Global Ready To Drink Premixes Market

Market Size in USD Billion

CAGR :

%

USD

24.83 Billion

USD

35.44 Billion

2024

2032

USD

24.83 Billion

USD

35.44 Billion

2024

2032

| 2025 –2032 | |

| USD 24.83 Billion | |

| USD 35.44 Billion | |

|

|

|

|

Ready to Drink Premixes Market Size

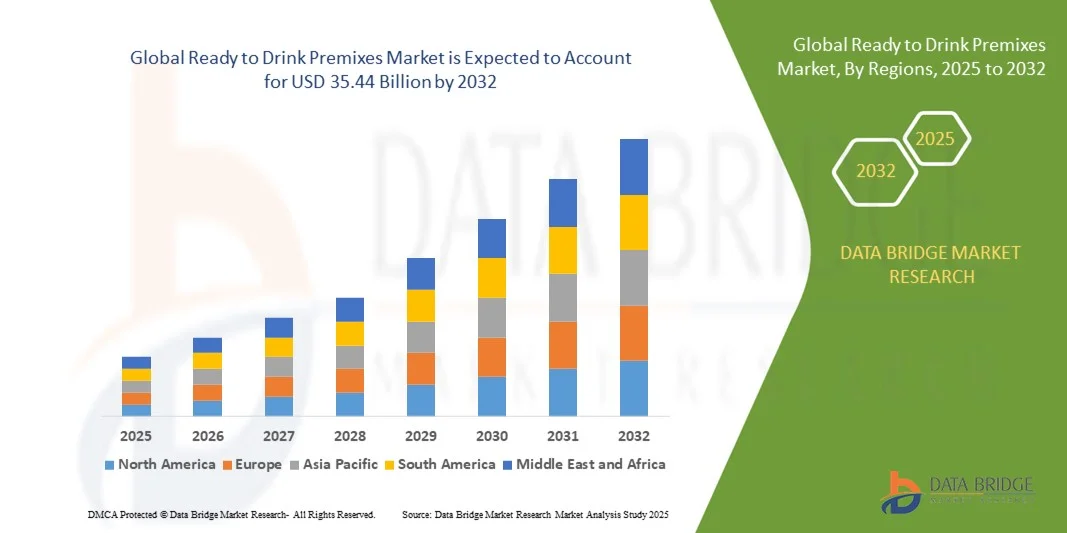

- The global ready to drink premixes market size was valued at USD 24.83 billion in 2024 and is expected to reach USD 35.44 billion by 2032, at a CAGR of 4.55% during the forecast period

- The market growth is largely fueled by the rising consumer preference for convenient, on-the-go beverages that require minimal preparation, coupled with increasing urbanization and busy lifestyles

- Furthermore, growing awareness of premium, ready-to-consume alcoholic and non-alcoholic drinks, along with innovative flavors, health-oriented formulations, and attractive packaging, is driving the adoption of RTD premixes across multiple consumer segments. These converging factors are accelerating market expansion and establishing RTD premixes as a preferred beverage choice among millennials and young adults

Ready to Drink Premixes Market Analysis

- Ready to drink premixes, encompassing pre-mixed alcoholic cocktails, flavored spirits, and non-alcoholic beverage blends, are becoming integral to modern consumer lifestyles due to their convenience, consistent taste, and accessibility across retail and online channels

- The escalating demand for RTD premixes is primarily driven by increasing at-home consumption, the growing trend of casual and social drinking occasions, and consumers’ preference for ready-to-serve, innovative beverage options. Premiumization, flavor diversification, and the emergence of functional or low-alcohol variants are further propelling the market’s growth globally

- North America dominated the ready to drink premixes market with a share of 37.7% in 2024, due to the growing consumer preference for convenient, low-preparation alcoholic and non-alcoholic beverages

- Asia-Pacific is expected to be the fastest growing region in the ready to drink premixes market during the forecast period due to rapid urbanization, rising disposable incomes, and changing consumption patterns among young adults

- Alcoholic beverages segment dominated the market with a market share of 72% in 2024, due to the growing popularity of pre-mixed cocktails, flavored spirits, and low-alcohol alternatives among younger demographics. Consumers are increasingly seeking ready-to-drink alcoholic options that provide bar-like experiences without the need for additional ingredients or preparation time. The segment is also bolstered by innovation in flavor profiles, premium packaging, and marketing campaigns emphasizing social convenience and lifestyle appeal

Report Scope and Ready to Drink Premixes Market Segmentation

|

Attributes |

Ready to Drink Premixes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink Premixes Market Trends

Rising Popularity of Flavored and Low-Alcohol RTD Beverages

- The global ready to drink premixes market is witnessing a notable trend of increasing consumer preference for flavored and low-alcohol beverages, driven by changing lifestyles and the growing inclination towards healthier and convenient drinking options. This trend is encouraging manufacturers to innovate with a variety of flavor profiles, packaging formats, and alcohol levels to cater to diverse consumer segments

- For instance, Bacardi has launched a new line of low-alcohol RTD cocktails in North America featuring tropical flavors such as pineapple and mango, targeting young adults seeking convenience without compromising taste. These product launches demonstrate the market’s shift towards innovation in flavor and alcohol content to meet evolving consumer expectations

- Flavored and low-alcohol RTD beverages are also gaining traction due to their suitability for multiple consumption occasions, such as at-home gatherings, social events, and casual outdoor activities, offering convenience and consistent taste. The ability to enjoy ready-to-consume drinks without preparation appeals to time-constrained consumers, boosting adoption across regions

- The rise of health-conscious consumers is further reinforcing this trend, with increasing demand for low-calorie, sugar-reduced, and natural ingredient-based RTD products. In addition, these beverages allow consumers to moderate alcohol intake while still enjoying premium flavors, enhancing market attractiveness

- The integration of premium ingredients, such as botanicals, fruit extracts, and functional additives, is also shaping product offerings, creating differentiation and appealing to sophisticated palates. This focus on quality and variety is motivating beverage companies to invest in research and development for innovative RTD premix products

- The sustained growth of flavored and low-alcohol RTD beverages is expected to continue, driven by evolving consumer preferences, increasing social occasions, and rising interest in convenient and healthier drinking alternatives, establishing these products as a core segment within the global ready to drink premixes market

Ready to Drink Premixes Market Dynamics

Driver

Increasing Demand for Convenient, On-The-Go Drinks

- The demand for ready-to-drink premixes is significantly rising due to consumers’ need for convenience and minimal preparation, as busy urban lifestyles limit time for traditional beverage preparation. Consumers increasingly seek products that are portable, ready to consume, and suitable for multiple occasions such as home, work, or social gatherings

- For instance, in 2024, Coca-Cola introduced the Bacardi & Coca-Cola RTD cocktail in select European markets, providing a ready-to-serve option for social and casual occasions. This instance highlights how major beverage companies are capitalizing on the convenience trend to expand market presence and cater to time-conscious consumers

- The growing popularity of at-home consumption, fueled by remote work trends and lifestyle changes, has also driven RTD premix adoption, allowing consumers to enjoy bar-quality beverages without leaving home. Ready-to-drink formats provide consistency in taste and quality, further encouraging repeat purchases and brand loyalty

- In addition, expansion of retail and e-commerce channels ensures easy accessibility of RTD premixes, enabling consumers to purchase products from supermarkets, convenience stores, or online platforms efficiently. The combination of convenience, accessibility, and variety is a strong factor propelling global market growth

- The convenience-driven demand, supported by innovations in packaging, portion sizes, and ready-to-serve alcoholic and non-alcoholic options, is expected to sustain robust market growth, reinforcing the central role of RTD premixes in contemporary beverage consumption patterns

Restraint/Challenge

Regulatory Restrictions and Varying Alcohol Laws Across Regions

- The global RTD premixes market faces challenges due to diverse regulatory frameworks and stringent alcohol laws that differ across countries and regions. Compliance with varying taxation, labeling, and sales regulations increases operational complexity for manufacturers and distributors

- For instance, the expansion of Bacardi & Coca-Cola RTD cocktails in Europe faced delays in certain markets due to differing licensing requirements and import regulations, illustrating the impact of regulatory barriers on market penetration. These constraints can limit product launch speed and geographic expansion

- Addressing these regulatory challenges requires companies to invest in legal compliance, certification, and market-specific formulations to meet local standards, which can increase operational costs and affect profitability. Differences in age restrictions, permissible alcohol content, and packaging norms further complicate international operations

- In addition, inconsistent enforcement and frequent updates to alcohol laws can create uncertainty, making it challenging for companies to plan long-term strategies and expand product portfolios. This uncertainty may also affect marketing approaches and distribution planning, limiting growth potential in certain regions

- Overcoming these regulatory and legal hurdles through strategic planning, localized compliance strategies, and proactive engagement with authorities will be crucial for sustained growth of the ready-to-drink premixes market, ensuring smoother market entry and broader consumer reach

Ready to Drink Premixes Market Scope

The market is segmented on the basis of type, distribution channel, and product type.

- By Type

On the basis of type, the Ready to Drink (RTD) Premixes market is segmented into Ready to Drinks and High Strength Premixes. The Ready to Drinks segment dominated the market with the largest revenue share in 2024, primarily driven by rising consumer preference for convenient, on-the-go alcoholic and non-alcoholic beverages. These products cater to evolving urban lifestyles, where consumers seek quick refreshment options without compromising on taste or quality. The segment also benefits from wide availability across retail channels and strong marketing by leading beverage brands emphasizing low-alcohol, flavored, and health-oriented variants appealing to millennials and young adults.

The High Strength Premixes segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand among younger consumers for bolder flavors and stronger alcohol content in ready-to-consume formats. The rising trend of at-home consumption, particularly among premium drink enthusiasts, is contributing to the expansion of this category. Moreover, the availability of diverse spirit-based premixes such as rum, vodka, and whiskey in innovative packaging formats is enhancing consumer appeal, driving rapid market growth across developed and emerging regions.

- By Distribution Channel

On the basis of distribution channel, the Ready to Drink Premixes market is segmented into Specialty Stores, Modern Trade, Duty-Free Stores, Online Stores, and Others. The Modern Trade segment held the largest market revenue share in 2024, owing to the extensive presence of supermarkets and hypermarkets offering a wide assortment of RTD beverages. These outlets provide consumers with easy access to both international and domestic brands while ensuring product freshness and promotional discounts. The growing trend of impulse purchases and attractive shelf displays in modern trade outlets further strengthen this segment’s dominance.

The Online Stores segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rapid expansion of e-commerce platforms and changing consumer buying preferences toward digital channels. Online retail allows consumers to explore a broader range of brands, price comparisons, and convenient doorstep delivery. In addition, the rising influence of digital marketing, coupled with increasing smartphone penetration and mobile payment adoption, is supporting the strong growth of online sales in the RTD premixes category.

- By Product Type

On the basis of product type, the Ready to Drink Premixes market is segmented into Alcoholic Beverages and Non-Alcoholic Beverages. The Alcoholic Beverages segment dominated the market with a share of 72% in 2024, supported by the growing popularity of pre-mixed cocktails, flavored spirits, and low-alcohol alternatives among younger demographics. Consumers are increasingly seeking ready-to-drink alcoholic options that provide bar-like experiences without the need for additional ingredients or preparation time. The segment is also bolstered by innovation in flavor profiles, premium packaging, and marketing campaigns emphasizing social convenience and lifestyle appeal.

The Non-Alcoholic Beverages segment is anticipated to register the fastest growth rate during 2025–2032, propelled by increasing health consciousness and demand for functional, low-sugar drinks. Rising consumption of mocktails, fruit-based blends, and energy-boosting formulations among health-oriented consumers is expanding the segment’s reach. Furthermore, beverage manufacturers are introducing non-alcoholic variants enriched with vitamins and natural extracts, appealing to both younger consumers and those seeking sober lifestyle alternatives, thereby driving sustained market expansion.

Ready to Drink Premixes Market Regional Analysis

- North America dominated the ready to drink premixes market with the largest revenue share of 37.7% in 2024, driven by the growing consumer preference for convenient, low-preparation alcoholic and non-alcoholic beverages

- The region’s market strength is supported by high disposable incomes, an active social culture, and the widespread availability of diverse flavored premixes across retail and online channels

- The popularity of pre-mixed cocktails and health-oriented low-alcohol beverages has further boosted consumption, particularly among millennials and young professionals seeking premium, ready-to-enjoy options

U.S. Ready to Drink Premixes Market Insight

The U.S. accounted for the largest revenue share within North America in 2024, propelled by strong demand for on-the-go alcoholic drinks and increasing experimentation with innovative flavors. The growing trend of at-home consumption, particularly after the pandemic, has fueled demand for prepackaged cocktails and mocktails. Major beverage companies are expanding product lines to include sugar-free and natural ingredient-based premixes, appealing to health-conscious consumers. The U.S. market also benefits from robust distribution networks and heavy investment in brand-led marketing campaigns.

Europe Ready to Drink Premixes Market Insight

The Europe ready to drink premixes market is projected to expand at a substantial CAGR throughout the forecast period, supported by the rising popularity of convenience-oriented beverages and premium cocktail culture. Consumers across Europe are increasingly embracing RTD options for social gatherings and casual drinking occasions. The growth of low- and no-alcohol segments, along with a preference for clean-label, sustainably packaged drinks, is further driving adoption. The region also benefits from strong presence of established beverage brands and innovation in locally inspired flavor profiles.

U.K. Ready to Drink Premixes Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expanding trend of pre-mixed cocktails and the growing inclination toward healthier beverage choices. Younger consumers are particularly drawn to low-calorie, flavored, and spirit-based premixes that offer both taste and convenience. The rapid growth of online alcohol delivery platforms and ready-to-drink product availability in supermarkets is further supporting market expansion across the U.K.

Germany Ready to Drink Premixes Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by increasing urbanization, busy lifestyles, and a rising preference for premium-quality, ready-to-consume beverages. German consumers are shifting toward RTD drinks as alternatives to traditional bar cocktails, especially in social and outdoor events. Manufacturers are focusing on clean ingredients, recyclable packaging, and sustainable production methods, aligning with the country’s strong eco-conscious consumer base.

Asia-Pacific Ready to Drink Premixes Market Insight

The Asia-Pacific ready to drink premixes market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and changing consumption patterns among young adults. Countries such as China, Japan, and India are witnessing increasing demand for flavored alcoholic and non-alcoholic RTD beverages, supported by the expansion of modern retail channels and online delivery services. The availability of affordable, regionally flavored premixes is attracting a diverse consumer base, further propelling market growth.

Japan Ready to Drink Premixes Market Insight

The Japan market is gaining traction due to its evolving drinking culture, focus on convenience, and strong preference for innovative beverage formats. Japanese consumers are adopting RTD cocktails and mocktails for casual and social occasions, with rising demand for low-alcohol and non-alcoholic options catering to health-conscious preferences. The presence of technologically advanced packaging and flavor innovation is strengthening market growth across the country.

China Ready to Drink Premixes Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2024, supported by rapid urbanization, a growing middle-class population, and increasing exposure to Western drinking trends. The expansion of e-commerce platforms, along with the growing popularity of ready-to-drink alcoholic beverages among younger consumers, is significantly driving demand. The country’s strong domestic manufacturing base and emphasis on affordable, trend-driven products continue to make China a key growth hub for RTD premixes in the region.

Ready to Drink Premixes Market Share

The ready to drink premixes industry is primarily led by well-established companies, including:

- Neel Beverages Pvt. Ltd. (India)

- Plus Beverages (India)

- Panama Foods (India)

- Tweak – Tea & Coffee Vending Machine (India)

- Nutritech Asia Group LTD. (Canada)

- Asahi Group Holdings, Ltd. (Japan)

- Kirin Holdings Company, Limited (Japan)

- Anheuser‑Busch Companies LLC (U.S.)

- TAKARA HOLDINGS INC. (Japan)

- Pernod Ricard (France)

- OENON Holdings, Inc. (Japan)

- Diageo plc (U.K.)

- SUNTORY HOLDINGS LIMITED. (Japan)

- Mark Anthony Brands International Unlimited (Canada)

- Brown‑Forman Corporation (U.S.)

- BACARDI Limited (Bermuda)

- Halewood Artisanal Spirits (U.K.)

Latest Developments in Global Ready to Drink Premixes Market

- In May 2025, Rasna Pvt. Ltd. acquired the iconic Jumpin brand from Hershey’s India to mark its entry into the Indian ready-to-drink segment. This strategic move positions Rasna to compete strongly in the domestic beverage market by reviving a nostalgic brand with modern health-centric attributes, including vitamin-fortified fruit-based drinks. The acquisition broadens Rasna’s product portfolio beyond powdered mixes, tapping into India’s rapidly growing RTD beverage demand. The company’s focus on locally sourced fruit juices and family-oriented packaging formats is expected to significantly strengthen its market share in India’s expanding non-alcoholic RTD segment

- In April 2025, Schweppes, under Coca-Cola Europacific Partners, launched Schweppes Mix, its first alcoholic ready-to-drink cocktail range in the U.K., featuring flavors such as Gin Twist and Paloma Bliss. This launch marks a pivotal diversification for Schweppes, traditionally known for its mixers, as it capitalizes on the surge in demand for premium, low-preparation alcoholic beverages. By entering the RTD cocktail space, Schweppes is targeting younger, urban consumers seeking convenience without compromising on flavor quality. The move enhances competition in the European RTD segment and underscores a broader industry shift of legacy beverage brands entering the alcoholic premix category

- In December 2024, Suntory Holdings introduced MARU-HI, a Japanese-inspired sparkling cocktail, in the U.S. market. The product combines cultural authenticity with contemporary flavor trends, reflecting Suntory’s global strategy to strengthen its RTD portfolio and appeal to premium consumers. The launch supports the company’s ambition to dominate the international RTD cocktail segment by 2030. With growing U.S. consumer interest in Asian-inspired beverages, this introduction is poised to elevate Suntory’s brand visibility and drive category expansion within the premium sparkling RTD space

- In September 2024, The Coca-Cola Company entered a strategic partnership with Bacardi Limited to launch the Bacardi & Coca-Cola RTD cocktail, combining Bacardi rum with Coca-Cola’s classic soft drink. This collaboration signifies the growing convergence of the soft drink and alcoholic beverage sectors, enabling Coca-Cola to extend its presence in the RTD alcohol category. The product’s initial rollout in select European markets and Mexico aims to capitalize on strong consumer preference for trusted global brands and convenient cocktail formats. This alliance is expected to intensify competition and accelerate the premiumization trend in the global alcoholic premixes market

- In June 2024, Ball Corporation partnered with CavinKare to introduce aluminum canned RTD milkshakes in India, featuring flavors such as Badam, Gulkhand, and Rajbhog. This collaboration highlights the growing diversification of RTD beverages beyond alcoholic and fruit-based drinks into dairy-based convenience formats. The adoption of aluminum cans ensures longer shelf life and portability and also aligns with sustainability goals by promoting recyclable packaging. This innovation is likely to set a new standard in India’s RTD segment, encouraging other beverage manufacturers to adopt eco-friendly and premium packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ready To Drink Premixes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ready To Drink Premixes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ready To Drink Premixes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.