Global Railcar Loader Market

Market Size in USD Billion

CAGR :

%

USD

1.28 Billion

USD

1.80 Billion

2024

2032

USD

1.28 Billion

USD

1.80 Billion

2024

2032

| 2025 –2032 | |

| USD 1.28 Billion | |

| USD 1.80 Billion | |

|

|

|

|

Railcar Loader Market Size

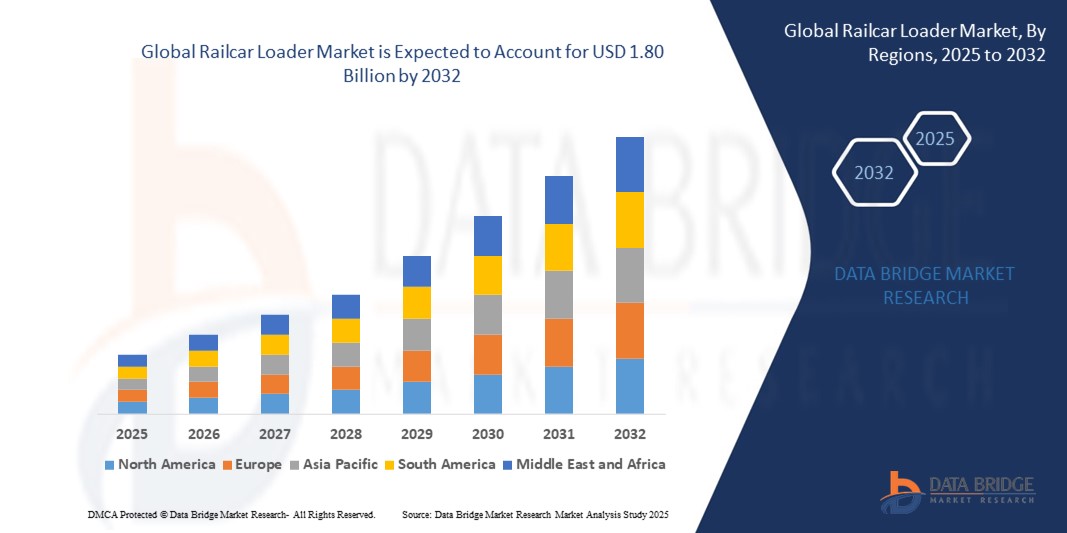

- The global railcar loader market size was valued at USD 1.28 billion in 2024 and is expected to reach USD 1.80 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by the increasing demand for efficient bulk material transportation, rising global trade, and the need for optimized supply chain solutions in industries such as mining, agriculture, and manufacturing

- Growing awareness of operational efficiency, safety, and sustainability in rail transport is further propelling the demand for advanced railcar loaders across both automated and semi-automated systems

Railcar Loader Market Analysis

- The railcar loader market is experiencing steady growth due to the rising need for efficient and high-capacity material handling solutions to support global logistics and transportation networks

- Increasing demand from industries such as mining, agriculture, and chemicals is encouraging manufacturers to innovate with automated, durable, and environmentally sustainable loading solutions

- North America dominates the railcar loader market with the largest revenue share of 33.2% in 2024, driven by a well-established railway infrastructure, high demand for bulk material transportation, and significant investments in automation technologies

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, expanding railway networks, and increasing demand for bulk material handling in countries such as China, India, and Australia

- The volumetric segment dominated the largest market revenue share of 36.61% in 2024, driven by its cost-effectiveness, operational simplicity, and suitability for bulk material handling in industries such as agriculture, mining, and construction

Report Scope and Railcar Loader Market Segmentation

|

Attributes |

Railcar Loader Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Railcar Loader Market Trends

Adoption of Automation and IoT-Enabled Systems

- The global railcar loader market is experiencing a strong trend toward integrating automation technologies and IoT-enabled systems for improved efficiency and operational precision

- These technologies allow for real-time monitoring, predictive maintenance, and optimization of loading processes, reducing downtime and operational costs

- Automated railcar loaders equipped with IoT sensors can detect loading irregularities, monitor material flow, and adjust operations dynamically to prevent overfilling or underloading

- For instance, several companies are deploying AI-powered analytics platforms connected to railcar loaders to improve loading accuracy and reduce material wastage in industries such as mining, agriculture, and chemicals

- This trend is significantly improving operational safety and efficiency, making railcar loaders more appealing to industries with high-volume material handling needs

- IoT-integrated systems can track performance metrics such as loading speed, material type, and environmental conditions, helping operators make data-driven decisions for optimal throughput

Railcar Loader Market Dynamics

Driver

Rising Demand for Efficient Bulk Material Handling and Infrastructure Expansion

- The increasing need for faster and more accurate bulk material handling solutions in industries such as mining, agriculture, and construction is driving the growth of the global railcar loader market

- Infrastructure expansion projects, particularly in freight transportation networks, are boosting the adoption of advanced railcar loading systems

- North America remains the dominating region due to its well-established rail freight infrastructure, high adoption of automated systems, and presence of key market players

- The growth of industrial production and the modernization of rail transport facilities in Asia-Pacific make it the fastest-growing region in the market

- The integration of gravimetric and volumetric loading systems in new and existing facilities enhances accuracy, reduces material losses, and improves operational throughput

Restraint/Challenge

High Installation Costs and Maintenance Complexity

- The significant upfront costs for advanced railcar loader systems, including automation components and IoT integration, can limit adoption, especially for small and medium-sized enterprises

- Retrofitting existing loading facilities to accommodate modern systems can be technically challenging and require substantial downtime

- Maintenance complexity increases with the integration of advanced technologies, as it requires skilled technicians and specialized parts

- Data connectivity and cybersecurity concerns also arise when IoT-enabled systems are used, as operational and production data may be vulnerable to unauthorized access

- Variations in safety regulations and technical standards across regions can create compliance challenges for international suppliers, adding to operational costs and project timelines

Railcar Loader market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the global railcar loader market is segmented into volumetric, gravimetric, and others. The volumetric segment dominated the largest market revenue share of 36.61% in 2024, driven by its cost-effectiveness, operational simplicity, and suitability for bulk material handling in industries such as agriculture, mining, and construction. Volumetric loaders are favored for their ability to quickly load large quantities of material without the need for complex calibration systems, making them especially appealing for facilities with high throughput requirements. Their ease of maintenance and adaptability to various wagon types have strengthened their position as the preferred choice for operators seeking reliability and lower operational costs.

The gravimetric segment is expected to register the fastest growth rate from 2025 to 2032, fueled by increasing demand for precision loading in industries where weight accuracy is critical for safety, compliance, and cost optimization. Gravimetric loaders allow for precise measurement and control of load weight, minimizing overloading risks and optimizing railcar utilization. This model supports advanced automation, integration with plant management systems, and compliance with stringent transport regulations. As logistics efficiency becomes a priority for high-value commodities, gravimetric systems are increasingly adopted by operators aiming to improve operational accuracy and reduce wastage.

- By Application

On the basis of application, the global railcar loader market is categorized into open wagon, hopper wagon, and others. The open wagon segment accounted for the highest revenue share in 2024, supported by its widespread use in transporting raw materials such as coal, ores, aggregates, and agricultural products. Open wagons are highly versatile and compatible with both volumetric and gravimetric loaders, making them a staple in heavy industries. Their large carrying capacity and ease of unloading via tippling or grab systems make them an integral part of bulk commodity supply chains across mining, energy, and construction sectors.

The hopper wagon segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the increasing need for efficient loading and unloading of granular and powdered materials such as grains, fertilizers, and cement. Hopper wagons, when paired with advanced railcar loaders, offer streamlined loading operations with minimal material spillage and faster turnaround times. The shift toward covered transportation for weather-sensitive cargo is also driving the adoption of hopper wagons, especially in emerging economies where agricultural exports and industrial output are rapidly expanding. Integration with automated loading systems further boosts efficiency and reduces labor costs, making hopper wagons an attractive choice for modern logistics networks.

Railcar Loader Market Regional Analysis

- North America dominates the railcar loader market with the largest revenue share of 33.2% in 2024, driven by a well-established railway infrastructure, high demand for bulk material transportation, and significant investments in automation technologies

- Industries prioritize railcar loaders for streamlining material transport, enhancing operational efficiency, and reducing loading times, particularly in regions with extensive rail networks

- Growth is supported by advancements in loader technology, such as automated and IoT-integrated systems, alongside increasing adoption in mining, agriculture, and manufacturing sectors

U.S. Railcar Loader Market Insight

The U.S. railcar loader market captured the largest revenue share of 72.9% in 2024 within North America, fueled by strong demand from the mining and agriculture sectors and growing adoption of automated loading systems. The trend towards operational efficiency and the need for precise material handling drive market expansion. The integration of advanced loaders in both new rail systems and retrofitted facilities complements industrial growth, creating a diverse product ecosystem.

Europe Railcar Loader Market Insight

The Europe railcar loader market is expected to witness significant growth, supported by regulatory emphasis on efficient and safe material transport. Industries seek loaders that enhance loading precision while reducing environmental impact. Growth is prominent in both new rail infrastructure projects and upgrades to existing systems, with countries such as Germany and France showing notable uptake due to increasing industrial activity and sustainability concerns.

U.K. Railcar Loader Market Insight

The U.K. market for railcar loaders is expected to experience rapid growth, driven by demand for efficient bulk material handling in industrial and logistics settings. Increased focus on reducing operational downtime and improving safety standards encourages adoption. Evolving regulations on rail transport safety and environmental impact influence industry choices, balancing loader efficiency with compliance.

Germany Railcar Loader Market Insight

Germany is expected to witness a high growth rate in the railcar loader market, attributed to its advanced industrial sector and strong focus on operational efficiency and sustainability. German industries prefer technologically advanced loaders, such as gravimetric systems, that ensure precise material handling and contribute to lower energy consumption. The integration of these loaders in large-scale rail projects and aftermarket solutions supports sustained market growth.

Asia-Pacific Railcar Loader Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding railway networks and rising industrial output in countries such as China, India, and Australia. Increasing demand for efficient bulk material transportation, particularly in mining and agriculture, boosts market growth. Government initiatives promoting infrastructure development and sustainable transport further encourage the adoption of advanced railcar loaders.

Japan Railcar Loader Market Insight

Japan’s railcar loader market is expected to experience rapid growth due to strong industry preference for high-quality, technologically advanced loaders that enhance operational efficiency and safety. The presence of major industrial manufacturers and the integration of loaders in modern rail systems accelerate market penetration. Rising interest in automated and IoT-enabled loaders also contributes to growth.

China Railcar Loader Market Insight

China holds the largest share of the Asia-Pacific railcar loader market, propelled by rapid industrialization, expanding railway infrastructure, and increasing demand for efficient material handling solutions. The country’s growing industrial base and focus on cost-effective logistics support the adoption of advanced loaders. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Railcar Loader Market Share

The railcar loader industry is primarily led by well-established companies, including:

- FLSmidth (Denmark)

- Schenck Process Europe GmbH (Germany)

- thyssenkrupp AG (Germany)

- PEBCO (India)

- FAM conveyor systems Magdeburg (Germany)

- Frigate Teknologies Pvt. Ltd. (India)

- Elecon Engineering Company Limited (India)

- BEUMER GROUP (Germany)

- AUMUND GROUP (Germany)

- TAKRAF Group (Germany)

What are the Recent Developments in Global Railcar Loader Market?

- In December 2024, Schrage GmbH, a leading provider of bulk material conveying solutions, launched a new railcar unloading system designed to enhance operational efficiency and minimize product damage during bulk material handling. The system features a low-profile design for easy integration and advanced control technologies that streamline the unloading process across various commodities. Engineered for durability and precision, it supports faster handling times, reduces labor costs, and ensures safe transfer of abrasive or sensitive materials—making it ideal for industries requiring high-performance, low-maintenance solutions

- In March 2024, W.S. Darley & Co. introduced a new line of heavy-duty hydraulic railcar loaders designed for demanding construction and mining applications. These loaders are built for robust performance and durability, featuring a quick-change bucket system that allows operators to rapidly adapt to different types of bulk materials. This innovation enhances operational flexibility, reduces downtime, and improves material handling efficiency across varied terrains and job sites

- In September 2024, FLSmidth, a global leader in equipment and services for the mining and cement industries, introduced a new automated high-speed railcar loading system for bulk materials. This advanced system utilizes volumetric sensors and a precision-controlled chute to ensure consistent, accurate loading—reducing spillage and maximizing payload efficiency. Designed to streamline bulk handling operations, it enhances safety, minimizes material loss, and supports faster turnaround times for rail logistics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.