Global Q Pcr And D Pcr Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.67 Billion

USD

21.34 Billion

2024

2032

USD

10.67 Billion

USD

21.34 Billion

2024

2032

| 2025 –2032 | |

| USD 10.67 Billion | |

| USD 21.34 Billion | |

|

|

|

|

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Size

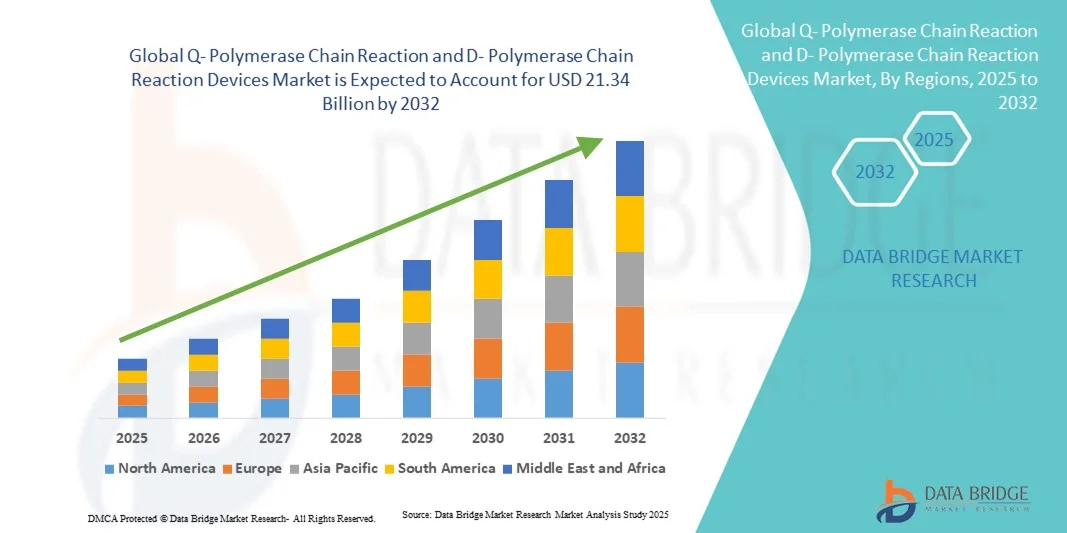

- The global Q- polymerase chain reaction and D- polymerase chain reaction devices market size was valued at USD 10.67 billion in 2024 and is expected to reach USD 21.34 billion by 2032, at a CAGR of 9.05% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced molecular diagnostics and technological innovations in qPCR and dPCR devices, leading to more accurate, rapid, and high-throughput testing across research, clinical, and industrial applications

- Furthermore, rising demand for precise and sensitive nucleic acid quantification, along with the need for fast pathogen detection and genetic analysis, is establishing qPCR and dPCR devices as essential tools in diagnostics and research laboratories. These converging factors are accelerating the uptake of qPCR and dPCR solutions, thereby significantly boosting the industry’s growth

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Analysis

- Q-Polymerase Chain Reaction (PCR) and D-Polymerase Chain Reaction (PCR) devices are essential tools in modern molecular diagnostics, enabling rapid and precise detection of genetic material for a wide range of applications in clinical, research, and industrial laboratories. Their ability to deliver high-throughput, accurate results has made them indispensable in fields such as infectious disease testing, oncology, and genetic research

- The escalating demand for Q- and D-PCR devices is primarily fueled by the increasing prevalence of infectious diseases, rising adoption of molecular diagnostic technologies, and growing emphasis on precision medicine. Laboratories and research centers are increasingly relying on these devices to enhance testing efficiency, reduce turnaround times, and improve overall diagnostic accuracy

- North America dominated the Q-polymerase chain reaction and D-polymerase chain reaction devices market with the largest revenue share of 41.2% in 2024, supported by advanced healthcare infrastructure, high adoption of molecular diagnostic technologies, and the presence of major market players in the U.S. The region has seen substantial growth in installations of both Q-PCR and D-PCR devices across hospitals, diagnostic laboratories, and research centers, driven by increasing government initiatives and investments in genomics research

- Asia-Pacific is expected to be the fastest-growing region in the Q-polymerase chain reaction and D-polymerase chain reaction devices market during the forecast period, registering a CAGR, due to rising government investments in healthcare infrastructure, expanding laboratory networks, growing awareness of molecular diagnostics, and increasing prevalence of infectious diseases in countries such as China and India

- The Quantitative PCR segment dominated the Q-polymerase chain reaction and D-polymerase chain reaction devices market with the largest market revenue share of 62% in 2024, driven by its widespread use in clinical diagnostics, research, and high-throughput testing applications

Report Scope and Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Segmentation

|

Attributes |

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Trends

Enhanced Convenience and Rapid Diagnostics

- A significant and accelerating trend in the global Q-polymerase chain reaction and D-polymerase chain reaction devices market is the increasing integration of automated workflows and high-throughput capabilities. These advancements are significantly enhancing laboratory efficiency, precision, and reliability in diagnostic and research applications

- For instance, modern Q-PCR and D-PCR systems now allow simultaneous processing of multiple samples, reducing turnaround times and improving overall productivity in clinical and research laboratories. Similarly, new digital droplet PCR platforms provide precise quantification of nucleic acids, enabling more accurate genetic analysis and pathogen detection

- The integration of advanced thermal cyclers, multiplexing capabilities, and automated sample preparation is enabling laboratories to streamline testing procedures while minimizing manual errors. This not only increases throughput but also enhances the reproducibility of experimental results

- High sensitivity and specificity of Q- and D-PCR devices are enabling early detection of infectious diseases, monitoring of gene expression, and identification of rare genetic mutations, supporting critical decision-making in clinical diagnostics and personalized medicine

- Enhanced user interfaces and software solutions now allow real-time monitoring of amplification curves, automated data analysis, and digital record-keeping, which facilitate better laboratory management and faster reporting of results

- These technological enhancements are fundamentally transforming expectations for molecular diagnostics, encouraging laboratories to adopt advanced Q- and D-PCR systems that combine speed, accuracy, and user-friendly operation

- The demand for Q- and D-PCR devices is growing rapidly across hospitals, diagnostic centers, and research laboratories worldwide, as institutions increasingly prioritize precision, throughput, and efficiency in genetic and molecular testing

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Dynamics

Driver

Growing Need Due to Rising Demand for Rapid and Accurate Diagnostics

- The increasing prevalence of infectious diseases, genetic disorders, and the rising demand for precision medicine is a significant driver for the heightened adoption of Q-Polymerase Chain Reaction (Q-PCR) and D-Polymerase Chain Reaction (D-PCR) devices

- For instance, in April 2024, Thermo Fisher Scientific announced the launch of an advanced Q-PCR system designed to enhance throughput and accuracy in clinical diagnostics and research laboratories. Such strategies by key companies are expected to drive the Q-PCR and D-PCR Devices industry growth in the forecast period

- As healthcare providers and research institutions seek rapid, reliable, and reproducible results, Q-PCR and D-PCR devices offer advanced features such as multiplexing, real-time monitoring, and digital record-keeping, providing a compelling upgrade over conventional PCR methods

- Furthermore, the growing emphasis on early disease detection, personalized medicine, and genomics research is driving the integration of Q-PCR and D-PCR devices into hospital laboratories, diagnostic centers, and research facilities worldwide

- The convenience of high-throughput testing, automated workflows, and precise nucleic acid quantification are key factors propelling the adoption of these devices in both clinical and research settings. The trend toward automated laboratory solutions and user-friendly interfaces further contributes to market growth

Restraint/Challenge

Concerns Regarding High Initial Costs and Technical Expertise

- The adoption of Q-PCR and D-PCR devices is often hindered by their relatively high initial purchase cost, which can be prohibitive for small laboratories, research institutes, and healthcare facilities in developing regions. These devices, especially high-end systems with advanced multiplexing capabilities or digital PCR functionality, require a significant financial investment that may not be immediately justifiable for institutions with limited budgets

- Furthermore, operating Q-PCR and D-PCR systems demands specialized technical expertise. Laboratory personnel must be trained to handle complex workflows, maintain calibration standards, and interpret quantitative data accurately, which can increase operational costs and limit the accessibility of these technologies to well-resourced institutions

- The integration of advanced features such as high-throughput automation, real-time detection, and droplet digital PCR adds additional layers of complexity, which can intimidate smaller labs and slow adoption despite the clear advantages of precision and speed

- While ongoing technological advancements are gradually simplifying device interfaces and workflow automation, the perception of complexity continues to influence purchasing decisions, particularly among institutions without experienced molecular biology staff

- Addressing these challenges requires manufacturers to focus on designing cost-effective, easy-to-use devices, providing comprehensive training programs, and offering customer support and service packages to build confidence among potential users

- Overcoming the barriers of cost and technical complexity will be critical to expanding market penetration and ensuring that Q-PCR and D-PCR technologies are accessible to a wider range of clinical, research, and diagnostic laboratories worldwide

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Scope

The market is segmented on the basis of technology, products and services, application, and end user

- By Technology

On the basis of technology, the Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices market is segmented into quantitative PCR (qPCR) and digital PCR (dPCR). The qPCR segment dominated the largest market revenue share of 62% in 2024, driven by its widespread use in clinical diagnostics, research, and high-throughput testing applications. Its established reliability, reproducibility, and rapid turnaround for pathogen detection, gene expression analysis, and molecular diagnostics make it a preferred choice among laboratories globally. The growing demand for disease monitoring, infectious disease testing, and precision medicine continues to reinforce qPCR adoption. qPCR platforms benefit from extensive compatibility with existing laboratory workflows and reagents, supporting widespread use. Moreover, hospitals and diagnostic centers prefer qPCR due to its robust validation, regulatory acceptance, and scalability. The segment also sees strong uptake in emerging markets, fueled by increasing investment in healthcare infrastructure. In addition, technological enhancements such as multiplexing and automation-ready formats further strengthen its dominance.

The dPCR segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032, driven by its superior sensitivity and ability to provide absolute nucleic acid quantification. Digital PCR enables precise detection of low-abundance targets, rare mutations, and copy number variations, making it critical in oncology, liquid biopsy, and infectious disease research. Its adoption is rising in clinical and research settings due to enhanced accuracy over conventional qPCR. User-friendly instruments, compact designs, and increasing awareness of its advantages support its rapid growth. dPCR is also gaining attention in genomics and personalized medicine applications, accelerating integration in advanced laboratories. Moreover, manufacturers are expanding offerings with automated workflows and high-throughput capabilities to cater to rising demand.

- By Products and Services

On the basis of products and services, the market is segmented into reagents, consumables, instruments, and software. The instruments segment dominated the market with a 48% share in 2024, fueled by the demand for robust, high-throughput qPCR and dPCR platforms. Research and clinical laboratories require reliable instruments capable of multiplexing, automation integration, and high sensitivity. Continuous innovation by key players to enhance accuracy, throughput, and user experience strengthens the instrument segment’s market leadership. Its wide adoption across clinical diagnostics, pharmaceutical research, and academic studies supports recurring sales and upgrades. Instruments also benefit from strong brand recognition and established vendor support services. Moreover, the rising need for compact and mobile PCR systems in decentralized testing scenarios further boosts the segment. Overall, the instrument segment remains the backbone of the qPCR/dPCR devices market.

The reagents and consumables segment is expected to witness the fastest CAGR of 12% from 2025 to 2032, driven by recurring usage in routine testing, research, and molecular biology experiments. The surge in infectious disease testing, oncology research, and genetic analysis increases demand for PCR kits, reagents, and consumables. Innovations in pre-mixed reagents, lyophilized kits, and universal assay formats are improving accessibility and efficiency. Expanding testing volumes in emerging markets, coupled with growing awareness of high-quality consumables, further accelerates growth. Integration with automated workflows enhances demand for compatible consumables. In addition, partnerships between reagent manufacturers and instrument vendors expand the product ecosystem, creating new revenue streams. Rising adoption of multiplex and high-sensitivity assays further supports the segment’s rapid expansion.

- By Application

On the basis of application, the market is segmented into clinical applications, research, forensic, and others. The clinical applications segment dominated the market with a 57% share in 2024, driven by its critical role in pathogen detection, genetic disorder screening, and disease monitoring. Hospitals and diagnostic centers rely on qPCR and dPCR for accurate and rapid results to support patient care. Adoption is further reinforced by favorable reimbursement policies, regulatory acceptance, and the growing need for early disease detection. The segment benefits from increasing laboratory automation and integration into healthcare workflows. High adoption is seen in infectious disease testing, oncology, and prenatal diagnostics. The growing prevalence of chronic and infectious diseases globally also sustains demand. Clinical labs continue to invest in advanced PCR platforms, ensuring sustained market dominance.

The research segment is expected to witness the fastest CAGR of 13% from 2025 to 2032, fueled by rising genomic studies, biomarker discovery, and drug development activities. Academic and private research labs increasingly invest in high-sensitivity qPCR and dPCR platforms. The segment’s growth is supported by advancements in personalized medicine, molecular biology innovations, and increased government funding for life sciences research. Expanding collaborations between academic institutions and pharmaceutical companies further accelerate adoption. High-throughput capabilities and automation compatibility make these platforms ideal for complex experiments. Emerging markets are rapidly integrating PCR-based research solutions, driving growth. In addition, technological innovations in multiplexing and digital quantification enhance research applications.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centres, research laboratories, academic institutes, pharmaceutical and biotechnology companies, clinical research organizations, and forensic laboratories. The hospitals segment dominated with a 50% share in 2024, driven by the increasing integration of molecular diagnostics into routine patient care and clinical workflows. Hospitals extensively utilize qPCR and dPCR devices for rapid and accurate infectious disease detection, genetic testing, and precision medicine initiatives. The adoption is further supported by the need for high-throughput testing, regulatory compliance, and enhanced patient management capabilities. In addition, hospitals benefit from automated and user-friendly PCR platforms that reduce operational complexities, improve turnaround times, and ensure reliable diagnostic results. Growing investments in advanced laboratory infrastructure, coupled with rising prevalence of chronic and infectious diseases, reinforce the segment’s leading market position.

The research laboratories and academic institutes segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, fueled by the expanding scope of genomic, proteomic, and biomarker research. Academic and private research laboratories are increasingly adopting high-sensitivity qPCR and dPCR platforms to support complex molecular studies, drug development research, and large-scale experimental workflows. Government funding, research grants, and collaborations between academia and pharmaceutical companies are accelerating the implementation of advanced PCR technologies. The demand is also driven by the growing trend of personalized medicine, molecular diagnostics research, and technological advancements in automation and multiplexing capabilities. Moreover, emerging markets are witnessing a rapid increase in research activities, further contributing to the fast-paced growth of this segment.

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Regional Analysis

- North America dominated the Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market with the largest revenue share of 41.2% in 2024, supported by advanced healthcare infrastructure, widespread adoption of molecular diagnostic technologies, and the presence of major market players in the U.S.

- The region has witnessed substantial growth in installations of both Q-PCR and D-PCR devices across hospitals, diagnostic laboratories, and research centers, fueled by increasing government initiatives and significant investments in genomics and infectious disease research

- The well-established R&D ecosystem, coupled with a strong pipeline of diagnostic applications, continues to drive the market in the region

U.S. Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

The U.S. Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market captured the largest revenue share of 82% within North America in 2024, reflecting the country’s leadership in molecular diagnostics. Growth is propelled by robust investments in precision medicine, oncology research, and infectious disease monitoring. Hospitals and private diagnostic laboratories are increasingly adopting high-throughput Q-PCR and D-PCR platforms to meet rising demand for accurate, rapid, and reproducible results. Furthermore, government funding for genomics and pandemic preparedness programs continues to support market expansion, while the continuous development of multiplexing assays strengthens the adoption of advanced devices.

U.K. Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

The U.K. Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market is projected to grow at a noteworthy CAGR over the forecast period, driven by the country’s robust healthcare infrastructure and strong R&D capabilities. Rising demand for molecular diagnostics in hospitals and clinical laboratories, combined with government support for genomics research and public health initiatives, is encouraging the adoption of both Q-PCR and D-PCR platforms. Increasing awareness of precision medicine and infectious disease diagnostics is further stimulating market growth in the U.K.

Germany Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

Germany Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market dominated the Europe Q-PCR and D-PCR Devices market with the largest revenue share of 36.5% in 2024, attributed to its well-established pharmaceutical and biotechnology sectors, extensive research facilities, and high adoption of high-performance PCR instruments. Strong government initiatives supporting molecular diagnostics, combined with substantial investment in laboratory infrastructure and clinical research, continue to boost demand. Hospitals and research institutions increasingly rely on PCR platforms for disease monitoring, drug development, and biotechnology applications.

France Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

France Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market is expected to be the fastest-growing country in Europe during the forecast period, supported by increasing investments in analytical and molecular laboratories, rising demand for environmental and food safety testing, and rapid adoption of advanced PCR platforms in clinical and research settings. The expansion of hospital networks and biotechnology research centers further accelerates market growth, with a focus on high-throughput and precision diagnostic solutions.

Asia-Pacific Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

The Asia-Pacific Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market is expected to register the fastest CAGR from 2025 to 2032, driven by rising government investments in healthcare infrastructure, expanding laboratory networks, growing awareness of molecular diagnostics, and increasing prevalence of infectious diseases.

China Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

China Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, growing healthcare expenditure, and high adoption of molecular diagnostics in hospitals and research laboratories. Increasing government focus on infectious disease monitoring, expansion of laboratory infrastructure, and local manufacturing of PCR devices continue to propel market growth.

India Q-Polymerase Chain Reaction and D-Polymerase Chain Reaction Devices Market Insight

India’s Q-polymerase chain reaction (Q-PCR) and D-polymerase chain reaction (D-PCR) devices market is gaining momentum due to rising investments in public health infrastructure, growing laboratory networks, and increasing adoption of molecular diagnostics for infectious diseases. Government initiatives supporting genomic research, combined with the expansion of private diagnostic laboratories, are expected to drive strong growth over the forecast period, making India one of the fastest-growing markets in the region.

Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market Share

The Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bio-Rad Laboratories, Inc. (U.S.)

- Takara Bio, Inc. (Japan)

- Agilent Technologies, Inc. (U.S.)

- BIOMÉRIEUX (France)

- Standard BioTools (U.S.)

- Danaher Corporation (U.S.)

- Abbott (U.S.)

- Merck KGaA (Germany)

- BD (U.S.)

- Promega Corporation (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Analytik Jena AG (Germany)

- BioFire Diagnostics (U.S.)

- Cepheid (U.S.)

- Thermo Fisher Scientific, Inc. (U.S.)

Latest Developments in Global Q- Polymerase Chain Reaction and D- Polymerase Chain Reaction Devices Market

- In July 2021, Stilla Technologies launched the industry's first six-color digital PCR system, offering high multiplexing and sensitivity for advancing cancer and liquid biopsy studies, cell and gene therapies, infectious disease and COVID-19 research, and environmental testing

- In September 2021, Thermo Fisher Scientific introduced the Applied Biosystems QuantStudio Absolute Q Digital PCR System, the first integrated digital PCR solution, ideal for oncology, cell and gene therapy development, and other research applications

- In November 2023, Roche launched the LightCycler PRO System, designed to be the most advanced qPCR technology for both clinical diagnostics and research, advancing personalized healthcare and supporting outbreak readiness

- In May 2024, Diagnostics.ai launched the industry's first fully-transparent machine learning platform for clinical real-time PCR diagnostics, demonstrating exactly how each result was achieved, a first for molecular-testing machine learning

- In June 2025, QIAGEN and GENCURIX announced a partnership to develop multiplex oncology assays for tissue and liquid biopsies using the QIAcuity Digital PCR platform, aiming to broaden adoption of the QIAcuityDx platform offering clinical diagnostic laboratories a range of clinical oncology assays.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.