Global Rare Earth Metals Leaching Chemicals Market

Market Size in USD Million

CAGR :

%

USD

574.27 Million

USD

1,001.55 Million

2024

2032

USD

574.27 Million

USD

1,001.55 Million

2024

2032

| 2025 –2032 | |

| USD 574.27 Million | |

| USD 1,001.55 Million | |

|

|

|

|

Rare Earth Metals Leaching Chemicals Market Size

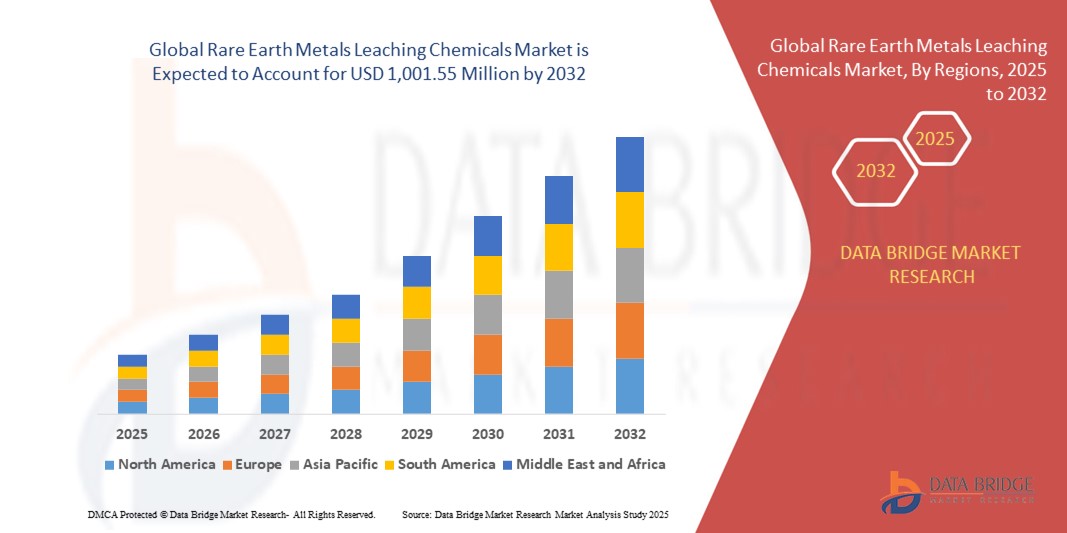

- The global rare earth metals leaching chemicals market size was valued at USD 574.27 million in 2024 and is expected to reach USD 1,001.55 million by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely driven by the increased demand for rare earth elements across high-tech industries such as renewable energy, electric vehicles, and electronics, which is creating sustained pressure on efficient extraction processes using specialized leaching chemicals

- Furthermore, the shift toward sustainable and environmentally conscious recovery methods, along with rising investment in rare earth recycling and secondary extraction, is positioning leaching chemicals as a crucial component in modern resource management. These converging factors are accelerating the adoption of advanced leaching solutions, thereby significantly boosting the industry's growth

Rare Earth Metals Leaching Chemicals Market Analysis

- Rare earth metals leaching chemicals, essential for extracting valuable elements such as neodymium, dysprosium, and cerium from ores and recycled materials, are becoming increasingly vital to the production of high-performance magnets, electronics, and renewable energy technologies due to their role in enabling efficient, selective, and scalable recovery processes

- The escalating demand for these chemicals is primarily fueled by the global push for electric vehicles, wind turbines, and advanced electronics, alongside rising efforts to diversify rare earth supply chains and implement eco-friendly hydrometallurgical extraction techniques

- Asia-Pacific dominated the rare earth metals leaching chemicals market with the largest revenue share 70.5% in 2024, led by China’s established rare earth processing infrastructure, robust demand from manufacturing industries, and government-backed initiatives aimed at securing critical mineral supply for domestic technology growth

- North America is expected to be the fastest growing region in the rare earth metals leaching chemicals market during the forecast period due to increased investments in domestic rare earth mining and processing, driven by strategic policies to reduce dependence on imports and support clean energy transitions

- Hydrochloric acid segment dominated the rare earth metals leaching chemicals market with a market share of over 40.5% in 2024, driven by its cost-effectiveness, high leaching efficiency, and compatibility with a wide range of rare earth-bearing minerals and secondary waste materials

Report Scope and Rare Earth Metals Leaching Chemicals Market Segmentation

|

Attributes |

Rare Earth Metals Leaching Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rare Earth Metals Leaching Chemicals Market Trends

Shift Toward Eco-Friendly and Selective Leaching Technologies

- A significant and accelerating trend in the global rare earth metals leaching chemicals market is the growing shift toward environmentally friendly and highly selective leaching agents that minimize waste, reduce environmental impact, and improve extraction efficiency. This trend is largely driven by global sustainability goals and tightening environmental regulations

- For instance, researchers and companies are increasingly investing in alternative leaching agents such as organic acids and ionic liquids, which offer selective extraction while avoiding the corrosiveness and disposal issues associated with traditional mineral acids

- Technologies using deep eutectic solvents (DES) are gaining momentum due to their biodegradability and lower toxicity, and some solutions allow the recovery of specific rare earths from complex ores or e-waste with higher precision. For instance, several pilot studies in Europe and China have demonstrated the effectiveness of DES in recovering neodymium and dysprosium from spent magnets

- These advancements are enabling more efficient recovery of valuable rare earths from both primary ores and secondary sources such as electronic waste, aligning with the circular economy and critical mineral strategies of major economies

- The development of green leaching solutions also supports the growing number of rare earth recycling facilities, where the need for low-impact, high-yield processes is essential. Companies such as Solvay and Ucore Rare Metals are actively exploring and investing in these next-generation leaching methods

- As regulatory bodies emphasize cleaner production practices, the demand for sustainable, safe, and highly targeted leaching chemicals is expected to surge across the global market, making eco-innovation a central force reshaping industry practices and expectations

Rare Earth Metals Leaching Chemicals Market Dynamics

Driver

Rising Demand for Rare Earths in Green Technologies and Electronics

- The growing global demand for rare earth elements (REEs) in key sectors such as electric vehicles (EVs), wind turbines, electronics, and defense is a major driver fueling the need for efficient leaching chemicals capable of extracting REEs from both mined ores and recycled sources

- For instance, the global transition to clean energy technologies, which rely heavily on rare earth magnets is placing pressure on upstream supply chains to produce and process REEs more efficiently and sustainably

- As new REE mines open in North America, Africa, and Australia, the demand for tailored leaching solutions is rising, with companies investing in chemicals that offer high yield, lower environmental impact, and suitability for diverse ore compositions

- In addition, increasing awareness around the strategic importance of rare earths for national security and technology leadership is leading governments to support domestic production, recycling, and chemical processing capacity

- Hydrometallurgical leaching, which allows for greater selectivity and control in the extraction process, is gaining prominence, particularly when coupled with advancements in automation and real-time monitoring to ensure consistency and safety. These factors, combined with rising R&D investments from players such as BASF, Solvay, and Lanxess, are contributing to a steady expansion of the global rare earth metals leaching chemicals market

Restraint/Challenge

Environmental Compliance and Handling Hazards of Acid-Based Leachants

- The toxic nature and environmental impact of commonly used acid-based leaching agents such as hydrochloric acid, sulfuric acid, and nitric acid pose a key challenge to the market, particularly in regions with stringent environmental regulations

- Improper handling and disposal of acidic waste can lead to soil and water contamination, creating legal and reputational risks for mining and recycling operators

- For instance, in 2021, several rare earth processing facilities in China’s Jiangxi province were temporarily shut down due to excessive chemical waste discharge, prompting the government to implement stricter environmental audits and licensing requirements for leaching operations

- Furthermore, the health and safety risks associated with the transport, storage, and application of corrosive leaching chemicals require strict infrastructure and compliance systems, increasing operational costs and complexity

- The high cost of waste treatment and remediation, especially in developing countries with limited industrial wastewater management capacity, can hinder the scalability of conventional acid-based leaching processes

- As a result, the industry faces growing pressure to adopt greener alternatives and to demonstrate environmental compliance through transparent sourcing and process monitoring

- Overcoming these challenges will require greater investment in sustainable leaching technologies, enhanced operator training, and global collaboration on best practices and regulatory standards to support responsible rare earth production

Rare Earth Metals Leaching Chemicals Market Scope

The market is segmented on the basis of type and end user industry.

- By Type

On the basis of type, the rare earth metals leaching chemicals market is segmented into hydrochloric acid, sulfuric acid, nitric acid, ammonium sulphate, citric acid, and others. The hydrochloric acid segment dominated the market with the largest market revenue share of 40.5% in 2024, driven by its high leaching efficiency, relatively low cost, and compatibility with a wide range of rare earth-bearing ores. Its strong acid strength and ability to dissolve both light and heavy rare earth metals make it the preferred choice for many hydrometallurgical operations.

The citric acid segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the global shift toward environmentally friendly and biodegradable leaching solutions. Citric acid, being a weak organic acid, offers selective leaching capabilities with minimal environmental impact, making it ideal for use in rare earth recycling and secondary resource recovery. Its growing adoption is driven by regulatory pressures for cleaner extraction processes and increased research into green chemistry alternatives for critical mineral recovery.

- By End User Industry

On the basis of end user industry, the rare earth metals leaching chemicals market is segmented into electronics, renewable energy, automotive, defense, healthcare, and others. The electronics segment held the largest market revenue share in 2024, as rare earth elements such as neodymium, europium, and yttrium are critical components in the manufacturing of semiconductors, displays, and other high-performance devices. Leaching chemicals are integral to extracting these elements efficiently, especially from lower-grade ores and recycled electronic waste

The renewable energy segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising global investments in wind power and electric vehicles, both of which rely heavily on rare earth permanent magnets. Leaching chemicals play a crucial role in processing neodymium and dysprosium, key materials for wind turbine generators and EV motors

Rare Earth Metals Leaching Chemicals Market Regional Analysis

- Asia-Pacific dominated the rare earth metals leaching chemicals market with the largest revenue share 70.5% in 2024, led by China’s established rare earth processing infrastructure, robust demand from manufacturing industries, and government-backed initiatives aimed at securing critical mineral supply for domestic technology growth

- Countries in the region prioritize efficient leaching technologies to support high-demand industries such as electronics, electric vehicles, and renewable energy, where rare earth elements are essential components

- The region’s leadership is further reinforced by favorable government policies, abundant mineral resources, and large-scale industrial applications, positioning Asia-Pacific as a central hub for rare earth extraction and processing, with leaching chemicals playing a critical role in maintaining output and purity standards across diverse end-use sectors

The China Rare Earth Metals Leaching Chemicals Market Insight

The China rare earth metals leaching chemicals market accounted for 60% of Asia Pacific’s market share in 2024, owing to its vast rare earth reserves and dominance in global supply chains. The country maintains extensive mining and separation facilities, backed by decades of expertise in hydrometallurgical processes. Government-controlled quotas and environmental regulations have led to the development of cleaner leaching technologies. China's rare earths are crucial for its domestic EV, electronics, and defense sectors, and it remains the global leader in rare earth refining and chemical processing.

India Rare Earth Metals Leaching Chemicals Market Insight

The India rare earth metals leaching chemicals market is poised to grow steadily, fueled by increasing focus on self-reliance in critical minerals. The Indian Rare Earths Limited (IREL) and other public-sector entities are investing in refining technologies and leaching processes to tap into coastal and monazite-rich reserves. With growing demand from renewable energy, electronics, and strategic sectors, the government is encouraging private participation and joint ventures to accelerate rare earth refining capacity, which is expected to boost the use of advanced leaching chemicals in the country.

Europe Rare Earth Metals Leaching Chemicals Market Insight

The Europe rare earth metals leaching chemicals market is projected to expand steadily over the forecast period, backed by growing regional initiatives to secure a sustainable and independent rare earth supply chain. The EU’s Critical Raw Materials Act and Green Deal goals are pushing member states to invest in localized refining and recycling capacities. Demand from EV manufacturing, wind power, and high-tech electronics is fostering chemical leaching innovations tailored to meet environmental standards. The region’s emphasis on closed-loop systems and traceability is encouraging the use of advanced and green leaching solutions.

U.K. Rare Earth Metals Leaching Chemicals Market Insight

The U.K. rare earth metals leaching chemicals market is emerging as a strategic player, driven by its commitment to securing critical mineral supply chains post-Brexit. In 2024, the country mapped eight high-potential regions, including parts of Scotland and southwest England, where rare earth elements such as neodymium and dysprosium may be extracted to support green technologies. These efforts are complemented by strong governmental backing for rare earth recycling and advanced leaching techniques, particularly bioleaching and acid-free processes. The U.K.’s focus on reducing reliance on foreign sources while supporting clean energy transition positions it as a growing contributor to Europe’s rare earth value chain.

Germany Rare Earth Metals Leaching Chemicals Market Insight

The Germany rare earth metals leaching chemicals market holds a pivotal role in the European market due to its extensive manufacturing base and demand for high-performance magnets and batteries. However, increasing demand for critical materials like scandium and iridium—essential for fuel cells and advanced electronics—has exposed raw material bottlenecks. In response, Germany is investing in refining technologies and environmentally friendly leaching solutions that prioritize sustainability. The country’s robust push toward localized supply chains, along with its leadership in industrial recycling and rare earth recovery from end-of-life products, supports steady market growth. Its strategic stance is further strengthened by alliances across the EU to diversify sources and enhance mineral independence.

North America Rare Earth Metals Leaching Chemicals Market Insight

The North America rare earth metals leaching chemicals market is anticipated to witness the fastest CAGR in the rare earth metals leaching chemicals market during the forecast period of 2025 to 2032. The region is actively pursuing domestic rare earth development, supported by strong government backing to reduce reliance on imports, particularly from China. Significant investments in R&D for eco-friendly leaching methods and rare earth recycling are transforming the regional landscape. The expanding electric vehicle, wind turbine, and defense sectors further amplify the need for localized refining. Collaboration between public and private stakeholders is accelerating innovation and boosting demand for advanced leaching chemicals across the region.

U.S. Rare Earth Metals Leaching Chemicals Market Insight

The U.S. rare earth metals leaching chemicals market held the largest share in North America in 2024, fueled by national security concerns and a strategic push for critical mineral independence. Rising demand from defense, clean energy, and electronics industries has prompted the development of new rare earth processing plants supported by the Department of Energy and Department of Defense. Technological advancements in selective, low-environmental-impact leaching processes, along with investments in rare earth recycling and circular economy initiatives, are propelling the U.S. market. Ongoing exploration and government grants are expected to further accelerate growth.

Mexico Rare Earth Metals Leaching Chemicals Market Insight

Mexico is witnessing growing interest in its rare earth metals leaching chemicals market, propelled by regional industrial expansion, favorable trade ties with the U.S., and government initiatives to modernize its mining sector. The country’s strategic proximity to the North American market, combined with its rich mineral reserves and cost-effective production environment, attracts global and domestic investment. Efforts to adopt cleaner extraction methods and integrate leaching technologies that minimize environmental impact are gaining traction. With rising demand from the automotive and electronics sectors, Mexico is increasingly viewed as a key growth region for rare earth chemical processing in Latin America.

Rare Earth Metals Leaching Chemicals Market Share

The rare earth metals leaching chemicals industry is primarily led by well-established companies, including:

- Lynas Rare Earths Ltd. (Australia)

- Iluka Resources Limited (Australia)

- MP Materials Corp. (U.S.)

- Solvay S.A. (Belgium)

- Arafura Rare Earths Limited (Australia)

- Rainbow Rare Earths Limited (U.K.)

- Neo Performance Materials Inc. (Canada)

- Ucore Rare Metals Inc. (Canada)

- REEtec AS (Norway)

- Metso Corporation (Finland)

- Shenghe Resources Holding Co., Ltd. (China)

- Less Common Metals Ltd. (U.K.)

- Carester SAS (France)

- Indian Rare Earths Limited (India)

- BatX Energies Pvt. Ltd. (India)

- Rocklink GmbH (Germany)

- Nippon Yttrium Co., Ltd. (Japan)

- Hitachi Metals, Ltd. (Japan)

- Siemens (Germany)

What are the Recent Developments in Global Rare Earth Metals Leaching Chemicals Market?

- In July 2025, Apple Inc., in collaboration with MP Materials, announced a USD 500 million investment to establish a rare earth recycling facility at the Mountain Pass site in California. This facility is designed to produce domestically sourced NdPr magnets for Apple devices, strengthening the supply chain resilience of critical materials. The initiative exemplifies Apple’s strategic shift toward vertical integration and sustainable sourcing, while reinforcing the growing demand for clean leaching technologies in high-performance magnet production

- In July 2025, the U.S. government launched a price-support initiative aimed at bolstering domestic production of rare earth metals through subsidies and guaranteed pricing. This move is intended to reduce dependency on Chinese imports, encourage sustainable mining practices, and support emerging leaching technologies. By incentivizing domestic players such as Phoenix Tailings and Momentum Technologies, the policy underscores a renewed national focus on securing critical mineral supply chains through innovative chemical extraction methods

- In June 2025, Solvay SA unveiled plans to expand rare earth processing operations at its La Rochelle facility in France, targeting 30% of Europe’s permanent magnet demand by 2030. This strategic investment, developed in response to Chinese export controls, integrates advanced solvent extraction and eco-friendly leaching systems. The expansion highlights Europe’s commitment to building a self-reliant, environmentally responsible rare earth ecosystem amid intensifying global competition

- In May 2025, India’s BatX Energies, in partnership with Germany’s Rocklink GmbH, announced the development of the country’s first rare earth magnet recycling and refining center. Located in New Delhi, the facility leverages low-impact leaching technologies to extract rare earths from e-waste, supporting India’s transition to a circular economy. This collaboration is part of broader EU-India initiatives focused on sustainability and cross-border technological exchange

- In May 2025, Less Common Metals (LCM), a UK-based processor, disclosed a EUR 110 million investment to build a rare earth separation and recycling plant in Lacq, France. Developed alongside Carester and supported by government grants, the project will utilize advanced chemical leaching techniques to refine rare earth oxides from recycled sources. The facility represents a pivotal step in Europe’s effort to strengthen its critical material infrastructure through green chemistry solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rare Earth Metals Leaching Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rare Earth Metals Leaching Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rare Earth Metals Leaching Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.