Global Recruitment Process Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

2.90 Billion

USD

6.78 Billion

2024

2032

USD

2.90 Billion

USD

6.78 Billion

2024

2032

| 2025 –2032 | |

| USD 2.90 Billion | |

| USD 6.78 Billion | |

|

|

|

|

Recruitment Process Outsourcing Market Size

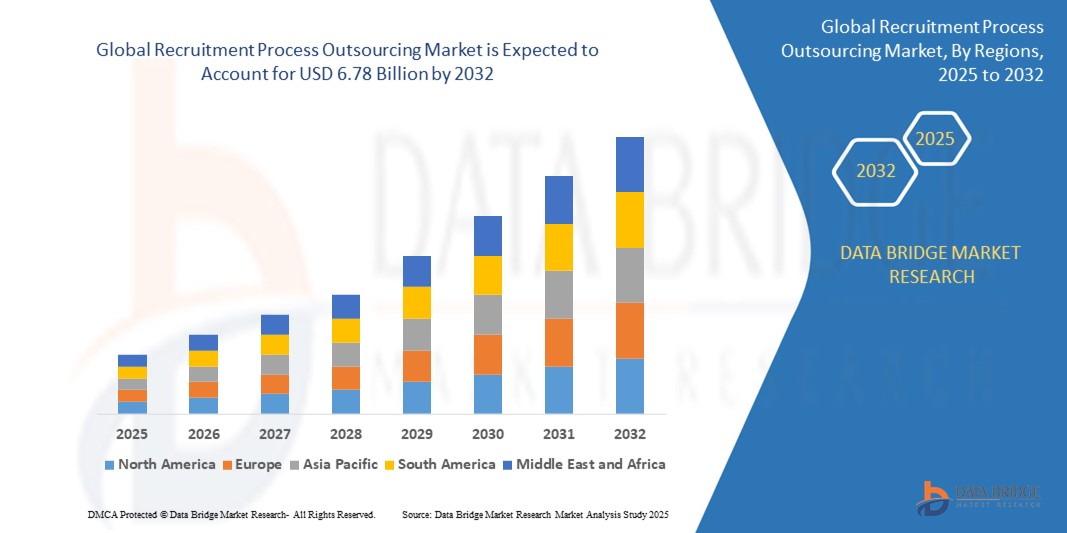

- The global recruitment process outsourcing market was valued at USD 2.90 billion in 2024 and is expected to reach USD 6.78 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20% primarily driven by the increasing demand for cost-effective and scalable hiring solutions

- This growth is driven by factors such as the rising adoption of digital recruitment technologies, growing need for workforce agility, and the emphasis on improving recruitment efficiency and candidate experience

Recruitment Process Outsourcing Market Analysis

- Recruitment Process Outsourcing (RPO) is a business practice where an organization outsources all or part of its recruitment processes to an external service provider to improve hiring efficiency and reduce costs

- The recruitment process outsourcing market is expanding steadily as more organizations turn to specialized hiring solutions to manage fluctuating workforce demands and improve recruitment efficiency across industries such as healthcare, finance, and technology

- For instance, healthcare networks have used outsourcing to fill urgent nursing shortages during high-demand periods

- Many businesses are moving toward blended models that combine internal talent acquisition teams with external recruitment support, enabling greater agility during high-volume hiring periods

- For instance, retail chains such as Target have used flexible RPO models to handle seasonal hiring surges during holiday months

- Real-time use of artificial intelligence in sourcing and screening is becoming more common, with platforms automating repetitive tasks such as resume filtering and candidate communication

- Customization is becoming a standard expectation, with companies requesting recruitment solutions tailored to their business goals

- For instance, tech start-ups often seek specialized RPO services focused on sourcing software engineers and product managers for rapid scaling

- Data-driven recruitment strategies are helping organizations monitor hiring performance in real time, track metrics such as time-to-hire and candidate quality, and adjust processes accordingly

- For instance, logistics firms are using real-time dashboards to optimize driver and warehouse staffing based on shipping volumes

Report Scope and Recruitment Process Outsourcing Market Segmentation

|

Attributes |

Recruitment Process Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Recruitment Process Outsourcing Market Trends

“Integration of Artificial Intelligence and Automation Technologies”

- Recruitment process outsourcing providers are incorporating artificial intelligence to automate tasks such as resume screening and candidate matching, which speeds up the process and enhances accuracy

- For instance, Unilever uses AI to assess candidates through video interviews and behavioural analytics

- Automation tools are improving communication efficiency, such as through automated email responses and interview scheduling; this helps reduce the administrative burden on recruiters, allowing them to focus more on strategic decision-making

- AI chatbots are becoming a key tool in engaging with candidates, answering their questions, and guiding them through the application process; this enhances candidate experience while saving recruiters time and effort

- Machine learning algorithms are being implemented to analyze past hiring data and predict the success of future candidates, enabling organizations to make more data-driven recruitment decisions

- For instance, Amazon uses predictive analytics to identify high-performing employees during the recruitment phase

- The integration of AI and automation helps organizations handle large volumes of applications quickly, improving scalability for companies with high-volume hiring needs such as during peak hiring seasons in retail or tech sectors

Recruitment Process Outsourcing Market Dynamics

Driver

“Increasing Demand for Scalable and Efficient Hiring Solutions”

- Organizations are turning to scalable and efficient hiring solutions to meet the evolving needs of their workforce, enabling them to quickly adapt to changing market conditions and ensure the right talent is in place when needed

- For instance, a leading global tech company such as Accenture uses RPO services to efficiently manage recruitment during periods of rapid technological growth

- Recruitment Process Outsourcing provides a flexible and cost-effective approach, allowing companies to manage recruitment processes more efficiently, especially during high-demand periods or when they are scaling rapidly

- For instance, during peak hiring seasons, retail giants such as Walmart use RPO providers to streamline recruitment and manage seasonal staff requirements

- High attrition rates, particularly in industries such as retail and healthcare, are pushing companies to turn to RPO providers to improve employee retention and streamline recruitment processes that can be burdensome if managed internally

- For instance, a company such as Amazon has partnered with RPO providers to improve its high-volume hiring and reduce turnover in its warehouse operations

- Companies in diverse industries are using RPO services to ensure compliance with local labor laws and streamline recruitment strategies, with RPO providers offering specialized knowledge of regional employment regulations to support businesses in global expansion

- For instance, a multinational company such as Siemens relies on RPO providers to ensure compliance with labor regulations across various countries where it operates

Opportunity

“Expansion into Emerging Markets with Growing Talent Needs”

- Emerging markets are creating major opportunities for recruitment process outsourcing providers as they offer growing talent pools and a dynamic business environment that demands flexible hiring solutions

- As companies in these regions aim to scale quickly, RPO services are becoming vital for managing recruitment more effectively and professionally

- For instance, many startups in Southeast Asia are relying on outsourced recruitment to fill technical and managerial roles while they focus on core operations

- RPO providers can tailor their services to local market conditions by offering multilingual support, region-specific compliance management, and culturally aligned recruitment strategies, helping businesses tap into the right talent more effectively

- For instance, in India and the Philippines, RPO firms are designing sector-specific solutions for industries such as IT and customer service, helping global clients set up offshore teams with minimal hiring delays and better retention rates

Restraint/Challenge

“Data Security and Privacy Concerns”

- The outsourcing of recruitment processes involves handling large volumes of sensitive candidate data, which raises serious concerns around data security and privacy for both organizations and job seekers

- Organizations must ensure that recruitment process outsourcing providers comply with strict data protection regulations such as the General Data Protection Regulation and other local laws, as failure to do so can expose them to legal penalties and reputational risks

- For instance, there have been cases where recruitment databases were targeted by cyberattacks, leading to unauthorized access to candidates’ personal information, prompting firms to revaluate the security protocols of their outsourcing partners

- Some companies, especially in highly regulated sectors such as finance and healthcare, are increasingly hesitant to outsource recruitment due to the risk of data breaches

- For instance, banks have implemented more in-house hiring solutions after experiencing third-party compliance issues

- To address these concerns, leading RPO providers are investing in encrypted platforms, multi-layer authentication systems, and regular audits to ensure secure data handling; however, the fear of lapses still leads some organizations to limit the extent of recruitment outsourcing they engage in

Recruitment Process Outsourcing Market Scope

The market is segmented on the basis of type, service, enterprise size, and end-users

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Service |

|

|

By Enterprise Size |

|

|

By End-Users |

|

Recruitment Process Outsourcing Market Regional Analysis

“North America is the Dominant Region in the Recruitment Process Outsourcing Market”

- North America is the dominant region in the global recruitment process outsourcing market, holding the largest market share due to its established and mature outsourcing infrastructure

- The region benefits from advanced recruitment technologies and widespread digital adoption, making it easier for organizations to integrate outsourced hiring solutions into their operations

- The U.S. and Canada have a strong presence across industries such as information technology, healthcare, and financial services, where recruitment outsourcing is commonly used to boost hiring efficiency

- Strategic workforce planning is a key focus in the region, and companies show a high level of awareness and adoption of structured recruitment strategies, which continues to fuel demand for outsourced recruitment services

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest-growing region in the recruitment process outsourcing market, the growth is driven by rapid industrialization and digital transformation across countries such as India, China, and Indonesia, where businesses are adopting modern hiring practices to meet workforce demands

- The expansion of small and medium enterprises is increasing the need for cost-efficient and scalable recruitment solutions, making RPO an attractive option in these emerging economies

- The region is also experiencing a rise in multi-country RPO contracts, showing growing confidence in RPO providers to manage recruitment operations across several Asian markets simultaneously

Recruitment Process Outsourcing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ADP, Inc. (U.S.)

- Alexander Mann Solutions (U.K.)

- Cielo, Inc. (U.S.)

- Hudson Global Inc. (U.S.)

- ManpowerGroup Inc. (U.S.)

- Korn Ferry (U.S.)

- PeopleScout – A TrueBlue Company (U.S.)

- WilsonHCG (U.S.)

- Sevenstep (U.S.)

- Permira I.P. Limited (U.K.)

- IBM (U.S.)

- Randstad NV (Netherlands)

- Kenexa Corporation (U.S.)

- Infosys Limited (India)

- Boston Consulting Group (U.S.)

- Pontoon Solutions, Inc. (U.S.)

- Pinstripe Incorporated (U.S.)

- Orion ICS, LLC (U.S.)

- Talent Fusion (U.S.)

- The RightThing, LLC (U.S.)

Latest Developments in Global Recruitment Process Outsourcing Market

- In January 2023, WilsonHCG (U.S.) completed the acquisition of Personify to expand its capabilities in the healthcare and life sciences recruitment sector. This development aims to address growing talent shortages in biotech, pharmaceuticals, and related industries. The move enhances WilsonHCG’s service offerings globally, including executive search and recruitment marketing. It strengthens the company’s position in delivering specialized talent solutions, creating a broader impact in high-demand sectors

- In May 2021, TrackTik (Canada) announced its integration with ADP Workforce Now, enabling security firms to streamline payroll management. This integration allows for seamless data synchronization between TrackTik and ADP, reducing manual data entry and minimizing errors. The one-click payroll processing feature simplifies payroll operations, saving time and resources. By automating employee matching and syncing actions such as hiring, rehiring, or termination, the integration ensures accurate and up-to-date employee records. This development enhances operational efficiency and supports data-driven decision-making in security organizations

- In November 2022, AMS (U.K.) acquired HirePower (Canada), a leading Toronto-based provider of Recruitment Process Outsourcing (RPO). This acquisition enhances AMS's capabilities in the North American market, particularly in technology and digital hiring. By integrating HirePower’s established team and expertise, AMS aims to create a digital and technology sourcing center of excellence in Canada, supporting both North American and global clients. The move expands AMS's client base and strengthens its position in the rapidly growing North American RPO sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.