Global Recreational Vehicle Rv Awnings Market

Market Size in USD Million

CAGR :

%

USD

1.17 Million

USD

1.60 Million

2025

2033

USD

1.17 Million

USD

1.60 Million

2025

2033

| 2026 –2033 | |

| USD 1.17 Million | |

| USD 1.60 Million | |

|

|

|

|

What is the Global Recreational Vehicle (RV) Awnings Market Size and Growth Rate?

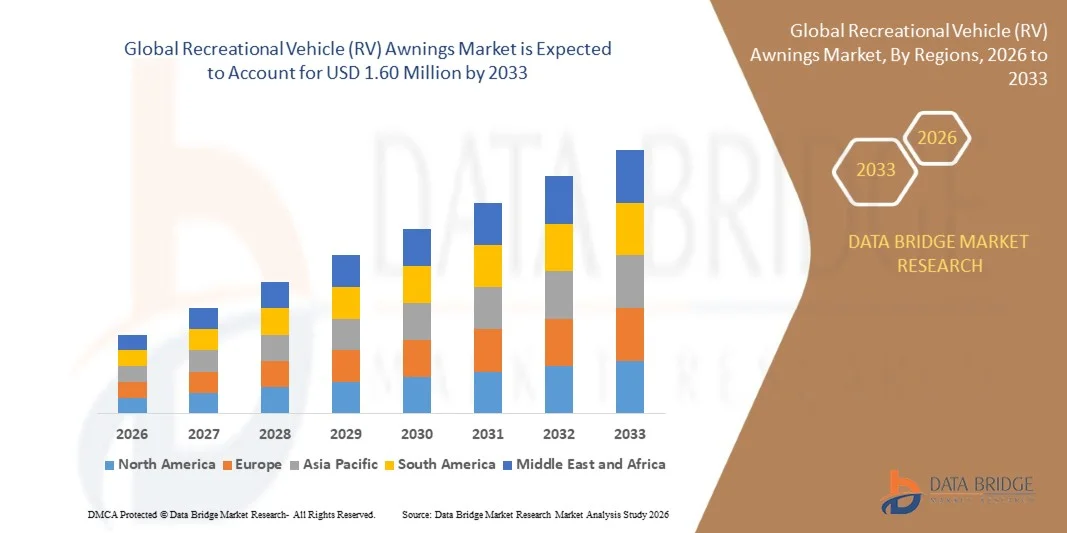

- The global recreational vehicle (RV) awnings market size was valued at USD 1.17 million in 2025 and is expected to reach USD 1.60 million by 2033, at a CAGR of4.00% during the forecast period

- The rise in the interest in outdoor activities such as camping among population across the globe acts as one of the major factors driving the growth of recreational vehicle (RV) awnings market

What are the Major Takeaways of Recreational Vehicle (RV) Awnings Market?

- The availability of vehicle awnings made up of different material such as vinyl and acrylic operating manually and electrically and increase in the inclination towards recreational vehicle awning over tents owning to various advantages accelerate the market growth

- The surge in the number of sales of recreational vehicle because of increasing recreational activities such as camping and installation of luminous LED, speakers, and fans further influence the market. In addition, change in lifestyle, urbanization and surge in disposable income positively affect the recreational vehicle (RV) awnings market

- North America dominated the recreational vehicle (RV) awnings market with an estimated 11.69% revenue share in 2025, driven by high RV ownership rates, a strong outdoor recreation culture, and widespread adoption of motorhomes and travel trailers across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by growing interest in road travel, expanding middle-class income, and increasing adoption of camper vans and compact RVs across emerging economies

- The Vinyl segment dominated the market with an estimated 58.6% share in 2025, owing to its cost-effectiveness, water resistance, ease of maintenance, and widespread availability

Report Scope and Recreational Vehicle (RV) Awnings Market Segmentation

|

Attributes |

Recreational Vehicle (RV) Awnings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Recreational Vehicle (RV) Awnings Market?

“Increasing Shift Toward Smart, Lightweight, and Automated Recreational Vehicle (RV) Awnings”

- The recreational vehicle (RV) awnings market is witnessing rising adoption of motorized, retractable, and sensor-enabled awnings that enhance convenience, comfort, and ease of operation for RV owners

- Manufacturers are increasingly introducing lightweight materials, such as acrylic fabrics, vinyl composites, and aluminum frames, to improve durability while reducing overall vehicle load

- Growing demand for weather-responsive awnings with wind, rain, and sun sensors is driving adoption across premium and mid-range RV models

- For instance, companies such as Dometic, Carefree of Colorado, Fiamma, Lippert, and Girard are launching smart awnings with automatic retraction, remote control operation, and improved UV resistance

- Rising preference for integrated outdoor living solutions, including LED lighting, sun blockers, and privacy screens, is accelerating demand for advanced RV awning systems

- As recreational travel continues to grow, RV awnings remain a key feature for enhancing outdoor comfort, safety, and user experience

What are the Key Drivers of Recreational Vehicle (RV) Awnings Market?

- Increasing popularity of RV tourism, road trips, and outdoor recreational activities across North America and Europe is significantly boosting demand for RV accessories

- For instance, during 2024–2025, leading RV component manufacturers expanded awning portfolios to support larger RVs, camper vans, and luxury motorhomes

- Rising consumer preference for enhanced outdoor living space, shade protection, and temperature control is driving widespread awning adoption

- Advancements in fabric technology, motor systems, and corrosion-resistant materials have improved awning lifespan, aesthetics, and performance

- Growing integration of smart RV systems and IoT-enabled controls is increasing demand for automated and connected awning solutions

- Supported by rising disposable incomes and growth in recreational vehicle sales, the RV awnings market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Recreational Vehicle (RV) Awnings Market?

- High costs associated with motorized, sensor-based, and premium fabric awnings can limit adoption among budget-conscious RV buyers

- For instance, during 2024–2025, fluctuations in aluminum prices, fabric costs, and logistics expenses increased overall manufacturing costs for awning suppliers

- Exposure to harsh weather conditions, including strong winds and heavy rainfall, can lead to maintenance issues and product wear

- Limited awareness among first-time RV buyers regarding advanced awning features and proper usage practices may slow premium product adoption

- Competition from low-cost manual awnings and aftermarket alternatives creates pricing pressure for established manufacturers

- To address these challenges, companies are focusing on cost-optimized designs, improved durability, modular features, and enhanced aftersales support to strengthen global adoption of RV awnings

How is the Recreational Vehicle (RV) Awnings Market Segmented?

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the recreational vehicle (RV) awnings market is segmented into Vinyl and Acrylic. The Vinyl segment dominated the market with an estimated 58.6% share in 2025, owing to its cost-effectiveness, water resistance, ease of maintenance, and widespread availability. Vinyl awnings are extensively used in entry-level and mid-range RVs, as they provide reliable protection against rain and moderate sunlight while remaining affordable for a broad consumer base. Their durability, lightweight structure, and suitability for mass production continue to support strong adoption across North America and Europe.

The Acrylic segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for premium RV accessories, superior UV resistance, enhanced breathability, and long-lasting color retention. Acrylic awnings are increasingly preferred in luxury motorhomes and high-end travel trailers, particularly among consumers seeking enhanced outdoor comfort, aesthetics, and thermal performance.

• By Application

On the basis of application, the recreational vehicle (RV) awnings market is segmented into Electric and Mechanical awnings. The Mechanical segment dominated the market with a 54.2% share in 2025, supported by its simple design, lower installation cost, and minimal maintenance requirements. Mechanical awnings remain widely used in traditional RVs and camper vans, especially among cost-sensitive buyers and regions with limited access to advanced RV electronics. Their reliability, manual control, and ease of repair make them a preferred choice for entry-level RV owners.

The Electric segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption of smart RV technologies, motorized systems, and automated comfort features. Electric awnings offer push-button operation, remote control access, and integration with sensors for wind and weather detection, making them highly attractive for modern, premium RV models and technologically advanced consumers.

Which Region Holds the Largest Share of the Recreational Vehicle (RV) Awnings Market?

- North America dominated the recreational vehicle (RV) awnings market with an estimated 11.69% revenue share in 2025, driven by high RV ownership rates, a strong outdoor recreation culture, and widespread adoption of motorhomes and travel trailers across the U.S. and Canada. Rising demand for enhanced outdoor comfort, sun protection, and weather-resistant accessories continues to support strong awning sales

- Presence of leading RV manufacturers, well-developed aftermarket networks, and frequent product upgrades such as electric and smart awnings strengthen regional market leadership

- High consumer spending power, mature campground infrastructure, and growing preference for premium RV accessories further reinforce North America’s dominant position

U.S. Recreational Vehicle (RV) Awnings Market Insight

The U.S. is the largest contributor in North America, supported by a strong RV manufacturing base, high recreational travel participation, and increasing adoption of motorized and luxury RVs. Growing demand for electric, retractable, and sensor-based awnings is driven by consumer preference for convenience and automation. Frequent road trips, expanding RV rental platforms, and rising customization trends further fuel awning installations across both OEM and aftermarket channels.

Canada Recreational Vehicle (RV) Awnings Market Insight

Canada contributes significantly to regional growth, driven by rising domestic tourism, camping culture, and seasonal RV usage. Demand for durable, weather-resistant awnings is strong due to varying climatic conditions. Increasing ownership of travel trailers and camper vans, along with steady growth in RV parks and outdoor recreation activities, continues to support market expansion across the country.

Asia-Pacific Recreational Vehicle (RV) Awnings Market

Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by growing interest in road travel, expanding middle-class income, and increasing adoption of camper vans and compact RVs across emerging economies. Rising tourism initiatives, infrastructure development, and awareness of recreational mobility are accelerating demand for RV accessories, including awnings, across the region.

China Recreational Vehicle (RV) Awnings Market Insight

China is the largest contributor to Asia-Pacific growth, supported by expanding domestic tourism, rising production of camper vans, and government initiatives promoting recreational travel. Growing demand for affordable, lightweight, and easy-to-install awnings is driving market adoption. Local manufacturing capabilities and competitive pricing further strengthen both domestic and export opportunities.

Japan Recreational Vehicle (RV) Awnings Market Insight

Japan shows steady growth driven by increasing popularity of compact RVs, camper conversions, and outdoor leisure activities. Limited parking space and urban travel patterns support demand for compact, retractable awning systems. High emphasis on quality, durability, and space-efficient designs continues to influence awning adoption.

India Recreational Vehicle (RV) Awnings Market Insight

India is emerging as a growth market, supported by rising interest in van-life culture, adventure tourism, and camper van conversions. Increasing awareness of recreational travel, improving road infrastructure, and growing disposable income among urban consumers are gradually driving demand for RV awnings, particularly in the aftermarket segment.

South Korea Recreational Vehicle (RV) Awnings Market Insight

South Korea contributes to regional growth through increasing outdoor recreation participation, camping popularity, and compact RV adoption. Demand for modern, electric, and aesthetically designed awnings is rising, supported by strong consumer preference for technologically advanced and space-saving RV accessories.

Which are the Top Companies in Recreational Vehicle (RV) Awnings Market?

The recreational vehicle (RV) awnings industry is primarily led by well-established companies, including:

- American RV Center (U.S.)

- Carefree of Colorado (U.S.)

- Dometic Group AB (Sweden)

- Fiamma Inc. (Italy)

- The Girard Group (U.S.)

- Lippert (U.S.)

- RV Awnings Online (U.S.)

- RV Parts Country (U.S.)

- Carparts (U.S.)

- Shade Pro, Inc. (U.S.)

- STONE VOS (China)

What are the Recent Developments in Global Recreational Vehicle (RV) Awnings Market?

- In May 2025, Winnebago, a pioneer in recreational vehicles with nearly six decades of experience, developed and launched the all-new Thrive, a lightweight, modern, and high-quality travel trailer designed to redefine comfort and expectations in its segment, while enhancing owners’ outdoor experiences through customer-focused innovation, thereby reinforcing Winnebago’s renewed brand energy and market positioning

- In January 2025, Grand Design RV introduced the new Lineage Series F Super C motorhomes at the 2025 Florida RV Super Show in Tampa, Florida, held from January 15–19, building on the success of the Lineage Series M with advanced engineering, premium amenities such as dual air conditioning and lithium battery systems, and high towing capacity, thereby setting new benchmarks in the Super C RV market

- In May 2023, First Hydrogen Corp., in collaboration with EDAG Group, unveiled its vision for a zero-emission recreational vehicle, highlighting future-ready hydrogen-based mobility concepts aimed at sustainable recreation, thereby signaling a strong shift toward environmentally responsible RV innovation

- In January 2023, Kia India announced an investment of Rs 2,000 crore in its electric vehicle program and revealed plans to launch a new all-electric recreational vehicle in 2025, underscoring the company’s long-term commitment to electrification and clean mobility in the Indian market

- In December 2022, Lexus, the luxury division of Toyota, launched a new hydrogen-powered recreational off-highway vehicle featuring strong off-road performance and near-zero emissions, demonstrating the brand’s focus on combining sustainability with high-performance recreational mobility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Recreational Vehicle Rv Awnings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recreational Vehicle Rv Awnings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recreational Vehicle Rv Awnings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.