Global Railway Buffer Stops Market

Market Size in USD Billion

CAGR :

%

USD

5.36 Billion

USD

7.62 Billion

2024

2032

USD

5.36 Billion

USD

7.62 Billion

2024

2032

| 2025 –2032 | |

| USD 5.36 Billion | |

| USD 7.62 Billion | |

|

|

|

|

What is the Global Railway Buffer Stops Market Size and Growth Rate?

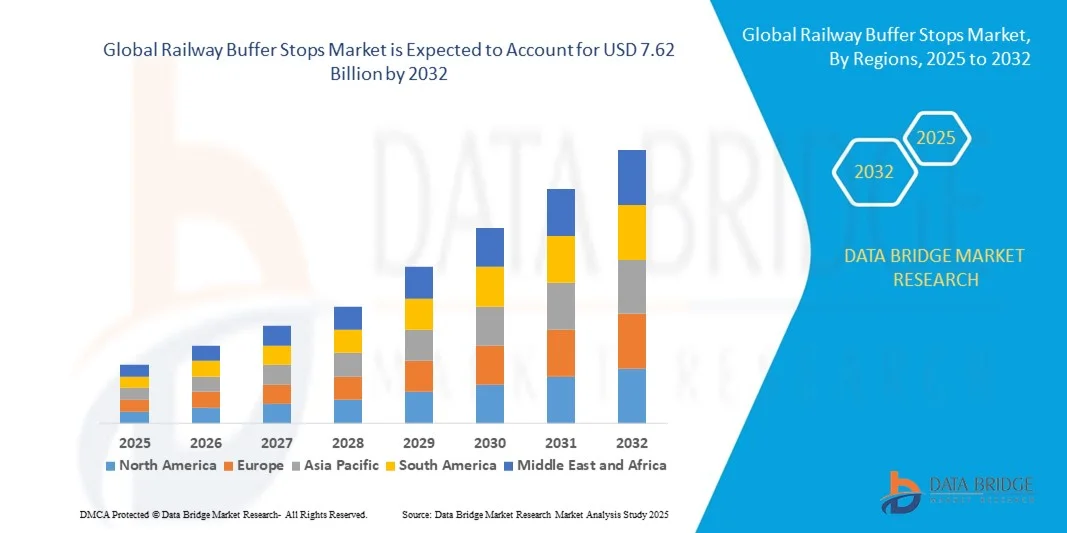

- The global railway buffer stops market size was valued at USD 5.36 billion in 2024 and is expected to reach USD 7.62 billion by 2032, at a CAGR of 4.50% during the forecast period

- Increasing consumer inclination towards safety and security, rising usages of public transport services by the majority of population, growth of the railway industry across the globe, adoption of stringent rules and regulation of the government in developed and developing economies, availability designed product according to the speed and weight of the vehicle are some of the major as well as important factors which will such asly to augment the growth of the railway buffer stops market

What are the Major Takeaways of Railway Buffer Stops Market?

- Availability of energy efficient product along with rising usages of product to prevent damage and reduce the risk of injury to the passenger which will further contribute by generating immense opportunities that will led to the growth of the railway buffer stops market in the above-mentioned projected timeframe

- Lower energy absorption capacity and high cost of product which will such asly to act as market restraints factor for the growth of the railway buffer stops in the above-mentioned forecasted period

- North America dominated the railway buffer stops market with the largest revenue share of 41.36% in 2024, driven by large-scale investments in rail infrastructure modernization and safety enhancement projects

- The Asia-Pacific railway buffer stops market is poised to grow at the fastest CAGR of 8.24% from 2025 to 2032, propelled by rapid urbanization, government-funded rail projects, and technological advancements in China, Japan, and India

- The Hydraulic/Mechanical Buffer Stops segment dominated the market with the largest revenue share of 44.8% in 2024, driven by their superior energy absorption capabilities and ability to handle varying impact loads effectively

Report Scope and Railway Buffer Stops Market Segmentation

|

Attributes |

Railway Buffer Stops Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Railway Buffer Stops Market?

Integration of Advanced Materials and Energy-Absorbing Technologies

- A prominent and accelerating trend in the global railway buffer stops market is the integration of advanced materials and energy-absorbing mechanisms designed to enhance safety and minimize collision impact. Modern buffer stops now utilize hydraulic, friction, and elastomeric systems to dissipate kinetic energy effectively during train impact

- For instance, GANTREX introduced modular hydraulic buffer systems that adapt to varying train speeds and loads, ensuring optimal energy absorption while minimizing structural damage. Similarly, OLEO International offers hydraulic buffer stops capable of handling heavy rolling stock with improved damping efficiency

- The adoption of composite materials, such as high-strength steel alloys and rubber-metal combinations, enhances durability and corrosion resistance, extending service life even under harsh weather conditions. This evolution supports reduced maintenance and life-cycle costs

- Furthermore, smart monitoring systems integrated into modern buffer stops enable real-time data collection and impact diagnostics, improving rail safety management. Digital tracking and predictive maintenance features are being increasingly deployed across major rail networks

- This trend toward technologically advanced, high-performance buffer stops is redefining the safety standards of railway terminals and freight yards globally. As governments and railway authorities continue emphasizing safety modernization, the adoption of intelligent, energy-efficient buffer stops is expected to accelerate across both passenger and freight rail systems

What are the Key Drivers of Railway Buffer Stops Market?

- The rising emphasis on railway safety enhancement and accident prevention is a major driver of the global Railway Buffer Stops market. Railway operators are increasingly upgrading infrastructure to comply with international safety regulations and standards

- For instance, in June 2024, voestalpine Railpro BV collaborated with Thales Group to implement next-generation buffer systems integrated with IoT-based sensors for impact detection and predictive maintenance. Such advancements are significantly improving train terminal safety

- In addition, the growth in urban and high-speed rail projects, especially in Asia-Pacific and Europe, is driving large-scale deployment of buffer stops at depots, terminals, and end-of-line stations. Rapid transit systems require compact yet highly efficient energy-absorbing solutions, boosting demand for modern hydraulic and friction-based designs

- The increasing replacement of conventional static stops with hydraulic and spring-based alternatives is also propelling market expansion. These modern systems reduce damage risk, minimize downtime, and improve safety in both passenger and freight rail networks

- Moreover, government initiatives promoting rail infrastructure modernization, such as the European Green Deal and India’s National Rail Plan 2030, are expected to further stimulate market growth by ensuring the adoption of advanced, sustainable safety equipment

Which Factor is Challenging the Growth of the Railway Buffer Stops Market?

- One of the major challenges restraining the railway buffer stops market is the high initial installation and maintenance cost associated with advanced hydraulic and friction-based systems. Smaller railway networks and freight yards often opt for cheaper mechanical or fixed stops to reduce capital expenditure

- For instance, several medium-scale operators in Eastern Europe and Latin America continue to rely on legacy steel buffers due to the significant cost differential between hydraulic and traditional systems. This limits large-scale modernization in cost-sensitive markets

- Another critical challenge is the complexity of retrofitting modern buffer systems into older railway infrastructure. Compatibility issues with existing track geometry and end-of-line configurations can delay implementation and increase engineering costs

- Environmental factors, such as temperature variations and corrosion, can also impact system performance, particularly in coastal or industrial regions, necessitating frequent inspection and replacement cycles

- To overcome these challenges, manufacturers are increasingly focusing on cost-effective modular designs, easy-install systems, and sustainable materials that reduce long-term maintenance burdens. Continuous innovation and collaboration with railway authorities will be crucial for overcoming economic and technical barriers to market expansion

How is the Railway Buffer Stops Market Segmented?

The market is segmented on the basis of type and sales channel.

- By Product Type

On the basis of product type, the railway buffer stops market is segmented into Frictional Buffer Stops, Fixed Buffer Stops, Hydraulic/Mechanical Buffer Stops, Wheel Stops, Folding Buffer Stops, and Special Designed Buffer Stops. The Hydraulic/Mechanical Buffer Stops segment dominated the market with the largest revenue share of 44.8% in 2024, driven by their superior energy absorption capabilities and ability to handle varying impact loads effectively. These systems are preferred for high-speed and heavy freight railways, where minimizing damage to rolling stock and infrastructure is critical. Hydraulic buffer stops use fluid damping technology to absorb kinetic energy, enhancing safety and durability.

The Frictional Buffer Stops segment is projected to witness the fastest growth rate of 22.3% from 2025 to 2032, owing to their cost-effectiveness, ease of installation, and suitability for metro and suburban lines. Increasing modernization of rail terminals and adoption of compact frictional systems are key factors fueling this segment’s expansion.

- By Sales Channel

On the basis of sales channel, the railway buffer stops market is categorized into Original Equipment Manufacturers (OEMs) and Aftermarket. The Original Equipment Manufacturers (OEMs) segment held the dominant market share of 61.2% in 2024, attributed to the growing number of new rail infrastructure projects, metro expansions, and modernization of freight terminals worldwide. OEMs provide customized buffer stop solutions integrated during new construction, ensuring compliance with safety standards and railway-specific requirements.

The Aftermarket segment, however, is expected to grow at the fastest CAGR of 20.6% from 2025 to 2032, driven by rising replacement demand in existing railway networks and the retrofitting of conventional stops with hydraulic and friction-based systems. Increasing focus on predictive maintenance and the adoption of modular designs are further promoting aftermarket sales. The growing emphasis on upgrading older stations to meet international safety norms will continue to support robust growth in this segment.

Which Region Holds the Largest Share of the Railway Buffer Stops Market?

- North America dominated the railway buffer stops market with the largest revenue share of 41.36% in 2024, driven by large-scale investments in rail infrastructure modernization and safety enhancement projects. The region’s strong emphasis on minimizing collision risks and improving terminal safety across freight and passenger rail networks has significantly contributed to this dominance

- The U.S. and Canada are leading in adopting hydraulic and friction-type buffer stops designed to meet stringent railway safety standards and performance requirements

- Continuous expansion of urban transit systems, metro lines, and freight terminals further supports the demand for advanced buffer stop technologies across the region

U.S. Railway Buffer Stops Market Insight

The U.S. railway buffer stops market captured the largest revenue share of 59% in 2024 within North America, supported by extensive rail network expansion, increasing freight movement, and modernization of passenger terminals. The U.S. is witnessing a rapid shift toward energy-absorbing hydraulic buffer stops to prevent rail car damage and improve end-of-line safety. Federal initiatives, such as the Bipartisan Infrastructure Law (2021), have accelerated investments in railway modernization. In addition, rising demand from commuter and light rail projects is fueling market growth. Growing partnerships between railway operators and engineering firms are expected to further propel adoption of high-performance and low-maintenance buffer stop systems across the country.

Europe Railway Buffer Stops Market Insight

The Europe railway buffer stops market is projected to grow at a steady CAGR throughout the forecast period, driven by stringent European Union (EU) railway safety regulations and increasing investments in sustainable rail transport. Countries such as Germany, the U.K., and France are leading adopters of buffer stop systems across high-speed, metro, and freight applications. Rising replacement demand for old mechanical systems with hydraulic and frictional buffer stops is a key growth driver. The growing emphasis on energy efficiency, low maintenance, and modular installation is encouraging adoption across both new and existing rail infrastructures. The EU’s focus on rail network interoperability and modernization continues to foster consistent market expansion in the region.

U.K. Railway Buffer Stops Market Insight

The U.K. railway buffer stops market is anticipated to grow at a robust CAGR during the forecast period, driven by large-scale upgrades under the Network Rail enhancement programs and increasing metro rail expansion in cities such as London and Manchester. The nation’s strong regulatory framework emphasizing end-of-track safety compliance has boosted demand for hydraulic and friction-type buffer stops. Moreover, the adoption of eco-friendly materials and low-noise absorption systems aligns with the U.K.’s sustainability objectives. Continued investments in passenger safety and modernization of terminal infrastructure are expected to keep the market on an upward trajectory.

Germany Railway Buffer Stops Market Insight

The Germany railway buffer stops market is expected to expand significantly during the forecast period, driven by the country’s leadership in rail engineering innovation and commitment to zero-collision safety standards. German railway operators are increasingly implementing customized buffer stop designs for heavy freight and high-speed train terminals. The integration of digital monitoring sensors within hydraulic systems for predictive maintenance is a growing trend. Germany’s emphasis on sustainable rail technologies and its role as a major exporter of rail components further strengthen its market position. The modernization of Deutsche Bahn’s rail infrastructure continues to drive steady demand for advanced buffer stop systems.

Which Region is the Fastest Growing in the Railway Buffer Stops Market?

The Asia-Pacific railway buffer stops market is poised to grow at the fastest CAGR of 8.24% from 2025 to 2032, propelled by rapid urbanization, government-funded rail projects, and technological advancements in China, Japan, and India. The expansion of metro networks and high-speed rail corridors is creating substantial demand for high-performance buffer stops designed to meet international safety standards. The region’s growing manufacturing base and cost-effective production capabilities are enhancing product availability and affordability.

Japan Railway Buffer Stops Market Insight

The Japan railway buffer stops market is gaining strong momentum owing to its extensive urban metro and bullet train infrastructure. Japan’s emphasis on precision, reliability, and compact engineering has accelerated the deployment of hydraulic and frictional buffer stop systems across its stations. Growing focus on automated safety mechanisms and IoT-based monitoring for railway assets is fostering continuous market growth. Moreover, the push toward sustainable and low-maintenance systems is encouraging domestic manufacturers to innovate in the buffer stop segment.

China Railway Buffer Stops Market Insight

The China railway buffer stops market held the largest revenue share in the Asia-Pacific region in 2024, driven by extensive rail infrastructure expansion under the Belt and Road Initiative (BRI) and continuous investment in high-speed and freight railway networks. China’s growing domestic production of railway components, including hydraulic and frictional buffer stops, enhances market affordability and local availability. Government-backed modernization programs and increased emphasis on passenger safety and terminal protection are key factors propelling growth. The integration of smart monitoring systems and energy-efficient designs in buffer stops is further supporting China’s dominance within the regional market.

Which are the Top Companies in Railway Buffer Stops Market?

The railway buffer stops industry is primarily led by well-established companies, including:

- A. RAWIE GmbH & Co. KG (Germany)

- Applegate Marketplace Ltd. (U.K.)

- GANTREX (Belgium)

- OLEO International (U.K.)

- Llalco Fluid Technology, S.L. (Spain)

- Star Track Fasteners Pvt. Ltd. (India)

- KGJ Price (Railway Contractors) Ltd (U.K.)

- Caterpillar (U.S.)

- GMT Rubber-Metal-Technic Ltd (U.K.)

- Industrispår Ystad AB (Sweden)

- CRRC Corporation Limited (CRRC) (China)

- voestalpine Railpro BV (Netherlands)

- Alterous (U.K.)

- HJ Skelton and Co Ltd. (U.K.)

- ARC DAMPERS (U.K.)

- Tria Group (U.K.)

- Thales Group (France)

- Kenro Metal Services (U.K.)

- Paul Norman Plastics Limited (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.