Global Reagent Localization And Supply Chain Resilience Market

Market Size in USD Million

CAGR :

%

USD

529.25 Million

USD

1,197.01 Million

2025

2033

USD

529.25 Million

USD

1,197.01 Million

2025

2033

| 2026 –2033 | |

| USD 529.25 Million | |

| USD 1,197.01 Million | |

|

|

|

|

Reagent Localization & Supply Chain Resilience Market Size

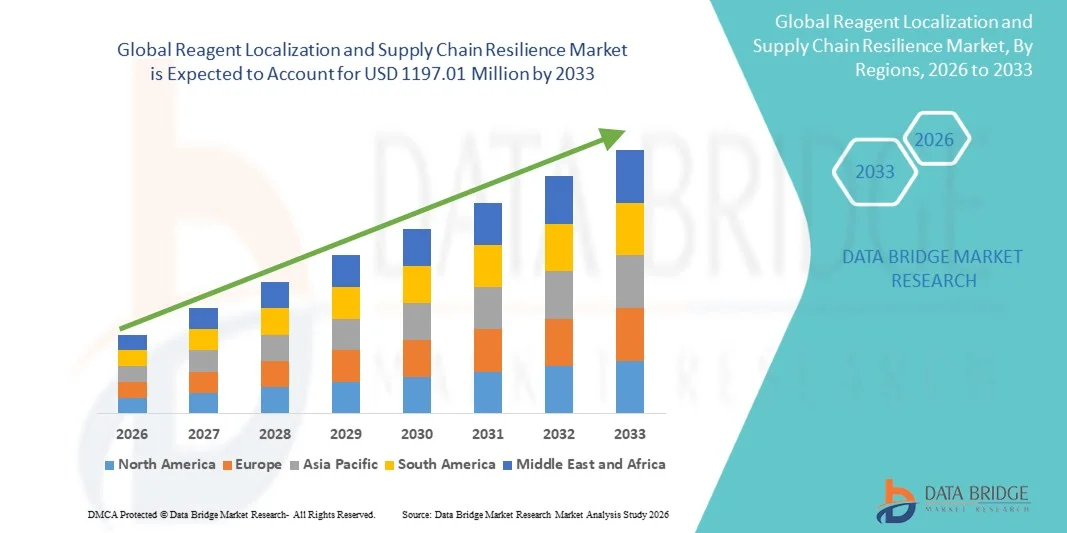

- The global Reagent Localization & Supply Chain Resilience market size was valued at USD 529.25 Million in 2025 and is expected to reach USD 1197.01 Million by 2033, at a CAGR of 10.74% during the forecast period

- The market growth of the Reagent Localization & Supply Chain Resilience market is largely fueled by the increasing emphasis on secure, reliable, and efficient supply chains for critical reagents across pharmaceutical, biotechnology, and research sectors

- Furthermore, rising demand from diagnostic laboratories, healthcare institutions, and academic research centers for resilient and localized reagent supply strategies is driving adoption of solutions such as domestic manufacturing, dual-sourcing models, strategic stockpiling, and public–private partnership–based production. These converging factors are accelerating the implementation of reagent localization and supply chain resilience strategies, thereby significantly boosting the industry's growth

Reagent Localization & Supply Chain Resilience Market Analysis

- Reagent localization and supply chain resilience solutions are becoming critical components of the global life sciences and diagnostics ecosystem, as they ensure uninterrupted availability of essential reagents for pharmaceutical manufacturing, clinical research, and diagnostic testing across both public and private healthcare settings

- The growing focus on reducing dependence on global suppliers, minimizing supply disruptions, and improving preparedness for future health emergencies is a key driver of market demand. Government initiatives, increased biopharmaceutical R&D activity, and rising investments in domestic manufacturing infrastructure are further accelerating adoption

- North America dominated the reagent localization & supply chain resilience market with the largest revenue share of approximately 36.4% in 2025, supported by a strong biopharmaceutical manufacturing base, advanced healthcare infrastructure, and proactive government policies promoting domestic reagent production. The U.S. accounted for the majority of regional demand, driven by reshoring initiatives, strategic stockpiling programs, and sustained investments by leading life science companies

- Asia-Pacific is expected to be the fastest-growing region in the reagent localization & supply chain resilience market during the forecast period, registering a CAGR of approximately 9.2%, driven by rapid expansion of pharmaceutical and biotechnology manufacturing, increasing healthcare expenditure, and strong government support for localized reagent production in countries such as China, India, and South Korea

- The domestic manufacturing segment accounted for the largest market revenue share of approximately 41.2% in 2025, driven by government initiatives aimed at strengthening national healthcare and life-science supply chains

Report Scope and Reagent Localization & Supply Chain Resilience Market Segmentation

|

Attributes |

Reagent Localization & Supply Chain Resilience Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Reagent Localization & Supply Chain Resilience Market Trends

“Shift Toward Localized Reagent Manufacturing and Regionalized Supply Networks”

- A major trend in the global reagent localization & supply chain resilience market is the increasing shift toward localized reagent manufacturing and regionally diversified supply chains to reduce dependency on single-source or overseas suppliers. This trend has gained strong momentum following global disruptions experienced during pandemics, geopolitical tensions, and logistics bottlenecks, which exposed vulnerabilities in centralized reagent supply models

- For instance, several diagnostic reagent manufacturers in North America, Europe, and Asia-Pacific have expanded regional production facilities to ensure uninterrupted supply for hospitals, diagnostic laboratories, and research institutes. Companies such as Thermo Fisher Scientific and Merck have invested in local manufacturing hubs to shorten lead times and mitigate cross-border trade risks

- Another notable trend is the growing adoption of inventory visibility and demand forecasting solutions across reagent supply chains. Manufacturers and distributors are increasingly focusing on real-time inventory tracking, multi-sourcing strategies, and safety stock optimization to ensure consistent reagent availability during demand surges

- The trend is further supported by government initiatives encouraging domestic production of critical healthcare and laboratory reagents to strengthen national healthcare preparedness. Many countries are promoting public–private partnerships and offering incentives for local reagent production to enhance supply chain resilience

- Overall, the growing emphasis on supply continuity, faster delivery timelines, and reduced exposure to global disruptions is reshaping how reagent manufacturers design and manage their supply chains, making localization a strategic priority worldwide

Reagent Localization & Supply Chain Resilience Market Dynamics

Driver

“Rising Demand for Uninterrupted Diagnostic and Research Reagent Supply”

- The increasing reliance on diagnostic testing, pharmaceutical research, biotechnology development, and clinical trials is a key driver for the Reagent Localization & Supply Chain Resilience market. Laboratories and healthcare providers require uninterrupted access to high-quality reagents to maintain operational continuity and patient care standards

- For instance, during recent global health emergencies, sudden spikes in demand for diagnostic reagents highlighted the critical need for resilient and flexible supply chains. As a result, healthcare systems and laboratory networks are prioritizing suppliers with localized manufacturing and robust distribution capabilities

- The expansion of molecular diagnostics, personalized medicine, and life science research has further intensified reagent consumption across hospitals, academic institutions, and commercial laboratories. This growing demand is driving investments in regional production, warehousing, and distribution infrastructure

- In addition, regulatory bodies and healthcare authorities are emphasizing supply reliability for essential reagents, encouraging manufacturers to adopt redundancy strategies, diversify sourcing, and strengthen local supply ecosystems

- The increasing focus on healthcare preparedness, rapid response capabilities, and continuity of diagnostic services is expected to continue driving market growth throughout the forecast period

Restraint/Challenge

“High Operational Costs and Complex Regulatory Compliance”

- One of the major challenges in the reagent localization & supply chain resilience market is the high operational and capital investment required to establish localized manufacturing facilities and regional distribution networks. Setting up compliant production units involves significant costs related to infrastructure, quality control, skilled labor, and regulatory approvals

- For instance, reagent manufacturers must comply with stringent regulatory standards such as Good Manufacturing Practices (GMP), quality certifications, and country-specific healthcare regulations, which can delay facility setup and increase operational complexity

- In addition, maintaining multiple regional production and inventory hubs can increase overhead costs, particularly for small and mid-sized manufacturers, limiting their ability to compete with large multinational players

- Supply chain fragmentation may also lead to challenges in maintaining consistent reagent quality and batch standardization across regions, requiring robust quality assurance systems and harmonized production protocols

- Overcoming these challenges will require strategic investments, regulatory alignment, and collaborative partnerships between manufacturers, governments, and healthcare institutions to balance cost efficiency with supply resilience and long-term market sustainability

Reagent Localization & Supply Chain Resilience Market Scope

The market is segmented on the basis of reagent type, localization strategy, and end user.

• By Reagent Type

On the basis of reagent type, the Reagent Localization & Supply Chain Resilience market is segmented into critical diagnostic reagents, research reagents, bioprocessing reagents, molecular biology reagents, and specialty/custom reagents. The critical diagnostic reagents segment dominated the largest market revenue share of approximately 38.6% in 2025, driven by their indispensable role in clinical diagnostics, disease surveillance, and routine testing workflows. These reagents are essential for in-vitro diagnostic kits used in hospitals and diagnostic laboratories, making uninterrupted supply a top priority for governments and healthcare systems. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, accelerating investments in domestic production of diagnostic reagents. Regulatory mandates, national stockpiling programs, and public funding initiatives further supported demand for localized manufacturing. High testing volumes, recurring consumption, and stringent quality requirements reinforced the dominance of this segment. Additionally, increasing prevalence of infectious diseases and chronic conditions sustained long-term demand. The segment is expected to maintain leadership due to continuous diagnostic innovation and mandatory quality compliance across regions.

The specialty and custom reagents segment is expected to witness the fastest CAGR of around 12.9% from 2026 to 2033, fueled by rising demand for tailored solutions in advanced research, precision medicine, and niche diagnostic applications. Specialty reagents are increasingly used in genomics, proteomics, and cell-based assays, where customization and performance consistency are critical. Growth in personalized medicine and complex biologics development has accelerated adoption of application-specific reagents. Localization strategies favor custom reagent suppliers to reduce lead times and dependency on imports. Academic and biotech collaborations are further driving innovation in this segment. Increased R&D spending and expansion of decentralized laboratories globally support rapid growth. As scientific workflows become more specialized, demand for customized reagent solutions continues to rise strongly.

• By Localization Strategy

On the basis of localization strategy, the Reagent Localization & Supply Chain Resilience market is segmented into domestic manufacturing, near-shore production, dual-sourcing models, strategic stockpiling, and public–private partnership–based production. The domestic manufacturing segment accounted for the largest market revenue share of approximately 41.2% in 2025, driven by government initiatives aimed at strengthening national healthcare and life-science supply chains. Countries across North America, Europe, and Asia-Pacific invested heavily in local reagent manufacturing infrastructure to reduce reliance on imports. Domestic production improves supply security, ensures regulatory compliance, and shortens delivery timelines. Financial incentives, tax benefits, and funding programs encouraged manufacturers to establish or expand local facilities. Domestic manufacturing also supports quality control and faster response during public health emergencies. The segment benefited from lessons learned during pandemic-related shortages. As a result, domestic manufacturing emerged as the cornerstone of supply chain resilience strategies.

The dual-sourcing models segment is projected to register the fastest CAGR of about 13.5% from 2026 to 2033, driven by increasing risk-mitigation strategies among pharmaceutical and diagnostics companies. Dual sourcing allows organizations to procure reagents from both local and international suppliers, reducing dependency on a single source. This approach enhances flexibility and continuity during geopolitical disruptions, logistics delays, or raw material shortages. Companies increasingly adopt dual-sourcing to balance cost efficiency with supply reliability. Regulatory bodies also encourage diversified sourcing to ensure uninterrupted availability of essential reagents. Advances in digital supply-chain monitoring further support implementation. As uncertainty in global trade persists, adoption of dual-sourcing models continues to accelerate rapidly.

• By End User

On the basis of end user, the Reagent Localization & Supply Chain Resilience market is segmented into pharmaceutical and biotechnology companies, diagnostic laboratories, academic and research institutes, contract research organizations (CROs), and healthcare institutions. The pharmaceutical and biotechnology companies segment dominated the market with a revenue share of approximately 36.8% in 2025, owing to high reagent consumption across drug discovery, development, and manufacturing processes. These companies rely heavily on consistent reagent supply for clinical trials, biologics production, and quality testing. Supply disruptions can significantly delay product development timelines, making resilience a strategic priority. Large pharma firms increasingly invest in localized reagent sourcing and long-term supplier agreements. Rising biologics and biosimilars production further increased reagent demand. Strong financial capabilities enable pharmaceutical companies to implement advanced supply-chain strategies. This segment’s dominance is reinforced by continuous R&D expansion and regulatory compliance needs.

The diagnostic laboratories segment is expected to witness the fastest CAGR of around 14.1% from 2026 to 2033, driven by the rapid expansion of diagnostic testing services worldwide. Growth in preventive healthcare, early disease detection, and decentralized testing models has increased reagent consumption. Diagnostic labs prioritize localized sourcing to ensure uninterrupted operations and fast turnaround times. Government-supported screening programs and rising private laboratory networks further boost demand. Automation and high-throughput testing platforms also require stable reagent availability. Emerging markets are witnessing strong diagnostic infrastructure development, accelerating growth. As diagnostic testing volumes continue to rise, this segment is expected to expand at a robust pace.

Reagent Localization & Supply Chain Resilience Market Regional Analysis

- North America dominated the reagent localization & supply chain resilience market with the largest revenue share of approximately 36.4% in 2025, supported by a strong biopharmaceutical manufacturing base, advanced healthcare infrastructure, and proactive government policies encouraging domestic reagent production

- The region has witnessed increased emphasis on supply chain security following disruptions experienced during global health crises. Strategic stockpiling initiatives, reshoring of critical raw materials, and investments in local reagent manufacturing facilities have strengthened regional resilience

- High R&D spending, robust regulatory frameworks, and strong presence of leading life science companies continue to reinforce North America’s leadership in reagent localization

U.S. Reagent Localization & Supply Chain Resilience Market Insight

The U.S. reagent localization & supply chain resilience market captured the largest revenue share in 2025 within North America, driven by aggressive reshoring initiatives and sustained investments in domestic life science manufacturing. Federal funding programs, public–private partnerships, and incentives for local reagent production have accelerated supply chain resilience. Major biopharmaceutical and diagnostics companies are expanding local reagent sourcing to reduce dependency on imports. Strategic national stockpiling programs and increasing demand from clinical diagnostics, research laboratories, and vaccine production further support market growth.

Europe Reagent Localization & Supply Chain Resilience Market Insight

The Europe reagent localization & supply chain resilience market is projected to expand at a steady CAGR during the forecast period, driven by regulatory focus on supply security, quality assurance, and regional manufacturing independence. European governments are increasingly supporting local production of critical reagents used in diagnostics, research, and pharmaceutical manufacturing. The region benefits from strong academic research institutions, expanding biotechnology hubs, and coordinated EU-level initiatives aimed at reducing reliance on non-regional suppliers.

U.K. Reagent Localization & Supply Chain Resilience Market Insight

The U.K. reagent localization & supply chain resilience market is anticipated to grow at a noteworthy CAGR, supported by rising investments in life sciences, diagnostics, and biomedical research. Government-backed programs promoting domestic manufacturing and supply chain continuity have strengthened reagent localization efforts. Growing demand from NHS laboratories, research institutions, and pharmaceutical companies continues to drive adoption of localized reagent sourcing.

Germany Reagent Localization & Supply Chain Resilience Market Insight

The Germany reagent localization & supply chain resilience market is expected to expand at a considerable CAGR, fueled by the country’s strong pharmaceutical manufacturing base and emphasis on industrial self-reliance. Germany’s advanced production capabilities, focus on quality standards, and innovation-driven ecosystem support increased localization of reagents. The presence of major chemical and life science companies further enhances supply chain stability across diagnostics and bioprocessing applications.

Asia-Pacific Reagent Localization & Supply Chain Resilience Market Insight

The Asia-Pacific reagent localization & supply chain resilience market is expected to be the fastest-growing region, registering a CAGR of approximately 9.2% during the forecast period, driven by rapid expansion of pharmaceutical and biotechnology manufacturing. Rising healthcare expenditure, growing diagnostics demand, and strong government support for domestic reagent production are accelerating market growth. Countries across the region are investing heavily in local manufacturing capabilities to reduce import dependency and improve supply continuity.

China Reagent Localization & Supply Chain Resilience Market Insight

China reagent localization & supply chain resilience market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by large-scale pharmaceutical manufacturing capacity, strong government backing, and increasing focus on self-sufficiency in critical medical supplies. National policies promoting localized production of reagents for diagnostics, vaccines, and biopharmaceuticals have significantly strengthened supply chain resilience. Expanding domestic consumption and export-oriented manufacturing further contribute to market leadership.

Japan Reagent Localization & Supply Chain Resilience Market Insight

The Japan reagent localization & supply chain resilience market is gaining steady momentum due to advanced R&D capabilities, strong quality standards, and emphasis on supply reliability. Japanese companies are increasingly investing in localized reagent production to support diagnostics, clinical research, and pharmaceutical manufacturing. Government initiatives focused on supply chain risk mitigation and technological innovation continue to support market growth.

India Reagent Localization & Supply Chain Resilience Market Insight

India is emerging as a high-growth market, driven by rapid expansion of pharmaceutical manufacturing, rising diagnostics demand, and supportive government initiatives such as “Make in India.” Increasing investments in reagent manufacturing infrastructure and growing export potential are strengthening supply chain resilience. Expanding healthcare access and cost-effective production capabilities position India as a key future contributor to regional growth.

Reagent Localization & Supply Chain Resilience Market Share

The Reagent Localization & Supply Chain Resilience industry is primarily led by well-established companies, including:

- Danaher Corporation (U.S.)

- Agilent Technologies (U.S.)

- Bio-Rad Laboratories (U.S.)

- Roche Diagnostics (Switzerland)

- Abbott (U.S.)

- Siemens Healthineers (Germany)

- PerkinElmer (U.S.)

- Becton, Dickinson and Company (U.S.)

- QIAGEN (Germany)

- Lonza Group (Switzerland)

- Sartorius AG (Germany)

- Fujifilm Irvine Scientific (U.S.)

- Takara Bio (Japan)

- Promega Corporation (U.S.)

- Avantor (U.S.)

- WuXi Biologics (China)

- GenScript Biotech (China)

- LGC Group (U.K.)

Latest Developments in Global Reagent Localization & Supply Chain Resilience Market

- In August 2025, Chinese pharmaceutical firms, including Shanghai Titan Scientific and Nanjing Vazyme Biotech, announced increased procurement of reagents from local suppliers to reduce costs and delivery times, as rising import tariffs and supply chain risks spurred a shift away from Western reagent manufacturers like Thermo Fisher and Merck. This move reflects an industry-wide trend toward localized sourcing and supply chain resilience in reagent procurement for research and diagnostics

- In August 2025, the U.S. Food and Drug Administration (FDA) announced the launch of the FDA PreCheck initiative to streamline the regulatory review process for new domestic pharmaceutical manufacturing facilities, including reagents and related critical supply chain inputs, to strengthen the resilience of the U.S. drug and reagent production ecosystem. This program aims to enhance early-stage coordination with manufacturers and support resilient domestic production capacity

- In April 2025, the Strategic Active Pharmaceutical Ingredients Reserve (SAPIR) initiative was formally strengthened via a U.S. government executive order directing federal agencies to build national API reserves, including precursor materials and key reagents critical to pharmaceutical and diagnostic supply chains. The expanded reserve seeks to reduce dependence on foreign sources and enhance long-term supply resilience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.