Global Rail Fasteners Market

Market Size in USD Million

CAGR :

%

USD

1.42 Million

USD

1.56 Million

2025

2033

USD

1.42 Million

USD

1.56 Million

2025

2033

| 2026 –2033 | |

| USD 1.42 Million | |

| USD 1.56 Million | |

|

|

|

|

What is the Global Rail Fasteners Market Size and Growth Rate?

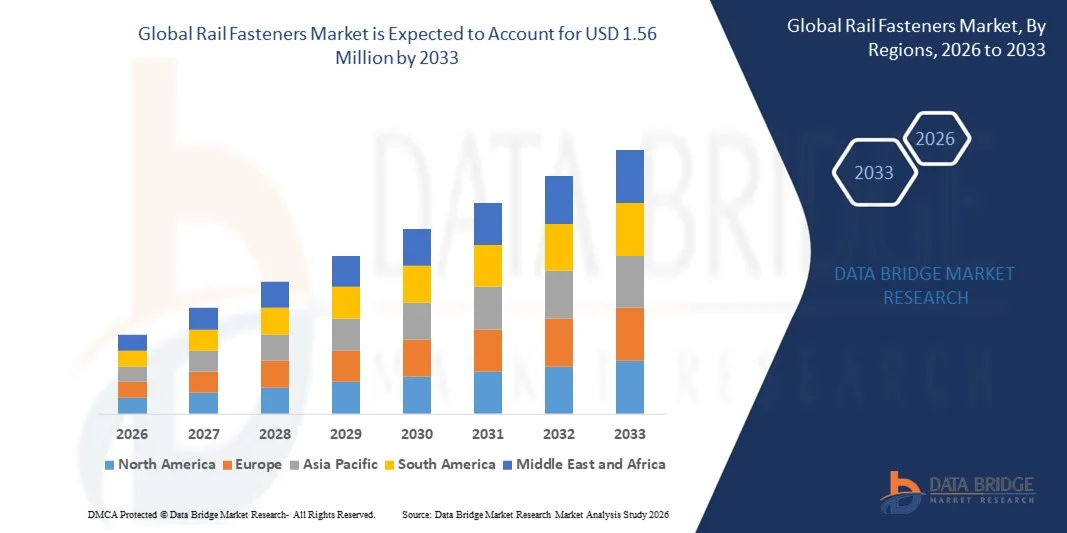

- The global rail fasteners market size was valued at USD 1.42 million in 2025 and is expected to reach USD 1.56 million by 2033, at a CAGR of1.20% during the forecast period

- Rising concerns related to the noise emission and their negative effects on network extensions is a crucial factor accelerating the market growth, also increase in passengers’ comfort, rising reduction in the cost of maintenance operation, increasing high-speed train industry, and subway industry, rising concerns pertaining to noise emissions and their negative impact on network extensions, rising rapid urbanization along with growing technological advancements in the railway industry are the major factors among others boosting the rail fasteners market

What are the Major Takeaways of Rail Fasteners Market?

- Rising positive economic conditions and interconnectivity between the places and rising research and development activities in the market will further create new opportunities for rail fasteners market in the forecast period mentioned above

- However, increasing advancements in the automotive industry and rising fares of railway services are the major factors among others restraining the market growth, and will further challenge the rail fasteners market

- Asia-Pacific dominated the rail fasteners market with a 43.2% revenue share in 2025, driven by massive investments in high-speed rail networks, metro expansions, and urban transit infrastructure across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 11.8% from 2026 to 2033, driven by urban rail modernization, metro expansion projects, and freight track upgrades across the U.S. and Canada. Increasing investments in high-performance rail components, vibration-reducing fastening systems, and advanced installation techniques are driving demand

- The Rail Clip segment dominated the market with a 38.6% share in 2025, driven by its critical role in securing rails to sleepers, maintaining track gauge, and ensuring vibration absorption for high-speed and heavy freight operations

Report Scope and Rail Fasteners Market Segmentation

|

Attributes |

Rail Fasteners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Rail Fasteners Market?

Increasing Shift Toward High-Performance, Durable, and Modular Rail Fasteners

- The rail fasteners market is witnessing strong adoption of modular, high-strength, and corrosion-resistant fasteners designed to support high-speed rail, heavy freight lines, and advanced signaling systems

- Manufacturers are introducing pre-assembled, vibration-resistant, and easy-to-install fasteners that offer enhanced load-bearing capacity, reduced maintenance, and compatibility with modern track designs

- Growing demand for cost-efficient, lightweight, and long-lasting fastening systems is driving usage across high-speed rail, metro networks, freight corridors, and light rail infrastructure

- For instance, companies such as Pandrol, Vossloh, LB Foster, Knorr-Bremse, and Taicang Zhongbo have upgraded their fastener portfolios with modular clips, elastic rails pads, and integrated anti-vibration systems

- Increasing need for safe, reliable, and maintenance-minimized rail systems is accelerating the shift toward innovative fastening solutions

- As rail networks expand and speeds increase, Rail Fasteners will remain critical for ensuring track stability, ride comfort, and operational efficiency

What are the Key Drivers of Rail Fasteners Market?

- Rising demand for durable, standardized, and easy-to-install fasteners to support high-speed rail, metro, and freight operations

- For instance, in 2025, leading companies such as Pandrol, Vossloh, and LB Foster introduced fasteners with higher load tolerance, modular designs, and reduced installation time

- Growing adoption of high-speed trains, urban transit expansion, and railway modernization is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in material science, anti-corrosion coatings, elastic rail pads, and pre-assembled clip systems have strengthened reliability, safety, and lifespan

- Rising government investment in rail infrastructure, track upgrades, and electrification projects is creating demand for high-performance fastening solutions

- Supported by continuous R&D, track modernization, and global rail network expansion, the Rail Fasteners market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Rail Fasteners Market?

- High costs associated with premium, vibration-resistant, and high-strength fasteners restrict adoption among smaller rail projects and developing regions

- For instance, during 2024–2025, fluctuations in steel prices, raw material costs, and specialized component availability increased production costs for several global suppliers

- Complex installation processes, site-specific adaptations, and compliance with safety standards increase the need for skilled labor and training

- Limited awareness in emerging markets regarding standardized track fastening solutions slows adoption

- Competition from traditional fastening systems, local manufacturers, and lower-cost substitutes creates pricing pressure and reduces differentiation

- To address these challenges, companies are focusing on modular designs, pre-assembled systems, maintenance-free solutions, and localized production to increase global adoption of rail fasteners

How is the Rail Fasteners Market Segmented?

The market is segmented on the basis of product type, speed, and rail type.

- By Product Type

On the basis of product type, the rail fasteners market is segmented into Rail Clip, Tie Plate, Dog Spike, Screw Spike, Rail Pad, Rail Insulator, Flat Washer, and Rail Plastic Dowel. The Rail Clip segment dominated the market with a 38.6% share in 2025, driven by its critical role in securing rails to sleepers, maintaining track gauge, and ensuring vibration absorption for high-speed and heavy freight operations. Rail Clips are widely adopted across high-speed rail, metro, and conventional lines due to their durability, ease of installation, and compatibility with modular fastening systems.

The Rail Pad segment is expected to grow at the fastest CAGR from 2026 to 2033, as demand rises for enhanced vibration damping, track stability, and noise reduction. Increasing investments in track modernization, metro expansions, and noise-reduction initiatives are driving the adoption of advanced Rail Pads across global rail infrastructure.

- By Speed

On the basis of speed, the market is segmented into Conventional Rail Fastening Systems and High-Speed Rail Fastening Systems. The Conventional segment dominated the market with a 55.2% share in 2025, supported by the extensive global railway network of freight and regional passenger lines that rely on proven fastening technologies for durability and safety. Conventional systems are preferred due to cost-effectiveness, easier maintenance, and widespread supplier availability.

The High-Speed Rail Fastening Systems segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid expansion of high-speed rail corridors in Asia-Pacific, Europe, and the U.S. Increasing deployment of trains exceeding 250 km/h demands fastening solutions that offer higher stability, precise track alignment, and enhanced vibration control. Governments and rail OEMs are prioritizing high-performance systems to ensure safety, ride comfort, and long-term reliability.

- By Rail Type

On the basis of rail type, the rail fasteners market is segmented into Passenger Rail and Transit Rail. The Passenger Rail segment dominated the market with a 60.1% share in 2025, driven by extensive high-speed, intercity, and regional rail networks that require robust, high-performance fastening systems. Passenger rail applications demand high safety standards, precise track alignment, and vibration mitigation, making advanced Rail Fasteners essential.

The Transit Rail segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by urban metro, light rail, and tram network expansions across Asia-Pacific, Europe, and North America. Increasing urbanization, government investment in mass transit, and focus on sustainable transport solutions are accelerating demand for modular, low-maintenance, and noise-reducing fastening systems in transit rail projects.

Which Region Holds the Largest Share of the Rail Fasteners Market?

- Asia-Pacific dominated the rail fasteners market with a 43.2% revenue share in 2025, driven by massive investments in high-speed rail networks, metro expansions, and urban transit infrastructure across China, Japan, India, South Korea, and Southeast Asia. Increasing government initiatives for rail modernization, adoption of advanced track fastening systems, and rapid urbanization are fueling regional demand. High-volume production of rail components, locally manufactured fastening solutions, and strong supply chains further strengthen market dominance

- Leading companies in Asia-Pacific are focusing on developing modular, high-durability, and vibration-absorbing fastening solutions that meet international safety standards. Adoption of advanced Rail Clips, Rail Pads, and fastening assemblies for high-speed rail and freight operations reinforces technological leadership

- Extensive engineering expertise, strong manufacturing capabilities, and supportive policy frameworks drive sustained growth and position Asia-Pacific as the largest contributor to the global rail fasteners market

China Rail Fasteners Market Insight

China is the largest contributor to Asia-Pacific, supported by world-leading rail expansion programs, rapid high-speed rail deployment, and strong government initiatives promoting domestic rail technology. Increasing investments in freight modernization and metro networks drive demand for high-performance Rail Fasteners. Local production capabilities and competitive pricing further expand domestic and export adoption.

Japan Rail Fasteners Market Insight

Japan shows steady growth, fueled by high-speed passenger rail networks, urban transit modernization, and advanced rail engineering practices. Demand for premium, long-life fastening solutions supports adoption of modular and low-maintenance Rail Fasteners for metro and Shinkansen lines.

India Rail Fasteners Market Insight

India is emerging as a major growth hub, driven by government-backed high-speed rail projects, metro expansions, and increasing urban transit initiatives. Demand for vibration-reducing, maintenance-efficient Rail Fasteners accelerates adoption across new and upgraded rail networks.

South Korea Rail Fasteners Market Insight

South Korea contributes significantly due to high-speed rail expansions, advanced metro systems, and technology-focused rail infrastructure projects. Adoption of modular Rail Fasteners with enhanced vibration absorption and long service life supports ongoing regional market growth.

North America Rail Fasteners Market

North America is projected to register the fastest CAGR of 11.8% from 2026 to 2033, driven by urban rail modernization, metro expansion projects, and freight track upgrades across the U.S. and Canada. Increasing investments in high-performance rail components, vibration-reducing fastening systems, and advanced installation techniques are driving demand. Government-backed infrastructure initiatives and rising adoption of modular and low-maintenance solutions support long-term regional growth.

U.S. Rail Fasteners Market Insight

The U.S. contributes the largest share in North America, supported by extensive urban rail networks, freight track maintenance programs, and increasing adoption of high-performance Rail Fasteners for metro and commuter lines. Focus on durability, safety, and compliance with federal standards drives market expansion.

Canada Rail Fasteners Market Insight

Canada contributes to regional growth with rising investments in high-speed rail corridors, urban transit expansions, and freight rail upgrades. Adoption of advanced fastening systems for vibration reduction and track stability enhances reliability and operational efficiency.

Which are the Top Companies in Rail Fasteners Market?

The rail fasteners industry is primarily led by well-established companies, including:

- Vossloh (Germany)

- Pandrol (France)

- LB Foster Rail Products (U.S.)

- Cooper & Turner Limited (U.K.)

- Taicang Zhongbo Railway Fastening Co., Ltd (China)

- MNP (U.S.)

- Pankaj Steel Industries (India)

- Eastern Trading Corporation (India)

- VJ Sourcing And Services (India)

- Hamidi Exports (India)

- Capital Bolts And Hardwares (India)

- Fasteners India (India)

- Brainard Rivet Co. (U.S.)

- Js Group (U.K.)

- General Industries (U.S.)

- Midas Industrial Product (U.K.)

- Key Fasteners Ltd (U.K.)

What are the Recent Developments in Global Rail Fasteners Market?

- In March 2024, L.B. Foster Company completed the acquisition of a leading rail fastening technology firm, strengthening its product portfolio and market presence, and enhancing its innovation capabilities across the railway infrastructure sector

- In February 2024, Pandrol launched its latest rail fastening system designed specifically for high-speed rail applications, utilizing advanced materials and technology to enhance durability and performance, effectively addressing the increasing demand for efficient rail transportation solutions

- In January 2024, Vossloh AG announced plans to expand its production capacity in the Asia-Pacific region to meet the growing demand for rail fasteners in developing markets, aiming to improve manufacturing efficiency and reduce delivery lead times for regional customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.