Global Relapsing Polychondritis Treatment Market

Market Size in USD Million

CAGR :

%

USD

60.50 Million

USD

97.15 Million

2025

2033

USD

60.50 Million

USD

97.15 Million

2025

2033

| 2026 –2033 | |

| USD 60.50 Million | |

| USD 97.15 Million | |

|

|

|

|

Relapsing Polychondritis Treatment Market Size

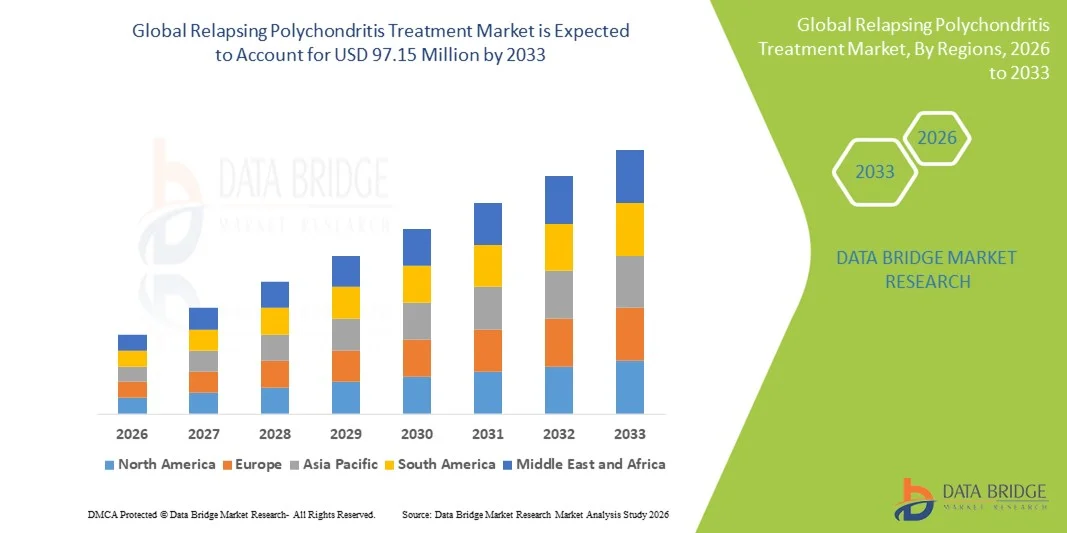

- The global relapsing polychondritis treatment market size was valued at USD 60.50 Million in 2025 and is expected to reach USD 97.15 Million by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by increasing awareness of rare autoimmune disorders, advancements in diagnostic technologies, and the rising prevalence of Relapsing Polychondritis (RP) worldwide

- Furthermore, growing demand for effective and targeted treatment options, including immunosuppressive therapies, biologics, and supportive care, is accelerating the uptake of Relapsing Polychondritis Treatment solutions, thereby significantly boosting the industry's growth

Relapsing Polychondritis Treatment Market Analysis

- Relapsing Polychondritis, a rare autoimmune disorder affecting cartilage throughout the body, is increasingly recognized as a critical condition requiring timely diagnosis and effective management in both adults and pediatric populations due to its progressive and potentially debilitating complications

- The escalating demand for relapsing polychondritis treatment is primarily fueled by growing awareness among clinicians, increasing prevalence of autoimmune disorders, and rising adoption of advanced therapeutic options including immunosuppressive drugs and biologics

- North America dominated the relapsing polychondritis treatment market with the largest revenue share of approximately 39.5% in 2025, supported by advanced healthcare infrastructure, high diagnosis rates, active clinical research programs, and the presence of leading biotechnology and pharmaceutical companies. The U.S. experienced substantial growth due to early disease recognition, availability of specialized treatment centers, and strong investment in rare autoimmune disorder management

- Asia-Pacific is expected to be the fastest-growing region in the relapsing polychondritis treatment market during the forecast period, driven by increasing healthcare expenditure, improving access to specialty clinics, rising awareness of rare autoimmune diseases, and ongoing government initiatives supporting rare-disease management in countries such as India, China, and Japan

- The Oral segment dominated the largest market revenue share of 57.5% in 2025, due to its convenience for chronic management of Relapsing Polychondritis. Oral therapies allow outpatient treatment and long-term adherence

Report Scope and Relapsing Polychondritis Treatment Market Segmentation

|

Attributes |

Relapsing Polychondritis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• F. Hoffmann-La Roche AG (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Relapsing Polychondritis Treatment Market Trends

Increasing Focus on Personalized and Multidisciplinary Management Approaches

- A major and accelerating trend in the global Relapsing Polychondritis Treatment market is the adoption of personalized treatment strategies combining pharmacological therapy, immunomodulatory agents, and multidisciplinary care approaches

- This trend is driven by the complexity of the disease, which affects multiple organ systems including cartilage, respiratory tract, and cardiovascular tissues

- For instance, in March 2024, a collaborative initiative between the University of California, San Francisco, and the National Institutes of Health highlighted the integration of immunosuppressive therapy with physiotherapy and respiratory monitoring for patients with severe airway involvement. Such initiatives are expected to enhance patient outcomes, improve quality of life, and shape global treatment practices

- In addition, the trend towards early intervention using biomarkers and imaging diagnostics is gaining momentum. Advanced imaging techniques, such as PET-CT and MRI for detecting cartilage inflammation, are increasingly being incorporated into routine monitoring, enabling timely treatment modifications

- Integration of patient registries and real-world evidence studies further supports this trend, helping physicians tailor therapy plans based on disease severity, comorbidities, and individual response patterns

Relapsing Polychondritis Treatment Market Dynamics

Driver

Rising Prevalence and Increasing Awareness Among Healthcare Providers

- The increasing global prevalence of Relapsing Polychondritis, coupled with rising awareness among clinicians regarding early diagnosis and intervention, is a key driver of market growth. Improved recognition of rare autoimmune conditions and better access to specialized care have fueled demand for advanced treatment modalities

- For instance, in June 2023, the European Alliance of Associations for Rheumatology (EULAR) launched new guidelines emphasizing early immunosuppressive therapy and monitoring protocols for Relapsing Polychondritis, which are expected to standardize care and encourage wider adoption of recommended therapies

- Expansion of patient support programs and awareness campaigns by healthcare organizations and pharmaceutical companies is also driving market uptake. Educational initiatives for both clinicians and patients are improving adherence to therapy and fostering early intervention

- Furthermore, the growing investment in clinical research and development for novel immunomodulatory agents and combination therapies is propelling the pipeline for more effective and targeted interventions, strengthening market growth prospects

Restraint/Challenge

Concerns Regarding Limited Therapeutic Options and High Treatment Costs

- Despite advancements, Relapsing Polychondritis remains a rare and complex disease, and the availability of approved therapies is limited

- Current treatment relies heavily on corticosteroids, immunosuppressants, and off-label biologics, which may not be effective in all patient subsets. This limitation poses a significant challenge to broader market expansion

- For instance, high costs associated with long-term immunosuppressive therapy, frequent monitoring, and hospitalizations have made treatment financially burdensome for many patients, especially in developing regions

- In addition, delays in diagnosis due to the disease’s heterogeneous presentation often result in more advanced disease requiring aggressive therapy, further escalating treatment expenditures

- Addressing these challenges through expanded access programs, development of novel targeted therapies, and improved diagnostic protocols will be critical to ensuring better patient outcomes and supporting sustained market growth

Relapsing Polychondritis Treatment Market Scope

The market is segmented on the basis of treatment, diagnosis, symptoms, dosage, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Relapsing Polychondritis Treatment market is segmented into Corticosteroids, Nonsteroidal Anti-inflammatory Drugs (NSAIDs), Immunosuppressive Drugs, Antibiotics, and Others. The Corticosteroids segment dominated the largest market revenue share of 54.2% in 2025, driven by their rapid anti-inflammatory effects and ability to manage acute flare-ups effectively. Clinicians prefer corticosteroids for initial treatment due to predictable outcomes. Widespread availability and insurance coverage further boost adoption. Hospital protocols often include corticosteroids as first-line therapy for symptom control. Increased patient awareness of effective therapies encourages earlier treatment. Clinical studies confirming efficacy in preventing cartilage deterioration reinforce usage. Specialty clinics adopt corticosteroids for systemic management of inflammation. Government healthcare programs in developed countries ensure steady access. Formulation improvements enhance safety profiles for long-term use. Pediatric and adult patient populations benefit from flexible dosing regimens. Pharmaceutical advancements in oral and injectable corticosteroids further strengthen market dominance. Collaboration between hospitals and biotech companies ensures reliable distribution. Ongoing clinical research supports expanding therapeutic indications.

The Immunosuppressive Drugs segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, driven by increasing adoption for patients with severe or refractory disease. Growing evidence supports immunosuppressants in reducing long-term cartilage and organ damage. Rising prevalence of autoimmune-related complications drives clinical usage. Biologics and novel small molecules expand treatment options. Hospitals and specialty clinics increasingly integrate immunosuppressive therapy into treatment protocols. Government reimbursement programs improve affordability in emerging regions. Physician awareness campaigns promote early initiation for high-risk patients. Combination therapy with corticosteroids enhances efficacy, further encouraging use. Clinical trials for next-generation immunomodulators stimulate market interest. Expanding patient registries provide real-world evidence supporting adoption. Telemedicine services support monitoring of immunosuppressive therapy adherence. Partnerships with pharmaceutical companies ensure supply stability. Improved patient outcomes strengthen overall acceptance of immunosuppressive drugs.

- By Diagnosis

On the basis of diagnosis, the market is segmented into Blood Tests, Imaging Tests, Biopsy, and Others. The Blood Tests segment dominated the largest market revenue share of 48.6% in 2025, driven by their widespread use in detecting inflammation markers such as ESR and CRP. Blood testing provides rapid, cost-effective assessment for monitoring disease activity. Physicians rely on lab panels to confirm flares and guide treatment decisions. Hospitals prioritize blood testing due to simplicity and minimal patient discomfort. Early detection through routine screening encourages timely intervention. Growing awareness among clinicians supports higher testing volumes. Integration of blood test results with electronic medical records improves follow-up care. Insurance coverage for diagnostic tests enhances adoption rates. Blood markers help predict disease progression, assisting in treatment planning. Laboratory network expansions facilitate easier access in urban and semi-urban areas. Diagnostic guidelines recommend routine blood tests for disease monitoring. Research linking blood biomarkers to clinical outcomes further validates usage. Ongoing improvements in assay accuracy maintain segment dominance.

The Imaging Tests segment is expected to witness the fastest CAGR of 9.7% from 2026 to 2033, driven by advances in MRI, CT, and PET imaging for precise cartilage assessment. Imaging supports early detection of structural damage and guides intervention strategies. Hospitals increasingly incorporate imaging protocols in diagnostic workflows. Enhanced resolution and 3D reconstruction improve lesion identification. Physicians prefer imaging for patients with atypical presentations. Insurance reimbursement for imaging tests increases patient accessibility. Radiology departments expand capabilities to meet rising demand. Imaging supports disease monitoring and evaluation of treatment efficacy. Collaboration between hospitals and diagnostic imaging centers facilitates workflow integration. Tele-radiology allows remote interpretation, increasing adoption in underserved regions. Clinical guidelines emphasize imaging in cases of airway or joint involvement. Research demonstrating predictive value of imaging for disease progression further strengthens usage. Growing patient demand for accurate diagnosis accelerates market growth.

- By Symptoms

On the basis of symptoms, the market is segmented into Dizziness, Inflamed Cartilage, Hearing Loss, Redness, Swelling, Joint Pain, Tissue Damage Causing Deformity, Tracheal Stenosis, Shortness of Breath, Wheezing, Nausea, Vomiting, and Others. The Inflamed Cartilage segment dominated the largest market revenue share of 42.3% in 2025, as it represents the primary clinical manifestation prompting medical evaluation. Swelling and tenderness drive early physician consultation. Symptom recognition in the ears, nose, and joints ensures timely diagnostic workup. Hospital clinics frequently monitor cartilage inflammation through both lab and imaging studies. Awareness campaigns help patients recognize warning signs for early treatment initiation. Corticosteroids and NSAIDs are commonly prescribed to manage these acute flares. Multidisciplinary teams collaborate for symptom management in severe cases. Disease registries track cartilage involvement trends, aiding treatment planning. Patient adherence improves when visible symptoms respond rapidly to therapy. Insurance coverage for initial evaluation encourages prompt care-seeking behavior. Clinical studies link cartilage inflammation to long-term joint outcomes. Early intervention prevents severe deformities and organ involvement. Physician training programs reinforce identification of key cartilage-related signs.

The Tracheal Stenosis segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, driven by increasing recognition of airway complications as a life-threatening manifestation. Hospitals incorporate routine airway imaging for early detection. Advanced surgical and interventional therapies are increasingly adopted to manage stenosis. Specialist ENT and pulmonology departments handle severe cases. Research links early diagnosis to improved survival rates. Clinical guidelines emphasize monitoring airway integrity in high-risk patients. Physician awareness campaigns highlight critical respiratory symptoms. Emergency care protocols support rapid intervention. Telemedicine enables remote assessment for at-risk patients. New medical devices improve airway management outcomes. Insurance coverage for surgical interventions encourages uptake. Increased prevalence of severe cases boosts segment growth. Collaboration with medical device manufacturers ensures availability of advanced treatment options.

- By Dosage

On the basis of dosage, the market is segmented into Tablet, Injection, and Others. The Tablet segment dominated the largest market revenue share of 53.7% in 2025, as oral administration remains the most convenient for long-term therapy. Tablets facilitate outpatient management of corticosteroids and NSAIDs. Patient adherence improves due to ease of administration. Standardized dosing protocols are widely accepted by clinicians. Hospitals and clinics stock oral medications for immediate use. Pharmacy networks ensure accessibility in urban and rural areas. Clinical studies confirm efficacy of tablet formulations for symptom control. Insurance coverage supports cost-effective access. Flexibility in dosing schedules accommodates individual patient needs. Pharmaceutical companies introduce sustained-release tablets for improved compliance. Tablets reduce the need for hospital visits compared with injectable therapy. Long-term safety profiles further strengthen adoption. Early intervention with oral therapy improves overall patient outcomes.

The Injection segment is expected to witness the fastest CAGR of 9.9% from 2026 to 2033, driven by increasing use of biologic and immunosuppressive therapies requiring parenteral administration. Injectable formulations offer rapid control of severe inflammation and flares. Hospitals provide structured monitoring for initial dosing. Specialty clinics administer injections for refractory cases. Home-based nurse-assisted injections are expanding access. Clinical trials validate improved outcomes with injectable biologics. Insurance coverage for injectables in chronic cases encourages adoption. Biotech innovation supports new long-acting injectable options. Patient education programs enhance adherence to injection schedules. Government initiatives support access to rare-disease biologics. Telemedicine monitoring ensures safe home administration. Injection therapy adoption grows in high-risk populations with severe organ involvement. Collaboration with pharmaceutical manufacturers ensures reliable supply.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Intravenous, and Others. The Oral segment dominated the largest market revenue share of 57.5% in 2025, due to its convenience for chronic management of Relapsing Polychondritis. Oral therapies allow outpatient treatment and long-term adherence. Physicians prefer tablets for early-stage and maintenance therapy. Hospitals integrate oral medication monitoring into routine visits. Standardized dosing guidelines support consistent treatment outcomes. Pharmacists provide counseling on adherence and side-effect management. Insurance coverage enhances affordability and patient access. Oral formulations reduce hospitalization frequency. Patient preference for non-invasive treatment promotes adoption. Clinical studies demonstrate efficacy comparable to injectable alternatives in mild to moderate cases. Long-term safety data further strengthens segment dominance. Telemedicine supports remote prescription and monitoring. Hospitals maintain robust supply chains for oral medications.

The Intravenous segment is expected to witness the fastest CAGR of 10.6% from 2026 to 2033, driven by adoption of biologic immunosuppressants and monoclonal antibody therapies. IV administration ensures rapid onset in severe or refractory cases. Hospitals and specialty clinics provide controlled infusion services. Research supports improved efficacy and reduced systemic toxicity for IV therapies. Clinical protocols emphasize IV therapy for acute flares and high-risk organ involvement. Insurance reimbursement encourages hospital-based IV treatment. Home infusion programs expand access for stable patients. Telemedicine allows remote monitoring during infusions. Increasing availability of portable infusion pumps supports outpatient care. Collaboration with biotech companies ensures IV medication supply. Clinical studies highlight improved patient outcomes with IV biologics. Physician education programs promote adherence to IV treatment guidelines. Specialized infusion centers enhance treatment accessibility.

- By End-Users

On the basis of end-users, the market is segmented into Clinic, Hospital, and Others. The Hospital segment dominated the largest market revenue share of 55.2% in 2025, due to access to multidisciplinary teams and advanced diagnostic facilities. Hospitals provide integrated care including diagnostics, therapy initiation, and monitoring. Severe or complicated cases often require hospital-based treatment. Collaboration between hospitals and research institutions supports patient enrollment in clinical trials. Hospital pharmacies ensure reliable medication supply and storage. Insurance coverage encourages patients to seek hospital care. Advanced imaging and lab services enhance accurate diagnosis. Hospitals lead in adoption of injectable and IV therapies. Multidisciplinary care improves outcomes for patients with organ involvement. Government programs support hospital-based rare-disease management. Telemedicine programs in hospitals expand follow-up care. Hospitals are central hubs for both outpatient and inpatient therapy. Clinical training programs in hospitals enhance expertise in Relapsing Polychondritis management.

The Clinic segment is expected to witness the fastest CAGR of 11.1% from 2026 to 2033, driven by increasing availability of outpatient services and decentralized care models. Clinics provide convenient follow-ups for long-term therapy. Patients prefer clinics for accessible, cost-effective care. Specialty clinics integrate monitoring of oral and injectable therapies. Collaboration with diagnostic labs ensures rapid testing and reporting. Clinics increasingly adopt telemedicine for remote consultations. Patient adherence programs enhance treatment continuity. Outpatient infusion services expand clinic adoption of biologics. Government initiatives promote primary healthcare modernization. Rising diagnosis of mild to moderate cases accelerates clinic visits. Clinics help reduce hospital burden by managing stable patients. Improved clinic infrastructure supports adoption of monitoring technologies. Clinics are pivotal for early detection and long-term disease management.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated the largest market revenue share of 50.3% in 2025, due to centralized dispensing for high-cost biologics and complex therapies. Hospitals ensure proper storage and handling of injectable and IV formulations. Pharmacists counsel patients on dosage and adherence. Hospitals maintain controlled inventories to prevent shortages. Physician preference for hospital pharmacies ensures correct initial dosing. Regulatory guidelines support hospital-based distribution for biologics. Hospital pharmacies coordinate with multidisciplinary teams for integrated care. Government programs reinforce hospital pharmacy usage for rare diseases. Monitoring and reporting of patient outcomes are easier in hospital settings. Centralized distribution supports equitable access. Hospitals facilitate adherence through scheduled refills. Clinical guidelines often mandate hospital dispensing for high-risk therapies. Hospital pharmacies remain the trusted point-of-care for complex treatment regimens.

The Online Pharmacy segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, fueled by digital prescription adoption and home delivery convenience. Online pharmacies provide doorstep delivery of chronic medications including biologics. Cold-chain packaging ensures safe shipment of temperature-sensitive drugs. Patients increasingly prefer online ordering for regular therapy adherence. Telemedicine supports online prescription verification and monitoring. E-pharmacy platforms expand access in remote and underserved areas. Transparent pricing encourages patient adoption. Subscription-based refill programs increase compliance. Digital platforms facilitate tracking of treatment history. Regulatory approvals for e-pharmacy operations increase reliability. Government initiatives promote telehealth integration with e-pharmacies. Patient confidence in online pharmacies is increasing due to secure and timely delivery. Rapid growth of online retail in emerging markets accelerates segment adoption.

Relapsing Polychondritis Treatment Market Regional Analysis

- North America dominated the relapsing polychondritis treatment market with the largest revenue share of approximately 39.5% in 2025

- Supported by advanced healthcare infrastructure, high diagnosis rates, active clinical research programs, and the presence of leading biotechnology and pharmaceutical companies

- The market experienced substantial growth due to early disease recognition, availability of specialized treatment centers, and strong investment in rare autoimmune disorder management

U.S. Relapsing Polychondritis Treatment Market Insight

The U.S. relapsing polychondritis treatment market captured the largest revenue share in North America in 2025, driven by the increasing number of specialty clinics, growing awareness of rare autoimmune diseases, and the adoption of advanced therapies such as immunosuppressive drugs and corticosteroids. Expansion of research initiatives and funding for rare autoimmune disorder treatment further propels the market.

Europe Relapsing Polychondritis Treatment Market Insight

The Europe relapsing polychondritis treatment market is projected to expand at a significant CAGR during the forecast period, driven by increasing healthcare expenditure, growing awareness of autoimmune disorders, and supportive regulatory frameworks promoting early diagnosis and effective treatment. Countries such as Germany, France, and the U.K. are seeing growth due to the establishment of specialized treatment centers and increased access to immunomodulatory therapies.

U.K. Relapsing Polychondritis Treatment Market Insight

The U.K. relapsing polychondritis treatment market is expected to grow steadily during the forecast period, fueled by rising awareness of rare autoimmune diseases, availability of advanced treatment protocols, and government initiatives supporting rare disease management.

Germany Relapsing Polychondritis Treatment Market Insight

The Germany relapsing polychondritis treatment market is anticipated to grow at a considerable rate, supported by robust healthcare infrastructure, adoption of advanced diagnostic tools, and increasing demand for immunosuppressive and biologic therapies in specialized clinical centers.

Asia-Pacific Relapsing Polychondritis Treatment Market Insight

The Asia-Pacific relapsing polychondritis treatment market is expected to grow at the fastest CAGR during the forecast period, driven by increasing healthcare expenditure, improving access to specialty clinics, rising awareness of rare autoimmune diseases, and ongoing government initiatives supporting rare-disease management in countries such as India, China, and Japan.

Japan Relapsing Polychondritis Treatment Market Insight

The Japan relapsing polychondritis treatment market is gaining momentum due to increasing patient awareness, advanced healthcare facilities, and the adoption of specialized treatments for autoimmune disorders. Early diagnosis and growing investment in rare disease management are fueling growth.

China Relapsing Polychondritis Treatment Market Insight

China relapsing polychondritis treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising healthcare expenditure, expanding specialty clinics, and increased awareness of rare autoimmune diseases. Government initiatives and growing research in rare disease management further support market growth.

Relapsing Polychondritis Treatment Market Share

The Relapsing Polychondritis Treatment industry is primarily led by well-established companies, including:

• F. Hoffmann-La Roche AG (Switzerland)

• Novartis AG (Switzerland)

• Pfizer Inc. (U.S.)

• GlaxoSmithKline plc (U.K.)

• Eli Lilly and Company (U.S.)

• AbbVie Inc. (U.S.)

• Johnson & Johnson (U.S.)

• Sanofi S.A. (France)

• AstraZeneca plc (U.K.)

• Bristol-Myers Squibb Company (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Amgen Inc. (U.S.)

• Boehringer Ingelheim GmbH (Germany)

• Takeda Pharmaceutical Company Limited (Japan)

• Bayer AG (Germany)

• Ferring Pharmaceuticals (Switzerland)

• Mitsubishi Tanabe Pharma Corporation (Japan)

• Sandoz International GmbH (Switzerland)

• Lupin Limited (India)

Latest Developments in Global Relapsing Polychondritis Treatment Market

- In April 2024, a comprehensive review article titled “Unveiling the clinical spectrum of relapsing polychondritis: insights into its pathogenesis, novel monogenic causes, and therapeutic strategies” was published. The paper broadened scientific understanding by detailing new insights into potential genetic causes (including overlaps with autoinflammatory syndromes), and discussed evolving therapeutic strategies — potentially opening new research directions for more targeted or personalized RP therapy

- In July 2024, a case report titled “Recurrent refractory polychondritis” was published in the Journal of Turkish Society for Rheumatology, documenting a patient with treatment‑refractory RP despite conventional immunosuppressive therapy. This report underscores the continuing unmet need in RP treatment and highlights the challenges clinicians face in managing refractory cases

- In July 2024, another significant publication described successful treatment of a patient suffering from both RP and pustular psoriasis using Secukinumab (an IL‑17 inhibitor), suggesting that biologic therapy targeting IL‑17 may offer a viable option for certain RP patients — especially those with overlapping autoimmune features

- In March 2025, a large multicenter observational cohort study — including 195 RP patients — was published documenting the “enormous burden of disease,” varied organ involvement (ear, airway, musculoskeletal), frequent use of glucocorticoids, and widespread application of non-biologic or biologic immunomodulatory therapies. This study offers an up‑to-date real‑world snapshot of RP treatment patterns and may guide future clinical trial design and standard‑of‑care development

- In March 2025, a new Phase II clinical trial (named “PROSECT RP Trial”) was publicly listed to evaluate immunomodulatory medications (including drugs like adalimumab, infliximab, methotrexate, azathioprine, tocilizumab) in patients with RP — representing one of the first formal clinical trials explicitly designed to compare treatment regimens in this rare disease

- In March 2025, the Relapsing Polychondritis Foundation announced continued investment in its “PURPOSE Biobank and Data Repository” — a patient‑centric initiative to collect blood specimens and medical data from individuals with RP and related autoimmune diseases, intended to accelerate discovery of diagnostics, biomarkers, and future therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.