Global Pvc Additives Market

Market Size in USD Billion

CAGR :

%

USD

6.80 Billion

USD

12.90 Billion

2024

2032

USD

6.80 Billion

USD

12.90 Billion

2024

2032

| 2025 –2032 | |

| USD 6.80 Billion | |

| USD 12.90 Billion | |

|

|

|

|

PVC Additives Market Size

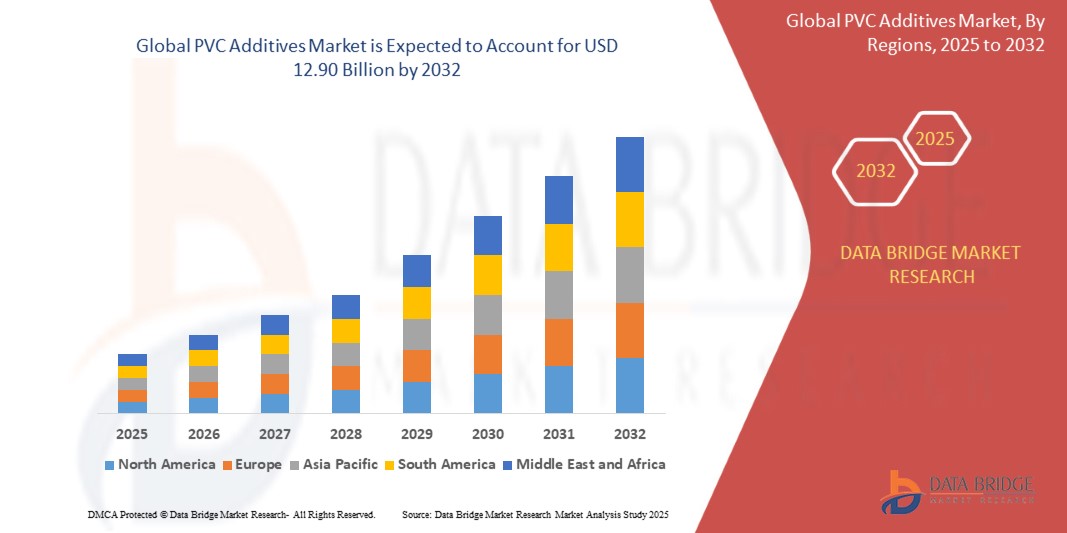

- The global PVC additives market size was valued at USD 6.80 billion in 2024 and is expected to reach USD 12.90 billion by 2032, at a CAGR of 6.0% during the forecast period

- Growth is driven by increasing demand for PVC products across construction, automotive, electrical, and packaging sectors, where additives improve the material’s durability, flexibility, and processing performance.

- The rising trend of substituting traditional materials with PVC, coupled with technological advancements and environmental sustainability initiatives, supports expanding additive consumption globally.

- Asia-Pacific leads the market due to rapid industrialization, growing construction activities, and increasing PVC production in countries like China and India.

PVC Additives Market Analysis

- PVC additives such as plasticizers enhance flexibility, while stabilizers improve thermal and UV durability, critical for outdoor applications like window profiles and roofing membranes.

- Impact modifiers and lubricants further tailor PVC properties to meet specific end-use requirements across industries.

- The construction sector remains the largest consumer, leveraging PVC for pipes, fittings, flooring, and profiles enhanced with these additives for longevity and safety.

- Growing automotive and electrical industries’ demand for lightweight and high-performance PVC components also propels market growth.

Report Scope and PVC Additives Market Segmentation

|

Attributes |

PVC Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PVC Additives Market Trends

Shift Toward Sustainable and Bio-Based Additives

- The industry is witnessing increased adoption of eco-friendly plasticizers and stabilizers, driven by stringent environmental regulations and growing consumer demand for safer, greener products.

- Development of biomass balance and renewable raw material-based additives enhances sustainability credentials while maintaining performance.

- Rising investments in additive research and innovation focus on reducing hazardous substances such as phthalates and heavy metal stabilizers.

- Integration of additives enhancing recyclability and durability aligns with circular economy principles spreading across end-use industries.

PVC Additives Market Dynamics

Driver

Robust Growth in Construction and Automotive Sectors

- Expanding global construction activities increase demand for PVC products reinforced with additives for durability, weather resistance, and safety, driving additive market growth.

- Automotive industry growth, especially in electric vehicles, fuels demand for lightweight and high-performance PVC components that rely on specialized additives for enhanced functionality.

- Increasing use of PVC in electrical and packaging applications also provides significant growth opportunities as additives enhance flame retardance, flexibility, and processing ease.

- Advancement in additive technologies helps manufacturers meet evolving regulatory and performance requirements, supporting sustained market expansion.

Restraint/Challenge

Environmental Regulations and Technical Formulation Challenges

- Stringent regulations limiting the use of certain plasticizers, stabilizers (e.g., lead-based), and flame retardants impose compliance costs and restrict additive formulations.

- Environmental and health concerns regarding additive toxicity and recycling challenges hinder market growth, pushing companies toward costly reformulations and new approvals.

- Technical complexities in formulating additives that balance performance, safety, and cost remain a barrier, especially in price-sensitive regions.

- Competition from alternative materials and additives that offer similar benefits may impact market share for traditional PVC additive products.

PVC Additives Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the PVC additives market is segmented into plasticizers, stabilizers, impact modifiers, lubricants, and others. The stabilizers segment dominates the largest market revenue share in 2024, primarily due to their essential role in enhancing the thermal stability and durability of PVC products, especially in outdoor applications like pipes, window profiles, and roofing membranes. Plasticizers hold significant importance for improving PVC flexibility and processability, with ongoing innovation in bio-based and non-toxic plasticizers driving growth. Impact modifiers and lubricants serve critical functions in tailoring performance for specific end-use requirements across industries.

- By Application

On the basis of application, the market is segmented into building & construction, automotive, electrical & electronics, packaging, and others. The building & construction sector holds the largest market share in 2024, driven by high demand for PVC products such as pipes, flooring, fittings, and profiles that require additives for enhanced performance and longevity. The automotive segment is expanding rapidly, supported by growing use of PVC in lightweight, flexible, and durable components, especially in electric vehicles. Electrical & electronics and packaging applications are also contributing significant demand due to increasing adoption of flame retardants, plasticizers, and process enhancers.

PVC Additives Market Regional Analysis

- Asia-Pacific dominates the PVC additives market with the largest revenue share of over 43% in 2024, driven by rapid industrialization, urbanization, and expanding construction and automotive sectors across countries like China, India, Japan, and Southeast Asia. The region benefits from growing PVC production capacity and increasing adoption of advanced and sustainable additive technologies that meet stringent environmental regulations.

- The region's market growth is further supported by government initiatives promoting infrastructure development, demand for durable and cost-effective PVC products in packaging and electrical applications, and access to low-cost labor and raw materials. Asia-Pacific's well-established export-oriented PVC industry and ongoing innovation in bio-based and eco-friendly additives contribute significantly to its market leadership.

- North America is another key region with robust demand primarily due to its mature construction and automotive industries, strong regulatory frameworks emphasizing environmental safety, and high investments in research and development of sustainable additive technologies. The U.S. leads the regional market with advanced manufacturing infrastructure and emphasis on high-performance PVC applications.

- Europe maintains steady growth influenced by stringent regulatory compliance, growing preference for bio-based and non-toxic additives, and innovations in additives for automotive, construction, and electrical sectors. Countries like Germany, France, and the U.K. contribute significantly to regional demand with strong chemical manufacturing and sustainable development policies.

U.S. PVC Additives Market Insight

The U.S. leads the North American PVC additives market in 2024, propelled by a mature construction and automotive industry, focus on innovation, and stringent environmental regulations. Demand for high-performance and sustainable additives in flexible and durable PVC products used in packaging, electrical applications, and building materials is rising. Significant investments in research and sustainable additive technologies by major manufacturers support the U.S. market’s strong position.

Europe PVC Additives Market Insight

Europe's market shows steady growth, driven by regulatory compliance on additive formulations and growing consumer demand for bio-based and non-toxic additives. Germany, France, and the U.K. are notable contributors, focusing on high-performance PVC applications in construction, automotive, and electrical sectors. Collaboration between industry and research institutions fosters innovation in eco-friendly and performance-enhancing additives.

U.K. PVC Additives Market Insight

The U.K. PVC additives market is expanding with increasing use of additives in building materials and automotive components, influenced by environmental policies and consumer preference for sustainable PVC products with enhanced durability and safety.

Germany PVC Additives Market Insight

Germany benefits from its strong chemical manufacturing base, engineering expertise, and sustainability focus driving the adoption of advanced PVC additives in automotive and construction sectors. The country emphasizes eco-friendly production processes and regulatory compliance.

Asia-Pacific PVC Additives Market Insight

Asia-Pacific dominates the global PVC additives market with the largest revenue share of over 43% in 2024, driven by rapid industrialization, urbanization, and expanding construction and automotive sectors in key countries such as China, India, Japan, and Southeast Asia. The region benefits from increasing PVC production capacity and growing adoption of advanced and sustainable additive technologies to meet stringent environmental standards. Additionally, government initiatives supporting infrastructure development and increasing demand for durable PVC products in packaging, electrical, and consumer goods further fuel market growth.

India PVC Additives Market Insight

India is witnessing significant growth due to expanding construction and automotive industries, supportive government initiatives promoting manufacturing, and increasing demand for sustainable, cost-effective PVC products enhanced with functional additives. Rising urbanization and infrastructure development also contribute to market expansion.

China PVC Additives Market Insight

China dominates the Asia-Pacific PVC additives market, supported by extensive PVC manufacturing capacity, booming construction, automotive sectors, and increasing integration of advanced sustainable additive technologies in response to stringent environmental regulations. Strong domestic demand and growing exports reinforce China’s leadership in the market.

PVC Additives Market Share

The PVC additives industry is primarily led by well-established companies, including:

- BASF (Germany)

- Arkema (France)

- Dow (U.S)

- Eastman Chemical Company (U.S)

- Evonik Industries AG (Germany)

- Clariant AG (Switzerland)

- Solvay (Belgium)

- Songwon Industrial Co. (South Korea)

- LANXESS (Germany)

- Kaneka Corporation (Japan)

- Akzo Nobel N.V. (Netherlands)

- Adeka Corporation (Japan)

- Mitsubishi Chemical Group (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- LG Chem (South Korea)

- Ineos Group (U.K.)

- Chemplast Sanmar Limited (India)

- Shandong Ruifeng Chemical Co., Ltd. (China)

Latest Developments in Global PVC Additives Market

- In September 2023 BASF SE launched the industry’s first biomass balance plastic additives, replacing fossil feedstock with renewable raw materials under certified sustainable approaches.

- In October 2022 Clariant introduced an anti-scratch additive for PP & TPO formulations at K 2022, enhancing plastic reuse potential in consumer applications.

- In March 2021 Evonik Industries expanded production capacity of specialty PVC additives to meet growing demand in construction and automotive sectors.

- In January 2021 Arkema S.A. launched a new stabilizer portfolio focusing on non-toxic, environmentally friendly additives to comply with evolving regulations.

- In November 2020 Dow unveiled innovative PVC plasticizers with lower VOC emissions, aligning with global sustainability goals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pvc Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pvc Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pvc Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.