Global Real Estate Unified Communication Market

Market Size in USD Billion

CAGR :

%

USD

29.71 Billion

USD

132.06 Billion

2024

2032

USD

29.71 Billion

USD

132.06 Billion

2024

2032

| 2025 –2032 | |

| USD 29.71 Billion | |

| USD 132.06 Billion | |

|

|

|

|

Global Real Estate Unified Communication Market Size

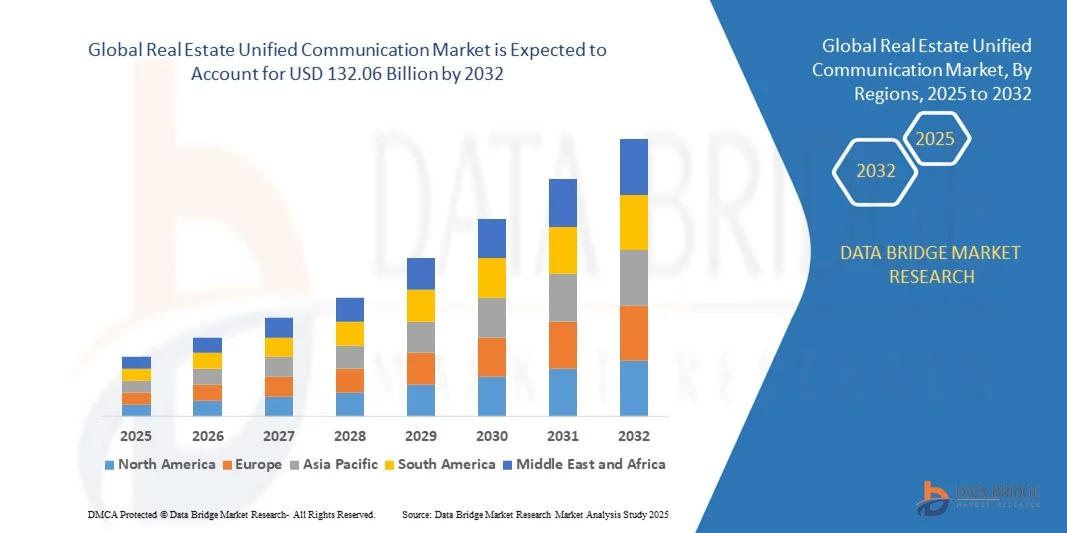

- The global Real Estate Unified Communication Market size was valued at USD 29.71billion in 2024 and is projected to reach USD 132.06 billion by 2032, growing at a CAGR of 20.50% during the forecast period

- Market expansion is being driven by the increasing integration of advanced communication tools and digital infrastructure across real estate operations, streamlining tenant management, remote collaboration, and property services

- Additionally, the rising demand for centralized, cloud-based communication platforms among property managers and developers is reinforcing unified communication as a core component in modern real estate strategies, fueling substantial industry growth

Global Real Estate Unified Communication Market Analysis

- Real Estate Unified Communication (UC) solutions, integrating voice, video, messaging, and collaboration tools, are becoming essential in modern property management and real estate operations, enabling seamless communication between tenants, property managers, service providers, and stakeholders across both residential and commercial sectors

- The surge in demand for UC solutions is primarily driven by the increasing digital transformation of the real estate industry, growing emphasis on remote property management, and the need for efficient tenant engagement and collaboration platforms

- North America led the global Real Estate UC market with the largest revenue share of 38.6% in 2024, supported by the region’s advanced digital infrastructure, early adoption of cloud-based communication tools, and presence of major UC solution providers, with the U.S. seeing strong uptake across large commercial real estate portfolios and co-working spaces

- Asia-Pacific is anticipated to be the fastest-growing region in the Real Estate UC market over the forecast period, fueled by rapid urban development, expanding smart city projects, and increasing adoption of proptech solutions across emerging economies

- The voice communication segment dominated the market with the largest revenue share of 36.4% in 2024, due to its foundational role in real estate operations including client interaction, leasing inquiries, and property support

Report Scope and Global Real Estate Unified Communication Market Segmentation

|

Attributes |

Real Estate Unified Communication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Real Estate Unified Communication Market Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the global Real Estate Unified Communication Market is the increasing integration of artificial intelligence (AI) and voice-controlled technologies such as Amazon Alexa, Google Assistant, and Apple Siri into property management and communication platforms. This convergence is revolutionizing how real estate professionals, tenants, and stakeholders interact within smart buildings and managed properties.

- For Instance, commercial buildings equipped with voice-activated UC systems allow property managers to schedule maintenance, access tenant communications, or launch virtual meetings using simple voice commands. Platforms like Cisco Webex and Microsoft Teams—commonly used in real estate firms—are being enhanced with AI-driven voice assistance to streamline workflows and automate repetitive tasks.

- AI integration in real estate unified communication enables intelligent features such as automated tenant response systems, sentiment analysis during client interactions, predictive maintenance alerts, and personalized communication routing. Some platforms now use natural language processing (NLP) to transcribe meetings, flag action items, and generate follow-ups automatically—enhancing productivity and engagement.

- Voice control further enhances remote accessibility and user convenience, particularly in smart offices and co-working spaces where touchless, voice-enabled communication tools support flexible work environments. With the growth of hybrid work, tenants and property managers alike benefit from voice-controlled booking systems, digital receptionist services, and automated voice alerts for security or facility updates.

- The integration of unified communication platforms with AI and voice assistants also enables centralized command over multiple property functions—from scheduling property tours to managing video intercoms and smart conference systems. This unified control hub improves operational efficiency and tenant satisfaction by reducing friction across digital touchpoints.

- As smart building technology advances, this trend toward AI- and voice-enhanced communication systems is redefining expectations in the real estate sector. Companies like Zoom, RingCentral, and Avaya are increasingly tailoring their UC solutions to real estate use cases, offering voice-enabled dashboards, AI-based analytics, and seamless CRM integration to meet evolving industry demands.

- The demand for UC systems with intelligent automation and voice control is expanding rapidly across residential developments, commercial towers, and co-living spaces, driven by the industry’s focus on convenience, digital-first interaction, and elevated tenant experiences.

Global Real Estate Unified Communication Market Dynamics

Driver

Growing Need Due to Rising Security Concerns and Smart Building Adoption

- The rising emphasis on operational security, data protection, and streamlined communication within smart buildings is a significant driver fueling the adoption of Real Estate Unified Communication (UC) systems. As smart building technologies become mainstream, secure and integrated communication platforms are increasingly viewed as critical infrastructure.

- For Instance, in March 2024, Cisco announced updates to its Webex Suite tailored for real estate environments, incorporating AI-driven security features and zero-trust architecture for tenant communications and facility management. Innovations like these are reshaping how the real estate sector addresses data and operational security through UC solutions.

- With increased tenant expectations for secure, responsive, and tech-enabled property experiences, UC platforms offer a robust solution by enabling secure video conferencing, real-time alerts, visitor verification, and access control integrations. These systems provide enhanced transparency and accountability in both residential and commercial property operations.

- The proliferation of smart building devices and PropTech innovations—such as connected HVAC, lighting, and surveillance systems—has led to a growing need for centralized communication hubs. Unified communication platforms serve as the backbone for these connected environments, allowing seamless interaction between devices, service teams, and end users.

- Key benefits such as remote accessibility, voice-enabled assistance, and automation of routine communications are also accelerating adoption. These platforms help real estate professionals and tenants manage appointments, maintenance requests, and emergency communications more efficiently, creating a streamlined and secure experience across smart developments.

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Concerns surrounding the cybersecurity vulnerabilities of unified communication (UC) systems pose a significant challenge to their widespread adoption in the real estate sector. As UC platforms rely heavily on internet connectivity, cloud storage, and integration with various smart building systems, they are susceptible to cyberattacks, data breaches, and unauthorized access—raising concerns among property managers, tenants, and investors about the protection of sensitive information and operational integrity.

- For instance, several high-profile cybersecurity incidents involving collaboration platforms and cloud-based communication tools have drawn attention to the risks associated with centralized digital communication systems. In the context of real estate, the potential exposure of tenant data, lease documents, or building access credentials can deter adoption of these technologies.

- Addressing these security concerns requires robust end-to-end encryption, secure user authentication protocols, regular software updates, and compliance with international data protection regulations such as GDPR and CCPA. Leading UC vendors such as Cisco, Microsoft, and Zoom are actively emphasizing their enhanced security frameworks and dedicated real estate solutions to build trust among enterprise users.

- Additionally, the relatively high initial cost of implementing advanced UC platforms—particularly those offering AI-powered analytics, IoT integration, and cloud-based infrastructure—can be a barrier for small to mid-sized real estate firms or operators in emerging markets. These companies may lack the financial and technical resources to overhaul existing legacy systems or train staff on new communication technologies.

- While the overall cost of UC solutions is gradually declining due to increased competition and the rise of subscription-based models (e.g., UCaaS), the perceived complexity and high upfront investment continue to hinder adoption among conservative market segments that are still dependent on traditional communication methods.

- Overcoming these challenges will require a combination of vendor-driven cybersecurity innovation, user education on safe digital practices, scalable pricing structures, and simplified onboarding experiences. As more real estate stakeholders recognize the operational efficiencies and tenant experience enhancements made possible through UC integration, addressing these concerns will be essential to driving long-term market growth and trust.

Global Real Estate Unified Communication Market Scope

The market is segmented on the basis of communication type, deployment type, end use, service type.

- By Communication Type

On the basis of communication type, the Real Estate Unified Communication Market is segmented into voice communication, video communication, messaging, and collaboration tools. The voice communication segment dominated the market with the largest revenue share of 36.4% in 2024, due to its foundational role in real estate operations including client interaction, leasing inquiries, and property support. Voice communication remains essential across both residential and commercial settings, providing direct and real-time connections with tenants and partners.

The collaboration tools segment is projected to witness the fastest CAGR of 22.8% from 2025 to 2032, fueled by increasing adoption of remote work and hybrid office models within the real estate sector. These tools integrate chat, file sharing, video calls, and scheduling in a single platform, improving operational efficiency. As more real estate firms adopt PropTech solutions, collaboration platforms like Microsoft Teams and Zoom are gaining traction for their seamless multi-channel communication capabilities.

- By Deployment Type

Based on deployment type, the market is segmented into on-premises and cloud-based. The cloud-based segment led the market with a revenue share of 46.7% in 2024, owing to its flexibility, cost-efficiency, and scalability. Cloud UC systems allow real estate organizations to centralize communication across multiple properties, enable remote workforces, and reduce infrastructure maintenance. These platforms also support integration with CRMs, IoT devices, and property management software, enhancing overall efficiency.

The cloud-based segment is also expected to experience the fastest growth through 2032, with a projected CAGR of 21.9%, as both large and mid-sized firms shift toward UCaaS (Unified Communication as a Service) models. This shift is particularly strong in commercial real estate and co-working spaces where agility and scalability are vital. On-premises solutions, while still relevant in highly regulated sectors, are increasingly viewed as less cost-effective and more difficult to scale in today’s digital-first property management landscape.

- By End Use

On the basis of end use, the Real Estate Unified Communication Market is segmented into residential, commercial, and industrial applications. The commercial segment accounted for the largest market revenue share of 48.9% in 2024, driven by the extensive need for centralized and integrated communication in office buildings, retail properties, and mixed-use developments. These environments benefit from UC tools that streamline operations, improve tenant experience, and support hybrid work arrangements for property management teams.

The residential segment is projected to register the fastest CAGR of 23.1% from 2025 to 2032, supported by the growing trend of smart homes, gated communities, and multi-dwelling units adopting tech-enabled management systems. Unified communication platforms in this space enable video intercoms, maintenance scheduling, automated alerts, and digital tenant engagement. Rising expectations for convenience, security, and connected living are driving the demand for UC solutions in residential real estate, particularly in premium and tech-forward developments.

- By Service Type

On the basis of service type, the market is segmented into managed services and professional services. The managed services segment dominated the market in 2024 with the highest revenue share of 54.2%, due to its comprehensive nature, covering UC platform deployment, monitoring, security, and support. Many real estate firms opt for managed services to reduce internal IT workload and ensure seamless system performance. These services are particularly popular in large commercial real estate portfolios that require 24/7 support.

The professional services segment is anticipated to grow at the fastest CAGR of 22.4% from 2025 to 2032, driven by the increasing complexity of UC integrations, which often require expert consultation, system customization, and staff training. As property firms invest in AI, IoT, and CRM-linked communication platforms, demand for specialized implementation and advisory services is rising. Professional services ensure that UC deployments align with business objectives, local regulations, and user requirements, making them essential for successful digital transformation.

Global Real Estate Unified Communication Market Regional Analysis

- North America dominated the Global Real Estate Unified Communication Market with the largest revenue share of 38.6% in 2024, driven by the early adoption of advanced communication technologies across residential and commercial real estate sectors.

- The region’s strong presence of major UC vendors, coupled with a tech-savvy workforce and widespread implementation of hybrid work models, has accelerated the adoption of unified communication platforms among property managers, developers, and tenants.

- This leadership is further supported by high enterprise IT spending, growing demand for centralized property management tools, and strong infrastructure for cloud services. Real estate firms across the U.S. and Canada are prioritizing digital transformation, with unified communication platforms being key to improving operational efficiency, tenant satisfaction, and cross-functional collaboration.

U.S. Real Estate Unified Communication Market Insight

The U.S. unified communication market captured the largest revenue share of 79% in North America in 2024, driven by widespread digital transformation initiatives and the real estate industry's rapid shift toward hybrid work environments. Real estate firms, property managers, and developers are increasingly adopting UC platforms to streamline operations, enhance tenant engagement, and enable remote property management. Integration with cloud-based tools like Microsoft Teams, Zoom, and RingCentral is boosting operational efficiency. The growing emphasis on smart building infrastructure, combined with rising investment in PropTech solutions, continues to drive demand for scalable and secure communication platforms across both residential and commercial real estate segments.

Europe Real Estate Unified Communication Market Insight

The Europe UC market is projected to grow at a substantial CAGR throughout the forecast period, fueled by regulatory requirements around data security, rising adoption of cloud-based services, and increasing digitization of real estate operations. The European real estate sector is progressively embracing unified communication platforms to support remote collaboration, improve tenant services, and reduce operational inefficiencies. Growth is particularly strong in countries such as Germany, France, and the Netherlands, where property owners are implementing UC solutions in smart buildings and sustainable housing projects. Demand is also increasing in cross-border real estate portfolios that require standardized communication and management tools.

U.K. Real Estate Unified Communication Market Insight

The U.K. UC market is expected to grow at a noteworthy CAGR during the forecast period, driven by a surge in digital transformation efforts within commercial and residential property management. The shift toward hybrid working models has prompted real estate stakeholders to adopt collaborative platforms for virtual meetings, document sharing, and tenant communication. Additionally, growing investment in digital infrastructure and the emergence of smart property management solutions are supporting the uptake of UC technologies. The integration of communication tools with customer service and leasing platforms is becoming increasingly common, helping real estate firms enhance engagement and operational responsiveness.

Germany Real Estate Unified Communication Market Insight

Germany’s unified communication market is forecasted to expand at a considerable CAGR during the forecast period, supported by its strong enterprise IT infrastructure, a mature real estate sector, and growing emphasis on digital sustainability. Real estate firms in Germany are increasingly adopting cloud-based UC platforms to support energy-efficient building operations, enhance tenant experience, and improve facility management processes. The integration of UC tools with IoT-based building management systems is becoming a standard in new developments and retrofit projects. Germany’s focus on privacy and data security is also influencing the selection of secure, GDPR-compliant UC providers across the market.

Asia-Pacific Real Estate Unified Communication Market Insight

The Asia-Pacific unified communication market is projected to grow at the fastest CAGR of 24.3% from 2025 to 2032, driven by rising urbanization, growing investment in smart city projects, and increased real estate digitization across countries like China, Japan, and India. The region’s booming commercial and residential real estate sectors are adopting UC solutions to meet tenant demands for responsive service, digital leasing, and remote collaboration. Infrastructural development and government-led digital transformation initiatives further support market expansion. Additionally, the affordability and scalability of cloud-based UCaaS platforms are enabling small and mid-sized real estate firms in APAC to modernize operations efficiently.

Japan Real Estate Unified Communication Market Insight

Japan’s UC market is gaining momentum, underpinned by its advanced technology landscape and increasing adoption of smart buildings and automated property management systems. Real estate developers are leveraging unified communication tools to streamline building operations, enhance tenant service, and support aging populations with more accessible digital engagement solutions. Japan’s emphasis on seamless integration with IoT, AI, and robotics in building systems further accelerates UC adoption. As the country continues to urbanize and modernize its infrastructure, demand for secure, scalable, and multilingual communication platforms is expected to rise significantly, particularly in multi-tenant and mixed-use properties.

China Real Estate Unified Communication Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, extensive digital infrastructure, and large-scale real estate development across commercial and residential sectors. Unified communication platforms are becoming essential tools in managing China's expanding property portfolios, particularly in tech-driven smart city projects. The strong presence of domestic UC providers, coupled with government policies promoting digital transformation, is accelerating market growth. Cloud-based communication tools are widely adopted for tenant management, internal collaboration, and virtual leasing processes, making China a leader in UC deployment within real estate.

Global Real Estate Unified Communication Market Share

The Real Estate Unified Communication industry is primarily led by well-established companies, including:

- CBRE Group Inc. (U.S.)

- Brookfield Asset Management (U.S.)

- American Tower (U.S.)

- Prologis (U.S.)

- Equinix (U.S.)

- Keller Williams (U.S.)

- RE/MAX (United States)

- Cushman & Wakefield (U.S.)

- JLL (U.S.)

- Simon Property Group (U.S.)

- Welltower (U.S.)

- AvalonBay Communities (U.S.)

- Equity Residential (U.S.)

- eXp Realty (U.S.)

- Public Storage (U.S.)

What are the Recent Developments in Global Real Estate Unified Communication Market?

- In September 2023, Cisco Systems, Inc., a global leader in networking and unified communications, launched a specialized suite of collaboration tools tailored for the real estate industry. Designed to streamline communication among agents, clients, and property managers, this initiative leverages Cisco’s Webex platform to enable seamless virtual property tours, real-time document sharing, and secure communication channels. By addressing the growing demand for digital transformation in property transactions, Cisco reinforces its commitment to enhancing operational efficiency and client engagement in the Global Real Estate Unified Communication Market.

- In August 2023, Zoom Video Communications, Inc. announced a strategic partnership with RE/MAX Europe to integrate Zoom’s enterprise-grade communication platform into real estate operations across the continent. This collaboration enables real-time virtual showings, team coordination, and client consultations, all within a unified interface. The partnership reflects Zoom’s ongoing expansion into vertical-specific markets, offering tailored solutions that meet the dynamic communication needs of real estate professionals in an increasingly hybrid work environment.

- In July 2023, RingCentral Inc., a leading provider of cloud-based communications and collaboration solutions, introduced its RealEstateConnect platform, designed specifically for real estate brokerages and agencies. The platform offers integrated voice, video, messaging, and CRM tools to enhance client interactions and internal workflows. By focusing on industry-specific needs, RingCentral is expanding its footprint in the Global Real Estate Unified Communication Market, helping firms improve responsiveness and productivity in a competitive landscape.

- In June 2023, Microsoft Corporation expanded its Teams platform capabilities to include a suite of tools tailored for real estate operations. The update includes customized templates for property management, document automation, and virtual client meetings, all embedded within Microsoft’s secure cloud infrastructure. This move highlights Microsoft’s commitment to delivering intelligent collaboration experiences that cater to the evolving demands of the real estate sector, further solidifying its role as a key player in the Unified Communication space.

- In May 2023, Avaya Inc. launched a new cloud-based communication platform aimed at supporting real estate enterprises with scalable, omni-channel communication tools. The platform offers advanced analytics, AI-driven customer engagement features, and seamless integration with property management systems. This initiative reflects Avaya’s strategic focus on delivering high-performance communication ecosystems tailored to the unique challenges of the real estate industry, contributing to the rapid digital transformation within the Global Real Estate Unified Communication Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.