Global Refrigeration Coolers Market

Market Size in USD Billion

CAGR :

%

USD

5.10 Billion

USD

7.65 Billion

2024

2032

USD

5.10 Billion

USD

7.65 Billion

2024

2032

| 2025 –2032 | |

| USD 5.10 Billion | |

| USD 7.65 Billion | |

|

|

|

|

Refrigeration Coolers Market Size

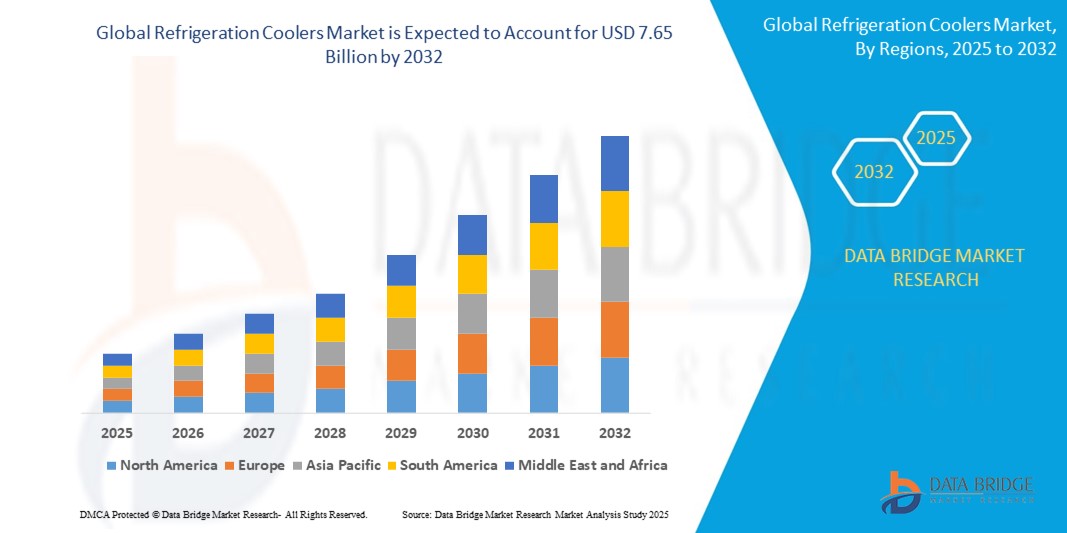

- The global refrigeration coolers market size was valued at USD 5.10 billion in 2024 and is expected to reach USD 7.65 billion by 2032, at a CAGR of 5.20% during the forecast period

- Market growth is primarily driven by rising demand in the food & beverage, healthcare, and logistics sectors, as well as increased global emphasis on cold chain infrastructure and the preservation of perishable goods

- In addition, advancements in energy-efficient cooling technologies, the adoption of natural refrigerants, and government incentives for green refrigeration solutions are significantly contributing to market expansion and creating new opportunities for manufacturers and suppliers

Refrigeration Coolers Market Analysis

- Refrigeration Coolers, essential for maintaining optimal temperatures in commercial and industrial environments, are becoming increasingly important in sectors such as food processing, pharmaceuticals, cold storage, and logistics, where temperature precision and reliability are critical

- The growing adoption of energy-efficient and eco-friendly cooling technologies, combined with stringent regulations on food safety and refrigerant usage, is propelling the demand for advanced refrigeration solutions across global markets

- In addition, the expansion of the organized retail and foodservice sectors, particularly in emerging economies, and the rising focus on sustainable refrigeration systems are key factors supporting the long-term growth of the refrigeration coolers industry

- North America dominates the refrigeration coolers market with the largest revenue share of 36.56% in 2024, driven by a growing demand for advanced refrigeration solutions across various application

- Asia-Pacific refrigeration coolers market is expected to grow at the fastest CAGR of over 24% in 2024, driven by rapid urbanization, a growing food and beverage industry, and rising disposable incomes in countries such as China, Japan, and India

- The commercial kitchen refrigeration segment held the largest market revenue share in 2024, driven by the growing demand from the hospitality and foodservice sectors for efficient, space-optimized, and energy-saving refrigeration solutions. The rise in quick-service restaurants and central kitchens further accelerates this segment

Report Scope and Refrigeration Coolers Market Segmentation

|

Attributes |

Refrigeration Coolers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Refrigeration Coolers Market Trends

“Growing Focus on Energy Efficiency and Smart Technology Integration”

- A significant trend in the global refrigeration coolers market is the increasing emphasis on energy efficiency due to rising energy costs and environmental concerns. This is driving the adoption of advanced technologies such as variable-speed compressors and electronic expansion valves

- For instance, Emerson introduced its Copeland variable speed reciprocating compressors, which offer energy savings up to 30% in commercial refrigeration applications

- The integration of smart technologies and IoT connectivity is another key trend. Modern refrigeration coolers are increasingly equipped with sensors and cloud-based monitoring platforms, allowing for real-time data tracking and predictive maintenance

- In cold chain logistics, companies such as Carrier Transicold are leveraging AI-powered telematics platforms such as Lynx Fleet, enabling optimized load control and real-time alerts for cargo safety

- Another emerging trend is the growing demand for refrigeration systems using natural refrigerants such as CO2 and ammonia, driven by stricter regulations on synthetic refrigerants with high global warming potential. Several companies are now offering coolers that utilize these eco-friendly refrigerants

Refrigeration Coolers Market Dynamics

Driver

“Rising Demand across End-Use Industries and Expansion of Cold Chain”

- The global refrigeration coolers market is primarily driven by the increasing demand from various end-use industries such as food and beverage, pharmaceuticals, and retail. The need for proper storage solutions to maintain product freshness and quality is a major factor

- For instance, Nestlé and PepsiCo have scaled up their cold chain investments across Southeast Asia and Africa to meet growing demand for processed and frozen food

- The cold chain infrastructure is rapidly expanding in emerging markets such as India, Brazil, and Indonesia, driven by government support. In 2023, the Indian government launched PM Gati Shakti, a USD 1.2 trillion infrastructure project that includes cold storage networks

- The pharmaceutical industry is also a significant contributor, especially with increasing needs for cold storage post-pandemic. For instance, Pfizer expanded its cold storage footprint in the U.S. and Europe to support mRNA-based drug production

- Furthermore, increasing investments in energy-efficient refrigeration technologies due to government regulations and sustainability initiatives are boosting the market

Restraint/Challenge

“Stringent Regulations and High Initial Costs”

- A major challenge facing the refrigeration coolers market is the increasing stringency of regulations concerning energy efficiency and the phase-out of certain refrigerants with high environmental impact. Compliance with these regulations can lead to increased costs for manufacturers and end-users

- For instance, the EU F-Gas Regulation (2024 revision) mandates tighter quotas on HFCs and promotes natural refrigerants, affecting both OEMs and end-users

- The high initial cost of advanced and energy-efficient refrigeration systems can be a barrier to adoption, particularly for smaller businesses and in price-sensitive markets. While the long-term operational cost savings can be significant, the upfront investment can be a deterrent

- Shortages of skilled technicians for the installation, maintenance, and repair of complex refrigeration systems can also pose a challenge to market growth

- Raising awareness among end-users about the importance of regular maintenance and the benefits of investing in energy-efficient equipment remains a challenge in some region

Refrigeration Coolers Market Scope

The market is segmented on the basis of product type, application, component type, system type, capacity, and refrigeration coolant type.

• By Product Type

On the basis of product type, the refrigeration coolers market is segmented into deep freezers, bottle coolers, display showcases, storage water coolers, commercial kitchen refrigeration, transportation refrigeration equipment, ice merchandisers & ice vending equipment, medical refrigeration, chest refrigeration, and other product types. The commercial kitchen refrigeration segment held the largest market revenue share in 2024, driven by the growing demand from the hospitality and foodservice sectors for efficient, space-optimized, and energy-saving refrigeration solutions. The rise in quick-service restaurants and central kitchens further accelerates this segment.

The medical refrigeration segment is expected to witness the fastest CAGR from 2025 to 2032, owing to increasing investments in healthcare infrastructure and the need for specialized cold storage solutions for vaccines, biologics, and other temperature-sensitive medications.

• By Application

On the basis of application, the refrigeration coolers market is segmented into commercial refrigeration and industrial refrigeration. The commercial refrigeration segment dominated the market in 2024, fueled by widespread use across food & beverage retail outlets, supermarkets, and convenience stores. The increasing demand for chilled and frozen foods and beverages is a key growth driver.

The industrial refrigeration segment is projected to experience the highest growth during the forecast period, driven by increased cold storage demand in food processing, dairy, meat, and pharmaceutical industries.

• By Component Type

On the basis of component type, the market is segmented into evaporators & air coolers and condensers. The evaporators & air coolers segment held the largest market share in 2024, due to their critical role in maintaining internal temperature and air distribution across commercial and industrial cooling units.

The condensers segment is expected to grow steadily owing to ongoing innovations in energy efficiency and the increased adoption of low-noise, compact condenser units in urban commercial spaces.

• By System Type

On the basis of system type, the refrigeration coolers market is segmented into self-contained refrigerator and remotely operated refrigerator. The self-contained refrigerator segment dominated the market in 2024, favored for its plug-and-play installation, low maintenance, and suitability for small retail setups and cafes.

The remotely operated refrigerator segment is anticipated to grow at the fastest rate due to the increasing need for centralized temperature monitoring, predictive maintenance, and smart IoT-enabled operations in large commercial and industrial facilities.

• By Capacity

On the basis of capacity, the market is segmented into less than 50 cu. ft, 50 cu. ft to 100 cu. ft, and more than 100 cu. ft. The more than 100 cu. ft segment held the largest revenue share in 2024, driven by demand from warehouses, large restaurants, and bulk storage facilities requiring high-capacity cooling systems.

The 50 cu. ft to 100 cu. ft segment is expected to grow at a significant CAGR, supported by its suitability for mid-sized enterprises seeking an optimal balance between capacity and energy efficiency.

• By Refrigeration Coolant Type

On the basis of refrigeration coolant type, the market is segmented into hydro fluorocarbon (HFC) or hydro fluoroolefin (HFO), ammonia (NH₃) refrigerant, carbon dioxide (CO₂) refrigerant, glycol refrigerant, and other coolants or refrigerants. The HFC/HFO segment accounted for the largest market share in 2024, due to their widespread use in commercial applications and established supply chains.

The CO₂ refrigerant segment is projected to witness the fastest growth from 2025 to 2032, driven by the global shift towards eco-friendly alternatives with low global warming potential (GWP) and regulatory support for natural refrigerants.

Refrigeration Coolers Market Regional Analysis

- North America dominates the refrigeration coolers market with the largest revenue share of 36.56% in 2024, driven by a growing demand for advanced refrigeration solutions across various applications

- Consumers and businesses in the region highly value energy efficiency, advanced cooling features, and reliable performance offered by modern refrigeration coolers

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for efficient cooling solutions in both residential and commercial properties

U.S. Refrigeration Coolers Market Insight

The U.S. refrigeration coolers market captured the largest revenue share within North America in 2024, fueled by the increasing demand from the food and beverage industry, healthcare sector, and residential applications. Consumers and businesses are increasingly prioritizing energy-efficient and high-performance refrigeration solutions. The growing preference for advanced features, combined with a robust demand across various end-use sectors, further propels the refrigeration coolers industry in the U.S.

Europe Refrigeration Coolers Market Insight

The European refrigeration coolers market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent energy efficiency regulations and the increasing focus on sustainable cooling solutions. The rise in the food and beverage industry, coupled with the demand for efficient refrigeration in retail and healthcare, is fostering the adoption of refrigeration coolers. European consumers and businesses are also drawn to the energy savings and environmental benefits these coolers offer.

U.K. Refrigeration Coolers Market Insight

U.K. refrigeration coolers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the consistent demand from the food retail sector, hospitality industry, and increasing household adoption of advanced refrigeration technologies. In addition, concerns regarding food waste and the desire for efficient cooling solutions for both commercial and residential use are encouraging the adoption of modern refrigeration coolers.

Germany Refrigeration Coolers Market Insight

German refrigeration coolers market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's strong focus on energy efficiency and technological innovation in cooling solutions. Germany’s well-developed infrastructure and emphasis on sustainability promote the adoption of advanced refrigeration coolers, particularly in commercial and industrial applications.

Asia-Pacific Refrigeration Coolers Market Insight

Asia-Pacific refrigeration coolers market is expected to grow at the fastest CAGR of over 24% in 2024, driven by rapid urbanization, a growing food and beverage industry, and rising disposable incomes in countries such as China, Japan, and India. The region's increasing demand for processed and packaged food, along with the expansion of the retail sector and cold chain infrastructure, is driving the adoption of refrigeration coolers.

Japan Refrigeration Coolers Market Insight

The Japan refrigeration coolers market is gaining momentum due to the country’s high focus on energy conservation and demand for reliable cooling solutions in food retail, healthcare, and commercial sectors. The Japanese market places a significant emphasis on quality and efficiency, and the adoption of advanced refrigeration coolers is driven by the need for precise temperature control and energy savings.

China Refrigeration Coolers Market Insight

The China refrigeration coolers market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's massive food processing and retail sectors, rapid urbanization, and increasing consumer demand for chilled and frozen products. The expanding cold chain infrastructure and the availability of a wide range of refrigeration cooler options are key factors propelling the market in China.

Refrigeration Coolers Market Share

The Refrigeration Coolers industry is primarily led by well-established companies, including:

- Johnson Controls (Ireland)

- Lennox International (U.S.)

- LU-VE Group (Italy)

- Rivacold (Italy)

- Kelvion Holding GmbH (Germany)

- Copeland (U.S.)

- Danfoss (Denmark)

- Daikin (Japan)

- Guntner (Germany)

- Thermofin (Canada)

- Evapco (U.S.)

- Modine Manufacturing (U.S.)

- Profroid (France)

- Thermokey (Italy)

- Cabero (Germany)

- ONDA (Italy)

- Roen Est (Italy)

- KFL (Italy)

- Baltimore Air Coil Company (U.S.)

- Friterm (Turkey) (Istanbul)

- Centauro International (Portugal)

- Stefani (Italy)

- Walter Roller (Germany)

Latest Developments in Global Refrigeration Coolers Market

- In November 2024, Kelvion introduced its brazed plate heat exchanger, GB 790, designed for superior energy efficiency. Compatible with natural refrigerants, this model supports a range of applications including data center liquid cooling, heat pumps, and industrial cooling. As part of the GBS and GBH series, it enhances energy and cost performance, reinforcing the company’s commitment to sustainable solutions

- In October 2024, Johnson Controls launched the PENN System 550, a modular electronic control solution for temperature, humidity, and pressure regulation. This intuitive system is the first to offer A2L refrigerant leak detection and mitigation features, along with optional two-way cloud connectivity. It enables building managers and HVAC professionals to comply with low-GWP refrigerant regulations effective from January 1, 2025

- In June 2024, the merger of Sest S.p.A. and Air Hex Alonte S.J. into LU-VE S.p.A. was officially approved. The move aimed to streamline internal operations, reduce costs, simplify the corporate structure, and improve overall efficiency and management from economic and financial perspectives

- In March 2024, Kelvion entered into a strategic partnership with Rosseau, a leader in immersion cooling, to transform liquid cooling systems in the High-Performance Computing (HPC) sector, beginning with bitcoin mining. This collaboration seeks to set new industry benchmarks in power density, efficiency, and thermal performance

- In October 2022, LU-VE announced the start of heat exchanger production at its Mel plant in Belluno, Italy, a facility acquired from Wanbao ACC in July 2022. The site now operates three production lines and plans to expand further, focusing on manufacturing static heat exchangers for refrigerated counters, air conditioners, chillers, and heat pumps, complementing operations at LU-VE’s Limana facility

- In May 2021, Johnson Controls completed the acquisition of Silent-Aire, a Canadian company specializing in custom air handlers and modular data centers for hyperscale cloud and colocation providers. This acquisition enhances Johnson Controls’ ability to deliver scalable, high-quality, and rapid-deployment infrastructure for data center clients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Refrigeration Coolers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Refrigeration Coolers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Refrigeration Coolers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.