Global Rear E Axle Market

Market Size in USD Billion

CAGR :

%

USD

62.73 Billion

USD

339.52 Billion

2024

2032

USD

62.73 Billion

USD

339.52 Billion

2024

2032

| 2025 –2032 | |

| USD 62.73 Billion | |

| USD 339.52 Billion | |

|

|

|

|

Rear Electric Axle (E-Axle) Market Size

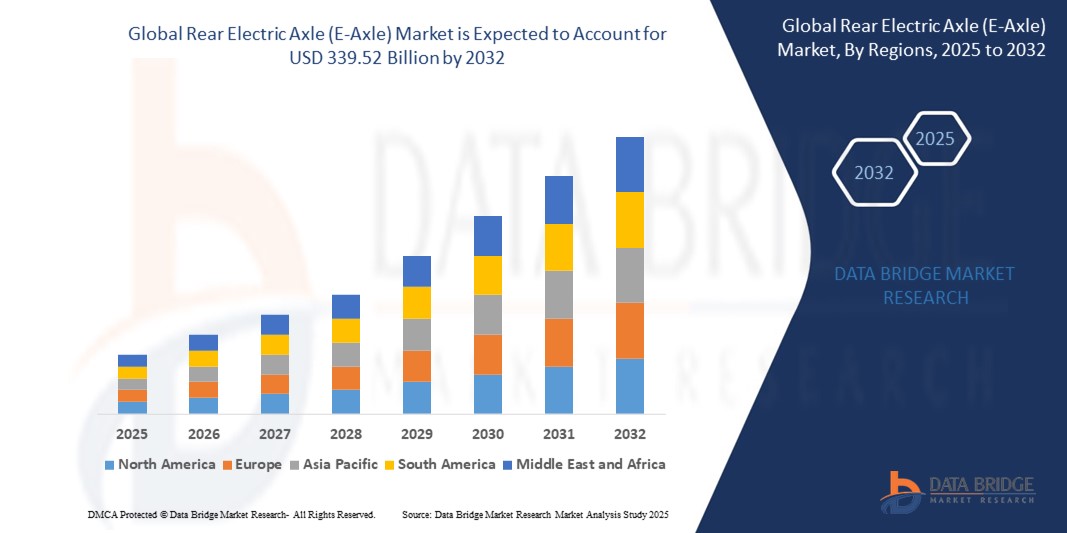

- The global rear electric axle (E-Axle) market size was valued at USD 62.73 billion in 2024 and is expected to reach USD 339.52 billion by 2032, at a CAGR of 23.50% during the forecast period

- The market growth is largely fuelled by the accelerating shift toward electric mobility, increasing government incentives for EV adoption, and the growing demand for integrated and compact drivetrain solutions in passenger and commercial electric vehicles

- Advancements in power electronics, lightweight materials, and thermal management systems are enhancing the efficiency and performance of rear electric axles, encouraging wider adoption across various EV segments

Rear Electric Axle (E-Axle) Market Analysis

- The rear electric axle market is experiencing rapid expansion as automakers increasingly prioritize powertrain electrification to meet regulatory targets and consumer demand for sustainable transport

- E-axles, which combine motor, transmission, and power electronics in a single unit, are gaining traction for their efficiency, reduced weight, and simplified vehicle architecture, especially in rear-wheel-drive EV configurations

- Asia-Pacific dominated the rear electric axle (E-Axle) market with the largest revenue share in 2024, driven by robust electric vehicle production, strong government policies, and the presence of leading automotive manufacturers

- Europe region is expected to witness the highest growth rate in the global rear electric axle (E-Axle) market, driven by increasing investments in electric mobility, stringent carbon emission regulations, and the rising production of electric vehicles across the region.

- The single axle segment dominated the market with the largest revenue share in 2024, primarily due to its simpler design, ease of integration, and suitability for compact electric vehicles. Its cost-effective structure and weight-saving benefits make it an ideal choice for manufacturers aiming for efficiency and performance

Report Scope and Rear Electric Axle (E-Axle) Market Segmentation

|

Attributes |

Rear Electric Axle (E-Axle) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Rear Electric Axle (E-Axle) Market Trends

“Integration of Power Electronics for Enhanced Efficiency”

- Integration of power electronics such as inverters and control units directly into the rear electric axle streamlines the drivetrain and minimizes transmission losses, boosting overall efficiency

- This approach results in a more compact and lightweight system, which helps enhance EV range and vehicle performance, especially in space-constrained designs

- Improved thermal management capabilities are achieved through tighter system integration, ensuring better reliability and sustained performance under demanding driving conditions

- The integration helps reduce total system cost by minimizing the number of separate components and simplifying assembly processes for OEMs

- For instance, ZF's integrated E-axle systems have been adopted in several next-generation EV platforms, supporting modular architecture for use across sedans, SUVs, and commercial electric vehicles

Rear Electric Axle (E-Axle) Market Dynamics

Driver

“Accelerating Electrification of Passenger and Commercial Vehicles”

- The global transition toward sustainable mobility is driving strong demand for electric vehicles, creating a surge in the need for efficient and compact powertrain solutions such as rear E-axles

- E-axles help consolidate multiple drivetrain components into one unit, offering benefits such as reduced weight, improved efficiency, and enhanced packaging flexibility

- Automakers are adopting rear E-axles to meet stricter fuel efficiency and emission regulations while maintaining performance in electric SUVs, sedans, and trucks

- The demand for all-electric and hybrid commercial vehicles, especially in last-mile delivery fleets, is further boosting market growth

- For instance, Volvo’s use of E-axles in electric trucks demonstrates this trend

- Rear E-axles also support high torque delivery and improved vehicle control, which are critical features for both consumer and commercial EV segments

Restraint/Challenge

“High Development Costs and Technological Complexity”

- Despite the advantages, rear electric axles present significant challenges due to their complex design and high development costs

- Integrating multiple functions such as motor, inverter, and transmission into one unit requires precision engineering and advanced materials, raising R&D expenditure

- Startups and smaller OEMs often face barriers entering the market due to the heavy initial investment needed for development, prototyping, and testing

- For instance, while Tier 1 suppliers such as Magna and Continental have succeeded in developing scalable E-axles, smaller players struggle with cost-efficiency and technology access

- In addition, ensuring reliability and thermal performance across different vehicle platforms adds complexity and slows down scalability in mass production

Rear Electric Axle (E-Axle) Market Scope

The rear electric axle (E-Axle) market is segmented on the basis of shaft type, material, component, drive type, and vehicle type.

• By Shaft Type

On the basis of shaft type, the market is segmented into single axle and multiple axle. The single axle segment dominated the market with the largest revenue share in 2024, primarily due to its simpler design, ease of integration, and suitability for compact electric vehicles. Its cost-effective structure and weight-saving benefits make it an ideal choice for manufacturers aiming for efficiency and performance.

The multiple axle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in electric trucks, buses, and heavy-duty vehicles where enhanced torque distribution and load handling are essential. As commercial fleets transition to electrification, the need for dual or multi-axle configurations is becoming more prominent to meet performance and capacity requirements.

• By Material

On the basis of material, the rear electric axle market is segmented into alloys and carbon fiber. The alloys segment held the largest market share in 2024 owing to their widespread use, strength, and cost-effectiveness across a broad range of electric vehicle applications. Alloy-based axles offer reliable mechanical performance while keeping manufacturing costs manageable.

The carbon fiber segment is expected to witness the fastest growth rate from 2025 to 2032, as manufacturers seek lightweight alternatives to improve vehicle efficiency and range. Carbon fiber's superior strength-to-weight ratio makes it an attractive option for premium electric vehicles and performance-driven applications.

• By Component

On the basis of component, the market is segmented into combining motors, power electronics, transmission, and others. The combining motors segment led the market in 2024, supported by the high demand for integrated propulsion systems that simplify drivetrain architecture and enhance EV power delivery. These motors offer compactness and high efficiency, making them suitable for rear axle configurations.

The power electronics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing trend toward integrated systems that include inverters and control units within the axle. These advancements improve energy efficiency and reduce system complexity, especially in rear-wheel-drive EVs.

• By Drive Type

On the basis of drive type, the market is segmented into all wheel type, front wheel type, and rear wheel type. The rear wheel type segment captured the highest revenue in 2024, driven by its increasing use in electric sedans and sports utility vehicles, where dynamic handling and performance are prioritized. Rear-wheel drive E-axles offer improved acceleration and better weight distribution for EV platforms.

The all wheel type segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising consumer interest in performance EVs and electric off-road vehicles. All-wheel-drive systems featuring dual or multiple E-axles provide superior traction and adaptability across various driving conditions.

• By Vehicle Type

On the basis of vehicle type, the rear electric axle market is segmented into passenger vehicle, commercial vehicle, and electric vehicle. The electric vehicle segment dominated the market in 2024 due to the increasing adoption of EVs across both consumer and commercial sectors. Government incentives, improved battery technologies, and rising environmental awareness are fueling the expansion of this segment.

The commercial vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by electrification of logistics fleets and public transport systems. Demand for durable, efficient, and high-torque axle systems in delivery vans, electric buses, and trucks is contributing to the segment’s upward trajectory.

Rear Electric Axle (E-Axle) Market Regional Analysis

• Asia-Pacific dominated the rear electric axle (E-Axle) market with the largest revenue share in 2024, driven by robust electric vehicle production, strong government policies, and the presence of leading automotive manufacturers

• The region benefits from high demand for compact and efficient powertrain solutions across electric passenger and commercial vehicles

• Ongoing investments in electrification infrastructure and battery technology, combined with favorable regulations and cost-effective manufacturing, are solidifying Asia-Pacific’s leadership in the market

China Rear Electric Axle Market Insight

The China rear electric axle market accounted for the largest revenue share within Asia-Pacific in 2024, supported by the country’s vast electric vehicle production capacity and advanced manufacturing ecosystem. China’s dominance in battery technology and growing adoption of electric mobility across all vehicle segments continue to strengthen market expansion. Strong government incentives, such as subsidies and EV mandates, further accelerate domestic demand. The presence of major E-axle manufacturers and EV brands, including BYD and NIO, is contributing to China’s central role in shaping the global E-axle industry.

Japan Rear Electric Axle Market Insight

The Japan is expected to witness the fastest growth rate from 2025 to 2032, driven by its strong automotive manufacturing base and advancements in electrification technology. Japanese automakers are emphasizing the development of compact and high-efficiency E-axle systems to support hybrid and electric vehicle platforms. The nation's focus on sustainable mobility, coupled with investments in EV infrastructure and R&D, supports the integration of rear E-axles into next-generation electric cars. Key players such as Toyota and Honda are actively incorporating these systems into both passenger and light commercial vehicles to enhance performance and energy efficiency.

Europe Rear Electric Axle Market Insight

The Europe rear electric axle market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict carbon emission regulations and increasing investments in e-mobility. European automakers are transitioning their fleets toward electrification, with growing demand for modular and integrated E-axle solutions to enhance efficiency and reduce weight. The expansion of public EV charging networks and rising adoption of zero-emission vehicles in countries such as France, Germany, and the Netherlands are boosting the regional market. Innovation in lightweight materials and system integration further supports growth

Germany Rear Electric Axle Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, supported by its strong automotive engineering base and leadership in EV technology innovation. German OEMs are incorporating rear E-axles into their next-generation electric platforms, driven by performance, range, and design flexibility. The country’s focus on developing sustainable mobility solutions and its active participation in EV component R&D makes it a key player in shaping the regional market landscape

U.K. Rear Electric Axle Market Insight

The U.K. rear electric axle market is expected to witness the fastest growth rate from 2025 to 2032od, supported by the government’s commitment to phasing out internal combustion engine vehicles and promoting EV adoption. British automakers are increasingly integrating rear E-axle systems into electric passenger cars to meet emission targets and consumer demand for performance. The presence of EV startups, combined with investment in domestic battery and drivetrain production, is enhancing the region’s capability to scale up advanced E-axle technologies. This transition aligns with the U.K.’s broader strategy toward net-zero transportation.

North America Rear Electric Axle Market Insight

The North America holds a substantial share in the rear electric axle market, primarily due to increased production of electric pickup trucks, SUVs, and light commercial vehicles. Automakers in the region are investing heavily in electrified drivetrains, and rear E-axles play a vital role in enhancing vehicle performance and torque management. The market is supported by government incentives, a rising number of EV startups, and infrastructure developments that make electrification more viable.

U.S. Rear Electric Axle Market Insight

The U.S. rear electric axle market captured the largest revenue share in North America in 2024, fueled by strong EV adoption and innovation in integrated powertrain systems. With a focus on electrifying trucks, crossovers, and commercial fleets, U.S. manufacturers are emphasizing high-efficiency and performance-oriented E-axle technologies. Collaborations between OEMs and component suppliers, along with government support for clean transportation, are accelerating the rollout of advanced rear E-axle platforms. The trend toward vehicle electrification across rural and urban markets continues to drive long-term demand.

Rear Electric Axle (E-Axle) Market Share

The Rear Electric Axle (E-Axle) industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Dana Limited (U.S.)

- MELROSE INDUSTRIES PLC (U.K.)

- Schaeffler AG (Germany)

- Robert Bosch GmbH (Germany)

- ZF Friedrichshafen AG (Germany)

- Magna International Inc. (Canada)

- Cummins Inc. (U.S.)

- AVL (Austria)

- GKN (U.K.)

- NIDEC CORPORATION (Japan)

- Linamar (Canada)

- Loccioni (Italy)

- Meritor, Inc. (U.S.)

- Automotive Axles Limited (India)

Latest Developments in Global Rear Electric Axle (E-Axle) Market

- In June 2023, Musashi Auto Parts India Pvt. Ltd., a subsidiary of Musashi Seimitsu Industries, unveiled plans to enter India's electric mobility market. They will produce an integrated EV unit including motor, power control unit (PCU), and gearbox at their Bengaluru plant from October 2023, emphasizing high-performance and safe automotive components for two-wheelers and four-wheelers

- In June 2023, Nidec Corporation and Renesas Electronics Corporation announced a partnership to develop semiconductor solutions for advanced E-Axle systems. Their collaborative X-in-1 system integrates EV drive motor and power electronics to enhance electric vehicle performance and efficiency, targeting next-generation mobility solutions

- In June 2023, Idemitsu Kosan Co., Ltd. introduced "E AXLE and Electric Parts Cooling Oil," a cutting-edge solution to optimize electric and hybrid vehicle drive units, electronics, and battery systems. This innovation aims to improve overall performance and efficiency in response to the growing demand for sustainable automotive solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.