Global Recycled Glass Market

Market Size in USD Billion

CAGR :

%

USD

4.80 Billion

USD

7.82 Billion

2024

2032

USD

4.80 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.80 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Recycled Glass Market Size

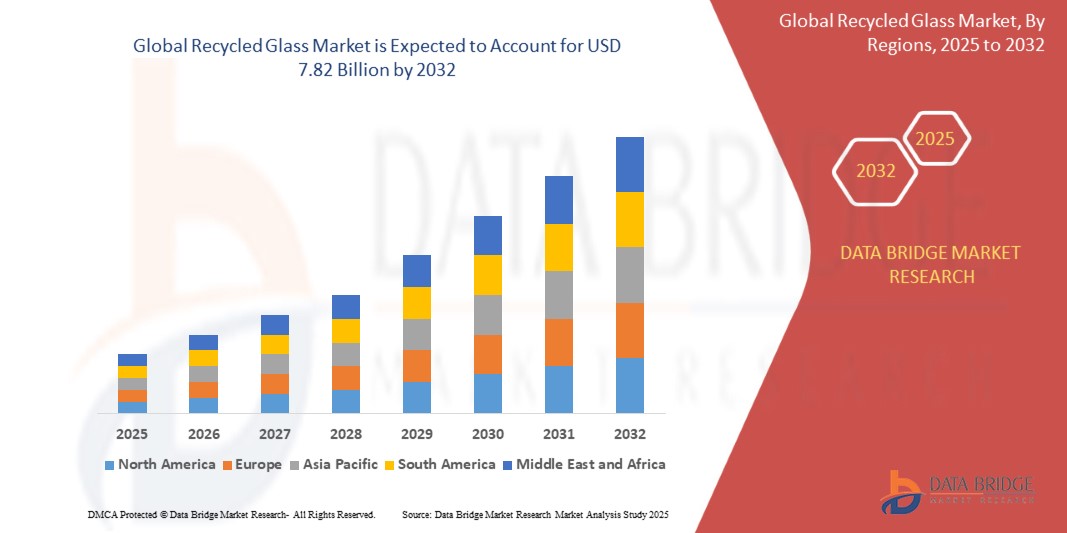

- The Global Recycled Glass Market size was valued at USD 4.8 Billion in 2024 and is expected to reach USD 7.82 Billion by 2032, at a CAGR of 6.40% during the forecast period

- This growth is primarily fueled by Increased focus of the government, manufacturers and general population on waste management coupled with achieving sustainable development.

Recycled Glass Market Analysis

- Glass is one material that can be recycled limitlessly without having to worry about the quality or purity content. Glass is recycled by crushing and melting processes and eventually is turned into different forms or shapes.

- Advantageous properties offered by recycled glass are another factor responsible for propelling growth in the recycled glass market value.

- Rising demand for recycled glass by building and construction industry owing to the rising urbanization and growth in construction activities especially in the developing economies will further accelerate the market growth rate.

- In 2025, Europe holds a dominant 36.1% share of the Global Recycled Glass Market, driven by strict environmental regulations, high recycling rates, and strong demand from the beverage and construction sectors. The region's circular economy policies and well-developed recycling infrastructure support efficient collection, sorting, and reuse of glass.

- Asia-Pacific is the fastest-growing region with a CAGR of 6.9%, driven by rising urban populations and packaging demand in India, China, and Southeast Asia. Limited infrastructure presents challenges, but growing awareness and policy reforms are boosting investment in recovery and reuse technologies.

- In 2025, The curbside collection segment dominates the recycled glass market, holding over 45% market share, due to its widespread implementation in municipal recycling programs, ease of consumer participation, and established infrastructure in North America and Europe.

Report Scope and Recycled Glass Market Segmentation

|

Attributes |

Recycled Glass Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Recycled Glass Market Trends

“Integration of Recycled Glass in Green Infrastructure and Specialty Applications”

- A growing trend in the Global Recycled Glass Market is the increasing integration of recycled glass into green infrastructure projects and high-performance industrial applications such as terrazzo flooring, filtration systems, and reflective highway beads, promoting both functionality and sustainability.

- Urban development and sustainable construction are driving demand for recycled glass aggregates and powders that meet both aesthetic and structural needs, particularly in LEED-certified and energy-efficient buildings.

For instance,

- In January 2024, Momentum Recycling expanded its Utah facility to triple production of recycled glass abrasives and construction-grade aggregate, citing rising demand from municipal projects and eco-friendly construction in western U.S. markets.

- This trend aligns with a broader push toward circular economy models, as manufacturers seek to reduce raw material consumption, lower carbon emissions, and repurpose glass waste into high-value, long-lasting applications across diverse industries.

Recycled Glass Market Dynamics

Driver

“Green Building Boom Accelerating Recycled Glass Demand”

- The rapid growth of sustainable construction and green infrastructure projects is driving the demand for recycled glass as a key material in insulation, decorative aggregates, and glassphalt. Builders prefer recycled glass for its durability, thermal properties, and eco-friendliness.

- Government mandates for using recycled content in construction, particularly in LEED- and BREEAM-certified buildings, are further accelerating adoption.

For instance,

- In March 2024, the City of Los Angeles mandated the use of recycled glass in 20% of new public infrastructure projects, boosting local glass recovery and circular construction goals.

- This trend supports reduced landfill use, energy savings, and carbon footprint reductions—cementing recycled glass as a vital material for future-ready construction.

Restraint/Challenge

“High Contamination Rates and Sorting Limitations”

- A major hurdle in the recycled glass industry is contamination during collection, especially from mixed waste streams. Colored glass mixing, ceramics, and organics often degrade the quality of recovered material, limiting its use in high-value applications like food-grade containers.

- Many recycling centers lack automated optical sorting or washing systems needed to efficiently purify glass cullet, particularly in developing economies.

For instance,

- In October 2023, the UK Glass Manufacturers Confederation reported that nearly 35% of recovered glass was unusable due to contamination—adding costs and reducing operational efficiency.

- These issues slow adoption, raise processing costs, and challenge sustainability targets across the value chain. Addressing contamination is critical to unlocking the market’s full circular potential.

Recycled Glass Market Scope

The market is segmented on the basis of source, product and application.

- By source

On the basis of source, the recycled glass market is segmented into deposit, buy back/drop off and curb-side. In 2025, The curbside collection segment dominates the recycled glass market, holding over 45% market share, due to its widespread implementation in municipal recycling programs, ease of consumer participation, and established infrastructure in North America and Europe.

The buy back/drop off segment is the fastest-growing, projected to grow at a CAGR of 7.5%, driven by increasing adoption in developing regions, growing awareness campaigns, and incentives promoting voluntary recycling behavior among eco-conscious consumers.

- By product

On the basis of product, the recycled glass market is segmented into cullet, crushed glass and glass powder. The cullet segment dominates the recycled glass market due to its direct reusability in glass manufacturing, particularly in container and bottle production. Its high cost-efficiency and energy-saving benefits make it the preferred material across industries.

The glass powder segment is the fastest-growing, fueled by its expanding use in construction, adhesives, ceramics, and filtration systems. Its fine texture and versatile properties drive demand, especially in green building applications and specialty industrial processes.

- By application

On the basis of application, the recycled glass market is segmented into glass bottles and containers, flat glass, fiberglass, highway beads, abrasives, fillers and others. The glass bottles and containers segment dominates the recycled glass market, driven by strong demand from the beverage and food industries. Recycled glass cullet is cost-effective and energy-efficient for remanufacturing bottles, making it the most widely used application globally.

The fiberglass segment is the fastest-growing, owing to rising demand in construction, automotive, and aerospace industries. Recycled glass is increasingly used in fiberglass insulation due to its thermal efficiency, sustainability, and ability to meet green building standards and energy regulations.

Recycled Glass Market Regional Analysis

- In 2025, Europe holds a dominant 36.1% share of the Global Recycled Glass Market, driven by strict environmental regulations, high recycling rates, and strong demand from the beverage and construction sectors. The region's circular economy policies and well-developed recycling infrastructure support efficient collection, sorting, and reuse of glass.

- Countries like Germany, France, and the Netherlands lead in closed-loop recycling systems, with widespread public participation and industrial collaboration. The European glass industry heavily utilizes cullet in new glass production, reducing energy consumption and CO₂ emissions.

- Additionally, EU Green Deal initiatives and mandates for recycled content in packaging are pushing manufacturers to invest in sustainable glass processing technologies, further enhancing regional competitiveness and supply reliability in both container glass and secondary applications like abrasives and insulation.

Germany Recycled Glass Market Insight

Germany is a leading force in Europe’s recycled glass sector, driven by stringent recycling mandates and advanced sorting infrastructure. In 2025, Germany is expected to maintain high container reuse with over 80% cullet integration in new glass production. Strong demand from organic food packaging, automotive applications, and green construction supports its leadership position, complemented by innovative engineering and eco-awareness.

France Recycled Glass Market Insight

France demonstrates strong momentum driven by its Eco-Emballages system and national waste reduction targets. The use of recycled glass in wine, cosmetics, and pharmaceutical packaging continues to grow. Consumer affinity for artisanal and eco-friendly products further boosts demand for cullet-based glass containers and circular design strategies.

North America Recycled Glass Market Insight

North America holds robust growth potential, driven by urban sustainability goals, construction sector reuse, and regulatory support for circular economy initiatives. Regional policies encourage recycled cullet integration in construction materials, fiberglass, and container glass, boosting demand across commercial and municipal sectors.

U.S. Recycled Glass Market Insight

The U.S. market remains dynamic, underpinned by high beverage consumption, recycling infrastructure modernization, and brand-led sustainable packaging mandates. Recycled glass finds growing application in food jars, craft beer bottles, and premium cosmetic containers, with rising support from zero-waste initiatives and local glass beneficiation programs.

Canada Recycled Glass Market Insight

Canada experiences gradual expansion fueled by green building programs, curbside recycling participation, and demand for low-carbon construction inputs. Recycled glass aggregates are widely adopted in concrete and road base, while packaging manufacturers prioritize closed-loop systems and clear cullet sourcing from urban centers.

Asia Pacific Recycled Glass Market Insight

Asia-Pacific is the fastest-growing region with a CAGR of 6.9%, driven by rising urban populations and packaging demand in India, China, and Southeast Asia. Limited infrastructure presents challenges, but growing awareness and policy reforms are boosting investment in recovery and reuse technologies.

China Recycled Glass Market Insight

China is projected to grow at a CAGR of 7.6% through 2025. With government emphasis on waste segregation and industrial reuse, recycled glass is gaining traction in container manufacturing and construction. Domestic manufacturers are investing in color-sorting and purification technologies to meet green packaging standards.

Recycled Glass Market Share

The Recycled Glass Market is primarily led by well-established companies, including:

- Strategic Materials, Inc. (U.S.)

- URM (United Resource Management) (Australia)

- Vetropack (Switzerland)

- Ardagh Group S.A. (Luxembourg)

- O-I Glass, Inc. (U.S.)

- Ngwenya Glass (Eswatini)

- BALCONES RESOURCES (U.S.)

- Reiling GmbH & Co. KG (Germany)

- Heritage Glass Inc. (U.S.)

- GLASS RECYCLED SURFACES (U.S.)

- Enva (Ireland)

- RETHMANN SE & CO. KG (Germany)

- Harasco Corporation (Japan)

- Coloured Aggregates Inc. (Canada)

- Pace Glass Co. (U.S.)

- Verallia (France)

- Momentum Recycling, LLC (U.S.)

- Dlubak Glass Company (U.S.)

- Gallo Glass Company (U.S.)

- Trivitro Corporation (U.S.)

Latest Developments in Global Recycled Glass Market

- In May 2024, Vetropack inaugurated a technologically advanced glass recycling facility in Austria, featuring state-of-the-art optical sorting systems to enhance cullet purity. This investment supports increased recycled glass integration into new bottles, enabling closed-loop production and reducing energy consumption and emissions, aligning with EU sustainability directives and growing demand for eco-friendly packaging solutions.

- In March 2025, NSG Pilkington successfully recycled 220 tonnes of greenhouse glass panes into float glass at its St. Helens facility. This project reduced carbon emissions by 55 tonnes and demonstrated the viability of full-circle glass reuse, setting a precedent for glass recycling in architectural and horticultural sectors across the United Kingdom and Europe.

- In February 2024, In February 2024, glass packaging leaders Verallia and Ardagh committed to ambitious recycling goals. Verallia aims for 60% recycled content in its products by 2025, while Ardagh partnered with O-I Glass to co-invest in a U.S.-based glass beneficiation facility, significantly enhancing domestic cullet supply and bolstering sustainable manufacturing across North America.

- In January 202, Solarcycle revealed plans for a $344 million solar panel recycling plant in Cedartown, Georgia. Operational by 2026, the facility will process over 1 million panels annually, reclaiming valuable materials including high-quality recycled glass. The project will create more than 600 jobs and contribute 5 GW to solar module supply chains.

- In April 2024, Extended Producer Responsibility (EPR) regulations expanded in 38 countries, mandating manufacturers to reclaim packaging waste. Simultaneously, investments surged in robotic and AI-powered optical sorting technologies to improve glass recovery rates and cullet purity. These trends reflect rising pressure on producers to meet recycling targets and minimize landfill contributions globally.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Recycled Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recycled Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recycled Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.