Global Rare Disease Api Orphan Drug Substance Market

Market Size in USD Million

CAGR :

%

USD

306.90 Million

USD

667.49 Million

2025

2033

USD

306.90 Million

USD

667.49 Million

2025

2033

| 2026 –2033 | |

| USD 306.90 Million | |

| USD 667.49 Million | |

|

|

|

|

Rare Disease API / Orphan Drug Substance Market Size

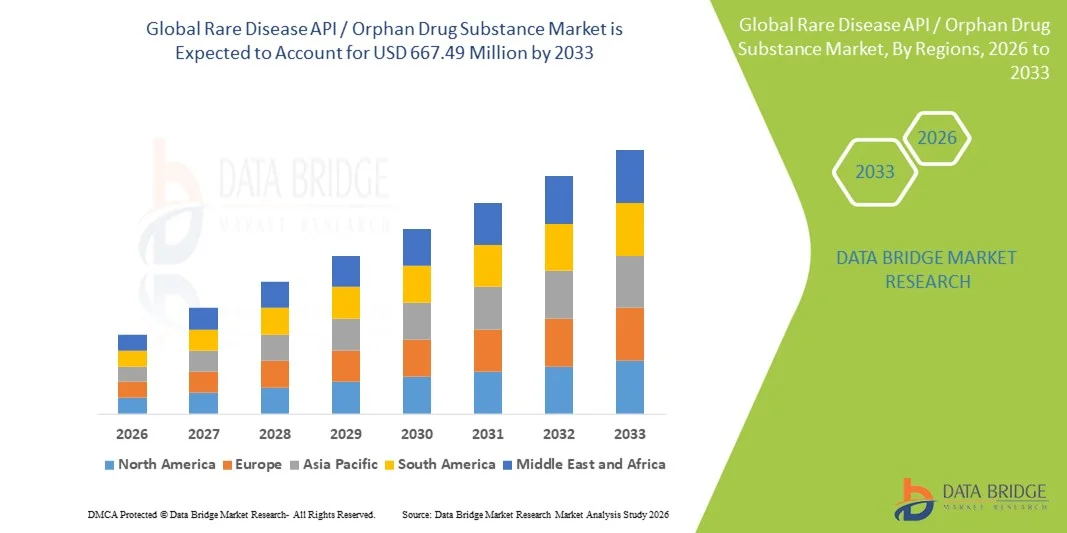

- The global rare disease API / orphan drug substance market size was valued at USD 306.90 million in 2025 and is expected to reach USD 667.49 million by 2033, at a CAGR of 10.20% during the forecast period

- The market growth is largely driven by the rising prevalence of rare diseases, expanding orphan drug pipelines, and increasing regulatory incentives that encourage the development and manufacturing of specialized active pharmaceutical ingredients for rare and ultra-rare conditions

- Furthermore, growing investments in biologics, gene therapies, and other advanced modalities, along with the need for high-quality, small-batch, and highly potent drug substances, are establishing orphan APIs as a critical component of modern pharmaceutical development. These converging factors are accelerating demand for rare disease APIs, thereby significantly boosting the industry’s growth

Rare Disease API / Orphan Drug Substance Market Analysis

- Rare disease APIs and orphan drug substances, comprising highly specialized active pharmaceutical ingredients for the treatment of rare and ultra-rare conditions, are becoming increasingly critical to modern pharmaceutical development due to their role in enabling targeted, precision, and life-saving therapies across multiple therapeutic areas

- The escalating demand for rare disease APIs is primarily driven by the growing prevalence of rare diseases, expanding orphan drug pipelines, favorable regulatory incentives, and increasing investment in advanced modalities such as biologics, gene therapies, and RNA-based treatments

- North America dominated the rare disease API / orphan drug substance market with the largest revenue share of 41.5% in 2025, supported by a strong orphan drug regulatory framework, high R&D spending, and a robust presence of biopharmaceutical companies and specialized CDMOs, with the U.S. witnessing significant growth in both clinical-stage and commercial-scale orphan API manufacturing

- Asia-Pacific is expected to be the fastest growing region in the rare disease API market during the forecast period driven by increasing outsourcing of API manufacturing, expanding biotechnology ecosystems, improving regulatory alignment, and rising investments in rare disease drug development across China, Japan, South Korea, and India

- Biologics APIs dominated the rare disease API / orphan drug substance market with a market share of 58.3% in 2025, driven by their widespread use in enzyme replacement therapies, monoclonal antibodies, and gene-based treatments, along with their strong efficacy in addressing complex genetic and metabolic rare diseases

Report Scope and Rare Disease API / Orphan Drug Substance Market Segmentation

|

Attributes |

Rare Disease API / Orphan Drug Substance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Rare Disease API / Orphan Drug Substance Market Trends

Shift Toward Advanced Biologic and Genetic Drug Substances

- A significant and accelerating trend in the global rare disease API / orphan drug substance market is the growing shift toward biologics, gene therapies, and RNA-based drug substances, driven by their ability to target the underlying genetic causes of rare and ultra-rare diseases with high precision

- For instance, the increasing number of regulatory approvals for gene and cell therapies targeting rare disorders is intensifying demand for viral vector APIs, recombinant proteins, and highly specialized biologic drug substances manufactured under stringent quality standards

- The advancement of molecular biology, genomics, and companion diagnostics is enabling the development of highly targeted orphan drug substances, allowing manufacturers to design APIs tailored to specific mutations or disease pathways, thereby improving treatment efficacy and patient outcomes

- The growing adoption of precision medicine approaches is encouraging pharmaceutical companies to invest in complex, low-volume, high-value API production, requiring specialized facilities, advanced analytical capabilities, and strict regulatory compliance

- The rise of platform-based manufacturing technologies is supporting flexible and scalable production of orphan APIs, allowing manufacturers to efficiently handle multiple rare disease programs simultaneously

- This trend toward more complex and customized orphan drug substances is reshaping API manufacturing strategies, with increased emphasis on small-batch production, high potency handling, and rapid changeover capabilities

- Consequently, companies such as Lonza and Catalent are expanding their biologics and gene therapy API capabilities to support the rising demand for advanced orphan drug substances across multiple rare disease indications

Rare Disease API / Orphan Drug Substance Market Dynamics

Driver

Expanding Orphan Drug Pipelines and Favorable Regulatory Incentives

- The increasing number of orphan drug designations and approvals, supported by favorable regulatory incentives such as market exclusivity, tax credits, and accelerated review pathways, is a key driver fueling demand for rare disease APIs

- For instance, regulatory frameworks in the U.S., Europe, and Japan have significantly reduced development timelines for orphan drugs, encouraging biopharmaceutical companies to expand their rare disease pipelines and invest in specialized API manufacturing

- As awareness, screening, and diagnosis rates of rare diseases improve globally, the need for consistent and high-quality drug substance supply is rising, directly supporting growth in the orphan API market

- Furthermore, strong venture capital and public funding for rare disease research are enabling smaller biotech firms to advance clinical programs, increasing reliance on outsourced API manufacturing and specialized CDMOs

- The growing focus on precision and personalized therapies, combined with long-term commercial potential due to limited competition, continues to propel sustained demand for orphan drug substances

- Increasing government and non-profit support for rare disease treatment development is strengthening the long-term viability of orphan drug manufacturing investments

- The ability of orphan drugs to command premium pricing is improving return on investment, further encouraging continued expansion of orphan API production capacity

Restraint/Challenge

Manufacturing Complexity and Regulatory Compliance Barriers

- The production of rare disease APIs often involves complex manufacturing processes, stringent quality requirements, and limited batch sizes, which can significantly increase production costs and technical risks

- For instance, biologic and gene therapy drug substances require specialized facilities, highly skilled personnel, and advanced containment systems, making manufacturing scale-up technically challenging and capital intensive

- Regulatory compliance across multiple regions adds further complexity, as orphan drug substances must meet diverse and evolving standards related to safety, traceability, and quality control

- These challenges can limit the number of qualified API suppliers, potentially leading to supply constraints and higher costs, thereby restraining broader market expansion

- Limited availability of specialized raw materials and reagents for advanced orphan APIs can further disrupt production timelines and increase dependency on niche suppliers

- The need for extensive validation, long lead times, and strict post-approval change controls can slow manufacturing agility and delay commercial supply for orphan drug substances

Rare Disease API / Orphan Drug Substance Market Scope

The market is segmented on the basis of API / drug substance type, therapeutic indication, and end user.

- By API / Drug Substance Type

On the basis of API / drug substance type, the global rare disease API / orphan drug substance market is segmented into biologics APIs, small-molecule APIs, viral vector APIs, RNA-based APIs, and cell therapy-related drug substances. The biologics APIs segment dominated the market with the largest revenue share of 58.3% in 2025, driven by the widespread use of monoclonal antibodies, enzyme replacement therapies, and recombinant proteins in the treatment of rare genetic and metabolic disorders. Biologics offer high specificity and clinical efficacy, making them the preferred choice for many orphan drug programs. The strong presence of approved biologic orphan drugs and continued pipeline expansion further supports this segment’s dominance. In addition, premium pricing and long-term treatment regimens contribute to higher revenue generation. Established manufacturing expertise and regulatory familiarity with biologics also reinforce their leading position.

The viral vector APIs segment is expected to witness the fastest growth during the forecast period, fueled by the rapid advancement of gene therapies for rare and ultra-rare diseases. Increasing approvals of adeno-associated virus (AAV) and lentiviral vector-based therapies are driving strong demand for specialized vector production. High unmet medical need, curative treatment potential, and growing investment in gene therapy platforms are accelerating this segment’s expansion. Limited supplier availability and complex manufacturing requirements further elevate the strategic importance and growth momentum of viral vector APIs.

- By Therapeutic Indication

On the basis of therapeutic indication, the market is segmented into oncology, hematologic disorders, neurological & neuromuscular disorders, metabolic & endocrine disorders, immunological & rare infectious diseases, and cardiovascular, ophthalmic, and other rare disorders. The oncology segment dominated the market in 2025, owing to the high number of orphan drug designations for rare cancers and sustained investment in targeted cancer therapies. Rare oncology drugs often rely on highly potent APIs and biologics, contributing significantly to overall API demand. Strong clinical pipelines, accelerated regulatory approvals, and higher treatment costs further support this segment’s revenue leadership. In addition, pharmaceutical companies prioritize rare oncology due to favorable reimbursement and market exclusivity benefits.

The neurological & neuromuscular disorders segment is projected to grow at the fastest rate during the forecast period, driven by increasing research into genetic neurological conditions such as spinal muscular atrophy, Duchenne muscular dystrophy, and rare epilepsies. Advances in gene therapy, RNA-based drugs, and precision medicine are transforming treatment approaches in this space. Rising diagnosis rates and strong advocacy support are further boosting development activity. As many of these therapies require complex APIs, demand for specialized drug substances is expanding rapidly within this segment.

- By End User

On the basis of end user, the global rare disease API / orphan drug substance market is segmented into biopharmaceutical companies, contract development & manufacturing organizations (CDMOs), and research institutes & specialty manufacturers. The biopharmaceutical companies segment accounted for the largest market share in 2025, driven by their ownership of orphan drug pipelines and direct control over commercial manufacturing for high-value therapies. Large and mid-sized biopharma companies invest heavily in securing reliable API supply to protect exclusivity periods and ensure consistent product quality. In-house manufacturing of critical APIs is often preferred for strategic and intellectual property reasons. The dominance of this segment is further reinforced by strong financial capabilities and regulatory expertise.

The CDMOs segment is expected to register the fastest growth over the forecast period, supported by increasing outsourcing trends among biotech and pharmaceutical companies. The complexity of orphan APIs, combined with small batch sizes and high capital requirements, is encouraging sponsors to rely on specialized CDMOs. CDMOs offer flexible manufacturing, regulatory support, and advanced technologies suited for rare disease drug substances. As smaller biotech firms drive innovation in orphan drugs, dependence on CDMOs for scalable and compliant API production is accelerating rapidly.

Rare Disease API / Orphan Drug Substance Market Regional Analysis

- North America dominated the rare disease API / orphan drug substance market with the largest revenue share of 41.5% in 2025, supported by a strong orphan drug regulatory framework, high R&D spending, and a robust presence of biopharmaceutical companies and specialized CDMOs

- Companies in the region place high value on advanced manufacturing capabilities, stringent quality compliance, and reliable supply of complex drug substances, particularly for biologics, gene therapies, and other high-value orphan APIs

- This widespread market leadership is further supported by a high concentration of orphan drug approvals, strong funding for rare disease research, and the presence of leading biopharmaceutical companies and specialized CDMOs, establishing North America as the primary hub for rare disease API development and production

U.S. Rare Disease API / Orphan Drug Substance Market Insight

The U.S. rare disease API / orphan drug substance market captured the largest revenue share within North America in 2025, driven by a strong orphan drug regulatory framework, extensive R&D investments, and a high concentration of biopharmaceutical and biotechnology companies. Manufacturers increasingly prioritize the development and secure supply of complex APIs to support expanding orphan drug pipelines. The presence of favorable incentives such as market exclusivity, tax credits, and accelerated approval pathways continues to stimulate demand for specialized drug substances. Moreover, the strong role of CDMOs and advanced manufacturing infrastructure significantly contributes to sustained market growth.

Europe Rare Disease API / Orphan Drug Substance Market Insight

The Europe rare disease API / orphan drug substance market is projected to expand at a substantial CAGR during the forecast period, primarily driven by supportive EMA orphan drug policies and rising investments in rare disease research. Increasing awareness, improved diagnosis rates, and cross-border collaborations are fostering orphan drug development across the region. European manufacturers emphasize quality, traceability, and regulatory compliance, supporting steady demand for high-value APIs. Growth is observed across both innovator-driven and outsourced manufacturing models, particularly for biologics and advanced therapies.

U.K. Rare Disease API / Orphan Drug Substance Market Insight

The U.K. rare disease API / orphan drug substance market is anticipated to grow at a noteworthy CAGR over the forecast period, supported by strong academic–industry collaboration and government-backed rare disease initiatives. The U.K.’s advanced life sciences ecosystem encourages early-stage orphan drug development, increasing demand for clinical-stage APIs. Continued investment in biologics and gene therapy research is strengthening the market outlook. In addition, regulatory alignment with global standards enhances the country’s attractiveness for orphan API manufacturing and development partnerships.

Germany Rare Disease API / Orphan Drug Substance Market Insight

The Germany rare disease API / orphan drug substance market is expected to expand at a considerable CAGR during the forecast period, fueled by a robust pharmaceutical manufacturing base and strong emphasis on innovation and quality. Germany’s leadership in biologics production and advanced manufacturing technologies supports steady demand for complex orphan drug substances. The country’s focus on compliance, safety, and precision manufacturing aligns well with the stringent requirements of rare disease APIs. Increasing investment in advanced therapies further strengthens market growth prospects.

Asia-Pacific Rare Disease API / Orphan Drug Substance Market Insight

The Asia-Pacific rare disease API / orphan drug substance market is poised to grow at the fastest CAGR during the forecast period, driven by expanding biotechnology capabilities, rising healthcare investments, and increasing outsourcing from Western markets. Countries such as China, Japan, and India are strengthening their rare disease regulatory frameworks and manufacturing infrastructure. The region’s cost advantages and growing technical expertise are attracting global biopharmaceutical companies seeking scalable API production. This trend is significantly accelerating market expansion across APAC.

Japan Rare Disease API / Orphan Drug Substance Market Insight

The Japan rare disease API / orphan drug substance market is gaining momentum due to strong government support for orphan drug development and advanced pharmaceutical manufacturing capabilities. Japan places high importance on quality, safety, and innovation, driving demand for highly specialized drug substances. The country’s focus on genetic and neurological rare diseases is increasing the need for complex APIs, including biologics and RNA-based substances. An aging population and rising prevalence of rare disorders further support market growth.

India Rare Disease API / Orphan Drug Substance Market Insight

The India rare disease API / orphan drug substance market accounted for a significant revenue share in Asia-Pacific in 2025, attributed to strong API manufacturing expertise, cost competitiveness, and expanding biotechnology investments. India is emerging as a key supplier of small-molecule and increasingly biologic orphan APIs for global markets. Government initiatives supporting rare disease treatment development and local manufacturing are improving market prospects. The growing presence of domestic CDMOs and contract manufacturers is further strengthening India’s role in the global orphan drug substance supply chain.

Rare Disease API / Orphan Drug Substance Market Share

The Rare Disease API / Orphan Drug Substance industry is primarily led by well-established companies, including:

- Lonza Ltd (Switzerland)

- Catalent, Inc. (U.S.)

- WuXi AppTec Co., Ltd. (China)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Amgen Inc. (U.S.)

- Sanofi (France)

- Takeda Pharmaceutical Company Limited (Japan)

- AbbVie Inc. (U.S.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- Vertex Pharmaceuticals Incorporated (U.S.)

- Biogen Inc. (U.S.)

- PTC Therapeutics, Inc. (U.S.)

- Swedish Orphan Biovitrum AB (Sweden)

- SOM Innovation Biotech, S.A. (Spain)

- Ultragenyx Pharmaceutical Inc. (U.S.)

What are the Recent Developments in Global Rare Disease API / Orphan Drug Substance Market?

- In August 2025, the U.S. FDA granted approval to Papzimeos (zopapogene imadenovec), the first immunotherapy for recurrent respiratory papillomatosis (RRP), an orphan-designated rare condition, underscoring gene-based immunotherapeutic advances for rare diseases

- In April 2025, the nonprofit Orphan Therapeutics Accelerator announced key partnerships aimed at advancing development and commercialization pathways for ultra-rare disease therapies, addressing historical challenges in funding and bringing orphan drug candidates forward

- In January 2024, the FDA’s orphan drug landscape saw significant expansion with a record number of approvals (28 novel orphan drugs), including first-in-class therapies for conditions such as Friedreich’s ataxia and Rett syndrome, highlighting rapid growth in rare disease therapeutic development

- In August 2023, the U.S. FDA approved pozelimab (Veopoz) as the first treatment for CHAPLE disease, an ultra-rare complement system disorder, representing a new recombinant monoclonal antibody therapy addressing an otherwise fatal condition

- In May 2023, the U.S. FDA approved Adzynma (apadamtase alfa), a recombinant ADAMTS13 enzyme replacement therapy for congenital thrombotic thrombocytopenic purpura (cTTP), marking the first approved biologic addressing this ultra-rare blood clotting disorder and expanding enzyme replacement options for rare disease patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.