Global Quality Grading And Inspection Services Market

Market Size in USD Billion

CAGR :

%

USD

279.97 Billion

USD

429.67 Billion

2025

2033

USD

279.97 Billion

USD

429.67 Billion

2025

2033

| 2026 –2033 | |

| USD 279.97 Billion | |

| USD 429.67 Billion | |

|

|

|

|

Global Quality Grading and Inspection Services Market Size

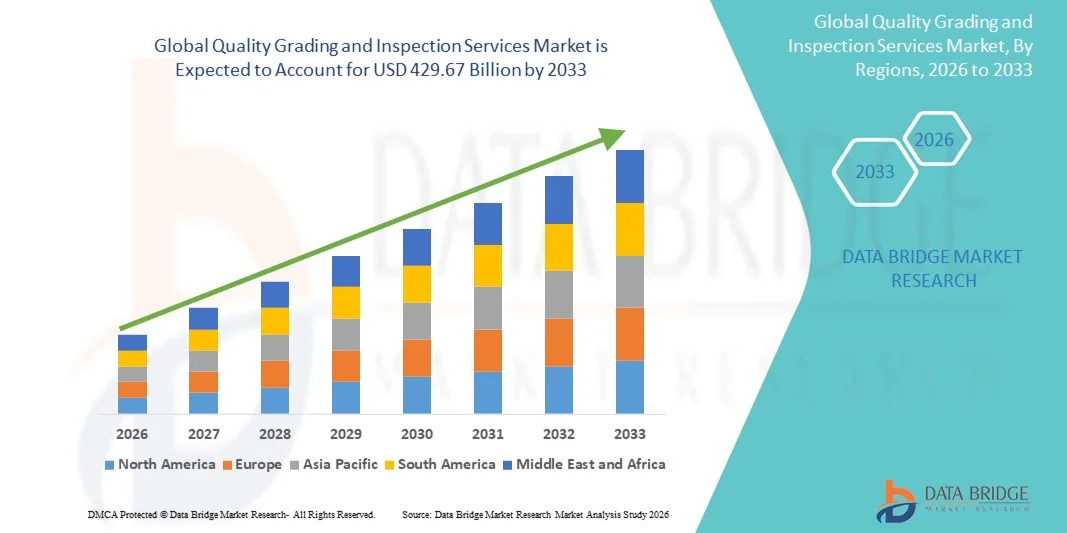

- The global Quality Grading and Inspection Services Market size was valued at USD 279.97 billion in 2025 and is projected to reach USD 429.67 billion by 2033, growing at a CAGR of 5.50% during the forecast period.

- The market expansion is primarily driven by increasing demand for standardized quality assessments and inspection services across diverse industries, including manufacturing, food, pharmaceuticals, and construction, ensuring compliance with regulatory standards and consumer expectations.

- In addition, the rising focus on product safety, reliability, and efficiency, coupled with technological advancements in automated inspection and grading systems, is enhancing operational accuracy and reducing errors. These factors collectively are propelling the adoption of quality grading and inspection services, significantly contributing to market growth.

Global Quality Grading and Inspection Services Market Analysis

- Quality grading and inspection services, encompassing systematic evaluation of products and processes across industries such as manufacturing, food, pharmaceuticals, and construction, are becoming essential for ensuring compliance, product safety, and operational efficiency in both commercial and industrial settings due to their ability to minimize defects, enhance reliability, and support regulatory adherence.

- The growing demand for quality grading and inspection services is primarily driven by increased regulatory scrutiny, rising consumer expectations for product safety and consistency, and the need for businesses to maintain competitive advantages through reliable quality assurance.

- Europe dominated the Global Quality Grading and Inspection Services Market with the largest revenue share of 33.2% in 2025, supported by the presence of major industry players, advanced manufacturing infrastructure, and stringent quality regulations, with the U.S. witnessing significant adoption of automated inspection and grading technologies across sectors such as food, automotive, and pharmaceuticals.

- Asia-Pacific is expected to be the fastest-growing region in the Global Quality Grading and Inspection Services Market during the forecast period due to rapid industrialization, increasing urbanization, rising disposable incomes, and the growing adoption of digitalized quality management systems across manufacturing hubs in China, India, and Southeast Asia.

- The soil segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the critical need for soil quality assessment to ensure optimum crop yields and sustainable farming practices.

Report Scope and Global Quality Grading and Inspection Services Market Segmentation

|

Attributes |

Quality Grading and Inspection Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Quality Grading and Inspection Services Market Trends

Enhanced Efficiency Through AI and Automated Inspection

- A significant and accelerating trend in the global Quality Grading and Inspection Services Market is the growing integration of artificial intelligence (AI) and advanced automation technologies into inspection and grading processes. This fusion of technologies is significantly improving accuracy, speed, and operational efficiency across industries.

- For instance, companies such as Intertek and SGS are deploying AI-powered visual inspection systems in manufacturing and food processing, enabling automated detection of defects or inconsistencies that would be difficult or time-consuming for human inspectors to identify. Similarly, TÜV SÜD and Bureau Veritas utilize AI-driven predictive analytics to optimize inspection schedules and resource allocation, enhancing overall operational efficiency.

- AI integration in quality grading allows systems to learn patterns and detect anomalies over time, enabling proactive recommendations for process improvements and predictive maintenance. For example, some Eurofins and Applus+ solutions use AI to analyze large datasets from production lines to predict potential quality failures, helping companies minimize errors and reduce waste.

- The seamless integration of AI-powered inspection tools with digital management platforms allows centralized monitoring and control of quality across multiple sites. Through a single interface, companies can manage inspections, analyze results, and generate compliance reports, creating a more unified and efficient operational workflow.

- This trend toward more intelligent, automated, and data-driven inspection systems is fundamentally transforming industry standards for quality assurance. Consequently, companies such as Element Materials Technology and QIMA are developing AI-enabled inspection services that combine automated defect detection, predictive analysis, and centralized reporting to meet rising client expectations.

- The demand for AI-integrated quality grading and inspection solutions is growing rapidly across manufacturing, food and beverage, pharmaceuticals, and other sectors, as businesses increasingly prioritize efficiency, reliability, and regulatory compliance.

Global Quality Grading and Inspection Services Market Dynamics

Driver

Growing Need Due to Rising Quality Standards and Regulatory Compliance

- The increasing emphasis on stringent quality standards, regulatory requirements, and consumer expectations across industries is a significant driver for the heightened demand for quality grading and inspection services.

- For instance, in 2025, Eurofins expanded its AI-powered inspection services for the food and pharmaceutical sectors, integrating advanced analytics and real-time monitoring to ensure compliance with global standards. Such initiatives by key players are expected to drive growth in the quality grading and inspection services market during the forecast period.

- As businesses become more aware of potential quality risks and the financial and reputational impacts of non-compliance, quality grading and inspection services offer advanced solutions such as automated defect detection, predictive analytics, and detailed reporting, providing a compelling advantage over manual inspection processes.

- Furthermore, the growing adoption of Industry 4.0 practices and digitalized production systems is making automated inspection an integral component of modern manufacturing and supply chain operations, enabling seamless integration with enterprise management and operational technologies.

- The ability to continuously monitor product quality, maintain compliance, and optimize operational efficiency are key factors propelling the adoption of quality grading and inspection services across manufacturing, food and beverage, pharmaceuticals, and construction sectors. The trend towards scalable, AI-driven inspection solutions and the increasing availability of user-friendly service options further contribute to market growth.

Restraint/Challenge

Concerns Regarding High Implementation Costs and Integration Complexities

- The relatively high initial investment required for advanced quality grading and inspection systems, including AI-powered and automated solutions, poses a significant challenge to broader market adoption, particularly for small and medium-sized enterprises (SMEs) or companies in developing regions.

- For instance, deploying automated visual inspection or inline grading systems can require substantial capital expenditure, specialized software, and integration with existing manufacturing processes, making some organizations hesitant to adopt these technologies.

- Additionally, integration complexities with legacy production lines and enterprise management systems can slow down implementation, requiring skilled personnel, training, and ongoing maintenance. Companies such as TÜV SÜD and SGS emphasize offering modular and scalable solutions to mitigate these barriers, but cost and technical challenges remain a concern for some potential clients.

- While technological advancements and service-based models are gradually reducing costs, the perceived investment barrier can still hinder widespread adoption, particularly among smaller players or industries with tight margins.

- Overcoming these challenges through cost-effective, modular inspection solutions, streamlined integration processes, and client education on long-term ROI and efficiency benefits will be crucial for sustained growth in the global quality grading and inspection services market.

Global Quality Grading and Inspection Services Market Scope

Quality grading and inspection services market is segmented on the basis of sample type, service type, end user, technology and offering.

- By Sample Type

On the basis of sample type, the Global Quality Grading and Inspection Services Market is segmented into soil, seed, water, fertilizer, food, and others. The soil segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the critical need for soil quality assessment to ensure optimum crop yields and sustainable farming practices. Soil testing provides essential information on nutrient content, pH levels, and contamination, enabling farmers and agribusinesses to make informed decisions on fertilization and crop management.

The seed segment is anticipated to witness the fastest CAGR of 19.2% from 2026 to 2033, fueled by the rising adoption of high-quality seeds, hybrid varieties, and genetically improved crops, which require rigorous inspection and quality grading before commercial use. Growing demand for certified seeds and regulatory requirements for seed quality across countries further support the rapid adoption of seed testing services.

- By Service Type

On the basis of service type, the market is segmented into off-site services and on-site services. The off-site services segment dominated the market with the largest revenue share of 52.4% in 2025, driven by centralized laboratory facilities offering comprehensive testing and grading across multiple sample types with advanced equipment and standardized protocols. Off-site services are preferred for their accuracy, reliability, and access to specialized testing capabilities, which many agricultural organizations or research institutions may not maintain in-house.

On-site services are expected to witness the fastest CAGR of 18.6% from 2026 to 2033, supported by the growing demand for rapid, on-field testing to enable real-time decision-making in farming operations. Portable testing kits and mobile inspection units allow farmers and consultants to assess soil, water, or fertilizer quality directly at the point of use, reducing turnaround time and facilitating timely interventions in agricultural workflows.

- By End User

On the basis of end user, the Global Quality Grading and Inspection Services Market is segmented into farmers, agricultural consultants, fertilizer manufacturers, research bodies, and others. The farmer segment dominated the market with a revenue share of 44.7% in 2025, driven by the increasing focus on precision agriculture, sustainable farming practices, and regulatory compliance in the use of fertilizers, water, and seeds. Farmers rely on quality grading services to optimize productivity and prevent losses due to poor inputs.

Agricultural consultants are expected to witness the fastest CAGR of 20.3% from 2026 to 2033, as their role in advising on crop management, soil fertility, and input utilization grows. The rising adoption of consultancy-driven agriculture, especially in emerging markets, increases the demand for timely and accurate inspection services to provide actionable insights for smallholders and commercial farms alike.

- By Technology

On the basis of technology, the Global Quality Grading and Inspection Services Market is segmented into conventional and rapid technologies. The conventional segment dominated the market with the largest revenue share of 55.2% in 2025, supported by its reliability, well-established protocols, and high accuracy in laboratory testing across soil, water, seed, and food samples. Conventional testing methods remain preferred for compliance with regulatory frameworks and certification standards.

The rapid technology segment is anticipated to witness the fastest CAGR of 21.1% from 2026 to 2033, driven by the increasing demand for faster results, real-time data analysis, and field-level testing capabilities. Emerging rapid technologies, including portable sensors, AI-based grading, and spectrometry, are gaining traction for their efficiency in delivering immediate insights and facilitating timely interventions, particularly in commercial agriculture and food supply chains.

- By Offering

On the basis of offering, the Global Quality Grading and Inspection Services Market is segmented into in-house and outsourced services. The outsourced services segment dominated the market with a revenue share of 61.0% in 2025, driven by the preference of companies and farms to leverage specialized laboratory expertise, advanced equipment, and accredited testing protocols without heavy investment in internal infrastructure. Outsourced services also offer scalability and flexibility for varying sample volumes and types.

The in-house services segment is expected to witness the fastest CAGR of 17.8% from 2026 to 2033, fueled by large agribusinesses and research institutions seeking greater control over testing processes, faster turnaround times, and confidential handling of proprietary agricultural research or product development data. Adoption of in-house services is further supported by the integration of automated and rapid testing technologies.

Global Quality Grading and Inspection Services Market Regional Analysis

- Europe dominated the Global Quality Grading and Inspection Services Market with the largest revenue share of 33.2% in 2025, driven by increasing demand for product safety, regulatory compliance, and high-quality standards across industries.

- Businesses in the region highly prioritize reliability, accuracy, and efficiency offered by advanced grading and inspection services, including automated and AI-powered solutions, to ensure defect-free products and maintain brand reputation.

- This widespread adoption is further supported by strict regulatory frameworks, well-established industrial infrastructure, and a strong presence of key service providers, establishing quality grading and inspection services as essential solutions for manufacturing, food and beverage, pharmaceuticals, and other commercial sectors.

U.S. Quality Grading and Inspection Services Market Insight

The U.S. quality grading and inspection services market captured the largest revenue share of 81% in 2025 within North America, driven by stringent regulatory standards, increasing consumer demand for product safety, and growing adoption of automated and AI-powered inspection technologies. Industries such as food & beverages, pharmaceuticals, and manufacturing are increasingly investing in quality assessment and compliance solutions to ensure consistent product standards. The rise of e-commerce and global trade further fuels the need for reliable inspection services.

Europe Quality Grading and Inspection Services Market Insight

The Europe quality grading and inspection services market is projected to expand at a substantial CAGR during the forecast period, fueled by strict safety and quality regulations across industries and rising consumer awareness regarding product standards. The increasing adoption of advanced inspection technologies, combined with urbanization and industrial growth, is driving demand. The region is witnessing growth across food, pharmaceutical, and industrial sectors, with inspection services integrated into both new production lines and renovation of existing facilities.

U.K. Quality Grading and Inspection Services Market Insight

The U.K. quality grading and inspection services market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising regulatory compliance requirements and the need for high-quality standards in manufacturing, food, and pharmaceutical sectors. Increasing industrial automation and growing consumer preference for safe, certified products are driving market adoption. The U.K.’s robust industrial and retail infrastructure, coupled with rising demand for third-party inspection services, continues to propel market growth.

Germany Quality Grading and Inspection Services Market Insight

The Germany quality grading and inspection services market is expected to expand at a considerable CAGR during the forecast period, fueled by strong regulatory frameworks, high industrial standards, and increasing demand for sustainable and technologically advanced inspection solutions. Germany’s well-established manufacturing base, focus on innovation, and adoption of AI-driven and automated quality grading systems contribute to market growth, particularly in industrial, automotive, and pharmaceutical sectors.

Asia-Pacific Quality Grading and Inspection Services Market Insight

The Asia-Pacific quality grading and inspection services market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rapid industrialization, increasing urbanization, and rising consumer awareness regarding product quality. Countries such as China, India, and Japan are investing heavily in inspection infrastructure and automated solutions. Growing exports, adoption of international quality standards, and government initiatives promoting industrial safety and compliance further accelerate market expansion.

Japan Quality Grading and Inspection Services Market Insight

The Japan quality grading and inspection services market is gaining momentum due to the country’s high-tech industrial base, emphasis on quality control, and regulatory compliance requirements. The adoption of automated inspection technologies, IoT-enabled quality monitoring systems, and advanced grading solutions is driving growth. Additionally, Japan’s aging workforce encourages the use of AI-assisted and automated inspection processes, enhancing efficiency across manufacturing and food sectors.

China Quality Grading and Inspection Services Market Insight

The China quality grading and inspection services market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid industrial growth, urbanization, and increasing exports of consumer goods and manufactured products. Rising consumer awareness, strict domestic and international quality standards, and the expansion of automated inspection solutions are key drivers. The presence of leading domestic and international service providers further strengthens China’s position as a major market for quality grading and inspection services.

Global Quality Grading and Inspection Services Market Share

The Quality Grading and Inspection Services industry is primarily led by well-established companies, including:

- SGS (Switzerland)

- Bureau Veritas (France)

- Intertek Group (U.K.)

- TÜV SÜD (Germany)

- UL LLC (U.S.)

- DNV (Norway)

- Eurofins Scientific (France)

- TÜV Rheinland (Germany)

- ALS Limited (Australia)

- Applus+ (Spain)

- Cotecna (Switzerland)

- Kiwa (Netherlands)

- Mistras Group (U.S.)

- Element Materials Technology (U.K.)

- Dekra (Germany)

- QIMA (Hong Kong)

- Inspecta (Finland)

- CIRS Group (China)

- TÜV NORD (Germany)

- InterScience (France)

What are the Recent Developments in Global Quality Grading and Inspection Services Market?

- In April 2024, SGS, a global leader in inspection, verification, testing, and certification services, launched a strategic initiative in South Africa to enhance industrial and consumer product quality standards across multiple sectors, including manufacturing and food & beverages. This initiative highlights SGS’s commitment to delivering innovative, reliable quality grading and inspection solutions tailored to regional compliance requirements, reinforcing its leadership in the growing Global Quality Grading and Inspection Services Market.

- In March 2024, Intertek Group, a UK-based quality assurance provider, introduced its Advanced AI-Powered Inspection Platform for the pharmaceutical and electronics sectors, designed to improve precision, reduce errors, and accelerate quality verification processes. This advancement underscores Intertek’s focus on leveraging cutting-edge technologies to ensure product compliance, safety, and efficiency across critical industries.

- In March 2024, Bureau Veritas successfully implemented the Shanghai Smart Manufacturing Quality Initiative, aimed at improving quality assurance in urban industrial complexes. By deploying advanced automated inspection technologies, the project enhances operational reliability and supports the region’s industrial digitization efforts, demonstrating Bureau Veritas’s commitment to innovative, technology-driven quality solutions.

- In February 2024, UL LLC, a leading provider of safety certification and inspection services, announced a strategic partnership with the Asia-Pacific Food Safety Consortium to develop a unified food grading and inspection framework for member organizations. The initiative improves product safety standards, streamlines compliance processes, and emphasizes UL’s role in advancing global quality and inspection practices.

- In January 2024, TÜV SÜD, a Germany-based inspection and certification company, unveiled its Smart Industrial Inspection Suite at the International Manufacturing Technology Show 2024. This innovative platform integrates IoT sensors, AI analytics, and real-time reporting to optimize inspection efficiency in industrial and automotive sectors, highlighting TÜV SÜD’s commitment to advancing digitalized, accurate, and reliable quality assurance solutions globally.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.