Global Reduced Fat Butter Market

Market Size in USD Billion

CAGR :

%

USD

1.62 Billion

USD

2.43 Billion

2024

2032

USD

1.62 Billion

USD

2.43 Billion

2024

2032

| 2025 –2032 | |

| USD 1.62 Billion | |

| USD 2.43 Billion | |

|

|

|

|

Fat Butter Market Size

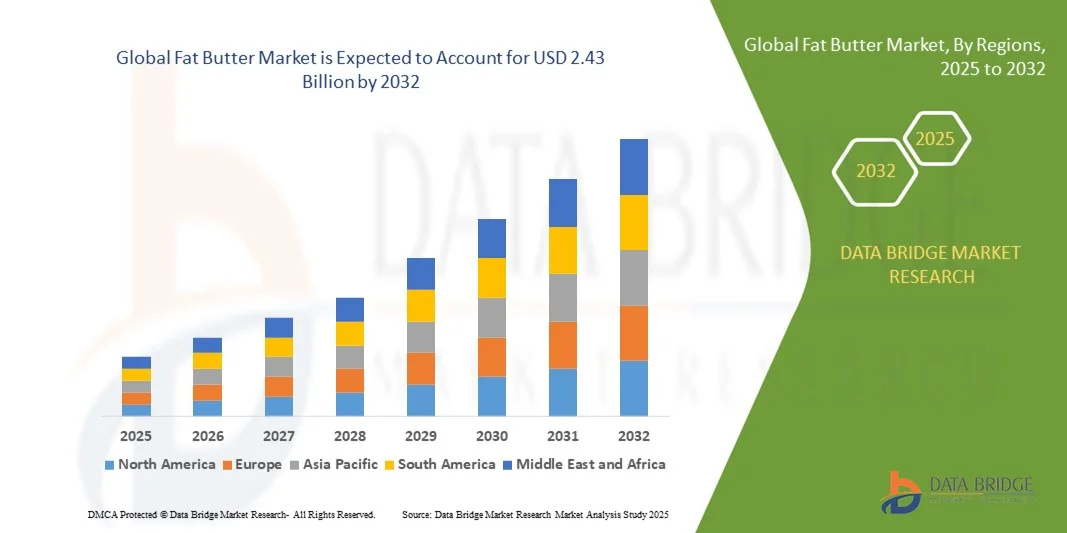

- The global fat butter market size was valued at USD 1.62 billion in 2024 and is expected to reach USD 2.43 billion by 2032, at a CAGR of 5.21% during the forecast period

- The market growth is largely fuelled by rising consumer preference for natural and high-quality dairy products, increasing demand from the bakery and confectionery sectors, and growing popularity of premium butter variants

- In addition, innovations in flavored, organic, and functional butter products, along with expanding distribution channels, are further supporting market expansion

Fat Butter Market Analysis

- The global fat butter market is witnessing steady growth, driven by increasing consumer preference for natural and high-quality dairy products, rising demand from the bakery and confectionery industries, and the growing popularity of premium spreads

- The market is also supported by innovations in product variants, including flavored and functional butter options, catering to diverse consumer tastes and health-conscious trends

- North America dominated the fat butter market with the largest revenue share in 2024, driven by rising demand for premium, artisanal, and natural butter products, as well as increasing consumption in bakery, confectionery, and foodservice industries

- Asia-Pacific region is expected to witness the highest growth rate in the global fat butter market, driven by expanding bakery and foodservice industries, increasing awareness of premium dairy products, and evolving consumer tastes toward natural and artisanal butter

- The unsalted segment held the largest market revenue share in 2024, driven by its widespread usage in bakery, confectionery, and gourmet cooking applications where precise flavor control is essential. Unsalted butter is preferred by manufacturers and chefs for its versatility and ability to enhance recipe outcomes

Report Scope and Fat Butter Market Segmentation

|

Attributes |

Fat Butter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fat Butter Market Trends

Increasing Preference for Premium and Artisanal Butter Products

- The growing consumer preference for natural, high-quality, and artisanal butter is transforming the fat butter market by encouraging the development of unique, premium variants. Consumers are increasingly choosing grass-fed, organic, and flavored butter for superior taste and perceived health benefits, driving demand across retail and foodservice channels. This trend is also promoting small-scale and boutique dairy producers, expanding product variety and supporting local economies

- The rising use of butter in bakery, confectionery, and gourmet cooking is accelerating market growth. Artisanal and specialty butter products are particularly sought after for premium desserts, pastries, and culinary applications where quality and flavor are critical. Increased collaboration between chefs, foodservice chains, and dairy brands is further boosting innovation and adoption of these products in culinary applications

- Innovations in packaging and product formats, such as portion-controlled packs, whipped variants, and blended flavors, are making butter more convenient and appealing to consumers. This supports frequent usage and helps maintain product freshness. Enhanced packaging also enables longer shelf life, better transportation, and reduced product wastage across retail and foodservice channels

- For instance, in 2023, several boutique dairy brands in Europe and North America reported strong sales growth in premium and flavored butter lines, driven by consumer demand for authentic and high-quality dairy products. The success of these products also encouraged other manufacturers to invest in artisanal variants, further expanding market diversity and consumer choice

- While premium and artisanal butter is expanding its market share, maintaining consistent supply of high-quality raw milk, managing production costs, and differentiating products remain key challenges. Manufacturers must balance traditional production methods with modern processing and marketing strategies to sustain growth, while also ensuring compliance with food safety standards and certifications to meet consumer expectations

Fat Butter Market Dynamics

Driver

Increasing Consumption of Butter in Bakery and Confectionery Industries

- The growing use of butter in bakery and confectionery applications is driving consistent demand across commercial and industrial sectors. Butter enhances flavor, texture, and shelf-life in baked goods, making it a preferred ingredient over margarine and other fat substitutes. Expansion of artisan bakeries, patisseries, and premium dessert outlets is further supporting steady market demand

- Rising consumer interest in natural and wholesome ingredients is further encouraging manufacturers to use real butter in premium baked products and desserts. This trend aligns with evolving dietary preferences and premiumization in food products. Marketing campaigns emphasizing authentic ingredients and health benefits are also helping drive consumer adoption

- Expanding foodservice and ready-to-eat product markets are supporting higher butter consumption, especially in urban regions where bakery and confectionery outlets are rapidly increasing. Growth in cafés, hotels, and restaurants is encouraging bulk purchases of butter, supporting the industrial and commercial segment of the market

- For instance, in 2022, several leading bakery chains in the U.S. and Europe increased their procurement of high-quality butter for pastries and specialty products, contributing to market growth. This trend also prompted manufacturers to scale production and innovate new variants to meet evolving culinary demands

- While demand is strong, the market requires careful management of production costs, supply chain efficiency, and adherence to food safety regulations to sustain long-term adoption. Manufacturers are investing in advanced processing, storage, and distribution systems to ensure product quality, consistency, and timely availability

Restraint/Challenge

Fluctuating Raw Milk Prices and Competition from Alternative Spreads

- Volatility in raw milk prices directly impacts butter production costs, creating challenges for manufacturers in maintaining stable pricing and profitability. Seasonal variations and supply shortages can exacerbate cost fluctuations. These price pressures may lead to increased retail prices, affecting demand in price-sensitive markets

- Competition from margarine, plant-based spreads, and other fat alternatives is limiting market expansion in price-sensitive segments. These substitutes often offer lower costs and longer shelf life, appealing to cost-conscious consumers. The growing plant-based and vegan product trends further intensify competition, especially in regions with high health and sustainability awareness

- Limited shelf life of butter, especially in premium and artisanal variants, poses logistical and storage challenges for producers and distributors, affecting product availability in remote or export markets. Temperature-sensitive storage requirements and transportation limitations increase operational complexity and costs

- For instance, in 2023, several dairy producers in India and Europe reported production slowdowns and higher retail prices due to rising milk costs, which affected overall butter consumption. Supply chain disruptions and export restrictions further constrained availability in certain markets, impacting sales growth

- While butter remains a popular dairy product, addressing supply volatility, pricing pressures, and alternative product competition is critical for maintaining market growth and consumer loyalty. Strategic sourcing, cost optimization, and product innovation are essential for manufacturers to remain competitive and sustain market share

Fat Butter Market Scope

The fat butter market is segmented on the basis of type, form, shape, fat content, packaging, application, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into salted and unsalted. The unsalted segment held the largest market revenue share in 2024, driven by its widespread usage in bakery, confectionery, and gourmet cooking applications where precise flavor control is essential. Unsalted butter is preferred by manufacturers and chefs for its versatility and ability to enhance recipe outcomes.

The salted segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for ready-to-use butter with enhanced taste and longer shelf life. Salted butter is particularly popular for household consumption and commercial applications where convenience and flavor consistency are key considerations.

- By Form

On the basis of form, the market is segmented into spreadable and non-spreadable. Spreadable butter held the largest share in 2024, fueled by its convenience for direct consumption and easy application on bread, pastries, and snacks.

Non-spreadable butter is expected to witness the fastest growth rate from 2025 to 2032, supported by its strong demand in baking, food processing, and industrial applications where controlled melting and precise measurements are required.

- By Shape

On the basis of shape, the market is segmented into block and sticks. Blocks held the largest revenue share in 2024 due to bulk usage in commercial kitchens and food processing units.

Sticks is expected to witness the fastest growth rate from 2025 to 2032, driven by consumer demand for portion-controlled packaging that supports convenience, easy melting, and precise culinary usage at home and in restaurants.

- By Fat Content

On the basis of fat content, the market is segmented into 15-40% fat content and 41-60% fat content. The 41-60% fat content segment held the largest market share in 2024, fueled by its richness in taste and suitability for premium bakery and confectionery applications.

The 15-40% fat content segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing consumer awareness regarding low-fat diets and demand for healthier butter alternatives.

- By Packaging

On the basis of packaging, the market is segmented into plastic tubs, carton packs, and bulk. Plastic tubs held the largest revenue share in 2024, driven by convenience, resealability, and popularity among household consumers.

Carton packs is expected to witness the fastest growth rate from 2025 to 2032, supported by eco-conscious consumer preferences and increasing adoption in commercial and industrial applications.

- By Application

On the basis of application, the market is segmented into household or residential and commercial. The household segment held the largest market share in 2024 due to high daily consumption and growing preference for premium butter variants in homes.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding bakery, confectionery, and foodservice sectors that rely heavily on butter for industrial-scale food preparation.

- By End User

On the basis of end user, the market is segmented into household, food service industry, and food industry. The household segment accounted for the largest share in 2024, supported by increasing demand for premium, artisanal, and flavored butter products for home cooking.

The food service industry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid expansion of restaurants, cafés, bakeries, and hotels using butter in culinary preparations.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct or B2B and indirect or B2C. The indirect or B2C segment held the largest market revenue share in 2024, fueled by supermarket, hypermarket, and online retail expansion.

The direct or B2B segment is expected to witness the fastest growth rate from 2025 to 2032, supported by bulk supply agreements with foodservice companies, bakeries, and industrial food manufacturers seeking reliable and consistent butter supplies.

Fat Butter Market Regional Analysis

- North America dominated the fat butter market with the largest revenue share in 2024, driven by rising demand for premium, artisanal, and natural butter products, as well as increasing consumption in bakery, confectionery, and foodservice industries

- Consumers in the region highly value the taste, quality, and versatility of butter, preferring grass-fed, organic, and flavored variants that enhance culinary experiences and perceived health benefits

- This widespread adoption is further supported by high disposable incomes, urbanized populations, and growing awareness of clean-label and sustainable dairy products, establishing butter as a staple in both household and commercial kitchens

U.S. Fat Butter Market Insight

The U.S. fat butter market captured the largest revenue share in North America in 2024, fueled by increasing usage in bakery, confectionery, and ready-to-eat products. Consumers are gravitating toward premium and artisanal butter variants, driving product innovation and diversification. Expanding foodservice chains and retail demand for convenient butter formats, such as spreadable tubs and portion-controlled packs, further propels market growth. In addition, the focus on natural, organic, and ethically sourced butter aligns with sustainability trends and health-conscious consumer preferences, enhancing market penetration.

Europe Fat Butter Market Insight

The Europe fat butter market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by rising consumer preference for artisanal and flavored butter products and increasing bakery and confectionery consumption. The region’s emphasis on premium, high-quality ingredients and culinary heritage is fostering butter demand. Innovative packaging, diverse product formats, and strong retail and foodservice networks are supporting widespread adoption across both household and commercial applications.

U.K. Fat Butter Market Insight

The U.K. fat butter market is expected to witness significant growth from 2025 to 2032, driven by premiumization trends, increasing demand for natural and organic dairy products, and expanding bakery and foodservice industries. Consumers are increasingly seeking butter with distinctive flavors, ethical sourcing, and eco-friendly packaging. The country’s developed retail infrastructure and online grocery penetration further facilitate market growth, making premium butter more accessible to a wider consumer base.

Germany Fat Butter Market Insight

The Germany fat butter market is expected to witness robust growth from 2025 to 2032, fueled by rising health-conscious consumption and strong bakery and confectionery sectors. German consumers show high preference for high-quality, sustainable, and locally sourced butter products. The market benefits from strong dairy farming practices, established supply chains, and growing demand for flavored and artisanal variants in both household and commercial segments.

Asia-Pacific Fat Butter Market Insight

The Asia-Pacific fat butter market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and evolving dietary preferences in countries such as China, India, and Japan. Growing demand for bakery, confectionery, and premium culinary products is accelerating butter consumption. In addition, expanding modern retail chains, foodservice networks, and awareness of high-quality, natural butter are supporting market penetration in both household and commercial applications.

Japan Fat Butter Market Insight

The Japan fat butter market is expected to witness steady growth from 2025 to 2032 due to the country’s focus on premium and artisanal food products, rising bakery and confectionery consumption, and strong culinary traditions. Consumers are increasingly adopting flavored and spreadable butter variants for home cooking and foodservice use. The integration of innovative packaging, portion-controlled formats, and high-quality dairy sourcing further enhances market demand.

China Fat Butter Market Insight

The China fat butter market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising middle-class population, and growing demand for premium and imported butter products. Butter consumption is increasing across bakery, confectionery, and household cooking applications. Expanding retail infrastructure, foodservice growth, and rising awareness of product quality, natural ingredients, and ethical sourcing are key factors propelling market growth.

Fat Butter Market Share

The Fat Butter industry is primarily led by well-established companies, including:

• Ornua (Ireland)

• Land O’Lakes, Inc. (U.S.)

• Arla Foods amba (Denmark)

• Agral S.A. (France)

• Upfield (Netherlands)

• Aurivo Co-operative Society Ltd. (Ireland)

• Saputo Inc. (Canada)

• GCMMF (India)

• Zyduswellness (India)

• Morrisons Ltd (U.K.)

• Connacht Gold (Ireland)

• ELVIR SAS (France)

• Finlandia Cheese, Inc. (U.S.)

• Goodman Fielder (Australia)

• Unilever (U.K.)

• Raisio Group (Finland)

• Savencia Fromage & Dairy (France)

Latest Developments in Global Fat Butter Market

- In April 2024, Lactalis introduced a new product, the Président Lighter Slightly Salted Spreadable Butter, in the UK and Ireland. This launch targets health-conscious consumers by offering a butter variant with 50% less fat compared to traditional options. The product is designed without vegetable oils, enhancing spreadability and maintaining authentic butter flavor. By catering to the growing demand for healthier and convenient dairy products, this innovation is expected to boost consumer adoption, strengthen Lactalis’s market presence, and drive growth in the premium and reduced-fat butter segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Reduced Fat Butter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Reduced Fat Butter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Reduced Fat Butter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.