Global Railway Operation Management Market

Market Size in USD Billion

CAGR :

%

USD

59.63 Billion

USD

127.35 Billion

2024

2032

USD

59.63 Billion

USD

127.35 Billion

2024

2032

| 2025 –2032 | |

| USD 59.63 Billion | |

| USD 127.35 Billion | |

|

|

|

|

Railway Operation Management Market Size

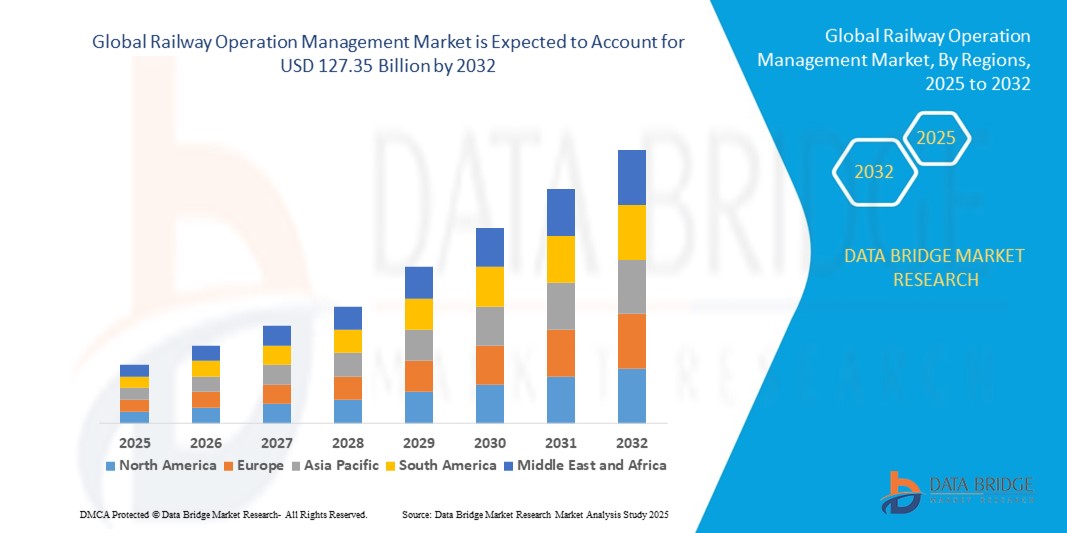

- The global railway operation management market size was valued at USD 59.63 billion in 2024 and is expected to reach USD 127.35 billion by 2032, at a CAGR of 9.95% during the forecast period

- The market growth is largely fueled by increasing investments in railway infrastructure modernization, rising demand for efficient train scheduling and control systems, and the integration of advanced technologies such as Internet of Things (IoT) and artificial intelligence (AI) to enhance operational efficiency and safety

- The increasing focus on sustainability and energy-efficient operations within the railway sector is propelling the adoption of advanced operation management systems designed to optimize fuel consumption and reduce environmental impact

Railway Operation Management Market Analysis

- The market is witnessing significant adoption of digital solutions aimed at optimizing asset management, predictive maintenance, and real-time monitoring to reduce downtime and operational costs

- Growing urbanization and the expansion of rail networks, particularly in emerging economies, are driving demand for sophisticated operation management systems that can handle increasing passenger and freight traffic

- North America dominated the railway operation management market with the largest revenue share of 38.5% in 2024, driven by significant investments in railway infrastructure modernization and the increasing adoption of digital operation management systems

- Asia-Pacific region is expected to witness the highest growth rate in the global railway operation management market, driven by accelerating urbanization, rising infrastructure development, and increasing government support for smart rail systems across countries such as China, India, and Japan

- The system integration and deployment segment dominated the market with the largest revenue share in 2024, driven by the growing demand for seamless implementation of advanced railway operation systems. Railway operators prioritize efficient integration of new technologies with existing infrastructure to enhance operational efficiency and safety. The segment also benefits from increasing investments in infrastructure modernization and digital transformation projects

Report Scope and Railway Operation Management Market Segmentation

|

Attributes |

Railway Operation Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption of Smart Railway Infrastructure and Automation Technologies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Railway Operation Management Market Trends

Increasing Integration of Digital Technologies in Railway Operations

- The adoption of digital technologies such as Internet of Things (IoT), artificial intelligence (AI), and big data analytics is revolutionizing railway operation management by enabling real-time monitoring and predictive maintenance. These technologies improve operational efficiency, reduce downtime, and enhance safety across rail networks

- The demand for smart railway systems that optimize train scheduling, track maintenance, and asset management is accelerating the deployment of cloud-based platforms and automated control systems. This trend supports faster decision-making and reduces human error in complex railway operations

- The growing focus on passenger experience and service reliability is driving investment in digital tools for real-time passenger information systems, ticketing, and network management. Rail operators are leveraging these technologies to improve punctuality and customer satisfaction

- For instance, in 2023, several European rail operators implemented AI-driven predictive maintenance solutions that reduced unscheduled downtime by 25%, significantly improving operational continuity and cost savings

- While digital integration is expanding rapidly, challenges such as data security, interoperability, and infrastructure modernization need to be addressed to fully realize the benefits of connected railway operations

Railway Operation Management Market Dynamics

Driver

Rising Investments in Railway Infrastructure and Modernization

• Increasing government and private sector investments in railway infrastructure development and modernization projects are fueling demand for advanced operation management solutions. These investments aim to improve capacity, safety, and efficiency in growing urban and freight rail networks, helping to meet rising transportation demands and reduce congestion. Enhanced infrastructure also supports sustainable mobility goals by promoting rail as an eco-friendly alternative to road transport

• The expansion of high-speed rail and metro systems worldwide is creating a need for sophisticated operation management platforms that can handle complex scheduling, traffic control, and real-time monitoring requirements. These platforms help optimize train frequency, reduce delays, and improve overall passenger experience, supporting the growing urban population’s mobility needs. This expansion also drives technology innovation and operational efficiency in railway networks globally

• Public-private partnerships and policy support for smart transportation systems are accelerating the adoption of technology-driven railway operation management tools globally. Governments are incentivizing digital transformation initiatives to modernize railways and enhance safety standards, encouraging collaboration between technology providers and operators. These partnerships facilitate funding, knowledge exchange, and faster deployment of cutting-edge solutions in diverse regions

• For instance, in 2022, the Indian government announced a multi-billion-dollar railway modernization program, significantly boosting demand for integrated operation management solutions across the country. This initiative focuses on upgrading signaling systems, implementing digital monitoring tools, and improving operational efficiency to support India’s rapidly growing rail network. The program also aims to improve passenger safety and service reliability on a large scale

• Despite strong investments, challenges remain in aligning legacy infrastructure with new technologies and ensuring skilled workforce availability to implement and maintain advanced systems. The coexistence of old and new systems requires seamless integration to avoid operational disruptions. In addition, training programs and capacity-building initiatives are essential to equip personnel with the necessary expertise to manage evolving railway operation technologies effectively

Restraint/Challenge

High Implementation Costs and Complexity of Integrating Legacy Systems

• The high upfront costs associated with deploying advanced railway operation management systems limit adoption, especially in developing regions with budget constraints. These costs include software licensing, hardware procurement, installation, and ongoing maintenance expenses, which can strain limited capital budgets. The financial burden slows down modernization efforts and creates a barrier for smaller rail operators to invest in cutting-edge solutions

• Integrating new digital platforms with existing legacy railway infrastructure presents technical complexities, requiring substantial customization and ongoing maintenance. Legacy equipment may not be compatible with modern software, necessitating specialized interfaces and middleware solutions. This integration challenge can lead to project delays, increased operational risks, and the need for continuous system updates to ensure interoperability and reliability

• Resistance to change among workforce and lack of skilled personnel to manage sophisticated systems further restrict market growth. Employees accustomed to traditional operational methods may be reluctant to adopt new technologies, impacting implementation timelines. Furthermore, the shortage of trained professionals capable of operating and maintaining advanced railway management systems complicates smooth transitions and long-term system sustainability

• For instance, in 2023, several rail operators in Southeast Asia reported delays in operation management system upgrades due to integration challenges with outdated signaling and control equipment. These delays resulted in extended project timelines and increased costs, highlighting the difficulties faced by operators in balancing modernization with existing infrastructure constraints. This instance underscores the critical need for tailored integration strategies and vendor support

• To overcome these barriers, market players must focus on scalable, modular solutions and provide comprehensive training and support services that ease transition and optimize system performance. Modular platforms allow gradual implementation, reducing upfront costs and minimizing disruptions. In addition, investing in workforce development programs and offering continuous technical support helps build operator confidence and ensures effective adoption of new technologies across railway networks

Railway Operation Management Market Scope

The market is segmented on the basis of service, deployment mode, and organization size.

- By Service

On the basis of service, the railway operation management market is segmented into consulting, system integration and deployment, and support and maintenance. The system integration and deployment segment dominated the market with the largest revenue share in 2024, driven by the growing demand for seamless implementation of advanced railway operation systems. Railway operators prioritize efficient integration of new technologies with existing infrastructure to enhance operational efficiency and safety. The segment also benefits from increasing investments in infrastructure modernization and digital transformation projects.

The consulting segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for expert guidance on technology adoption, process optimization, and regulatory compliance. Consulting services help railway operators plan and execute complex projects, ensuring alignment with business goals and industry standards. This is especially critical for small and medium-sized enterprises seeking to upgrade their operation management capabilities.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into cloud and on-premises. The on-premises segment held the largest revenue share in 2024, driven by the preference of many railway operators for localized data control and security. On-premises solutions offer robust customization options and are favored in regions with limited internet connectivity or strict data privacy regulations.

The cloud deployment segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing adoption of scalable, cost-effective cloud platforms that enable real-time data access and remote management. Cloud solutions facilitate easier updates, lower upfront costs, and enhanced collaboration across geographically dispersed railway networks, making them popular among large enterprises and tech-savvy operators.

- By Organization Size

On the basis of organization size, the market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The large enterprise segment dominated the market revenue in 2024, owing to the extensive rail networks they operate and their higher budgets for adopting sophisticated operation management systems. Large operators focus on comprehensive solutions that improve asset utilization, safety, and passenger experience.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of the benefits of digital operation management and government initiatives supporting infrastructure upgrades in smaller rail networks. SMEs are adopting modular and scalable systems that provide efficient management without large capital expenditure.

Railway Operation Management Market Regional Analysis

• North America dominated the railway operation management market with the largest revenue share of 38.5% in 2024, driven by significant investments in railway infrastructure modernization and the increasing adoption of digital operation management systems.

• Operators in the region focus on enhancing safety, efficiency, and real-time monitoring capabilities, supported by advanced technologies such as AI and IoT. The presence of well-established rail networks and government initiatives promoting smart transportation further accelerate market growth.

• High demand for predictive maintenance and asset management solutions, along with growing urbanization and freight transport requirements, reinforce the region’s leadership in the market.

U.S. Railway Operation Management Market Insight

The U.S. railway operation management market captured the largest revenue share of 82% within North America in 2024, fueled by ongoing digital transformation efforts and extensive investments in rail infrastructure upgrades. Rail operators increasingly prioritize integrated solutions that optimize scheduling, traffic control, and safety compliance. The expansion of high-speed rail projects and government-backed smart rail initiatives are also key drivers. Furthermore, the growing emphasis on sustainability and reducing operational costs is pushing adoption of advanced operation management platforms.

Europe Railway Operation Management Market Insight

The Europe railway operation management market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent safety regulations, increasing urban rail projects, and the modernization of aging infrastructure. The rise in cross-border freight and passenger rail traffic necessitates advanced management systems capable of handling complex logistics. European operators also emphasize energy-efficient and eco-friendly rail solutions, boosting demand for innovative operation management technologies.

U.K. Railway Operation Management Market Insight

The U.K. railway operation management market is expected to witness the fastest growth rate from 2025 to 2032, due to substantial investments in rail network upgrades and digital signaling systems. The government’s commitment to expanding and modernizing urban and intercity rail services supports market growth. Increased focus on passenger experience and operational efficiency further stimulates demand for integrated management platforms. The U.K.’s strong rail regulatory framework encourages adoption of cutting-edge technologies to improve safety and reliability.

Germany Railway Operation Management Market Insight

The Germany railway operation management market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s emphasis on high-speed rail expansion and smart transportation initiatives. Germany’s advanced technological infrastructure and focus on Industry 4.0 facilitate the integration of AI and IoT-based operation management solutions. The government’s sustainability goals and investments in rail freight optimization also contribute to the market’s expansion, particularly across commercial and public transport sectors.

Asia-Pacific Railway Operation Management Market Insight

The Asia-Pacific railway operation management market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, infrastructure development, and rising government investments in high-speed rail and metro systems. Countries such as China, India, and Japan are at the forefront of adopting advanced operation management technologies to enhance safety, efficiency, and capacity. The region’s emergence as a manufacturing hub for rail components further supports cost-effective deployment of these systems.

Japan Railway Operation Management Market Insight

The Japan railway operation management market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s advanced rail network and culture of technological innovation. The focus on precision scheduling, real-time monitoring, and safety management drives adoption of AI-powered and IoT-integrated platforms. Japan’s aging population and demand for reliable public transport also increase the need for efficient operation management solutions in both urban and regional rail systems.

China Railway Operation Management Market Insight

The China railway operation management market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s extensive rail infrastructure expansion, including high-speed rail projects and urban transit systems. Strong government support and ambitious smart city initiatives are accelerating the deployment of integrated operation management solutions. In addition, China’s domestic manufacturing capabilities and growing adoption of digital technologies enable rapid scaling and innovation in railway operations across commercial and passenger segments.

Railway Operation Management Market Share

The railway operation management industry is primarily led by well-established companies, including:

- Hitachi, Ltd. (Japan)

- Bombardier (Canada)

- Huawei Technologies Co., Ltd. (China)

- INDRA SISTEMAS, S.A. (Spain)

- Atos SE (France)

- Toshiba India Pvt. Ltd. (India)

- Tech Mahindra Limited (India)

- Nokia (Finland)

- OptaSense (United Kingdom)

- IBM Corporation (U.S.)

- GENERAL ELECTRIC (U.S.)

- GAO Group Inc. (Canada)

- EKE-Electronics Ltd (Finland)

- Sierra Wireless (Canada)

- EUROTECH (Italy)

- Trimble Inc. (U.S.)

- Frequentis AG (Austria)

- Siemens (Germany)

- Thales Group (France)

- DXC Technology Company (U.S.)

- ABB (Switzerland)

- Amadeus IT Group SA (Spain)

- Alstom (France)

- Cisco Systems, Inc. (U.S.)

Latest Developments in Global Railway Operation Management Market

- In October 2020, Hitachi announced a strategic partnership with Bay Area Rapid Transit (BART) to design and implement advanced digital train control technologies in San Francisco. This collaboration aims to increase train capacity, enhance service reliability, and improve overall passenger experience. The deployment of cutting-edge systems is expected to boost operational efficiency and set new standards for urban rail transit, positively impacting the global railway operation management market

- In February 2020, Alstom completed the acquisition of Bombardier Transportation, significantly expanding its rolling stock portfolio and strengthening its services division. The acquisition provides Alstom with access to an extensive network of maintenance facilities and a large fleet of trains in operation. This move enhances Alstom’s market position, enabling it to offer comprehensive solutions and drive innovation across the railway operation management sector worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Railway Operation Management Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Railway Operation Management Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Railway Operation Management Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.