Global Recombinant Non Glycosylated Proteins Market

Market Size in USD Billion

CAGR :

%

USD

283.28 Billion

USD

498.86 Billion

2025

2033

USD

283.28 Billion

USD

498.86 Billion

2025

2033

| 2026 –2033 | |

| USD 283.28 Billion | |

| USD 498.86 Billion | |

|

|

|

|

Recombinant Non-Glycosylated Proteins Market Size

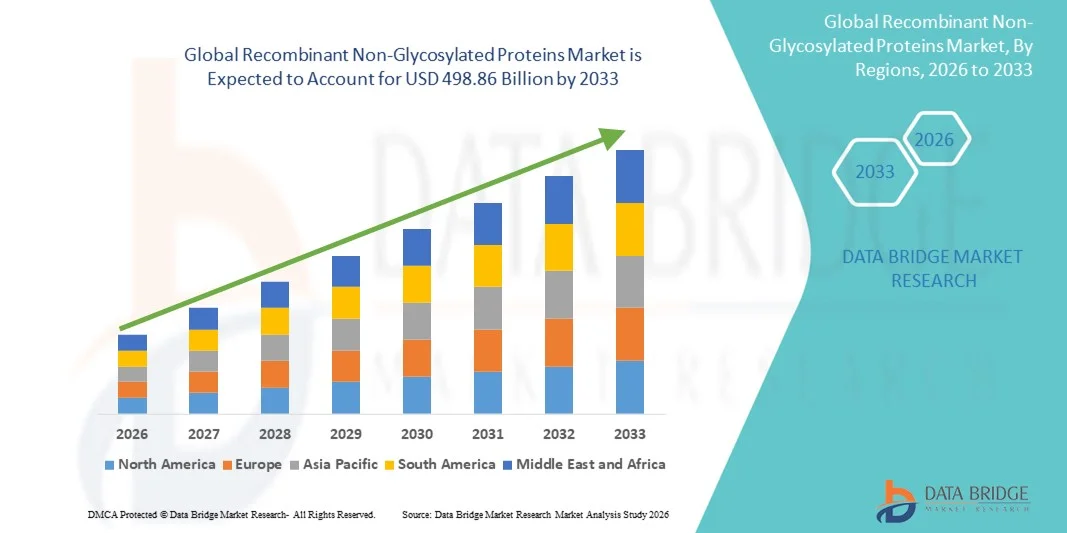

- The global recombinant non-glycosylated proteins market size was valued at USD 283.28 billion in 2025 and is expected to reach USD 498.86 billion by 2033, at a CAGR of 7.33% during the forecast period

- The market growth is largely fueled by the increasing use of recombinant non-glycosylated proteins in biopharmaceutical manufacturing, diagnostics, and research applications, supported by advances in genetic engineering, microbial expression systems, and large-scale fermentation technologies

- Furthermore, rising demand for cost-effective, high-purity therapeutic and research-grade proteins, coupled with expanding applications in vaccines, enzyme production, and protein-based therapeutics, is establishing recombinant non-glycosylated proteins as a preferred solution across pharmaceutical and biotechnology industries. These converging factors are accelerating the uptake of recombinant non-glycosylated protein solutions, thereby significantly boosting the industry’s growth

Recombinant Non-Glycosylated Proteins Market Analysis

- Recombinant non-glycosylated proteins, widely used in therapeutics, diagnostics, vaccines, and research applications, play a critical role in modern biopharmaceutical development due to their high purity, consistency, and suitability for large-scale production using microbial expression systems such as E. coli

- The escalating demand for recombinant non-glycosylated proteins is primarily driven by the growing prevalence of chronic diseases, increasing use of protein-based therapeutics, rising demand for enzymes and hormones, and expanding research activities in biotechnology and life sciences

- North America dominated the recombinant non-glycosylated proteins market with the largest revenue share of approximately 38.9% in 2025, supported by a strong biopharmaceutical industry, high R&D investments, advanced manufacturing capabilities, and the presence of major biotechnology and pharmaceutical companies. The U.S. continues to lead adoption due to extensive clinical research and commercialization of recombinant therapeutics

- Asia-Pacific is expected to be the fastest-growing region in the recombinant non-glycosylated proteins market during the forecast period, registering a high CAGR due to increasing biopharmaceutical production, rising healthcare expenditure, expanding contract manufacturing organizations (CMOs), and growing investments in biotechnology sectors across China, India, and South Korea

- The Chronic Diseases segment accounted for the largest market revenue share of around 41.2% in 2025, driven by the extensive use of recombinant non-glycosylated proteins such as insulin and interferons in long-term disease management

Report Scope and Recombinant Non-Glycosylated Proteins Market Segmentation

|

Attributes |

Recombinant Non-Glycosylated Proteins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Recombinant Non-Glycosylated Proteins Market Trends

Advancement in Recombinant Expression Technologies and Manufacturing Efficiency

- A significant and accelerating trend in the global recombinant non-glycosylated proteins market is the continuous advancement in recombinant DNA expression systems and scalable biomanufacturing technologies. Improvements in microbial expression platforms such as E. coli and yeast systems are enabling higher yields, improved purity, and faster production timelines for non-glycosylated proteins used in therapeutics, diagnostics, and research applications

- For instance, several biopharmaceutical manufacturers have increasingly optimized E. coli-based expression systems to enhance protein folding efficiency and reduce production-related impurities, thereby improving product consistency for commercially important recombinant proteins such as insulin, interferons, and growth factors. These advancements significantly lower manufacturing costs while improving batch reproducibility

- Process innovations such as high-cell-density fermentation, continuous bioprocessing, and improved downstream purification techniques are further enhancing production efficiency. Advanced chromatography resins and filtration technologies enable higher recovery rates and reduce protein aggregation, which is particularly critical for maintaining the structural integrity of non-glycosylated proteins

- The adoption of automation and digital bioprocess monitoring tools is also improving manufacturing scalability and quality control. Real-time analytics and process analytical technologies (PAT) allow manufacturers to closely monitor critical parameters, reduce batch failures, and ensure regulatory compliance across large-scale production facilities

- This trend toward more efficient, scalable, and cost-effective recombinant protein manufacturing is reshaping competition within the market. Consequently, companies such as Thermo Fisher Scientific, Merck KGaA, and GenScript are investing heavily in advanced expression platforms and contract manufacturing capabilities to strengthen their recombinant protein portfolios and meet growing global demand

- The increasing focus on process optimization and high-efficiency production systems is supporting the expansion of recombinant non-glycosylated proteins across therapeutic, diagnostic, and research applications, reinforcing long-term market growth prospects

Recombinant Non-Glycosylated Proteins Market Dynamics

Driver

Rising Demand for Biopharmaceuticals and Protein-Based Therapeutics

- The increasing prevalence of chronic diseases such as diabetes, cancer, autoimmune disorders, and hormonal deficiencies, coupled with the global rise in biologic drug development, is a major driver for the growing demand for recombinant non-glycosylated proteins. These proteins play a crucial role in therapeutic applications due to their well-characterized structures, consistent performance, and cost-effective production

- For instance, in March 2024, multiple biopharmaceutical companies expanded production capacity for recombinant insulin and cytokine-based therapies to address rising patient populations and growing global demand. Such expansions are expected to significantly accelerate growth within the Recombinant Non-Glycosylated Proteins market over the forecast period

- Recombinant non-glycosylated proteins are widely utilized in approved biologic drugs, vaccines, diagnostics, and in vitro research due to their predictable behavior and lower immunogenic risks when properly engineered. Their extensive application across clinical and laboratory settings continues to propel market demand

- Furthermore, the rapid growth of biosimilars and increasing emphasis on cost-efficient biologic manufacturing are making non-glycosylated recombinant proteins an attractive option for pharmaceutical companies seeking scalable and economically viable solutions

- The expanding biotechnology research ecosystem, rising R&D expenditure, and increasing collaboration between academic institutions and biopharmaceutical companies further contribute to strong market momentum. Growing adoption in contract research and manufacturing organizations (CROs and CMOs) also supports sustained market expansion

Restraint/Challenge

Complex Manufacturing Processes and Regulatory Compliance Challenges

- Despite robust growth potential, the recombinant non-glycosylated proteins market faces notable challenges related to complex manufacturing workflows and stringent regulatory requirements. Maintaining correct protein folding, stability, and biological activity during large-scale production remains technically demanding

- For instance, variations in expression conditions or purification steps can lead to protein degradation or aggregation, impacting product efficacy and increasing production costs. Such technical challenges may limit scalability, particularly for smaller manufacturers with limited process optimization capabilities

- Regulatory compliance adds another layer of complexity, as recombinant proteins intended for therapeutic use must meet strict quality, safety, and consistency standards set by regulatory authorities. Extensive validation, documentation, and quality control measures are required, increasing time-to-market and overall development costs

- In addition, the relatively high capital investment required for advanced bioprocessing equipment, quality testing infrastructure, and skilled workforce can act as a barrier for new entrants and companies in developing regions. While technological advancements are gradually reducing production costs, the initial investment burden remains significant

- Addressing these challenges through enhanced process optimization, improved protein engineering techniques, workforce training, and regulatory harmonization will be essential for ensuring long-term competitiveness and sustained growth in the Recombinant Non-Glycosylated Proteins market

Recombinant Non-Glycosylated Proteins Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the Recombinant Non-Glycosylated Proteins market is segmented into Recombinant Human Growth Hormone, Granulocyte Colony-Stimulating Factor (G-CSF), Insulin, Interferon, and others. The Insulin segment dominated the largest market revenue share of approximately 38.6% in 2025, driven by the globally rising prevalence of diabetes and the long-standing reliance on recombinant insulin for effective glycemic control. Recombinant non-glycosylated insulin products are widely adopted due to their high purity, predictable pharmacokinetics, and cost-efficient large-scale production using microbial expression systems. The strong demand from both developed and emerging economies, supported by increasing healthcare access and reimbursement coverage, further reinforces the segment’s dominance. Continuous product innovations, including rapid-acting and long-acting insulin analogs, are enhancing treatment outcomes and patient adherence. Additionally, the expanding biosimilar insulin market is improving affordability, particularly in price-sensitive regions, thereby boosting overall consumption. The presence of major pharmaceutical manufacturers with established insulin portfolios and robust distribution networks continues to solidify insulin’s leading position within the recombinant non-glycosylated proteins market.

The Recombinant Human Growth Hormone (rhGH) segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, fueled by increasing diagnosis rates of growth hormone deficiency in both pediatric and adult populations. Growing awareness regarding hormonal disorders, improved diagnostic capabilities, and expanding therapeutic applications of rhGH beyond classical deficiency treatment are supporting rapid market growth. Technological advancements in recombinant protein expression and formulation are improving the safety, efficacy, and shelf life of rhGH products. Additionally, rising adoption in emerging markets, supported by improving healthcare infrastructure and insurance coverage, is significantly accelerating demand. Increased research activity focused on long-acting growth hormone formulations is also enhancing treatment compliance and clinical outcomes. The growing emphasis on personalized medicine and long-term endocrine care is expected to further propel the rhGH segment’s expansion during the forecast period.

- By Application

On the basis of application, the Recombinant Non-Glycosylated Proteins market is segmented into Oncology, Chronic Diseases, Autoimmune Diseases, Blood Disorders, Growth Hormone Deficiency, Infectious Diseases, and Other Diseases. The Chronic Diseases segment accounted for the largest market revenue share of around 41.2% in 2025, driven by the extensive use of recombinant non-glycosylated proteins such as insulin and interferons in long-term disease management. The increasing global burden of diabetes, anemia, and hormonal deficiencies has led to sustained demand for protein-based biologics that offer consistent therapeutic efficacy. These products are favored due to their well-established clinical profiles, scalable manufacturing, and suitability for prolonged treatment regimens. Strong patient reliance on continuous biologic therapy, along with favorable reimbursement policies in developed markets, further reinforces segment dominance. Additionally, the rising prevalence of chronic conditions in aging populations has significantly increased treatment volumes worldwide. Ongoing improvements in formulation stability and delivery methods are further supporting long-term adoption across chronic disease indications.

The Oncology segment is projected to grow at the fastest CAGR of 10.4% from 2026 to 2033, driven by increasing use of recombinant proteins such as interferons and colony-stimulating factors in cancer treatment and supportive care. Rising global cancer incidence, coupled with expanding adoption of biologic therapies to manage chemotherapy-induced complications, is accelerating market growth. Recombinant non-glycosylated proteins play a critical role in immune modulation, infection prevention, and hematopoietic recovery in oncology patients. Increased investment in cancer research, combined with growing clinical applications of biologics in targeted therapy and immunotherapy support, is further fueling demand. Expanding access to oncology care in emerging economies and improving survival rates are also contributing to higher usage volumes. As biologic-based supportive therapies become integral to comprehensive cancer treatment protocols, the oncology application segment is expected to experience robust growth throughout the forecast period.

Recombinant Non-Glycosylated Proteins Market Regional Analysis

- North America dominated the recombinant non-glycosylated proteins market with the largest revenue share of approximately 38.9% in 2025, driven by a robust biopharmaceutical ecosystem, high R&D investments, advanced manufacturing infrastructure, and the presence of leading biotechnology and pharmaceutical companies. The U.S. accounts for the majority of this market share due to extensive clinical research, rapid commercialization of recombinant therapeutics, and early adoption of innovative biologics such as insulin, growth hormones, and interferons

- Increasing prevalence of chronic and rare diseases, coupled with favorable regulatory policies supporting fast-track approvals and orphan drug development, further enhances market growth. The growing focus on personalized medicine and targeted therapeutics is prompting significant investment in non-glycosylated recombinant protein production

- Moreover, collaborations between research institutions, CMOs, and pharmaceutical companies are strengthening supply chains, improving accessibility, and accelerating market penetration. The well-established healthcare infrastructure, strong intellectual property protections, and high healthcare expenditure make North America a key global hub for recombinant non-glycosylated protein development and commercialization

U.S. Recombinant Non-Glycosylated Proteins Market Insight

The U.S. recombinant non-glycosylated proteins market captured the largest revenue share within North America in 2025, fueled by its extensive pipeline of recombinant non-glycosylated therapeutics across indications such as diabetes, growth hormone deficiency, and oncology-related treatments. High adoption of novel biologics, supportive reimbursement frameworks, and robust funding for biotechnology R&D contribute to steady market expansion. Leading players are focusing on the commercialization of insulin analogs, granulocyte colony-stimulating factors, and interferons, addressing both chronic and rare disease patient populations. The U.S. also benefits from strong contract manufacturing and bioprocessing capabilities, allowing for efficient large-scale production and distribution of recombinant proteins. Government incentives for orphan drugs and regulatory facilitation through the FDA fast-track process enable accelerated market entry. Additionally, strategic collaborations and licensing agreements between biotech firms and global pharmaceutical companies enhance technology transfer, product innovation, and market reach. The U.S. market is also supported by increasing patient awareness, specialized healthcare centers, and a mature clinical research ecosystem.

Europe Recombinant Non-Glycosylated Proteins Market Insight

Europe recombinant non-glycosylated proteins market is projected to expand at a substantial CAGR during the forecast period, driven by well-established biopharmaceutical hubs in countries like Germany, Switzerland, and France. Market growth is supported by stringent regulatory frameworks ensuring product safety, increasing prevalence of chronic diseases, and strong governmental funding for biotechnology research. Countries across Europe are witnessing high adoption of recombinant therapeutics, particularly in oncology, diabetes management, and growth disorders. The presence of advanced contract manufacturing organizations and integrated supply chains facilitates production scalability and rapid market access. Moreover, growing collaborations between academic research institutions and pharmaceutical companies are driving innovation in non-glycosylated recombinant protein development. Increasing healthcare expenditure, expanding patient awareness, and government-backed healthcare programs further enhance accessibility. The region is also seeing investments in advanced manufacturing technologies such as single-use bioreactors and continuous processing, improving production efficiency and cost-effectiveness.

U.K. Recombinant Non-Glycosylated Proteins Market Insight

The U.K. recombinant non-glycosylated proteins market is anticipated to grow at a noteworthy CAGR, supported by active research in recombinant protein therapeutics, strategic biopharmaceutical partnerships, and early adoption of innovative biologics. Rising incidence of chronic and rare diseases, coupled with robust healthcare infrastructure, facilitates market penetration. The U.K. is witnessing growth in recombinant insulin, granulocyte colony-stimulating factors, and interferons, primarily driven by high patient awareness and well-established reimbursement frameworks. Government initiatives promoting biotechnology, access to skilled workforce, and presence of world-class research institutions further strengthen market growth. Moreover, increasing outsourcing to contract manufacturing organizations ensures cost-effective and scalable production of non-glycosylated recombinant proteins.

Germany Recombinant Non-Glycosylated Proteins Market Insight

Germany recombinant non-glycosylated proteins market is expected to expand at a considerable CAGR, fueled by a strong biotechnology and pharmaceutical sector, high healthcare expenditure, and adoption of recombinant therapeutics across hospitals and clinics. The country benefits from technological advancement in bioprocessing, regulatory support, and robust clinical research infrastructure. Germany has a growing demand for recombinant proteins in chronic disease management, oncology, and endocrinology. Collaborative efforts between biotech startups and multinational pharmaceutical companies enhance innovation and production efficiency. The focus on precision medicine and personalized treatment options also contributes to the increasing uptake of recombinant non-glycosylated proteins.

Asia-Pacific Recombinant Non-Glycosylated Proteins Market Insight

Asia-Pacific recombinant non-glycosylated proteins market is projected to be the fastest-growing region, registering a high CAGR during the forecast period, driven by increasing biopharmaceutical production, rising healthcare expenditure, and expanding contract manufacturing organizations (CMOs) in countries such as China, India, and South Korea. The growing patient population, awareness of chronic and rare diseases, and government support for biotechnology development are significant growth enablers. The region is witnessing rapid adoption of recombinant proteins for diabetes management, growth disorders, and oncology treatments. Rising investments in biotechnology infrastructure, improvements in cold chain logistics, and the availability of affordable therapeutics are facilitating greater accessibility. Additionally, increasing collaborations with global pharmaceutical companies are enhancing technology transfer, production efficiency, and local manufacturing capabilities, making APAC a key hub for global recombinant protein supply.

Japan Recombinant Non-Glycosylated Proteins Market Insight

Japan recombinant non-glycosylated proteins market is experiencing steady growth due to advanced healthcare infrastructure, increasing prevalence of chronic and rare diseases, and high adoption of innovative recombinant therapeutics. Strategic collaborations between local biotechnology firms and multinational pharmaceutical companies are accelerating market expansion. The country emphasizes the development and production of recombinant insulin, granulocyte colony-stimulating factors, and interferons. High patient awareness, favorable reimbursement policies, and supportive regulatory frameworks contribute to Japan’s expanding market share. Additionally, increasing investment in biotechnology research and clinical trials ensures continuous introduction of advanced therapeutics.

China Recombinant Non-Glycosylated Proteins Market Insight

China recombinant non-glycosylated proteins market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding healthcare expenditure, increasing prevalence of chronic and rare diseases, and strong government initiatives supporting biotechnology development. The country has become a global hub for recombinant protein manufacturing, with growing adoption in hospitals, clinics, and specialty care centers. Domestic pharmaceutical and biotechnology companies are increasingly investing in research, development, and commercialization of recombinant non-glycosylated proteins. Improvements in regulatory frameworks, growing patient awareness, and expanding distribution networks further support market growth.

Recombinant Non-Glycosylated Proteins Market Share

The Recombinant Non-Glycosylated Proteins industry is primarily led by well-established companies, including:

• Eli Lilly and Company (U.S.)

• Sanofi SA (France)

• Pfizer Inc. (U.S.)

• F. Hoffmann-La Roche Ltd. (Switzerland)

• Amgen Inc. (U.S.)

• Merck & Co., Inc. (U.S.)

• Bristol Myers Squibb Company (U.S.)

• AbbVie Inc. (U.S.)

• Biogen Inc. (U.S.)

• Genentech, Inc. (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Dr. Reddy’s Laboratories Ltd. (India)

• Biocon Limited (India)

• Celltrion, Inc. (South Korea)

Latest Developments in Global Recombinant Non-Glycosylated Proteins Market

- In July 2021, Biocon Biologics announced the U.S. FDA approval of Semglee (insulin glargine-yfgn), the first interchangeable biosimilar insulin in the United States. Semglee is a recombinant insulin produced using microbial expression systems and represents a key non-glycosylated protein therapeutic. The approval marked a major milestone by enabling pharmacy-level substitution, improving patient access to affordable insulin, and strengthening the role of recombinant non-glycosylated proteins in diabetes treatment. This development significantly increased competitive dynamics within the insulin market and supported wider adoption of recombinant protein-based therapies

- In December 2022, the U.S. FDA approved Rezvoglar (insulin glargine-aglr), developed by Eli Lilly and Boehringer Ingelheim, as an interchangeable insulin biosimilar. Rezvoglar is a fully recombinant, non-glycosylated protein designed to match the clinical efficacy and safety profile of reference insulin glargine products. This approval further expanded treatment choices for patients with diabetes and reinforced the growing reliance on recombinant protein manufacturing technologies. The launch also highlighted regulatory confidence in biosimilar non-glycosylated protein products

- In August 2023, Viatris and Biocon Biologics received expanded regulatory approvals across multiple regions for Fulphila (pegfilgrastim-jmdb), a recombinant granulocyte colony-stimulating factor (G-CSF). Recombinant G-CSF is a non-glycosylated protein widely used to reduce the risk of infection in cancer patients undergoing chemotherapy. The expanded approvals strengthened global availability of this therapy and demonstrated continued innovation and scaling in recombinant protein production. This development supported broader adoption of non-glycosylated growth factors in oncology supportive care

- In February 2025, the U.S. FDA approved Merilog (insulin aspart-szjj), a rapid-acting recombinant insulin biosimilar, expanding treatment options for diabetes management. Merilog is produced using recombinant DNA technology and classified as a non-glycosylated protein. The approval emphasized ongoing advancements in biosimilar development and manufacturing efficiency. This launch contributed to increased competition in short-acting insulin therapies and highlighted sustained innovation in recombinant non-glycosylated protein formulations aimed at improving glycemic control and patient access

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.