Global Swab Market

Market Size in USD Billion

CAGR :

%

USD

3.48 Billion

USD

5.75 Billion

2024

2032

USD

3.48 Billion

USD

5.75 Billion

2024

2032

| 2025 –2032 | |

| USD 3.48 Billion | |

| USD 5.75 Billion | |

|

|

|

|

Swab Market Size

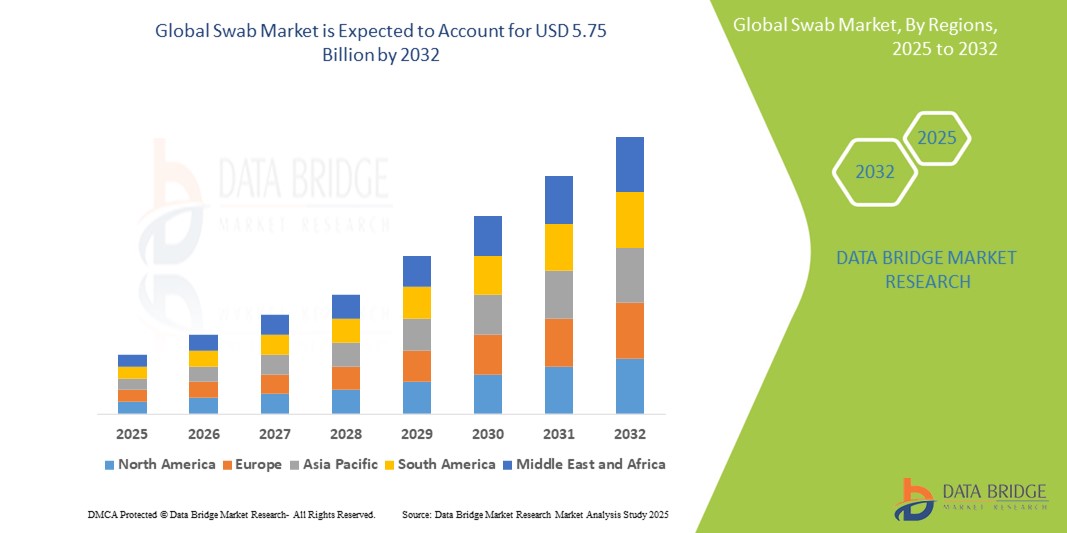

- The global swab market size was valued at USD 3.48 billion in 2024 and is expected to reach USD 5.75 billion by 2032, at a CAGR of 6.48% during the forecast period

- This growth is driven by factors such as the increasing demand for diagnostic testing, particularly in healthcare settings, and the rising need for hygiene and infection control across various industries

Swab Market Analysis

- Swabs are essential medical tools used for specimen collection, cleaning wounds, and applying medication, playing a vital role in diagnostics, hygiene, and infection control across various sectors including healthcare, forensics, and pharmaceuticals

- The demand for swabs is significantly driven by the increasing need for diagnostic testing, especially in the wake of global health concerns, and growing awareness of hygiene practices

- North America is expected to dominate the swabs market with a market share of 31.4%, due to a robust healthcare system, widespread use of diagnostic testing, and strong manufacturing capabilities

- Asia-Pacific is expected to be the fastest growing region in the swab market with a market share of 28.8%, during the forecast period due to increasing healthcare investments, rising demand for diagnostic testing, and expanding public health initiatives

- Cotton Tipped Swabs segment is expected to dominate the market with a market share of 50.5% due to its widespread availability, cost-effectiveness, and versatility across various medical and non-medical applications

Report Scope and Swab Market Segmentation

|

Attributes |

Swab Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Swab Market Trends

“Rising Adoption of Sterile Swabs in Diagnostic and Point-of-Care Testing”

- One prominent trend in the global swab market is the increasing adoption of sterile swabs in diagnostic and point-of-care (POC) testing, particularly driven by the need for rapid, accurate, and safe specimen collection methods

- The use of sterile swabs ensures contamination-free sampling, which is essential in disease detection, especially for infectious conditions such as COVID-19, influenza, and sexually transmitted infections

- For instance, rapid antigen and molecular testing kits widely rely on sterile nasopharyngeal or oropharyngeal swabs, which have become integral to decentralized testing environments such as clinics, pharmacies, and home-based testing

- This trend is transforming diagnostic workflows, enhancing early disease detection, and boosting the demand for high-quality swabs tailored for precision and biosafety across healthcare settings

Swab Market Dynamics

Driver

“Increased Demand for Diagnostic Testing and Infection Control”

- The rising global emphasis on early disease detection and infection prevention is significantly driving demand for medical swabs, particularly in diagnostic and clinical applications

- Swabs are essential tools for collecting samples for various tests, including respiratory, genetic, and microbiological analysis, especially in light of recent public health emergencies such as the COVID-19 pandemic

- Growing awareness about hygiene, rising healthcare expenditures, and the need for accurate specimen collection in decentralized and hospital-based testing environments are fueling this demand

For instance,

- In 2022, the World Health Organization (WHO) emphasized the importance of diagnostic preparedness and the global expansion of laboratory testing infrastructure to combat emerging infectious diseases, directly contributing to increased swab usage across healthcare systems

- As diagnostic testing becomes more integral to preventive healthcare and public safety, the global swab market continues to expand, supported by innovation in swab materials and compatibility with various testing technologies

Opportunity

“Expansion of Swab Applications in Molecular Diagnostics and At-Home Testing”

- The growing adoption of swabs in molecular diagnostics, including PCR and rapid antigen testing, presents a significant opportunity for market expansion, particularly in point-of-care and at-home testing segment

- Swabs are increasingly being integrated into user-friendly testing kits designed for self-collection, enabling patients to collect samples conveniently without the need for healthcare professionals, thus expanding access to diagnostics in remote and underserved areas

- Moreover, swabs compatible with next-generation sequencing and genetic testing are gaining traction in research and clinical laboratories, offering new avenues for market growth

For instance,

- In 2024, a report by the U.S. FDA noted a sharp rise in Emergency Use Authorizations (EUAs) for at-home COVID-19 and flu testing kits using nasal and saliva swabs, highlighting a shift in consumer behavior toward decentralized and accessible diagnostics

- This growing demand for swabs tailored for molecular and home-use applications provides a substantial growth opportunity for manufacturers, especially those investing in sterile, high-absorbency, and user-friendly swab technologies

Restraint/Challenge

“Fluctuating Raw Material Availability and Quality Control Issues”

- The global swab market faces challenges due to fluctuations in the availability and cost of raw materials such as medical-grade cotton, foam, and synthetic fibers, which are critical for swab production

- Variations in material quality and supply chain disruptions—especially during public health emergencies—can impact production consistency and lead to delays in meeting large-scale demand

- Ensuring sterility and adherence to regulatory standards adds further complexity, particularly for manufacturers in low-cost regions, where quality control may be compromised due to limited infrastructure or oversight

For instance,

- In 2020–2021, during the COVID-19 pandemic, the U.S. FDA reported shortages and quality concerns related to imported swabs, prompting stricter regulations and inspections to ensure compliance with medical device standard

- Such challenges in material sourcing and manufacturing quality not only affect production capacity but also pose a risk to patient safety, thus restraining the growth potential of the swab market in price-sensitive and resource-constrained regions

Swab Market Scope

The market is segmented on the basis of product, shaft, test type, type covers, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Shaft |

|

|

By Test Type |

|

|

By Test Covers |

|

|

By Application |

|

|

By End users |

|

In 2025, cotton tipped swabs is projected to dominate the market with a largest share in type covers segment

The cotton tipped swabs segment is expected to dominate the swab market with the largest share of 50.5% in 2025 due to its widespread availability, cost-effectiveness, and versatility across various medical and non-medical applications. These swabs are commonly used in specimen collection, wound cleaning, and personal hygiene. Their compatibility with a variety of substances and easy disposability further enhances their market appeal

The specimen collection is expected to account for the largest share during the forecast period in application market

In 2025, the specimen collection segment is expected to dominate the market with the largest market share of 49.9% due to the rising demand for diagnostic testing, particularly for infectious diseases and genetic analysis. Increased global health awareness, expansion of laboratory services, and advancements in testing technologies are fueling this growth. The segment benefits from widespread use in hospitals, clinics, and research laboratories

Swab Market Regional Analysis

“North America Holds the Largest Share in the Swab Market”

- North America dominates the swab market with a market share of estimated 31.4%, driven, by a robust healthcare system, widespread use of diagnostic testing, and strong manufacturing capabilities

- U.S. holds a market share of 14.4%, due to high testing rates in clinical and point-of-care settings, coupled with consistent demand from hospitals, laboratories, and home healthcare sectors

- The presence of major swab manufacturers, frequent technological advancements, and favorable government policies supporting disease prevention and testing are key contributors to regional market leadership

- In addition, the rising number of infectious disease outbreaks and continuous innovation in diagnostic kits are further strengthening North America’s dominance in the swab market

“Asia-Pacific is Projected to Register the Highest CAGR in the Swab Market”

- Asia-Pacific is expected to witness the highest growth rate in the swab market with a market share of 28.8%, driven by increasing healthcare investments, rising demand for diagnostic testing, and expanding public health initiatives

- Countries such as India, China, and Japan are at the forefront due to their large populations, growing awareness of infection control, and government-driven healthcare reforms

- Japan, known for its technological advancements and stringent quality standards, continues to be a major contributor to the premium segment of the swab market, particularly in clinical diagnostics and research applications.

- India is projected to register the highest CAGR of 7.5% in the swab market, driven by a surge in laboratory testing, expanding diagnostic networks, and a strong push toward self-testing kits in urban and semi-urban areas

Swab Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cardinal Health. (U.S.)

- B. Braun SE (Germany)

- Puritan Medical Products (U.S.)

- SARSTEDT AG & Co. KG (Germany)

- Medical Wire & Equipment (U.K.)

- FL MEDICAL s.r.l (Italy)

- Clean Cross Co.,LTD. (Japan)

- Neogen Corporation (U.S.)

- Citotest Labware Manufacturing Co., Ltd. (China)

- Unilever (U.K.)

- GPC Medical Ltd. (India)

- Copan Diagnostics Inc. (Italy)

- AdvoCare Pharma (U.S.)

- Strema S.r.l. (Italy)

- Blue Manufacturing Co. (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Sirchie (U.S.)

- Groupe Lemoine (France)

Latest Developments in Global Swab Market

- In February 2023, 3M announced plans to upgrade its swab production capacity to meet the rising demand for COVID-19 testing. This expansion aimed to support global healthcare needs by ensuring a steady supply of essential diagnostic tools

- In December 2023, Kimberly-Clark launched a new line of eco-friendly cotton swabs made from 100% recycled paper. This initiative reflects the company's commitment to sustainability and reducing environmental impact

- In February 2022, Rhinostics partnered with Nexus Medical Laboratories to launch rapid, cost-effective swab sample processing solutions. The collaboration aimed to enhance telehealth services by improving swab-based laboratory testing efficiencies and turnaround times

- In May 2022, Nexus Medical Labs received approval from USFDA for Emergency Use Authorization for SARS-CoV-2 Testing Using the RHINOstic Automated Nasal Swab collection device. RHINOstic Automated Swab collection device comes with a unique swab head design and active cap that helps with accessioning, de-capping, elution, and preparation of the assay plate for polymerase chain reaction (PCR), next-generation sequencing (NGS), or protein-based testing workflows hands-free with the help of robotics arm.

- In March 2021, Roche Diagnostics launched a rapid antigen nasal test in U.K. The latest addition to Roche’s COVID-19 portfolio is a test to support the healthcare systems in diagnosing COVID infection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.