLIO

20.29.5 RECENT DEVELOPMENTS

20.3 QUIDEL CORPORATION

20.30.1 COMPANY OVERVIEW

20.30.2 REVENUE ANALYSIS

20.30.3 GEOGRAPHIC PRESENCE

20.30.4 PRODUCT PORTFOLIO

20.30.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 CONCLUSION

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.