Global Refurbished Medical Device Market

Market Size in USD Billion

CAGR :

%

USD

16.91 Billion

USD

41.30 Billion

2024

2032

USD

16.91 Billion

USD

41.30 Billion

2024

2032

| 2025 –2032 | |

| USD 16.91 Billion | |

| USD 41.30 Billion | |

|

|

|

|

Refurbished Medical Device Market Size

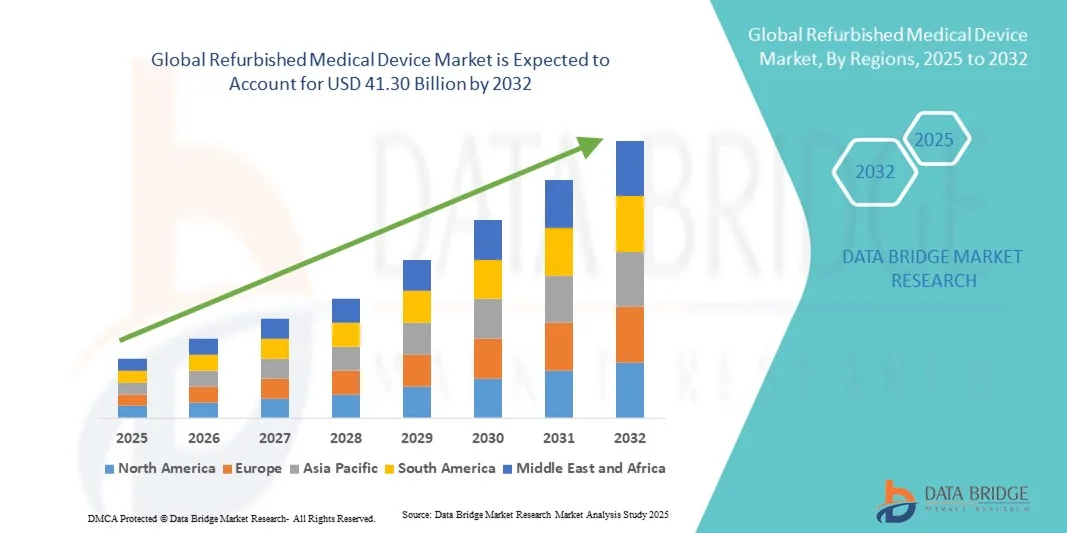

- The global refurbished medical device market size was valued at USD 16.91 billion in 2024 and is expected to reach USD 41.30 billion by 2032, at a CAGR of 11.81% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in medical devices, increasing demand for cost-effective healthcare solutions, and rising digitalization across hospitals, clinics, and diagnostic centres

- Furthermore, increasing healthcare expenditure, the need for affordable and reliable medical equipment, and rising awareness among healthcare providers about the benefits of refurbished devices are driving the adoption of Refurbished Medical Devices. These converging factors are accelerating market uptake, thereby significantly boosting the industry’s growth

Refurbished Medical Device Market Analysis

- Refurbished medical equipment, encompassing pre-owned devices that have been restored to original manufacturer specifications, is gaining traction in healthcare settings worldwide. This trend is driven by the need for cost-effective solutions without compromising on quality or performance. Refurbished equipment offers hospitals, clinics, and diagnostic centers access to advanced technologies at a fraction of the cost of new devices. The process involves thorough inspection, repair, and certification to meet stringent standards, ensuring reliability and safety

- The growing adoption of refurbished medical equipment is primarily fueled by the escalating demand for affordable healthcare solutions, particularly in emerging economies. Healthcare providers are increasingly seeking ways to optimize budgets while maintaining high-quality care standards. Refurbished devices provide a practical alternative, allowing institutions to acquire advanced equipment without the financial strain associated with new purchases. In addition, advancements in refurbishment technologies and quality assurance processes have enhanced the appeal of refurbished equipment

- North America dominated the refurbished medical equipment market with the largest revenue share of 40.52% in 2024. This dominance is attributed to the region's advanced healthcare infrastructure, early adoption of innovative medical technologies, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region in the refurbished medical equipment market during the forecast period. Countries such as China, India, and Japan are experiencing rapid urbanization, rising disposable incomes, and an expansion of healthcare infrastructure. These factors contribute to an increased demand for medical devices, including refurbished equipment, as healthcare providers seek affordable alternatives to new devices. The region's growing healthcare needs and budget constraints make refurbished medical equipment an attractive option

- The Diagnostic segment dominated the refurbished medical equipment market with a revenue share of 55.4% in 2024. This segment includes imaging systems, laboratory analyzers, and patient monitoring devices that facilitate early detection, routine assessments, and preventive care

Report Scope and Refurbished Medical Device Market Segmentation

|

Attributes |

Refurbished Medical Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Refurbished Medical Device Market Trends

Rising Adoption of Cost-Effective and High-Quality Medical Equipment

- A significant and accelerating trend in the global refurbished medical device market is the growing reliance on pre-owned medical devices that have been restored to original manufacturer specifications. These devices allow healthcare providers to access advanced technology at a fraction of the cost of new equipment, which is particularly important in emerging economies and smaller clinics

- Refurbished devices now cover a wide spectrum of medical equipment, including imaging systems (MRI, CT, X-ray), diagnostic instruments, surgical tools, infusion pumps, and patient monitoring systems. The increasing availability of diverse device categories is helping hospitals optimize workflows and expand service offerings without significant capital investment

- For instance, in 2023, GE Healthcare launched a program offering refurbished MRI and ultrasound systems across hospitals in Southeast Asia, enabling facilities to deploy advanced diagnostic tools at lower costs

- Technological advancements in the refurbishment process, including detailed inspection protocols, component replacement, software updates, and rigorous safety testing, ensure that these devices meet or exceed industry standards. This improves end-user confidence and encourages broader adoption

- In another instance, Philips’ certified refurbished imaging program supplied over 200 CT and X-ray systems to clinics in India in 2024, enhancing access to diagnostic care while reducing procurement costs

- The COVID-19 pandemic accelerated the adoption of refurbished medical devices, as healthcare facilities faced urgent demand for ventilators, monitoring equipment, and diagnostic tools. This temporary surge highlighted the long-term value of refurbished equipment in managing sudden surges in healthcare needs

- Environmental sustainability is another key trend driving the market, as refurbished devices reduce electronic waste and support circular economy initiatives in healthcare. Many hospitals are now incorporating refurbished equipment into their sustainability strategies, further boosting adoption

- Partnerships between original equipment manufacturers (OEMs) and certified refurbishment companies are increasing, ensuring that refurbished devices retain quality and reliability, which further reinforces market credibility

Refurbished Medical Device Market Dynamics

Driver

Growing Demand Driven by Cost Constraints and Expanding Healthcare Infrastructure

- The primary driver of the refurbished medical device market is the rising need for affordable healthcare solutions amid increasing healthcare expenditure globally. Healthcare providers, particularly in developing nations, are leveraging refurbished equipment to maintain quality care while staying within budget limits

- Expanding healthcare infrastructure in emerging economies is fueling demand, as new hospitals, diagnostic centers, and home care facilities often face budgetary constraints. Refurbished medical equipment allows these facilities to access advanced technology without the financial burden of new equipment

- For instance, In April 2024, multiple hospitals in India and Southeast Asia procured refurbished MRI and ultrasound machines to expand diagnostic capabilities, reflecting the practicality and cost-efficiency of refurbished solutions

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is driving demand for diagnostic and monitoring equipment, which can be effectively met by refurbished devices. This trend is particularly strong in regions with limited healthcare budgets

- Healthcare providers are increasingly seeking ways to optimize asset utilization, and refurbished equipment enables facilities to replace outdated devices or expand capacity without significant capital investment

- Budget-conscious clinics and small healthcare facilities prefer refurbished devices with warranties and post-sale support, as they offer reliability and cost advantages compared to purchasing new systems

- The market is also driven by government initiatives and subsidies in certain countries to encourage the adoption of affordable medical technologies, which often include refurbished equipment as a viable option

Restraint/Challenge

Concerns Regarding Quality Assurance, Warranty, and Regulatory Compliance

- Despite the advantages, adoption of refurbished medical equipment is restrained by concerns related to quality, reliability, and regulatory compliance. Healthcare providers are sometimes hesitant to invest due to fears of device malfunction, shorter life span, or insufficient post-sale support

- Regulatory standards for refurbished medical devices vary across regions

- For instance, the U.S. FDA, EU CE marking, and other local authorities have differing requirements for certification, inspection, and documentation, making global distribution challenging

- Warranty and after-sales support are significant concerns; hospitals often require assurances that refurbished devices will operate reliably over time. Some facilities are hesitant to adopt equipment without extended warranty options or access to certified maintenance services

- Negative perceptions or lack of awareness about refurbishment processes can limit market growth. Some healthcare decision-makers mistakenly assume refurbished devices are of lower quality, despite industry-standard testing and certification practices

- Supply chain limitations and inconsistent availability of refurbished devices in certain regions can also hinder adoption, particularly for specialized equipment like MRI or PET scanners.

- The complexity of integrating refurbished devices with existing hospital IT systems and digital infrastructure may pose operational challenges, especially when software updates or compatibility with other medical devices are required

- Overcoming these challenges requires rigorous quality assurance, transparent certification, training programs for hospital staff, and clear communication about device reliability and performance standards

Refurbished Medical Device Market Scope

The market is segmented on the basis of product, application, and end users

- By Product

On the basis of product, the refurbished medical device market is segmented into medical imaging equipment and operating room and surgical equipment, patient monitors, cardiology equipment, urology equipment, neurology equipment, intensive care equipment, endoscopy equipment, and others. The Medical Imaging Equipment segment dominated the global refurbished medical device market with a revenue share of 38.6% in 2024. This segment includes MRI machines, CT scanners, X-ray systems, and ultrasound devices, which are essential for accurate diagnosis in hospitals and diagnostic centers. The high cost of new imaging systems has driven healthcare providers to adopt refurbished alternatives, allowing access to advanced technology at lower capital expenditure. Refurbished imaging equipment undergoes strict testing, recalibration, and OEM certification to ensure reliability and safety. Hospitals in emerging regions, particularly Asia-Pacific and Latin America, are deploying refurbished imaging systems to expand diagnostic services without financial strain. In addition, refurbished imaging devices enable smaller clinics and outpatient centers to provide high-quality diagnostic care comparable to large hospitals. The segment’s demand is further driven by increasing chronic disease prevalence, aging populations, and government initiatives to improve healthcare access. Technological upgrades in refurbished imaging devices, such as enhanced software and network connectivity, support better integration with hospital IT systems. Environmental sustainability initiatives also encourage the adoption of refurbished equipment.

The Operating Room and Surgical Equipment segment is anticipated to witness the fastest CAGR of 21.3% from 2025 to 2032. This includes surgical tables, anesthesia machines, electrosurgical units, and laparoscopic instruments. Hospitals and surgical centers increasingly prefer refurbished equipment to expand surgical capabilities while optimizing budgets. Refurbished surgical devices offer the same functionality as new equipment, with warranties and certifications ensuring safety and reliability. Adoption is particularly high in emerging economies where capital expenditure for new surgical devices is limited. The segment benefits from rising surgical volumes, increasing outpatient procedures, and expansion of specialty hospitals. Refurbished surgical equipment allows rapid deployment and flexibility for hospitals upgrading operating rooms. Technological refurbishments, including component replacement and software updates, enhance device longevity and usability. Government programs promoting affordable healthcare infrastructure also support the growth of this segment. Partnerships between OEMs and refurbishment companies ensure quality and post-sale service. The segment’s growth is supported by hospitals’ increasing preference for cost-effective yet reliable surgical solutions.

- By Application

On the basis of application, the Refurbished Medical Device market is segmented into diagnostic and therapeutic applications. The Diagnostic segment dominated the market with a revenue share of 55.4% in 2024. This segment includes imaging systems, laboratory analyzers, and patient monitoring devices that facilitate early detection, routine assessments, and preventive care. Hospitals, clinics, and diagnostic centers widely adopt refurbished diagnostic equipment to reduce operational costs while maintaining high-quality services. The segment is driven by the increasing prevalence of chronic diseases, growing patient awareness, and expanding healthcare infrastructure in emerging economies. Refurbished diagnostic devices ensure compliance with safety and accuracy standards through OEM certification. The growing need for diagnostic imaging in both inpatient and outpatient settings further strengthens adoption. Technological upgrades and integration capabilities enhance the value proposition of refurbished diagnostic equipment. OEM-certified refurbishment programs improve trust among healthcare providers. Hospitals can deploy multiple devices simultaneously, optimizing patient throughput without excessive expenditure. The demand is particularly high in countries where healthcare budgets are constrained but patient volumes are large.

The Therapeutic segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032. This segment includes surgical equipment, intensive care devices, cardiology equipment, and physiotherapy devices. Refurbished therapeutic equipment allows hospitals and specialty centers to provide advanced treatment at reduced costs while ensuring safety and operational efficiency. Growth is driven by rising numbers of surgeries, expanding ICU capacities, and the increasing prevalence of chronic diseases worldwide. Technological refurbishments, component replacement, and updated software enhance device functionality. The segment benefits from the rising adoption of outpatient treatment centers and specialty clinics. OEM-certified refurbished devices improve confidence and reliability. Refurbished therapeutic equipment also supports hospitals in managing replacement cycles cost-effectively. Budget-conscious healthcare providers prefer refurbished therapeutic devices to maintain quality care. Government initiatives promoting affordable healthcare infrastructure further support the growth of this segment.

- By End Users

On the basis of end users, the Refurbished Medical Device market is segmented into Hospitals, Clinics, Diagnostic Centres, and Others. The Hospitals segment dominated the market with a share of 46.2% in 2024, owing to their large-scale operations and continuous need for multiple types of medical devices. Hospitals adopt refurbished medical equipment to optimize budgets, expand capacity, and enhance patient care. Refurbished devices allow hospitals to deploy advanced imaging, monitoring, surgical, and therapeutic equipment without heavy capital investment. Both public and private hospitals in developed and emerging regions are actively adopting refurbished devices. OEM certification and post-sale support assure hospitals of quality and reliability. High patient volumes and the increasing need for modern diagnostics drive demand. Refurbished equipment helps hospitals manage replacement cycles efficiently. Integration with hospital IT systems and compatibility with existing devices enhance usability. Environmental sustainability initiatives further encourage adoption.

The Clinics segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2032, especially multi-specialty and outpatient clinics. Refurbished medical equipment allows clinics to expand services, provide advanced diagnostics, and improve patient care cost-effectively. Growth is supported by the rising number of specialty clinics, increasing outpatient procedures, and the need for budget-friendly equipment solutions. OEM-certified refurbished devices ensure operational efficiency and compliance with safety standards, resulting in more cost-efficient output. In addition, the integration of refurbished devices with modern healthcare IT systems enables clinics to streamline patient data management and improve overall workflow efficiency, further enhancing service quality and operational productivity.

Refurbished Medical Device Market Regional Analysis

- North America dominated the refurbished medical device market with the largest revenue share of 40.52% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative medical technologies, and a strong presence of key industry players

- The region has witnessed significant uptake of refurbished medical equipment in hospitals, clinics, and diagnostic centers, supported by both established companies and startups focusing on AI-enabled and voice-activated features. The preference for cost-effective solutions amid rising healthcare expenditures further accelerates market growth

- Consumers and healthcare providers in the region highly value the affordability, reliability, and enhanced functionality offered by refurbished medical devices, which provide a practical alternative to new equipment without compromising on quality. The widespread adoption is further supported by technological awareness, increasing demand for digital healthcare solutions, and a growing focus on efficient patient care delivery

U.S. Refurbished Medical Device Market Insight

The U.S. refurbished medical device market captured the largest revenue share within North America in 2024, fueled by rapid adoption in hospitals, clinics, and homecare facilities. Innovations in AI-enabled monitoring systems, predictive analytics, and voice-activated features are driving the preference for refurbished equipment. The combination of cost efficiency, technological advancement, and high-quality standards has strengthened market expansion across both clinical and residential care settings

Europe Refurbished Medical Device Market Insight

The Europe refurbished medical device market is projected to expand at a substantial CAGR throughout the forecast period, fueled by a combination of stringent healthcare regulations, growing awareness of cost-effective medical solutions, and the increasing adoption of technologically advanced refurbished equipment across hospitals and clinics. Healthcare providers are actively seeking high-quality, reliable medical devices that offer reduced costs without compromising patient care, driving widespread market acceptance. In addition, the emphasis on sustainable and eco-friendly practices in the medical sector is further supporting the growth of refurbished equipment across the region.

U.K. Refurbished Medical Device Market Insight

The U.K. refurbished medical device market is expected to grow at a noteworthy CAGR, bolstered by a well-developed healthcare infrastructure and a strong focus on budget-friendly medical solutions. Hospitals, diagnostic centers, and clinics are increasingly turning to refurbished devices as a practical alternative to new equipment, allowing them to enhance operational efficiency and manage rising healthcare costs. The growing confidence in the quality, reliability, and regulatory compliance of refurbished medical equipment is also contributing to market expansion.

Germany Refurbished Medical Device Market Insight

The Germany refurbished medical device market is anticipated to expand steadily during the forecast period, driven by ongoing technological innovations in medical equipment, strong adoption of eco-conscious practices, and rising awareness of the financial and operational benefits of refurbished solutions among healthcare providers. Hospitals and clinical facilities are increasingly investing in refurbished medical devices to optimize costs, ensure high-quality patient care, and integrate advanced features such as AI-enabled monitoring and automated diagnostics, further supporting sustainable market growth.

Asia-Pacific Refurbished Medical Device Market Insight

The Asia-Pacific refurbished medical device market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding healthcare infrastructure in countries such as China, India, and Japan. The region’s increasing demand for affordable and reliable medical devices, coupled with limited healthcare budgets, is propelling the adoption of refurbished equipment.

Japan Refurbished Medical Device Market Insight

The Japanese refurbished medical device market is gaining momentum due to high-tech healthcare culture, an aging population, and growing adoption of refurbished medical devices in hospitals and clinics. The focus on cost-effective solutions that maintain quality and reliability supports the expanding use of refurbished equipment in clinical settings.

China Refurbished Medical Device Market Insight

China refurbished medical device market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding middle-class population, rising healthcare needs, and increasing adoption of cost-efficient refurbished medical equipment. Hospitals, clinics, and diagnostic centers are increasingly deploying refurbished devices to meet growing healthcare demand while optimizing expenditure.

Refurbished Medical Device Market Share

The Refurbished Medical Device industry is primarily led by well-established companies, including:

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Soma Tech Intl (U.S.)

- Avante Health Solutions (U.S.)

- Block Imaging, Inc. (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Mindray (China)

- Drägerwerk AG (Germany)

- Agito Medical (Denmark)

- Amber Diagnostics (U.S.)

- Integrity Medical Systems (U.S.)

- Master Medical Equipment (U.S.)

- US Med-Equip (U.S.)

- Skanray Technologies (India)

- Radio Oncology Systems (U.S.)

- TRACO (Switzerland)

- First Source (India)

- Everx Pvt. Ltd. (India)

- Hilditch Group (U.K.)

Latest Developments in Global Refurbished Medical Device Market

- In February 2022, Avista Capital Partners announced the acquisition of Probo Medical, a leading provider of refurbished medical imaging equipment and services. The transaction aimed to enhance Probo's capabilities in offering cost-effective solutions to healthcare providers

- In April 2023, Probo Medical expanded its service offerings by acquiring Ultra Select Medical, a provider of ultrasound equipment sales, service, and training. This acquisition allowed Probo to broaden its reach and enhance its service capabilities in the ultrasound equipment sector

- In August 2022, Probo Medical further strengthened its position in the European market by acquiring Mi Healthcare, a UK-based provider of medical imaging equipment and services. This acquisition enabled Probo to extend its diagnostic imaging equipment sales, rentals, and service capabilities throughout the UK

- In April 2022, Probo Medical acquired Canute Medical, a Canadian service provider specializing in the installation, de-installation, and remarketing of pre-owned medical equipment. This acquisition expanded Probo's presence in Canada and enhanced its service offerings in the region

- In February 2024, Probo Medical acquired Alpha Source Group, a provider of technical field service, depot repair, equipment refurbishment, and parts distribution services for diagnostic imaging equipment. This acquisition added over 100 field-based engineers to Probo's workforce and expanded its service capabilities across North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.