Global Recovered Carbon Black Rcb Market

Market Size in USD Million

CAGR :

%

USD

243.10 Million

USD

1,453.69 Million

2024

2032

USD

243.10 Million

USD

1,453.69 Million

2024

2032

| 2025 –2032 | |

| USD 243.10 Million | |

| USD 1,453.69 Million | |

|

|

|

|

Recovered Carbon Black (rCB) Market Size

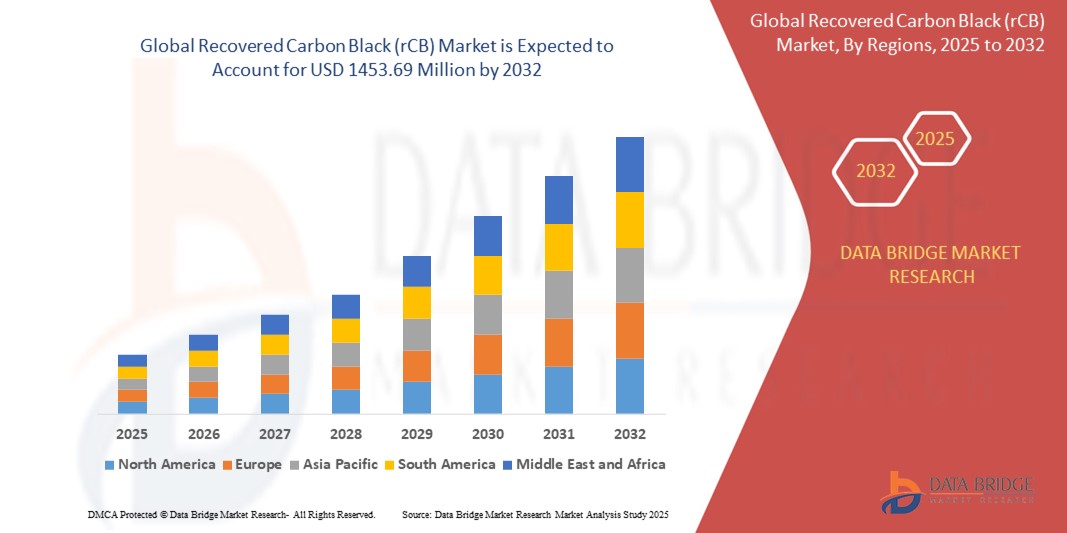

- The global recovered carbon black (rCB) market size was valued at USD 243.10 million in 2024 and is expected to reach USD 1453.69 million by 2032, at a CAGR of 25.05% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable and cost-effective alternatives to virgin carbon black, driven by increasing environmental regulations and growing awareness of circular economy principles

- The increasing use of recovered carbon black in tire manufacturing, plastics, coatings, and inks is further accelerating market expansion due to its comparable performance and lower environmental footprint

Recovered Carbon Black (rCB) Market Analysis

- The recovered carbon black market is witnessing significant traction as industries prioritize eco-friendly materials and circular economy practices

- Manufacturers are increasingly adopting recovered carbon black to reduce dependence on conventional carbon black and minimize production costs

- North America dominates the recovered carbon black (rCB) market with the largest revenue share of 38.5% in 2024, driven by the presence of a strong automotive industry and stringent environmental regulations encouraging the use of sustainable materials.

- The Asia-Pacific region is expected to witness the highest growth rate in the global recovered carbon black (rCB) market, driven by rapid industrialization, growing automotive and manufacturing sectors, and increasing environmental regulations promoting sustainable material use in countries such as China, India, and Japan

- The primary carbon black segment holds the largest market revenue share in 2024, driven by its widespread use as a reinforcing filler in rubber products, particularly tires. Its consistency and performance in enhancing durability and wear resistance make it the preferred choice for many manufacturers.

Report Scope and Recovered Carbon Black (rCB) Market Segmentation

|

Attributes |

Recovered Carbon Black (rCB) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Recovered Carbon Black (rCB) Market Trends

“Growing Adoption of Sustainable Raw Materials in Manufacturing”

- Companies across industries are increasingly turning to recovered carbon black as a sustainable alternative to virgin carbon black

- This shift is driven by rising awareness of environmental impact and a strong push toward green manufacturing practice

- For instance, major tire manufacturers are incorporating recovered carbon black into their production lines to reduce carbon emissions and improve sustainability ratings

- In addition, plastic and rubber producers are utilizing recovered carbon black to meet sustainability goals while maintaining product performance

- This trend aligns with global sustainability standards and corporate responsibility initiatives, such as those adopted by firms including Continental and Bridgestone, which have publicly committed to increasing the use of recycled materials in their supply chains

Recovered Carbon Black (rCB) Market Dynamics

Driver

“Rising Focus on Circular Economy and Waste Reduction”

- The recovered carbon black market is gaining momentum due to the global shift toward circular economy practices and waste reduction efforts

- Reusing carbon black from end-of-life tires and rubber products offers an environmentally friendly alternative to traditional disposal methods

- Recovered carbon black helps reduce reliance on virgin carbon black, which is energy-intensive and derived from fossil fuels

- Many manufacturers, especially in the automotive sector, are integrating recovered carbon black to comply with sustainability regulations and lower emissions

- For instance, Michelin has collaborated with Scandinavian Enviro Systems to boost the use of recovered carbon black in tire production as part of its eco-innovation strategy

Restraint/Challenge

“Inconsistent Product Quality and Performance Standards”

- A major challenge in the recovered carbon black market is the inconsistency in product quality and the absence of uniform performance standards

- Variations in raw materials, recovery techniques, and processing technologies lead to differences in properties such as particle size and structure

- These inconsistencies can limit its use in high-performance sectors where reliability and precision are essential, such as automotive manufacturing

- For instance, automakers often require materials with strict performance metrics for use in tire production and engine components

- The lack of global quality benchmarks also hampers regulatory approval and slows market acceptance, requiring industry-wide efforts to establish testing standards and improve process control

Recovered Carbon Black (rCB) Market Scope

The market is segmented on the basis of type, grade, application, and end-user.

- By Type

On the basis of type, the recovered carbon black market is segmented into primary carbon black and inorganic ash. The primary carbon black segment holds the largest market revenue share in 2024, driven by its widespread use as a reinforcing filler in rubber products, particularly tires. Its consistency and performance in enhancing durability and wear resistance make it the preferred choice for many manufacturers.

The inorganic ash segment is expected to witness a fastest growth from 2025 to 2032, due to its applications in specialty industries requiring filler materials with specific chemical properties.

- By Grade

On the basis of grade, the recovered carbon black market is segmented into commodity and specialty. The commodity grade dominates the market in 2024 owing to its broad applicability in the tire and non-tire rubber industries, where large volumes are required at competitive prices.

The specialty grade is expected to witness a fastest growth from 2025 to 2032, driven by demand from high-performance applications such as inks, coatings, and plastics, where enhanced properties such as improved dispersion and specific particle size are critical.

- By Application

On the basis of application, the recovered carbon black market is segmented into tire, non-tire rubber, plastics, inks, coatings, and others. The tire segment accounted for the largest market revenue share in 2024, fuelled by the rising global demand for automotive vehicles and the corresponding need for durable, high-performance tires.

The inks and coatings segment is expected to witness a fastest growth from 2025 to 2032, supported by increasing use in printing and packaging industries seeking sustainable and cost-effective alternatives to virgin carbon black.

- By End-User

On the basis of end-user, the recovered carbon black market is segmented into transportation, industrial, printing and packaging, building and construction, and others. The transportation segment holds the largest revenue share in 2024, driven by the automotive industry's heavy reliance on carbon black for tire manufacturing and other rubber components.

The printing and packaging segment is expected to witness a fastest growth from 2025 to 2032, due to the rising demand for eco-friendly printing inks and sustainable packaging solutions. Industrial applications also contribute significantly, benefiting from the use of recovered carbon black in various manufacturing processes.

Recovered Carbon Black (rCB) Market Regional Analysis

- North America dominates the recovered carbon black (rCB) market with the largest revenue share of 38.5% in 2024, driven by the presence of a strong automotive industry and stringent environmental regulations encouraging the use of sustainable materials.

- Manufacturers and end-users in the region prioritize recycled and eco-friendly carbon black due to increasing environmental awareness and regulatory compliance requirements.

- The market growth is further supported by established industrial infrastructure, advanced recycling technologies, and rising demand from tire and non-tire rubber industries across the U.S. and Canada.

U.S. Recovered Carbon Black (rCB) Market Insight

The U.S. recovered carbon black (rCB) market captured the largest revenue share of 80% in North America in 2024, fuelled by increasing demand from the transportation sector, particularly tire manufacturing. The push towards sustainability and circular economy principles in the U.S. is driving adoption of rCB in industrial and manufacturing processes. In addition, growing investments in recycling infrastructure and rising demand for specialty grades for inks and coatings are bolstering market expansion. Strong government policies supporting waste reduction also encourage manufacturers to incorporate recovered carbon black in their supply chains.

Europe Recovered Carbon Black (rCB) Market Insight

The Europe recovered carbon black (rCB) market is expected to witness a fastest growth from 2025 to 2032, driven by stringent environmental regulations and the rising emphasis on sustainable manufacturing. The region’s focus on circular economy initiatives encourages the reuse of carbon black from end-of-life tires and other rubber products. Germany, France, and the U.K. lead the adoption of recovered carbon black across tire production, printing inks, and plastics sectors. Increasing consumer demand for eco-friendly products further supports market growth.

Germany Recovered Carbon Black (rCB) Market Insight

The Germany recovered carbon black (rCB) market is expected to witness a fastest growth from 2025 to 2032, propelled by the country’s commitment to sustainability and innovation in recycling technologies. Germany’s strong automotive and manufacturing sectors are increasingly adopting recovered carbon black to meet regulatory standards and reduce environmental impact. The demand for specialty-grade rCB in high-performance applications such as coatings and plastics is also on the rise, supported by research and development efforts.

U.K. Recovered Carbon Black (rCB) Market Insight

The U.K. recovered carbon black (rCB) is expected to witness a fastest growth from 2025 to 2032, driven by growing environmental regulations and increasing adoption of sustainable manufacturing practices. The country’s focus on reducing industrial waste and carbon footprint encourages manufacturers to utilize recovered carbon black in tire production and other rubber applications. In addition, advancements in recycling technologies and the presence of key players in the rCB supply chain further support market expansion in both industrial and printing sectors.

Asia-Pacific Recovered Carbon Black (rCB) Market Insight

The Asia-Pacific recovered carbon black (rCB) market is expected to witness a fastest growth from 2025 to 2032, driven by rapid industrialization, expanding automotive production, and growing demand for cost-effective and sustainable materials. China, India, and Japan are key contributors to the market’s growth, with rising tire production and increasing investments in recycling infrastructure. Government initiatives promoting circular economy and waste management, along with the presence of major rCB manufacturers, enhance market accessibility and affordability in the region.

China Recovered Carbon Black (rCB) Market Insight

The China recovered carbon black (rCB) market held the largest revenue share in the Asia-Pacific region in 2024, supported by the country’s expansive tire manufacturing industry and aggressive environmental policies. China’s increasing focus on reducing carbon emissions and waste generation promotes the use of recycled carbon black in multiple applications such as tires, plastics, and inks. The availability of locally produced rCB and ongoing technological advancements contribute to the region’s strong market position.

Japan Recovered Carbon Black (rCB) Market Insight

The Japan recovered carbon black (rCB) market is expected to witness a fastest growth from 2025 to 2032, supported by the country’s advanced automotive and electronics industries. Japan’s emphasis on innovation and eco-friendly materials fosters the use of specialty grades of rCB in high-performance applications such as inks, coatings, and plastics. Government initiatives promoting resource efficiency and waste reduction, coupled with technological advancements in carbon black recovery, are driving the market forward. The aging population and demand for sustainable solutions in manufacturing further contribute to growth.

Recovered Carbon Black (rCB) Market Share

The Recovered Carbon Black (rCB) industry is primarily led by well-established companies, including:

- Tyrepress (U.K.)

- Black Bear Carbon B.V. (Netherlands)

- Klean Industries (Canada)

- Radhe Group of Energy (India)

- Scandinavian Enviro Systems AB (Sweden)

- DVA Renewable Energy JSC. (Vietnam)

- Bolder Industries Corporate (U.S.)

- Wild Bear Carbon B.V. (Netherlands)

- Greetings Green Carbon (India)

- Pyrolyx AG (Germany)

- Enrestec Inc. (Taiwan)

- Coordinated Resource Recovery, Inc. (U.S.)

- Delta-Energy, LLC (U.S.)

- Alpha Carbone (France)

- SR2O Holdings, LLC (U.S.)

Latest Developments in Global Recovered Carbon Black (rCB) Market

- In May 2022, Pyrum Innovations AG began test operations of a new pelletizer at its facility in Germany. This development enables the conversion of recovered carbon black into pellet form, improving ease of transport and simplifying material handling. The advancement is expected to enhance efficiency in the processing and application of recovered carbon black, positively impacting market scalability and logistics

- In March 2022, Continental AG expanded its partnership with Pyrum Innovations AG to advance the recycling of end-of-life tires using pyrolysis technology. This collaboration focuses on producing high-quality recovered carbon black for use in Continental’s tire manufacturing. The initiative supports the company’s sustainability goals and contributes to increased adoption of recycled materials in the recovered carbon black market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL RECOVERED CARBON BLACK (RCB) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL RECOVERED CARBON BLACK (RCB) MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

5.9 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET: TIRE RECYCLING MARKET

5.1 GLOBAL END-OF-LIFE TIRE MARKET

5.10.1 GLOBAL END-OF-LIFE TIRE MARKET, BY REGION

5.10.1.1. ASIA-PACIFIC

5.10.1.2. EUROPE

5.10.1.3. NORTH AMERICA

5.10.1.4. SOUTH AMERICA

5.10.1.5. MIDDLE EAST AND AFRICA

5.11 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET: EUROPE REGULATORY FRAMEWORK

5.12 GRADE COMPARISION

5.13 IMPACT OF CRUDE OIL PRICE DECLINE ON CARBON BLACK INDUSTRY

5.14 TECHNOLOGY OVERVIEW

5.14.1 PYROLYSIS

5.14.2 SOLVOLYSIS

5.14.3 STEAM WATER THERMOLYSIS (SWT)

5.15 IMPACT OF TIRE/AUTO INDUSTRY SLOWDOWN

5.16 INDUSTRY INSIGHTS

5.17 PATENT ANALYSIS

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, BY TYPE, 2022-2031 (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 PRIMARY CARBON BLACK

10.3 INORGANIC ASH

10.3.1 INORGANIC ASH, BY CONTENT

10.3.2 SILICA

10.3.3 ZINC OXIDE

10.3.4 SULFUR

10.3.5 OTHERS

11 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, BY GRADE, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 COMMODITY

11.3 SPECIALTY

12 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 TIRE

12.3 NON-TIRE RUBBER

12.4 PLASTICS

12.5 COATINGS

12.6 INKS

12.7 OTHERS

13 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, BY END-USER, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 TRANSPORTATION

13.3 INDUSTRIAL

13.4 BUILDING & CONSTRUCTION

13.5 PRINTING & PACKAGING

13.6 OTHERS

14 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, BY REGION, 2022-2031 (USD MILLION) (KILO TONS)

GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 SWITZERLAND

14.2.7 RUSSIA

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 AUSTRALIA

14.3.6 SINGAPORE

14.3.7 THAILAND

14.3.8 INDONESIA

14.3.9 MALAYSIA

14.3.10 PHILIPPINES

14.3.11 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 UNITED ARAB EMIRATES

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AMERICA

15 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT ANALYSIS

17 GLOBAL RECOVERED CARBON BLACK (RCB) MARKET - COMPANY PROFILES

17.1 BLACK BEAR CARBON B.V

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 REOIL SP. Z O.O.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 SCANDINAVIAN ENVIRO SYSTEMS AB

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATES

17.4 AVIENT CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 AMPACET CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 DELTA-ENERGY GROUP, LLC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT UPDATES

17.7 KLEAN CARBON

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATES

17.8 STREBL GREEN CARBON PTE LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATES

17.9 BOLDER INDUSTRIES

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 ALPHA RECYCLAGE FRANCHE COMTE

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATES

17.11 BERRA SP. Z O.O

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 CARBON RECOVERY GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 CONTEC SP Z O.O.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT UPDATES

17.14 DRON INDUSTRIES

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT UPDATES

17.15 NEW ENERGY KFT

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT UPDATES

17.16 POLIMIX

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT UPDATES

17.17 PYRUM INNOVATIONS AG

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATES

17.18 SR2O HOLDINGS, LLC

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT UPDATES

17.19 WAVERLY CARBON LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT UPDATES

17.2 RADHE GROUP OF ENERGY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

17.21 DVA RENEWABLE ENERGY JSC.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT UPDATES

17.22 ENRESTEC; SR2O HOLDINGS, LLC

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT UPDATES

17.23 THE GROWING GROUP

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT UPDATES

17.24 CAPITAL CARBON

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT UPDATES

17.25 INTEGRATED CHEMICALS SPECIALTIES BV

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Recovered Carbon Black Rcb Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recovered Carbon Black Rcb Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recovered Carbon Black Rcb Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.