Global Reach Stacker Market

Market Size in USD Million

CAGR :

%

USD

531.05 Million

USD

721.21 Million

2025

2033

USD

531.05 Million

USD

721.21 Million

2025

2033

| 2026 –2033 | |

| USD 531.05 Million | |

| USD 721.21 Million | |

|

|

|

|

Reach Stacker Market Size

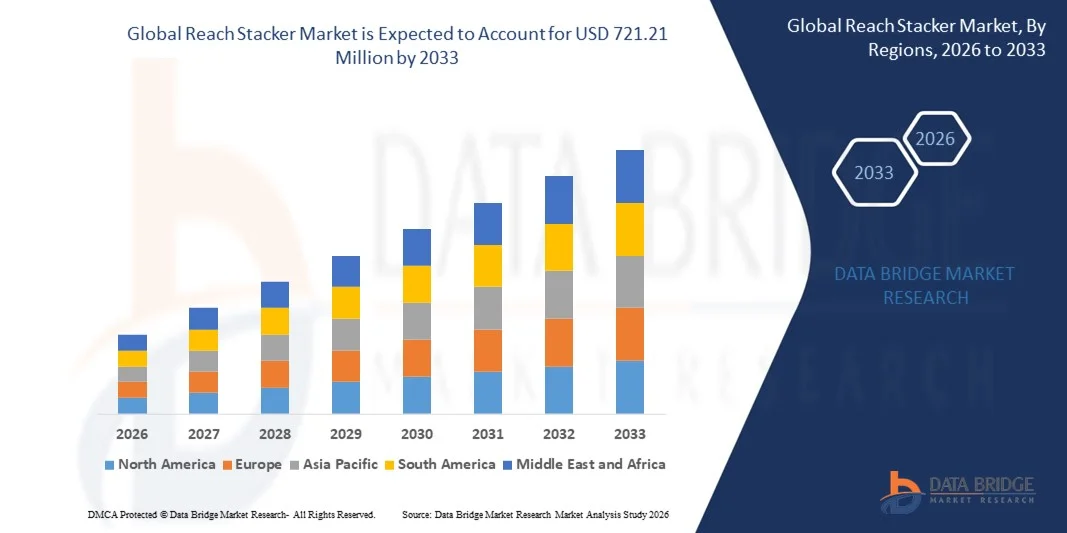

- The global reach stacker market size was valued at USD 531.05 million in 2025 and is expected to reach USD 721.21 million by 2033, at a CAGR of 3.90% during the forecast period

- The market growth is largely fueled by the rising expansion of global port infrastructure, increasing containerization in maritime trade, and accelerated adoption of advanced cargo-handling equipment across terminals and logistics hubs. Growing investment in automation, electrification, and fleet modernization is strengthening demand for high-performance reach stackers equipped with enhanced lifting capacity and operational efficiency

- Furthermore, the need for faster cargo movement, reduced turnaround time, and higher yard productivity is driving operators to deploy technologically upgraded reach stackers with improved safety, precision, and energy efficiency. These converging factors are significantly boosting the adoption of reach stackers and contributing to strong market growth

Reach Stacker Market Analysis

- Reach stackers, designed for efficient stacking, lifting, and handling of containers in ports, terminals, and industrial yards, are becoming essential equipment for modern logistics ecosystems due to their versatility, mobility, and high load-handling capabilities. Their role in optimizing container movement, improving yard organization, and supporting intermodal operations positions them as a critical asset in global trade infrastructure

- The escalating demand for reach stackers is primarily driven by increasing global freight volumes, rapid growth in port automation, and a heightened focus on improving operational throughput in logistics and warehousing applications. Rising preference for energy-efficient electric and hybrid models and ongoing digital transformation across cargo-handling operations are further accelerating market expansion

- Asia-Pacific dominated the reach stacker market with a share of 43.02% in 2025, due to strong port expansion projects, growing container traffic, and increasing investments in logistics infrastructure

- North America is expected to be the fastest growing region in the reach stacker market during the forecast period due to increasing demand for efficient cargo-handling equipment, rising intermodal transport activities, and modernization of port and rail terminals

- Sea port/ terminal segment dominated the market with a market share of 69% in 2025, due to its critical role in managing high container traffic and ensuring uninterrupted cargo handling across global maritime trade operations. Sea ports rely heavily on reach stackers for efficient stacking, loading, and repositioning of containers, which supports faster vessel turnaround times and overall port productivity. The growing scale of global trade has led to increased containerization, further strengthening the demand for high-performance reach stackers in terminal environments. Infrastructure modernization programs at major ports, along with rising investments in fleet upgrades, also contributed to the segment’s leadership

Report Scope and Reach Stacker Market Segmentation

|

Attributes |

Reach Stacker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Reach Stacker Market Trends

Growing Integration of Automation and Telematics in Reach Stackers

- A key trend in the reach stacker market is the rising integration of automation, telematics, and intelligent monitoring systems that enhance real-time fleet visibility, operational efficiency, and safety in container handling operations. These technologies are elevating equipment performance through functions such as fuel monitoring, predictive diagnostics, and automated load management

- For instance, manufacturers such as Konecranes and Kalmar offer reach stackers equipped with advanced telematics platforms that track equipment health, optimize fuel usage, and provide remote operational insights. These capabilities help terminal operators reduce downtime, improve handling accuracy, and strengthen overall productivity

- Automated assistance systems are becoming increasingly important as ports and terminals transition toward smarter and more digitalized material-handling environments. Features such as automated spreader control and stability management support safer lifting operations and minimize manual errors

- The demand for intelligent fleet management solutions is growing due to the need for ports to streamline container movement, reduce congestion, and improve asset utilization. This is increasing the adoption of connected reach stackers capable of delivering real-time performance analytics

- The integration of automation is facilitating smoother interoperability between reach stackers and other port equipment through unified digital platforms that enhance workflow efficiency. This is strengthening the shift toward coordinated and data-driven terminal operations

- The expanding requirement for faster, more accurate, and cost-efficient container handling solutions continues to reinforce this trend. The integration of telematics and automation is shaping the future of reach stackers, enabling terminals to operate with greater control, visibility, and operational resilience

Reach Stacker Market Dynamics

Driver

Rising Expansion of Global Container Handling and Port Operations

- The steady increase in global trade volumes, port expansions, and containerized cargo movement is driving strong demand for reach stackers that support high-speed loading, unloading, and stacking activities in ports, rail yards, and inland terminals. These machines are essential for improving throughput capacity and maintaining efficient cargo flow across modern logistics networks

- For instance, Hyster and Liebherr supply high-performance reach stackers designed for heavy-duty container handling in rapidly expanding ports across Asia and Europe. Their equipment enables faster stacking cycles, higher load capacity, and smooth maneuvering within congested terminal spaces, ensuring operational continuity

- The rise of intermodal logistics networks is increasing the need for flexible container-handling equipment capable of operating across diverse environments such as inland container depots and freight terminals. This growth is compelling operators to invest in advanced reach stackers that provide reliability and operational versatility

- The expansion of international trade corridors is boosting container traffic, leading to higher demand for equipment that can manage increased throughput efficiently. This is reinforcing the role of reach stackers as crucial assets for modern supply chains

- The long-term rise in global cargo volumes and the continuous expansion of port infrastructure continue to strengthen this driver. The growing need for fast, accurate, and reliable container handling is directly accelerating the adoption of reach stackers

Restraint/Challenge

High Initial Investment and Maintenance Costs

- The reach stacker market faces challenges due to the high upfront cost of procuring advanced equipment, which includes sophisticated hydraulics, heavy-duty components, and telematics systems that increase overall capital expenditure for port operators and logistics companies. These costs can limit adoption, especially among small and mid-sized terminal operators

- For instance, premium reach stackers from brands such as Kalmar and Konecranes require substantial investment due to their advanced load-handling technologies, emissions-compliant engines, and digital monitoring systems. These features, while enhancing performance, significantly increase acquisition and long-term maintenance expenses

- The requirement for specialized maintenance, skilled technicians, and high-quality replacement parts further adds to operational costs, making long-term ownership financially demanding for many operators. This creates barriers to scaling fleet sizes in cost-sensitive markets

- Complex mechanical structures and high-precision hydraulic systems require regular inspection and servicing to maintain safe and efficient operations. These maintenance needs extend downtime and contribute to higher lifecycle costs

- The industry continues to face constraints related to balancing high equipment performance with cost-efficient operations. These financial challenges collectively limit market penetration and influence procurement decisions among port operators and logistics companies

Reach Stacker Market Scope

The market is segmented on the basis of capacity, propulsion, fuel type, application, vehicle type, and sales channel.

- By Capacity

On the basis of capacity, the reach stacker market is segmented into Below 30 Ton, 30–45 Ton, and Above 45 Ton. The 30–45 Ton segment dominated the market with the largest revenue share in 2025 due to its versatility in handling diverse container weights across ports and logistics hubs. This category is widely adopted because it offers a balanced combination of power, operational efficiency, and cost-effectiveness for terminal operators. Its compatibility with standard container operations and ability to support frequent stacking cycles makes it the preferred choice for high-throughput environments. The segment benefits from strong demand across both developed and emerging port infrastructures, reinforcing its leadership position. Operational reliability and reduced downtime further drive adoption among users seeking consistent performance.

The Above 45 Ton segment is projected to witness the fastest growth rate from 2026 to 2033, driven by the rising need to manage heavier cargo loads at large-scale ports and transshipment hubs. Increasing deployment of mega container vessels has prompted terminals to adopt higher-capacity reach stackers capable of handling intense workloads. This segment also benefits from infrastructure upgrades across global trade corridors where heavy-duty load handling is crucial for operational efficiency. Manufacturers are integrating advanced lifting technologies and enhanced stability systems, enabling safer and more efficient high-capacity operations. Growing volumes of industrial cargo movement further accelerate its demand within heavy logistics zones.

- By Propulsion

On the basis of propulsion, the market is categorized into Internal Combustion Engine (ICE), Electric, and Hybrid. The Internal Combustion Engine segment dominated the market in 2025 owing to its long-standing reliability, high torque output, and suitability for extended, heavy-duty operations. ICE reach stackers remain preferred in high-capacity container terminals where continuous operation is required without charging interruptions. Their extensive availability, ease of maintenance, and compatibility with rugged port environments strengthen their market leadership. The segment’s strong global fleet presence and widespread service ecosystem further enhance user confidence. High operational endurance and proven field performance continue to support its dominance across regions.

The Electric segment is expected to record the fastest growth from 2026 to 2033, driven by increasing emphasis on emission reduction and sustainability targets across ports. Operators are shifting toward electric reach stackers to meet regulatory requirements and reduce fuel costs over long-term operation cycles. Technological advancements such as high-density battery systems and rapid charging solutions have improved operational feasibility for electric models. These machines offer quieter operations and lower maintenance needs, making them suitable for modern automated terminals. Port authorities investing in green logistics infrastructure further accelerate the adoption of electric propulsion systems.

- By Fuel Type

On the basis of fuel type, the market is segmented into Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG). The Compressed Natural Gas segment dominated the market in 2025 because of its lower emissions profile, reduced operating cost, and growing adoption across environmentally conscious logistics hubs. CNG-powered reach stackers offer cleaner combustion and help operators comply with stringent emission norms enforced at ports. The segment benefits from increasing expansion of CNG fueling infrastructure near industrial clusters and commercial shipping terminals. Operators prefer CNG as a transitional solution toward greener equipment while maintaining operational power levels. Its cost-efficiency in long-term operations strengthens dominance in regions prioritizing sustainable fuel adoption.

The Liquefied Petroleum Gas segment is anticipated to be the fastest growing between 2026 and 2033 owing to its flexibility, availability, and operational efficiency in medium-duty reach stacker applications. LPG systems offer smoother combustion and reduced engine strain, contributing to extended equipment lifespan. As logistics facilities integrate alternative fuel choices, LPG becomes attractive for operators aiming for reduced emissions without investing in full electric systems. Growth in industrial and yard applications further boosts demand where LPG infrastructure is easily accessible. Increasing adoption of hybrid-LPG system designs also supports this segment’s accelerated expansion.

- By Application

On the basis of application, the reach stacker market is segmented into Sea Port/Terminal, Yards/Landside, and Industrial. The Sea Port/Terminal segment dominated the market with the largest share of 69% in 2025, driven by its critical role in managing high container traffic and ensuring uninterrupted cargo handling across global maritime trade operations. Sea ports rely heavily on reach stackers for efficient stacking, loading, and repositioning of containers, which supports faster vessel turnaround times and overall port productivity. The growing scale of global trade has led to increased containerization, further strengthening the demand for high-performance reach stackers in terminal environments. Infrastructure modernization programs at major ports, along with rising investments in fleet upgrades, also contributed to the segment’s leadership.

The Yards/Landside segment is projected to register the fastest growth from 2026 to 2033 driven by the rise of inland container depots, logistics parks, and multimodal transport hubs. Increasing domestic freight movement and growth of e-commerce supply chains are boosting the need for high-performance lifting equipment within yard environments. Landside facilities now require advanced reach stackers for container repositioning, intermodal transfers, and cargo consolidation operations. Expansion of warehousing and third-party logistics networks further elevates growth prospects. Adoption of efficient equipment for faster cargo turnaround enhances the segment’s upward momentum.

- By Vehicle Type

On the basis of vehicle type, the market is categorized into Passenger Cars and Commercial Vehicles. The Commercial Vehicles segment dominated the market in 2025 owing to the extensive use of reach stackers in logistics, shipping, manufacturing, and industrial transport operations. Commercial sectors rely heavily on these machines for heavy container handling and streamlined movement of goods. Large fleet operators and logistics companies consistently invest in high-performance equipment to improve operational throughput. The rising scale of import–export activities strengthens commercial demand at ports and depots. Continuous modernization of commercial logistics fleets reinforces the dominance of this segment.

The Passenger Cars segment is expected to grow at the fastest rate from 2026 to 2033 due to expanding automotive production and increased export movement across global transport networks. Automotive hubs require reach stackers for handling vehicle containers, spare parts shipments, and distribution center logistics. Growth in automobile manufacturing clusters enhances the need for efficient yard management solutions. Increasing trade of finished vehicles through sea ports also raises the demand for specialized handling equipment. Modernization of automotive logistics infrastructure supports the rapid expansion of this segment.

- By Sales Channel

On the basis of sales channel, the market is segmented into Original Equipment Manufacturers (OEMs) and Aftermarket. The OEM segment dominated the market in 2025 due to strong demand for new high-capacity reach stackers equipped with advanced technologies. Ports and logistics facilities increasingly prefer factory-integrated systems that ensure long-term reliability and warranty coverage. OEMs provide tailored configurations for different terminal needs, boosting procurement of new units. Continuous innovations in lifting efficiency, fuel systems, and safety features strengthen the segment’s leadership. Rising port expansions and fleet upgrades further support OEM demand.

The Aftermarket segment is anticipated to grow the fastest from 2026 to 2033 driven by increasing fleet aging, frequent maintenance needs, and rising demand for replacement components. Operators invest in aftermarket parts to extend equipment lifespan and maintain consistent operational performance. Growth in service contracts, refurbishment activities, and cost-effective component sourcing enhances the segment’s expansion. As reach stacker fleets expand across developing logistics hubs, the need for repair, overhaul, and periodic component upgrades increases. Availability of third-party service providers also contributes to the rapid growth of the aftermarket segment.

Reach Stacker Market Regional Analysis

- Asia-Pacific dominated the reach stacker market with the largest revenue share of 43.02% in 2025, driven by strong port expansion projects, growing container traffic, and increasing investments in logistics infrastructure

- The region’s rapid industrialization, rising maritime trade activities, and development of inland container depots are accelerating the adoption of reach stackers across major economies

- Availability of cost-efficient manufacturing, supportive government initiatives for port modernization, and expanding logistics and warehousing networks are further contributing to the region’s strong market position

China Reach Stacker Market Insight

China held the largest share in the Asia-Pacific reach stacker market in 2025 owing to its extensive port network, strong manufacturing capabilities, and significant container handling volume. Continuous investments in port automation, expansion of export-oriented industries, and upgrades to cargo-handling equipment are key factors driving demand. The country’s leadership in global trade and large-scale logistics operations further strengthens its dominant market position.

India Reach Stacker Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising port development activities, increasing domestic freight movement, and expanding containerization across major industrial corridors. Government programs such as Sagarmala and Bharatmala are improving cargo-handling efficiency, boosting demand for high-performance reach stackers. Growth in warehousing, multimodal logistics parks, and private port operations also contributes to India’s accelerated market expansion.

Europe Reach Stacker Market Insight

The Europe reach stacker market is expanding steadily, supported by modernization of port infrastructure, increasing focus on operational efficiency, and rising adoption of advanced cargo-handling equipment. The region maintains strong standards for safety, sustainability, and automation within maritime and logistics operations. Growing investment in intermodal transport networks and inland terminals is further enhancing reach stacker usage across Europe.

Germany Reach Stacker Market Insight

Germany’s reach stacker market is driven by its highly developed logistics sector, strong cargo-handling capabilities, and extensive network of inland terminals and freight villages. The country's emphasis on efficiency, reliability, and technology integration encourages the adoption of advanced reach stacker models. Strong manufacturing, export-driven industries, and well-structured supply chain systems continue to support market growth.

U.K. Reach Stacker Market Insight

The U.K. market is supported by ongoing port upgrades, rising demand for efficient container-handling solutions, and strengthening of domestic logistics networks. Post-Brexit supply chain restructuring has increased focus on localized port development and operational efficiency, driving reach stacker adoption. Investments in intermodal terminals, warehousing facilities, and digitalized logistics operations further reinforce the U.K.'s market presence.

North America Reach Stacker Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for efficient cargo-handling equipment, rising intermodal transport activities, and modernization of port and rail terminals. Strong growth in containerized trade, expansion of logistics automation, and higher investments in fleet upgrades are supporting the region’s rapid market development.

U.S. Reach Stacker Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its advanced logistics infrastructure, high cargo throughput, and significant presence of large port and rail terminals. Investments in strengthening supply chain resilience, upgrading material-handling fleets, and adopting technologically advanced equipment are key growth drivers. The country’s robust import–export ecosystem and extensive industrial base further reinforce its leading position in the region.

Reach Stacker Market Share

The reach stacker industry is primarily led by well-established companies, including:

- Cargotec Corporation (Finland)

- CVS Ferrari S.p.A. (Italy)

- DLCC (China)

- Hoist Material Handling, Inc. (U.S.)

- Hyster-Yale Group, Inc. (U.S.)

- Jay Equipment & Systems Pvt. Ltd. (India)

- Konecranes (Finland)

- Liebherr-International Deutschland GmbH (Germany)

- Linde Material Handling (Germany)

- Mitsubishi Logisnext Europe B.V. (Netherlands)

- SANY Group (China)

- Taylor Machine Works, Inc. (U.S.)

- Terex Cranes (U.S.)

- Toyota Material Handling India (India)

- Anhui JAC International Co., Ltd. (China)

- BOMAQ Industries (Spain)

- Komatsu Ltd. (Japan)

- TASK Forklifts (Australia)

- Hinrichs Flurfördergeräte GmbH & Co. KG (Germany)

- Anhui Heli Co., Ltd. (China)

Latest Developments in Global Reach Stacker Market

- In July 2025, Hyster-Yale Group announced the expansion of its European manufacturing facility to accelerate the production of low-emission and fully electric reach stackers. This strategic expansion strengthens the company’s capacity to meet rising demand for sustainable cargo-handling solutions as ports shift toward decarbonization. By increasing manufacturing output and reducing delivery timelines, the move is expected to significantly enhance the availability of next-generation reach stackers across Europe, supporting modernization efforts at terminals and boosting competition within the electric equipment category

- In June 2025, Saudi Arabia’s Port of NEOM completed the installation of its first set of automated cranes, marking a major advancement toward the port’s planned 2026 operational launch under the Vision 2030 logistics infrastructure program. The integration of automation technologies signals the port’s transition toward a highly digitalized cargo-handling ecosystem, which will require advanced reach stackers capable of supporting synchronized container movement and high-throughput operations. This development is poised to stimulate regional demand for technologically advanced equipment as the port prepares to operate as a future global logistics hub

- In June 2025, Synnex announced a USD 150 million automated logistics hub in Melbourne featuring advanced container handling systems and integrated automation technologies. The hub aims to streamline supply chain efficiency and enable high-speed cargo processing across Australia’s distribution networks. As the facility scales operations, the demand for high-performance reach stackers is expected to rise, particularly models compatible with automated yard workflows. This project reinforces the growing adoption of intelligent cargo-handling equipment across Oceania

- In June 2025, Kalmar Group delivered an electric reach stacker to DFDS Ghent—the ERG450-65S5—featuring a 587 kWh battery, the largest capacity available in its range. This milestone highlights the rapid technological advancements in electric heavy-duty lifting equipment and the increasing readiness of ports to transition toward emission-free operations. The deployment of such high-capacity electric models is anticipated to drive broader market adoption, encouraging ports to replace diesel units with eco-efficient alternatives to meet environmental compliance targets

- In February 2025, DP World achieved a significant milestone by completing 65% of Phase 1 of the Sokhna Logistics Park located in the Suez Canal Economic Zone. With an investment of USD 80 million, the project is designed to enhance Egypt’s logistics capabilities and establish it as a regional trade center. As new warehousing, container handling zones, and intermodal facilities become operational, demand for reach stackers is expected to rise sharply to support expanded cargo flow, inland transport connectivity, and industrial growth across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.