Global Relapsed Or Refractory Diffuse Large B Cell Lymphoma Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

2.21 Billion

2025

2033

USD

1.89 Billion

USD

2.21 Billion

2025

2033

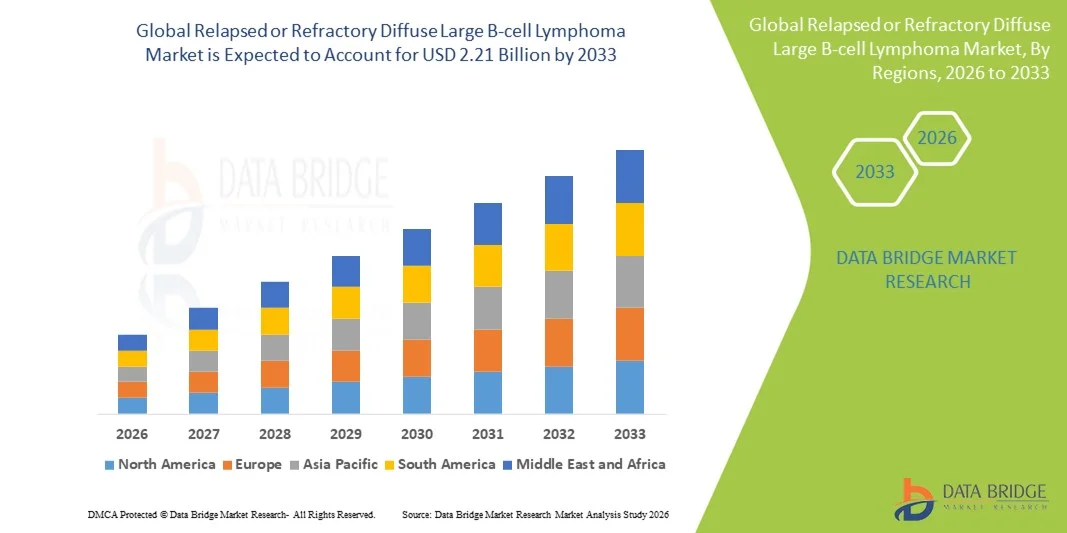

| 2026 –2033 | |

| USD 1.89 Billion | |

| USD 2.21 Billion | |

|

|

|

|

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Size

- The global Relapsed or Refractory Diffuse Large B-cell Lymphoma market size was valued at USD 1.89 billion in 2025 and is expected to reach USD 2.21 billion by 2033, at a CAGR of 8.1% during the forecast period

- The market growth is largely fueled by the rising incidence of diffuse large B-cell lymphoma, increased awareness, and growing adoption of advanced therapies such as CAR-T cell therapies, antibody-drug conjugates, and immunomodulatory agents

- Furthermore, increasing investment by pharmaceutical companies in novel and personalized treatment options, coupled with ongoing research and development, is driving the expansion of treatment availability and accessibility, thereby significantly boosting the industry's growth

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Analysis

- Relapsed or Refractory Diffuse Large B-cell Lymphoma is an aggressive subtype of non-Hodgkin lymphoma, with therapies including CAR-T cell treatments, monoclonal antibodies, and small-molecule targeted agents, increasingly recognized for their role in improving patient outcomes in both hospital and specialty clinic settings

- The escalating demand for Relapsed or Refractory Diffuse Large B-cell Lymphoma therapies is primarily driven by the rising incidence of DLBCL, increased patient awareness, and the adoption of advanced therapies such as CAR-T, bispecific antibodies, and antibody-drug conjugates

- North America dominated the Relapsed or Refractory Diffuse Large B-cell Lymphoma market with the largest revenue share of 39.1% in 2025, characterized by a strong healthcare infrastructure, high access to advanced therapies, and extensive clinical trial networks, with the U.S. experiencing substantial growth in adoption of novel therapies, particularly CAR-T and personalized medicine approaches

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, due to improving healthcare access, growing oncology infrastructure, rising investments in clinical trials, and increasing patient awareness

- Monjuvi segment dominated the Relapsed or Refractory Diffuse Large B-cell Lymphoma market with a market share of 29.7% in 2025, driven by its growing adoption for relapsed or refractory patients, strong clinical efficacy, and increasing regulatory approvals facilitating broader availability

Report Scope and Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Segmentation

|

Attributes |

Relapsed or Refractory Diffuse Large B-cell Lymphoma Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Trends

Advancements in CAR-T and Bispecific Antibody Therapies

- A significant and accelerating trend in the Relapsed or Refractory Diffuse Large B-cell Lymphoma market is the rapid adoption of CAR-T cell therapies and bispecific antibodies, which are increasingly improving patient outcomes and expanding treatment options

- For instance, Kymriah and Yescarta have demonstrated durable responses in relapsed or refractory patients, making these therapies preferred choices in hospital oncology settings

- These advanced therapies enable targeted and personalized treatment approaches, reducing relapse rates and enhancing overall survival; bispecific antibodies, such as Mosunetuzumab, provide off-the-shelf alternatives that can be administered more conveniently than autologous CAR-T therapies

- The integration of novel therapies with existing treatment regimens allows oncologists to tailor care plans based on patient genetics, prior treatment response, and disease progression, improving clinical efficacy and patient quality of life

- This trend towards personalized, highly effective therapies is reshaping treatment protocols, prompting pharmaceutical companies such as Bristol Myers Squibb and Gilead to invest in next-generation CAR-T and bispecific antibody innovations

- The demand for innovative, targeted, and effective treatments is growing rapidly across both developed and emerging markets, as healthcare providers seek solutions that address unmet needs in relapsed or refractory DLBCL patients

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Dynamics

Driver

Growing Need Due to Rising Security Concerns and Smart Home Adoption

- The increasing prevalence of diffuse large B-cell lymphoma, especially relapsed or refractory cases, combined with a significant unmet medical need, is a major driver for market growth

- For instance, in 2024, the FDA approved Polivy in combination with chemotherapy for R/R DLBCL patients, expanding treatment accessibility and adoption

- As more patients require advanced therapies, hospitals and specialty clinics are increasingly utilizing CAR-T and bispecific antibody therapies to improve survival rates and treatment outcomes

- Furthermore, growing awareness among oncologists and patients regarding innovative therapies is accelerating adoption, making advanced treatments an integral component of clinical protocols

- The accessibility of hospital-administered therapies, coupled with improved insurance coverage and reimbursement policies, is further propelling the uptake of CAR-T therapies and targeted agents in both developed and emerging markets

- The introduction of patient assistance programs and expanded insurance coverage is enhancing affordability and enabling a larger patient population to access high-cost therapies

- Rapidly increasing government and private funding for oncology research is supporting the development and approval of new drugs, driving growth opportunities in the Relapsed or Refractory Diffuse Large B-cell Lymphoma market.

Restraint/Challenge

High Treatment Costs and Limited Accessibility

- The high cost of advanced therapies, such as CAR-T treatments and bispecific antibodies, along with limited accessibility in certain regions, poses a significant challenge to market growth

- For instance, the price of Kymriah and Yescarta can exceed USD 400,000 per treatment, making affordability a key barrier for many patients and healthcare providers

- Limited availability of specialized treatment centers capable of administering CAR-T therapies restricts access, particularly in developing regions or rural areas

- While initiatives by pharmaceutical companies and healthcare systems are gradually improving patient access, the complexity and logistics of therapy delivery continue to hinder widespread adoption

- Overcoming these challenges through cost reduction strategies, expansion of treatment centers, and improved patient assistance programs will be critical for sustained market growth

- Safety concerns and potential severe side effects, such as cytokine release syndrome and neurotoxicity, limit the use of certain therapies and require careful patient monitoring, restricting broader adoption

- Regulatory hurdles and lengthy approval processes for novel therapies in different regions can delay market entry, impacting revenue growth and slowing treatment accessibility for patients

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Scope

The market is segmented on the basis of drug type, distribution channel, and end user

- By Drug Type

On the basis of drug type, the R/R DLBCL market is segmented into Monjuvi, XPOVIO, Polivy, Kymriah, Yescarta, and Others. The Monjuvi segment dominated the market with the largest market revenue share of 29.7% in 2025, driven by its growing adoption for relapsed or refractory patients and strong clinical efficacy. Monjuvi’s use in combination with standard therapies has shown improved patient outcomes, making it a preferred option in hospital and specialty clinic settings. The segment benefits from increasing regulatory approvals and favorable reimbursement policies in key markets such as the U.S. and Europe. Its relatively straightforward administration and manageable side-effect profile contribute to its widespread acceptance. Physicians often favor Monjuvi for its ability to address the unmet medical need in Relapsed or Refractory Diffuse Large B-cell Lymphoma, which continues to support its market dominance. The segment’s robust clinical data and physician trust further reinforce its leading position in the market.

The Kymriah segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising adoption of CAR-T cell therapies globally. Kymriah offers highly personalized treatment targeting patients with refractory disease, and its ability to induce durable responses has increased its demand. The segment is supported by ongoing clinical trials and expansions into emerging markets, providing new growth opportunities. Hospitals and specialized treatment centers are rapidly integrating Kymriah into their oncology protocols due to its potential to significantly improve survival outcomes. Moreover, collaborations between manufacturers and healthcare providers are enhancing accessibility and patient education, further accelerating adoption. The segment’s innovative nature and strong pipeline support its rapid CAGR, positioning it as the fastest-growing therapy type in the market.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market with the largest revenue share in 2025, as most advanced therapies such as CAR-T and monoclonal antibodies require hospital administration and monitoring. Hospitals provide the necessary infrastructure for safe infusion and management of therapy-related side effects, ensuring patient safety. This segment benefits from established relationships with oncologists and treatment centers, which facilitate higher prescription volumes. Hospital pharmacies also play a central role in educating patients about therapy schedules, side effects, and follow-up care. The availability of reimbursement programs through hospital networks further supports the dominance of this segment. Hospitals’ capacity to handle complex therapies maintains their leading position in Relapsed or Refractory Diffuse Large B-cell Lymphoma drug distribution.

The online pharmacies segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing patient preference for convenient access to oral targeted therapies such as XPOVIO. Online platforms provide timely home delivery, prescription management, and teleconsultation support, which are especially valuable for patients in remote or underserved regions. Growing digital health adoption and e-pharmacy regulations are enabling broader patient access. Manufacturers are collaborating with online pharmacies to ensure adherence to treatment protocols and provide educational resources. The convenience and accessibility offered by online pharmacies are expected to significantly accelerate their adoption in the Relapsed or Refractory Diffuse Large B-cell Lymphoma market.

- By End User

On the basis of end user, the market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment dominated the market in 2025 due to their ability to administer advanced therapies, manage adverse effects, and provide specialized care. Hospitals have structured oncology departments with trained personnel and access to diagnostic facilities, ensuring safe and effective treatment. Hospital-based treatment ensures better monitoring for CAR-T therapies and antibody-drug conjugates, which require strict administration protocols. Large hospitals also have access to patient assistance programs and insurance coverage, facilitating higher therapy uptake. Hospitals serve as the primary point of care for the majority of Relapsed or Refractory Diffuse Large B-cell Lymphoma patients, reinforcing their dominant market position. Strong referral networks and treatment success rates further support the hospitals segment’s leadership.

The homecare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing use of oral therapies and supportive care that can be administered outside hospitals. Homecare services reduce patient travel, lower hospital congestion, and improve convenience for patients undergoing long-term treatment. The segment is supported by telemedicine platforms and remote monitoring technologies, ensuring therapy adherence and safety. Rising awareness of home-based oncology care and patient preference for comfort and flexibility are accelerating adoption. Partnerships between healthcare providers and homecare agencies are expanding service coverage. Homecare’s convenience and cost-effectiveness make it a rapidly growing end-user segment in the R/R DLBCL market.

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Regional Analysis

- North America dominated the Relapsed or Refractory Diffuse Large B-cell Lymphoma market with the largest revenue share of 39.1% in 2025, characterized by a strong healthcare infrastructure, high access to advanced therapies, and extensive clinical trial networks

- Patients and oncologists in the region highly value the availability of CAR-T cell therapies, monoclonal antibodies, and bispecific antibody treatments, which offer improved survival outcomes and personalized treatment options

- This widespread adoption is further supported by favorable reimbursement policies, strong clinical trial networks, high healthcare spending, and increasing awareness among physicians and patients, establishing North America as a leading market for Relapsed or Refractory Diffuse Large B-cell Lymphoma therapies

U.S. Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The U.S. Relapsed or Refractory Diffuse Large B-cell Lymphoma market captured the largest revenue share of 82% in 2025 within North America, fueled by the early adoption of advanced therapies, strong healthcare infrastructure, and high prevalence of relapsed or refractory DLBCL cases. Patients and oncologists are increasingly prioritizing access to CAR-T cell therapies, monoclonal antibodies, and bispecific antibodies to improve survival outcomes. The growing preference for hospital-administered and homecare-supported therapies, along with robust insurance coverage and reimbursement policies, further propels the Relapsed or Refractory Diffuse Large B-cell Lymphoma market. Moreover, ongoing clinical trials, research collaborations, and FDA approvals for novel therapies are significantly contributing to market expansion.

Europe Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The Europe Relapsed or Refractory Diffuse Large B-cell Lymphoma market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased adoption of CAR-T and targeted therapies across hospitals and specialty clinics. Rising awareness of advanced oncology treatments and supportive reimbursement frameworks encourage patient access to high-cost therapies. The presence of well-established healthcare systems, coupled with continuous research and development initiatives, fosters Relapsed or Refractory Diffuse Large B-cell Lymphoma market growth. European oncology centers are also increasingly integrating novel therapies into standard treatment protocols, enhancing patient outcomes across both relapsed and refractory cases.

U.K. Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The U.K. Relapsed or Refractory Diffuse Large B-cell Lymphoma market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by high awareness among patients and oncologists regarding innovative therapies and improved survival rates. Concerns regarding treatment options for relapsed or refractory cases encourage hospitals and specialty clinics to adopt CAR-T and bispecific antibody therapies. The country’s strong healthcare infrastructure, alongside government-backed initiatives for rare and oncology disease management, is expected to continue stimulating Relapsed or Refractory Diffuse Large B-cell Lymphoma market growth. Access to supportive patient programs and specialty care networks further strengthens the uptake of advanced therapies.

Germany Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The Germany Relapsed or Refractory Diffuse Large B-cell Lymphoma market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of advanced cancer therapies and growing oncology healthcare infrastructure. Germany’s well-developed hospital network and emphasis on precision medicine promote the adoption of CAR-T and targeted therapies. Hospitals and specialty clinics are increasingly integrating innovative treatment protocols, while reimbursement policies for high-cost therapies improve patient access. The focus on safety, efficacy, and patient outcomes aligns with local treatment expectations, further driving Relapsed or Refractory Diffuse Large B-cell Lymphoma market expansion.

Asia-Pacific Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The Asia-Pacific Relapsed or Refractory Diffuse Large B-cell Lymphoma market is poised to grow at the fastest CAGR of 25% during 2026–2033, driven by increasing awareness of advanced therapies and expanding oncology healthcare infrastructure in countries such as China, Japan, and India. Rising urbanization, improving insurance coverage, and government initiatives to support rare disease treatment are promoting adoption. Hospitals, specialty clinics, and homecare services are rapidly integrating CAR-T and targeted therapies into treatment protocols. Furthermore, ongoing clinical trials, technology transfer agreements, and growing domestic pharmaceutical capabilities are expanding therapy accessibility and affordability across the region.

Japan Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The Japan Relapsed or Refractory Diffuse Large B-cell Lymphoma market is gaining momentum due to a high prevalence of relapsed or refractory cases, advanced healthcare infrastructure, and demand for innovative therapies. The market growth is driven by hospitals and specialty clinics adopting CAR-T and bispecific antibodies, alongside increasing patient awareness of treatment options. Integration of supportive care and remote monitoring programs further enhances patient outcomes. Moreover, Japan’s aging population and the rising need for personalized oncology therapies are such asly to spur demand for easier-to-administer, effective treatment solutions in both hospital and homecare settings.

India Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Insight

The India Relapsed or Refractory Diffuse Large B-cell Lymphoma market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the growing patient pool, improving healthcare infrastructure, and rising adoption of advanced therapies such as CAR-T and monoclonal antibodies. The expansion of specialty clinics and hospital networks offering oncology care is driving treatment accessibility. Government initiatives supporting rare and oncology disease management, along with increasing patient awareness and insurance coverage, further propel Relapsed or Refractory Diffuse Large B-cell Lymphoma market growth. The availability of cost-effective therapies and local pharmaceutical manufacturing also contributes to the rapid expansion of the Relapsed or Refractory Diffuse Large B-cell Lymphoma market in India.

Relapsed or Refractory Diffuse Large B-cell Lymphoma Market Share

The Relapsed or Refractory Diffuse Large B-cell Lymphoma industry is primarily led by well-established companies, including:

- F. Hoffmann La Roche Ltd (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- Novartis AG (Switzerland)

- Bristol Myers Squibb Company (U.S.)

- AbbVie Inc. (U.S.)

- Genmab A/S (Denmark)

- Karyopharm Therapeutics, Inc. (U.S.)

- Morphosys AG (Germany)

- ADC Therapeutics SA (Switzerland)

- Incyte Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Cellular Biomedicine Group, Inc. (U.S.)

- Eagle Pharmaceuticals, Inc. (U.S.)

- IMV Inc. (Canada)

- BeiGene, Ltd. (China)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Adaptive Biotechnologies (U.S.)

- Sunesis Pharmaceuticals, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

What are the Recent Developments in Global Relapsed or Refractory Diffuse Large B-cell Lymphoma Market?

- In May 2025, Roche reported two‑year follow‑up results from the Phase III STARGLO study, showing that Columvi (glofitamab) plus GemOx continues to provide a clinically meaningful overall survival benefit in R/R DLBCL, with updated data showing a 40% survival improvement

- In December 2024, Roche announced that the U.S. FDA accepted a supplemental Biologics License Application (sBLA) for Columvi (glofitamab) in combination with gemcitabine + oxaliplatin (GemOx) for R/R DLBCL, based on Phase III STARGLO trial data. The STARGLO data showed a 41% reduction in the risk of death versus the standard R GemOx regimen

- In May 2021, Chugai officially launched Polivy (polatuzumab vedotin) for R/R DLBCL in Japan, following its approval earlier that year. The launch followed its inclusion on Japan’s national health insurance reimbursement list, making the drug more accessible for patients

- In April 2021, The U.S. FDA granted accelerated approval to loncastuximab tesirine lpyl (Zynlonta) for adult patients with relapsed or refractory large B cell lymphoma, including diffuse large B cell lymphoma (DLBCL), who have received two or more prior systemic therapies. This is significant because it introduced a novel CD19 targeted antibody-drug conjugate (ADC) as a therapy option for difficult-to-treat, heavily pretreated patients

- In March 2021, Chugai Pharmaceutical received regulatory approval in Japan for Polivy (polatuzumab vedotin), in combination with bendamustine and rituximab, for patients with relapsed or refractory DLBCL. Polivy is a first in-class anti CD79b antibody drug conjugate, making it a novel mechanism in the R/R DLBCL space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.