Global Rapid Test Market

Market Size in USD Billion

CAGR :

%

USD

40.75 Billion

USD

77.63 Billion

2024

2032

USD

40.75 Billion

USD

77.63 Billion

2024

2032

| 2025 –2032 | |

| USD 40.75 Billion | |

| USD 77.63 Billion | |

|

|

|

|

Global Rapid Test Market Size

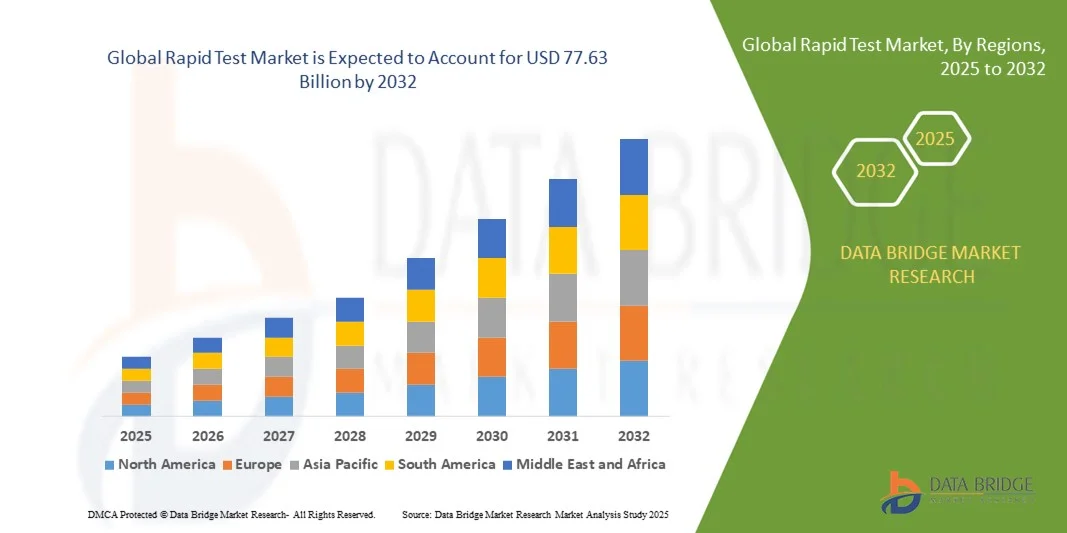

- The global Rapid Test Market size was valued at USD 40.75 billion in 2024 and is projected to reach USD 77.63 billion by 2032, growing at a CAGR of 8.39% during the forecast period

- Market expansion is driven by the increasing demand for quick and reliable diagnostic tools across healthcare, food safety, veterinary, and environmental sectors, reflecting a global shift toward faster disease detection and prevention

- Additionally, advancements in rapid testing technologies, rising prevalence of infectious diseases, and heightened public health awareness are propelling adoption rates, positioning rapid tests as essential tools for timely and effective decision-making

Global Rapid Test Market Analysis

- Rapid tests, which provide quick and reliable diagnostic results without the need for complex laboratory infrastructure, are becoming critical tools in healthcare, food safety, veterinary, and environmental applications due to their speed, ease of use, and cost-effectiveness

- The growing demand for rapid tests is primarily driven by the global need for early disease detection, increased public health awareness, and the rising incidence of infectious and chronic diseases across both developed and developing regions

- North America dominated the Global Rapid Test Market with the largest revenue share of 34.6% in 2024, supported by robust healthcare infrastructure, proactive disease screening initiatives, and a strong presence of leading diagnostic companies, with the U.S. leading in test adoption across hospitals, clinics, and at-home settings

- Asia-Pacific is expected to be the fastest growing region in the Global Rapid Test Market during the forecast period due to expanding healthcare access, rising healthcare expenditures, and increased government support for disease control programs

- The Professional Rapid Test Product segment dominated the market with the largest revenue share of 61.4% in 2024, driven by widespread usage across hospitals, clinics, and diagnostic laboratories for infectious disease detection, drug testing, and critical care diagnostics.

Report Scope and Global Rapid Test Market Segmentation

|

Attributes |

Rapid Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Rapid Test Market Trends

Enhanced Accuracy and Efficiency Through AI Integration

- A significant and accelerating trend in the global Rapid Test Market is the growing integration of artificial intelligence (AI) into diagnostic platforms, enabling faster, more accurate, and data-driven health assessments across clinical and point-of-care settings. This technological convergence is transforming rapid testing into a more intelligent and responsive tool for real-time diagnostics.

- For instance, AI-enhanced rapid test readers now utilize image recognition and machine learning algorithms to interpret test results with high precision, reducing the chances of human error. Devices like the BD Veritor™ Plus System and Abbott’s ID NOW™ integrate AI to analyze test samples and deliver accurate results within minutes.

- AI integration also supports features such as automated result interpretation, disease pattern recognition, and integration with electronic health records (EHRs), enabling healthcare providers to make quicker and better-informed decisions. Some platforms even use AI to identify trends in test results across populations, assisting in early outbreak detection and personalized treatment strategies.

- Furthermore, mobile-connected rapid test kits equipped with AI offer remote testing capabilities, allowing patients to perform tests at home while securely sharing results with healthcare professionals in real-time. This is especially beneficial for managing chronic conditions or monitoring infectious diseases in rural or underserved areas.

- The seamless connectivity between AI-powered rapid tests and digital health platforms enables centralized data management, remote monitoring, and integration with telehealth services. Users can track test history, receive automated insights, and get alerts for follow-up care, contributing to a more proactive and preventive healthcare approach.

- This trend toward intelligent, connected, and user-friendly diagnostic solutions is reshaping consumer and provider expectations. As a result, companies like Siemens Healthineers and Thermo Fisher Scientific are investing heavily in AI-driven diagnostic innovations, aiming to deliver faster, scalable, and more accurate rapid testing solutions across global healthcare ecosystems.

Global Rapid Test Market Dynamics

Driver

Growing Need Due to Increasing Disease Burden and Demand for Fast Diagnostics

- The rising global burden of infectious diseases, coupled with the growing need for early detection and immediate diagnosis, is a major driver behind the increased demand for rapid test solutions across healthcare systems

- For Instance, in March 2024, Abbott launched a new generation of its ID NOW™ platform capable of delivering molecular results in under 10 minutes for multiple infectious diseases, enabling faster clinical decisions and reducing the risk of disease transmission. Such innovations are accelerating the adoption of rapid tests across hospitals, clinics, and even at-home settings

- As public health authorities, healthcare providers, and individuals seek ways to manage disease outbreaks more efficiently, rapid tests offer significant advantages including speed, ease of use, and the ability to deploy testing at the point of care without complex infrastructure

- Furthermore, the COVID-19 pandemic has catalyzed a broader shift toward decentralized diagnostics, leading to widespread public familiarity and acceptance of rapid tests. This shift is now expanding beyond viral detection into areas such as chronic disease monitoring, cancer screening, and women's health

- The convenience of rapid diagnostic tools, particularly in remote or resource-limited settings, along with increased government investments in diagnostic infrastructure, is further fueling market expansion. Growing awareness about the importance of timely diagnosis and the development of compact, connected testing devices are also contributing to the market’s rapid growth

Restraint/Challenge

Concerns Regarding Accuracy, Regulatory Compliance, and Cost Accessibility

- Despite their advantages, concerns over the accuracy and reliability of some rapid tests—especially in comparison to laboratory-based methods—pose a significant challenge to their broader clinical adoption. Variability in sensitivity and specificity, particularly for early-stage infections, can lead to false negatives or positives, impacting clinical outcomes

- For instance, multiple studies have highlighted discrepancies in accuracy between different brands of COVID-19 antigen tests, leading regulatory bodies to issue stricter performance requirements and reassess emergency use authorizations

- Ensuring consistent regulatory compliance across global markets is also a hurdle, as different regions have varying standards for diagnostic approval. Manufacturers must navigate complex and evolving regulatory frameworks, which can delay product launches and limit market access

- In addition, while rapid tests are cost-effective compared to traditional lab diagnostics, pricing can still be a barrier in low- and middle-income regions. High-quality molecular rapid tests remain expensive, limiting their accessibility in public health settings without government or donor subsidies

- Addressing these challenges through improved test accuracy, harmonized regulatory standards, increased transparency in performance data, and strategic partnerships for affordable distribution will be crucial for sustaining growth and trust in the rapid test market

Global Rapid Test Market Scope

The rapid test market is segmented on the basis of product, contaminant, technology, food tested, application, and end user.

- By Product

On the basis of product, the Global Rapid Test Market is segmented into Over-the-Counter (OTC) Rapid Test Product and Professional Rapid Test Product. The Professional Rapid Test Product segment dominated the market with the largest revenue share of 61.4% in 2024, driven by widespread usage across hospitals, clinics, and diagnostic laboratories for infectious disease detection, drug testing, and critical care diagnostics. These tests are crucial for timely medical decisions and are supported by institutional purchasing and healthcare infrastructure.

The OTC Rapid Test Product segment is expected to register the fastest CAGR from 2025 to 2032, fueled by rising consumer awareness and demand for at-home testing kits. Products for pregnancy, glucose, COVID-19, and drug testing are increasingly accessible in retail outlets and online platforms. Government support for self-testing and improvements in user-friendly formats are further accelerating growth in this segment.

- By Contaminant

On the basis of contaminant, the Global Rapid Test Market is segmented into Pathogens, Meat Speciation, GMOs, Allergens, Pesticides, Mycotoxins, Heavy Metals, and Others. The Pathogens segment held the largest market revenue share of 39.6% in 2024, driven by the growing prevalence of foodborne illnesses and regulatory mandates to ensure microbiological safety in food products. Rapid detection of E. coli, Listeria, and Salmonella is a top priority across food production and processing units.

The Allergens segment is projected to witness the fastest CAGR from 2025 to 2032, as food manufacturers strive to meet stringent labeling regulations and protect consumers with allergies. Rapid allergen tests for nuts, dairy, soy, and gluten are in high demand, particularly in processed and packaged food sectors. Rising consumer awareness and liability concerns are pushing producers to adopt robust allergen testing protocols.

- By Technology

On the basis of technology, the Global Rapid Test Market is segmented into PCR-Based, Immunoassay-Based, Chromatography-Based, and Spectroscopy-Based methods. The Immunoassay-Based segment dominated the market in 2024 with a revenue share of 43.2%, driven by its cost-effectiveness, ease of use, and strong presence in infectious disease diagnostics and drug screening. Technologies like lateral flow and ELISA are widely used in clinical and food safety applications.

The PCR-Based segment is anticipated to register the fastest CAGR from 2025 to 2032, due to its high sensitivity and specificity in detecting genetic material, making it suitable for COVID-19, HIV, and TB detection. The growing demand for accurate molecular diagnostics at the point of care and advancements in miniaturized PCR platforms are driving growth in this segment.

- By Food Tested

On the basis of food tested, the Global Rapid Test Market is segmented into Meat and Seafood Products, Dairy Products, Processed Food, Fruits and Vegetables, Cereals and Grains, Nuts, Seeds and Spices, Crops, and Others. The Meat and Seafood Products segment led the market with the largest revenue share of 28.7% in 2024, attributed to growing concerns over pathogens, veterinary drug residues, and meat authenticity. Regulatory bodies mandate stringent testing, boosting the demand for rapid tests.

The Processed Food segment is projected to grow at the fastest CAGR from 2025 to 2032, as packaged and ready-to-eat food consumption rises globally. Rapid tests for preservatives, allergens, and GMOs in processed foods help manufacturers ensure product safety and compliance with international standards. Increasing consumer awareness of food quality further supports segment growth.

- By Application

On the basis of application, the Global Rapid Test Market is segmented into Infectious Disease, Cardiology, Oncology, Pregnancy and Fertility, Toxicology, Glucose Monitoring, and Others. The Infectious Disease segment dominated the market with a revenue share of 46.5% in 2024, due to the high incidence of diseases such as COVID-19, influenza, HIV, and hepatitis. Rapid diagnostic tests in this segment offer timely results that are crucial for isolation, treatment, and containment strategies.

The Oncology segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for early cancer detection and monitoring. Rapid tests for specific tumor markers are being developed to facilitate screening outside traditional lab environments, including in clinics and home settings. Rising cancer awareness and innovation in biomarker testing are accelerating growth.

- By End User

On the basis of end user, the Global Rapid Test Market is segmented into Hospital and Clinic, Diagnostic Laboratory, Home Care, and Others. The Hospital and Clinic segment accounted for the largest revenue share of 51.3% in 2024, supported by the frequent use of rapid tests in emergency, inpatient, and outpatient settings for quick clinical decision-making. Professional supervision ensures correct interpretation and enhances reliability.

The Home Care segment is forecasted to grow at the fastest CAGR from 2025 to 2032, fueled by increased self-monitoring, aging populations, and the widespread availability of over-the-counter rapid test kits. Tests for glucose monitoring, pregnancy, and infectious diseases are gaining popularity among individuals managing chronic conditions or seeking preventive care at home. The integration of mobile apps and telemedicine further boosts this segment.

Global Rapid Test Market Regional Analysis

- North America dominated the Global Rapid Test Market with the largest revenue share of 34.6% in 2024, driven by the high prevalence of infectious and chronic diseases, strong healthcare infrastructure, and increasing demand for point-of-care diagnostic solutions.

- Consumers in the region increasingly prefer rapid testing options for conditions such as COVID-19, influenza, pregnancy, and glucose monitoring due to their speed, accuracy, and convenience.

- This widespread adoption is further supported by favorable regulatory frameworks, rising health awareness, and broad availability of over-the-counter rapid test kits, particularly in the U.S. and Canada. The region's focus on preventive healthcare and early disease detection has firmly established rapid tests as an essential component of modern medical diagnostics, across both clinical and home care settings.

U.S. Rapid Test Market Insight

The U.S. rapid test market accounted for the largest revenue share of 81% in North America in 2024, driven by the high demand for point-of-care diagnostics, strong healthcare infrastructure, and favorable regulatory support for self-testing solutions. The widespread adoption of rapid COVID-19 tests during the pandemic significantly boosted consumer awareness and trust in rapid diagnostic tools, which has now expanded into areas such as flu, pregnancy, glucose monitoring, and drug testing. The availability of over-the-counter (OTC) rapid tests in retail and pharmacy channels, coupled with advancements in digital health integration, is further strengthening the U.S. market. Strategic collaborations between diagnostic companies and tech firms are also facilitating innovation and remote diagnostics across healthcare and home care settings.

Europe Rapid Test Market Insight

The Europe rapid test market is projected to expand at a significant CAGR throughout the forecast period, supported by growing demand for early disease detection, an aging population, and strong regulatory backing for decentralized diagnostics. Key drivers include rising awareness about lifestyle diseases, favorable reimbursement policies, and the adoption of rapid tests in both professional and self-testing contexts. European governments are actively supporting preventive care, which is accelerating the use of rapid diagnostic tools in national healthcare systems. Additionally, the region is witnessing a surge in demand for food safety rapid tests, particularly in the EU’s stringent regulatory environment, making rapid testing essential for compliance across the food and beverage sector.

U.K. Rapid Test Market Insight

The U.K. rapid test market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by government initiatives promoting early disease screening and a strong focus on consumer health. The adoption of rapid testing during the COVID-19 pandemic set the stage for a broader shift toward home-based diagnostics. Increasing demand for at-home pregnancy tests, glucose monitoring kits, and infectious disease screening tools is driving market growth. The U.K.'s well-established healthcare network, high public health awareness, and investments in digital health infrastructure support the ongoing transition toward rapid and remote testing models across both public and private healthcare sectors.

Germany Rapid Test Market Insight

The Germany rapid test market is expected to expand at a robust CAGR throughout the forecast period, driven by the country’s focus on technological advancement, preventive healthcare, and medical device innovation. Germany's healthcare providers are integrating rapid tests into clinical workflows to enhance diagnostic efficiency and reduce lab burden. The strong demand for food safety testing, especially in meat and dairy processing, is also fueling market growth. Additionally, Germany’s stringent quality and safety standards are encouraging the adoption of high-accuracy rapid tests in both medical and food sectors. Innovation, regulatory compliance, and consumer trust remain key themes in this market.

Asia-Pacific Rapid Test Market Insight

The Asia-Pacific rapid test market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by increasing healthcare expenditure, rapid urbanization, and a surge in demand for accessible and affordable diagnostics across emerging economies. Countries such as China, India, and Japan are witnessing a rising burden of infectious and chronic diseases, prompting greater adoption of point-of-care testing. Government-led health screening programs and the expansion of rural healthcare access are further accelerating market growth. Additionally, APAC is becoming a hub for manufacturing rapid test kits, which enhances supply chain efficiency and cost competitiveness. The convergence of mobile health technologies with diagnostics is also driving innovation in the region.

Japan Rapid Test Market Insight

The Japan rapid test market is growing steadily, supported by the country’s emphasis on health technology, aging population, and need for rapid disease detection. The adoption of rapid diagnostics is being driven by consumer preferences for home testing and the integration of these tools into elder care and chronic disease management programs. Japan’s healthcare system encourages innovation, and many local companies are developing advanced molecular and immunoassay-based rapid tests tailored for high accuracy and ease of use. Additionally, the integration of rapid test devices with telehealth platforms is helping to enhance early diagnosis, particularly in remote and aging communities.

China Rapid Test Market Insight

The China rapid test market captured the largest revenue share in the Asia-Pacific region in 2024, fueled by a rapidly expanding middle class, increasing health awareness, and strong government focus on public health initiatives. China is a major hub for the production of rapid test kits, benefiting from a robust manufacturing ecosystem and supportive policies for medical device exports. Rapid tests for infectious diseases, food safety, and chronic illness monitoring are widely adopted across both urban and rural areas. Government-backed digital health platforms and e-commerce distribution channels have made OTC rapid test kits highly accessible, contributing to increased uptake across the population.

Global Rapid Test Market Share

The Rapid Test industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Hologic, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Abbott (U.S.)

- BD (U.S.)

- Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- NeuroLogica Corp.(U.S.)

- Shimadzu Medical (India) pvt. Ltd. (Japan)

- GENERAL ELECTRIC (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Sysmex India Pvt. Ltd. (Japan)

- Hitachi, Ltd. (Japan)

- Canon Inc. (Japan)

- FUJIFILM Holdings Corporation (U.K.)

What are the Recent Developments in Global Rapid Test Market?

- In April 2023, Abbott Laboratories launched an innovative rapid diagnostic test for infectious diseases in South Africa, aimed at improving timely disease detection in both urban and rural healthcare settings. This initiative highlights Abbott’s commitment to expanding access to reliable, point-of-care testing solutions tailored to regional healthcare challenges, thereby strengthening its position in the growing Global Rapid Test Market.

- In March 2023, Hologic, Inc. introduced a new rapid test product specifically designed for women’s health applications, including pregnancy and fertility monitoring. The advanced test offers enhanced accuracy and faster results, underlining Hologic’s focus on developing specialized rapid diagnostic tools that address critical healthcare needs in both clinical and home care environments.

- In March 2023, Thermo Fisher Scientific Inc. completed the deployment of a large-scale rapid test screening program in Bengaluru, India, aimed at enhancing early detection of infectious diseases through its cutting-edge rapid PCR-based tests. This initiative demonstrates Thermo Fisher’s dedication to leveraging advanced technology to improve public health outcomes in densely populated urban areas.

- In February 2023, Siemens Healthineers partnered with regional diagnostic laboratories in the U.S. to develop an integrated rapid test platform that streamlines infectious disease screening for healthcare providers. This collaboration aims to enhance diagnostic efficiency and patient throughput, reinforcing Siemens’ role as a key innovator in the Global Rapid Test Market.

- In January 2023, BD (Becton, Dickinson and Company) unveiled its latest immunoassay-based rapid test kits at a leading medical conference, featuring improved sensitivity and faster turnaround times. The launch underscores BD’s commitment to advancing rapid diagnostic technologies that empower healthcare professionals with quick, reliable testing options in both hospital and point-of-care settings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rapid Test Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rapid Test Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rapid Test Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.