Global Radiation Shielding Composite Material Components Market

Market Size in USD Million

CAGR :

%

USD

175.00 Million

USD

456.73 Million

2024

2032

USD

175.00 Million

USD

456.73 Million

2024

2032

| 2025 –2032 | |

| USD 175.00 Million | |

| USD 456.73 Million | |

|

|

|

|

Radiation-Shielding Composite Material Components Market Size

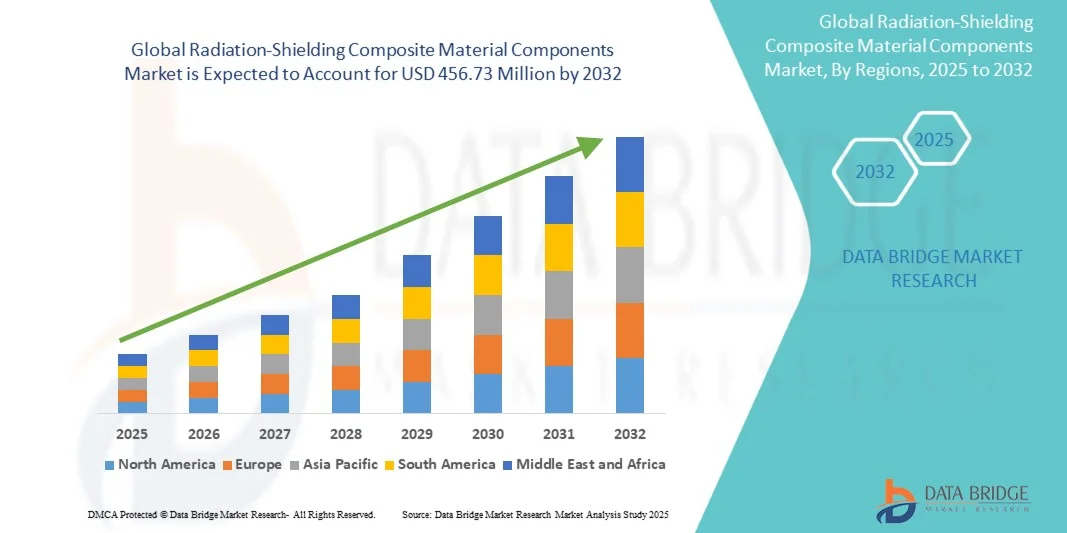

- The global radiation-shielding composite material components market size was valued at USD 175 Million in 2024 and is expected to reach USD 456.73 Million by 2032, at a CAGR of 12.74% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced protection solutions across healthcare, nuclear, and aerospace industries, driven by the rising awareness regarding radiation hazards and the need for lightweight yet effective shielding materials

- Furthermore, the growing adoption of non-lead and eco-friendly radiation-shielding composite materials, along with advancements in material science and nanotechnology, is accelerating the uptake of Radiation-Shielding Composite Material Components solutions, thereby significantly boosting the industry's growth

Radiation-Shielding Composite Material Components Market Analysis

- The Radiation-Shielding Composite Material Components market is increasingly vital across healthcare, nuclear power, and aerospace sectors due to its critical role in protecting against harmful ionizing radiation while maintaining material strength and durability. These advanced composites offer enhanced safety, reduced weight, and environmental benefits compared to traditional lead-based shielding solutions

- The escalating demand for radiation-shielding composite material components is primarily fueled by the rising adoption of diagnostic imaging equipment, growing nuclear energy initiatives, and advancements in composite manufacturing technologies, which together are driving the expansion of radiation protection applications globally

- North America dominated the radiation-shielding composite material components market with the largest revenue share of 38.66% in 2024, driven by the strong presence of major manufacturers, increasing investments in nuclear power generation, and the widespread use of radiation-shielding materials in medical imaging, aerospace, and defense sectors. The U.S. accounted for the majority of this regional share due to the growing number of radiological facilities and stringent safety regulations by organizations such as the NRC and FDA

- Asia-Pacific is expected to be the fastest-growing region, projected to register a CAGR during the forecast period 2025–2032, owing to rapid industrialization, expansion of healthcare infrastructure, and rising adoption of radiation-shielding materials in emerging economies such as China, India, and South Korea

- The Medical segment dominated the largest market revenue share of 52.6% in 2024, attributed to extensive utilization in diagnostic imaging centers, radiotherapy rooms, and nuclear medicine departments

Report Scope and Radiation-Shielding Composite Material Components Market Segmentation

|

Attributes |

Radiation-Shielding Composite Material Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Radiation-Shielding Composite Material Components Market Trends

“Growing Adoption of Lightweight and Lead-Free Radiation-Shielding Composites”

- A notable and accelerating trend in the global radiation-shielding composite material components market is the increasing shift toward lightweight, lead-free composite materials. These advanced materials are replacing traditional lead-based shielding solutions in medical, industrial, and nuclear applications due to health, environmental, and regulatory concerns

- Lightweight composites offer comparable or superior radiation attenuation while being easier to handle, transport, and install, reducing operational challenges in hospitals, diagnostic centers, and nuclear facilities

- For instance, in March 2023, DENSECOMPOSITES introduced a new tungsten-bismuth polymer composite designed for use in radiology and nuclear medicine, combining high shielding efficiency with reduced weigh

- The push for eco-friendly and non-toxic materials is further accelerating research into bismuth, boron, and other high-density metals integrated into polymer matrices. These innovations allow manufacturers to produce more versatile and flexible shielding panels suitable for complex applications

- Furthermore, the trend is reinforced by regulatory pressures to reduce environmental lead exposure, especially in healthcare and educational institutions, leading to broader acceptance of alternative composite materials

- As a result, demand for lightweight, lead-free shielding components is expected to continue growing rapidly across medical, industrial, and defense sectors, shaping the future development trajectory of the market

Radiation-Shielding Composite Material Components Market Dynamics

Driver

“Rising Demand from Healthcare and Nuclear Industries Due to Increased Radiation Exposure Risks”

- The growing use of radiation in medical imaging, cancer treatment, industrial testing, and nuclear power generation has significantly increased the demand for advanced radiation-shielding composite material components across various sectors. These materials are designed to protect individuals and equipment from harmful ionizing radiation, thereby playing a critical role in maintaining occupational and environmental safety

- Increasing awareness of radiation hazards among healthcare professionals, patients, and industrial workers has driven the adoption of lightweight and efficient shielding materials that offer superior protection without compromising functionality

- For instance, in February 2024, ETS-Lindgren announced advancements in its composite shielding materials for use in MRI suites and nuclear medicine facilities, offering enhanced attenuation properties and improved installation flexibility. Such developments underscore the industry’s focus on innovation to meet the evolving safety standards in radiation-intensive environments

- In addition, the expanding application of radiation in fields such as aerospace, defense, and nuclear energy has necessitated the use of high-performance shielding materials that can withstand extreme conditions while ensuring safety and durability

- The shift towards environmentally sustainable and lead-free shielding materials has also contributed to market growth, as industries and regulatory authorities prioritize eco-friendly solutions without compromising shielding effectiveness

- Furthermore, the surge in healthcare infrastructure expansion, particularly in emerging economies, coupled with the increasing number of diagnostic and therapeutic radiology centers, is expected to fuel steady demand for radiation-shielding composite material components globally

Restraint/Challenge

“High Production Costs and Stringent Regulatory Standards”

- Despite the rising demand, the market faces challenges due to the high production and raw material costs associated with advanced composite shielding materials. These materials often involve complex manufacturing processes and the use of specialized elements such as tungsten, bismuth, or boron, which increase overall production expenses

- The requirement for strict compliance with international safety and performance standards—such as those set by the International Atomic Energy Agency (IAEA) and national radiation safety authorities—adds further complexity and cost to product development and certification

- Small and medium-sized manufacturers often struggle to meet these regulatory demands, limiting their ability to compete with large, established players. The extensive testing and validation processes for ensuring consistent shielding performance can also delay product commercialization

- Moreover, fluctuations in raw material prices and limited availability of certain high-density metals can impact production efficiency and profit margins, particularly in developing regions with constrained supply chain

- In addition, the lack of standardization in testing methodologies and the need for continuous innovation to achieve lighter, more effective shielding materials place constant pressure on research and development budgets

- Overcoming these challenges through advancements in cost-effective composite formulations, strategic collaborations with research institutions, and government incentives for radiation safety innovations will be essential for ensuring the sustained growth of the global Radiation-Shielding Composite Material Components market

Radiation-Shielding Composite Material Components Market Scope

The market is segmented on the basis of material type, application, and end user

• By Material Type

On the basis of material type, the market is segmented into Lead-Based Composites, Non-Lead Composites, Bismuth-Based Composites, Tungsten-Based Composites, and Others. Lead-Based Composites dominated the market with the largest revenue share of 41.8% in 2024, owing to their long-standing efficacy in blocking ionizing radiation and widespread use in medical imaging, nuclear, and industrial applications. Lead-based materials are cost-effective, easily formable, and highly reliable, which has made them the industry standard for radiation protection. Their dominance is reinforced by high-density shielding performance, extensive clinical adoption in X-ray and CT rooms, and well-established manufacturing infrastructure. Furthermore, continuous innovation in lead-laminated panels and lead–polymer blends ensures sustained relevance across sectors. The segment benefits from its regulatory familiarity and long-term effectiveness in mitigating exposure risks in diagnostic and industrial radiology environments.

Non-Lead Composites are expected to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by growing environmental concerns and stringent regulations against toxic materials such as lead. These composites, developed using polymers integrated with bismuth, tungsten, or tin, offer superior flexibility, recyclability, and reduced ecological impact. The increasing shift toward lightweight, eco-friendly shielding alternatives in hospitals, nuclear research facilities, and aerospace applications boosts adoption. Rising R&D investments to enhance attenuation efficiency while maintaining mechanical strength further accelerate market growth. Their expanding applicability in portable radiation protection equipment and wearable shields supports segment acceleration globally.

• By Application

On the basis of application, the market is segmented into Medical, Industrial, Defense & Aerospace, and Others. The Medical segment dominated the largest market revenue share of 52.6% in 2024, attributed to extensive utilization in diagnostic imaging centers, radiotherapy rooms, and nuclear medicine departments. Growing demand for protective barriers, X-ray aprons, and shielding panels in hospitals and diagnostic labs sustains segment dominance. Increasing global diagnostic volumes, along with rapid advancements in radiology infrastructure in emerging economies, enhances market demand. Hospitals continue to prioritize safety protocols to reduce occupational exposure among radiologists and healthcare workers. Government regulations mandating shielding compliance further reinforce the market. Additionally, partnerships between hospitals and composite manufacturers for tailored solutions support ongoing leadership.

The Defense & Aerospace segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, fueled by the increasing use of composite shielding materials in nuclear submarines, satellites, and military-grade equipment. Heightened focus on protection against cosmic and nuclear radiation in space exploration projects drives adoption. Lightweight yet durable composites offer superior shielding with minimal payload impact, meeting aerospace engineering requirements. Strategic defense modernization programs in the U.S., China, and India amplify market potential. The development of multifunctional composites combining electromagnetic interference (EMI) and radiation shielding properties further strengthens this segment’s expansion trajectory.

• By End User

On the basis of end user, the market is segmented into Hospitals & Diagnostic Centers, Nuclear Facilities, Research Laboratories, Aerospace & Defense Organizations, and Others. Hospitals & Diagnostic Centers dominated the market with a revenue share of 48.9% in 2024, owing to their extensive demand for radiation shielding products in imaging and therapy facilities. Increasing global investments in medical infrastructure, combined with higher volumes of diagnostic procedures such as CT, PET, and X-ray, underpin segment leadership. The presence of specialized radiology suites and strict radiation protection norms reinforces usage. Integration of shielding components into modular room designs enhances compliance and safety standards. Additionally, collaborations between healthcare institutions and material manufacturers to develop ergonomic and aesthetic shielding solutions contribute to sustained market control.

Nuclear Facilities are expected to witness the fastest CAGR of 9.8% from 2025 to 2032, driven by growing investments in nuclear power generation, research reactors, and radioactive waste management systems. The rising emphasis on safety protocols for plant workers and equipment protection propels adoption. The need for long-term radiation-resistant materials that maintain performance under high temperatures and extreme conditions fosters innovation in composite design. Expanding nuclear capacity in Asia-Pacific and the Middle East enhances demand. Furthermore, initiatives for nuclear decommissioning projects in Europe require specialized shielding, further boosting segment growth.

Radiation-Shielding Composite Material Components Market Regional Analysis

- North America dominated the radiation-shielding composite material components market with the largest revenue share of 38.66% in 2024

- Driven by the strong presence of major manufacturers, increasing investments in nuclear power generation, and the widespread use of radiation-shielding materials in medical imaging, aerospace, and defense sectors

- The U.S. accounted for the majority of this regional share due to the growing number of radiological facilities and stringent safety regulations enforced by organizations such as the NRC and FDA. High-quality infrastructure, ongoing research initiatives, and a robust supply chain for composite materials further reinforce the region’s dominance

U.S. Radiation-Shielding Composite Material Components Market Insight

The U.S. radiation-shielding composite material components market captured the largest revenue share within North America in 2024, supported by the increasing implementation of radiation safety protocols in hospitals, oncology centers, and nuclear facilities. Growing awareness of occupational safety, advancements in composite material technology, and the adoption of standardized safety and quality regulations have significantly contributed to market growth in the country.

Europe Radiation-Shielding Composite Material Components Market Insight

Europe’s radiation-shielding composite material components market is projected to expand at a substantial CAGR throughout the forecast period, fueled by strict safety regulations and the growing demand for protective materials in medical and nuclear applications. Countries such as Germany, France, and the U.K. are witnessing increased investments in radiology and nuclear infrastructure, along with a focus on environmentally friendly, lead-free shielding solutions.

U.K. Radiation-Shielding Composite Material Components Market Insight

The U.K. radiation-shielding composite material components market is anticipated to grow steadily during the forecast period, supported by the expansion of healthcare facilities, rising adoption of radiation safety standards, and growing emphasis on occupational health protection. Increasing research funding in radiation physics and oncology further supports regional growth.

Germany Radiation-Shielding Composite Material Components Market Insight

The Germany radiation-shielding composite material components market is expected to expand at a considerable CAGR during the forecast period, driven by rising awareness of advanced protective materials and their application in nuclear, medical, and industrial sectors. The country’s focus on innovation, sustainability, and stringent regulatory frameworks encourages adoption of modern radiation-shielding composites.

Asia-Pacific Radiation-Shielding Composite Material Components Market Insight

Asia-Pacific radiation-shielding composite material components market is expected to be the fastest-growing region in the Radiation-Shielding Composite Material Components market, projected to register a high CAGR during the forecast period 2025–2032, owing to rapid industrialization, expansion of healthcare infrastructure, and rising adoption of radiation-shielding materials in emerging economies such as China, India, and South Korea. Increased investments in nuclear energy, medical imaging, and aerospace applications, coupled with government initiatives promoting safety standards, are driving market expansion.

Japan Radiation-Shielding Composite Material Components Market Insight

The Japan radiation-shielding composite material components market is gaining momentum due to the country’s emphasis on advanced medical infrastructure, nuclear safety protocols, and industrial radiation protection. Investments in hospitals, research centers, and nuclear power facilities are fueling demand for high-performance shielding composites.

China Radiation-Shielding Composite Material Components Market Insight

The China radiation-shielding composite material components market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapid industrialization, expansion of healthcare and nuclear infrastructure, and rising demand for advanced protective materials. China’s push toward nuclear energy, medical imaging facilities, and aerospace applications, along with strong domestic manufacturing capabilities, supports widespread adoption of radiation-shielding composite solutions.

Radiation-Shielding Composite Material Components Market Share

The Radiation-Shielding Composite Material Components industry is primarily led by well-established companies, including:

- Mirion Technologies, Inc. (U.S.)

- MarShield (Canada)

- Aldon Chemical Company (U.S.)

- Burlington Medical, LLC (U.S.)

- 3M Company (U.S.)

- Barrier Technologies (U.S.)

- Radiation Protection Products, Inc. (U.S.)

- Ecoflex (Germany)

- Corning Incorporated (U.S.)

- Lead Free Shielding Ltd. (U.K.)

- ETS-Lindgren (U.S.)

- Amray Medical (Ireland)

- INFAB Corporation (U.S.)

- Schneider Electric SE (France)

- Western Lead Products (Canada)

- MAVIG GmbH (Germany)

- Polymer Technologies Inc. (U.S.)

- Fluke Biomedical (U.S.)

Latest Developments in Global Radiation-Shielding Composite Material Components Market

- In May 2024, researchers at the Hefei Institutes of Physical Science, Chinese Academy of Sciences, developed a new class of PbWO₄ filler-reinforced B₄C/HDPE composites with tunable microstructures. These composites achieved a 97.32% shielding rate against ²⁵²Cf neutrons and 76.43% against ¹³⁷Cs gamma photons at a thickness of 15 cm, surpassing conventional materials in both radiation attenuation and mechanical performance. This advancement provides a novel strategy for the development of radiation protection technology from the perspective of materials science

- In June 2025, scientists engineered composite materials with enhanced shielding properties against neutron and gamma radiation. By synthesizing PbWO₄ fillers with varied microstructures, they achieved superior characteristics such as increased specific surface area and better dispersion within the polymer matrix. The optimized PbWO₄-III/B₄C/HDPE composite demonstrated a 97.32% shielding rate against neutrons and 76.43% against gamma rays at a thickness of 15 cm. This development offers a promising strategy for radiation protection

- In September 2025, a study published in Composites Science and Technology introduced a novel composite material combining Sm₂O₃ micron plates with B₄C/HDPE. This composite demonstrated a 98.7% shielding efficiency against neutron radiation from a ^252Cf source and a 72.1% shielding efficiency against gamma radiation from a ^137Cs source at a thickness of 15 cm, offering a promising strategy for radiation protection technology

- In August 2025, a study published in Composites Part A: Applied Science and Manufacturing reported the development of PbWO₄ filler-reinforced B₄C/HDPE composites with tunable microstructures. These composites achieved a 97.32% shielding rate against ²⁵²Cf neutrons and 76.43% against ¹³⁷Cs gamma photons at a thickness of 15 cm, surpassing conventional materials in both radiation attenuation and mechanical performance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.