Global Rare Earth Metal Market

Market Size in USD Billion

CAGR :

%

USD

8.42 Billion

USD

19.62 Billion

2024

2032

USD

8.42 Billion

USD

19.62 Billion

2024

2032

| 2025 –2032 | |

| USD 8.42 Billion | |

| USD 19.62 Billion | |

|

|

|

|

Rare Earth Metal Market Size

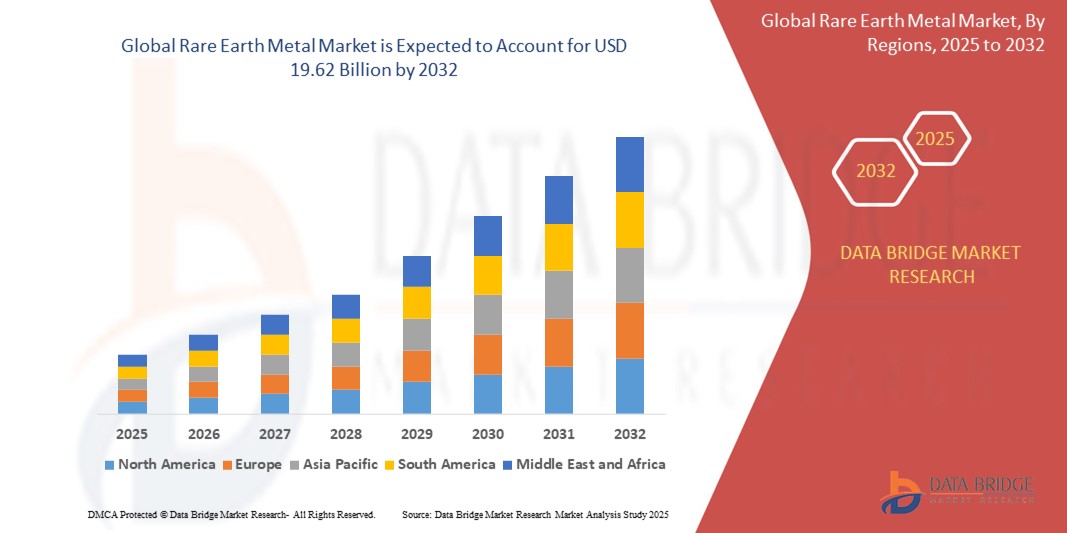

- The global rare earth metal market size was valued at USD 8.42 billion in 2024 and is expected to reach USD 19.62 billion by 2032, at a CAGR of 11.15% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance magnets, catalysts, and batteries across industries such as electronics, renewable energy, automotive, and defense

- The market is also witnessing growth due to rising investments in electric vehicles and wind energy, where rare earth elements such as neodymium and dysprosium are critical for efficient motor and turbine performance

Rare Earth Metal Market Analysis

- The rare earth metal market is growing steadily as demand rises across advanced electronics, green technologies, and permanent magnets used in modern applications

- Industries are actively seeking secure and diversified supply chains to meet rising needs, prompting exploration and recycling initiatives globally

- North America dominated the rare earth metal market with a revenue share of 38.5% in 2024, driven by strong investments in domestic mining and processing capabilities. The region is focused on securing its supply chains to reduce dependency on imports, especially for critical clean energy and defense applications

- The Asia-Pacific region is expected to witness the highest growth rate in the global rare earth metal market, driven by rapid industrialization, expanding electric vehicle production, and government initiatives promoting clean energy technologies

- The neodymium segment dominated the market with the largest revenue share in 2024, driven by its critical role in manufacturing high-performance permanent magnets used in electric vehicles and wind turbines. Its magnetic strength and efficiency make it a preferred choice for industries focused on clean energy and advanced electronics. Demand for neodymium is further bolstered by increasing investments in renewable energy projects and the growing adoption of electric mobility worldwide

Report Scope and Rare Earth Metal Market Segmentation

|

Attributes |

Rare Earth Metal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rare Earth Metal Market Trends

“Rising Focus on Supply Chain Diversification and Recycling Technologies”

- The rare earth metal market is shifting toward supply chain diversification as countries aim to reduce reliance on dominant suppliers, such as China, to ensure resource security and avoid disruptions

- Manufacturers are investing in recycling technologies to recover rare earth elements from end-of-life electronics and industrial magnets, offering a sustainable and cost-effective alternative to traditional mining

- The U.S. Department of Energy has funded rare earth recovery projects, such as the one led by Texas-based MP Materials, to promote domestic sourcing and reduce import dependency

- Japan is advancing its rare earth recycling initiatives through companies such as Hitachi, which have developed techniques to extract rare earths from used appliances and hybrid vehicle motors

- These strategies are helping global industries meet environmental targets, stabilize supply chains, and support the circular economy while reducing geopolitical and environmental risks associated with primary extraction

Rare Earth Metal Market Dynamics

Driver

“Rising Demand for Clean Energy Technologies and Electric Vehicles”

- The increasing demand for clean energy technologies is driving rare earth metal usage, particularly for producing high-performance magnets

- Elements such as neodymium, dysprosium, and praseodymium are essential for wind turbine generators and electric vehicle motors

- Governments globally are promoting renewable energy and electric mobility through incentives and sustainability policies

- Companies such as Tesla and General Motors are expanding electric vehicle manufacturing, boosting rare earth metal consumption

- Offshore wind energy projects, especially in Europe and Asia, are contributing to the rising need for rare earth-based components, such as in the Hornsea Project in the in the U.K., which is one of the world’s largest offshore wind farms and relies heavily on high-performance rare earth magnets for its turbines’ generators

Restraint/Challenge

“Environmental Concerns and Processing Complexities in Rare Earth Mining”

- The extraction and processing of rare earth metals cause significant environmental concerns, including land disruption, high water usage, and toxic waste generation

- Refining rare earth ores is complex and expensive, requiring specialized facilities and stringent environmental safeguards

- Stricter regulations in regions such as North America and Europe make it challenging to start new mining projects due to environmental compliance requirements

- Local community opposition and environmental activism have delayed or halted projects, increasing costs and deterring investors

- For instance, rare earth mining initiatives in the U.S. have faced such challenges

- These issues limit global supply and encourage manufacturers to seek sustainable alternatives such as recycling and diversified sourcing strategies

Rare Earth Metal Market Scope

The global rare earth metal market is segmented on the basis of element and application.

- By Element

On the basis of element, the rare earth metal market is segmented into cerium, neodymium, lanthanum, dysprosium, terbium, erbium, europium, gadolinium, holmium, lutetium, praseodymium, promethium, samarium, thulium, ytterbium, yttrium, scandium, and others. The neodymium segment dominated the market with the largest revenue share in 2024, driven by its critical role in manufacturing high-performance permanent magnets used in electric vehicles and wind turbines. Its magnetic strength and efficiency make it a preferred choice for industries focused on clean energy and advanced electronics. Demand for neodymium is further bolstered by increasing investments in renewable energy projects and the growing adoption of electric mobility worldwide.

The dysprosium segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, due to its ability to improve the temperature stability and performance of magnets used in harsh environments, making it vital for automotive and aerospace applications.

- By Application

On the basis of application, the rare earth metal market is segmented into catalysts, ceramics, phosphors, glass and polishing, metallurgy, magnets, and others. The magnets segment held the largest market revenue share in 2024, primarily due to the rising demand from electric vehicles, renewable energy sectors, and consumer electronics, where powerful and lightweight magnets are essential for efficient operation. Rare earth magnets offer superior performance, energy efficiency, and miniaturization benefits that drive their widespread use.

The catalysts segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, propelled by increasing demand in automotive catalytic converters and industrial chemical processes aimed at reducing harmful emissions and enhancing energy efficiency. This trend is particularly strong in regions implementing stringent environmental regulations.

Rare Earth Metal Market Regional Analysis

- North America dominated the rare earth metal market with a revenue share of 38.5% in 2024, driven by strong investments in domestic mining and processing capabilities. The region is focused on securing its supply chains to reduce dependency on imports, especially for critical clean energy and defense applications

- Government initiatives promoting rare earth production and recycling programs further support market growth

- Advanced technology adoption and robust demand from the automotive and electronics sectors contribute significantly to the market expansion

U.S. Rare Earth Metal Market Insight

U.S. accounted for around 85% of North America’s market share in 2024, fuelled by government policies aimed at boosting domestic rare earth metal production and reducing import reliance. The rising demand for electric vehicles, wind turbines, and national security applications is a major growth driver. Several projects to develop new mining and refining facilities are underway, supporting the country’s strategic resource independence. In addition, investments in recycling technologies are helping to enhance material recovery and sustainability.

Asia-Pacific Rare Earth Metal Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate during the forecast period from 2025 to 2032. Rapid industrialization, urbanization, and growing electronics manufacturing contribute to this growth. Countries such as China, Japan, and India are expanding their rare earth production capacities and downstream processing facilities. The region’s strong focus on renewable energy and electric vehicles is further boosting demand. Government initiatives promoting technological innovation and sustainability accelerate market development.

China Rare Earth Metal Market Insight

The China market leads the Asia-Pacific region with a 65% market share in 2024, supported by its vast rare earth reserves and comprehensive mining and refining infrastructure. It remains the largest global supplier of rare earth metals, fulfilling extensive domestic and export demand. The country’s growing electric vehicle market and renewable energy projects create consistent demand for rare earth elements. In addition, China’s strategic initiatives to control the global rare earth supply chain strengthen its market dominance.

Japan Rare Earth Metal Market Insight

The Japan market is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, driven by its advanced technology sector and high demand for sustainable energy solutions. The country is focusing on developing rare earth recycling and recovery technologies to reduce reliance on imports. Japan’s electric vehicle production and electronics manufacturing sectors significantly contribute to rare earth demand. Government support through strategic partnerships and investments enhances domestic capabilities in processing and supply chain resilience. Japan’s commitment to innovation and sustainability positions it as a key player in the global rare earth market.

Europe Rare Earth Metal Market Insight

The Europe market is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, driven by increasing demand from green technology sectors and recycling efforts. European countries are investing heavily in securing sustainable sources and advancing processing capabilities. The region’s automotive and electronics industries rely on rare earth materials for high-performance applications. Policies encouraging circular economy practices and resource efficiency further promote market growth. Europe’s focus on reducing import dependence supports ongoing investments in rare earth initiatives.

Germany Rare Earth Metal Market Insight

The Germany market captured about 45% of Europe’s rare earth metal market share in 2024, backed by its strong automotive sector and industrial base. The country emphasizes innovation in sustainable sourcing and eco-friendly processing technologies. Germany’s strict environmental regulations motivate manufacturers to adopt advanced recycling and cleaner extraction methods. Demand for rare earth metals in electric vehicles, wind turbines, and electronics drives steady market expansion. Strategic collaborations between government and industry strengthen its position in the global supply chain.

U.K. Rare Earth Metal Market Insight

The U.K. market is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, supported by growing investments in recycling technologies and supply chain diversification. The U.K.’s electronics and clean energy sectors are key contributors to rare earth demand. Focus on circular economy principles encourages sustainable resource management and reduces reliance on imports. The country’s government incentives and research initiatives foster development in rare earth recovery and processing. This approach enhances the U.K.’s role in the evolving global rare earth landscape.

Rare Earth Metal Market Share

The Rare Earth Metal industry is primarily led by well-established companies, including:

- Alkane Resources Ltd (Australia)

- Arafura Rare Earths (Australia)

- Lynas Rare Earths Ltd (Australia)

- China Rare Earth Holdings Limited (China)

- Avalon Advanced Materials Inc. (Canada)

- IREL(INDIA) LIMITED (India)

- Rare Element Resources Ltd. (U.S.)

- Frontier Rare Earths Limited (Canada)

- Canada Rare Earth Corporation (Canada)

- Iluka Resources Limited (Australia)

- NORTHERN MINERALS (Australia)

- Krakatoa Resources Ltd. (Australia)

- Ucore Rare Metals Inc. (U.S.)

- Namibia Critical Metals Inc. (Namibia)

Latest Developments in Global Rare Earth Metal Market

- In September 2022, Solvay announced an expansion of its rare earth metal operations in La Rochelle, France. The company aims to establish a significant hub for rare earth magnets to serve growing demand in electric vehicles, clean energy, and electronics. This development supports Europe’s focus on sustainable technologies and strengthens the regional supply chain for critical materials

- In August 2022, Lynas Rare Earths Ltd revealed plans to expand capacity at its Mt Weld mine in Western Australia, known for deposits of neodymium and praseodymium. The expansion is set to begin in early 2023 and be fully operational by 2024. This move enhances the company’s ability to meet increasing global demand and secures a stable supply of key rare earth metals

- In April 2022, Iluka Resources Ltd announced a USD 1.2 billion investment in the Eneabba Phase 3 rare earth refinery project in Western Australia. The initiative aims to boost the company’s downstream processing of rare earth oxides, strengthening its position in the global market. The investment also contributes to Australia’s economic development and promotes sustainable resource management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rare Earth Metal Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rare Earth Metal Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rare Earth Metal Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.