Global Remote Diagnostics Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.98 Billion

USD

11.96 Billion

2024

2032

USD

3.98 Billion

USD

11.96 Billion

2024

2032

| 2025 –2032 | |

| USD 3.98 Billion | |

| USD 11.96 Billion | |

|

|

|

|

Remote Diagnostics Devices Market Size

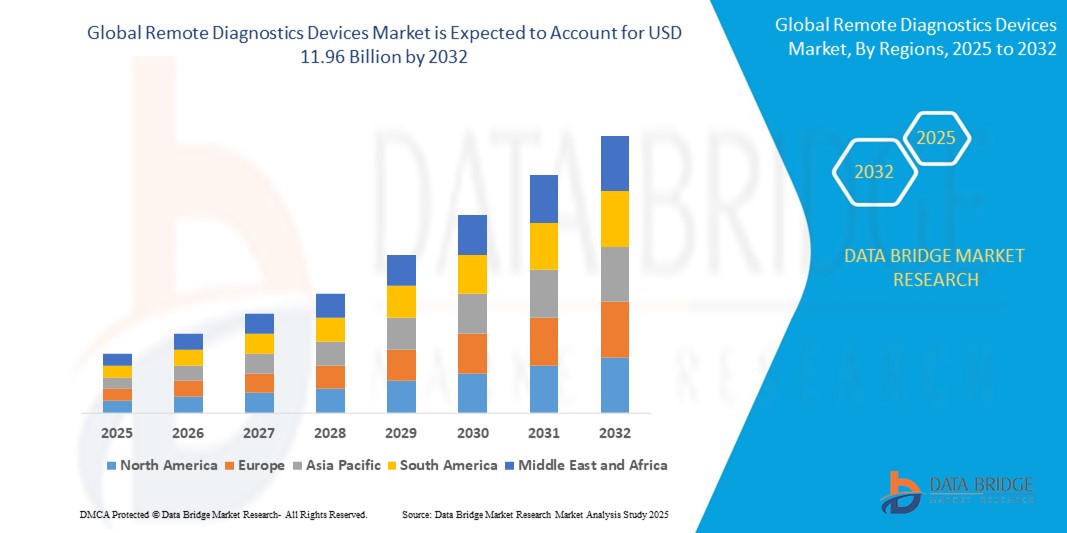

- The global remote diagnostics devices market size was valued at USD 3.98 billion in 2024 and is expected to reach USD 11.96 billion by 2032, at a CAGR of 14.74% during the forecast period

- The Market growth is driven by increasing demand for real-time vehicle monitoring, predictive maintenance, and enhanced connectivity solutions, coupled with the rising adoption of telematics in the automotive industry

- Growing awareness among fleet operators and individual vehicle owners about the benefits of remote diagnostics, such as reduced downtime and improved vehicle performance, is further propelling market demand across OEM and aftermarket channels

Remote Diagnostics Devices Market Analysis

- The remote diagnostics devices market is experiencing robust growth due to the rising need for advanced vehicle health monitoring and predictive maintenance solutions to enhance operational efficiency

- The integration of IoT and AI technologies in diagnostic systems is enabling manufacturers to develop innovative, high-performance solutions that provide real-time data analytics and actionable insights

- Asia-Pacific dominates the remote diagnostics devices market with the largest revenue share of 36.2% in 2024, driven by, rapid advancements in automotive technology, increasing vehicle production, and widespread adoption of connected vehicle solutions in countries such as China, Japan, and India

- Europe is projected to be the fastest-growing region during the forecast period, fueled by stringent regulations on vehicle emissions, growing demand for connected vehicles, and increasing investments in smart mobility solutions

- The diagnostic equipment segment holds the largest market revenue share of 60.5% in 2024, driven by the critical need for robust hardware to connect with vehicle systems for real-time data collection and diagnostics

Report Scope and Remote Diagnostics Devices Market Segmentation

|

Attributes |

Remote Diagnostics Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Remote Diagnostics Devices Market Trends

“Rising Preference for Advanced Connectivity in Remote Diagnostics”

- The adoption of 4G LTE and emerging 5G connectivity is gaining traction due to their high-speed, low-latency capabilities, enabling real-time vehicle diagnostics and data transmission. These technologies ensure seamless communication between vehicles and diagnostic systems, critical for modern connected vehicle

- The integration of Internet of Things (IoT) and telematics in remote diagnostics enhances vehicle health monitoring and predictive maintenance, offering drivers real-time insights into vehicle performance without compromising functionality

- In regions with high temperatures, such as the U.A.E. and India, remote diagnostics are increasingly valued for monitoring vehicle systems like cooling and battery health, reducing the risk of overheating and improving efficiency

- Luxury car owners, particularly of brands like BMW and Mercedes-Benz, prefer advanced diagnostic systems for their ability to provide detailed vehicle health reports and enhance driving experience through predictive maintenance

- Automakers like Tesla and Volkswagen are increasingly offering factory-installed remote diagnostic systems, integrating them as standard or premium features to enhance vehicle reliability and customer satisfaction

- Dealerships, especially in the U.S. and Europe, are bundling remote diagnostic software and equipment as value-added options, appealing to buyers seeking enhanced vehicle management and convenience

Remote Diagnostics Devices Market Dynamics

Driver

“Rising Demand for Vehicle Efficiency and Safety”

- Growing awareness of the importance of real-time vehicle health monitoring is driving demand for remote diagnostics devices that provide accurate insights into system performance and potential issues

- Remote diagnostics help optimize vehicle performance by monitoring critical systems, reducing fuel consumption in internal combustion vehicles and extending battery life in electric vehicles (EVs), particularly in regions like Asia Pacific with high EV adoption

- These devices enable proactive maintenance, automatic crash notifications, and roadside assistance, improving driver safety and convenience, especially in high-traffic regions like the U.A.E. and India

- OEMs, such as Mercedes-Benz and General Motors, are integrating remote diagnostics into premium models to meet consumer demand for connected vehicles and advanced safety features

- The rise of EVs, particularly in Asia Pacific, which dominates OEM revenue growth, fuels demand for specialized diagnostic tools to monitor battery health and thermal management, enhancing energy efficiency and passenger comfort

Restraint/Challenge

“Regulatory and Connectivity Challenges”

- Different countries impose varying regulations on vehicle connectivity and data privacy, complicating standardization for manufacturers and limiting global scalability of remote diagnostics systems

- The reliance on wireless connectivity raises security risks, as remote diagnostics systems are vulnerable to cyber threats, potentially deterring adoption in security-conscious markets

- In regions with limited internet access or unstable networks, such as rural areas, the effectiveness of remote diagnostics is hampered, restricting market growth

- The cost of integrating advanced diagnostic equipment and software, especially in aftermarket applications, can deter smaller fleet operators or budget-conscious consumers, limiting market expansion

- Older vehicles without integrated connectivity features may not support modern remote diagnostics, creating challenges for widespread adoption in markets with diverse vehicle fleets

Remote Diagnostics Devices Market Scope

The market is segmented on the basis of product type, vehicle type, connectivity, application, and region.

By Product Type

On the basis of product type, the market is segmented into diagnostic equipment and software. The diagnostic equipment segment holds the largest market revenue share of 60.5% in 2024, driven by the critical need for robust hardware to connect with vehicle systems for real-time data collection and diagnostics. This segment is favored for its compatibility with advanced vehicle systems and its role in enabling accurate diagnostics across passenger and commercial vehicles.

The software segment is expected to witness the fastest growth rate, with a CAGR of 18.5% from 2025 to 2032, fueled by advancements in AI, machine learning, and cloud-based analytics. These technologies enhance predictive maintenance, real-time monitoring, and integration with IoT ecosystems, driving demand for sophisticated diagnostic software solutions.

By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger car segment dominates with a market revenue share of 70% in 2024, attributed to high global vehicle ownership, consumer demand for safety features, and the integration of remote diagnostics in both OEM-installed and aftermarket systems.

The light commercial vehicles segment is anticipated to experience the fastest growth, with a CAGR of 20.1% from 2025 to 2032, driven by increasing adoption in logistics, e-commerce, and last-mile delivery fleets. These vehicles rely on remote diagnostics for real-time monitoring, predictive maintenance, and operational efficiency, reducing downtime and costs. The HCV segment also sees steady growth, particularly for fleet management in construction and logistics industries.

By Connectivity

On the basis of connectivity, the market is segmented into Bluetooth, 3G/4G, and Wi-Fi. The 3G/4G segment commands the largest market share of 65.5% in 2024, owing to its reliability, widespread coverage, and ability to transmit diagnostic data in real-time, particularly with the rise of 4G LTE and emerging 5G technologies.

The Wi-Fi segment is expected to exhibit the fastest growth rate, with a CAGR of 18.3% from 2025 to 2032, driven by its widespread availability, cost-effectiveness, and increasing adoption in urban environments for in-garage diagnostics and connected vehicle ecosystems. Bluetooth remains significant for short-range diagnostics, particularly for technician use in close proximity to vehicles.

By Application

On the basis of application, the market is segmented into vehicle system and component access, vehicle health tracking & diagnosis, and service assistance. The vehicle health tracking & diagnosis segment holds the largest market share of 45.5% in 2024, driven by the growing need for real-time monitoring to prevent failures, optimize maintenance schedules, and enhance vehicle safety.

This segment is critical for both passenger and commercial vehicles, enabling proactive maintenance and reducing downtime. The service assistance segment is projected to grow at the fastest rate, with a CAGR of 18.7% from 2025 to 2032, fueled by increasing demand for roadside assistance, automatic crash notifications, and remote support, particularly in connected and electric vehicles.

Remote Diagnostics Devices Market Regional Analysis

- Asia-Pacific dominates the remote diagnostics devices market with the largest revenue share of 36.2% in 2024, driven by, rapid advancements in automotive technology, increasing vehicle production, and widespread adoption of connected vehicle solutions in countries such as China, Japan, and India

- Europe is projected to be the fastest-growing region during the forecast period, fueled by stringent regulations on vehicle emissions, growing demand for connected vehicles, and increasing investments in smart mobility solutions

- The region's tech-savvy population, rising disposable incomes, and government initiatives promoting smart mobility and vehicle safety further bolster market growth

U.S. Remote Diagnostics Devices Market Insight

The U.S. is expected to witness the fastest growth within North America, with a CAGR of 16.8% from 2025 to 2032. This growth is driven by strong aftermarket demand, increasing consumer awareness of safety and convenience benefits, and the growing integration of remote diagnostics in OEM vehicles. Regulatory pushes for safer driving and the adoption of connected vehicle technologies further accelerate market growth. The U.S. benefits from a diverse ecosystem of factory-fitted and aftermarket diagnostic solutions.

Europe Remote Diagnostics Devices Market Insight

Europe’s market is expected to witness the fastest growth, supported by regulatory mandates like the eCall system and consumer demand for advanced safety and connectivity features. Germany and France lead due to their advanced automotive industries and focus on technological innovation. The market is driven by both new vehicle integrations and retrofit solutions, with increasing adoption in urban areas to address traffic and environmental concerns.

U.K. Remote Diagnostics Devices Market Insight

The U.K. market is anticipated to experience robust growth, with a CAGR of 16.5% from 2025 to 2032, driven by demand for enhanced safety, fleet management, and stolen vehicle recovery solutions. Urban and suburban fleet operators increasingly adopt remote diagnostics for operational efficiency, while evolving vehicle safety regulations encourage consumer adoption. The U.K.’s focus on connectivity and smart transportation systems further supports market growth.

Germany Remote Diagnostics Devices Market Insight

Germany is a key market in Europe, with significant growth driven by its advanced automotive manufacturing sector and consumer preference for high-tech diagnostic solutions. The market benefits from the integration of remote diagnostics in premium vehicles and strong aftermarket demand. German OEMs, such as Bosch and Continental, lead in developing sophisticated diagnostic tools, contributing to a projected CAGR of 17.2% from 2025 to 2032.

Asia-Pacific Remote Diagnostics Devices Market Insight

The Asia-Pacific region is expected to dominate the market revenue share of 36.2% in 2024, driven by high vehicle production, rapid urbanization, and increasing demand for connected vehicle solutions in China, India, and Japan. Government initiatives promoting smart cities and intelligent transportation systems, combined with a growing middle class, enhance market accessibility. The region’s competitive manufacturing landscape and adoption of 5G technology further drive growth.

Japan Remote Diagnostics Devices Market Insight

Japan’s market is expected to grow robustly, with a CAGR of 18.0% from 2025 to 2032, driven by consumer demand for advanced telematics solutions and the presence of major OEMs like Toyota and Honda. The integration of diagnostics in electric and hybrid vehicles, coupled with aftermarket customization, supports market expansion. Japan’s focus on safety and connectivity enhances adoption across passenger and commercial vehicles.

China Remote Diagnostics Devices Market Insight

China holds the largest share within Asia-Pacific, driven by rapid urbanization, high vehicle ownership, and strong domestic manufacturing capabilities. The market is propelled by a growing middle class and increasing demand for smart mobility solutions. Remote diagnostics are widely adopted in both OEM and aftermarket applications, with a projected CAGR of 18.3% from 2025 to 2032, supported by competitive pricing and government-backed smart city initiatives.

Remote Diagnostics Devices Market Share

The remote diagnostics devices industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- OnStar, LLC (U.S.)

- Tech Mahindra Limited (India)

- Verizon (U.S.)

- ACTIA Group (France)

- Magneti Marelli S.p.A (Italy)

- Softing AG (Germany)

- ETAS (Germany)

- General Technologies Corp. (U.S.)

- KPIT (India)

- Fluke Corporation (U.S.)

- DSA Daten- und Systemtechnik GmbH (Germany)

- VOXX International (U.S.)

- Mindteck (India)

Latest Developments in Global Remote Diagnostics Devices Market

- In July 2024, Repairify partnered with NAPA to launch asTech Mechanical, a device providing access to a wide range of original equipment (OE) tools for repair shops. This collaboration enhances diagnostic capabilities for aftermarket repair, strengthening market growth by offering scalable solutions to shop owners

- In September 2024, Cummins Inc., Bosch Global Software, and KPIT collaborated to launch Eclipse CANought, an open-source project for commercial vehicle telematics. This initiative aims to standardize telematics platforms, improving interoperability and enabling seamless remote diagnostics and data analysis across diverse commercial vehicle fleets

- In June 2024, Bosch introduced advanced IoT-based diagnostic tools for commercial fleets, offering real-time data analysis and predictive maintenance capabilities. These tools leverage cloud-based technologies to enhance diagnostic accuracy, reduce vehicle downtime, and optimize fleet management, addressing the growing demand for efficient remote diagnostics in the automotive sector

- In February 2024, THINKCAR introduced the ThinkTool Master X2, a 10.1-inch Android-based touchscreen tablet for automotive diagnostics. Featuring advanced capabilities like PassThru and remote diagnostics, this tool caters to automotive professionals, enhancing diagnostic precision and efficiency for a wide range of vehicle systems

- In December 2023, Viasat Group acquired the remaining 40% of TRACKiT’s share capital, bolstering its position in IoT and connected mobility solutions. This acquisition enhances Viasat’s remote diagnostics offerings, enabling more robust real-time monitoring and predictive maintenance for fleet operators. Learn more on Targa Telematics or International Fleet World.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Remote Diagnostics Devices Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Remote Diagnostics Devices Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Remote Diagnostics Devices Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.