Global Radiology Positioning Aids Market

Market Size in USD Billion

CAGR :

%

USD

1.54 Billion

USD

2.32 Billion

2024

2032

USD

1.54 Billion

USD

2.32 Billion

2024

2032

| 2025 –2032 | |

| USD 1.54 Billion | |

| USD 2.32 Billion | |

|

|

|

|

Radiology Positioning Aids Market Size

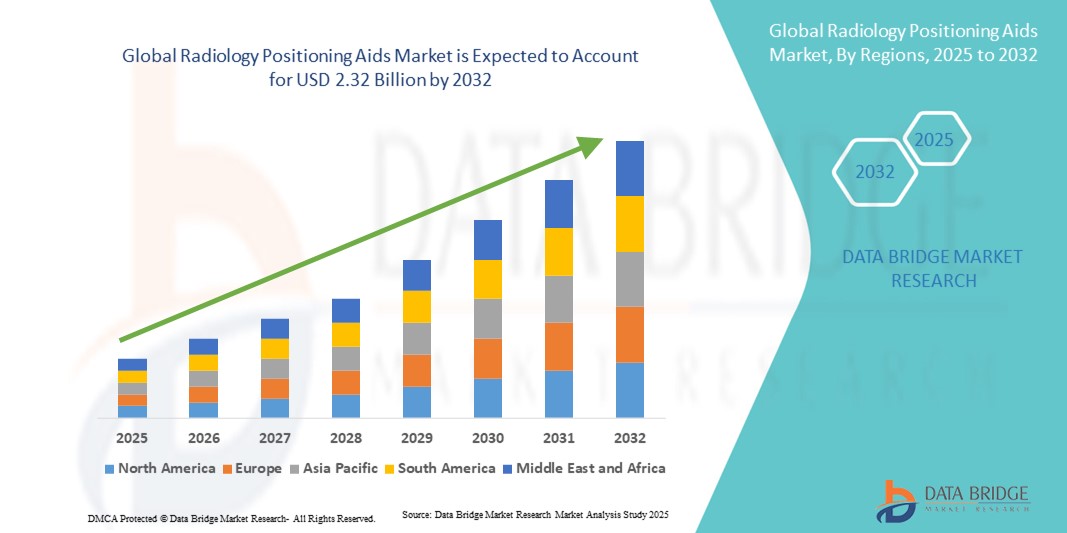

- The global radiology positioning aids market size was valued at USD 1.54 billion in 2024 and is expected to reach USD 2.32 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced imaging technologies and continuous technological progress in radiology departments, which is driving increased demand for precise and reliable positioning aids. These tools enhance diagnostic accuracy, reduce imaging errors, and improve workflow efficiency across both hospitals and diagnostic centers

- Furthermore, growing patient demand for safe, comfortable, and user-friendly imaging procedures is establishing radiology positioning aids as an essential component of modern diagnostic imaging systems. These converging factors are accelerating the uptake of radiology positioning aids solutions, thereby significantly boosting the industry's growth

Radiology Positioning Aids Market Analysis

- Radiology positioning aids, designed to enhance accuracy, patient comfort, and workflow efficiency during diagnostic imaging procedures, are becoming increasingly vital in hospitals, diagnostic centers, and specialty clinics. Their role is critical in ensuring proper alignment, reducing motion artifacts, and improving the reproducibility of imaging results

- The growing demand for radiology positioning aids is primarily fueled by the rising prevalence of chronic diseases requiring frequent imaging, increased adoption of advanced imaging modalities such as CT, MRI, and PET, and the global emphasis on patient-centric healthcare practices

- North America dominated the radiology positioning aids market with the largest revenue share of 40.2% in 2024, attributed to the region’s advanced healthcare infrastructure, high imaging procedure volumes, and strong presence of leading medical device manufacturers. The U.S. contributed significantly to this dominance, driven by early adoption of innovative positioning products, rising demand for minimally invasive imaging, and continuous R&D investments

- Asia-Pacific is expected to be the fastest growing region in the Radiology Positioning Aids market during the forecast period, supported by increasing healthcare investments, rapid urbanization, and rising awareness of the importance of precise diagnostic imaging. Countries like China and India are driving growth through expanding diagnostic centers and government-led healthcare modernization initiatives

- The Wedge X-ray segment dominated the radiology positioning aids market with the largest revenue share of 44.5% in 2024, as it plays a pivotal role in ensuring precise beam shaping and accurate patient positioning during imaging procedures

Report Scope and Radiology Positioning Aids Market Segmentation

|

Attributes |

Radiology Positioning Aids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Radiology Positioning Aids Market Trends

Growing Demand for Precision and Patient Safety

- A significant and accelerating trend in the global radiology positioning aids market is the increasing adoption of advanced patient positioning tools to enhance imaging accuracy and diagnostic outcomes. These devices are helping radiologists and technicians ensure precise alignment, minimize motion artifacts, and maintain consistency across repeated imaging procedures

- For instance, modular positioning cushions, immobilization pads, and ergonomic supports are increasingly being utilized in MRI, CT, and X-ray procedures to stabilize patients during scans. Such innovations are improving workflow efficiency, patient comfort, and the overall quality of diagnostic imaging results

- Improved patient safety is a critical factor driving market growth, as proper positioning reduces the risk of repeated scans and unnecessary radiation exposure. Hospitals and diagnostic centers are prioritizing aids that ensure reproducibility of results and compliance with regulatory standards for imaging quality

- The seamless integration of positioning aids into imaging workflows facilitates quicker setup times, reduces technician workload, and allows for better management of diverse patient populations, including pediatric, geriatric, and mobility-challenged patients

- This trend toward precision-focused, ergonomic, and patient-friendly positioning solutions is reshaping expectations within diagnostic imaging. Consequently, companies such as CIVCO, Orfit, and Kendall are developing innovative products like adjustable cushions, immobilization systems, and multi-functional supports to cater to the evolving needs of radiology departments

- The demand for high-quality radiology positioning aids is growing rapidly across hospitals, diagnostic centers, and research institutions worldwide, as the focus on accurate diagnostics, patient comfort, and procedural efficiency becomes increasingly critical in modern healthcare

Radiology Positioning Aids Market Dynamics

Driver

Growing Need Due to Enhanced Diagnostic Accuracy and Patient Safety

- The increasing demand for precise imaging and improved patient safety is a significant driver for the heightened adoption of radiology positioning aids across hospitals, diagnostic centers, and research institutions

- For instance, in April 2024, CIVCO Medical Solutions announced the launch of its new modular patient positioning system designed to improve reproducibility and reduce setup times during MRI and CT scans. Such strategic innovations by key companies are expected to propel the Radiology Positioning Aids market growth during the forecast period

- As healthcare providers aim to minimize motion artifacts and enhance image quality, positioning aids such as immobilization cushions, headrests, and ergonomic supports are becoming essential tools in diagnostic workflows

- Furthermore, the growing focus on patient comfort and safety, especially for pediatric, geriatric, and mobility-challenged patients, is increasing the adoption of advanced positioning solutions in clinical settings

- The ability to achieve consistent patient positioning, reduce scan repetitions, and streamline radiology operations are key factors driving market growth. The trend towards modernized imaging facilities and the increasing availability of versatile Radiology Positioning Aids are further contributing to the market expansion

Restraint/Challenge

High Initial Costs and Equipment Maintenance Requirements

- The relatively high initial cost of advanced radiology positioning aids, compared to traditional positioning methods, poses a significant challenge to widespread adoption, particularly in smaller clinics or budget-constrained healthcare facilities

- For instance, premium positioning systems with adjustable supports and multi-functional modules often require substantial capital investment, which can be a barrier for certain end-users

- Maintenance and calibration requirements also present challenges, as improper usage or inadequate upkeep can affect performance and diagnostic accuracy. Healthcare providers must invest in staff training and regular servicing to ensure optimal functionality

- Limited awareness among smaller hospitals and diagnostic centers about the benefits of modern positioning aids can hinder adoption, as some institutions continue to rely on conventional methods without recognizing the improvements in accuracy and efficiency offered by advanced aids

- Integration challenges with existing imaging equipment may occur in some facilities, requiring additional customization or workflow modifications, which can increase implementation time and operational complexity

- While prices are gradually decreasing and modular, cost-effective solutions are emerging, the perceived high cost can still limit adoption, particularly in developing regions

- Overcoming these challenges through the introduction of affordable, easy-to-use, and durable Radiology Positioning Aids, along with proper training programs for clinical staff, will be crucial for sustained market growth and widespread acceptance across healthcare facilities

Radiology Positioning Aids Market Scope

The market is segmented on the basis of X-ray type, product, and end user.

- By X-ray Type

On the basis of X-ray type, the radiology positioning aids market is segmented into Wedge X-ray, Block X-ray, and Others. The Wedge X-ray segment dominated the market with the largest revenue share of 44.5% in 2024, as it plays a pivotal role in ensuring precise beam shaping and accurate patient positioning during imaging procedures. Wedge X-ray aids are extensively used in diagnostic and therapeutic radiology to minimize radiation exposure to surrounding tissues while enhancing image clarity. Their versatility allows application across multiple imaging modalities including CT, MRI, and conventional X-ray. The segment benefits from continuous innovations such as lightweight materials and customizable wedge angles, which improve clinical efficacy and patient comfort. Hospitals and diagnostic centers prioritize Wedge X-rays due to their ability to maintain reproducible results and streamline imaging workflows.

The Block X-ray segment is expected to witness the fastest CAGR of 12.3% from 2025 to 2032, driven by rising demand for precise radiation targeting in radiotherapy and specialized imaging. Block X-rays enhance beam collimation, ensuring that only the intended areas are exposed, which is crucial for patient safety and imaging accuracy. Their adoption is growing in oncology centers, specialized radiology clinics, and research institutions due to their contribution to better treatment outcomes. Increasing awareness of radiation safety, coupled with advances in imaging technology and the proliferation of outpatient diagnostic facilities, is accelerating the demand for Block X-ray devices.

- By Product

On the basis of product, the radiology positioning aids market is segmented into head, neck, and brain positioning devices, thorax and breast positioning devices, tables, pediatric, and others. The head, neck, and brain positioning devices segment held the largest revenue share of 42.8% in 2024, as it ensures accurate immobilization and alignment during neurological and cranial imaging procedures. These devices are critical for reducing motion artifacts and improving diagnostic precision in MRI, CT, and X-ray scans. Their ergonomic designs and compatibility with various imaging machines make them a preferred choice in hospitals and diagnostic centers. Continuous technological improvements and a focus on patient comfort have further strengthened their adoption. The segment is also favored in research institutions and specialty clinics for precise and repeatable imaging, enhancing clinical decision-making.

The thorax and breast positioning devices segment is expected to witness the fastest CAGR of 11.9% from 2025 to 2032, driven by the increasing focus on early cancer detection, particularly breast cancer, and the growing demand for accurate thoracic imaging. These devices improve image reproducibility and facilitate multi-angle imaging, which is essential for mammography and chest X-rays. Hospitals, diagnostic centers, and specialized oncology clinics are adopting these aids to enhance workflow efficiency and ensure patient safety. Rising awareness of preventive healthcare and government initiatives for early cancer screening are also contributing to the segment’s growth.

- By End User

On the basis of end user, the radiology positioning aids market is segmented into hospitals, ambulatory surgical centers, and diagnostic imaging centers. The hospitals segment accounted for the largest revenue share of 46.3% in 2024, owing to the high patient throughput and the extensive use of advanced imaging equipment across departments. Hospitals leverage positioning aids to improve imaging accuracy, reduce retakes, and enhance patient comfort during complex procedures. Investments in state-of-the-art diagnostic infrastructure and the expansion of hospital facilities are supporting steady demand. Additionally, hospitals are increasingly adopting modern positioning aids to meet regulatory standards and improve operational efficiency.

The diagnostic imaging centers segment is anticipated to witness the fastest CAGR of 12.5% from 2025 to 2032, driven by the growing number of outpatient facilities and the increasing need for precise, reproducible imaging. These centers prioritize positioning aids to optimize patient alignment, enhance diagnostic accuracy, and deliver high-quality results efficiently. Rising patient awareness, preventive healthcare initiatives, and the proliferation of independent imaging centers are key factors driving the adoption of these aids. The segment benefits from technological advancements that reduce setup time and improve patient throughput.

Radiology Positioning Aids Market Regional Analysis

- North America dominated the radiology positioning aids market with the largest revenue share of 40.2% in 2024, attributed to the region’s advanced healthcare infrastructure, high imaging procedure volumes, and strong presence of leading medical device manufacturers.

- This dominance, driven by early adoption of innovative positioning products, rising demand for minimally invasive imaging, and continuous R&D investments. Hospitals and diagnostic centers in the region are increasingly deploying precise positioning aids to enhance imaging accuracy, improve patient comfort, and reduce procedure times

- The presence of well-established suppliers and strong regulatory frameworks further supports widespread adoption and market stability

U.S. Radiology Positioning Aids Market Insight

The U.S. radiology positioning aids market captured the largest revenue share within North America in 2024, fueled by the increasing number of diagnostic imaging procedures and the integration of advanced imaging technologies such as CT, MRI, and PET. Rising demand for high-precision positioning systems, coupled with continuous innovations in patient immobilization and ergonomic design, is driving market growth. Additionally, healthcare providers are prioritizing patient safety, operational efficiency, and reproducibility of imaging results, further propelling adoption of radiology positioning aids across hospitals, ambulatory centers, and diagnostic imaging facilities.

Europe Radiology Positioning Aids Market Insight

The Europe radiology positioning aids market is projected to expand at a substantial CAGR during the forecast period, driven by increasing demand for high-quality diagnostic imaging, stringent healthcare standards, and rapid adoption of advanced imaging technologies. Growth is further supported by the modernization of hospitals and diagnostic centers, as well as a focus on improving patient comfort and workflow efficiency. Countries such as Germany, France, and the U.K. are witnessing strong demand for innovative positioning devices, particularly in oncology imaging, pediatric diagnostics, and neurology.

U.K. Radiology Positioning Aids Market Insight

The U.K. radiology positioning aids market is expected to grow at a noteworthy CAGR during the forecast period, supported by modernization of healthcare facilities and rising adoption of advanced diagnostic imaging techniques. Hospitals and diagnostic imaging centers are increasingly using precise positioning aids to enhance image quality and improve patient outcomes. Government initiatives to improve healthcare access and efficiency, alongside robust medical infrastructure, further stimulate market expansion.

Germany Radiology Positioning Aids Market Insight

The Germany radiology positioning aids market is anticipated to expand at a considerable CAGR during the forecast period, fueled by the country’s focus on high-quality healthcare, advanced imaging procedures, and innovation-driven medical device adoption. Hospitals and clinics are prioritizing devices that enhance patient positioning accuracy, reduce procedure times, and support complex imaging workflows. Strong R&D investments and collaborations between medical device manufacturers and healthcare institutions contribute to the market’s steady growth.

Asia-Pacific Radiology Positioning Aids Market Insight

The Asia-Pacific radiology positioning aids market is poised to grow at the fastest CAGR during the forecast period, driven by increasing healthcare investments, rapid urbanization, and rising awareness of the importance of precise diagnostic imaging. Countries such as China, India, and Japan are leading growth by expanding diagnostic centers, adopting advanced imaging systems, and modernizing healthcare infrastructure. The affordability of innovative positioning aids and government initiatives to enhance healthcare accessibility further accelerate market adoption across hospitals, imaging centers, and ambulatory care facilities.

Japan Radiology Positioning Aids Market Insight

The Japan radiology positioning aids market is gaining momentum due to the country’s high-tech medical infrastructure, aging population, and rising demand for precision imaging. Hospitals and diagnostic centers are increasingly implementing advanced positioning solutions to support efficient workflows, improve patient comfort, and ensure high-quality imaging outcomes. The focus on minimally invasive procedures and integration with modern imaging technologies drives sustained growth in the market.

China Radiology Positioning Aids Market Insight

The China radiology positioning aids market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding healthcare infrastructure, and increasing demand for accurate diagnostic imaging. Investments in hospital modernization, government-led healthcare programs, and the rising number of imaging centers are key factors propelling growth. Additionally, the domestic manufacturing of innovative positioning aids enhances affordability and availability, supporting wider adoption across clinical and diagnostic applications.

Radiology Positioning Aids Market Share

The radiology positioning aids industry is primarily led by well-established companies, including:

- Bionix LLC (Singapore)

- Clear Image Devices (U.S.)

- CIVCO Medical Solutions (U.S.)

- Elekta (Sweden)

- Vertec, Inc. (U.K.)

- AADCO Medical, Inc. (U.S.)

- IZI Medical Products (U.S.)

- Klarity Medical (U.S.)

- Qfix (U.S.)

- Orfit Industries (Belgium)

- Mizuho OSI (U.S.)

- CDR Systems (Canada)

- CQ Medical (U.S.)

- Pearl Technology (U.S.)

- Alimed (U.S.)

- Techno-Aide (U.S.)

- TIDI Products, LLC (U.S.)

- Standard Imaging, Inc. (U.S.)

- Candor ApS (Denmark)

Latest Developments in Global Radiology Positioning Aids Market

- In November 2022, Canon Medical Systems Corporation introduced the Mobirex i9 mobile X-ray system and the CXDI-Elite series of wireless digital radiography detectors. These products were showcased at the RSNA 2022 Annual Meeting in Chicago. The Mobirex i9 is designed for enhanced mobility and image quality, featuring a compact design and advanced imaging software. The CXDI-Elite series offers high sensitivity and image quality, incorporating Built-in AEC Assistance technology for general X-ray imaging

- In March 2025, Canon Medical Systems USA launched the Adora DRFi, a hybrid radiographic and fluoroscopic imaging system, following its FDA 510(k) clearance in December 2024. The Adora DRFi combines static and dynamic radiography with low-dose fluoroscopy, featuring a rotating ceiling unit with independently moving X-ray tube and detector arms. This system enables exposures from virtually any angle, enhancing flexibility in patient positioning

- In March 2025, GE HealthCare announced a collaboration with NVIDIA to develop AI-enabled X-ray and ultrasound systems by leveraging the new NVIDIA Isaac for Healthcare platform. This partnership aims to advance innovation in autonomous imaging, focusing on developing autonomous X-ray technologies and ultrasound applications. The integration of AI technologies is expected to transform diagnostic imaging by enabling autonomous analysis and decision-making processes

- In January 2025, Quibim, a company specializing in AI-based medical imaging, raised $50 million in a Series A funding round. The investment is intended to accelerate the development of advanced imaging biomarker technology and expand Quibim's global market presence. This funding underscores the growing importance of AI in radiology and the potential for innovation in imaging technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.