Global Rainwater Harvesting System Market

Market Size in USD Million

CAGR :

%

USD

301.87 Million

USD

432.59 Million

2024

2032

USD

301.87 Million

USD

432.59 Million

2024

2032

| 2025 –2032 | |

| USD 301.87 Million | |

| USD 432.59 Million | |

|

|

|

|

Rainwater Harvesting System Market Size

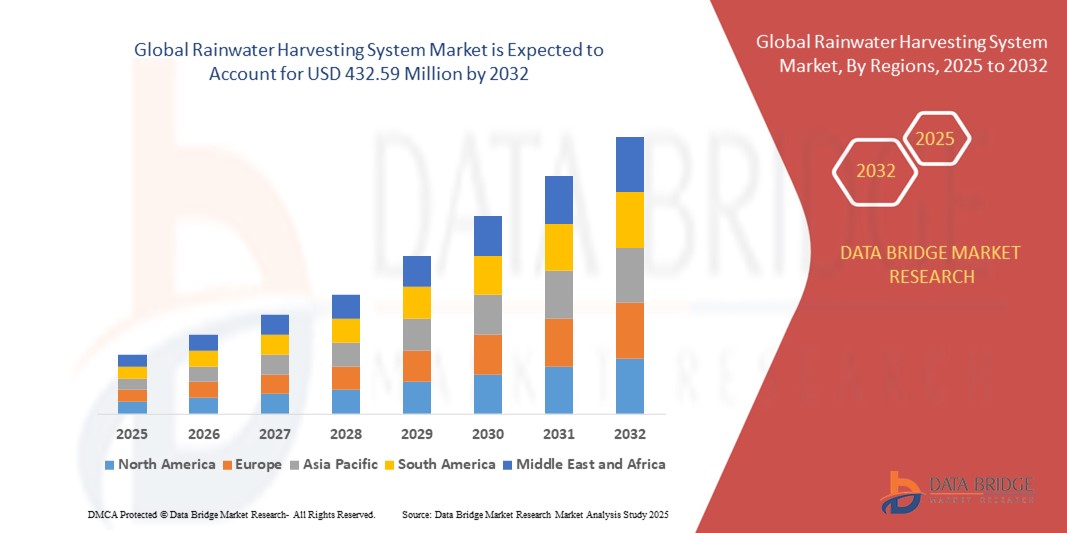

- The global rainwater harvesting system market size was valued at USD 301.87 million in 2024 and is expected to reach USD 432.59 million by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is largely fueled by the increasing concerns over water scarcity and the growing emphasis on sustainable water management practices across residential, commercial, and industrial sectors. Supportive government initiatives and regulatory mandates encouraging water conservation are further driving widespread adoption of rainwater harvesting systems globally

- Furthermore, rising consumer demand for cost-effective, eco-friendly, and decentralized water solutions is positioning rainwater harvesting systems as a practical choice for meeting daily water needs. These converging factors are accelerating deployment across both urban and rural areas, thereby significantly boosting the industry’s growth

Rainwater Harvesting System Market Analysis

- Rainwater harvesting systems are designed to collect, store, and utilize rainwater for various purposes, including irrigation, domestic use, and industrial applications. These systems typically consist of storage tanks, filtration units, and distribution mechanisms, enabling efficient utilization of rainwater and reducing dependency on conventional water supplies

- The escalating demand for rainwater harvesting systems is primarily driven by rising freshwater shortages, increasing urbanization, and growing awareness about sustainable resource utilization. In addition, supportive subsidies and incentives provided by governments are encouraging greater adoption among households, industries, and agricultural users, thereby propelling market expansion

- North America dominated the rainwater harvesting system market with a share of 40.01% in 2024, due to rising concerns about water scarcity and a strong emphasis on sustainable water management solutions

- Asia-Pacific is expected to be the fastest growing region in the rainwater harvesting system market during the forecast period due to rapid urbanization, population growth, and rising water scarcity across countries such as China, India, and Japan

- Tanks segment dominated the market with a market share of 52.9% in 2024, due to their critical role as the primary storage component in rainwater harvesting infrastructure. High demand arises from their use across residential, commercial, and agricultural applications, ensuring efficient storage of collected rainwater for later use. The growing emphasis on water conservation in urban and semi-urban regions, along with technological advancements in tank materials such as reinforced plastics and concrete, further strengthens their adoption. Moreover, tanks are increasingly integrated with filtration and purification systems, making them central to ensuring clean and safe water supply

Report Scope and Rainwater Harvesting System Market Segmentation

|

Attributes |

Rainwater Harvesting System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rainwater Harvesting System Market Trends

Increasing Water Scarcity

- The rise in global water scarcity is strongly motivating households, industries, and municipalities to adopt rainwater harvesting systems for meeting supplementary freshwater needs. These systems reduce dependency on conventional municipal supplies while promoting conservation and resilience against drought conditions

- For instance, Kingspan Environmental has expanded its product offerings with advanced rainwater harvesting systems that store and filter rainwater for agricultural, residential, and commercial use. Their solutions are increasingly adopted across regions experiencing noticeable water stress conditions

- Urbanization trends coupled with rapid population growth are pushing civic authorities to integrate rainwater harvesting into building codes and infrastructure. In many smart city projects, municipal planners are mandating such systems as part of sustainable building regulations, making them a mainstream practice

- In addition, growing interest in decentralized water reuse solutions is fueling adoption of rainwater harvesting in households and industries. By utilizing rainwater directly at the source, these systems reduce strain on municipal infrastructure and deliver cost-efficient alternatives to centralized water facilities

- The agricultural sector is also embracing rainwater harvesting to reduce reliance on irregular rainfall and erratic water supplies. By capturing and storing water, farmers can maintain irrigation for crops during dry spells, ensuring higher productivity and reducing climate vulnerability

- Collectively, these dynamics emphasize the pivotal role of rainwater harvesting systems in tackling water shortages. As global freshwater demand rises and climate change further stresses traditional resources, the contribution of rainwater harvesting to long-term water security is becoming indispensable

Rainwater Harvesting System Market Dynamics

Driver

Growing Emphasis on Sustainable Water Management

- Increasing awareness about sustainable water utilization practices is driving adoption of rainwater harvesting systems across residential, agricultural, and industrial sectors. Governments and organizations are advocating these systems as crucial solutions to support water conservation agendas

- For instance, companies such as Watts Water Technologies are developing integrated rainwater harvesting solutions that address both residential and commercial needs. Their systems provide filtration, storage, and reuse capabilities, representing practical measures that advance sustainability goals

- Rising demand for green building certifications such as LEED has created strong incentives for rainwater harvesting implementation. Developers are incorporating these systems into building projects to secure sustainability credentials while delivering long-term water savings and operational cost reductions

- In addition, corporate entities and industries are prioritizing water responsibility initiatives as part of ESG frameworks. Adoption of rainwater harvesting aligns with sustainability reporting metrics and helps businesses demonstrate measurable progress in resource conservation to stakeholders

- The prominence of sustainable practices in addressing water scarcity reflects the momentum behind rainwater harvesting. As regulatory frameworks, consumer awareness, and corporate responsibility converge, these systems are expected to become standard infrastructure for water management in both developed and developing regions

Restraint/Challenge

High Installation Expenses

- High upfront costs associated with rainwater harvesting systems remain a barrier for widespread adoption, especially in developing economies. Expenses related to storage tanks, filtration equipment, and plumbing configurations increase the financial burden for residential and small business users

- For instance, leading manufacturers such as CST Industries face challenges when offering industrial rainwater storage solutions because of their higher capital requirements. Many potential customers hesitate to invest despite long-term cost savings due to the elevated initial expenditure

- The limited access to financing solutions exacerbates the issue, as households and smaller organizations often lack subsidies or credit to cover these costs. This financial gap reduces the adoption rate even in regions where water conservation initiatives are critical

- In addition, the perception of long payback periods deters investments in large-scale systems. Uncertainty about immediate benefits compared to initial expenses discourages many stakeholders from taking advantage of these sustainable systems, especially in areas with inconsistent rainfall

- Resolving this challenge requires innovative financing models, broader government subsidies, and cost-effective product innovations. Lowering installation costs and improving accessibility will be crucial for ensuring higher adoption of rainwater harvesting systems in both urban and rural regions

Rainwater Harvesting System Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the rainwater harvesting system market is segmented into tanks, accessories, and services. The tanks segment dominated the largest market revenue share of 52.9% in 2024, driven by their critical role as the primary storage component in rainwater harvesting infrastructure. High demand arises from their use across residential, commercial, and agricultural applications, ensuring efficient storage of collected rainwater for later use. The growing emphasis on water conservation in urban and semi-urban regions, along with technological advancements in tank materials such as reinforced plastics and concrete, further strengthens their adoption. Moreover, tanks are increasingly integrated with filtration and purification systems, making them central to ensuring clean and safe water supply.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for installation, maintenance, and system optimization services. With increasing adoption of rainwater harvesting across diverse sectors, the requirement for skilled professionals to design customized systems is expanding significantly. The growth of smart water management solutions and digital monitoring platforms also enhances the scope of services. In addition, governments and municipalities offering incentives for system deployment are boosting service-based demand, as households and businesses seek expert assistance for regulatory compliance and operational efficiency.

- By Application

On the basis of application, the rainwater harvesting system market is segmented into commercial, residential, industrial, and agricultural. The residential segment held the largest market revenue share in 2024, driven by increasing awareness of water scarcity and rising adoption of cost-effective water conservation practices among households. Urban housing projects and smart home initiatives often integrate rainwater harvesting systems to reduce reliance on municipal water supply. Rising construction activities in both developed and developing regions further contribute to the segment’s dominance. In addition, the ability of residential systems to support both potable and non-potable needs such as gardening, cleaning, and flushing enhances their market demand.

The agricultural segment is expected to register the fastest CAGR from 2025 to 2032, propelled by the growing need for sustainable irrigation solutions amid increasing climate variability. Rainwater harvesting in agriculture reduces dependency on groundwater and surface water resources while providing a reliable water source during dry spells. Farmers and agribusinesses are increasingly adopting such systems to improve crop yields and minimize risks associated with water shortages. Supportive government subsidies, awareness programs, and the integration of modern storage and distribution technologies are further accelerating adoption in this sector.

Rainwater Harvesting System Market Regional Analysis

- North America dominated the rainwater harvesting system market with the largest revenue share of 40.01% in 2024, driven by rising concerns about water scarcity and a strong emphasis on sustainable water management solutions

- Increasing regulatory initiatives encouraging water conservation, coupled with growing adoption of eco-friendly building practices, have accelerated market growth in the region

- Consumers and businesses alike are prioritizing rainwater harvesting systems to reduce dependency on municipal water supplies and manage costs effectively. This adoption is further supported by high awareness levels, favorable government policies, and advanced infrastructure enabling efficient deployment of rainwater storage and distribution systems

U.S. Rainwater Harvesting System Market Insight

The U.S. rainwater harvesting system market captured the largest revenue share in 2024 within North America, fueled by the country’s rising demand for sustainable water solutions across residential, agricultural, and industrial sectors. Increasing water stress in arid states, coupled with government-led incentives for conservation systems, has propelled adoption. The market is also benefiting from integration with smart water management technologies that allow monitoring and optimization of stored water. The trend of green building certifications such as LEED further supports rainwater harvesting adoption, making the U.S. a leader in both technological innovation and large-scale implementation.

Europe Rainwater Harvesting System Market Insight

The Europe rainwater harvesting system market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent environmental regulations and increasing demand for water conservation in urban and rural areas. The region is witnessing rapid adoption across residential and commercial buildings, aided by government subsidies and incentives for sustainable construction practices. European consumers are increasingly motivated by the need to reduce water bills, achieve energy efficiency, and comply with regulatory standards. Renovation of older infrastructure and integration of advanced storage tanks and filtration systems are also fueling regional growth.

U.K. Rainwater Harvesting System Market Insight

The U.K. rainwater harvesting system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by mounting water scarcity concerns and the government’s strong focus on sustainable development. Rising adoption in residential housing projects, as well as in commercial facilities such as schools, offices, and hospitals, is expanding market presence. Supportive regulations that encourage rainwater utilization for non-potable purposes, such as toilet flushing and irrigation, are further driving demand. The country’s growing emphasis on climate resilience and cost-efficient water solutions will continue to support market expansion.

Germany Rainwater Harvesting System Market Insight

The Germany rainwater harvesting system market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing consumer awareness about water sustainability and eco-conscious practices. Germany’s advanced infrastructure and focus on innovative, green building technologies make it a key adopter of rainwater harvesting systems. Residential and commercial adoption is being accelerated by strong support from environmental initiatives and policies that promote reduced reliance on public water supply. The integration of automated monitoring systems and efficient storage solutions is further aligning with Germany’s sustainability goals.

Asia-Pacific Rainwater Harvesting System Market Insight

The Asia-Pacific rainwater harvesting system market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, population growth, and rising water scarcity across countries such as China, India, and Japan. Government-led initiatives supporting sustainable water use and infrastructure development are playing a pivotal role in promoting adoption. The agricultural sector is a major contributor, as farmers turn to rainwater harvesting to secure irrigation needs amid fluctuating rainfall patterns. Increasing construction activity and rising awareness of water-efficient practices are further propelling growth in the region.

Japan Rainwater Harvesting System Market Insight

The Japan rainwater harvesting system market is gaining momentum due to the country’s emphasis on sustainable urban development and efficient water utilization. Growing urban density and limited freshwater resources are driving widespread adoption across residential complexes, commercial establishments, and public infrastructure. Technological innovations in compact storage tanks and automated water treatment systems are strengthening market appeal. In addition, government programs encouraging resilience against natural disasters and water shortages are boosting demand for reliable rainwater harvesting solutions.

China Rainwater Harvesting System Market Insight

The China rainwater harvesting system market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, large-scale infrastructure projects, and government-led sustainability mandates. As one of the world’s most water-stressed countries, China has prioritized rainwater harvesting in both residential and industrial sectors. Strong domestic manufacturing capacity ensures cost-effective availability of tanks, accessories, and services, driving widespread adoption. The nation’s smart city initiatives and large agricultural base further accelerate market growth, making China the leading contributor to the Asia-Pacific market.

Rainwater Harvesting System Market Share

The rainwater harvesting system industry is primarily led by well-established companies, including:

- Rain Harvest Systems (U.S.)

- Aqua Harvest (Australia)

- Waterbox (South Africa)

- Eco-Rainwater Solution (Canada)

- Rainwater Management Solutions. (U.S.)

- Greenscape (Ireland)

- Stormsaver Ltd (U.K.)

- HarvestH2o (U.S.)

- Aquascape (U.S.)

- Innovative Water Solutions LLC. (Australia)

Latest Developments in Global Rainwater Harvesting System Market

- In November 2024, the Indian government expanded the National Water Mission with a dedicated focus on rainwater harvesting and water conservation. This initiative is expected to accelerate the adoption of rainwater harvesting systems across rural and semi-urban areas by providing financial incentives and technical assistance. The program strengthens policy-level support, creating a favorable ecosystem for manufacturers and service providers in the rainwater harvesting market while also addressing India’s urgent water scarcity issues

- In July 2024, Veolia Water Technologies entered into a strategic partnership with Coca-Cola to deploy rainwater harvesting systems across multiple manufacturing plants in India. This collaboration reduces the companies’ overall water footprint and also sets a precedent for large-scale industrial adoption of rainwater harvesting solutions. By showcasing the scalability and effectiveness of these systems in industrial applications, this initiative is expected to encourage further uptake among global corporations seeking sustainable water management practices

- In February 2023, Bluewater launched its new HydroFill rainwater harvesting system targeted at residential consumers. Featuring a compact and easy-to-install design, HydroFill expands accessibility for homeowners looking to adopt sustainable water solutions without requiring complex infrastructure. This launch is poised to strengthen the residential market segment by meeting consumer demand for cost-effective, user-friendly systems while also fostering broader awareness of water conservation at the household level

- In March 2021, Watts Water Technologies Inc., in collaboration with the Planet Water Foundation, played a pivotal role in developing an inclusive water system in a Vietnamese city to ensure access to potable water. This initiative highlights the company’s commitment to corporate social responsibility while also demonstrating the role of rainwater harvesting technologies in humanitarian and community-level applications. The project underscores how rainwater harvesting can be effectively deployed in regions facing critical water challenges, potentially inspiring similar initiatives worldwide

- In August 2020, Kingspan’s Rokietnica plant in Poland completed the installation of a 20,000-liter rainwater collection tank, marking a significant step toward sustainable water management. The company’s long-term goal of collecting 100 million liters of rainwater by 2030 showcases its dedication to reducing reliance on freshwater sources. This initiative demonstrates industrial leadership in sustainability and signals how manufacturing facilities can integrate rainwater harvesting as part of broader environmental strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rainwater Harvesting System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rainwater Harvesting System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rainwater Harvesting System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.