Global Recycled Plastic Pipes Market

Market Size in USD Billion

CAGR :

%

USD

6.99 Billion

USD

15.20 Billion

2024

2032

USD

6.99 Billion

USD

15.20 Billion

2024

2032

| 2025 –2032 | |

| USD 6.99 Billion | |

| USD 15.20 Billion | |

|

|

|

|

Recycled Plastic Pipes Market Size

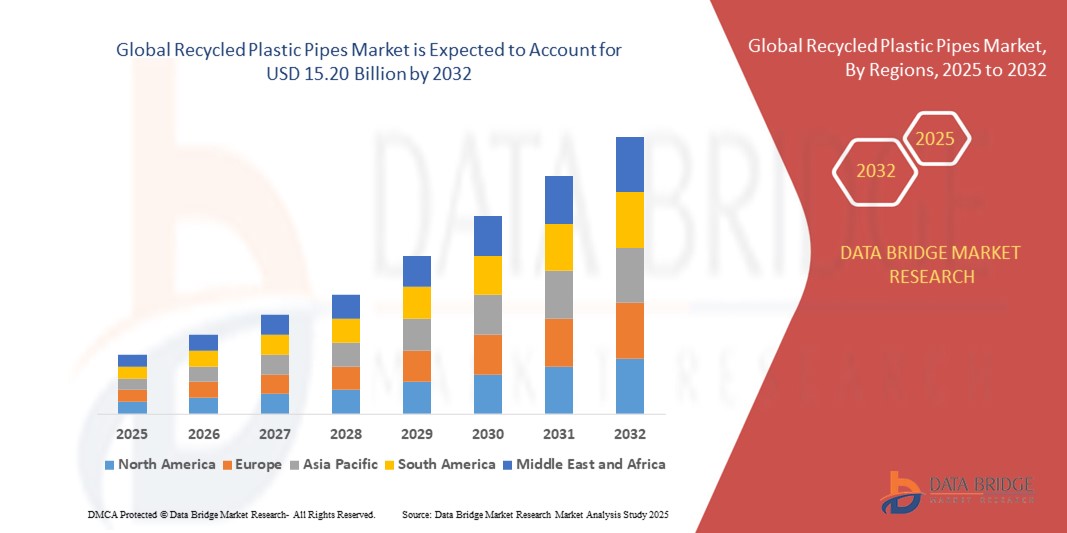

- The global recycled plastic pipes market size was valued at USD 6.99 billion in 2024 and is expected to reach USD 15.20 billion by 2032, at a CAGR of 10.20% during the forecast period

- The market growth is fuelled by circular-economy policies, cost-effective pipeline rehabilitation, and rising ESG commitments from utilities and developers, alongside improvements in recyclate quality (PCR/PIR) and additive technologies that match virgin-resin performance in many use cases

- Accelerating infrastructure replacement (water loss reduction, sewer upgrades, and stormwater management) and green building certifications are propelling demand across both OEM/plant-fabricated systems and the aftermarket/retrofit value chain

Recycled Plastic Pipes Market Analysis

- The recycled plastic pipes market is witnessing steady adoption as end users prioritize sustainability, durability, and lifecycle cost savings for potable water, non-potable water, and conduit applications. Increased availability of certified PCR streams and traceability systems supports spec-in decisions by engineers and municipalities

- Demand from residential and municipal/infrastructure end users is encouraging manufacturers to scale PE and PVC solutions with high impact strength, chemical resistance, and long service life, while PP gains traction in HVAC and building drainage

- North America dominated the recycled plastic pipes market with the largest revenue share of 37.5% in 2024 driven by active pipeline rehabilitation programs, storm water management investments, and supportive procurement guidelines that recognize recycled-content performance

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, supported by rapid urbanization, large-scale water and sanitation projects, telecom network expansion, and government incentives for recycling infrastructure—particularly in China, India, and Southeast Asian nations

- The PVC segment dominated the largest market revenue share of 52.4% in 2024, driven by its versatility, durability, and cost-effectiveness. PVC recycled pipes are extensively used in water supply, sanitation, and drainage systems due to their corrosion resistance, lightweight nature, and long service life

Report Scope and Recycled Plastic Pipes Market Segmentation

|

Attributes |

Recycled Plastic Pipes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Recycled Plastic Pipes Market Trends

Increasing Adoption of Sustainable Infrastructure Solutions

- The global recycled plastic pipes market is witnessing a notable trend toward adopting eco-friendly and sustainable piping solutions across multiple industries

- Advances in recycling technologies are enabling higher-quality recycled polymers, such as Polyvinyl Chloride (PVC), Polypropylene (PP), and Polyethylene (PE), to be used in demanding applications without compromising durability or performance

- These innovations support circular economy goals by reducing plastic waste, lowering carbon footprints, and conserving resources compared to virgin plastic production

- For instance, several manufacturers are introducing high-performance recycled plastic pipes designed for water supply, sewer systems, HVAC installations, and agricultural irrigation, meeting both environmental and functional requirements

- This trend is particularly strong in regions with strict sustainability regulations and incentives, encouraging builders, municipalities, and industries to choose recycled options over conventional materials

- Recycled plastic pipes are increasingly engineered to withstand extreme temperatures, resist chemical corrosion, and offer long service life, making them viable for a wide range of residential, industrial, and municipal/infrastructure projects

Recycled Plastic Pipes Market Dynamics

Driver

Rising Demand for Cost-Effective and Environmentally Friendly Piping Solutions

- Increasing awareness of environmental issues, combined with the need for cost-effective alternatives, is driving the adoption of recycled plastic pipes globally

- Recycled pipes offer significant advantages such as lightweight construction, ease of installation, low maintenance requirements, and strong resistance to rust and corrosion

- Government regulations promoting the use of recycled materials in construction and infrastructure projects are further accelerating market growth

- The rising demand for sustainable water supply and sanitation solutions, coupled with expanding agricultural irrigation networks, is creating opportunities across multiple applications

- The large-scale adoption, while Asia-Pacific is witnessing rapid growth due to urbanization, industrial expansion, and increasing investments in smart city developments

Restraint/Challenge

Quality Consistency and Regulatory Compliance Issues

- Variability in the quality and composition of recycled plastic feedstock can present challenges in manufacturing pipes with consistent performance and reliability

- Ensuring that recycled plastic pipes meet industry standards and regulatory requirements for strength, safety, and long-term durability can increase production complexity and costs

- Limited consumer awareness about the performance capabilities of recycled plastic pipes in certain regions may slow adoption, especially in applications traditionally dominated by metal or concrete

- Concerns over potential leaching of chemicals and compliance with health and environmental safety standards remain important barriers to market penetration

- Differences in recycling infrastructure, policies, and certification processes between countries complicate operations for global manufacturers and suppliers, making standardization a key challenge

Recycled Plastic Pipes market Scope

The market is segmented on the basis of material type, application, and end use.

- By Material Type

On the basis of material type, the global recycled plastic pipes market is segmented into polyvinyl chloride (PVC), polypropylene (PP), polyethylene (PE), and other materials. The PVC segment dominated the largest market revenue share of 52.4% in 2024, driven by its versatility, durability, and cost-effectiveness. PVC recycled pipes are extensively used in water supply, sanitation, and drainage systems due to their corrosion resistance, lightweight nature, and long service life. The ease of processing recycled PVC and its compatibility with existing infrastructure have further strengthened its market dominance, especially in regions focusing on sustainable construction practices.

The PP segment is expected to register the fastest growth rate from 2025 to 2032, supported by increasing demand for chemically resistant, lightweight, and high-performance piping solutions. PP recycled pipes are gaining traction in HVAC, industrial fluid handling, and agricultural irrigation applications, where temperature stability and mechanical strength are critical. The segment’s growth is also fueled by advancements in recycling technology that improve the quality and performance of PP materials, making them competitive with virgin plastic pipes while offering strong sustainability benefits.

- By Application

On the basis of application, the global recycled plastic pipes market is categorized into water supply & sanitation, sewer/drainage, HVAC, agricultural irrigation, electrical/telecom conduit, and other applications. The water supply & sanitation segment accounted for the highest revenue share in 2024, driven by increasing urbanization, growing demand for sustainable water infrastructure, and government initiatives promoting the use of eco-friendly construction materials. Recycled plastic pipes offer an efficient, low-maintenance alternative to traditional materials, enabling municipalities and utilities to meet environmental targets while reducing lifecycle costs.

The HVAC segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the rising adoption of energy-efficient heating and cooling systems in residential, commercial, and industrial settings. Recycled plastic pipes, particularly PP and PE, are valued in HVAC applications for their thermal stability, resistance to scaling, and ease of installation. As green building certifications and sustainable construction practices gain global momentum, demand for recycled plastic piping solutions in HVAC systems is set to accelerate.

- By End Use

On the basis of end use, the global recycled plastic pipes market is segmented into residential, industrial, and municipal/infrastructure. The municipal/infrastructure segment held the largest revenue share in 2024, supported by large-scale investments in water management systems, urban drainage networks, and public utility upgrades. The use of recycled plastic pipes in infrastructure projects aligns with government sustainability mandates and reduces reliance on virgin materials, contributing to both cost savings and environmental impact reduction.

The industrial segment is projected to grow at the fastest rate from 2025 to 2032, driven by the need for durable, chemical-resistant piping in manufacturing, processing, and utility systems. Industrial users are increasingly turning to recycled plastic pipes to meet corporate sustainability targets without compromising performance. Enhanced resistance to wear, corrosion, and extreme temperatures makes these pipes suitable for a wide range of industrial processes, from fluid transport to protective cable conduit systems.

Recycled Plastic Pipes Market Regional Analysis

- North America dominated the recycled plastic pipes market with the largest revenue share of 37.5% in 2024 driven by active pipeline rehabilitation programs, storm water management investments, and supportive procurement guidelines that recognize recycled-content performance

- Consumers prioritize durability, corrosion resistance, lifecycle cost savings, and verifiable recycled content that still meets potable-water, sanitation, and pressure-rating standards—especially in climates with freeze–thaw cycles and heat stress

- Market growth is supported by advances in high-purity sorting/reprocessing, multilayer co-extrusion, and third-party certification schemes, alongside rising adoption across municipal retrofits, industrial utilities, residential renovations, and telecom/electrical conduit

U.S. Recycled Plastic Pipes Market Insight

The U.S. recycled plastic pipes market captured the largest revenue share of 86.43% in 2024 within North America, fueled by strong municipal and utility procurement for water supply, sewer/drainage, and trenchless rehabilitation; growing state and city recycled-content targets; and heightened awareness of corrosion-free alternatives. Replacement of legacy metal/clay lines, drought-resilience projects, and suburban housing upgrades bolster demand across PE, PVC, and PP, while standardized testing and code compliance support wider specification by engineers and contractors.

Europe Recycled Plastic Pipes Market Insight

The Europe is set for sustained growth, supported by stringent circular-economy frameworks, green public procurement, and harmonized product standards that improve trust in recycled inputs. Utilities and contractors seek pipes that pair thermal/chemical resistance with verified recycled content for sanitation, HVAC, and conduit. Retrofit activity in dense urban areas and industrial decarbonization projects continue to expand addressable demand.

U.K. Recycled Plastic Pipes Market Insight

The U.K. market is accelerating as water utilities and local authorities prioritize leak reduction and sustainable materials. Demand centers on pipes that deliver flow efficiency, glare-free cable protection for electrification projects, and UV/weatherable options for above-ground runs. Evolving specifications balance recycled content with safety, traceability, and compliance.

Germany Recycled Plastic Pipes Market Insight

Germany shows robust growth, driven by advanced recycling infrastructure, precision extrusion capabilities, and strong end-user focus on energy efficiency and material circularity. Preference leans toward technologically advanced, multilayer PVC/PE solutions for district heating/HVAC, industrial process water, and high-reliability sewer lines, supported by active retrofit cycles and a premium on quality assurance.

Asia-Pacific Recycled Plastic Pipes Market Insight

The Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, large-scale water/sanitation build-outs, telecom network expansion, and rising construction activity in China, India, and Southeast Asia. Government programs promoting resource efficiency and lower-carbon infrastructure are boosting adoption of recycled PVC, PE, and PP across municipal, residential, and industrial endpoints.

Japan Recycled Plastic Pipes Market Insight

Japan’s market is expanding steadily, with strong preference for high-spec, certified recycled materials that enhance reliability in seismic-aware infrastructure and compact urban settings. OEM integration in building systems, coupled with meticulous quality control and lifecycle cost focus in HVAC and drainage, supports continuous adoption.

China Recycled Plastic Pipes Market Insight

China holds the largest share within Asia-Pacific, supported by extensive domestic recycling capacity, competitive pricing, and ongoing upgrades to urban water/sewer networks, agricultural irrigation, and electrical/telecom conduit. Rising middle-class housing demand and smart-city investments continue to broaden application breadth across PE, PVC, and PP pipe systems.

Recycled Plastic Pipes Market Share

The recycled plastic pipes industry is primarily led by well-established companies, including:

- Advanced Drainage Systems (ADS) (U.S.)

- JM Eagle (U.S.)

- Orbia – Wavin (Mexico)

- Aliaxis Group (Belgium)

- Pipelife (Austria)

- Genuit Group (formerly Polypipe) (U.K.)

- Uponor (Finland)

- Sekisui Chemical Co., Ltd. (Japan)

- Iplex Pipelines (Australia)

- Vinidex (Australia)

- Astral Limited (India)

- The Supreme Industries Ltd. (India)

- Finolex Industries Ltd. (India)

What are the Recent Developments in Global Recycled Plastic Pipes Market?

- In June 2024, Pipelife launched drinking water pressure pipes in Vienna made from chemically recycled polyethylene. This groundbreaking initiative utilized Borealis’ Borcycle™ C technology, which transforms polyolefin-based waste into virgin-quality plastic suitable for demanding applications. The pipes meet the same stringent safety and performance standards as those made from new materials, demonstrating the viability of chemical recycling for high-quality, durable infrastructure. Certified under ISCC PLUS, the project marks a major step toward a circular economy in the water management sector.

- In March 2023, Aliaxis introduced what it claims to be India’s first anti-microbial UPVC pipes, developed using silver ion technology to offer robust protection against bacteria, viruses, fungi, and algae. These pipes are designed to prevent biofilm buildup, making them ideal for applications where hygiene and water purity are critical, such as in residential and commercial plumbing systems. While not exclusively made from recycled materials, this innovation reflects a growing trend toward functional enhancements in plastic piping, with future potential for integration into sustainable manufacturing practice

- In October 2022, Veolia launched PlastiLoop, a new global brand offering a wide range of high-performance recycled resins, including PET, PP, HDPE, PS, ABS, LDPE, and PC. While not a finished pipe product, PlastiLoop provides manufacturers with ready-to-use circular polymers essential for producing a new generation of recycled plastic pipes and other industrial goods. Backed by Veolia’s network of 37 recycling plants worldwide, this initiative supports the circular economy by reducing reliance on virgin plastics, cutting carbon emissions by up to 75%, and promoting sustainable resource use across multiple sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Recycled Plastic Pipes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Recycled Plastic Pipes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Recycled Plastic Pipes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.