Global Quaternary Ammonium Compounds Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.66 Billion

2024

2032

USD

1.16 Billion

USD

1.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 1.66 Billion | |

|

|

|

|

Quaternary Ammonium Compounds Market Size

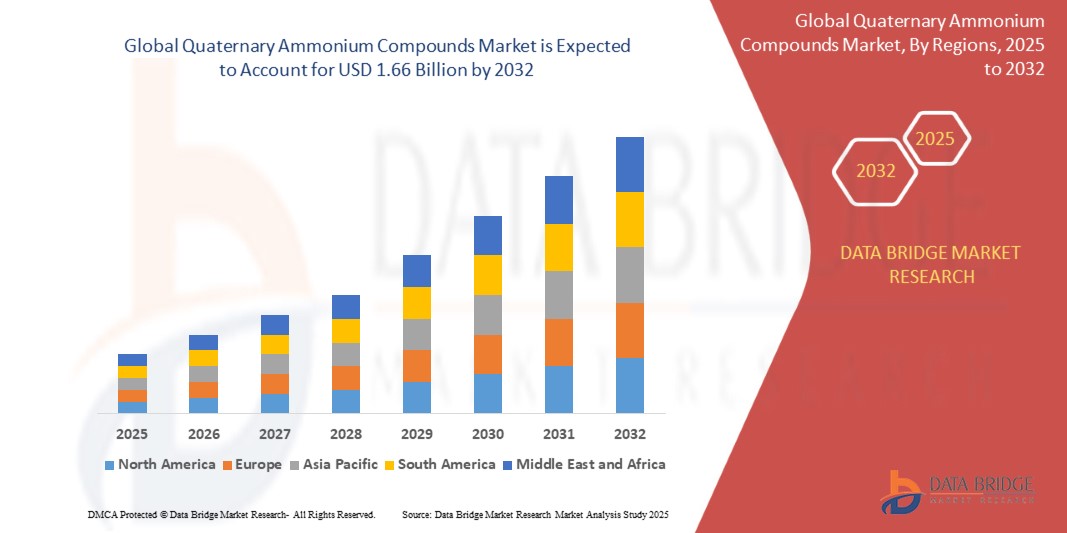

- The global quaternary ammonium compounds market size was valued at USD 1.16 billion in 2024 and is expected to reach USD 1.66 billion by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is largely fueled by increasing demand for effective antimicrobial agents in healthcare, industrial, and personal care applications, driven by heightened awareness of hygiene and infection control worldwide

- Furthermore, stringent regulations and standards regarding sanitation and disinfectant use across various industries are promoting the adoption of quaternary ammonium compounds as preferred solutions for microbial control, accelerating market expansion

Quaternary Ammonium Compounds Market Analysis

- Quaternary ammonium compounds are versatile chemical disinfectants widely used in surface sanitization, fabric softening, water treatment, and personal care products. Their broad-spectrum antimicrobial efficacy, quick action, and compatibility with various formulations make them indispensable across healthcare, industrial, and household sectors

- The escalating demand for QACs is primarily driven by growing concerns over healthcare-associated infections, rising industrial sanitation requirements, and increasing consumer preference for fabric care and hygiene products containing effective antimicrobial agents

- Europe dominated the quaternary ammonium compounds market with a share of 31.5% in 2024, due to stringent environmental and safety regulations and growing demand across pharmaceutical, industrial, and personal care sectors

- Asia-Pacific is expected to be the fastest growing region in the quaternary ammonium compounds market during the forecast period due to rapid urbanization, industrialization, and increasing healthcare infrastructure investments in countries such as China, India, and Japan

- Industrial grade segment dominated the market with a market share of 65.5% in 2024, due to its extensive utilization in diverse industries such as water treatment, disinfectants, surfactants, and fabric softeners. Industrial grade QACs are favored due to their cost-effectiveness, robust antimicrobial properties, and ability to function efficiently in large-scale applications. Their chemical stability and compatibility with various industrial chemicals further enhance their adoption in sectors including food processing, wastewater management, and manufacturing

Report Scope and Quaternary Ammonium Compounds Market Segmentation

|

Attributes |

Quaternary Ammonium Compounds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Quaternary Ammonium Compounds Market Trends

Growth of Eco-Friendly Quaternary Ammonium Compounds

- The market is rapidly evolving with an increasing focus on developing and commercializing eco-friendly, biodegradable, and low-toxicity quaternary ammonium compounds in response to stricter environmental regulations and consumer demand for sustainable solutions

- For instance, leading players such as Evonik and BASF are investing in greener QAC formulations for disinfectants and sanitizers, including bio-based surfactants and next-generation antimicrobial agents that minimize environmental load while maintaining high efficacy in healthcare, food processing, and water treatment applications

- Ongoing research targets new applications for sustainable QACs such as green fabric softeners, anti-static agents, and wood preservatives amid rising preference for multipurpose and sustainable household products

- Enabling technology in production and purification is allowing manufacturers to reduce hazardous by-products, improve yields, and meet new voluntary and mandated environmental benchmarks

- Expansion of distribution through online and specialized green retail channels reflects the market’s responsiveness to eco-conscious shoppers and emerging consumer segments

- As competition grows, major chemical companies are forming partnerships to accelerate the introduction and scale-up of sustainable QAC solutions globally, responding to both regulatory shifts and differentiated consumer needs

Quaternary Ammonium Compounds Market Dynamics

Driver

Rising Demand for Disinfectants in Healthcare

- Surging need for infection control post-pandemic drives strong uptake of QACs in hospital, medical device, and laboratory settings, as these compounds offer broad-spectrum antimicrobial properties and proven safety profiles for critical disinfection

- For instance, more than 10,000 QAC formulations are listed by the CDC and used in noncritical healthcare environments, with companies such as Croda, KAO Corporation, and Clariant reporting sustained growth in healthcare and residential sectors driven by elevated hygiene standards, regular surface disinfection, and regulatory guidance

- Increasing outbreaks of infectious disease and strict mandates for hospital-acquired infection reduction boost adoption of high-performance QAC products for surface, instrument, and environmental sanitation

- Trends include the integration of smart dosing and digital traceability for disinfectant management in healthcare to improve compliance and reduce wastage

- Partnerships between QAC manufacturers and healthcare institutions are accelerating R&D for more targeted and safe disinfectant formulations that address emerging pathogenic threats and antimicrobial resistance

Restraint/Challenge

Environmental and Eco-toxicological Concerns

- Growth in QAC use has raised significant concern over environmental persistence, aquatic toxicity, and bioaccumulation, leading to regulatory scrutiny and calls for lower-impact alternatives

- For instance, certain traditional QACs are associated with risks of antimicrobial resistance and environmental contamination, prompting manufacturers to invest in new R&D initiatives to reformulate products and develop sustainable substitutes that align with evolving chemical stewardship policies

- Ongoing debate challenges balancing disinfection efficacy with eco-friendliness, as stricter standards in regions such as Europe and North America impose limitations on the use and disposal of hazardous QACs, affecting supply chain and cost structures

- The complexity and cost of compliance with emerging regulations covering wastewater treatment, labeling, and ingredient transparency restrict the market’s flexibility, particularly for smaller producers

- Industry leaders face pressure to proactively address eco-toxicological issues while maintaining product reliability, pushing for collaborative research and cross-industry innovation in safe, effective, and environmentally responsible QAC chemistry

Quaternary Ammonium Compounds Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the quaternary ammonium compounds market is segmented into industrial grade and pharmaceutical grade. The industrial grade segment dominated the largest market revenue share of 65.5% in 2024, driven by its extensive utilization in diverse industries such as water treatment, disinfectants, surfactants, and fabric softeners. Industrial grade QACs are favored due to their cost-effectiveness, robust antimicrobial properties, and ability to function efficiently in large-scale applications. Their chemical stability and compatibility with various industrial chemicals further enhance their adoption in sectors including food processing, wastewater management, and manufacturing. Moreover, the growing emphasis on hygiene and sanitation across industries fuels consistent demand for industrial grade QACs, reinforcing their dominant market position.

The pharmaceutical grade segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by increasing demand in the healthcare and personal care sectors where high purity and safety standards are mandatory. Pharmaceutical grade QACs play a critical role in antiseptics, sterilizers, and drug formulations, supporting infection control and hygiene maintenance. The segment’s growth is further accelerated by stringent government regulations, rising healthcare infrastructure investments, and heightened consumer awareness about health and wellness. In addition, the expansion of pharmaceutical and personal care product lines globally creates ample opportunities for pharmaceutical grade QACs to capture a larger market share.

- By Application

On the basis of application, the quaternary ammonium compounds market is segmented into disinfectants, fabric softeners, wood preservatives, surfactants, antistatic agents, and other applications. The disinfectants segment held the largest market revenue share in 2024, attributable to the essential role QACs play in inhibiting microbial growth across healthcare facilities, commercial establishments, and residential environments. Their broad-spectrum antimicrobial efficacy, rapid action, and ease of application make them indispensable for surface sanitization and infection prevention. The increasing frequency of disease outbreaks and growing awareness of hygiene standards have further intensified the reliance on QAC-based disinfectants worldwide.

The fabric softeners segment is expected to witness the fastest CAGR from 2025 to 2032, driven by evolving consumer preferences toward enhanced textile care, softness, and static elimination. QACs serve as effective conditioning agents in fabric softeners, improving fabric texture, reducing static cling, and aiding fragrance retention. The rising penetration of modern laundry care products and growing demand for premium fabric care solutions significantly fuel this segment’s growth. In addition, the expanding detergent and homecare industries offer vast opportunities for QACs in surfactants and antistatic applications, broadening their use across multiple end-use markets and sustaining overall market expansion.

Quaternary Ammonium Compounds Market Regional Analysis

- Europe dominated the quaternary ammonium compounds market with the largest revenue share of 31.5% in 2024, driven by stringent environmental and safety regulations and growing demand across pharmaceutical, industrial, and personal care sectors

- The region’s emphasis on sustainability and eco-friendly chemical products supports increasing adoption of both industrial and pharmaceutical grade QACs

- Rising urbanization, healthcare sanitation, and consumer awareness about hygiene and safety further accelerate market growth, establishing Europe as a key market globally

Germany Quaternary Ammonium Compounds Market Insight

Germany’s market held the largest share within Europe, due to its strong industrial base and focus on hygiene and safety standards. The demand for advanced antimicrobial solutions in healthcare and water treatment drives QAC adoption. Germany’s regulatory framework encourages sustainable and safe chemical use, promoting innovation in QAC formulations. Industrial and pharmaceutical sectors in the country are investing in effective disinfectants and sanitizers, reinforcing market growth.

North America Quaternary Ammonium Compounds Market Insight

North America market is experiencing rapid growth due to, strong industrial and healthcare sectors emphasizing hygiene and sanitation. The growing demand for effective disinfectants, fabric softeners, and surfactants, combined with stringent regulations on microbial control, supports market growth. Consumers and industries in the region prioritize product safety, efficacy, and sustainability, boosting demand for high-quality QAC formulations. The region’s advanced infrastructure, high disposable incomes, and increasing investments in healthcare and water treatment sectors further reinforce the adoption of QACs across applications.

U.S. Quaternary Ammonium Compounds Market Insight

The U.S. market captured the largest revenue share within North America in 2024, driven by rapid adoption in healthcare facilities, commercial cleaning, and water treatment applications. The rising prevalence of infectious diseases and increasing sanitation standards are key factors propelling QAC demand. Growth in personal care products and fabric softeners, along with heightened government regulations regarding disinfectants, supports steady market expansion. The increasing use of QACs in pharmaceuticals and antiseptics also contributes significantly to the market size.

Asia-Pacific Quaternary Ammonium Compounds Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, supported by rapid urbanization, industrialization, and increasing healthcare infrastructure investments in countries such as China, India, and Japan. Rising awareness of hygiene and growing demand for disinfectants and fabric softeners drive market expansion. Government initiatives promoting sanitation and clean water further boost QAC adoption. The presence of emerging economies and expanding manufacturing bases make the region a significant growth hub for QACs.

China Quaternary Ammonium Compounds Market Insight

China holds the largest market revenue share in Asia-Pacific, propelled by the country’s booming healthcare and industrial sectors. The expanding middle class, rising urbanization, and increasing investments in sanitation and personal care products fuel demand. China’s focus on smart water treatment solutions and industrial hygiene enhances the adoption of industrial grade QACs. In addition, domestic manufacturers and competitive pricing make QAC products more accessible across various applications.

India Quaternary Ammonium Compounds Market Insight

India’s market is experiencing rapid growth due to rising awareness about sanitation, hygiene, and infection control. Increasing healthcare infrastructure, expanding textile and manufacturing industries, and government initiatives for clean water and sanitation support QAC demand. The country is witnessing heightened adoption in disinfectants and fabric softeners, driven by both residential and commercial sectors. Growing population and improving economic conditions further contribute to market growth.

Quaternary Ammonium Compounds Market Share

The quaternary ammonium compounds industry is primarily led by well-established companies, including:

- Arkema (France)

- BASF SE (Germany)

- DuPont (U.S.)

- Evonik Industries (Germany)

- Henkel Adhesives Technologies India Private Limited (India)

- Huntsman International LLC (U.S.)

- Kao Chemicals Europe, S.L.U (Spain),

- KLK OLEO (Malaysia)

- Nouryon (Netherlands)

- PDI, Inc (U.S.)

- S. C. Johnson & Son, Inc. (U.S.)

Latest Developments in Global Quaternary Ammonium Compounds Market

- In June 2023, Global Amines Company Pte. Ltd. expanded its market presence by acquiring the quaternary ammonium compounds business of Clariant in Indonesia, Brazil, and Germany. This strategic acquisition strengthens Global Amines’ footprint in key international markets, enhances its production capabilities, and broadens its product portfolio. The move is expected to boost competitive advantage, increase market share, and accelerate growth by leveraging Clariant’s established customer base and regional expertise, particularly in emerging economies and mature markets alike

- In May 2023, Lonza expanded its quaternary ammonium compounds portfolio by launching a new range of eco-friendly disinfectants targeting the healthcare and hospitality sectors. These products are formulated to meet increasing regulatory demands for sustainable and non-toxic cleaning agents without compromising antimicrobial efficacy. Lonza’s introduction of biodegradable and low-odor QAC disinfectants is anticipated to attract environmentally conscious consumers and institutions, thereby strengthening the company’s competitive position and driving growth in the rapidly evolving disinfectants market

- In April 2023, Ecolab introduced its new line of quaternary ammonium compound-based surface disinfectants designed specifically for food processing facilities. This product launch addresses the growing demand for effective antimicrobial solutions that meet strict food safety regulations while ensuring operational efficiency. By combining strong germicidal activity with quick-drying formulas, Ecolab’s disinfectants help reduce downtime and contamination risks, enhancing hygiene standards across the food industry. This development is expected to boost Ecolab’s market share and drive further adoption of QAC-based disinfectants in the food processing sector

- In February 2022, SC Johnson Professional launched its Quaternary Disinfectant Cleaner in North America, introducing a new user-friendly bottle designed for easier measuring, squeezing, and pouring. This innovation simplifies dilution processes across various cleaning applications such as buckets, automatic scrubbers, and spray bottles, saving time and effort for end users. The product’s multifunctional ability to clean, disinfect, and deodorize in one step is poised to enhance operational efficiency in healthcare and commercial settings, thereby driving increased adoption of QAC-based disinfectants in the region

- In March 2022, PDI introduced three advanced disinfectant products—the Sani-24 Germicidal Disposable Wipe, Sani-HyPerCide Germicidal Disposable Wipe, and Sani-HyPerCide Germicidal Spray—aimed at supporting infection prevention professionals amid the rising incidence of healthcare-associated infections (HAIs). These novel products provide effective and convenient antimicrobial solutions, reinforcing infection control protocols across healthcare environments. Their launch addresses the critical need for high-performance disinfectants, thereby strengthening PDI’s market position and contributing to overall growth in the quaternary ammonium compounds disinfectant segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Quaternary Ammonium Compounds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Quaternary Ammonium Compounds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Quaternary Ammonium Compounds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.