Global Ready To Drink Alcoholic Tea Market

Market Size in USD Billion

CAGR :

%

USD

39.84 Billion

USD

72.13 Billion

2025

2033

USD

39.84 Billion

USD

72.13 Billion

2025

2033

| 2026 –2033 | |

| USD 39.84 Billion | |

| USD 72.13 Billion | |

|

|

|

|

Ready to Drink Alcoholic Tea Market Size

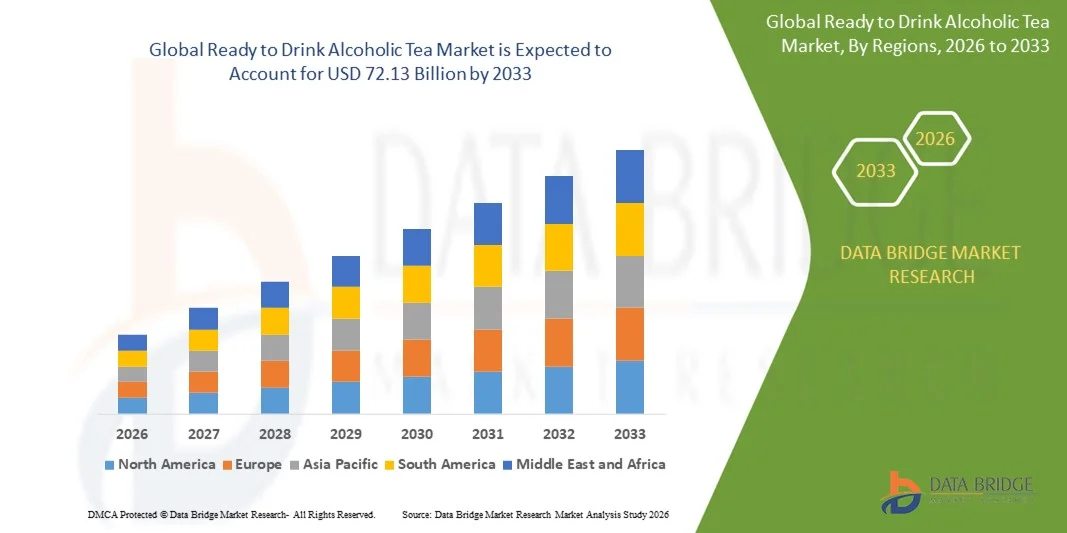

- The global ready to drink alcoholic tea market size was valued at USD 39.84 billion in 2025 and is expected to reach USD 72.13 billion by 2033, at a CAGR of 7.70% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for convenient, ready-to-drink alcoholic beverages, coupled with the increasing popularity of tea-based and low-alcohol drinks among millennials and health-conscious consumers

- In addition, innovative flavor offerings, premium packaging, and the growing presence of alcoholic tea in bars, restaurants, and e-commerce channels are further supporting market expansion

Ready to Drink Alcoholic Tea Market Analysis

- The market is witnessing increased product innovation with a focus on unique tea blends, natural ingredients, and low-calorie options, catering to consumer demand for healthier alcoholic beverages

- Expanding distribution channels, including online retail, convenience stores, and supermarkets, are improving accessibility and boosting sales globally

- North America dominated the ready-to-drink alcoholic tea market with the largest revenue share of 35.62% in 2025, driven by growing consumer preference for convenient, low-alcohol beverages and increasing awareness of flavored and functional RTD drinks

- Asia-Pacific region is expected to witness the highest growth rate in the global ready to drink alcoholic tea market, driven by rapid urbanization, increasing disposable incomes, growing demand for convenient and flavored alcoholic beverages, and expansion of retail and hospitality sectors

- The vodka segment held the largest market revenue share in 2025, driven by its popularity as a versatile alcoholic base and its widespread consumer acceptance across urban and semi-urban regions. Vodka-based RTD alcoholic teas are often preferred for their smooth taste, mixability, and compatibility with diverse tea flavors

Report Scope and Ready to Drink Alcoholic Tea Market Segmentation

|

Attributes |

Ready to Drink Alcoholic Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink Alcoholic Tea Market Trends

Rise of Flavored and Innovative Alcoholic Tea Beverages

- The growing consumer preference for flavored and innovative alcoholic tea beverages is transforming the global ready-to-drink (RTD) alcoholic tea market by offering unique taste experiences and convenient consumption. These beverages combine traditional tea flavors with alcohol, catering to millennials and health-conscious consumers, which drives higher demand

- The high interest in low-alcohol and functional beverages is accelerating the adoption of RTD alcoholic teas in bars, restaurants, and retail outlets. These products are particularly popular among consumers seeking alternative alcoholic drinks with perceived health benefits and refreshing flavors

- The convenience and ready-to-consume format of RTD alcoholic teas are making them attractive for on-the-go consumption, leading to increased household and outdoor usage. Consumers benefit from portable packaging without compromising on taste or quality, supporting market growth

- For instance, in 2023, several global beverage retailers reported increased sales of flavored and herbal alcoholic teas in urban areas, reflecting the rising popularity of RTD options. These products enhanced consumer experiences while boosting brand visibility and retailer revenue

- While flavored and functional RTD alcoholic teas are driving market expansion, their impact depends on continued innovation in flavors, alcohol content, and packaging. Manufacturers must focus on product differentiation, marketing strategies, and regional customization to fully capitalize on this growing demand

Ready to Drink Alcoholic Tea Market Dynamics

Driver

Rising Preference for Convenient and Low-Alcohol Beverages

- The increasing consumer preference for convenient, ready-to-drink, and low-alcohol beverages is pushing manufacturers to focus on RTD alcoholic teas. Consumers perceive these drinks as healthier and easier to consume, boosting adoption across urban and semi-urban populations

- Bars, restaurants, and retail outlets are increasingly promoting RTD alcoholic teas as alternatives to traditional alcoholic beverages, enhancing consumer exposure. The trend is further supported by cocktail culture, premium beverage experiences, and social media influence

- Marketing initiatives and product innovations highlighting unique tea blends, natural ingredients, and functional benefits are strengthening market penetration. From flavored herbal teas to kombucha-based alcoholic variants, wide product variety is attracting a diverse consumer base

- For instance, in 2022, major global beverage brands launched premium RTD alcoholic tea ranges, driving awareness and trial among younger consumers. Promotions in e-commerce and subscription models further increased accessibility and sales

- While rising consumer awareness and demand for convenient alcoholic beverages are driving the market, continuous efforts are needed to innovate flavors, improve shelf-life, and maintain quality standards for sustained growth

Restraint/Challenge

Regulatory Constraints and Flavor Acceptance Barriers

- Strict regulations regarding alcohol content, labeling, and health claims in various countries can limit product launch and distribution of RTD alcoholic teas. Compliance costs and approval processes add to operational challenges, restricting market expansion

- In some regions, consumer acceptance of tea-based alcoholic drinks remains low due to unfamiliarity with taste profiles or preferences for traditional alcoholic beverages. Limited awareness and trial further constrain growth in emerging markets

- Supply chain and production challenges, such as sourcing quality tea extracts and maintaining flavor stability in RTD formats, can impact product consistency and market penetration. Seasonal variations in tea quality may also affect large-scale production

- For instance, in 2023, reports indicated that several Asian and European markets had lower adoption of RTD alcoholic teas due to regulatory restrictions and limited consumer familiarity, while urban markets showed higher demand

- While product innovation continues, addressing regulatory compliance, flavor acceptance, and production challenges remains crucial. Market stakeholders must focus on R&D, localized flavors, and strategic distribution channels to unlock long-term potential

Ready to Drink Alcoholic Tea Market Scope

The market is segmented on the basis of flavor, base, and end-use

- By Flavor

On the basis of flavor, the global ready-to-drink alcoholic tea market is segmented into gin, vodka, bourbon, rum, Irish cream, and others. The vodka segment held the largest market revenue share in 2025, driven by its popularity as a versatile alcoholic base and its widespread consumer acceptance across urban and semi-urban regions. Vodka-based RTD alcoholic teas are often preferred for their smooth taste, mixability, and compatibility with diverse tea flavors.

The gin segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising consumer interest in botanical and craft flavors. Gin-based alcoholic teas are gaining traction in premium and artisanal beverage segments, appealing to consumers seeking innovative and sophisticated drinking experiences.

- By Base

On the basis of base, the market is segmented into berries, lime, cucumber, peach, mint, coconut, mango, sweet apricot, and others. The berry base segment held the largest market revenue share in 2025 due to its strong flavor profile, antioxidant properties, and compatibility with multiple alcoholic spirits. Berry-based RTD alcoholic teas are widely consumed for their refreshing taste and perceived health benefits.

The lime base segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer preference for citrus-flavored and low-calorie alcoholic beverages. Lime-infused RTD teas are particularly popular for on-the-go consumption and in outdoor or social settings.

- By End-Use

On the basis of end-use, the market is segmented into retail and industrial. The retail segment held the largest market revenue share in 2025 owing to the increasing availability of RTD alcoholic teas in supermarkets, convenience stores, and online platforms. Retail distribution ensures easy consumer access and supports impulse and repeat purchases.

The industrial segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in bars, restaurants, hotels, and event catering services. Industrial end-use supports bulk consumption and brand promotion, enabling wider market penetration and visibility.

Ready to Drink Alcoholic Tea Market Regional Analysis

- North America dominated the ready-to-drink alcoholic tea market with the largest revenue share of 35.62% in 2025, driven by growing consumer preference for convenient, low-alcohol beverages and increasing awareness of flavored and functional RTD drinks

- Consumers in the region highly value the variety of flavors, innovative formulations, and ease of consumption offered by RTD alcoholic teas, making them popular for home consumption, social gatherings, and on-the-go occasions

- This widespread adoption is further supported by high disposable incomes, a growing millennial and Gen Z population, and increasing availability through retail and online channels, establishing RTD alcoholic teas as a favored alternative to traditional alcoholic beverages

U.S. Ready-to-Drink Alcoholic Tea Market Insight

The U.S. RTD alcoholic tea market captured the largest revenue share in 2025 within North America, fueled by increasing demand for convenient alcoholic beverages and the rising trend of low-alcohol drinks. Consumers are increasingly prioritizing unique flavors and healthier alternatives, boosting the popularity of tea-based alcoholic beverages. The growing penetration of bars, restaurants, and e-commerce platforms further propels the market. In addition, marketing campaigns promoting natural ingredients and functional benefits are significantly contributing to market expansion.

Europe Ready-to-Drink Alcoholic Tea Market Insight

The Europe RTD alcoholic tea market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by evolving consumer tastes, rising health consciousness, and increased demand for low-alcohol alternatives. Urbanization, lifestyle changes, and the popularity of flavored beverages are fostering the adoption of RTD alcoholic teas. The region is experiencing significant growth across retail, foodservice, and hospitality channels, with new product launches targeting premium and artisanal segments.

U.K. Ready-to-Drink Alcoholic Tea Market Insight

The U.K. RTD alcoholic tea market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of on-the-go consumption, social drinking occasions, and premiumization of alcoholic beverages. Consumer interest in innovative flavors and convenient packaging, combined with the increasing availability of RTD products in supermarkets and online platforms, is expected to continue to stimulate market growth.

Germany Ready-to-Drink Alcoholic Tea Market Insight

The Germany RTD alcoholic tea market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of low-alcohol and functional beverages, coupled with an increasing inclination towards health-conscious drinking habits. Germany’s well-developed retail and e-commerce infrastructure promotes the adoption of RTD alcoholic teas, particularly among urban consumers. Innovative flavors and premium packaging are also enhancing consumer preference and market penetration.

Asia-Pacific Ready-to-Drink Alcoholic Tea Market Insight

The Asia-Pacific RTD alcoholic tea market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and evolving lifestyle preferences in countries such as China, Japan, and India. The growing inclination towards convenient and flavored alcoholic beverages, supported by government initiatives promoting retail modernization, is driving market adoption. Furthermore, as APAC emerges as a production hub for RTD alcoholic tea, affordability and accessibility are expanding to a wider consumer base.

Japan Ready-to-Drink Alcoholic Tea Market Insight

The Japan RTD alcoholic tea market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s preference for innovative, low-alcohol beverages and convenience-oriented products. The adoption of RTD alcoholic teas is driven by the increasing number of urban consumers and social drinking occasions. Integration with lifestyle trends, such as premium and flavored beverages, is fueling growth. Moreover, Japan’s aging population is likely to spur demand for easier-to-consume, ready-made alcoholic tea options.

China Ready-to-Drink Alcoholic Tea Market Insight

The China RTD alcoholic tea market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and high acceptance of novel alcoholic beverages. China stands as one of the largest markets for RTD drinks, and alcoholic teas are becoming increasingly popular in retail, hospitality, and e-commerce channels. The push towards convenient, ready-to-drink options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Ready to Drink Alcoholic Tea Market Share

The Ready to Drink Alcoholic Tea industry is primarily led by well-established companies, including:

• Red Diamond (U.S.)

• Tea Venture Limited (U.K.)

• MB Holding Company LLC (U.S.)

• NOVELTEA (U.K.)

• Döhler (Germany)

• Synergy Flavors (U.S.)

• Tazo Tea Company (U.S.)

• Celestial Seasonings (U.S.)

• Twinings (U.K.)

• Lipton (U.K.)

Latest Developments in Global Ready to Drink Alcoholic Tea Market

- In November 2023, The Coca-Cola Company expanded its presence in Delhi with the launch of The ChaiChun Store under its ChaiChun brand, offering a range of premium teas. This development aims to strengthen brand visibility and attract tea enthusiasts, enhancing customer engagement and supporting growth in the Indian RTD and specialty tea market

- In January 2023, Lipton Tea partnered with Full Cart, a program under U.S. Hunger, and a virtual food pantry to provide heart-friendly nutrition and grocery assistance. This initiative helps improve consumer access to healthy products, reinforces Lipton’s commitment to social responsibility, and positively influences brand perception in the market

- In December 2022, Pure Leaf introduced a limited-edition Merry Mint Iced Tea, coinciding with the release of the Christmas movie ‘Christmas Class Reunion’. The launch included a social media giveaway, creating excitement among consumers, boosting seasonal sales, and enhancing brand engagement in the RTD tea segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ready To Drink Alcoholic Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ready To Drink Alcoholic Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ready To Drink Alcoholic Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.