Global Rapid Oral Fluid Screening Device Market

Market Size in USD Billion

CAGR :

%

USD

14.13 Billion

USD

44.87 Billion

2025

2033

USD

14.13 Billion

USD

44.87 Billion

2025

2033

| 2026 –2033 | |

| USD 14.13 Billion | |

| USD 44.87 Billion | |

|

|

|

|

Rapid Oral Fluid Screening Device Market Size

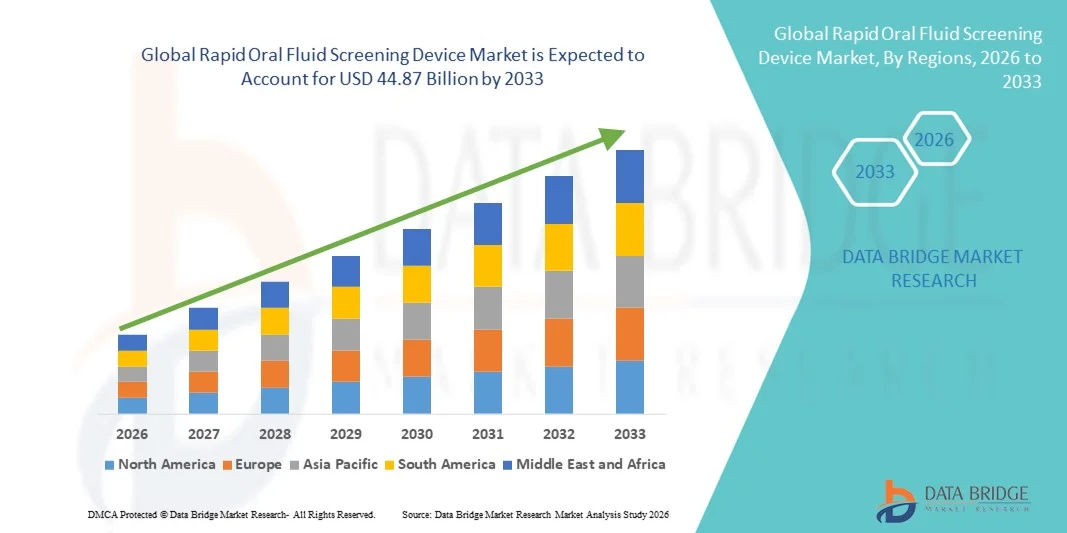

- The global rapid oral fluid screening device market size was valued at USD 14.13 billion in 2025 and is expected to reach USD 44.87 billion by 2033, at a CAGR of 15.54% during the forecast period

- The market growth is largely fueled by the rising adoption of on-site drug testing solutions across workplaces, law enforcement agencies, and roadside screening programs, along with increasing regulatory emphasis on substance abuse monitoring and compliance requirements

- Furthermore, growing demand for non-invasive, fast, and accurate drug detection methods, coupled with technological advancements in portable diagnostic devices, is positioning rapid oral fluid screening devices as a preferred solution for real-time substance detection. These converging factors are accelerating the uptake of rapid oral fluid screening technologies, thereby significantly boosting the industry's growth

Rapid Oral Fluid Screening Device Market Analysis

- Rapid oral fluid screening devices, designed for the quick and non-invasive detection of alcohol and multiple drugs through saliva samples, are increasingly vital tools in criminal justice systems, workplace testing programs, and healthcare settings due to their ease of administration, rapid results, and minimized risk of sample adulteration compared to traditional urine-based methods

- The escalating demand for rapid oral fluid screening devices is primarily fueled by rising substance abuse cases, stricter workplace safety and zero-tolerance policies, expansion of roadside drug testing initiatives, and a growing preference for convenient, real-time screening solutions that enhance compliance and operational efficiency

- North America dominated the rapid oral fluid screening device market with the largest revenue share of 38.76% in 2025, characterized by well-established regulatory frameworks, widespread adoption of workplace and roadside drug testing, and strong presence of leading diagnostic manufacturers, with the U.S. experiencing substantial growth driven by federal transportation safety mandates and increasing criminal justice testing programs

- Asia-Pacific is expected to be the fastest growing region in the rapid oral fluid screening device market during the forecast period due to increasing urbanization, strengthening law enforcement regulations, rising workplace safety awareness, and expanding healthcare and diagnostic infrastructure

- The 5- Panel Saliva Drug Test Kits segment dominated the rapid oral fluid screening device market with a market share of 41.8% in 2025, driven by its ability to simultaneously detect commonly abused substances such as marijuana, cocaine, opioids, amphetamines, and methamphetamine, offering a balanced combination of cost-effectiveness, comprehensive screening capability, and suitability for workplace and criminal justice testing applications

Report Scope and Rapid Oral Fluid Screening Device Market Segmentation

|

Attributes |

Rapid Oral Fluid Screening Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Rapid Oral Fluid Screening Device Market Trends

Growing Adoption of Portable Multi-Panel and Digital-Integrated Testing Solutions

- A significant and accelerating trend in the global rapid oral fluid screening device market is the increasing adoption of portable multi-panel drug test kits integrated with digital readers and cloud-based data management systems. This convergence of rapid diagnostics and digital technologies is significantly enhancing testing efficiency, traceability, and compliance monitoring across workplace and criminal justice settings

- For instance, several manufacturers have introduced multi-panel saliva drug test kits capable of detecting substances such as marijuana, cocaine, opioids, and amphetamines simultaneously, enabling on-site screening with rapid result interpretation through compact digital analyzers

- Digital integration in rapid oral fluid screening devices enables automated result capture, reduced human interpretation errors, secure data storage, and real-time reporting to centralized systems. For instance, certain advanced devices incorporate Bluetooth or USB connectivity to transfer test outcomes directly to compliance management platforms, while built-in digital readers minimize subjective visual interpretation. Furthermore, portable configurations allow authorities and employers to conduct efficient roadside and workplace testing with minimal operational disruption

- The seamless integration of rapid oral fluid screening devices with digital compliance systems and occupational health platforms facilitates centralized monitoring of substance testing programs. Through unified dashboards, organizations can manage employee screening records, analyze testing trends, and ensure adherence to regulatory standards, creating a more structured and accountable testing environment

- This trend toward more accurate, connected, and user-friendly screening solutions is fundamentally reshaping expectations for drug and alcohol testing programs. Consequently, companies are developing advanced saliva-based rapid test kits with enhanced sensitivity, broader drug panels, and improved digital compatibility to meet evolving regulatory and employer requirements

- The demand for rapid oral fluid screening devices offering portability, multi-drug detection, and digital integration is growing rapidly across workplaces, law enforcement agencies, and healthcare institutions, as stakeholders increasingly prioritize efficiency, compliance transparency, and non-invasive testing methodologies

Rapid Oral Fluid Screening Device Market Dynamics

Driver

Rising Substance Abuse Concerns and Expansion of Workplace & Roadside Testing Programs

- The increasing prevalence of substance abuse cases globally, coupled with stricter workplace safety regulations and expanded roadside drug testing initiatives, is a significant driver for the heightened demand for rapid oral fluid screening devices

- For instance, transportation authorities and regulatory agencies in several countries have strengthened impaired-driving enforcement frameworks, promoting the adoption of on-site saliva-based drug screening devices to enhance public safety and regulatory compliance. Such initiatives by governing bodies are expected to drive the rapid oral fluid screening device market growth in the forecast period

- As employers and law enforcement agencies become more vigilant about substance-related risks, rapid oral fluid screening devices offer advantages such as non-invasive collection, shorter detection windows for recent drug use, and reduced opportunities for sample adulteration compared to urine testing

- Furthermore, the growing emphasis on maintaining safe work environments in industries such as transportation, manufacturing, and construction is making oral fluid testing an integral component of occupational health and safety programs, supporting zero-tolerance policies and compliance standards

- The convenience of on-site testing, faster turnaround times, and the ability to screen multiple drugs simultaneously through multi-panel kits are key factors propelling the adoption of rapid oral fluid screening devices across both public and private sectors. The increasing availability of easy-to-administer kits and improved detection sensitivity further contributes to market expansion

Restraint/Challenge

Accuracy Variability and Regulatory Compliance Complexities

- Concerns surrounding the accuracy variability of certain rapid oral fluid screening devices and differences in regulatory approval standards across regions pose a significant challenge to broader market penetration. As screening results may require confirmatory laboratory testing, questions about sensitivity and specificity can create hesitation among end users

- For instance, variations in cutoff levels and regulatory guidelines between countries can complicate device approval and adoption, particularly when manufacturers seek to commercialize products across multiple jurisdictions with differing compliance frameworks

- Addressing these concerns through continuous technological refinement, improved assay sensitivity, and adherence to stringent validation standards is crucial for building user confidence. Companies emphasize performance validation data and regulatory clearances to reassure buyers about reliability and compliance. In addition, the cost of implementing comprehensive testing programs, including device procurement and confirmatory laboratory analysis, can be a barrier for smaller organizations or resource-constrained regions

- While technological advancements are improving reliability and affordability, the need for confirmatory testing and compliance with evolving regulatory standards can still slow procurement decisions, especially in regions with complex legal frameworks governing drug testing practices

- Overcoming these challenges through harmonized regulatory standards, enhanced device accuracy, user training programs, and cost-effective multi-panel solutions will be vital for sustaining long-term growth in the rapid oral fluid screening device market

Rapid Oral Fluid Screening Device Market Scope

The market is segmented on the basis of drug type, product, form, application, and end user.

- By Drug Type

On the basis of drug type, the market is segmented into alcohol, marijuana, opioids, cocaine, amphetamine, methamphetamine, benzodiazepines and others. The marijuana segment dominated the market with the largest revenue share in 2025, driven by increasing legalization in various countries and the corresponding rise in regulatory drug monitoring requirements. As marijuana consumption becomes more widespread, workplace and roadside screening programs are placing greater emphasis on detecting recent cannabis use. Oral fluid testing is particularly effective for identifying recent marijuana intake, making it highly suitable for law enforcement and occupational safety applications. Employers in safety-sensitive industries prioritize marijuana screening to ensure compliance with zero-tolerance policies. In addition, advancements in assay sensitivity have improved detection accuracy for THC in saliva samples. These factors collectively contribute to the segment’s leading market position.

The opioids segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the ongoing global opioid crisis and increasing government initiatives aimed at curbing opioid misuse. Rising cases of prescription opioid dependency and illicit opioid consumption have intensified the need for rapid and on-site screening solutions. Oral fluid devices provide a non-invasive and efficient method for detecting recent opioid exposure, particularly in emergency and forensic settings. Expanding rehabilitation and public health monitoring programs are further driving demand for opioid-specific screening. Regulatory bodies are also encouraging broader opioid testing in workplace and criminal justice systems. These trends are expected to significantly accelerate segment growth over the forecast period.

- By Product

On the basis of product, the market is segmented into 1- Panel, 4- Panel, 5- Panel, 6- Panel, 10- Panel, and 12- Panel Saliva Drug Test Kits. The 5- Panel Saliva Drug Test Kits segment dominated the market in 2025 with a market share of 41.8%, primarily due to its balanced combination of cost-effectiveness and comprehensive drug coverage. These kits typically detect commonly abused substances such as marijuana, cocaine, opioids, amphetamines, and methamphetamine. Employers and law enforcement agencies widely prefer 5-panel kits as they align with standard workplace drug testing requirements. The ability to simultaneously screen multiple substances enhances operational efficiency while maintaining affordability. Their widespread regulatory acceptance further strengthens their market penetration. As a result, 5-panel kits continue to account for the largest revenue contribution.

The 10- Panel Saliva Drug Test Kits segment is projected to be the fastest growing during the forecast period, driven by increasing demand for broader substance detection capabilities. Organizations are expanding their screening scope to include additional drugs such as benzodiazepines and synthetic substances. Multi-panel kits offer greater diagnostic coverage without significantly increasing testing time. Growing concerns about polysubstance abuse are further supporting demand for expanded panels. Law enforcement agencies and forensic laboratories are increasingly adopting 10-panel kits for comprehensive roadside and criminal investigations. This shift toward broader drug detection is expected to propel segment growth.

- By Form

On the basis of form, the market is segmented into cassettes, swabs, and strips. The cassettes segment dominated the market in 2025, owing to its structured design, ease of handling, and integrated result display window. Cassette-based devices are widely preferred in professional settings due to their reduced risk of contamination and clear visual interpretation of results. They are commonly used in workplace and criminal justice testing where standardized procedures are essential. The enclosed format enhances sample integrity and minimizes user error. In addition, cassette designs often support multi-panel configurations, increasing their versatility. These advantages have contributed to their dominant market share.

The swabs segment is expected to witness the fastest growth from 2026 to 2033, supported by their convenience and simplified sample collection process. Swab-based devices allow direct oral sample collection, reducing procedural complexity and saving time. They are particularly suitable for roadside testing and high-volume workplace screening scenarios. The compact and portable design enhances field usability for law enforcement officers. Technological improvements in absorbent materials have increased sample reliability and detection sensitivity. These benefits are anticipated to drive rapid adoption of swab-based screening devices.

- By Application

On the basis of application, the market is segmented into criminal justice testing, workplace testing, and disease testing. The workplace testing segment dominated the market in 2025, driven by stringent occupational safety regulations and zero-tolerance drug policies in safety-sensitive industries. Employers increasingly rely on rapid oral fluid screening devices to ensure workforce productivity and compliance. Industries such as transportation, construction, and manufacturing require routine and random drug screening programs. Oral fluid testing offers non-invasive collection and quick turnaround times, making it practical for on-site testing. The ability to detect recent drug use further enhances its relevance in workplace environments. These factors collectively support the segment’s dominant share.

The criminal justice testing segment is projected to be the fastest growing during the forecast period, fueled by expanding roadside drug testing initiatives and stricter impaired-driving laws. Governments are adopting saliva-based screening devices to enhance traffic safety enforcement. Rapid testing enables law enforcement officers to conduct immediate assessments during traffic stops. Increased investments in public safety infrastructure are further supporting adoption. The growing focus on reducing drug-impaired accidents is accelerating demand within this segment. Consequently, criminal justice testing is expected to register strong growth momentum.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic laboratories, forensic laboratories, private employers, home care settings and others. The private employers segment dominated the market in 2025, attributed to widespread implementation of workplace drug testing policies. Corporations prioritize rapid screening to maintain safety standards and minimize liability risks. Oral fluid testing provides employers with efficient on-site screening capabilities without requiring specialized laboratory infrastructure. Increasing awareness about substance abuse-related productivity losses further drives adoption. Multi-panel kits align with corporate compliance requirements and industry regulations. These dynamics position private employers as the leading end-user segment.

The forensic laboratories segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising criminal investigations and expanded toxicology testing programs. Forensic institutions require accurate and rapid screening tools to complement confirmatory laboratory analysis. Oral fluid devices serve as preliminary screening tools before advanced chromatographic testing. Growing investments in forensic science infrastructure are strengthening segment expansion. In addition, increasing collaboration between law enforcement agencies and forensic labs is boosting procurement of advanced screening kits. These factors are expected to accelerate growth within the forensic laboratories segment.

Rapid Oral Fluid Screening Device Market Regional Analysis

- North America dominated the rapid oral fluid screening device market with the largest revenue share of 38.76% in 2025, characterized by well-established regulatory frameworks, widespread adoption of workplace and roadside drug testing, and strong presence of leading diagnostic manufacturers

- Organizations and regulatory authorities in the region highly value the accuracy, non-invasive collection method, and rapid result capabilities offered by oral fluid screening devices, particularly for detecting recent drug use in workplace and law enforcement settings

- This widespread adoption is further supported by advanced healthcare infrastructure, strong regulatory frameworks, and the presence of leading diagnostic manufacturers, along with increasing emphasis on public safety and occupational health compliance, establishing rapid oral fluid screening devices as a preferred solution across criminal justice, workplace, and healthcare applications

The U.S. Rapid Oral Fluid Screening Device Market Insight

The U.S. rapid oral fluid screening device market captured the largest revenue share within North America in 2025, fueled by stringent workplace drug testing regulations and expanding roadside drug enforcement initiatives. Employers across transportation, construction, and manufacturing sectors are increasingly prioritizing rapid, non-invasive testing solutions to ensure compliance with federal safety mandates. The growing emphasis on combating opioid misuse and impaired driving is further accelerating adoption. Moreover, advancements in portable multi-panel saliva drug test kits and digital reporting integration are significantly contributing to the market's expansion across occupational and criminal justice applications.

Europe Rapid Oral Fluid Screening Device Market Insight

The Europe rapid oral fluid screening device market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict road safety regulations and the escalating need for effective substance abuse monitoring. The increase in workplace compliance requirements, coupled with growing public awareness regarding drug-impaired driving, is fostering the adoption of saliva-based testing devices. European authorities are increasingly incorporating oral fluid screening into roadside enforcement programs. The region is experiencing notable growth across forensic, workplace, and healthcare settings, with rapid testing devices being utilized for both preventive and investigative purposes.

U.K. Rapid Oral Fluid Screening Device Market Insight

The U.K. rapid oral fluid screening device market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by strengthened drug-driving laws and expanded roadside screening capabilities. In addition, workplace safety standards and employer-led substance testing programs are encouraging organizations to adopt rapid saliva-based testing methods. The U.K.’s structured regulatory environment and established forensic infrastructure are expected to continue stimulating market growth. Rising awareness about public safety and substance misuse prevention further supports the adoption of rapid oral fluid screening devices.

Germany Rapid Oral Fluid Screening Device Market Insight

The Germany rapid oral fluid screening device market is expected to expand at a considerable CAGR during the forecast period, fueled by heightened public safety initiatives and increasing enforcement against drug-impaired driving. Germany’s strong healthcare and forensic infrastructure, combined with its emphasis on regulatory compliance, promotes the adoption of advanced screening technologies. Employers in safety-sensitive industries are increasingly implementing saliva-based testing as part of occupational health programs. The integration of reliable, portable screening devices into law enforcement procedures is also becoming more prevalent, aligning with national safety objectives.

Asia-Pacific Rapid Oral Fluid Screening Device Market Insight

The Asia-Pacific rapid oral fluid screening device market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising substance abuse awareness, expanding workplace safety regulations, and increasing government focus on road safety enforcement in countries such as China, Japan, and India. The region's growing healthcare infrastructure and regulatory development are supporting the adoption of non-invasive rapid testing technologies. Furthermore, as Asia-Pacific strengthens its diagnostic manufacturing capabilities, the affordability and accessibility of saliva-based drug testing devices are expanding to a broader institutional user base.

Japan Rapid Oral Fluid Screening Device Market Insight

The Japan rapid oral fluid screening device market is gaining momentum due to the country’s strong regulatory compliance culture, advanced healthcare system, and emphasis on public safety. The Japanese market places significant importance on workplace discipline and traffic law enforcement, driving the adoption of rapid and accurate drug screening technologies. The integration of portable testing devices into occupational health and forensic applications is fueling growth. Moreover, Japan’s focus on technological innovation is supporting the development of more precise and user-friendly saliva-based screening solutions.

India Rapid Oral Fluid Screening Device Market Insight

The India rapid oral fluid screening device market accounted for a significant revenue share in Asia Pacific in 2025, attributed to increasing urbanization, rising workplace safety awareness, and expanding law enforcement initiatives. India represents a rapidly developing market for diagnostic and screening technologies, with saliva-based drug testing gaining traction across corporate and forensic sectors. The push toward improved road safety standards and stricter compliance frameworks is supporting market growth. In addition, the availability of cost-effective multi-panel saliva drug test kits and strengthening domestic healthcare infrastructure are key factors propelling the market in India.

Rapid Oral Fluid Screening Device Market Share

The Rapid Oral Fluid Screening Device industry is primarily led by well-established companies, including:

- OraSure Technologies Inc (U.S.)

- Abbott (U.S.)

- Securetec Detektions-Systeme AG (Germany)

- Premier Biotech, Inc (U.S.)

- AccuBioTech Co., Ltd (China)

- Neogen Corporation (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Omega Laboratories, Inc. (U.S.)

- Intoximeters, Inc. (U.S.)

- Oranoxis Inc. (Canada)

- Guangzhou Wondfo Biotech Co., Ltd. (China)

- Prometheus Bio Inc. (China)

- Nanjing Synthgene Medical Technology Co., Ltd. (China)

- UCP Biosciences, Inc. (U.S.)

- Lin-Zhi International, Inc. (Taiwan)

- MEDACX (U.S.)

What are the Recent Developments in Global Rapid Oral Fluid Screening Device Market?

- In December 2025, New Zealand’s Land Transport (Approved Oral Fluid Screening Device) Notice 2025 officially approved the Securetec DrugWipe® 3 S oral fluid screening device for roadside drug testing under national law, demonstrating government adoption of saliva-based screening for impaired driving enforcement

- In November 2025, nform’s breakthrough oral fluid rapid drug tests were integrated with the Origin One occupational health platform, enabling real-time digital workflows for decentralized workplace and clinic drug screening with improved data capture and traceability

- In October 2025, AccuBioTech launched the Accu-Tell® Multi-Drug Midstream Pro (Saliva) rapid oral fluid drug test offering simultaneous qualitative detection of over 20 common drugs of abuse and metabolites with results in about 10 minutes, enhancing workplace safety, law enforcement, and public health screening capabilities

- In October 2023, the Substance Abuse and Mental Health Services Administration (SAMHSA) updated the Mandatory Guidelines for Federal Workplace Drug Testing Programs to include oral fluid testing procedures and collection criteria, laying groundwork for broader acceptance and standardization of oral fluid screening in federal programs

- In May 2023, the U.S. Department of Transportation finalized a rule to include oral fluid (saliva) drug testing as an authorized method in its regulated workplace drug and alcohol testing program, offering a less invasive alternative to urine testing for safety-sensitive employees, though implementation awaits certified labs

- https://www.federalregister.gov/documents/2023/05/02/2023-08041/procedures-for-transportation-workplace-drug-and-alcohol-testing-programs-addition-of-oral-fluid?ut

- https://policy.disa.com/news/samhsa-updates-mandatory-urine-and-oral-fluid-guidelines?u

- https://www.globenewswire.com/news-release/2025/11/05/3181569/0/en/nform-s-Breakthrough-Oral-Fluid-Rapid-Drug-Tests-Now-Integrated-into-Origin-One-s-Occupational-Health-Platform.html

- https://www.legislation.govt.nz/regulation/public/2025/0246/latest/whole.html

- https://www.accubiotech.com/news-accubiotech-launches-accu-tell-multi-drug-midstream-pro-saliva-a-new-accurate-reliable-and-efficient-rapid-oral-fluid-drug-test.html

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.