Global Pvdc Coated Films Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

3.36 Billion

2024

2032

USD

2.10 Billion

USD

3.36 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.36 Billion | |

|

|

|

|

PVDC Coated Films Market Size

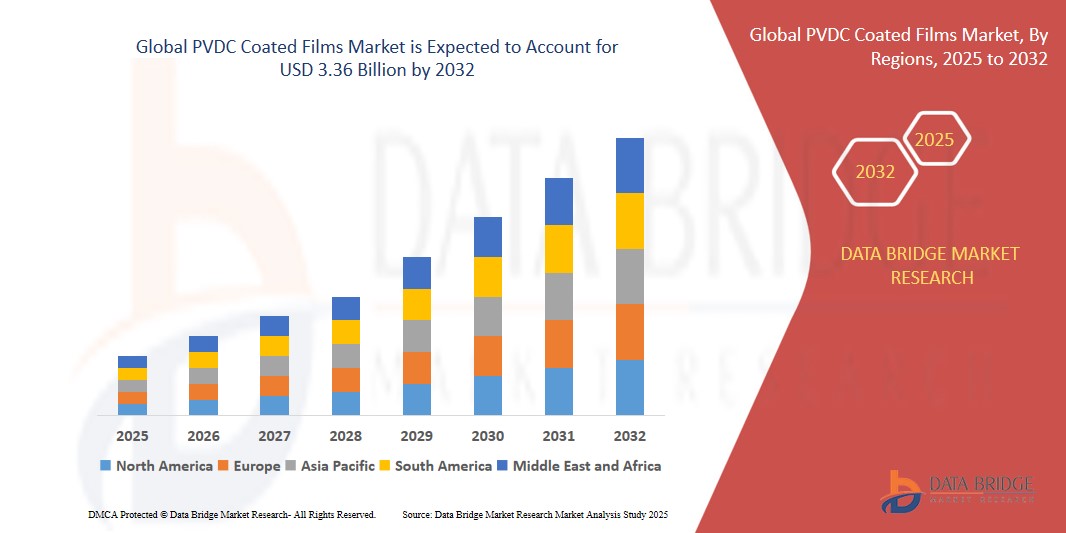

- The global PVDC Coated Films market size was valued at USD 2.10 billion in 2024 and is expected to reach USD 3.36 billion by 2032, at a CAGR of 6.05% during the forecast period

- The market growth is largely fueled by increasing adoption and technological advancements in connected home devices and smart home technologies, which are accelerating digitalization across residential and commercial sectors

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for homes and businesses is positioning PVDC Coated Films as a preferred material in modern applications. These converging factors are propelling the adoption of PVDC Coated Films solutions, thereby significantly boosting the industry's expansion

PVDC Coated Films Market Analysis

-

PVDC Coated Films are essential in packaging and barrier applications, providing superior moisture, oxygen, and chemical resistance, which are critical for extending the shelf life of food, pharmaceuticals, and other sensitive products in both residential and commercial sectors.

-

The growing demand for high-performance packaging solutions is primarily driven by increasing consumer awareness about product freshness, safety, and sustainability, along with stringent regulatory requirements for packaging materials.

- North America dominates the PVDC Coated Films market with the largest revenue share of 42.91% in 2025, supported by advanced packaging industries, high consumer demand for packaged goods, and the presence of key manufacturers investing in innovative coating technologies and sustainable film solutions. The U.S. leads regional growth, driven by advancements in packaging automation and growing adoption of eco-friendly packaging alternatives incorporating PVDC films.

- Asia-Pacific is expected to be the fastest growing region in the PVDC Coated Films market during the forecast period, fueled by rapid urbanization, expanding food and pharmaceutical industries, and rising disposable incomes in countries like China, India, and Japan, which boost demand for high-quality packaging materials.

- The Polyethylene Terephthalate (PET) segment is expected to dominate the PVDC Coated Films market with a market share of 34.15% in 2025, due to its excellent opacifying properties, durability, and widespread use in enhancing film opacity and protecting products from light exposure.

Report Scope and PVDC Coated Films Market Segmentation

|

Attributes |

PVDC Coated Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

PVDC Coated Films Market Trends

“Rising Demand for High-Barrier Sustainable Packaging Films”

- A significant and accelerating trend in the global PVDC Coated Films market is the growing demand for high-barrier yet environmentally sustainable packaging solutions, especially across food, pharmaceutical, and personal care sectors. Manufacturers are increasingly developing PVDC-coated films that combine superior barrier performance with recyclability or reduced environmental impact.

- For instance, companies like Cosmo Films and Perlen Packaging are launching innovative multi-layer PVDC-coated films that maintain exceptional moisture and oxygen barrier properties while reducing material usage or improving recyclability. These films help preserve product freshness and integrity, making them ideal for perishable food and moisture-sensitive pharmaceuticals.

- Sustainability regulations and consumer preferences are driving innovation. For example, in the European Union, stringent guidelines under the Circular Economy Action Plan have led companies to reformulate packaging films to meet eco-design criteria. PVDC-coated films, traditionally difficult to recycle, are now being engineered with eco-friendlier resins and coatings to minimize environmental burden.

- Advanced PVDC coatings now enable downgauging—reducing film thickness without compromising protective properties. This not only reduces raw material consumption but also decreases overall packaging weight, which translates into lower transportation costs and a smaller carbon footprint.

- The trend towards sustainable barrier films is also supported by increasing R&D investment into hybrid coating technologies that blend PVDC with other biodegradable or recyclable polymers. For instance, some producers are experimenting with PVDC-PVOH combinations to enhance both biodegradability and gas barrier performance.

- This shift is fundamentally reshaping the competitive landscape of packaging, with companies like SRF Limited, Vacmet India, and Toray Industries pivoting toward next-generation PVDC-coated films that meet both performance and environmental expectations. As brand owners and consumers increasingly prioritize circular economy principles, the demand for sustainable PVDC-coated barrier films is expected to grow rapidly across global markets.

PVDC Coated Films Market Dynamics

Driver

“Surging Demand for Extended Shelf Life in Packaged Goods”

- The growing consumer demand for packaged goods with extended shelf life—especially in the food and pharmaceutical industries—is a significant driver fueling the demand for PVDC coated films globally.

- For instance, in March 2024, Perlen Packaging introduced an advanced line of PVDC-coated barrier films tailored for high-performance pharmaceutical blister packaging, highlighting the industry's focus on maintaining drug stability under challenging environmental conditions. These developments are expected to significantly drive PVDC coated film market growth in the forecast period.

- As global supply chains become more complex and distribution distances increase, manufacturers require packaging solutions that offer superior barrier protection against moisture, oxygen, and other environmental contaminants—functions in which PVDC-coated films excel.

- Furthermore, urbanization and changing consumer lifestyles have led to increased consumption of ready-to-eat meals, processed snacks, and single-serve products. These formats demand robust barrier packaging to ensure freshness and safety throughout extended shelf life.

- Pharmaceutical companies also rely heavily on PVDC films to maintain the efficacy of moisture- and light-sensitive medications, particularly in tropical regions where high humidity poses a constant threat to drug stability.

- Increased awareness of food safety and hygiene, along with regulatory pressure to reduce food waste, has further encouraged manufacturers to adopt PVDC-coated films that help products stay fresh longer. This, combined with expanding retail and e-commerce sectors, reinforces the strategic value of advanced barrier packaging in safeguarding product quality from factory to end-user.

Restraint/Challenge

“Environmental Concerns and Recycling Limitations of PVDC Films”

- Environmental concerns related to the non-recyclability and ecological impact of PVDC coated films present a significant challenge to the broader adoption of these materials, particularly as global attention intensifies on sustainable packaging practices.

- For instance, several environmental agencies and regulatory bodies in regions such as the European Union have identified PVDC as problematic for recycling systems due to the generation of harmful byproducts like hydrochloric acid during incineration. These concerns are prompting manufacturers and brand owners to reconsider the use of PVDC in packaging applications.

- Addressing these sustainability concerns is crucial, as an increasing number of multinational companies are committing to eco-friendly packaging goals, including 100% recyclability or compostability within the next decade. This trend places pressure on PVDC film producers to innovate or risk being phased out in favor of more sustainable alternatives like EVOH or bio-based polymers.

- Additionally, the complexity and cost associated with separating PVDC-coated layers from multi-material packaging further complicate recycling efforts and discourages use, especially in markets with stringent waste management protocols.

- While efforts are underway to develop recyclable or biodegradable variants of PVDC-coated films, these innovations are still in nascent stages and often come at a premium, making it difficult to scale across price-sensitive markets or high-volume applications.

- Overcoming this challenge will require significant R&D investment, partnerships with recycling technology providers, and proactive adaptation to evolving regulatory frameworks. Manufacturers that can offer high-barrier, eco-compliant alternatives will be better positioned for long-term competitiveness in the global market.

PVDC Coated Films Market Scope

The market is segmented on the basis of type, application, and coating side.

- By Type

On the basis of type, the PVDC Coated Films market is segmented into Polyethylene (PE), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polypropylene (PP), and Polyamide (PA). The Polyethylene Terephthalate (PET) segment is expected to dominate the largest market revenue share of 34.15% in 2025 due to its excellent dimensional stability, mechanical strength, and transparency. PET’s compatibility with PVDC coating makes it highly suitable for applications requiring high moisture and gas barrier properties, especially in food and pharmaceutical packaging. The recyclability of PET also contributes to its appeal amid increasing environmental regulations.

The Polypropylene (PP) segment is anticipated to witness the fastest growth rate of 5.6% from 2025 to 2032. This is attributed to its cost-effectiveness, flexibility, and growing usage in flexible packaging formats. PP films coated with PVDC provide strong moisture barrier properties, and their lightweight nature makes them increasingly favored in food and snack packaging sectors.

- By Application

On the basis of application, the PVDC Coated Films market is segmented into Food, Healthcare and Pharmaceuticals, and Cosmetics and Personal Care. The Food segment holds the largest share of the market in 2025, driven by growing demand for extended shelf life and premium packaging. PVDC-coated films are widely used in food wraps, pouches, and snack packaging due to their excellent oxygen and moisture barrier properties, helping preserve freshness and prevent spoilage.

The Healthcare and Pharmaceuticals segment is projected to grow at the fastest CAGR through 2032. This is driven by stringent regulations on drug stability, growing global pharmaceutical production, and increased usage of PVDC-coated blister packs for moisture- and light-sensitive medications. The rise in demand for unit-dose packaging formats further supports this growth trajectory.

- By Coating Side

On the basis of coating side, the PVDC Coated Films market is segmented into Single-sided and Double-sided coating. The Single-sided segment is expected to dominate the market in 2025 due to its widespread use in cost-sensitive applications and ease of processing. Single-sided PVDC coatings offer sufficient barrier protection for a variety of products while maintaining affordability and compatibility with standard lamination equipment.

The Double-sided coating segment is expected to register faster growth through 2032, as it offers enhanced barrier protection and is ideal for applications that demand high-performance packaging, such as pharmaceuticals and sensitive cosmetics. As brand owners seek superior protection without compromising aesthetics, double-coated PVDC films are gaining popularity in premium product segments.

PVDC Coated Films Market Regional Analysis

- North America dominates the PVDC Coated Films market with the largest revenue share of 42.91% in 2024, driven by increasing demand for high-performance barrier packaging, particularly in the food and pharmaceutical sectors.

- The region benefits from advanced manufacturing capabilities, strong R&D investments, and a highly regulated packaging industry that favors the use of materials like PVDC for extended shelf life and contamination prevention.

- Growing consumer preference for convenient, ready-to-eat packaged foods and rising awareness of pharmaceutical product integrity are further supporting market growth.

U.S. PVDC Coated Films Market Insight

The U.S. PVDC Coated Films market captured the largest revenue share of 81% within North America in 2025, fueled by robust demand in food packaging and healthcare industries. Major pharmaceutical firms operating in the U.S. rely on PVDC-coated blister packaging due to its superior moisture and oxygen barrier properties. Additionally, sustainability efforts are prompting innovation in recyclable PVDC alternatives, maintaining steady market momentum.

Europe PVDC Coated Films Market Insight

The European PVDC Coated Films market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent regulations around pharmaceutical and food safety, along with consumer demand for premium packaging. European nations are adopting barrier films for sustainability and compliance with EU directives that emphasize shelf life and reduced food waste. Increased demand from nutraceutical and cosmetic industries also contributes to market growth.

U.K. PVDC Coated Films Market Insight

The U.K. PVDC Coated Films market is anticipated to grow at a noteworthy CAGR, driven by increased demand for reliable, high-barrier packaging in pharmaceuticals and personal care. Rising health awareness, coupled with expanding retail channels, is pushing companies to adopt PVDC-coated packaging to preserve product integrity and meet consumer expectations.

Germany PVDC Coated Films Market Insight

The German PVDC Coated Films market is expected to expand at a considerable CAGR, supported by the country’s strong pharmaceutical sector and commitment to sustainable packaging. Germany’s packaging industry emphasizes innovation and compliance, favoring high-barrier materials such as PVDC in sensitive applications, including medical devices and high-end cosmetics.

Asia-Pacific PVDC Coated Films Market Insight

The Asia-Pacific PVDC Coated Films market is poised to grow at the fastest CAGR of over 24% in 2025, driven by rapid industrialization, rising disposable incomes, and expanding healthcare infrastructure Countries such as China, Japan, India, and South Korea are experiencing significant growth in food exports and pharmaceutical production, which requires high-barrier films to ensure product stability and safety during storage and transportation.

Japan PVDC Coated Films Market Insight

The Japan PVDC Coated Films market is gaining momentum due to strong demand for packaging innovations in pharmaceuticals and high-end food products,. Japan’s focus on convenience, hygiene, and minimal food waste promotes adoption of advanced PVDC films, particularly for ready meals and dose-specific medicine packaging.

China PVDC Coated Films Market Insight

The China PVDC Coated Films market accounted for the largest market revenue share in Asia Pacific in 2025, driven by its position as a major global manufacturing hub for packaged foods and pharmaceuticals. Government support for improving packaging standards and the country’s rapid shift toward urban lifestyles fuel the demand for PVDC-coated films that ensure safety and product longevity.

PVDC Coated Films Market Share

The PVDC Coated Films industry is primarily led by well-established companies, including:

- Treofan Group (Germany)

- Cosmo Films Ltd. (India)

- SKC, Inc. (U.S.)

- VIBAC S.p.A. (Italy)

- Perlen Packaging (Switzerland)

- POLINAS (Turkey)

- SRF Limited (India)

- Toray Industries, Inc. (Japan)

- ACG (India)

- Vacmet India (India)

- Transcendia (U.S.)

- Junish (India)

- Mitsubishi Polyester (U.S.)

- Olunro Corporation (China)

- PT. Trias Sentosa, Tbk (Indonesia)

- SD PACK CO., LTD (South Korea)

- Maruti Vinyls (India)

- Dass & Company (India)

- Bhargava Poly Packs (India)

- Advance Syntex Limited (India)

Latest Developments in Global PVDC Coated Films Market

- In February 2021, Transcendia, Inc. expanded its product portfolio by acquiring LPF Flexible Packaging, a manufacturer specializing in high-barrier films for the food and pharmaceutical sectors. This strategic acquisition enhances Transcendia's capabilities in providing advanced barrier and packaging film solutions

- In September 2020, Cosmo Films Ltd. enhanced its specialty polyester films portfolio by commissioning a new production line in Maharashtra, India. This strategic expansion aims to support the company’s capability to deliver more advanced and diversified solutions for packaging, lamination, and various other applications

- In August 2020, Cosmo Films Ltd. introduced a transparent antifog film characterized by exceptional hot and cold antifogging performance. The film features a hot tack strength ranging from 280 to 530 grams/inch and supports sealing at temperatures between 130°C and 140°C, making it ideal for various packaging applications

- In March 2019, Transcendia, Inc. completed the acquisition of Purestat Engineered Technologies (U.S.). This move enabled Transcendia to broaden its product offerings, particularly in the areas of barrier and packaging films, strengthening its market presence

- Solvay launched Diofan® Ultra736, a new polyvinylidene chloride (PVDC) coating solution specifically designed for pharmaceutical blister films. This aqueous dispersion provides an ultra-high water vapor barrier, is fluorine-free, and meets regulatory standards for direct pharmaceutical contact. The innovation enables the production of sustainable films with thinner coatings, thereby helping to reduce the carbon footprint of pharmaceutical packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pvdc Coated Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pvdc Coated Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pvdc Coated Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.