Global Ready To Use Pharmaceutical Packaging Market

Market Size in USD Billion

CAGR :

%

USD

10.39 Billion

USD

18.67 Billion

2024

2032

USD

10.39 Billion

USD

18.67 Billion

2024

2032

| 2025 –2032 | |

| USD 10.39 Billion | |

| USD 18.67 Billion | |

|

|

|

|

Ready-to-Use Pharmaceutical Packaging Market Size

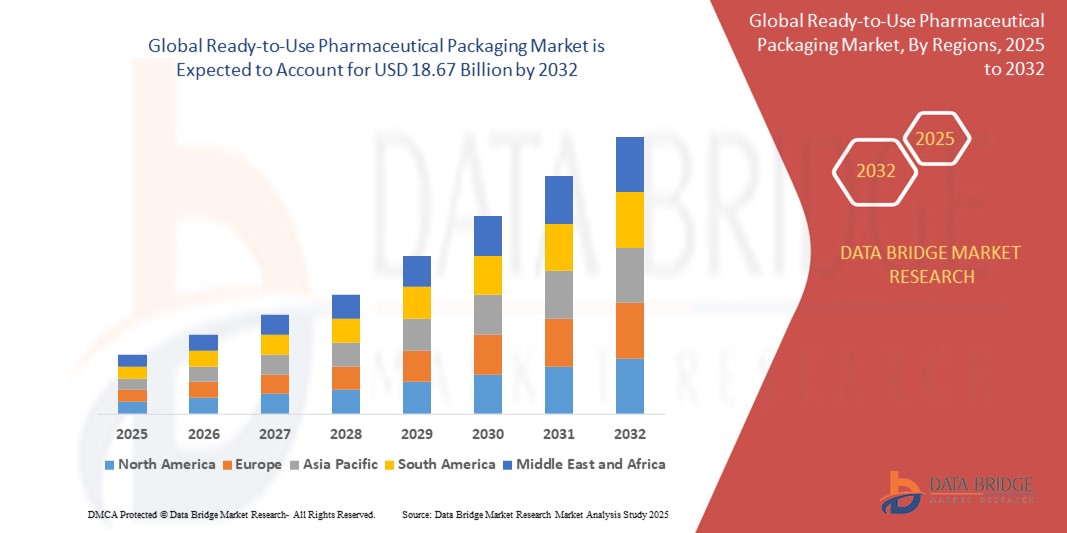

- The global ready-to-use pharmaceutical packaging market size was valued at USD 10.39 billion in 2024 and is expected to reach USD 18.67 billion by 2032, at a CAGR of 7.6% during the forecast period

- The market growth is largely fuelled by the increasing demand for safe, efficient, and contamination-free packaging solutions in the pharmaceutical industry

- Rising adoption of advanced packaging technologies and growing regulatory emphasis on product safety are further propelling the market expansion

Ready-to-Use Pharmaceutical Packaging Market Analysis

- The market is experiencing increased demand due to the rising need for efficient, contamination-free pharmaceutical packaging solutions that ensure drug safety and integrity throughout the supply chain

- Manufacturers are focusing on developing innovative packaging options that offer convenience, enhanced protection, and compliance with stringent industry standards to meet the evolving needs of pharmaceutical companies

- North America dominates the ready-to-use pharmaceutical packaging market with the largest revenue share in 2024, driven by advanced pharmaceutical manufacturing infrastructure and increasing demand for sterile packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global ready-to-use pharmaceutical packaging market, driven by increasing pharmaceutical manufacturing activities, rising demand for biologics, and supportive government initiatives enhancing healthcare infrastructure

- The sterile syringes segment holds the largest market revenue share in 2024, driven by their widespread use in injectable drug delivery and the growing demand for prefilled, ready-to-use options that minimize contamination risks. Sterile syringes offer convenience and improved patient safety, which makes them a preferred choice for both hospitals and outpatient settings

Report Scope and Ready-to-Use Pharmaceutical Packaging Market Segmentation

|

Attributes |

Ready-to-Use Pharmaceutical Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Eco-Friendly Pharmaceutical Packaging • Growth In Personalized Medicine Boosting Customized Packaging |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready-to-Use Pharmaceutical Packaging Market Trends

“Integration of Smart Packaging Technologies”

- The ready-to-use pharmaceutical packaging market is seeing a strong shift towards smart packaging solutions to improve patient engagement and medication adherence

- Technologies such as embedded sensors, Near Field Communication, and Internet of Things connectivity are becoming common in packaging designs

- For instance, smart blister packs and bottles can monitor dosage intake and send reminders to patients through mobile apps

- These smart packages also allow real-time data sharing with healthcare providers, enabling better treatment management

- The growing use of smart packaging transforms pharmaceutical containers into interactive tools that help enhance patient outcomes through improved monitoring and communication

Ready-to-Use Pharmaceutical Packaging Market Dynamics

Driver

“Increasing Demand for Efficient and Safe Drug Delivery Systems”

- The rising need for efficient and safe drug delivery systems is driving demand for ready-to-use pharmaceutical packaging

- Ready-to-use packaging reduces contamination risks and human error by offering sterile, pre-assembled solutions, which is critical for injectable drugs and biologics

- Growing chronic disease prevalence and an aging population increase demand for convenient packaging that improves patient compliance and simplifies dosage administration

- This packaging format supports personalized medicine by enabling efficient packaging of customized doses and formulations

- Regulatory agencies promote advanced packaging to ensure safety and traceability, encouraging pharmaceutical companies to adopt ready-to-use solutions

- For instance, several biologic drug manufacturers have shifted to ready-to-use syringes to maintain sterility and improve patient safety

Restraint/Challenge

“High Cost Associated with Advanced Packaging Technologies”

- The high cost of advanced packaging technologies is a major challenge, as sophisticated materials, aseptic processing, and strict quality controls increase manufacturing expenses

- Small and medium-sized pharmaceutical companies often find these costs prohibitive, limiting the widespread adoption of ready-to-use packaging

- Specialized equipment and trained personnel are required, posing barriers in emerging markets with limited resources

- Packaging biologics and sensitive drugs is complex, needing precise environmental controls to maintain stability and avoid regulatory issues

- Supply chain challenges arise due to bulky packaging formats, increasing logistics and storage costs, while limited recyclability raises environmental concerns impacting market growth

- For instance, manufacturers are investing in innovations to reduce costs and improve sustainability to overcome these challenges

Ready-to-Use Pharmaceutical Packaging Market Scope

The market is segmented on the basis of container type and end use.

- By Container Type

On the basis of container type, the ready-to-use pharmaceutical packaging market is segmented into sterile syringes and sterile cartridges. The sterile syringes segment holds the largest market revenue share in 2024, driven by their widespread use in injectable drug delivery and the growing demand for prefilled, ready-to-use options that minimize contamination risks. Sterile syringes offer convenience and improved patient safety, which makes them a preferred choice for both hospitals and outpatient settings.

The sterile cartridges segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing adoption in biologics and specialty drug applications. Cartridges provide flexibility in dosing and are compatible with various drug delivery devices, supporting the trend toward personalized medicine.

- By End Use

On the basis of end use, the market is segmented into glass, plastic, and rubber. The glass segment accounted for the largest market revenue share in 2024, due to its superior barrier properties, chemical resistance, and regulatory acceptance for injectable drugs. Glass containers ensure drug stability and are favoured in the manufacturing of high-value biologics and vaccines.

The plastic segment is expected to witness the fastest growth rate from 2025 to 2032, during the forecast period, driven by advances in polymer technology offering lightweight, break-resistant, and cost-effective packaging solutions. Plastic containers are increasingly used for convenience and safety in outpatient care and home healthcare settings. The rubber segment maintains steady growth, primarily for its role in stoppers and seals that ensure container integrity and sterility.

Ready-to-Use Pharmaceutical Packaging Market Regional Analysis

- North America dominates the ready-to-use pharmaceutical packaging market with the largest revenue share in 2024, driven by advanced pharmaceutical manufacturing infrastructure and increasing demand for sterile packaging solutions

- The region benefits from stringent regulatory standards, well-established pharmaceutical companies, and growing investments in biologics and injectable drugs, which boost the adoption of ready-to-use packaging systems

U.S. Ready-to-Use Pharmaceutical Packaging Market Insight

The U.S. market holds the largest revenue share in North America, propelled by the rapid expansion of biopharmaceutical manufacturing and increasing preference for pre-sterilized, ready-to-use containers. Pharmaceutical companies focus on reducing contamination risks and improving production efficiency through RTU syringes and cartridges. The growing emphasis on personalized medicine and the rising prevalence of chronic diseases further drive demand. In addition, regulatory encouragement for high-quality sterile packaging enhances market growth.

Europe Ready-to-Use Pharmaceutical Packaging Market Insight

The European market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent regulations on drug safety and a strong presence of major pharmaceutical manufacturers. Rising demand for biologics and injectable drugs, along with increased focus on reducing contamination during drug delivery, fosters adoption of RTU packaging. The region is witnessing growth in glass and plastic container use for various pharmaceutical applications, with sustainability concerns encouraging innovation.

U.K. Ready-to-Use Pharmaceutical Packaging Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, due to increased investments in pharmaceutical R&D and manufacturing facilities. The rise in chronic diseases and aging population fuels demand for convenient, safe drug delivery systems. Regulatory bodies are pushing for improved packaging standards, encouraging the use of RTU syringes and cartridges, especially in biologics and specialty drugs.

Germany Ready-to-Use Pharmaceutical Packaging Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by its advanced pharmaceutical sector and focus on precision medicine. Increasing awareness of drug safety, along with the adoption of eco-friendly packaging materials, supports growth. The integration of automation in pharmaceutical packaging further enhances production efficiency and reduces contamination risks, boosting demand for RTU solutions.

Asia-Pacific Ready-to-Use Pharmaceutical Packaging Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising pharmaceutical manufacturing activities and increasing healthcare investments in countries such as China, India, and Japan. The demand for injectable drugs and biologics is rising, encouraging the use of ready-to-use sterile syringes and cartridges. Government initiatives promoting healthcare infrastructure development and digitalization also support market growth.

Japan Ready-to-Use Pharmaceutical Packaging Market Insight

The Japan’s market growth is driven by its aging population and the demand for safe, user-friendly drug delivery systems. The country’s technological advancements in pharmaceutical manufacturing and strong regulatory environment support the adoption of RTU packaging. Integration with automated filling and inspection systems further boosts efficiency and product safety.

China Ready-to-Use Pharmaceutical Packaging Market Insight

The China accounts for the largest revenue share in the Asia-Pacific region, supported by rapid urbanization, growing pharmaceutical production, and expanding biopharmaceutical sectors. The increasing middle-class population and government support for healthcare modernization accelerate demand for ready-to-use packaging solutions. Domestic manufacturers are also contributing to market growth by offering cost-effective RTU products.

Ready-to-Use Pharmaceutical Packaging Market Share

The Ready-to-Use Pharmaceutical Packaging industry is primarily led by well-established companies, including:

- Schott AG (Germany)

- Gerresheimer AG (Germany)

- West Pharmaceutical Services (U.S.)

- Stevanato Group (Italy)

- SGD Pharma (France)

- Nipro Corporation (Japan)

- AptarGroup (U.S.)

- Berry Global (U.S.)

- Datwyler (Switzerland)

Latest Developments in Global Ready-to-Use Pharmaceutical Packaging Market

- In April 2025, Syntegon launched the MLD Advanced, a high-speed filling machine for ready-to-use nested syringes designed to meet pharmaceutical manufacturers’ demand for precision and efficiency. The machine processes up to 400 syringes per minute with full in-process control to ensure accurate filling and minimize waste. Its features include automatic aseptic transfer systems and gentle syringe handling to maintain product integrity, enhancing production yield and reducing downtime. This innovation is expected to improve manufacturing efficiency and support the growing use of ready-to-use packaging in the pharmaceutical industry

- In September 2024, Stevanato Group, Gerresheimer, and SCHOTT Pharma formed the "Alliance for RTU," a strategic partnership to promote ready-to-use vials and cartridges in pharmaceutical manufacturing. The alliance aims to share expertise and highlight the benefits of RTU packaging, including reduced operational risks, enhanced efficiency, lower costs, and improved product quality, driving wider adoption of advanced sterile packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ready To Use Pharmaceutical Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ready To Use Pharmaceutical Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ready To Use Pharmaceutical Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.