Global Purpose Built Backup Appliance Market

Market Size in USD Billion

CAGR :

%

USD

9.10 Billion

USD

27.83 Billion

2024

2032

USD

9.10 Billion

USD

27.83 Billion

2024

2032

| 2025 –2032 | |

| USD 9.10 Billion | |

| USD 27.83 Billion | |

|

|

|

|

Purpose-Built Backup Appliance Market Size

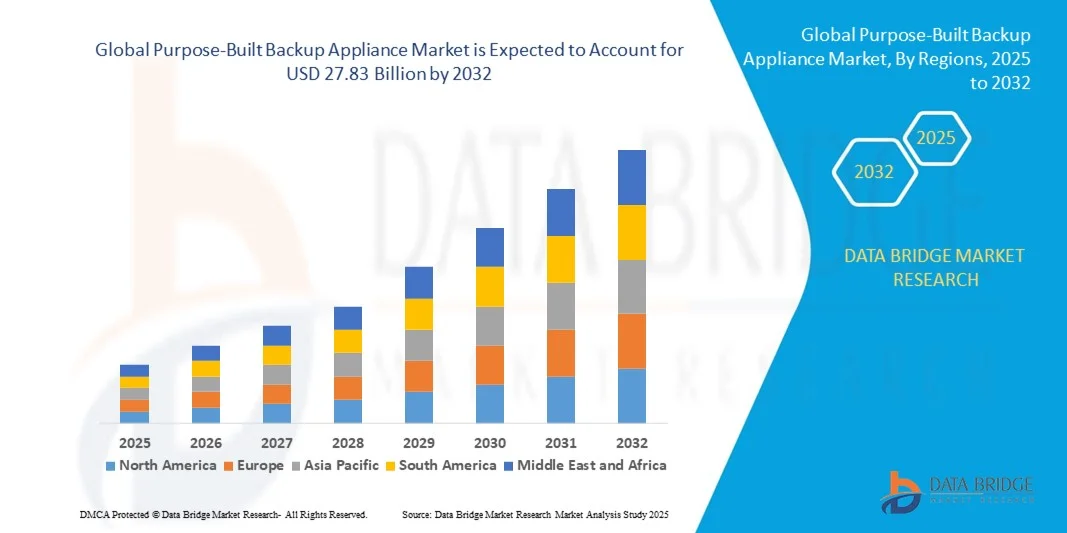

- The global purpose-built backup appliance market size was valued at USD 9.1 billion in 2024 and is expected to reach USD 27.83 billion by 2032, at a CAGR of 15.0% during the forecast period

- The market growth is largely fueled by the rising adoption of cloud computing, virtualization, and hybrid IT environments, leading to increased demand for high-performance, reliable, and scalable backup solutions across enterprises and SMBs

- Furthermore, growing concerns over data security, regulatory compliance, and business continuity are driving organizations to implement purpose-built backup appliances. These converging factors are accelerating the adoption of PBBA solutions, thereby significantly boosting the industry’s growth

Purpose-Built Backup Appliance Market Analysis

- Purpose-built backup appliance solutions, designed to provide dedicated, high-performance backup and recovery for enterprise data, are increasingly critical components of modern IT infrastructure due to their reliability, scalability, and ability to integrate with on-premises and cloud environments

- The escalating demand for PBBA solutions is primarily fueled by the surge in enterprise data generation, growing awareness of data protection, and the need for rapid recovery and ransomware resilience, making these appliances essential for secure and efficient data management

- North America dominated the purpose-built backup appliance market in 2024, due to rising data volumes, stringent regulatory compliance, and increasing enterprise adoption of advanced backup solutions

- Asia-Pacific is expected to be the fastest growing region in the purpose-built backup appliance market during the forecast period due to rapid urbanization, growing IT infrastructure investments, and rising adoption of cloud and hybrid backup solutions in countries such as China, Japan, and India

- Hardware segment dominated the market with a market share of 48.3% in 2024, due to its critical role in ensuring high-performance backup, storage efficiency, and data protection. Hardware appliances are preferred for their reliability, scalable storage options, and compatibility with diverse IT environments, making them the backbone of enterprise backup solutions. Organizations increasingly invest in high-capacity, purpose-built hardware to manage growing volumes of structured and unstructured data. Advanced features such as deduplication, encryption, and high-speed data transfer enhance the appeal of hardware solutions

Report Scope and Purpose-Built Backup Appliance Market Segmentation

|

Attributes |

Purpose-Built Backup Appliance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Purpose-Built Backup Appliance Market Trends

Growing Adoption of Hybrid and Cloud Backup Solutions

- The purpose-built backup appliance (PBBA) market is rapidly evolving as enterprises increasingly seek hybrid and cloud-integrated backup solutions to tackle exponential growth in data volumes and cyber threats. Organizations are shifting from legacy tape and disk-based appliances to next-generation systems that seamlessly connect on-premises hardware with public and private cloud environments, ensuring redundancy, scalability, and business continuity

- For instance, Dell Technologies and Commvault have expanded their PBBA portfolios to support cloud tiering, deduplication, and automated data lifecycle management. Such hybrid appliances allow customers to leverage elastic cloud storage for archiving and disaster recovery while maintaining high-speed, local backup performance for critical applications

- Integration of cloud-native capabilities—including backup-as-a-service (BaaS), ransomware protection, and policy-driven data movement—enables more flexible and cost-efficient backup strategies. Modern PBBAs are equipped with user-friendly interfaces, edge integration, and AI-powered analytics for intelligent backup automation and compliance reporting

- The ongoing shift to hybrid work, digital transformation initiatives, and edge data proliferation is propelling PBBA adoption in a wide variety of sectors, including finance, healthcare, and government. Increasing ransomware sophistication and regulatory requirements strengthen the market need for highly secure, immutable, and rapidly recoverable backup solutions across distributed IT infrastructures

- Industry innovation is focused on scalable architectures, enhanced networking support, and data reduction technologies such as inline deduplication and compression. PBBAs that support seamless integration with major cloud providers and multicloud architectures are gaining market share as users demand greater agility, uptime, and operational efficiency

- As the hybrid IT landscape expands, the role of purpose-built backup appliances is becoming central to holistic data protection strategies. Enterprises are prioritizing end-to-end backup solutions capable of addressing modern workload demands, disaster recovery requirements, and evolving cybersecurity risks

Purpose-Built Backup Appliance Market Dynamics

Driver

Rising Demand for Secure, High-Performance Data Protection

- The increasing incidence of data breaches, ransomware attacks, and critical IT outages is driving enterprises to invest in purpose-built backup appliances that offer robust, high-performance data protection. The need for minimal downtime, rapid recovery, and regulatory compliance is prompting organizations to favor turnkey backup platforms with hardened security features and rapid snapshot capabilities

- For instance, Veritas Technologies and IBM Corporation have developed backup appliances with integrated anomaly detection, encryption, and air-gapped architecture to prevent unauthorized data modification or exfiltration. These solutions are tailored for enterprises that require secure trusted backup environments, fast restore speeds, and granular recovery across physical, virtual, and cloud workloads

- High-performance characteristics—such as low-latency backup, parallel processing, and scalable throughput—allow enterprises to rapidly protect and recover multi-terabyte workloads with minimal impact on production environments. Policy-driven automation and tiered data storage strategies further support compliance, retention, and disaster readiness

- In addition, industry regulations (such as GDPR, HIPAA, and SOX) require verifiable backup and recovery mechanisms, compelling organizations to adopt advanced PBBA platforms with auditable security controls and retention management

- With the rising value of digital data and the operational costs of downtime escalating, secure and high-performance backup appliances remain a critical element of enterprise risk management and business continuity planning

Restraint/Challenge

High Deployment Costs and Complexity

- Despite their compelling benefits, PBBA adoption is often hindered by high initial deployment costs and substantial integration complexity—especially in large, geographically distributed or legacy-rich environments. Advanced appliances demand significant capital expenditure for hardware, licensing, and configuration

- For instance, Hewlett Packard Enterprise (HPE) has noted that integrating modern PBBAs with heterogeneous storage, legacy backup software, and multicloud management tools requires specialized skills and custom engineering, driving up project timelines and risk profiles

- IT teams must accommodate data migration, compatibility testing, and network reconfiguration, further complicating rollout and increasing the potential for service disruption. Transitioning to hybrid architectures with seamless cloud connectivity adds to project expenses, demanding changes in data governance, security policy, and ongoing operational practices

- Smaller organizations and resource-constrained enterprises may be deterred by the total cost of ownership, including support, software updates, and compliance audits. Rapid technology advancement also leads to faster obsolescence, pressuring buyers to continually reinvest in infrastructure upgrades

- To address these barriers, PBBA vendors are innovating with modular appliance design, subscription-based pricing models, and managed backup services that reduce complexity and upfront costs. As deployment automation matures and integration tools improve, broader PBBA adoption across all enterprise segments is anticipated, supporting resilient and agile data protection strategies

Purpose-Built Backup Appliance Market Scope

The market is segmented on the basis of component, system, deployment, enterprise, vertical, service model, service type, and type.

- By Component

On the basis of component, the purpose-built backup appliance market is segmented into hardware, software, and professional services. The hardware segment dominated the market with the largest revenue share of 48.3% in 2024, driven by its critical role in ensuring high-performance backup, storage efficiency, and data protection. Hardware appliances are preferred for their reliability, scalable storage options, and compatibility with diverse IT environments, making them the backbone of enterprise backup solutions. Organizations increasingly invest in high-capacity, purpose-built hardware to manage growing volumes of structured and unstructured data. Advanced features such as deduplication, encryption, and high-speed data transfer enhance the appeal of hardware solutions.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising adoption of intelligent backup management, automation, and analytics capabilities. Software solutions enable enterprises to optimize storage utilization, streamline backup workflows, and integrate with cloud or hybrid environments. Increasing demand for flexible, policy-driven backup software that supports heterogeneous IT systems is driving its growth.

- By System

On the basis of system, the purpose-built backup appliance market is segmented into integrated systems, target systems, open systems, and mainframe systems. The integrated system segment dominated the market in 2024, owing to its plug-and-play capability, simplified management, and ready-to-use deployment for enterprise backup needs. Integrated systems reduce operational complexity and offer unified data protection, making them attractive for organizations seeking minimal setup time and predictable performance. Enterprises value these systems for their pre-validated configurations and vendor support, ensuring reliability and compliance.

The target systems segment is expected to grow at the fastest CAGR during 2025–2032, driven by the increasing need for specialized storage targets for backup and archival purposes. Target systems allow businesses to customize backup architectures, optimize storage efficiency, and integrate with existing IT infrastructure, supporting both on-premises and hybrid deployments.

- By Deployment

On the basis of deployment, the purpose-built backup appliance market is segmented into cloud and on-premises. The on-premises segment dominated the market in 2024, primarily due to its ability to provide direct control over sensitive enterprise data, low latency, and compliance with strict data security regulations. On-premises deployments are preferred by organizations with high data volumes and critical applications, ensuring faster recovery times and predictable performance. Enterprises also leverage on-premises appliances for integration with existing IT infrastructure and tailored backup policies.

The cloud deployment segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of hybrid cloud strategies, flexible scalability, and remote accessibility. Cloud-based PBBA solutions offer cost-efficient subscription models, automated management, and disaster recovery capabilities, appealing to enterprises aiming to reduce upfront infrastructure costs.

- By Enterprise

On the basis of enterprise size, the purpose-built backup appliance market is segmented into small and mid-level enterprises (SMEs) and large enterprises. The large enterprise segment dominated the market in 2024, driven by the significant data volumes, complex IT infrastructure, and stringent regulatory compliance requirements that characterize these organizations. Large enterprises increasingly prioritize purpose-built appliances for reliable backup, rapid recovery, and advanced features such as deduplication, encryption, and multi-site replication.

The SME segment is expected to register the fastest growth from 2025 to 2032, owing to rising IT modernization initiatives, cloud adoption, and the need for cost-effective, scalable backup solutions. SMEs are investing in purpose-built appliances to ensure business continuity while optimizing storage and management costs.

- By Vertical

On the basis of vertical, the purpose-built backup appliance market is segmented into BFSI, telecom and IT, government, healthcare, education, manufacturing, travel and hospitality, energy and utility, and others. The BFSI segment dominated the market in 2024, driven by the critical need for secure, reliable, and compliant backup solutions to protect sensitive financial data, transactional records, and customer information. BFSI enterprises prioritize appliances with high performance, encryption, and disaster recovery capabilities to maintain operational continuity.

The telecom and IT segment is expected to witness the fastest CAGR during 2025–2032, fueled by the exponential growth in data generation, cloud-based services, and the need for high-speed, scalable backup solutions. Telecom and IT enterprises require solutions that support rapid data recovery, integration with virtualized environments, and multi-location backup strategies.

- By Service Model

On the basis of service model, the purpose-built backup appliance market is segmented into Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS). The IaaS segment dominated the market in 2024, owing to its ability to provide scalable, on-demand infrastructure resources that are critical for enterprise backup workloads. IaaS-based PBBA offerings enable organizations to deploy appliances without heavy capital expenditure while maintaining robust data protection and high availability.

The SaaS segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for cloud-based backup applications, automated management, and subscription-based models. SaaS offerings allow enterprises to simplify deployment, reduce IT complexity, and ensure seamless updates and maintenance.

- By Service Type

On the basis of service type, the purpose-built backup appliance market is segmented into support, installation, integration, and maintenance. The integration segment dominated the market in 2024, owing to the critical need for seamless incorporation of PBBA solutions with existing IT infrastructure, storage systems, and enterprise applications. Proper integration ensures optimal performance, data consistency, and efficient backup workflows, making it a top priority for enterprises.

The support segment is expected to witness the fastest growth from 2025 to 2032, driven by rising demand for continuous monitoring, technical assistance, and troubleshooting to ensure uninterrupted data protection. Enterprises are increasingly relying on vendor-provided support services to maintain appliance performance and meet service-level agreements.

- By Type

On the basis of type, the purpose-built backup appliance market is segmented into virtual appliances and physical appliances. The physical appliance segment dominated the market in 2024, driven by its high-performance storage capabilities, reliable disaster recovery, and suitability for enterprises with large-scale data backup requirements. Physical appliances are preferred for their dedicated hardware, predictable performance, and compatibility with high-capacity storage systems.

The virtual appliance segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by the increasing adoption of virtualization, cloud integration, and cost-efficient deployment. Virtual appliances provide flexibility, scalability, and rapid deployment for enterprises seeking software-defined backup solutions without heavy hardware investment.

Purpose-Built Backup Appliance Market Regional Analysis

- North America dominated the purpose-built backup appliance market with the largest revenue share in 2024, driven by rising data volumes, stringent regulatory compliance, and increasing enterprise adoption of advanced backup solutions

- Enterprises in the region prioritize high-performance, reliable, and scalable backup appliances to ensure business continuity and disaster recovery

- The market growth is further supported by the presence of leading PBBA vendors, high IT infrastructure investments, and the adoption of hybrid and cloud-based backup solutions

U.S. Purpose-Built Backup Appliance Market Insight

The U.S. purpose-built backup appliance market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of cloud infrastructure, virtualization, and enterprise IT modernization. Companies are increasingly implementing purpose-built appliances to manage growing data volumes, ensure secure storage, and optimize backup and recovery processes. High demand for integrated, automated solutions, combined with the trend of hybrid cloud deployment, further drives market expansion. In addition, stringent data protection regulations such as HIPAA and GDPR are encouraging organizations to invest in reliable PBBA systems.

Europe Purpose-Built Backup Appliance Market Insight

The Europe purpose-built backup appliance market is projected to expand at a substantial CAGR during the forecast period, driven by growing digitalization, strict data security regulations, and rising adoption of cloud-based enterprise solutions. Enterprises are increasingly seeking advanced backup appliances to comply with GDPR and other local regulatory frameworks. The region is witnessing growth in both SMBs and large enterprises adopting PBBA for data management, business continuity, and disaster recovery.

U.K. Purpose-Built Backup Appliance Market Insight

The U.K. purpose-built backup appliance market is expected to grow at a noteworthy CAGR, supported by increasing IT modernization initiatives, adoption of hybrid IT environments, and demand for secure, scalable backup solutions. Organizations are focusing on minimizing downtime, ensuring rapid recovery, and leveraging PBBA systems for regulatory compliance. The rising preference for managed services and cloud-integrated solutions is further accelerating market growth.

Germany Purpose-Built Backup Appliance Market Insight

The Germany purpose-built backup appliance market is poised for considerable growth, driven by increasing awareness of data security, high IT infrastructure investments, and strong demand from enterprise and government sectors. Germany’s focus on industrial digitalization and innovation encourages adoption of purpose-built appliances for secure, efficient backup and recovery operations. Integration with hybrid cloud and enterprise IT ecosystems is becoming more prevalent in both commercial and public sectors.

Asia-Pacific Purpose-Built Backup Appliance Market Insight

The Asia-Pacific purpose-built backup appliance market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, growing IT infrastructure investments, and rising adoption of cloud and hybrid backup solutions in countries such as China, Japan, and India. The expanding enterprise base, increasing digitalization, and rising awareness of data protection are major growth factors. Moreover, cost-effective solutions and local manufacturing are enhancing accessibility across small and mid-sized enterprises.

Japan Purpose-Built Backup Appliance Market Insight

The Japan purpose-built backup appliance market is witnessing steady growth due to the country’s technologically advanced enterprise landscape, high adoption of cloud computing, and increasing focus on data protection. Enterprises prioritize high-performance backup appliances for critical business operations, disaster recovery, and secure storage. Government initiatives promoting digital transformation and IoT adoption in enterprises are further driving market demand.

China Purpose-Built Backup Appliance Market Insight

The China purpose-built backup appliance market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid digital transformation, expanding enterprise IT infrastructure, and rising awareness of data protection. The market is fueled by increasing demand from BFSI, IT, and manufacturing sectors for scalable, reliable backup solutions. Local PBBA vendors offering cost-effective appliances and integration with hybrid cloud systems are further accelerating market adoption across enterprises.

Purpose-Built Backup Appliance Market Share

The purpose-built backup appliance industry is primarily led by well-established companies, including:

- Dell Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM Corporation (U.S.)

- Oracle (U.S.)

- Hitachi Vantara Corporation (Japan)

- NetApp (U.S.)

- Veritas Technologies LLC (U.S.)

- Quantum Corporation (U.S.)

- Commvault (U.S.)

- Barracuda Networks, Inc. (U.S.)

- Veeam Software (Switzerland)

- Rubrik (U.S.)

- STORServer, Inc. (U.S.)

- Cohesity (U.S.)

- Unitrends (U.S.)

- Storage Switzerland, Inc. (U.S.)

- Vembu Technologies (India)

- Microsoft (U.S.)

- RACKSPACE TECHNOLOGY (U.S.)

- Iron Mountain Incorporated (U.S.)

Latest Developments in Global Purpose-Built Backup Appliance Market

- In September 2025, Barracuda introduced the Backup 3004, an entry-level hybrid backup appliance designed for small businesses and edge environments. This model offers on-site backup, cloud replication, and full data recovery capabilities. Notably, Barracuda transitioned from capacity-based licensing to a streamlined subscription model, starting at £110/month for local storage and £210/month for cloud support. The Backup 3004 features efficient block-level deduplication, ransomware protection, and supports robust recovery options, including file-level restores and bare metal recovery. This development enhances affordability and scalability for SMBs seeking reliable backup solutions

- In August 2025, Veeam released Kasten V5.0, a comprehensive risk management solution tailored for Kubernetes environments. This update enhances continuous integration and continuous deployment (CI/CD) pipelines, providing robust data protection for cloud-native applications. The improvements aim to reduce risks associated with Kubernetes investments, facilitating safer and more effective execution of cloud-native apps. This advancement underscores the growing importance of Kubernetes in enterprise IT and the need for specialized backup solutions

- In May 2022, the Kubernetes-specific Veeam Kasten V5.0 was designed to provide a comprehensive risk management strategy, enhance CI/CD pipelines, and support ecosystem development, maximizing benefits and reducing risks associated with Kubernetes deployments. These improvements enable the expanding Kubernetes community to run cloud-native applications safely and effectively

- In December 2021, NVIDIA introduced the BlueField-2, a Data Processing Unit (DPU) designed to enhance data center infrastructure. Combining an Arm core set, an NVIDIA ConnectX-6 Dx network adapter, and infrastructure-specific offloads, the BlueField-2 DPU delivers hardware-accelerated engines with complete software programmability. Positioned as a solution for business cloud and high-performance computing applications, this development improves data processing efficiency and scalability in enterprise environments

- In July 2021, Dell Technologies launched its PowerProtect DD series with integrated cyber resiliency features. The new appliances provide ransomware detection, automated backup verification, and enhanced disaster recovery capabilities. By combining high-speed storage with intelligent software, the DD series improves backup reliability, reduces downtime, and ensures rapid recovery, addressing the growing need for secure and resilient data protection in enterprise environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Purpose Built Backup Appliance Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Purpose Built Backup Appliance Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Purpose Built Backup Appliance Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.