Global Recombinant Protein Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

3.43 Billion

USD

9.37 Billion

2024

2032

USD

3.43 Billion

USD

9.37 Billion

2024

2032

| 2025 –2032 | |

| USD 3.43 Billion | |

| USD 9.37 Billion | |

|

|

|

|

Recombinant Protein Vaccines Market Size

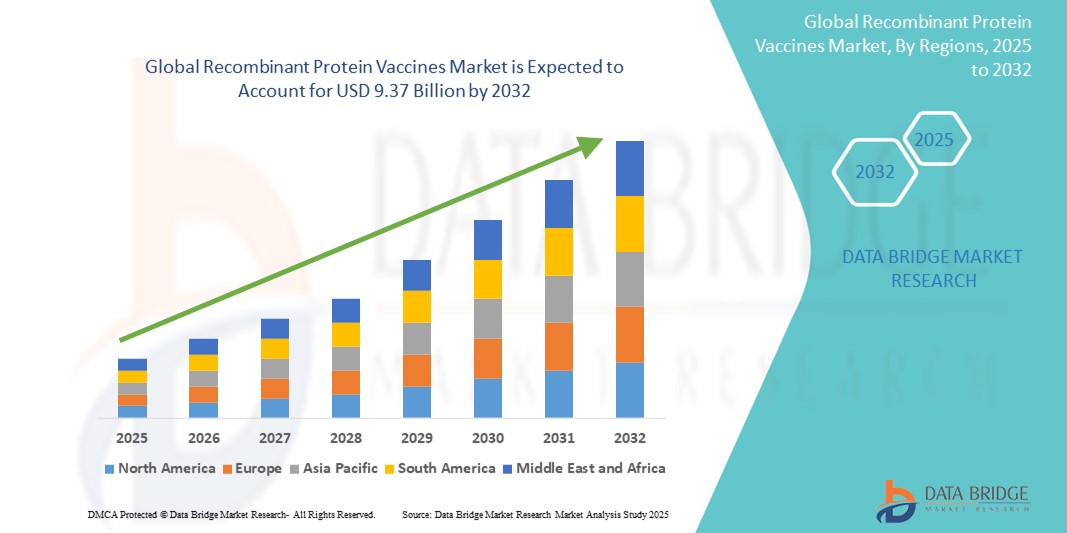

- The global Recombinant Protein Vaccines market size was valued at USD 3.43 billion in 2024 and is expected to reach USD 9.37 billion by 2032, at a CAGR of 13.40% during the forecast period

- The market growth is largely fueled by the increasing adoption and continuous technological progress in biotechnology and genetic engineering, enabling the development of highly specific, safe, and effective recombinant protein-based vaccines. These advancements have significantly enhanced production efficiency and scalability, supporting large-scale immunization programs across both developed and developing regions

- Furthermore, rising global demand for safer vaccine alternatives, improved immunogenicity, and reduced risk of adverse reactions is establishing recombinant protein vaccines as the preferred choice in both pediatric and adult immunization schedules. These converging factors are accelerating the uptake of recombinant protein vaccines solutions, thereby significantly boosting the industry's growth

Recombinant Protein Vaccines Market Analysis

- Recombinant protein vaccines, developed using engineered DNA to produce immunogenic proteins, are gaining prominence due to their safety profile, scalability in production, and ability to target specific antigens without using live pathogens. They are increasingly vital in immunization programs targeting diseases such as hepatitis B, HPV, and COVID-19

- The rising demand for recombinant protein vaccines is driven by growing global vaccination initiatives, advancements in recombinant DNA technology, and an increasing preference for subunit vaccines due to fewer side effects and improved stability

- North America dominated the recombinant protein vaccines market with the largest revenue share of 41.9% in 2024, attributed to robust healthcare infrastructure, early adoption of advanced biotechnologies, and a high rate of immunization coverage. The U.S. leads the region with strong R&D investments and government support for vaccine development and procurement

- Asia-Pacific is projected to be the fastest growing region in the recombinant protein vaccines market during the forecast period (2025–2032), driven by expanding healthcare access, rising investments in biopharmaceuticals, and large-scale government-led immunization programs across countries such as China, India, and Japan

- The Bacterial Cells Culture segment dominated the recombinant protein vaccines market with the largest revenue share of 61.3% in 2024, owing to its cost-effective production process, rapid growth rate, and scalability for high-yield recombinant protein expression. This culture system is widely used for producing non-glycosylated proteins and bacterial-targeted vaccines. Its widespread application across R&D and commercial platforms strengthens its market leadership

Report Scope and Recombinant Protein Vaccines Market Segmentation

|

Attributes |

Recombinant Protein Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Recombinant Protein Vaccines Market Trends

“Enhanced Convenience Through Intelligent Integration”

- A significant and accelerating trend in the global recombinant protein vaccines market is the increased use of advanced biotechnological tools and integration of innovative platforms that enhance production efficiency and immunogenicity. This evolution is reshaping how vaccines are designed, delivered, and scaled for both pandemic preparedness and routine immunization programs

- For instance, advancements in recombinant DNA technology have allowed for the development of highly specific antigens with reduced risk of adverse reactions. This has been instrumental in the success of vaccines such as GlaxoSmithKline’s Shingrix for shingles and Novavax’s Nuvaxovid for COVID-19, which leverage recombinant protein subunits to elicit strong immune responses

- Cutting-edge platforms now enable the expression of vaccine antigens in various systems such as insect cells, yeast, and mammalian cells, allowing for improved scalability and safety. These technologies also allow for faster response to emerging variants or pathogens by streamlining the antigen design and testing process

- Furthermore, automated bioreactor systems and AI-driven quality control monitoring are being increasingly adopted in the manufacturing of recombinant protein vaccines. These tools ensure precise production conditions, minimize batch variability, and increase overall yield and cost-efficiency—essential for large-scale immunization campaigns

- The broader integration with digital health ecosystems is also notable. Recombinant protein vaccine providers are adopting electronic health record (EHR) compatibility and mobile vaccination tracking tools, which allow healthcare providers to better track patient vaccination schedules and outcomes, enhancing coverage and compliance

- This ongoing evolution in the vaccine ecosystem is driving not just convenience for providers and patients but also paving the way for more personalized and precision-based vaccination strategies. As healthcare systems and governments prioritize preventive care, the demand for safer, stable, and efficacious recombinant protein vaccines continues to surge across global markets

Recombinant Protein Vaccines Market Dynamics

Driver

“Growing Need Due to Rising Infectious Disease Burden and Advancements in Vaccine Technology”

- The global demand for recombinant protein vaccines is being significantly driven by the increasing burden of infectious diseases and the growing need for safe, effective, and targeted immunization strategies. These vaccines offer high specificity and safety, making them ideal for populations with compromised immunity and for emerging diseases

- For instance, in April 2024, Novavax Inc. announced continued advancements in its recombinant nanoparticle COVID-19 vaccine, which incorporates proprietary Matrix-M™ adjuvant technology. Such developments are boosting investor confidence and accelerating product pipeline expansions across the recombinant protein vaccines industry

- Governments and healthcare organizations are increasingly investing in next-generation vaccine platforms to prepare for future pandemics and improve population-wide immunization coverage. Recombinant protein vaccines, due to their stability and lower cold chain requirements, are gaining traction, especially in low- and middle-income countries

- Moreover, the scalability of recombinant technology allows for rapid production and adaptation, which is particularly useful in the case of evolving viral strains. These attributes have made recombinant protein vaccines an attractive alternative to traditional inactivated or live attenuated vaccines

- The increasing prevalence of zoonotic and vector-borne diseases, growing focus on veterinary immunization, and the expansion of vaccine R&D funding have all contributed to the surge in demand for recombinant protein vaccines across both human and animal health sectors

Restraint/Challenge

“High Manufacturing Costs and Regulatory Complexity”

- The high cost of manufacturing recombinant protein vaccines, due to complex expression systems, purification processes, and the need for stringent quality control, remains a significant barrier for new market entrants and for large-scale deployment in resource-constrained regions

- In addition, recombinant protein vaccines often require adjuvants to enhance their immunogenicity, which adds to formulation complexity and increases development timelines and regulatory scrutiny

- For instance, while recombinant platforms such as baculovirus-insect cell expression systems offer advantages in yield and safety, they also present scalability and consistency challenges that must be addressed to meet global supply demands

- Regulatory challenges are another major concern. Developing recombinant protein vaccines involves a detailed and often lengthy approval process, especially when novel adjuvants or delivery methods are involved. This can slow down market entry and increase overall development costs

- Companies such as Sanofi and GlaxoSmithKline (GSK) continue to invest in platform technologies and collaborative efforts to reduce these bottlenecks, but cost and time remain major hurdles—particularly for emerging market players

- Addressing these challenges through public-private partnerships, standardization of production platforms, and regulatory harmonization will be critical to ensure broader accessibility and faster commercialization of recombinant protein vaccines globally

Recombinant Protein Vaccines Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the recombinant protein vaccines market is segmented into bacterial cells culture and mammalian cells culture. The bacterial cells culture segment dominated the market with the largest revenue share of 61.3% in 2024, owing to its cost-effective production process, rapid growth rate, and scalability for high-yield recombinant protein expression. This culture system is widely used for producing non-glycosylated proteins and bacterial-targeted vaccines. Its widespread application across R&D and commercial platforms strengthens its market leadership.

The mammalian cells culture segment is projected to witness the fastest growth with a CAGR of 19.2% from 2025 to 2032, driven by its ability to produce complex glycosylated proteins that mimic human proteins more accurately. This is especially critical for therapeutic vaccines and those targeting chronic or viral diseases. Growing adoption of CHO and HEK293 cell lines for clinical-grade vaccine development further supports the segment’s rapid growth.

- By Application

On the basis of application, the recombinant protein vaccines market is segmented into human and animal. The human segment held the largest market revenue share of 77.5% in 2024, supported by rising demand for precision-targeted, safe, and scalable vaccine solutions. The COVID-19 pandemic further boosted investment and interest in recombinant protein vaccine platforms for human use, particularly for respiratory and viral infections.

The animal segment is expected to register the fastest CAGR of 17.8% from 2025 to 2032, fueled by increasing adoption of preventive vaccination in livestock and companion animals. Factors such as zoonotic disease outbreaks, improved veterinary healthcare infrastructure, and regulatory support for animal biologics are contributing to this segment’s rapid expansion.

Recombinant Protein Vaccines Market Regional Analysis

- North America dominated the recombinant protein vaccines market with the largest revenue share of 41.9% in 2024, driven by robust healthcare infrastructure, significant R&D investments, and the presence of key vaccine manufacturers such as Novavax and Sanofi. The region’s advanced biotechnology capabilities and strong regulatory support further enable rapid vaccine development and deployment

- Consumers and healthcare providers in the region benefit from well-established immunization programs, streamlined approval processes, and increased government funding for vaccine innovation. This results in widespread adoption of recombinant protein vaccines across both public and private healthcare systems

- The expanding demand for high-efficacy vaccines with minimal side effects, especially for infectious and chronic diseases, has made recombinant protein vaccines a preferred option, reinforcing North America’s leadership position in the market

U.S. Recombinant Protein Vaccines Market Insight

The U.S. recombinant protein vaccines market captured the largest revenue share of 71% in 2024 within North America, fueled by extensive government initiatives such as Operation Warp Speed and strong public-private partnerships in biopharmaceutical R&D. The growing number of FDA approvals and emergency use authorizations for recombinant protein vaccines has further supported market expansion. The country’s robust manufacturing capabilities, coupled with increased awareness and acceptance of preventive healthcare, continue to drive adoption. Additionally, the presence of major companies such as Novavax and Sanofi Pasteur reinforces the U.S. position as a global hub for vaccine innovation and deployment.

Europe Recombinant Protein Vaccines Market Insight

The Europe recombinant protein vaccines market is projected to expand at a substantial CAGR during the forecast period, driven by strong regulatory oversight from the European Medicines Agency (EMA), increasing public health campaigns, and the growing need for safe, effective vaccines. The region is placing emphasis on next-generation vaccines with improved immunogenicity and fewer side effects. Countries such as Germany, France, and the U.K. are leading vaccine producers and consumers, contributing significantly to regional market growth. The integration of recombinant vaccines into national immunization schedules across Europe is also supporting broader market penetration.

U.K. Recombinant Protein Vaccines Market Insight

The U.K. recombinant protein vaccines market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by significant government investments in vaccine R&D and pandemic preparedness. The U.K. Vaccine Taskforce has played a pivotal role in accelerating vaccine development and securing long-term supply agreements with major players. In addition, the National Health Service (NHS)’s established vaccine distribution network and the country's proactive approach to emerging infectious diseases are expected to further drive adoption of recombinant protein vaccines.

Germany Recombinant Protein Vaccines Market Insight

The Germany recombinant protein vaccines market is expected to expand at a considerable CAGR during the forecast period, bolstered by the country's strong biotech ecosystem, emphasis on innovation, and public trust in vaccination programs. German firms and research institutions are deeply involved in developing novel adjuvants and expression systems that improve vaccine efficacy. Furthermore, government initiatives to combat rising healthcare costs through preventive solutions are pushing for greater incorporation of recombinant vaccines across both pediatric and adult populations.

Asia-Pacific Recombinant Protein Vaccines Market Insight

The Asia-Pacific recombinant protein vaccines market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by increasing investments in healthcare infrastructure, rapid urbanization, and the rising burden of infectious diseases. Countries such as China, India, and Japan are scaling up domestic vaccine production and implementing large-scale immunization campaigns. Government-led initiatives promoting local manufacturing and innovation, along with cost-effective recombinant vaccine technologies, are making these solutions more accessible to broader populations, including rural and underserved regions.

Japan Recombinant Protein Vaccines Market Insight

The Japan recombinant protein vaccines market is gaining momentum due to its aging population, rising prevalence of chronic diseases, and high demand for vaccines with favorable safety profiles. Japan’s emphasis on technologically advanced healthcare solutions and its supportive regulatory framework encourage domestic innovation in recombinant vaccine development. Moreover, Japanese companies are focusing on combining recombinant technologies with novel adjuvants to enhance immune response, positioning the country as a significant contributor to global vaccine innovation.

China Recombinant Protein Vaccines Market Insight

The China recombinant protein vaccines market accounted for the largest revenue share in Asia-Pacific in 2024, supported by massive government investment in biotechnology and the expansion of universal immunization programs. The country’s extensive production capacity and rapid adoption of advanced manufacturing technologies allow it to serve both domestic and international markets. China’s focus on self-sufficiency in vaccine supply, coupled with strategic collaborations between public institutions and private firms, continues to accelerate the development and distribution of recombinant protein vaccines across various infectious disease categories.

Recombinant Protein Vaccines Market Share

The recombinant protein vaccines industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Sanofi (France)

- Zoetis Services LLC (U.S.)

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Indian Immunologicals Ltd. (India)

- Plumbline Life Sciences (South Korea)

- Novavax (U.S.)

- Medicago (Canada)

- Vaxart (U.S.)

- Bharat Biotech (India)

- Clover Biopharmaceuticals (China)

- CanSino Biologics (China)

- Valneva (France)

- Bavarian Nordic (Denmark)

- UvaxBio (Germany)

- Serum Institute of India (India)

- Biological E. Limited (India)

- Dynavax Technologies (U.S.)

- Eubiologics (South Korea)

Latest Developments in Global Recombinant Protein Vaccines Market

- In July 2025, India’s ICMR–RMRC Bhubaneswar issued an Expression of Interest for licensing its new recombinant multi-stage malaria vaccine, AdFalciVax, designed to prevent Plasmodium falciparum infection and reduce community transmission. This initiative aims to partner with manufacturers for development and commercialization of this technology

- In December 2024, a pre-clinical and Phase 1 clinical study demonstrated that a monovalent recombinant protein vaccine (RBD XBB.1.5‑HR) provided strong safety and immunogenicity against Omicron XBB‑lineage variants—including JN.1 and EG.5.1—in both animal models and humans

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.