Global Radiation Dose Management Market

Market Size in USD Billion

CAGR :

%

USD

7.50 Billion

USD

21.24 Billion

2024

2032

USD

7.50 Billion

USD

21.24 Billion

2024

2032

| 2025 –2032 | |

| USD 7.50 Billion | |

| USD 21.24 Billion | |

|

|

|

|

Radiation Dose Management Market Size

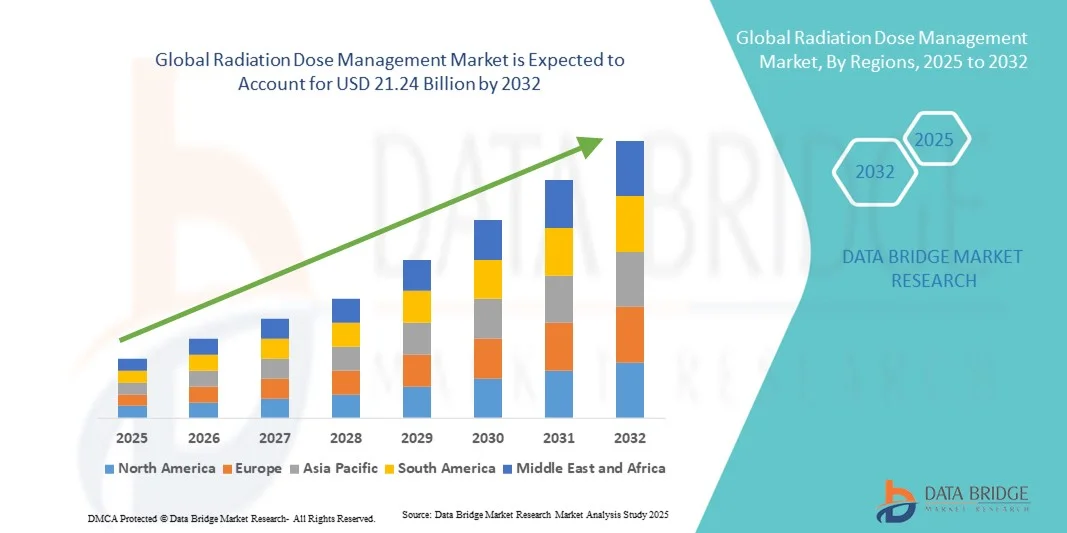

- The global radiation dose management market size was valued at USD 7.5 billion in 2024 and is expected to reach USD 21.24 billion by 2032, at a CAGR of 13.90% during the forecast period

- The market growth is largely fueled by the increasing implementation of advanced imaging technologies and the growing emphasis on patient safety and regulatory compliance in healthcare facilities. Hospitals and diagnostic centers are rapidly adopting Radiation Dose Management (RDM) solutions to monitor and optimize radiation exposure during diagnostic and interventional procedures. This trend is further supported by the rising number of imaging procedures and the demand for dose tracking to ensure adherence to international safety standards

- Furthermore, the growing focus on precision diagnostics, coupled with technological advancements such as AI-enabled dose optimization and automated data analytics, is driving the adoption of Radiation Dose Management systems. Healthcare providers are increasingly seeking integrated, user-friendly platforms that enhance operational efficiency and reduce patient risk. These converging factors are accelerating the uptake of Radiation Dose Management solutions, thereby significantly boosting the industry’s growth

Radiation Dose Management Market Analysis

- Radiation Dose Management solutions, which involve the monitoring, recording, and optimization of radiation exposure during medical imaging procedures, are becoming increasingly crucial in modern healthcare systems. Their growing importance stems from the rising focus on patient safety, regulatory compliance, and the need to balance diagnostic image quality with minimal radiation exposure across radiology and nuclear medicine departments

- The escalating demand for Radiation Dose Management systems is primarily driven by the surge in diagnostic imaging procedures such as CT, fluoroscopy, and interventional radiology, as well as the growing adoption of AI-enabled analytics for dose optimization and workflow efficiency. Hospitals and imaging centers are increasingly prioritizing dose management to meet international radiation safety standards and accreditation requirements

- North America dominated the radiation dose management market with the largest revenue share of 42.6% in 2024, characterized by advanced healthcare infrastructure, early adoption of digital health technologies, and strong regulatory mandates from bodies such as the FDA and The Joint Commission. The U.S. has been at the forefront of implementing Radiation Dose Management systems, driven by growing awareness of radiation exposure risks and the integration of RDM software with hospital information systems and PACS platforms

- Asia-Pacific is expected to be the fastest-growing region in the radiation dose management market during the forecast period, expanding at a CAGR of 13.8% from 2025 to 2032, fueled by increasing investments in healthcare infrastructure, rising medical imaging volumes, and growing awareness of radiation safety. Countries such as China, India, and Japan are witnessing accelerated adoption of RDM software, supported by government initiatives promoting digital healthcare and patient safety

- The Radiation Dose Management Solutions segment dominated the market with the largest revenue share of 67.4% in 2024, driven by increasing adoption of integrated software platforms that monitor and optimize patient radiation exposure

Report Scope and Radiation Dose Management Market Segmentation

|

Attributes |

Radiation Dose Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Radiation Dose Management Market Trends

Integration of Artificial Intelligence (AI) and Cloud-Based Analytics in Radiation Dose Management

- A significant and accelerating trend in the global radiation dose management market is the deepening integration of artificial intelligence (AI), machine learning (ML), and cloud-based data analytics platforms. These advanced technologies are revolutionizing how hospitals and diagnostic centers monitor, analyze, and optimize radiation exposure levels for patients and healthcare staff

- For instance, leading players such as GE HealthCare, Siemens Healthineers, and Philips have introduced AI-enabled dose tracking software that can automatically detect deviations in exposure, generate real-time alerts, and recommend optimized scanning parameters. These innovations are transforming traditional manual monitoring into dynamic, data-driven decision systems

- AI integration also facilitates predictive analytics by analyzing vast datasets of imaging protocols and patient profiles, thereby helping radiologists balance image quality with minimal radiation exposure. For instance, the latest AI-based dose management systems from Bayer and Sectra are capable of learning from cumulative dose data to predict and prevent overexposure in future imaging sessions

- The adoption of cloud-based platforms allows hospitals and imaging centers to centralize dose data from multiple modalities—CT, PET, and fluoroscopy—ensuring compliance with international safety regulations such as those from the International Commission on Radiological Protection (ICRP). These integrated platforms also support remote access for quality assurance teams and clinical administrators

- This trend toward intelligent, automated, and connected dose optimization systems is reshaping the global market by enhancing workflow efficiency, patient safety, and regulatory compliance. Consequently, companies are increasingly investing in AI-powered, cloud-integrated dose management platforms to deliver more precise and proactive radiation monitoring solutions

Radiation Dose Management Market Dynamics

Driver

Growing Need for Patient Safety and Regulatory Compliance

- The increasing global focus on patient safety, combined with the rising volume of diagnostic imaging procedures, is a major driver of the radiation dose management market. The use of ionizing radiation in modalities such as CT, fluoroscopy, and mammography has increased significantly, prompting healthcare institutions to adopt solutions that ensure patient exposure remains within safe limits

- For instance, in March 2024, Philips Healthcare introduced an advanced radiation dose management platform integrated into its IntelliSpace Radiation Dose Management system, which provides automated dose reports and analytics to support compliance with European and U.S. safety standards. Such developments are expected to propel market growth in the coming years

- Moreover, strict regulations introduced by health authorities such as the U.S. FDA and the European Commission’s Radiation Protection Directives have mandated dose tracking, monitoring, and reporting systems across hospitals and diagnostic centers

- These guidelines are accelerating the deployment of radiation dose management software to ensure transparency and accountability in imaging practices

- Furthermore, the growing emphasis on quality-based reimbursement models and accreditation by organizations such as the Joint Commission and ACR is encouraging hospitals to integrate dose management solutions as part of their broader quality assurance framework

Restraint/Challenge

High Implementation Costs and Data Integration Challenges

- Despite the strong growth potential, the high cost of implementing comprehensive radiation dose management systems remains a major challenge, particularly for small and medium-sized healthcare facilities. The integration of these platforms with existing PACS, RIS, and HIS systems often requires substantial investment in IT infrastructure and interoperability support

- For instance, many hospitals face technical and financial barriers when upgrading legacy imaging systems to be compatible with modern dose monitoring software, which can limit adoption rates, especially in developing regions

- In addition, managing and securing large volumes of sensitive patient data across interconnected digital platforms raises concerns over cybersecurity and data privacy. The increasing risk of data breaches or unauthorized access poses a significant restraint, compelling vendors to continuously enhance encryption and compliance with data protection standards such as HIPAA and GDPR

- Another major restraint is the shortage of trained personnel capable of interpreting radiation dose analytics effectively. While automation helps streamline operations, clinical validation and human oversight are still required to make informed safety decisions

- Overcoming these challenges through vendor partnerships, improved affordability, enhanced interoperability, and training programs will be crucial to ensuring the sustainable adoption of Radiation Dose Management systems globally

Radiation Dose Management Market Scope

The market is segmented on the basis of product and services, modality, application, and end user.

- By Product and Services

On the basis of product and services, the Radiation Dose Management market is segmented into Radiation Dose Management Solutions and Radiation Dose Management Services. The Radiation Dose Management Solutions segment dominated the market with the largest revenue share of 67.4% in 2024, driven by increasing adoption of integrated software platforms that monitor and optimize patient radiation exposure. The rising focus on patient safety and compliance with international radiation protection standards such as those from the IAEA and FDA has prompted large healthcare institutions to invest in automated systems. These solutions offer real-time monitoring, dose analytics, and reporting features, reducing manual errors and ensuring regulatory compliance. Major players such as Philips Healthcare, GE HealthCare, and Siemens Healthineers are expanding their dose tracking portfolios with AI-powered modules that deliver predictive dose control and cumulative dose analytics. The demand for these software-based solutions is especially high in advanced economies where hospitals are modernizing their radiology infrastructure.

The Radiation Dose Management Services segment is anticipated to witness the fastest growth rate of 19.6% CAGR from 2025 to 2032. This growth is primarily fueled by increasing outsourcing of technical support, compliance auditing, and data management activities by healthcare providers aiming to reduce operational costs. Service providers offer expertise in continuous system maintenance, calibration, and staff training, enabling healthcare facilities to enhance efficiency while meeting radiation safety guidelines. The growing popularity of subscription-based and cloud-enabled service models allows for scalable dose monitoring without major upfront investments. Emerging markets, particularly in Asia-Pacific and Latin America, are increasingly adopting managed services due to limited in-house IT infrastructure and a rising focus on digital transformation in healthcare.

- By Modality

On the basis of modality, the Radiation Dose Management market is segmented into Computed Tomography (CT), Fluoroscopy and Interventional Imaging, Radiography and Mammography, and Nuclear Medicine. The Computed Tomography (CT) segment dominated the market with the largest revenue share of 49.8% in 2024, owing to the extensive use of CT scanners and their comparatively higher radiation dose exposure per scan. With CT being a core imaging modality in diagnostics, oncology, and cardiology, hospitals are prioritizing dose monitoring to maintain safety while ensuring image quality. Vendors are integrating AI-based algorithms into CT systems to optimize scanning parameters automatically and reduce unnecessary radiation exposure. Government regulations in the U.S., Europe, and Japan mandating dose documentation have further supported this segment’s dominance. Hospitals are deploying enterprise-level CT dose tracking tools that consolidate patient dose histories across multiple imaging centers, driving software standardization in radiology departments.

The Fluoroscopy and Interventional Imaging segment is projected to register the fastest CAGR of 20.3% from 2025 to 2032, supported by the rising volume of minimally invasive procedures in cardiology, orthopedics, and neurology. Fluoroscopic procedures involve continuous real-time imaging, which can expose patients and clinicians to high radiation doses, making dose management critical. The growing awareness of occupational exposure risks among interventional radiologists is boosting demand for real-time dose tracking systems. Hospitals are adopting smart dose-monitoring displays and predictive AI tools to alert staff during high-dose procedures. Furthermore, technological advancements such as digital dose mapping and cumulative exposure dashboards are enhancing safety and compliance, leading to strong uptake across advanced and mid-tier hospitals globally.

- By Application

On the basis of application, the Radiation Dose Management market is segmented into Oncology, Cardiology, Orthopedic Applications, and Others. The Oncology segment dominated the market with the largest revenue share of 45.2% in 2024, driven by the high number of imaging and radiation therapy procedures involved in cancer diagnosis and treatment. Oncology centers rely heavily on advanced imaging systems such as CT, PET-CT, and radiography to track tumor progression and treatment response, which require precise radiation dose monitoring. Rising cancer prevalence globally has increased the need for cumulative dose tracking across diagnostic and therapeutic cycles. AI-integrated oncology dose platforms now allow personalized dose optimization based on patient-specific factors, improving safety and outcomes. Moreover, stringent hospital protocols for minimizing radiation toxicity and maintaining treatment quality assurance further contribute to the segment’s dominance.

The Cardiology segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, primarily due to the increasing frequency of interventional cardiology procedures such as angioplasty, stenting, and catheterization that involve fluoroscopy. The high exposure levels during these procedures have prompted cardiology departments to implement automated dose monitoring solutions for both patients and clinicians. Real-time dose tracking, personalized dose alerts, and cloud-based reporting tools are gaining traction to ensure compliance with occupational safety standards. Hospitals and cardiac specialty centers are increasingly adopting radiation management systems that interface directly with imaging equipment, ensuring accuracy in dose data collection and minimizing manual input. The integration of dose analytics into cardiac PACS and EMR systems is further accelerating adoption across advanced healthcare networks.

- By End User

On the basis of end user, the Radiation Dose Management market is segmented into Hospitals (Small Hospitals and Large Hospitals), Ambulatory Care Settings, and Others. The Large Hospitals segment dominated the market with the largest revenue share of 52.6% in 2024, owing to the higher imaging volumes and extensive diagnostic infrastructure across tertiary healthcare centers. These hospitals often have multiple radiology departments, making centralized radiation monitoring essential for compliance and operational efficiency. Large hospitals also have greater financial capability to invest in AI-driven and enterprise-level dose management platforms, ensuring data standardization and real-time analysis. Regulatory mandates in developed countries for dose documentation in large healthcare institutions further strengthen this segment’s dominance. Additionally, collaborations with leading software vendors have allowed hospitals to customize dashboards for cumulative dose reporting and risk assessment.

The Ambulatory Care Settings segment is projected to grow at the fastest CAGR of 21.4% from 2025 to 2032, supported by the rapid expansion of outpatient diagnostic imaging centers and same-day surgical facilities. These centers are focusing on implementing cloud-based and subscription-driven dose management tools that offer flexibility and scalability at lower costs. The decentralization of healthcare and the shift toward preventive diagnostics are also contributing to higher imaging volumes in ambulatory facilities. The ability to remotely monitor patient radiation exposure, generate automated compliance reports, and optimize imaging protocols without extensive IT infrastructure makes these systems attractive. Furthermore, regulatory emphasis on patient safety and digital reporting in emerging markets is accelerating adoption in independent imaging centers and smaller clinics.

Radiation Dose Management Market Regional Analysis

- North America dominated the radiation dose management market with the largest revenue share of 42.6% in 2024, characterized by advanced healthcare infrastructure, early adoption of digital health technologies, and strong regulatory mandates from organizations such as the U.S. Food and Drug Administration (FDA) and The Joint Commission

- The region’s focus on radiation safety, coupled with a rise in diagnostic imaging procedures, has significantly boosted the implementation of Radiation Dose Management (RDM) systems across hospitals and imaging centers

- Integration of RDM software with Picture Archiving and Communication Systems (PACS) and Hospital Information Systems (HIS) further enhances compliance and reporting efficiency

U.S. Radiation Dose Management Market Insight

The U.S. radiation dose management market accounted for the largest revenue share of 80.3% within North America in 2024, driven by a robust regulatory framework, increasing imaging volumes, and a strong push toward patient safety and compliance. The U.S. healthcare sector has been at the forefront of adopting advanced RDM software integrated with AI-based analytics to monitor, track, and optimize radiation exposure. Key hospitals and diagnostic centers are investing in dose-tracking solutions to align with national initiatives such as Image Gently and Image Wisely, fostering continuous market growth.

Europe Radiation Dose Management Market Insight

The Europe radiation dose management market is expected to expand at a steady CAGR throughout the forecast period, supported by stringent EU regulations on radiation safety, the implementation of the Euratom Directive, and the growing emphasis on patient-centered care. The rise in radiological procedures and the need for compliance with dose documentation standards are fueling the demand for dose management solutions across hospitals and imaging facilities.

U.K. Radiation Dose Management Market Insight

The U.K. radiation dose management market is projected to grow at a significant CAGR, driven by the adoption of digital radiology solutions, government initiatives promoting electronic health records, and an increasing number of CT and interventional procedures. Hospitals and diagnostic centers are prioritizing radiation tracking software to ensure compliance with Care Quality Commission (CQC) and IR(ME)R guidelines, ensuring patient safety and operational efficiency.

Germany Radiation Dose Management Market Insight

The Germany radiation dose management market is witnessing substantial growth, attributed to the country’s advanced healthcare system, strong emphasis on data-driven diagnostics, and regulatory adherence under the EU Basic Safety Standards Directive. German healthcare providers are increasingly integrating RDM solutions with existing IT infrastructure to improve radiation dose optimization and audit readiness.

Asia-Pacific Radiation Dose Management Market Insight

The Asia-Pacific radiation dose management market is expected to be the fastest-growing region, expanding at a CAGR of 13.8% from 2025 to 2032, fueled by rising healthcare investments, growing imaging procedure volumes, and expanding awareness of radiation safety protocols. Increasing government initiatives to promote digital healthcare transformation in countries such as China, India, and Japan are further propelling market growth.

Japan Radiation Dose Management Market Insight

The Japan radiation dose management market is advancing rapidly due to the country’s strong focus on healthcare technology, increasing adoption of AI in radiology, and stringent safety standards in medical imaging. The growing emphasis on workflow efficiency and dose monitoring across hospitals and diagnostic centers supports consistent market expansion.

China Radiation Dose Management Market Insight

The China radiation dose management market accounted for the largest market share in the Asia-Pacific region in 2024, driven by expanding hospital infrastructure, the rise in CT and interventional procedures, and active participation by domestic health-tech companies. Government-backed digital health initiatives and efforts to enhance patient safety are accelerating the deployment of radiation monitoring solutions across public and private healthcare facilities.

Radiation Dose Management Market Share

The Radiation Dose Management industry is primarily led by well-established companies, including:

• Bayer AG (Germany)

• GE Healthcare (U.S.)

• Siemens Healthineers AG (Germany)

• Koninklijke Philips N.V. (Netherlands)

• FUJIFILM Holdings Corporation (Japan)

• Sectra AB (Sweden)

• Agfa-Gevaert Group (Belgium)

• Novarad Corporation (U.S.)

• QAELUM NV (Belgium)

• Infinitt Healthcare Co. Ltd. (South Korea)

• Medic Vision Imaging Solutions Ltd. (Israel)

• PACSHealth, LLC (U.S.)

• Canon Medical Systems Corporation (Japan)

• Bracco Imaging S.p.A. (Italy)

• RamSoft Inc. (Canada)

Latest Developments in Global Radiation Dose Management Market

- In July 2021, Philips expanded its DoseWise portfolio and integration with the Azurion image-guided therapy platform, highlighting system-level dose reductions and advanced dose-awareness features designed to reduce patient and staff X-ray exposure during interventional procedures. The DoseWise/Azurion combination emphasizes real-time dose displays, structured dose reporting, and protocol optimization to help hospitals meet ALARA principles and regulatory dose-reporting requirements

- In November 2022, Canon Medical Systems unveiled advances in AI-assisted image reconstruction and dose-reduction technologies (Precise IQ Engine/PIQE), showcased at RSNA 2022, that enable lower radiation exposures while preserving image quality. This development is positioned to accelerate adoption of dose-management workflows in CT and other modalities that feed enterprise dose-tracking systems

- In August 2024, Bayer announced a collaboration with Alara Imaging to explore CT dose-variation analytics and strengthen clinical dose-optimization programs. The partnership focuses on using automated benchmarking and feedback to reduce unnecessary CT radiation across hospitals, underscoring the industry shift toward data-driven and vendor-agnostic dose management services

- In February 2024, Philips published clinical and product updates around the Azurion/ClarityIQ platform and launched initiatives (later formalized into the RADIQAL trial in 2025) focused on ultra-low X-ray dose technologies for coronary and other interventional procedures, emphasizing multi-study clinical evidence of substantial dose reductions while maintaining diagnostic confidence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.