Global Reconstructive Surgery Injectable Fillers Market

Market Size in USD Million

CAGR :

%

USD

429.94 Million

USD

862.36 Million

2025

2033

USD

429.94 Million

USD

862.36 Million

2025

2033

| 2026 –2033 | |

| USD 429.94 Million | |

| USD 862.36 Million | |

|

|

|

|

Reconstructive Surgery Injectable Fillers Market Size

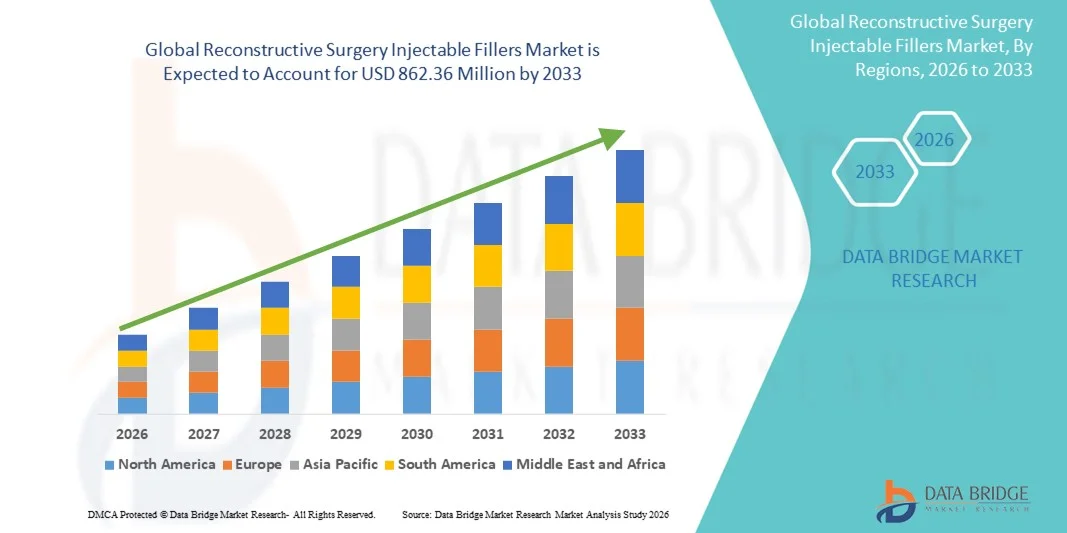

- The global reconstructive surgery injectable fillers market size was valued at USD 429.94 million in 2025 and is expected to reach USD 862.36 million by 2033, at a CAGR of 9.09% during the forecast period

- The market expansion is driven by the rising prevalence of trauma injuries, congenital deformities, and post-oncologic reconstruction procedures, which are increasing the demand for minimally invasive soft-tissue restoration solutions

- In addition, the growing preference for biocompatible and long-lasting filler materials such as hyaluronic acid, calcium hydroxylapatite, and autologous fat combined with continuous advancements in regenerative and reconstructive techniques, is accelerating product adoption across hospitals and specialty clinics, thereby propelling overall market growth

Reconstructive Surgery Injectable Fillers Market Analysis

- Reconstructive surgery injectable fillers, used to restore facial and soft-tissue volume loss resulting from trauma, congenital defects, or post-surgical deformities, are becoming increasingly vital in both reconstructive and aesthetic medicine due to their minimally invasive nature, biocompatibility, and ability to deliver natural-looking results

- The market’s growth is primarily driven by the rising number of reconstructive procedures following accidents, cancer surgeries, and congenital abnormalities, alongside increasing adoption of advanced filler materials such as hyaluronic acid, calcium hydroxylapatite, and poly-L-lactic acid for soft-tissue regeneration

- North America dominated the reconstructive surgery injectable fillers market with the largest revenue share of 40.1% in 2025, supported by high procedural volumes, advanced healthcare infrastructure, and strong presence of major manufacturers and specialized surgeons in the U.S. and Canada

- Asia-Pacific is expected to witness the fastest growth during the forecast period, driven by rising medical tourism, expanding reconstructive surgery facilities, and growing awareness of minimally invasive treatment options across emerging economies such as China, India, and South Korea

- The hyaluronic acid filler segment dominated the market with a share of 42.8% in 2025, attributed to its excellent safety profile, reversibility, and wide applicability across both reconstructive and aesthetic indications, making it the most preferred choice among surgeons worldwide

Report Scope and Reconstructive Surgery Injectable Fillers Market Segmentation

|

Attributes |

Reconstructive Surgery Injectable Fillers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Reconstructive Surgery Injectable Fillers Market Trends

Advancements in Biocompatible and Regenerative Injectable Materials

- A significant and accelerating trend in the global reconstructive surgery injectable fillers market is the development of next-generation biocompatible and regenerative filler materials designed to enhance tissue integration, promote collagen synthesis, and support natural healing outcomes

- For instance, companies are introducing bioengineered hyaluronic acid and collagen stimulators that not only restore lost volume but also encourage long-term tissue regeneration, offering dual aesthetic and therapeutic benefits. Similarly, newer calcium hydroxylapatite-based formulations are being tailored for reconstructive indications to achieve more durable volume correction in post-traumatic and post-oncologic cases

- Advancements in regenerative technologies, such as stem-cell–enriched fillers and autologous fat-derived injectables, enable improved biocompatibility and patient-specific results, reducing the risk of rejection and post-procedure complications. Furthermore, these innovations are expanding the scope of minimally invasive reconstructive procedures in clinical practice

- The integration of biotechnology and nanotechnology into filler development is enhancing product safety, longevity, and tissue response. Through optimized cross-linking and bioactive molecule incorporation, manufacturers are creating fillers that deliver superior elasticity and sustained aesthetic outcomes while minimizing inflammation and migration

- This trend toward regenerative and patient-tailored injectable fillers is transforming reconstructive surgery by providing surgeons with more predictable and natural results. Consequently, key players such as Galderma and Allergan Aesthetics are focusing on R&D collaborations to develop bioactive filler systems specifically suited for reconstructive applications

- The growing demand for scientifically advanced and biologically active injectable fillers is rapidly increasing across reconstructive and aesthetic domains, as both surgeons and patients prioritize natural restoration, safety, and long-term tissue compatibility

Reconstructive Surgery Injectable Fillers Market Dynamics

Driver

Rising Demand for Minimally Invasive Reconstruction and Post-Surgical Restoration

- The increasing prevalence of trauma injuries, cancer-related deformities, and congenital abnormalities is significantly driving the demand for injectable fillers as a minimally invasive alternative to surgical grafting in reconstructive procedures

- For instance, in March 2025, Revance Therapeutics announced the development of an advanced hyaluronic acid filler aimed at reconstructive and restorative applications, targeting patients recovering from facial trauma and post-oncologic surgery. Such advancements are expected to propel the market’s growth in the coming years

- As reconstructive surgeons seek safer, faster-healing, and less invasive solutions, injectable fillers offer immediate volume restoration, reduced downtime, and improved patient satisfaction compared to traditional surgical reconstruction techniques

- Furthermore, growing awareness among healthcare professionals about the therapeutic use of fillers for scar revision, soft-tissue contour correction, and post-surgical enhancement is broadening clinical acceptance across hospitals and specialty clinics

- The convenience of office-based filler procedures, reduced hospitalization, and improved patient-reported outcomes are key factors fueling their adoption in both reconstructive and aesthetic settings. The rising focus on regenerative results through bioactive fillers is further strengthening the market’s long-term growth outlook

Restraint/Challenge

Adverse Reactions and Stringent Regulatory Approvals

- Concerns regarding post-injection complications such as inflammation, granuloma formation, or skin necrosis continue to pose challenges to the broader adoption of injectable fillers in reconstructive applications

- For instance, reports of vascular occlusion and tissue ischemia following filler injections have prompted regulatory authorities to tighten product approval requirements and emphasize physician training to mitigate risks

- Addressing these safety issues through the use of biocompatible materials, enhanced injection techniques, and standardized clinical protocols is critical for ensuring patient safety and maintaining surgeon confidence. Companies such as Merz Aesthetics and Sinclair Pharma emphasize clinical validation and robust safety data in their product launches to meet regulatory expectations

- In addition, the lengthy and costly approval processes for reconstructive-use fillers compared to cosmetic variants can delay market entry, limiting innovation in certain regions with complex compliance frameworks. While demand continues to grow, navigating diverse international regulatory standards remains a key challenge for manufacturers aiming for global expansion

- Overcoming these regulatory and clinical hurdles through advanced product safety testing, professional training programs, and strategic partnerships with healthcare authorities will be vital for the sustainable growth of the reconstructive surgery injectable fillers market

Reconstructive Surgery Injectable Fillers Market Scope

The market is segmented on the basis of material, application, end user, and distribution channel.

- By Material

On the basis of material, the market is segmented into hyaluronic acid fillers, collagen-based fillers, calcium hydroxylapatite fillers, poly-l-lactic acid fillers, Polymethylmethacrylate (PMMA) fillers, and biologic fillers. The Hyaluronic Acid Fillers segment dominated the market with the largest revenue share of 42.8% in 2025, driven by its biocompatibility, reversibility, and minimal risk of adverse reactions. HA fillers are widely preferred in reconstructive applications due to their ability to integrate naturally with tissue and restore soft-tissue volume following trauma or surgery. Their safety profile, regulatory approvals, and extensive use across both aesthetic and reconstructive procedures make them the gold standard among injectable fillers. Moreover, ongoing innovations in cross-linking technology and long-lasting formulations continue to strengthen HA’s market leadership.

The Biologic Fillers segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of autologous fat grafting, stem-cell–enriched fillers, and platelet-rich plasma (PRP)-based injectables. These biologically derived fillers offer regenerative benefits, improved tissue healing, and reduced immune reactions, making them ideal for reconstructive cases involving tissue loss or scarring. The growing clinical acceptance of regenerative medicine and advancements in cell-based injectable systems are expected to accelerate this segment’s expansion across hospitals and specialized clinics.

- By Application

On the basis of application, the market is segmented into scar revision, post-traumatic soft tissue reconstruction, post-oncologic volume restoration, facial asymmetry & craniofacial defect correction, palate reconstruction, and cosmetic augmentation. The Scar Revision segment dominated the market with the largest revenue share in 2025, as injectable fillers are increasingly being used to correct depressed or irregular scars following trauma, surgery, or acne. Surgeons favor fillers for scar management due to their ability to elevate the skin surface, improve texture, and deliver immediate aesthetic improvement with minimal downtime. Hyaluronic acid and collagen-based fillers are particularly effective in this indication because of their tissue compatibility and predictable results. The growing demand for non-surgical scar correction and advancements in microinjection techniques further contribute to the segment’s leadership.

The Post-Oncologic Volume Restoration segment is anticipated to witness the fastest growth rate during the forecast period, driven by increasing use of fillers in patients recovering from tumor resections, reconstructive cancer surgeries, and facial asymmetry corrections. These fillers provide a minimally invasive alternative to surgical grafts, helping restore lost volume and improve facial contour. Rising cancer survival rates, combined with greater emphasis on post-treatment quality of life, are propelling the clinical acceptance of injectable fillers in reconstructive oncology practices worldwide.

- By End User

On the basis of end user, the market is segmented into hospitals, plastic & reconstructive surgery clinics, dermatology and aesthetic clinics, ambulatory surgical centers, and dental & maxillofacial clinics. The Hospitals segment dominated the market with the largest share in 2025, supported by the high volume of reconstructive procedures conducted within multidisciplinary healthcare settings. Hospitals serve as key centers for trauma care, oncology reconstruction, and congenital defect correction, all of which frequently utilize injectable fillers for soft-tissue restoration. The presence of trained reconstructive surgeons, access to advanced medical infrastructure, and favorable reimbursement frameworks further strengthen this segment’s position. In addition, collaborations between hospitals and filler manufacturers for clinical research and product trials enhance product innovation and adoption.

The Plastic & Reconstructive Surgery Clinics segment is projected to record the fastest growth from 2026 to 2033, owing to increasing demand for minimally invasive, outpatient filler procedures. Specialized clinics provide personalized reconstructive and aesthetic treatments, offering patients quicker recovery and lower costs compared to hospital-based interventions. The growing availability of advanced filler materials, skilled professionals, and high patient satisfaction rates are driving strong procedural growth in this segment across both developed and emerging markets.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, medical distributors, E-commerce medical platforms, and hospital pharmacies. The Direct Sales segment dominated the market with the largest revenue share in 2025, attributed to manufacturers’ preference for direct partnerships with hospitals, clinics, and medical professionals. This channel ensures product authenticity, quality control, and compliance with regulatory standards, which is critical in medical-grade injectable products. Direct sales also enable manufacturers to provide clinical training and product support, strengthening surgeon confidence and brand loyalty. Leading companies such as Allergan Aesthetics, Galderma, and Merz Aesthetics have established extensive direct sales networks to maintain a strong market presence globally.

The E-commerce Medical Platforms segment is anticipated to be the fastest growing during the forecast period, supported by the digital transformation of medical procurement and the convenience of online ordering for authorized clinics. The increasing adoption of secure, B2B online platforms for medical devices and injectables is streamlining product access, especially in emerging markets. In addition, digital channels are enhancing market transparency, price competitiveness, and accessibility to smaller aesthetic and reconstructive practices seeking certified injectable products.

Reconstructive Surgery Injectable Fillers Market Regional Analysis

- North America dominated the reconstructive surgery injectable fillers market with the largest revenue share of 40.1% in 2025, supported by high procedural volumes, advanced healthcare infrastructure, and strong presence of major manufacturers and specialized surgeons in the U.S. and Canada

- Patients in the region increasingly value the effectiveness, safety, and natural outcomes offered by advanced injectable fillers such as hyaluronic acid and calcium hydroxylapatite for reconstructive purposes

- This strong market presence is further supported by advanced healthcare infrastructure, high healthcare expenditure, and a concentration of leading manufacturers and certified reconstructive specialists, establishing North America as the primary hub for reconstructive filler innovation and adoption

U.S. Reconstructive Surgery Injectable Fillers Market Insight

The U.S. reconstructive surgery injectable fillers market captured the largest revenue share of 82% in 2025 within North America, driven by the high prevalence of trauma, post-oncologic reconstruction, and craniofacial surgeries. Patients are increasingly opting for minimally invasive filler-based reconstruction over traditional grafting methods due to reduced downtime and improved aesthetic outcomes. The growing availability of FDA-approved products, coupled with advancements in biocompatible filler formulations, is strengthening market adoption. Furthermore, the presence of skilled reconstructive surgeons and favorable reimbursement frameworks continue to support the dominance of the U.S. market.

Europe Reconstructive Surgery Injectable Fillers Market Insight

The Europe reconstructive surgery injectable fillers market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong demand for non-surgical reconstructive solutions and government support for post-cancer and trauma rehabilitation programs. Increasing awareness of facial reconstruction and scar revision procedures is fostering product utilization across hospitals and specialized clinics. European consumers value filler safety, regulatory compliance, and natural results, prompting widespread use of CE-marked injectable fillers. In addition, rising investments in medical aesthetics and reconstructive R&D across Germany, France, and the U.K. are accelerating market penetration.

U.K. Reconstructive Surgery Injectable Fillers Market Insight

The U.K. reconstructive surgery injectable fillers market is anticipated to grow at a notable CAGR during the forecast period, driven by an increasing number of post-surgical and trauma-related reconstructive cases. The emphasis on minimally invasive facial correction and tissue restoration procedures is fueling demand across both public and private healthcare sectors. Strong clinical expertise, favorable NHS collaborations in reconstructive medicine, and the popularity of hyaluronic acid fillers in facial symmetry correction are supporting market expansion. In addition, advancements in regenerative filler materials are gaining traction within U.K. reconstructive applications.

Germany Reconstructive Surgery Injectable Fillers Market Insight

The Germany reconstructive surgery injectable fillers market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s focus on advanced medical technologies and patient-specific reconstructive care. German clinics and hospitals are increasingly adopting bioresorbable and long-lasting filler materials for trauma and craniofacial applications. The strong presence of global and domestic filler manufacturers, coupled with high regulatory standards, ensures product safety and innovation. Moreover, the growing integration of injectable fillers in post-oncologic and facial reconstruction procedures underscores Germany’s leadership in Europe’s reconstructive domain.

Asia-Pacific Reconstructive Surgery Injectable Fillers Market Insight

The Asia-Pacific reconstructive surgery injectable fillers market is poised to grow at the fastest CAGR of 23.8% from 2026 to 2033, propelled by expanding access to advanced reconstructive care and increasing cosmetic awareness in countries such as China, Japan, and India. Rapid healthcare infrastructure development and medical tourism are driving filler adoption for scar, facial asymmetry, and trauma correction procedures. The region’s rising disposable incomes and local manufacturing capabilities are making injectable fillers more affordable and accessible. Government initiatives promoting reconstructive healthcare post-injury and oncology treatment are further stimulating regional growth.

Japan Reconstructive Surgery Injectable Fillers Market Insight

The Japan reconstructive surgery injectable fillers market is gaining momentum, supported by the nation’s strong technological capabilities and focus on regenerative medical solutions. Japanese clinicians emphasize precision-based filler procedures for craniofacial and reconstructive applications, leveraging advanced materials for optimal tissue integration. The growing elderly population and increasing need for reconstructive correction after facial trauma or oncologic surgery are key demand drivers. Moreover, Japan’s active participation in R&D and stringent product quality standards are fostering the adoption of premium, biocompatible filler products.

India Reconstructive Surgery Injectable Fillers Market Insight

The India reconstructive surgery injectable fillers market accounted for the largest revenue share within Asia-Pacific in 2025, fueled by the rapid expansion of aesthetic and reconstructive clinics, as well as rising awareness of minimally invasive treatments. Increasing cases of facial trauma, burns, and corrective surgeries post-oncology are boosting filler demand. The growing number of trained reconstructive surgeons and access to affordable filler options have made India a regional leader in reconstructive care. In addition, medical tourism and government efforts toward reconstructive rehabilitation are strengthening market growth across urban healthcare centers.

Reconstructive Surgery Injectable Fillers Market Share

The Reconstructive Surgery Injectable Fillers industry is primarily led by well-established companies, including:

- AbbVie (U.S.)

- GALDERMA (Switzerland)

- Merz Pharmaceuticals GmbH (Germany)

- TEOXANE (Switzerland)

- Croma Pharma GmbH (Austria)

- Prollenium Medical Technologies Inc. (Canada)

- Sinclair Pharma Limited (U.K.)

- Suneva Medical, Inc. (U.S.)

- REVANCE. (U.S.)

- Evolus, Inc. (U.S.)

- Bloomage Biotechnology Corporation Limited (China)

- Hugel, Inc. (South Korea)

- Medytox, Inc. (South Korea)

- LG Chem, Ltd. (South Korea)

- Laboratoires Vivacy SAS (France)

- BioScience GmbH (Germany)

- RegenLab SA (Switzerland)

- Fillmed Laboratories (France)

- Contura International A/S (Denmark)

- Sculptra Aesthetic. (U.S.)

What are the Recent Developments in Global Reconstructive Surgery Injectable Fillers Market?

- In January 2025, Galderma released interim data from a first-of-its-kind trial, showing that combining its biostimulator Sculptra® (poly-L-lactic acid) with HA fillers significantly improved facial contour, skin radiance and thickness in patients experiencing medication-driven weight loss and facial volume deficiency

- In May 2024, Galderma announced the launch of Restylane VOLYME™ in China, a hyaluronic acid injectable designed for mid-face volumization and contouring, along with the supporting “Shape Up Holistic Individualised Treatment (HIT™)” methodology. This geographic expansion into China marks a key growth step in the Asia-Pacific reconstructive/aesthetic fillers market, where reconstructive indications are also emerging

- In April 2024, a Business Insider article highlighted that the weight-loss drug Ozempic (a GLP-1 RA) has created a surge in demand for facial injectable fillers (notably from Galderma) to address the so‐called “Ozempic face” —a sunken, aged appearance from rapid fat/volume loss. The article noted that Galderma is conducting a study using its fillers (Sculptra®, Restylane®) to counter facial volume loss resulting from the weight-loss drug

- In March 2023, Galderma launched the digital tool FACE by Galderma™, an aesthetic visualization-platform aimed at supporting injector-patient consultations in filler treatments. The software allows injectors to simulate filler effects for mid-face, cheek, chin or contour treatments which are increasingly relevant in reconstructive scenarios post-trauma or surgery

- In June 2021, Galderma received U.S. Food and Drug Administration (FDA) approval for Restylane Contour, a hyaluronic-acid filler formulated with XpresHAn Technology™, indicated for cheek augmentation and correction of mid-face contour deficiencies in adults aged 21+ (U.S.). This approval marked a landmark expansion of HA-fillers into a structural contour-category within reconstructive or semi-reconstructive application

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.