Global Rapid Degradation Drug Delivery Films Market

Market Size in USD Billion

CAGR :

%

USD

7.50 Billion

USD

12.93 Billion

2024

2032

USD

7.50 Billion

USD

12.93 Billion

2024

2032

| 2025 –2032 | |

| USD 7.50 Billion | |

| USD 12.93 Billion | |

|

|

|

|

Rapid-Degradation Drug Delivery Films Market Size

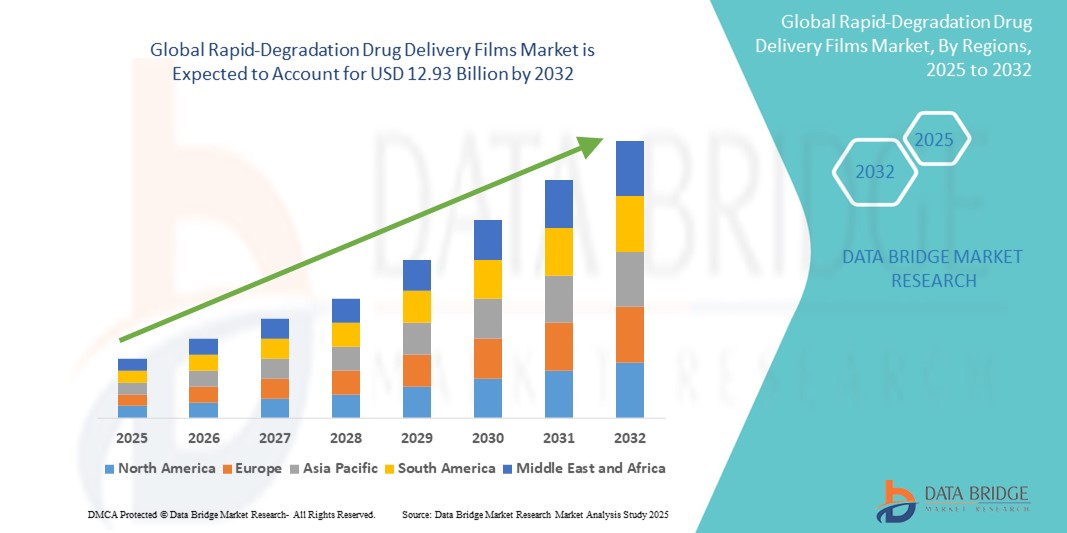

- The global rapid-degradation drug delivery Films market size was valued at USD 7.50 billion in 2024 and is expected to reach USD 12.93 billion by 2032, at a CAGR of 7.04% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in drug delivery systems, particularly within the pharmaceutical and healthcare sectors, leading to enhanced patient compliance and faster therapeutic action in both hospital and home care settings

- Furthermore, rising consumer and healthcare provider demand for convenient, non-invasive, and fast-acting medication solutions is establishing rapid-degradation drug delivery films as a preferred alternative to traditional oral dosage forms. These converging factors are accelerating the uptake of rapid-degradation drug delivery Films solutions, thereby significantly boosting the industry's growth

Rapid-Degradation Drug Delivery Films Market Analysis

- Rapid-Degradation drug delivery films, offering quick-dissolving and non-invasive drug administration, are increasingly vital components of modern drug delivery systems in both clinical and homecare settings due to their enhanced patient compliance, faster onset of action, and ease of use without water or swallowing

- The escalating demand for these films is primarily fueled by the growing geriatric and pediatric populations, rising prevalence of chronic and acute conditions, and a strong preference among patients and caregivers for pain-free, easy-to-administer therapeutic solutions

- North America dominated the rapid-degradation drug delivery films market with the largest revenue share of 38.7% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative drug delivery systems, and a strong presence of key pharmaceutical and biotech players. The U.S. experienced substantial growth in product adoption, particularly in outpatient and homecare applications, driven by technological innovations in film formulations and demand for fast-acting therapies

- Asia-Pacific is expected to be the fastest-growing region in the rapid-degradation drug delivery films market during the forecast period, with a projected CAGR of 9.9% from 2025 to 2032, fueled by increasing urbanization, rising healthcare expenditure, and expanding access to affordable and advanced drug delivery options across countries like China, India, and Japan

- The oral films segment dominated the rapid-degradation drug delivery films market with a market revenue share of 46.8% in 2024, owing to their wide acceptance across multiple therapeutic areas such as pain relief, allergy, and antiemetics. Their ease of administration, rapid onset of action, and high patient compliance make them a preferred choice in both pediatric and geriatric populations

Report Scope and Rapid-Degradation Drug Delivery Films Market Segmentation

|

Attributes |

Rapid-Degradation Drug Delivery Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rapid-Degradation Drug Delivery Films Market Trends

“Advancing Innovation in Fast-Acting, Patient-Centric Therapies”

- A significant and accelerating trend in the global rapid-degradation drug delivery films market is the focus on enhancing patient convenience and adherence through innovative, fast-acting, and non-invasive therapeutic formats. These films are becoming increasingly popular for their ability to deliver precise doses without the need for water or swallowing—critical advantages for pediatric, geriatric, and dysphagic patients

- For instance, in 2024, several pharmaceutical companies launched orally dissolvable films (ODFs) targeting pain relief, allergy management, and antiemetic applications, where speed of action and patient comfort are key. These launches aim to replace traditional solid or liquid dosage forms with thin films that dissolve rapidly upon contact with saliva

- Ongoing formulation advancements now enable rapid-degradation films to carry complex molecules such as cannabinoids, hormones, and nutraceuticals, expanding their application across chronic and acute conditions. These films offer quick absorption through the oral mucosa, bypassing the gastrointestinal tract and providing faster therapeutic effects

- The integration of digital health platforms and personalized dosing systems is further driving the market forward. Companies are exploring patient-specific film dosages in clinical trials to improve treatment precision, particularly in behavioral health and pain management

- This trend towards highly efficient, portable, and user-friendly drug delivery systems is reshaping expectations within the pharmaceutical industry. Manufacturers are investing in smart packaging, moisture-resistant storage solutions, and scalable production technologies to meet growing global demand

- The demand for rapid-degradation films continues to grow across therapeutic categories and geographies, as both healthcare providers and patients increasingly prioritize ease of administration, compliance, and rapid onset of action in modern medication delivery

Rapid-Degradation Drug Delivery Films Market Dynamics

Driver

“Growing Need Due to Rising Demand for Patient-Friendly Drug Delivery and Faster Therapeutic Response”

- The increasing prevalence of chronic diseases and acute conditions, coupled with the accelerating demand for patient-centric and non-invasive drug delivery methods, is a significant driver for the heightened demand for rapid-degradation drug delivery films

- For instance, in April 2024, ZIM Laboratories announced advancements in thin film formulations aimed at improving bioavailability and rapid symptom relief across therapeutic categories including pain management, antiemetics, and CNS disorders. Such innovations by key industry players are expected to drive the rapid-degradation drug delivery films industry growth during the forecast period

- As patients, caregivers, and healthcare providers become more aware of the limitations of traditional tablets and injectables—particularly among pediatric, geriatric, and dysphagic populations—rapid-degradation films offer a compelling alternative with faster onset of action, no need for water, and improved ease of use

- Furthermore, the growing popularity of outpatient care, self-medication, and home-based treatment is making rapid-degradation films an integral part of evolving pharmaceutical delivery strategies, offering seamless integration with mobile health initiatives and patient engagement tools

- The convenience of discreet administration, ease of carrying and storage, and the ability to incorporate a wide range of APIs—including cannabinoids, antihistamines, and pain relievers—are key factors propelling adoption in both developed and emerging healthcare systems. The trend toward personalized medicine and on-the-go treatment options further contributes to market growth

Restraint/Challenge

“Concerns Regarding Drug Loading Capacity and Manufacturing Costs”

- Concerns surrounding the limited drug loading capacity of rapid-degradation films pose a significant challenge to broader adoption, particularly for therapeutic applications requiring higher dosages or complex combination regimens. This limitation restricts the use of these films to low-dose, highly potent APIs

- For instance, pharmaceutical developers have reported formulation challenges in delivering hormones, antibiotics, or extended-release drugs through thin film platforms without compromising stability or efficacy

- Addressing these concerns through advanced polymer technologies, nanocarrier integration, and precision dosing systems will be critical for expanding the application range. Companies like IntelGenx and Aquestive Therapeutics are investing in research to enhance film durability, API stability, and controlled-release profiles

- In addition, the relatively high initial cost of development and manufacturing of rapid-degradation drug delivery films—compared to traditional tablets or capsules—can act as a barrier, particularly for generic manufacturers or cost-sensitive markets. Specialized equipment, rigorous quality control, and regulatory compliance add to production expenses

- While economies of scale and technology adoption are gradually reducing costs, the perception of these products as premium formulations may hinder widespread integration, especially in underfunded healthcare systems

- Overcoming these challenges through continued R&D, strategic collaborations, and the development of cost-efficient manufacturing platforms will be vital for sustaining market growth and ensuring equitable access to innovative drug delivery solutions

Rapid-Degradation Drug Delivery Films Market Scope

The market is segmented on the basis of type, mechanism, end user, and distribution channel.

- By Type

On the basis of type, the rapid-degradation drug delivery films market is segmented into oral films, buccal films, sublingual films, and others. The oral films segment dominated the largest market revenue share of 46.8% in 2024, owing to their wide acceptance across multiple therapeutic areas such as pain relief, allergy, and antiemetics. Their ease of administration, rapid onset of action, and high patient compliance make them a preferred choice in both pediatric and geriatric populations.

The sublingual films segment is expected to witness the fastest growth at a CAGR of 20.9% from 2025 to 2032, driven by increasing demand for rapid systemic delivery and higher bioavailability by bypassing the gastrointestinal tract. Sublingual films are gaining traction in CNS disorders, cardiovascular conditions, and breakthrough pain management.

- By Mechanism

On the basis of mechanism, the rapid-degradation drug delivery films market is segmented into polymer-based degradation, enzyme-based degradation, and ph-sensitive degradation. The polymer-based degradation segment held the largest revenue share in 2024, accounting for 52.3%, due to its scalability, versatility in drug loading, and suitability for a wide range of APIs. This method supports controlled disintegration within seconds upon contact with saliva.

The Enzyme-Based Degradation segment is projected to witness the fastest CAGR of 19.6% from 2025 to 2032, owing to its precision targeting, application in site-specific drug release, and increasing use in biologics and sensitive formulations.

- By End User

On the basis of end user, the rapid-degradation drug delivery films market is segmented into hospitals, homecare settings, clinics, research & academic institutes, and others. The hospitals segment accounted for the largest market revenue share of 49.5% in 2024, driven by rising use of rapid-degradation films for pre- and post-operative care, pain relief, and emergency drug delivery. Hospitals prefer these films for their ease of administration and fast therapeutic response.

The homecare settings segment is expected to grow at the highest CAGR of 21.4% from 2025 to 2032, fueled by the global shift toward patient-managed care, especially for chronic conditions and palliative treatments.

- By Distribution Channel

On the basis of distribution channel, the rapid-degradation drug delivery films market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share of 45.7% in 2024, supported by institutional use in hospitals for acute care, cancer support therapies, and pediatric medications.

The online pharmacies segment is projected to grow at the fastest CAGR of 22.8% from 2025 to 2032, due to increased digital health adoption, telemedicine expansion, and consumer preference for doorstep delivery of specialty medications like rapid-degradation films.

Rapid-Degradation Drug Delivery Films Market Regional Analysis

- North America dominated the rapid-degradation drug delivery films market with the largest revenue share of 38.7% in 2024, driven by strong demand for patient-friendly drug delivery formats, rising prevalence of chronic diseases, and a well-established pharmaceutical infrastructure

- The region’s pharmaceutical companies are increasingly adopting innovative thin-film technologies to improve patient compliance, especially for pediatric and geriatric populations

- This growth is further supported by significant R&D investments, presence of leading market players, and FDA-approved product launches that encourage rapid integration into mainstream treatment protocols

U.S. Rapid-Degradation Drug Delivery Films Market Insight

The U.S. rapid-degradation drug delivery films market captured the largest revenue share of 71% in 2024 within North America, fueled by the country's advanced drug delivery landscape and growing preference for alternatives to traditional oral solid dosage forms. U.S. patients and healthcare providers are increasingly favoring rapid-degradation films for their ease of administration, fast onset of action, and minimal swallowing difficulty. In addition, the rise in telehealth and home-based care is encouraging the development of self-administered treatment solutions, further propelling the demand for these films across therapeutic areas like pain relief, nausea, and CNS disorders.

Europe Rapid-Degradation Drug Delivery Films Market Insight

The Europe rapid-degradation drug delivery films market is projected to expand at a substantial CAGR during the forecast period, primarily driven by the shift towards non-invasive and patient-centric drug delivery systems. Stringent regulatory focus on improving medication adherence and reducing hospitalization rates supports the adoption of innovative dosage forms such as dissolvable films. The region is experiencing strong growth across clinical and consumer healthcare segments, especially in countries like Germany, France, and the U.K., where demand for pediatric and elderly-friendly medications is high.

U.K. Rapid-Degradation Drug Delivery Films Market Insight

The U.K. rapid-degradation drug delivery films market is expected to grow at a noteworthy CAGR, driven by increasing healthcare awareness, a growing aging population, and rising acceptance of advanced drug delivery formats. With rising demand for rapid relief solutions in conditions such as migraines and nausea, pharmaceutical companies are exploring thin-film options as an effective alternative to tablets and injections. The U.K.'s favorable regulatory landscape for novel formulations is further expected to boost clinical adoption and consumer preference for oral and sublingual film technologies.

Germany Rapid-Degradation Drug Delivery Films Market Insight

The Germany rapid-degradation drug delivery films market is expected to expand at a considerable CAGR, supported by the country’s robust pharmaceutical sector, research-oriented approach, and preference for sustainable and efficient healthcare solutions. Consumers and healthcare providers are showing strong interest in eco-friendly packaging and film-based drug delivery that reduces pill burden. Increased use of thin films in hospitals and outpatient settings for conditions such as pain, vomiting, and allergies contributes significantly to market growth.

Asia-Pacific Rapid-Degradation Drug Delivery Films Market Insight

The Asia-Pacific rapid-degradation drug delivery Films market is poised to grow at the fastest CAGR of 9.9% during the forecast period of 2025 to 2032, driven by increasing urbanization, growing healthcare access, and rising investment in drug formulation technologies. Government support for localized manufacturing, along with a rapidly expanding middle class, is making these advanced therapies more accessible in countries like India, China, and Japan. The region is becoming a hotspot for clinical trials and pharmaceutical R&D, helping to accelerate the adoption of rapid-degradation film technologies.

Japan Rapid-Degradation Drug Delivery Films Market Insight

The Japan rapid-degradation drug delivery films market is gaining momentum due to a tech-savvy healthcare system, growing elderly population, and high demand for convenience in drug administration. The use of dissolvable films is rising, particularly in treatments for nausea, insomnia, and neurological disorders.Furthermore, innovations in packaging and API stabilization tailored to Japan’s climate are helping pharmaceutical firms gain market traction.

China Rapid-Degradation Drug Delivery Films Market Insight

The China rapid-degradation drug delivery films market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s large patient population, increasing chronic disease burden, and strong domestic manufacturing capabilities. China’s pharmaceutical firms are rapidly scaling up production of buccal and sublingual films for mainstream applications in allergy relief, gastrointestinal conditions, and pediatric care. Government initiatives promoting healthcare innovation and smart drug delivery formats are further accelerating market expansion, especially in urban areas.

Rapid-Degradation Drug Delivery Films Market Share

The rapid-degradation drug delivery films industry is primarily led by well-established companies, including:

- Sanofi (France)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Camurus AB (Sweden)

- Merck & Co., Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- GSK plc. (U.K.)

- Pfizer Inc. (U.S.)

- ZIM LABORATORIES LIMITED (India)

- Indivior PLC (U.S.)

- Aquestive Therapeutics, Inc. (U.S.)

- Cure Pharmaceutical (U.S.)

Latest Developments in Global Rapid-Degradation Drug Delivery Films Market

- In February 2024, CD Formulation announced the launch of its innovative oral thin film (OTF) drug delivery platform designed to enhance the bioavailability and patient compliance of various therapeutics. This novel system enables rapid drug absorption through the oral mucosa, bypassing first-pass metabolism and offering a convenient alternative for populations with swallowing difficulties. The OTF technology is expected to benefit a broad range of pharmaceutical applications, including pain management, CNS disorders, and pediatric care

- In 2023, Acacia Pharma introduced Barhemsys and Amisulpride as primary antiemetics for managing PONV. Barhemsys, an intravenous selective dopamine D2 and D3 receptor antagonist, effectively prevents and treats PONV, gaining regulatory approval in the US and Europe for its high efficacy

- In 2023, Roche developed a patient-controlled analgesia (PCA) system for PONV. This system administers opioids and antiemetics via a pump, significantly reducing PONV incidence and enhancing patient satisfaction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.