Global Redox Flow Battery Market

Market Size in USD Million

CAGR :

%

USD

663.84 Million

USD

5,971.89 Million

2024

2032

USD

663.84 Million

USD

5,971.89 Million

2024

2032

| 2025 –2032 | |

| USD 663.84 Million | |

| USD 5,971.89 Million | |

|

|

|

|

Redox Flow Battery Market Size

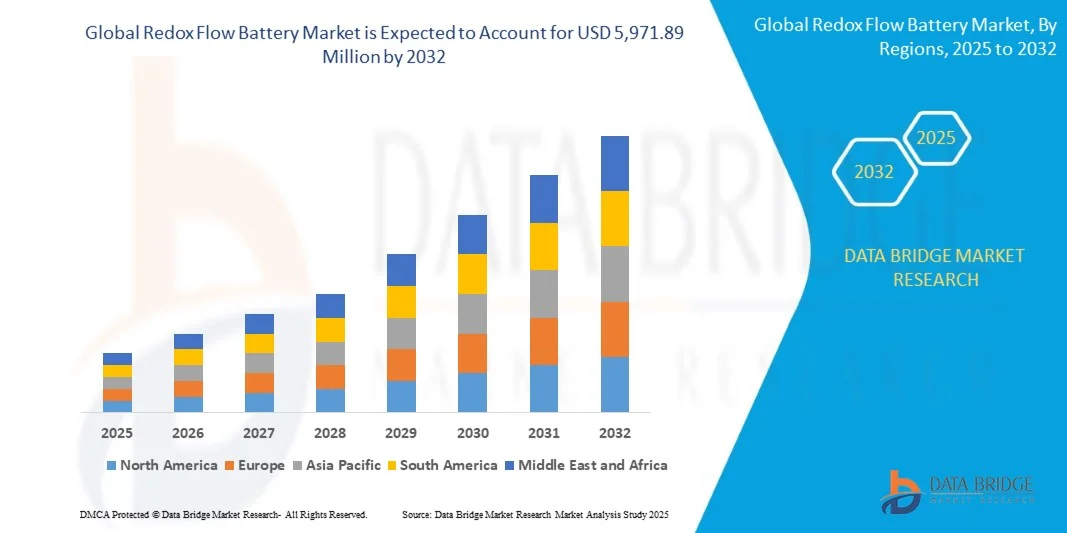

- The global Redox Flow Battery Market size was valued at USD 663.84 million in 2024 and is expected to reach USD 5,971.89 million by 2032, growing at a CAGR of 31.60% during the forecast period

- The market expansion is primarily driven by the rising demand for long-duration energy storage systems to support grid stability and renewable energy integration, particularly from solar and wind sources

- Additionally, technological advancements in electrolyte chemistry, scalability, and cost-efficiency are positioning redox flow batteries as a preferred solution for large-scale energy storage applications, fueling substantial growth across utility and industrial sectors

Redox Flow Battery Market Analysis

- Redox flow batteries, known for their scalable architecture and long cycle life, are becoming essential components of modern energy storage infrastructure, particularly for renewable energy integration and grid stability in both utility and commercial applications due to their safety, deep discharge capabilities, and flexible design

- The accelerating demand for redox flow batteries is primarily driven by the global shift toward decarbonization, increasing deployment of renewable energy sources, and the need for durable, long-duration storage solutions that can outperform conventional lithium-ion systems in large-scale applications

- North America dominated the global redox flow battery market with the largest revenue share of 35.2% in 2024, attributed to strong investments in renewable energy projects, favorable government policies, and the presence of major technology providers, with the U.S. leading adoption in utility-scale storage and microgrid deployments supported by innovations in vanadium and hybrid chemistries

- Asia-Pacific is expected to be the fastest growing region in the global redox flow battery market during the forecast period, fueled by rapid industrialization, increasing energy demand, and national commitments to renewable energy targets, particularly in countries like China, Japan, and South Korea

- The vanadium segment dominated the market with the largest revenue share of 68.4% in 2024, attributed to its high energy efficiency, long operational life, and the ability to maintain performance over thousands of charge-discharge cycles

Report Scope and Redox Flow Battery Market Segmentation

|

Attributes |

Redox Flow Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Redox Flow Battery Market Trends

“Enhanced Efficiency Through AI and Grid Intelligence Integration”

- A significant and accelerating trend in the global Redox Flow Battery Market is the deepening integration with artificial intelligence (AI) and smart grid management systems, enabling real-time optimization of energy storage, distribution, and load balancing across utility and commercial applications. This fusion of technologies is greatly enhancing system responsiveness, reliability, and overall energy efficiency.

- For instance, companies like ESS, Inc. and Invinity Energy Systems are incorporating AI-based analytics into their battery management platforms to predict demand spikes, optimize charging/discharging cycles, and improve the lifecycle efficiency of their flow batteries in dynamic grid environments.

- AI-driven systems can monitor variables such as weather patterns, grid frequency, and renewable energy input to autonomously adjust battery operation. This results in smarter dispatch strategies, reduced energy waste, and improved asset utilization. In microgrid applications, AI enables redox flow batteries to operate more intelligently alongside solar PV and wind systems, ensuring stable and resilient power delivery even in remote or off-grid settings.

- The integration with digital twin technologies allows operators to simulate performance scenarios, predict maintenance needs, and avoid costly downtime. For example, some providers are leveraging machine learning to detect electrolyte degradation or flow rate anomalies before system failures occur, enhancing operational safety and cost-effectiveness.

- Seamless integration with utility energy management systems (EMS), SCADA platforms, and AI-powered forecasting tools is enabling centralized control over energy infrastructure. These systems can coordinate energy storage with demand response programs, time-of-use pricing, and ancillary grid services—helping utilities reduce peak load pressures and meet decarbonization targets.

- This trend toward intelligent, data-driven, and highly automated energy storage systems is transforming how grid operators, industries, and renewable energy developers approach large-scale power management. As a result, companies such as Sumitomo Electric and VRB Energy are investing heavily in AI-powered control platforms to offer customers smarter, more adaptive, and future-ready redox flow battery solutions.

- The demand for redox flow batteries with AI and smart grid compatibility is expanding rapidly across utility-scale, commercial, and industrial sectors, as energy providers increasingly seek long-duration storage solutions that can adapt in real time to changing energy landscapes.

Redox Flow Battery Market Dynamics

Driver

“Growing Need Due to Renewable Energy Expansion and Grid Modernization”

- The accelerating global transition toward renewable energy sources, such as solar and wind, combined with the growing emphasis on grid modernization, is significantly driving demand for redox flow batteries. These systems provide long-duration energy storage, essential for balancing the intermittent nature of renewables and ensuring grid stability.

- For instance, in June 2024, Invinity Energy Systems announced the deployment of a 15 MWh vanadium redox flow battery for a large-scale solar + storage project in California. This project exemplifies how key industry players are scaling up redox flow battery installations to support clean energy targets and grid reliability.

- As governments and utilities across the globe invest in sustainable energy infrastructure, the demand for scalable, safe, and durable storage systems like redox flow batteries is growing. These systems offer deep discharge capability, long cycle life, and enhanced safety compared to conventional lithium-ion batteries, making them ideal for utility-scale, commercial, and off-grid applications.

- Moreover, the increasing emphasis on energy independence, peak load management, and carbon reduction goals is pushing industries, municipalities, and energy providers to adopt redox flow technologies as part of their broader energy transition strategies.

- The ability of redox flow batteries to integrate with microgrids, EV charging networks, and smart grid platforms also positions them as a critical enabler of future-ready energy systems. Their modular design allows for flexible capacity expansion, supporting both emerging markets and developed regions with aging grid infrastructure.

Restraint/Challenge

“High Capital Costs and Limited Technology Awareness”

- One of the primary challenges hindering wider adoption of redox flow batteries is their high initial capital cost compared to more established energy storage technologies like lithium-ion. The cost of key components—especially vanadium electrolytes and large-scale flow systems—remains a significant barrier, particularly for smaller utilities and price-sensitive markets.

- Additionally, limited awareness and understanding of redox flow technology among potential end-users, developers, and policymakers can slow adoption. Unlike lithium-ion batteries, which benefit from strong brand visibility and commercial familiarity, redox flow systems often require longer sales cycles, detailed technical education, and site-specific feasibility studies.

- For Instance , although vanadium prices have stabilized in recent years, the upfront investment for a commercial-scale flow battery remains high. This can deter adoption in regions lacking strong policy incentives or where shorter-term returns on investment are prioritized.

- Moreover, infrastructure requirements—such as space for tanks and auxiliary systems—may pose installation challenges in urban or space-constrained environments.

- Overcoming these challenges will require a combination of technology standardization, economies of scale, and policy support. Key players like ESS, Inc. and Sumitomo Electric are working to address cost barriers through innovations in alternative electrolytes, modular product designs, and strategic partnerships with utilities and governments.

- Increasing global education on the total cost of ownership (TCO) benefits and superior lifespan of redox flow batteries, compared to lithium-based alternatives, will be critical to driving broader market acceptance and long-term growth.

Redox Flow Battery Market Scope

Redox flow battery market is segmented on the basis of material, storage and application.

• By Material

On the basis of material, the redox flow battery market is segmented into vanadium, zinc–bromine, iron, and others. The vanadium segment dominated the market with the largest revenue share of 68.4% in 2024, attributed to its high energy efficiency, long operational life, and the ability to maintain performance over thousands of charge-discharge cycles. Vanadium redox batteries are widely preferred for utility-scale energy storage due to their scalability, deep discharge capabilities, and minimal degradation over time. Their proven track record in grid applications has reinforced investor confidence and driven large-scale deployments globally.

The zinc–bromine segment is projected to witness the fastest CAGR from 2025 to 2032, due to its lower raw material cost, enhanced safety (non-flammable), and compact design. These batteries are gaining traction in commercial and off-grid applications, offering a balance of performance and affordability. As decentralized energy systems expand, zinc–bromine solutions are expected to capture a larger share of emerging markets.

• By Storage

On the basis of storage, the redox flow battery market is segmented into large-scale and small-scale systems. The large-scale segment dominated the market with the largest revenue share of 74.1% in 2024, driven by growing demand from utilities and grid operators for long-duration energy storage. Large-scale redox flow systems are especially suitable for renewable integration, frequency regulation, and peak shaving. Their ability to independently scale power and energy capacity makes them ideal for stabilizing variable energy sources like solar and wind.

The small-scale segment is expected to register the fastest CAGR from 2025 to 2032, supported by rising adoption in commercial buildings, small industries, and microgrid applications. Small-scale flow batteries are gaining popularity for their durability, safety, and ease of integration with solar PV systems in off-grid or remote areas. Technological advancements are also enabling more compact and cost-effective designs, making small-scale systems viable for residential and localized energy storage needs.

• By Application

On the basis of application, the Global Redox Flow Battery Market is segmented into Renewable Energy Integration, Utility Services, Uninterruptible Power Supply (UPS), Commercial, Telecommunications, Electric Vehicle Charging, Solar, Off-Grid Solutions, Residential, Wind, and Industrial. The Renewable Energy Integration segment held the largest market revenue share of 38.7% in 2024, fueled by the rising global push toward clean energy and the need for stable, long-duration storage to manage intermittency in solar and wind generation. Redox flow batteries are increasingly used in solar and wind farms to store surplus energy and support grid balancing.

The Electric Vehicle (EV) Charging segment is anticipated to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by the growing EV market and the need for decentralized energy storage solutions. Redox flow batteries offer an ideal solution for load leveling and energy buffering at EV charging stations, supporting sustainable and reliable infrastructure expansion.

Redox Flow Battery Market Regional Analysis

- North America dominated the global redox flow battery market with the largest revenue share of 35.2% in 2024, driven by robust investments in renewable energy infrastructure, grid modernization initiatives, and supportive government policies promoting energy storage adoption

- The region's utilities and energy providers are increasingly deploying redox flow batteries for long-duration energy storage, especially in solar and wind integration projects. These systems are valued for their safety, scalability, and ability to deliver consistent performance over extended periods

- Widespread adoption is further supported by a well-developed energy ecosystem, strong presence of leading players such as Invinity Energy Systems and ESS, Inc., and growing demand for sustainable, resilient energy solutions. Redox flow batteries are emerging as a preferred choice for utility-scale storage across the U.S. and Canada, particularly in states and provinces with aggressive clean energy targets and grid reliability concerns

U.S. Redox Flow Battery Market Insight

The U.S. Redox Flow Battery Market captured the largest revenue share of 79% in 2024 within North America, fueled by rapid deployment of renewable energy projects and increasing investments in grid-scale energy storage. The country’s commitment to decarbonization and modernization of aging grid infrastructure drives demand for long-duration storage solutions like redox flow batteries. Growing adoption of distributed energy resources (DERs) and microgrids further boosts market growth. Additionally, advancements in AI-based battery management and government incentives for clean energy storage projects are accelerating commercial and industrial deployments, positioning the U.S. as a global leader in redox flow battery adoption.

Europe Redox Flow Battery Market Insight

The Europe Redox Flow Battery Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent energy regulations and the EU’s ambitious climate targets. Increasing integration of renewable energy into the grid and rising investments in large-scale energy storage projects are major growth factors. Urbanization and the need for reliable, scalable storage solutions in both residential and commercial sectors are fostering adoption. Countries such as Germany, France, and the Netherlands are spearheading technological innovation and pilot projects, with growing emphasis on sustainability and energy resilience supporting redox flow battery market expansion.

U.K. Redox Flow Battery Market Insight

The U.K. Redox Flow Battery Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the government’s push for net-zero carbon emissions and renewable energy integration. The rising demand for reliable energy storage systems to balance intermittent wind and solar power sources is propelling market adoption. Increased investment in smart grid infrastructure and support for energy storage innovations are encouraging commercial and utility-scale redox flow battery deployments. The U.K.’s commitment to clean energy and robust financing ecosystem continues to stimulate market growth.

Germany Redox Flow Battery Market Insight

The Germany Redox Flow Battery Market is expected to expand at a considerable CAGR during the forecast period, fueled by strong national policies supporting renewable energy and energy storage. Germany’s focus on energy transition (Energiewende) and grid stabilization technologies boosts demand for advanced storage solutions. Widespread industrial adoption and innovation in flow battery chemistry and system integration are further fueling growth. The country’s emphasis on energy efficiency and decarbonization aligns well with redox flow battery advantages such as long cycle life, scalability, and eco-friendliness, leading to rising deployment across residential, commercial, and utility sectors.

Asia-Pacific Redox Flow Battery Market Insight

The Asia-Pacific Redox Flow Battery Market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid urbanization, expanding renewable energy capacity, and rising government support in countries such as China, Japan, India, and South Korea. The region’s growing need for reliable, cost-effective long-duration storage solutions, coupled with strong manufacturing capabilities and technology development, is accelerating market expansion. Increasing electrification, smart grid rollouts, and off-grid applications in emerging economies are further bolstering demand for redox flow batteries across the region.

Japan Redox Flow Battery Market Insight

The Japan Redox Flow Battery Market is gaining momentum due to the country’s advanced technology landscape and commitment to clean energy transition. Japan’s focus on smart grid technologies, energy security, and disaster resilience drives adoption of reliable and scalable energy storage systems like redox flow batteries. Increasing deployments in commercial buildings, microgrids, and utility projects are supporting market growth. Additionally, Japan’s aging population and need for energy-efficient, easy-to-maintain systems in residential sectors create new opportunities for redox flow battery integration with IoT and smart home energy management platforms.

China Redox Flow Battery Market Insight

The China Redox Flow Battery Market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to rapid urbanization, robust renewable energy installations, and strong governmental support for energy storage technologies. China’s expanding industrial base and increasing focus on smart grids and electric vehicle infrastructure drive the demand for grid-scale redox flow battery systems. Domestic manufacturers and ongoing research investments are advancing battery performance and cost-effectiveness, while large-scale pilot projects demonstrate commercial viability. The country’s strategic push toward smart cities and carbon neutrality goals underpin sustained market growth in the coming years.

Redox Flow Battery Market Share

The Global Redox Flow Battery industry is primarily led by well-established companies, including:

- Invinity Energy Systems (U.K.)

- Dalian Rongke Energy Storage Technology Development Co., Ltd. (China)

- HydraRedox (Spain)

- H2, Inc. (South Korea)

- LE SYSTEM CO., Ltd. (Japan)

- StorEn Technologies (U.S.)

- Storion Energy (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- UniEnergy Technologies (U.S.)

- VRB ENERGY (China/Canada)

- CellCube Energy Storage (Austria)

- Redflow Limited (Australia)

- Big Pawer Electrical Technology Xiangyang Inc. Co., Ltd. (China)

- Pinflow Energy Storage, s.r.o. (Czech Republic)

- ViZn Energy Systems (U.S.)

- SCHMID Group (Germany)

- ESS, Inc. (U.S.)

- thyssenkrupp (Germany)

- Primus Power (U.S.)

- JenaBatteries GmbH (Germany)

What are the Recent Developments in Redox Flow Battery Market?

- In April 2023, ESS, Inc., a global leader in long-duration energy storage, announced a strategic partnership with a major utility in South Africa to deploy advanced redox flow battery systems aimed at enhancing grid stability and supporting renewable energy integration. This initiative demonstrates ESS’s commitment to delivering reliable, scalable energy storage solutions tailored to regional energy challenges, reinforcing its position in the rapidly growing Global Redox Flow Battery Market.

- In March 2023, Invinity Energy Systems, headquartered in the UK, launched its next-generation vanadium redox flow battery optimized for commercial and industrial applications. The new system is designed to provide enhanced efficiency and longer lifecycle performance, addressing the increasing demand for durable energy storage solutions that support grid resilience and decarbonization efforts. This advancement highlights Invinity’s focus on innovation and meeting evolving market needs.

- In March 2023, Honeywell International Inc. successfully completed a pilot project deploying redox flow battery technology as part of the Bengaluru Safe City initiative, aimed at improving energy reliability for critical urban infrastructure. The project underscores Honeywell’s commitment to integrating cutting-edge energy storage solutions that support smart city developments and foster safer, more resilient urban environments.

- In February 2023, Dalian Rongke Energy Storage Technology Development Co., Ltd. announced a strategic collaboration with major real estate developers in China to integrate redox flow battery energy storage systems in smart residential and commercial complexes. This partnership aims to enhance energy efficiency and provide sustainable power backup, supporting the growing trend of energy-smart buildings. The move highlights Dalian Rongke’s role in advancing clean energy storage within the expanding Chinese market.

- In January 2023, Primus Power, a U.S.-based energy storage innovator, unveiled its latest flow battery system featuring enhanced modularity and scalable capacity at a leading renewable energy conference. The system’s Wi-Fi-enabled monitoring and management capabilities allow remote optimization, reflecting Primus Power’s commitment to integrating digital technologies with advanced storage solutions to improve operational flexibility and customer value.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Redox Flow Battery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Redox Flow Battery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Redox Flow Battery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.